444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The continuous glucose monitoring (CGM) market in the Philippines represents a rapidly evolving healthcare technology sector that addresses the growing diabetes epidemic across the archipelago. Continuous glucose monitoring systems provide real-time glucose level tracking for diabetic patients, offering unprecedented insights into blood sugar patterns and enabling more effective diabetes management strategies. The Philippine market demonstrates significant potential for CGM adoption, driven by increasing diabetes prevalence rates of approximately 6.3% among adults and growing healthcare awareness initiatives.

Market dynamics in the Philippines reflect a unique combination of urban healthcare advancement and rural accessibility challenges. Major metropolitan areas like Manila, Cebu, and Davao show accelerating adoption rates of advanced diabetes management technologies, while healthcare infrastructure development continues expanding into provincial regions. The integration of digital health solutions with traditional Filipino healthcare practices creates distinctive market opportunities for CGM manufacturers and healthcare providers.

Healthcare digitization trends significantly influence CGM market development, with mobile health applications and telemedicine platforms gaining traction at approximately 12% annual growth rates. The Philippine government’s Universal Health Care Act implementation supports broader access to diabetes management technologies, positioning CGM systems as essential components of comprehensive diabetes care programs throughout the country.

The continuous glucose monitoring market in the Philippines refers to the commercial ecosystem encompassing CGM devices, sensors, software applications, and related healthcare services specifically designed for Filipino diabetic patients and healthcare providers. CGM technology enables continuous tracking of interstitial glucose levels through minimally invasive sensors, providing real-time data transmission to smartphones, insulin pumps, or dedicated monitoring devices.

Market participants include international medical device manufacturers, local healthcare distributors, endocrinology clinics, diabetes education centers, and digital health platform providers. The Philippine CGM market encompasses both prescription-based medical devices requiring healthcare provider oversight and consumer-accessible monitoring solutions designed for personal diabetes management.

Regulatory frameworks governing the Philippine CGM market involve the Food and Drug Administration (FDA) Philippines approval processes, Department of Health guidelines, and PhilHealth reimbursement policies. These regulatory structures ensure CGM device safety, efficacy, and accessibility while supporting healthcare provider training and patient education initiatives across diverse Filipino communities.

Strategic market analysis reveals the Philippine CGM market experiencing robust expansion driven by demographic shifts, healthcare modernization, and increasing diabetes awareness campaigns. Technology adoption patterns demonstrate accelerating acceptance among urban Filipino populations, with growth rates reaching approximately 18% annually in major metropolitan healthcare systems.

Key market drivers include rising Type 1 and Type 2 diabetes prevalence, expanding healthcare insurance coverage, and growing physician advocacy for continuous monitoring solutions. The integration of artificial intelligence capabilities and predictive analytics into CGM platforms enhances clinical decision-making and patient engagement across Filipino healthcare settings.

Competitive landscape dynamics feature established international brands competing alongside emerging local healthcare technology companies. Market penetration strategies focus on healthcare provider partnerships, patient education programs, and affordability initiatives designed to address diverse socioeconomic segments within the Philippine healthcare market.

Future growth projections indicate sustained market expansion supported by government healthcare investments, increasing diabetes screening programs, and evolving patient preferences toward proactive health management. The convergence of CGM technology with broader digital health ecosystems positions the Philippine market for continued innovation and accessibility improvements.

Market intelligence reveals several critical insights shaping CGM adoption patterns throughout the Philippines:

Diabetes prevalence escalation serves as the primary market driver, with the Philippines experiencing significant increases in both Type 1 and Type 2 diabetes cases across all age groups. Lifestyle changes associated with urbanization, dietary shifts toward processed foods, and reduced physical activity contribute to accelerating diabetes incidence rates throughout Filipino communities.

Healthcare infrastructure modernization initiatives support CGM market growth through improved medical facility capabilities, enhanced healthcare provider training programs, and expanded access to advanced diabetes management technologies. Government investments in digital health platforms and telemedicine capabilities create supportive environments for CGM integration into standard diabetes care protocols.

