444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

Continuous testing has become a critical component of software development, enabling teams to deliver high-quality applications at speed. The global continuous testing market is expected to grow from $1.1 billion in 2020 to $2.2 billion by 2025, at a CAGR of 14.8% during the forecast period (2020-2025).

This growth is being driven by the need for businesses to stay competitive by accelerating their software development lifecycles, the rise of agile and DevOps methodologies, and the increasing adoption of cloud computing and digital transformation initiatives.

In this article, we will explore the continuous testing market in detail, including its definition, key market insights, drivers, restraints, opportunities, dynamics, segmentation, regional analysis, competitive landscape, key trends, COVID-19 impact, industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Continuous testing refers to the process of running automated tests at every stage of the software development lifecycle, from code creation to deployment, to ensure that the application functions as intended and meets the required quality standards.

The goal of continuous testing is to enable teams to catch defects early in the development cycle, when they are less costly and time-consuming to fix. This helps to reduce the overall time-to-market and improve the quality of the application, ultimately leading to better customer satisfaction and increased revenue.

Executive Summary

The global continuous testing market is expected to grow at a CAGR of 14.8% during the forecast period (2020-2025), driven by the need for businesses to stay competitive by accelerating their software development lifecycles, the rise of agile and DevOps methodologies, and the increasing adoption of cloud computing and digital transformation initiatives.

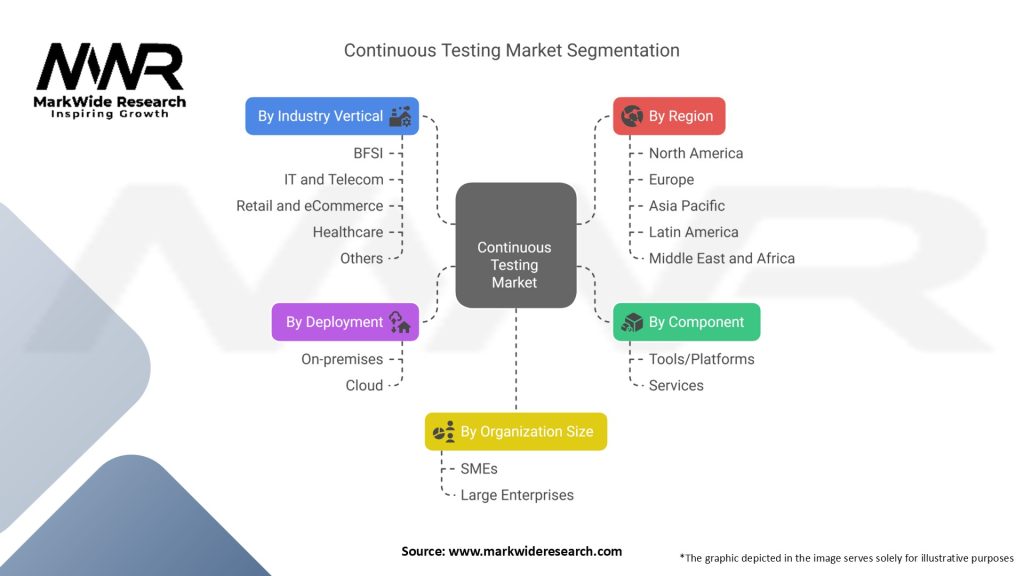

The market is segmented by component (tools/ solutions, services), deployment (on-premises, cloud), organization size (large enterprises, small and medium-sized enterprises), industry vertical (BFSI, healthcare, IT and telecom, retail, manufacturing, others), and region (North America, Europe, Asia-Pacific, Middle East and Africa, Latin America).

