444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The copper mining market is a vital component of the global mining industry, providing the raw material for a range of industrial and consumer applications. Copper is a highly conductive and malleable metal with excellent corrosion resistance, making it ideal for use in electrical wiring, plumbing, and construction materials. The copper mining market is characterized by a handful of large-scale players, who are responsible for the majority of global production.

Copper mining involves the extraction of copper ore from the earth’s crust, followed by processing to refine the metal and produce copper concentrate. The process of copper mining involves several stages, including exploration, development, production, and closure. Exploration involves the search for copper deposits, while development refers to the establishment of infrastructure and equipment necessary for mining operations. Production involves the extraction of copper ore from the ground and processing it to produce copper concentrate, which is then sold to smelters for further refining. Closure involves the decommissioning of the mine and the rehabilitation of the site.

Executive Summary

The global copper mining market is expected to grow at a CAGR of XX% during the forecast period, driven by increasing demand for copper in industrial and consumer applications, particularly in emerging markets. The market is characterized by a handful of large-scale players, who are responsible for the majority of global production. Key trends in the market include the adoption of new technologies and mining methods, increasing focus on sustainability and environmental responsibility, and consolidation among major players.

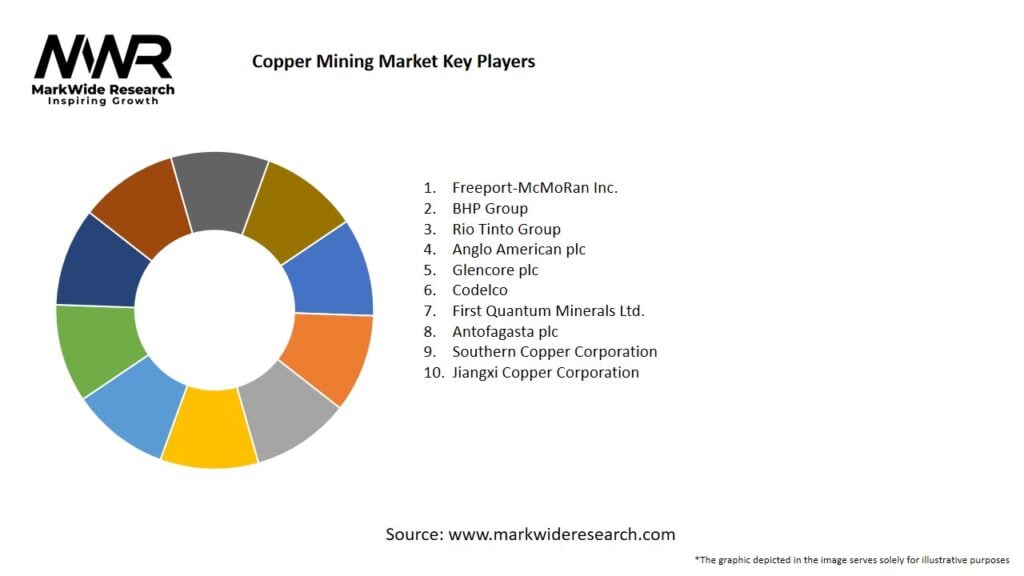

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global copper mining market is influenced by a range of factors, including supply and demand dynamics, technological advancements, regulatory and political factors, and environmental and social considerations. The market is characterized by a handful of large-scale players, who are responsible for the majority of global production. Key trends in the market include the adoption of new technologies and mining methods, increasing focus on sustainability and environmental responsibility, and consolidation among major players.

Regional Analysis

The global copper mining market is geographically diverse, with significant production taking place in several regions around the world. The largest copper producing countries include Chile, Peru, China, the United States, and Australia.

Chile is the world’s largest producer of copper, accounting for approximately one-third of global production. The country is home to several large-scale copper mining operations, including Escondida, Collahuasi, and El Teniente.

Peru is the second-largest producer of copper, with significant production taking place in the Andes mountains. The country is home to several large-scale mining operations, including Las Bambas, Antapaccay, and Cerro Verde.