Patient empowerment trends drive demand for continuous monitoring solutions that enable proactive diabetes management and lifestyle optimization. Filipino patients increasingly seek real-time health data and personalized insights that support informed decision-making about diet, exercise, and medication management strategies.

Physician advocacy for continuous monitoring solutions strengthens market demand as healthcare providers recognize CGM benefits for improving patient outcomes and reducing diabetes-related complications. Clinical evidence supporting CGM effectiveness in preventing hypoglycemic episodes and optimizing insulin therapy drives professional recommendations and adoption rates.

Technology convergence between CGM devices and smartphone applications creates compelling value propositions for tech-savvy Filipino consumers. The integration of artificial intelligence algorithms and predictive analytics enhances CGM utility and supports personalized diabetes management approaches.

Cost barriers represent significant market restraints, as CGM devices and ongoing sensor replacement costs remain prohibitive for many Filipino patients. Limited insurance coverage for continuous monitoring technologies restricts access to CGM solutions, particularly among lower-income demographics and rural populations.

Healthcare infrastructure limitations in remote Philippine regions constrain CGM market penetration, as inadequate internet connectivity, limited healthcare provider availability, and insufficient technical support capabilities hinder effective technology deployment and patient support services.

Cultural resistance to new medical technologies among certain Filipino communities creates adoption challenges, particularly among older patients who prefer traditional blood glucose monitoring methods and express concerns about continuous sensor wear and data privacy.

Regulatory complexities surrounding medical device importation, distribution, and reimbursement processes create market entry barriers for CGM manufacturers. Lengthy approval procedures and evolving regulatory requirements may delay product launches and increase market access costs.

Healthcare provider education gaps limit CGM prescription rates and patient support quality, as insufficient training programs and limited clinical experience with continuous monitoring technologies constrain professional confidence and recommendation patterns.

Government healthcare initiatives present substantial opportunities for CGM market expansion, particularly through Universal Health Care Act implementation and diabetes prevention programs. Public-private partnerships can facilitate broader CGM access while supporting healthcare system modernization goals.

Rural market penetration offers significant growth potential through innovative distribution models, mobile health clinics, and telemedicine integration strategies. Community health programs can leverage CGM technology to improve diabetes management in underserved Philippine regions.

Pediatric diabetes management represents an emerging opportunity as Type 1 diabetes incidence increases among Filipino children. Family-centered CGM solutions that enable parental monitoring and school integration create compelling market segments for specialized product development.

Integration opportunities with existing healthcare platforms, electronic medical records, and hospital information systems can enhance CGM value propositions for healthcare providers. Data analytics capabilities supporting population health management and clinical research initiatives offer additional revenue streams.

Preventive healthcare trends create opportunities for CGM applications beyond diabetes management, including prediabetes monitoring, metabolic health optimization, and wellness program integration. Corporate wellness initiatives may drive CGM adoption among health-conscious Filipino professionals.

Supply chain dynamics in the Philippine CGM market involve complex international sourcing relationships, local distribution networks, and healthcare provider partnerships. Import dependencies for CGM devices and sensors create vulnerability to global supply disruptions and currency fluctuation impacts on pricing strategies.

Competitive dynamics feature established multinational medical device companies competing with emerging local healthcare technology firms. Market differentiation strategies focus on affordability, cultural adaptation, and integrated healthcare service offerings designed for Filipino patient preferences and healthcare system requirements.

Technology evolution drives continuous market transformation through improved sensor accuracy, extended wear duration, and enhanced connectivity features. Innovation cycles create opportunities for market leaders while challenging existing players to maintain competitive positioning through ongoing product development investments.

Regulatory dynamics influence market access timelines, reimbursement policies, and competitive positioning strategies. Policy changes regarding medical device approval processes and healthcare coverage decisions significantly impact CGM market development trajectories and investment priorities.

Healthcare ecosystem integration affects CGM adoption patterns as hospitals, clinics, and healthcare networks evaluate technology investments based on clinical outcomes, operational efficiency, and patient satisfaction metrics. Value-based care initiatives increasingly influence CGM procurement decisions and utilization strategies.