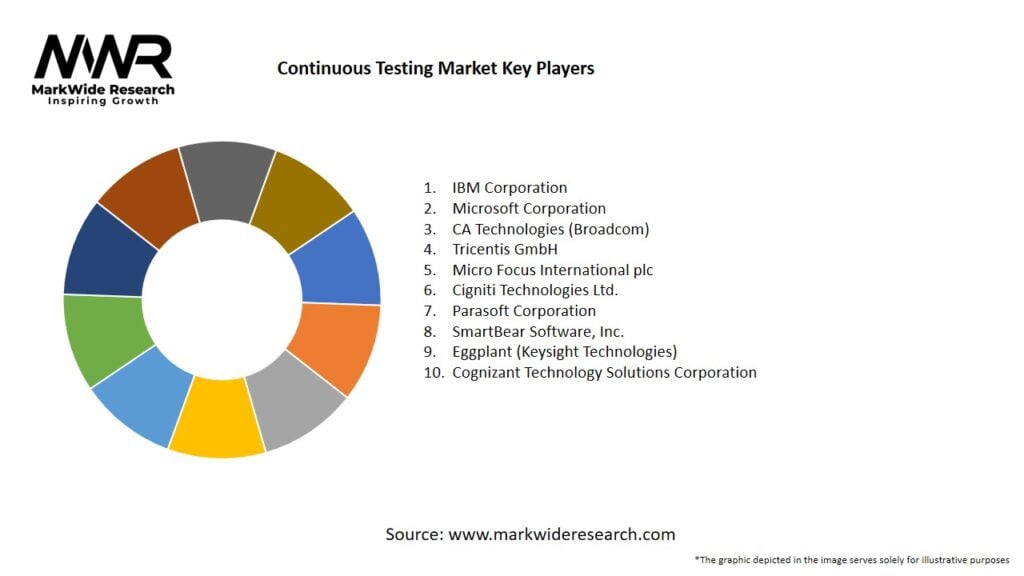

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The increasing demand for software applications that can be released quickly and continuously has led to the adoption of agile and DevOps practices, which require continuous testing to ensure that the application meets the required quality standards. Continuous testing helps to reduce the time-to-market by catching defects early in the development cycle, enabling teams to fix them before they become more costly and time-consuming to fix during later stages of the software development lifecycle.

Agile and DevOps methodologies have become increasingly popular in recent years, driven by the need for businesses to stay competitive and deliver high-quality software applications at speed. Continuous testing is a key component of both agile and DevOps, enabling teams to ensure that the application functions as intended and meets the required quality standards at every stage of the software development lifecycle.

The adoption of cloud computing and digital transformation initiatives has led to the need for faster and more reliable software development and deployment. Continuous testing enables teams to catch defects early in the development cycle and ensure that the application meets the required quality standards, ultimately leading to better customer satisfaction and increased revenue.

Market Restraints

The implementation of continuous testing requires a significant initial investment in tools, infrastructure, and personnel, which can be a barrier for some businesses, especially smaller enterprises.

Continuous testing requires skilled personnel who are experienced in test automation, scripting, and other technical skills. The lack of such personnel can be a challenge for businesses, especially in regions where the talent pool is limited.

Market Opportunities

The Integration of artificial intelligence and machine learning into continuous testing can enable more intelligent and efficient testing, improving the accuracy and effectiveness of the testing process.

Low-code development platforms are becoming increasingly popular, enabling businesses to build software applications with minimal coding knowledge. The integration of continuous testing into these platforms can enable even non-technical users to ensure that their applications meet the required quality standards.

Market Dynamics

The global continuous testing market is highly competitive, with a large number of players offering a variety of tools, solutions, and services. The market is characterized by constant innovation and the emergence of new technologies, such as artificial intelligence and machine learning, which are being integrated into continuous testing to improve the accuracy and efficiency of the testing process.

Regional Analysis

The global continuous testing market is segmented by region into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America. North America is expected to hold the largest market share during the forecast period, due to the presence of a large number of IT companies and the early adoption of DevOps and agile practices. The Asia-Pacific region is expected to grow at the fastest rate during the forecast period, driven by the increasing adoption of cloud computing and digital transformation initiatives.

Competitive Landscape

Leading companies in the Continuous Testing market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global continuous testing market is segmented by component into tools/ solutions and services. By deployment, the market is segmented into on-premises and cloud. By organization size, the market is segmented into large enterprises and small and medium-sized enterprises. By industry vertical, the market is segmented into BFSI, healthcare, IT and telecom, retail, manufacturing, and others.

Category-wise Insights

The tools/ solutions segment is expected to hold the largest market share during the forecast period, driven by the increasing adoption of DevOps practices and the need for faster time-to-market. The key players in this segment include IBM, CA Technologies, Microsoft, Tricentis, and SmartBear.

The services segment is expected to grow at a faster rate than the tools/ solutions segment, driven by the increasing demand for consulting, training, and support services. The key players in this segment include Cognizant, Capgemini, Accenture, Infosys, and Wipro.

The on-premises deployment segment is expected to hold a significant market share during the forecast period, driven by the need for control and security. This segment is particularly popular in industries such as healthcare and financial services. The key players in this segment include IBM, CA Technologies, and Micro Focus.

The cloud deployment segment is expected to grow at a faster rate than the on-premises deployment segment, due to the benefits of scalability, flexibility, and cost-effectiveness. This segment is particularly popular in industries such as retail and manufacturing. The key players in this segment include Microsoft, Tricentis, and SmartBear.

The large enterprises segment is expected to hold the largest market share during the forecast period, due to their greater resources and ability to invest in continuous testing tools and services. The key players in this segment include IBM, CA Technologies, Microsoft, and Tricentis.

The small and medium-sized enterprises segment is expected to grow at a faster rate than the large enterprises segment, due to the increasing adoption of agile and DevOps practices in these organizations. The key players in this segment include SmartBear, Cognizant, and Capgemini.

The BFSI industry vertical is expected to hold the largest market share during the forecast period, due to the increasing demand for digital banking services and the need for secure and reliable software applications. The key players in this segment include IBM, CA Technologies, Microsoft, and Tricentis.

The healthcare industry vertical is expected to grow at a faster rate than other industry verticals, due to the increasing adoption of electronic medical records and telemedicine services. The key players in this segment include Cognizant, Micro Focus, and SmartBear.

Key Benefits for Industry Participants and Stakeholders

Continuous testing enables teams to catch defects early in the development cycle, reducing the time and cost required to fix them during later stages of the software development lifecycle.

