444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The convertible bond fund market represents a unique segment within the broader fixed-income investment landscape. Convertible bonds are hybrid securities that offer investors the opportunity to benefit from both equity and fixed-income characteristics. Convertible bond funds pool together these instruments, providing investors with exposure to a diversified portfolio of convertible bonds issued by various companies across different sectors and regions.

Meaning

Convertible bonds are debt instruments issued by corporations that can be converted into a predetermined number of the issuer’s common stock shares after a specified period. These securities typically offer a fixed interest rate and maturity date, similar to traditional bonds. However, what sets convertible bonds apart is their embedded optionality, allowing bondholders to convert their bonds into equity shares under certain conditions, such as when the issuer’s stock price reaches a predetermined level.

Convertible bond funds, also known as convertible bond mutual funds or exchange-traded funds (ETFs), invest in a portfolio of convertible bonds issued by different companies. These funds provide investors with exposure to a diversified basket of convertible securities, offering potential upside participation in equity markets while providing downside protection through the fixed-income component.

Executive Summary

The convertible bond fund market has gained popularity among investors seeking a balance between equity-like returns and fixed-income stability. These funds offer an attractive investment proposition, combining the potential for capital appreciation with income generation and downside protection. As interest rates remain low and equity market volatility persists, convertible bond funds present a compelling investment opportunity for investors looking to diversify their portfolios and manage risk.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The convertible bond fund market operates within a dynamic environment influenced by various factors, including market conditions, economic trends, regulatory developments, and investor sentiment. These dynamics shape the performance and growth trajectory of convertible bond funds, driving opportunities and challenges for fund managers and investors alike.

Regional Analysis

The convertible bond fund market spans across regions, with opportunities and challenges varying based on geographic factors, market conditions, and regulatory environments. While North America and Europe dominate the global convertible bond market, emerging markets in Asia Pacific and Latin America present growth opportunities for fund managers looking to expand their footprint and tap into diverse investor bases.

Competitive Landscape

Leading Companies in the Convertible Bond Fund Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

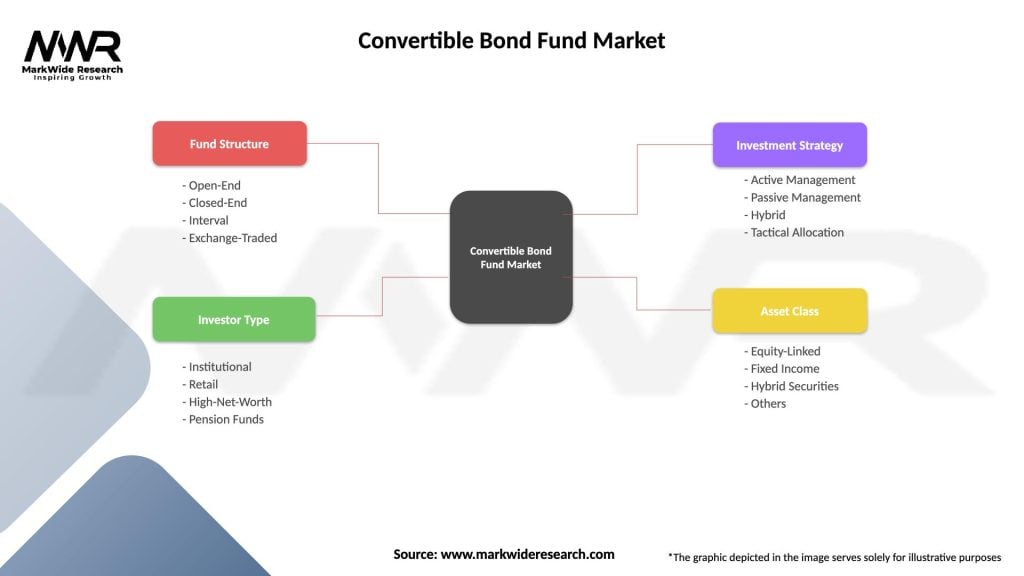

Segmentation

Convertible bond funds can be segmented based on various factors, including investment objective, fund structure, geographic focus, and underlying asset allocation. Common segments include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the convertible bond fund market. While the initial market volatility and economic uncertainty led to temporary disruptions and capital outflows, central bank interventions, fiscal stimulus measures, and vaccine rollouts have supported market recovery and investor sentiment. The pandemic underscored the importance of diversification, risk management, and active portfolio monitoring in navigating market turbulence, reaffirming the value proposition of convertible bond funds for investors seeking stability and growth potential.

Key Industry Developments

Analyst Suggestions

Future Outlook

The convertible bond fund market is poised for continued growth and innovation, driven by favorable market dynamics, evolving investor preferences, and technological advancements. As interest rates gradually normalize, and equity market volatility persists, convertible bond funds are expected to gain traction as a valuable component of diversified investment portfolios. Fund managers that prioritize innovation, risk management, and investor engagement are well-positioned to capitalize on emerging opportunities and deliver value to stakeholders in the evolving investment landscape.

Conclusion

The convertible bond fund market offers investors a unique investment proposition, combining the income-generating potential of fixed-income securities with the upside participation of equities. With their hybrid nature and diversified portfolio holdings, convertible bond funds provide investors with opportunities for capital appreciation, income generation, and downside protection, making them a valuable addition to diversified investment portfolios. As investors seek to navigate uncertain market conditions and achieve their investment objectives, convertible bond funds are poised to play an increasingly important role in delivering attractive risk-adjusted returns and enhancing long-term investment outcomes.

What is a Convertible Bond Fund?

A Convertible Bond Fund is an investment vehicle that primarily invests in convertible bonds, which are hybrid securities that can be converted into a predetermined number of the issuing company’s equity shares. These funds aim to provide investors with income through bond interest while also offering potential capital appreciation through equity conversion.

What are the key players in the Convertible Bond Fund Market?

Key players in the Convertible Bond Fund Market include investment firms such as Franklin Templeton, BlackRock, and PIMCO, which manage a variety of convertible bond funds. These companies focus on different strategies and sectors, catering to diverse investor needs, among others.

What are the growth factors driving the Convertible Bond Fund Market?

The Convertible Bond Fund Market is driven by factors such as low-interest rates, which make convertible bonds more attractive, and increasing demand for hybrid securities among investors seeking both income and growth. Additionally, the rising trend of corporate debt issuance supports the market’s expansion.

What challenges does the Convertible Bond Fund Market face?

The Convertible Bond Fund Market faces challenges such as interest rate volatility, which can affect bond prices, and credit risk associated with the underlying companies. Furthermore, market sentiment can impact the attractiveness of converting bonds into equities, posing risks to fund performance.

What opportunities exist in the Convertible Bond Fund Market?

Opportunities in the Convertible Bond Fund Market include the potential for increased issuance of convertible bonds as companies seek flexible financing options. Additionally, the growing interest in sustainable investing may lead to the development of green convertible bonds, attracting environmentally conscious investors.

What trends are shaping the Convertible Bond Fund Market?

Trends shaping the Convertible Bond Fund Market include the increasing integration of technology in fund management, such as algorithmic trading and data analytics. Moreover, there is a growing focus on ESG factors, influencing investment decisions and fund strategies.

Convertible Bond Fund Market

| Segmentation Details | Description |

|---|---|

| Fund Structure | Open-End, Closed-End, Interval, Exchange-Traded |

| Investor Type | Institutional, Retail, High-Net-Worth, Pension Funds |

| Investment Strategy | Active Management, Passive Management, Hybrid, Tactical Allocation |

| Asset Class | Equity-Linked, Fixed Income, Hybrid Securities, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Convertible Bond Fund Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at