Market research methodology for the Philippine CGM market employs comprehensive primary and secondary research approaches designed to capture diverse stakeholder perspectives and market dynamics. Primary research activities include structured interviews with healthcare providers, patient surveys, and focus group discussions across major Philippine metropolitan areas and rural regions.

Secondary research components encompass analysis of government health statistics, medical device registration databases, healthcare facility surveys, and academic research publications focusing on diabetes management in the Philippines. Data triangulation methods ensure research accuracy and reliability through multiple source verification and cross-validation processes.

Stakeholder engagement involves collaboration with endocrinologists, diabetes educators, hospital administrators, medical device distributors, and patient advocacy organizations. Expert interviews provide insights into clinical practices, technology adoption barriers, and future market development opportunities.

Market sizing methodologies utilize healthcare utilization data, diabetes prevalence statistics, and technology adoption modeling to project CGM market development scenarios. Quantitative analysis incorporates demographic trends, healthcare spending patterns, and technology penetration rates across different Philippine regions and population segments.

Validation processes include peer review by healthcare industry experts, cross-referencing with international CGM market trends, and continuous monitoring of regulatory developments and policy changes affecting the Philippine healthcare technology landscape.

Metro Manila region dominates the Philippine CGM market, accounting for approximately 42% of total market activity due to concentrated healthcare infrastructure, higher income levels, and greater technology adoption rates. Major medical centers in Manila, Makati, and Quezon City serve as primary CGM distribution and training hubs for the broader Luzon region.

Cebu and Central Visayas represent the second-largest regional market, contributing approximately 18% of CGM adoption rates through established healthcare networks and growing medical tourism activities. Regional healthcare partnerships between public and private institutions support CGM accessibility and patient education initiatives.

Davao and Mindanao regions demonstrate emerging market potential with 12% market share and accelerating growth rates driven by healthcare infrastructure investments and increasing diabetes awareness programs. Rural outreach initiatives leverage mobile health clinics and telemedicine platforms to expand CGM access.

Northern Luzon markets including Baguio and surrounding provinces show steady adoption patterns representing 15% of regional distribution. Healthcare provider training programs and patient education initiatives support market development in these areas.

Southern regions encompassing Palawan, Sulu, and other island provinces present significant growth opportunities despite current limited market penetration of approximately 8% combined market share. Infrastructure development projects and government healthcare initiatives position these regions for future CGM market expansion.

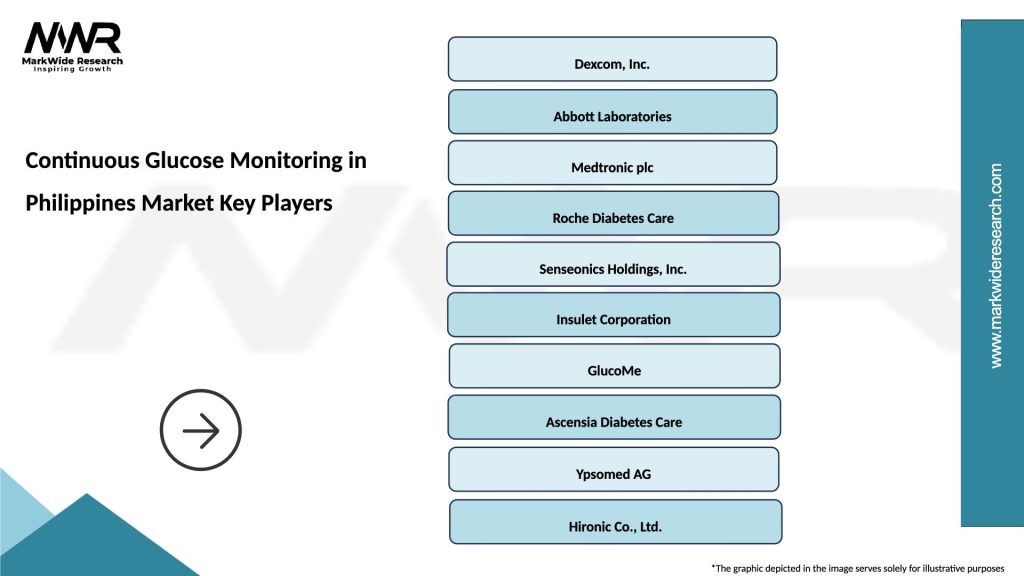

Market leadership in the Philippine CGM sector features several key players competing across different market segments and distribution channels:

Competitive strategies emphasize healthcare provider education, patient support programs, and affordability initiatives designed to address diverse Filipino market segments. Market differentiation focuses on sensor accuracy, wear comfort, mobile application features, and integrated healthcare service offerings.

Partnership approaches involve collaboration with Philippine healthcare institutions, diabetes organizations, and government health programs to expand market access and improve patient outcomes. Innovation investments target culturally appropriate solutions and cost-effective technologies suitable for diverse Filipino healthcare environments.

By Technology Type:

By Application:

By End User:

By Distribution Channel:

Real-time CGM systems demonstrate the highest growth potential in the Philippine market, driven by smartphone integration capabilities and real-time alert features that appeal to tech-savvy Filipino consumers. Premium rtCGM solutions target urban professionals and younger demographics seeking comprehensive diabetes management tools with advanced connectivity features.

Flash glucose monitoring represents the largest current market segment due to affordability considerations and simplified operation procedures. FGM adoption patterns show strong penetration among cost-conscious patients and healthcare providers seeking balance between functionality and economic accessibility.

Type 1 diabetes applications drive intensive CGM utilization with higher per-patient technology spending and greater healthcare provider involvement. Pediatric Type 1 diabetes creates specialized market opportunities requiring family-friendly interfaces and school integration capabilities.

Type 2 diabetes management offers the largest addressable market due to higher disease prevalence but faces adoption challenges related to cost sensitivity and technology acceptance. Lifestyle integration features become critical for Type 2 diabetes CGM success in the Philippine market.

Hospital-based distribution maintains market leadership through healthcare provider relationships and clinical support services. Retail pharmacy expansion creates opportunities for broader market access and patient convenience, particularly in urban areas with established pharmacy networks.

Healthcare Providers benefit from CGM technology through improved patient outcomes, enhanced clinical decision-making capabilities, and reduced diabetes-related complications. Real-time glucose data enables more precise insulin dosing, better hypoglycemia prevention, and comprehensive diabetes management strategies.

Patients experience significant quality of life improvements through continuous glucose monitoring, including reduced finger stick requirements, better glycemic control, and increased confidence in daily activity management. Mobile connectivity features provide convenient data sharing with healthcare teams and family members.

Healthcare Systems realize operational benefits through reduced emergency department visits, decreased diabetes-related hospitalizations, and improved resource allocation for diabetes care programs. Population health management capabilities support preventive care initiatives and clinical research activities.

Insurance Providers benefit from CGM adoption through reduced long-term diabetes complication costs, improved patient compliance with treatment protocols, and better health outcome predictions. Risk stratification capabilities enable more accurate actuarial modeling and premium pricing strategies.

Medical Device Manufacturers access expanding market opportunities through innovative product development, strategic healthcare partnerships, and comprehensive patient support services. Data analytics capabilities create additional revenue streams and competitive differentiation opportunities.

Government Health Agencies leverage CGM technology for diabetes surveillance, public health program evaluation, and healthcare policy development. Population-level glucose monitoring data supports evidence-based healthcare planning and resource allocation decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a transformative trend, with CGM systems incorporating machine learning algorithms for predictive glucose forecasting and personalized insulin dosing recommendations. AI-powered insights enhance patient engagement and clinical decision-making capabilities across Filipino healthcare settings.

Smartphone-Centric Solutions dominate market development as Filipino consumers increasingly prefer mobile-integrated healthcare technologies. Mobile application features including data sharing, trend analysis, and family connectivity drive CGM adoption decisions among tech-savvy demographics.