Continuous testing helps to ensure that the application functions as intended and meets the required quality standards, leading to better customer satisfaction and increased revenue.

Continuous testing enables teams to automate the testing process, reducing the need for manual testing and enabling teams to focus on other critical tasks.

Continuous testing encourages collaboration and communication between different teams and departments, leading to greater efficiency and better outcomes.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The integration of artificial intelligence and machine learning into continuous testing is a key trend in the market, as it enables more intelligent and efficient testing, improving the accuracy and effectiveness of the testing process.

Low-code development platforms are becoming increasingly popular, enabling businesses to build software applications with minimal coding knowledge. The integration of continuous testing into these platforms can enable even non-technical users to ensure that their applications meet the required quality standards.

There is a growing shift towards cloud-based continuous testing, as businesses seek to take advantage of the benefits of scalability, flexibility, and cost-effectiveness that cloud computing offers.

Test automation and CI/CD are becoming increasingly important in the continuous testing market, as businesses seek to reduce the time-to-market and improve the quality of their software applications.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the continuous testing market, as businesses around the world have been forced to adapt to remote working and the need for digital transformation. The pandemic has accelerated the adoption of agile and DevOps practices, as businesses seek to stay competitive and deliver high-quality software applications at speed.

The pandemic has also highlighted the importance of continuous testing in ensuring that software applications are reliable and secure, particularly in industries such as healthcare and financial services. The shift towards cloud-based continuous testing has also accelerated, as businesses seek to take advantage of the benefits of cloud computing and remote work.

Key Industry Developments

In 2020, IBM announced the acquisition of TRIRIGA, a leading provider of continuous testing solutions for the real estate and facilities management industry. The acquisition is expected to enhance IBM’s capabilities in the continuous testing market.

In 2021, Micro Focus announced the acquisition of Astute Business Solutions, a leading provider of continuous testing solutions for the healthcare industry. The acquisition is expected to enhance Micro Focus’s capabilities in the healthcare sector.

Analyst Suggestions

Analysts suggest that the continuous testing market will continue to grow in the coming years, driven by the increasing adoption of agile and DevOps practices, the shift towards cloud-based continuous testing, and the emergence of new technologies such as artificial intelligence and machine learning.

They also suggest that businesses should focus on test automation and CI/CD, as well as the integration of continuous testing into low-code development platforms, to stay competitive and deliver high-quality software applications at speed.

Future Outlook

The future outlook for the continuous testing market is positive, with continued growth expected in the coming years. The integration of artificial intelligence and machine learning into continuous testing is expected to drive innovation and improve the accuracy and efficiency of the testing process.

The shift towards cloud-based continuous testing is also expected to accelerate, as businesses seek to take advantage of the benefits of cloud computing and remote work. The emergence of low-code development platforms is also expected to create new opportunities for businesses to build and test software applications with minimal coding knowledge.

Conclusion

Continuous testing has become a critical component of software development, enabling teams to deliver high-quality applications at speed. The global continuous testing market is expected to grow from $1.1 billion in 2020 to $2.2 billion by 2025, at a CAGR of 14.8% during the forecast period (2020-2025).

What is continuous testing?

Continuous testing refers to the practice of executing automated tests as part of the software delivery pipeline. It aims to provide immediate feedback on the quality of the software, ensuring that any issues are identified and addressed promptly throughout the development process.

Who are the key players in the continuous testing market?

Key players in the continuous testing market include companies like Micro Focus, Tricentis, and SmartBear, which offer various tools and solutions for automated testing. These companies focus on enhancing software quality and accelerating delivery cycles, among others.

What are the main drivers of growth in the continuous testing market?

The main drivers of growth in the continuous testing market include the increasing demand for faster software delivery, the rise of DevOps practices, and the need for improved software quality. Additionally, the growing complexity of applications and the need for continuous integration and deployment are significant factors.

What challenges does the continuous testing market face?

Challenges in the continuous testing market include the integration of testing tools with existing development environments, the need for skilled personnel, and the management of test data. Additionally, ensuring comprehensive test coverage in complex applications can be a significant hurdle.

What opportunities exist in the continuous testing market?

Opportunities in the continuous testing market include the expansion of AI and machine learning in testing processes, the growth of cloud-based testing solutions, and the increasing adoption of agile methodologies. These trends can lead to more efficient testing practices and improved software quality.

What trends are shaping the continuous testing market?

Trends shaping the continuous testing market include the rise of shift-left testing, where testing is integrated earlier in the development process, and the increasing use of test automation tools. Additionally, the focus on DevOps and continuous delivery practices is driving innovation in testing methodologies.

Continuous Testing Market:

| Segmentation Details | Description |

|---|---|

| By Component | Tools/Platforms, Services |

| By Deployment | On-premises, Cloud |

| By Organization Size | Small and Medium-sized Enterprises (SMEs), Large Enterprises |

| By Industry Vertical | BFSI, IT and Telecom, Retail and eCommerce, Healthcare, Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Continuous Testing market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at