444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The convertible bond market is a dynamic and significant segment of the global financial market. Convertible bonds are hybrid securities that offer the features of both debt and equity instruments. These bonds provide investors with the option to convert their bond holdings into a predetermined number of company shares at a specified conversion price. The convertible bond market has gained popularity due to its unique characteristics, providing investors with potential upside through equity participation while offering downside protection through the bond’s fixed income component. This market offers benefits to both issuers and investors and plays a crucial role in corporate financing and investment strategies.

Meaning

Convertible bonds are financial instruments that combine the characteristics of traditional bonds and equity securities. These bonds are issued by companies and provide investors with the option to convert their bond holdings into a specified number of company shares at a predetermined conversion price. Convertible bonds offer investors the potential for capital appreciation if the company’s share price increases, while also providing the safety of fixed income payments if the conversion option is not exercised. These bonds are an attractive investment option for both issuers and investors, offering a balance between risk and return.

Executive Summary

The convertible bond market is a key segment of the global financial market, providing issuers with a flexible financing option and investors with a unique investment opportunity. Convertible bonds offer the potential for capital appreciation through equity participation and downside protection through fixed income payments. The market is influenced by various factors, including market dynamics, investor sentiment, interest rate movements, and the financial health of issuers. It is characterized by the presence of diverse issuers, ranging from established companies to start-ups, and attracts a wide range of investors, including institutional investors, hedge funds, and individual investors.

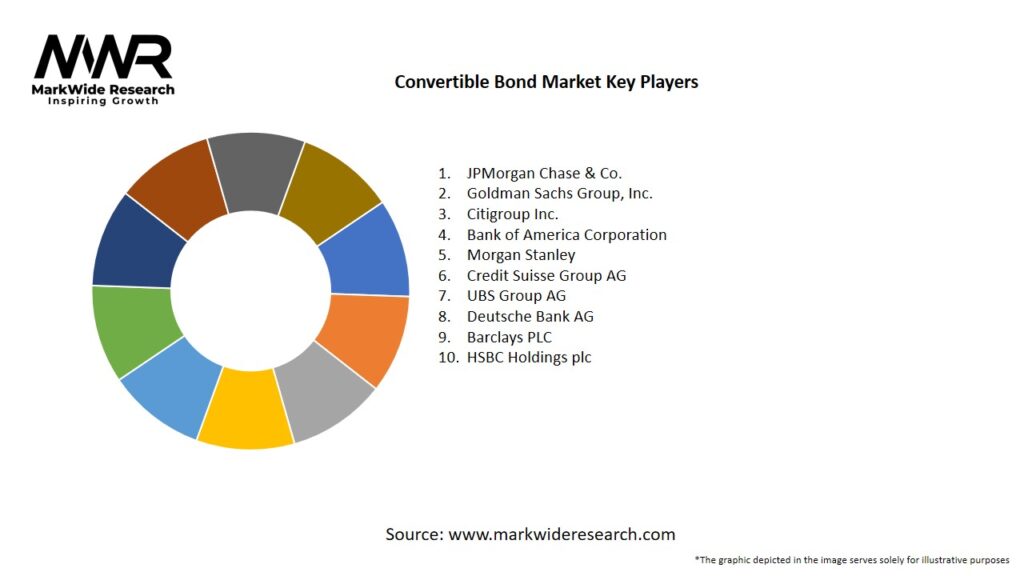

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The convertible bond market is influenced by various dynamics, including interest rates, equity market conditions, investor sentiment, and regulatory factors. The interaction between these dynamics impacts the pricing, issuance volume, and investor demand for convertible bonds. Fluctuations in interest rates and equity market performance can affect the attractiveness of convertible bonds, leading to changes in their valuation and trading activity. Additionally, regulatory changes and market developments can influence the market’s structure and transparency.