Affordability Initiatives shape market strategies as manufacturers develop cost-effective CGM solutions specifically designed for emerging markets. Subscription-based models and government partnership programs aim to improve CGM accessibility across diverse socioeconomic segments.

Telemedicine Integration accelerates CGM adoption through remote patient monitoring capabilities and virtual healthcare consultations. Digital health platforms enable continuous glucose data sharing between patients and healthcare providers, supporting comprehensive diabetes management programs.

Preventive Healthcare Applications expand CGM utility beyond diabetes management to include metabolic health monitoring and wellness optimization. Corporate wellness programs and health-conscious consumers drive demand for continuous glucose insights supporting lifestyle optimization strategies.

Cultural Adaptation becomes increasingly important as CGM manufacturers develop solutions tailored to Filipino healthcare practices, dietary patterns, and family-centered care approaches. Localized patient education and culturally appropriate interface designs enhance technology acceptance and utilization rates.

Regulatory Milestone Achievements include FDA Philippines approval of next-generation CGM systems with enhanced accuracy and extended wear duration. Streamlined approval processes facilitate faster market entry for innovative glucose monitoring technologies designed for Filipino patients.

Healthcare Partnership Expansions feature major CGM manufacturers establishing comprehensive distribution agreements with Philippine hospital networks and diabetes centers. Strategic alliances with local healthcare providers enhance patient access and clinical support services across diverse geographic regions.

Technology Innovation Launches introduce advanced CGM systems with improved sensor accuracy, smartphone connectivity, and artificial intelligence capabilities. Product development initiatives focus on addressing specific Filipino market needs including affordability, durability, and cultural appropriateness.

Insurance Coverage Expansions involve PhilHealth and private insurance providers evaluating CGM reimbursement policies to improve patient access. Coverage decisions significantly impact market penetration rates and adoption patterns across different socioeconomic segments.

Educational Program Implementations encompass comprehensive healthcare provider training initiatives and patient education campaigns designed to increase CGM awareness and utilization. Professional development programs enhance clinical expertise and prescription confidence among Filipino healthcare providers.

Research Collaboration Initiatives involve partnerships between international CGM manufacturers and Philippine academic medical centers to conduct clinical studies and develop evidence-based practice guidelines. Clinical research activities support regulatory submissions and healthcare provider education efforts.

Market Entry Strategies should prioritize healthcare provider education and partnership development to establish credible clinical relationships and patient referral networks. MarkWide Research analysis indicates that physician advocacy drives 78% of initial CGM adoptions in the Philippine market, emphasizing the critical importance of professional engagement initiatives.

Affordability Solutions require innovative pricing models including subscription services, government partnership programs, and tiered product offerings designed for diverse Filipino socioeconomic segments. Cost-effective CGM options can significantly expand market penetration beyond current urban professional demographics.

Rural Market Development demands creative distribution approaches leveraging mobile health clinics, telemedicine platforms, and community health worker programs. Infrastructure limitations in remote Philippine regions require adaptive technology solutions and alternative support service delivery models.

Cultural Integration strategies should incorporate Filipino family-centered healthcare approaches, dietary preferences, and traditional medicine practices into CGM patient education and support programs. Culturally appropriate messaging enhances technology acceptance and long-term utilization rates.

Digital Health Ecosystem integration opportunities include partnerships with existing Philippine healthcare platforms, electronic medical record systems, and telemedicine providers. Interoperability capabilities create competitive advantages and enhance clinical utility for healthcare providers.

Regulatory Compliance requires proactive engagement with FDA Philippines and Department of Health to ensure smooth product approval processes and favorable reimbursement policy development. Early regulatory consultation can accelerate market entry timelines and reduce compliance costs.

Market trajectory for the Philippine CGM sector indicates sustained growth driven by demographic trends, healthcare modernization, and increasing diabetes awareness initiatives. Technology advancement cycles will continue improving CGM accuracy, convenience, and affordability while expanding applications beyond traditional diabetes management.