China is the world’s third-largest producer of copper, with significant production taking place in the Xinjiang and Inner Mongolia regions. The country is also the world’s largest consumer of copper, driven by its rapidly growing economy and infrastructure development.

The United States is the fourth-largest producer of copper, with significant production taking place in Arizona, Utah, New Mexico, and Montana. The country is home to several large-scale mining operations, including the Bingham Canyon Mine in Utah and the Morenci Mine in Arizona.

Australia is the fifth-largest producer of copper, with significant production taking place in the Mount Isa region of Queensland and the Olympic Dam mine in South Australia.

Competitive Landscape

Leading Companies in the Copper Mining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global copper mining market can be segmented based on type, application, and geography.

By type, the market can be segmented into sulfide ore, oxide ore, and others. Sulfide ore is the most common type of copper ore, accounting for approximately 80% of global production.

By application, the market can be segmented into electrical and electronics, construction, transportation, and others. Electrical and electronics is the largest application segment, accounting for approximately 45% of global demand.

Category-wise Insights

The global copper mining market can be categorized into open-pit mining and underground mining. Open-pit mining is the most common method of copper mining, accounting for approximately 75% of global production.

Key Benefits for Industry Participants and Stakeholders

The copper mining market provides significant benefits to industry participants and stakeholders, including:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The global copper mining market has been impacted by the COVID-19 pandemic, which has disrupted supply chains, reduced demand for copper in certain applications, and caused volatility in copper prices. The pandemic has also led to changes in mining operations, including the implementation of social distancing measures and increased use of automation and remote monitoring technologies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global copper mining market is expected to continue growing in the coming years, driven by increasing demand for copper in industrial and consumer applications, particularly in emerging markets. The market is characterized by a handful of large-scale players, who are expected to continue to benefit from economies of scale and significant barriers to entry. Key trends in the market include the adoption of new technologies and mining methods, increasing focus on sustainability and environmental responsibility, and consolidation among major players.

Conclusion

The copper mining market is a vital component of the global mining industry, providing the raw material for a range of industrial and consumer applications. The market is characterized by a handful of large-scale players, who are responsible for the majority of global production. Key trends in the market include the adoption of new technologies and mining methods, increasing focus on sustainability and environmental responsibility, and consolidation among major players.

Companies in the copper mining market should focus on adopting new technologies and methods to improve efficiency, safety, and environmental responsibility, while also diversifying their portfolios and investing in new mining projects to maintain competitiveness and meet growing demand for copper.

Overall, the copper mining market plays a vital role in the global economy, providing raw materials for a range of industrial and consumer applications, while also driving innovation and technological advancements in the mining industry.

What is copper mining?

Copper mining refers to the process of extracting copper from the earth, which involves various methods such as open-pit mining and underground mining. This process is essential for producing copper, a metal widely used in electrical wiring, plumbing, and various industrial applications.

What are the major companies in the copper mining market?

Major companies in the copper mining market include Freeport-McMoRan, BHP, and Southern Copper Corporation, among others. These companies play a significant role in the global supply of copper and are involved in various mining operations worldwide.

What are the key drivers of growth in the copper mining market?

Key drivers of growth in the copper mining market include the increasing demand for copper in renewable energy technologies, electric vehicles, and construction. Additionally, urbanization and infrastructure development in emerging economies are contributing to the rising need for copper.

What challenges does the copper mining market face?

The copper mining market faces several challenges, including environmental concerns related to mining activities, fluctuating copper prices, and regulatory hurdles. These factors can impact the profitability and sustainability of mining operations.

What opportunities exist in the copper mining market?

Opportunities in the copper mining market include advancements in mining technology that enhance efficiency and reduce environmental impact. Additionally, the growing focus on sustainable practices and recycling of copper presents new avenues for growth.

What trends are shaping the copper mining market?

Trends shaping the copper mining market include the increasing integration of automation and digital technologies in mining operations. Furthermore, the shift towards sustainable mining practices and the exploration of new copper deposits are also significant trends.

Copper Mining Market

| Segmentation | Details |

|---|---|

| Type | Concentrate, Cathode |

| Application | Electrical & Electronics, Construction, Industrial Machinery, Others |

| Region | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Copper Mining Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at