Regional Analysis

The convertible bond market exhibits regional variations in terms of market size, issuance volume, and investor preferences. North America dominates the global market, with a significant number of issuances from companies in sectors such as technology, healthcare, and consumer goods. Europe follows closely, with issuances from diverse industries, including financial services and automotive. Asia-Pacific has been witnessing substantial growth in the convertible bond market, driven by the rise of emerging economies and increasing investor appetite for hybrid securities. Other regions, such as Latin America and the Middle East, are also experiencing convertible bond market development, albeit at a relatively smaller scale.

Competitive Landscape

Leading Companies in the Convertible Bond Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

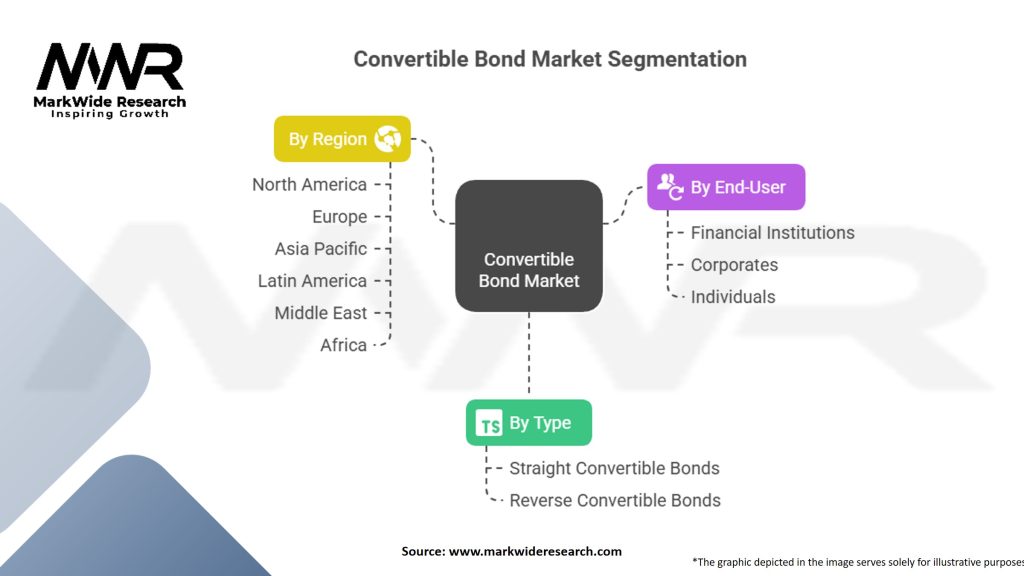

Segmentation

The convertible bond market can be segmented based on various factors, including issuer type, sector, and geography.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both short-term and long-term impacts on the convertible bond market. In the initial phase of the pandemic, market volatility increased, leading to a decline in new issuances as companies faced uncertainty and market disruptions. However, as markets stabilized and investor confidence returned, convertible bond issuances regained momentum. The pandemic also highlighted the importance of flexible financing options, leading companies to consider convertible bonds as a means to strengthen their balance sheets and support growth strategies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The convertible bond market is expected to continue its growth trajectory, driven by factors such as investor demand for diversified investment strategies, financing flexibility for issuers, and the emergence of sustainable and ESG-focused convertible bonds. The market may witness increased digitalization, improved market infrastructure, and further regional expansion, with Asia-Pacific continuing to gain prominence. The evolving regulatory landscape, economic conditions, and investor sentiment will shape the future direction of the convertible bond market.

Conclusion

The convertible bond market is a vital segment of the global financial market, offering a unique investment opportunity that combines the features of both debt and equity instruments. It provides issuers with flexible financing options and investors with the potential for capital appreciation and downside protection. Despite challenges such as interest rate sensitivity and market volatility, the market presents significant opportunities for innovative structuring, regional growth, and sustainability-focused issuances. As the market continues to evolve and adapt to changing dynamics, participants should embrace technology, navigate regulatory requirements, and consider ESG factors to capitalize on the market’s potential and drive long-term success.

Convertible Bond Market

| Segmentation Details | Description |

|---|---|

| By Type | Straight Convertible Bonds, Reverse Convertible Bonds |

| By End-User | Financial Institutions, Corporates, Individuals |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Convertible Bond Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at