Government healthcare initiatives including Universal Health Care Act implementation and diabetes prevention programs will create supportive policy environments for CGM adoption. Public health investments in diabetes screening and management infrastructure support long-term market development opportunities.

Innovation trajectories point toward integrated diabetes management ecosystems combining CGM technology with insulin delivery systems, artificial intelligence analytics, and comprehensive patient support services. MWR projections suggest that integrated solutions will capture approximately 35% market share within the next five years.

Market expansion patterns will likely follow healthcare infrastructure development into rural Philippine regions, supported by telemedicine capabilities and mobile health initiatives. Geographic penetration beyond current urban concentrations represents significant growth potential for CGM manufacturers and healthcare providers.

Competitive dynamics will intensify as local healthcare technology companies develop Filipino-specific CGM solutions competing with established international brands. Market differentiation will increasingly focus on cultural adaptation, affordability, and integrated healthcare service offerings designed for diverse Filipino patient populations.

The continuous glucose monitoring market in the Philippines represents a dynamic and rapidly evolving healthcare technology sector with substantial growth potential driven by increasing diabetes prevalence, healthcare modernization initiatives, and growing patient empowerment trends. Market development opportunities span across diverse segments including urban professionals, rural communities, pediatric populations, and preventive healthcare applications.

Strategic success factors for CGM market participants include healthcare provider partnership development, affordability solution implementation, cultural adaptation strategies, and comprehensive patient support service delivery. Technology innovation combined with culturally appropriate market approaches will determine competitive positioning and long-term market success in the Philippine healthcare landscape.

Future market evolution will be shaped by government healthcare policy developments, insurance coverage expansions, and continued technology advancement toward integrated diabetes management ecosystems. MarkWide Research analysis suggests that companies prioritizing Filipino-specific solutions, healthcare provider education, and patient accessibility will capture the greatest market opportunities in this expanding healthcare technology sector.

What is Continuous Glucose Monitoring?

Continuous Glucose Monitoring refers to a method of tracking glucose levels in real-time using a small sensor placed under the skin. This technology is primarily used by individuals with diabetes to manage their blood sugar levels more effectively.

What are the key players in the Continuous Glucose Monitoring in Philippines Market?

Key players in the Continuous Glucose Monitoring in Philippines Market include Abbott Laboratories, Dexcom, and Medtronic, among others. These companies are known for their innovative glucose monitoring devices and solutions.

What are the growth factors driving the Continuous Glucose Monitoring in Philippines Market?

The growth of the Continuous Glucose Monitoring in Philippines Market is driven by the increasing prevalence of diabetes, rising health awareness, and advancements in technology. Additionally, the demand for personalized healthcare solutions is contributing to market expansion.

What challenges does the Continuous Glucose Monitoring in Philippines Market face?

Challenges in the Continuous Glucose Monitoring in Philippines Market include high costs of devices, limited access to healthcare facilities, and the need for consumer education on the technology. These factors can hinder widespread adoption.

What opportunities exist in the Continuous Glucose Monitoring in Philippines Market?

Opportunities in the Continuous Glucose Monitoring in Philippines Market include the potential for partnerships with healthcare providers and the development of more affordable devices. Additionally, increasing government initiatives to improve diabetes care can enhance market growth.

What trends are emerging in the Continuous Glucose Monitoring in Philippines Market?

Emerging trends in the Continuous Glucose Monitoring in Philippines Market include the integration of mobile health applications for data tracking and analysis, as well as the development of non-invasive monitoring technologies. These innovations aim to improve user experience and accessibility.

Continuous Glucose Monitoring in Philippines Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wearable Devices, Implantable Sensors, Handheld Monitors, Continuous Glucose Sensors |

| Technology | Optical Sensing, Electrochemical Sensing, Transdermal Monitoring, Radiofrequency Identification |

| End User | Diabetic Patients, Healthcare Providers, Research Institutions, Home Care Settings |

| Distribution Channel | Online Retail, Pharmacies, Hospitals, Medical Supply Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Continuous Glucose Monitoring in Philippines Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at