444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The construction testing, inspection, and certification market represents a critical segment of the global construction industry, encompassing comprehensive quality assurance services that ensure structural integrity, safety compliance, and regulatory adherence across diverse construction projects. This specialized market has experienced substantial growth driven by increasing infrastructure development, stringent building codes, and heightened safety awareness across residential, commercial, and industrial construction sectors.

Market dynamics indicate robust expansion fueled by urbanization trends, government infrastructure investments, and evolving construction technologies requiring specialized testing protocols. The sector encompasses various testing methodologies including non-destructive testing, material analysis, structural assessments, and environmental compliance verification. Growing at a significant CAGR of 6.2%, the market demonstrates strong resilience and adaptation to emerging construction challenges.

Regional distribution shows North America and Europe maintaining dominant positions, accounting for approximately 58% of global market share, while Asia-Pacific emerges as the fastest-growing region with accelerated urbanization and infrastructure development initiatives. The market’s evolution reflects increasing emphasis on sustainable construction practices, digital transformation in testing procedures, and integration of advanced technologies such as artificial intelligence and IoT-enabled monitoring systems.

The construction testing, inspection, and certification market refers to the comprehensive ecosystem of specialized services designed to evaluate, verify, and certify the quality, safety, and compliance of construction materials, processes, and completed structures throughout the entire construction lifecycle.

Testing services encompass laboratory analysis of construction materials, field testing of structural components, and performance evaluation of building systems. Inspection activities involve systematic examination of construction work, adherence to design specifications, and compliance with building codes and safety regulations. Certification processes provide official documentation confirming that construction projects meet established standards, regulatory requirements, and industry best practices.

This market serves as a critical quality gateway ensuring that construction projects achieve desired performance standards, maintain structural integrity, and provide safe environments for occupants. The sector encompasses diverse service categories including geotechnical testing, concrete analysis, steel inspection, environmental assessments, and specialized testing for emerging construction technologies and sustainable building materials.

Market fundamentals demonstrate strong growth trajectory supported by increasing construction activity, regulatory compliance requirements, and technological advancement in testing methodologies. The construction testing, inspection, and certification sector has evolved into an indispensable component of modern construction processes, with quality assurance becoming increasingly sophisticated and comprehensive.

Key growth drivers include infrastructure modernization initiatives, stringent building safety regulations, and growing awareness of construction quality impacts on long-term performance and sustainability. The market benefits from technological integration with approximately 42% of service providers adopting digital testing platforms and automated reporting systems to enhance efficiency and accuracy.

Competitive landscape features a mix of established multinational corporations and specialized regional providers, with market consolidation trends creating opportunities for enhanced service offerings and geographic expansion. The sector demonstrates resilience through economic cycles, maintaining steady demand driven by essential safety and compliance requirements across all construction segments.

Future prospects indicate continued expansion supported by emerging construction technologies, sustainability requirements, and increasing complexity of modern building systems requiring specialized testing expertise and certification processes.

Infrastructure development initiatives serve as primary market catalysts, with governments worldwide investing heavily in transportation networks, utilities, and public facilities requiring comprehensive testing and certification services. These large-scale projects demand extensive quality assurance protocols to ensure structural integrity and long-term performance, creating sustained demand for specialized testing services.

Regulatory compliance requirements continue expanding as building codes become more stringent and comprehensive, particularly regarding seismic safety, fire resistance, and environmental impact. Construction projects must demonstrate adherence to increasingly complex regulatory frameworks, driving demand for certified inspection services and compliance documentation throughout project lifecycles.

Technological advancement in construction materials and methods necessitates corresponding evolution in testing capabilities. New composite materials, prefabricated components, and innovative construction techniques require specialized testing protocols and certification processes, with approximately 38% of testing demand now focused on emerging construction technologies and sustainable building materials.

Safety awareness has intensified following high-profile construction failures and accidents, leading to increased emphasis on comprehensive testing and inspection programs. Project stakeholders prioritize risk mitigation through thorough quality assurance processes, recognizing that investment in testing services prevents costly failures and ensures occupant safety.

Cost pressures in construction projects often lead to budget constraints affecting comprehensive testing and inspection programs. Project developers may attempt to minimize quality assurance expenses, potentially compromising testing thoroughness and creating market challenges for service providers seeking to maintain comprehensive service standards while remaining cost-competitive.

Skilled workforce shortages present significant challenges as the industry requires highly trained professionals with specialized certifications and technical expertise. The complexity of modern testing equipment and evolving regulatory requirements demand continuous professional development, with talent acquisition becoming increasingly competitive and expensive for service providers.

Economic volatility impacts construction activity levels, directly affecting demand for testing and inspection services. During economic downturns, construction projects may be delayed or canceled, reducing market opportunities and creating revenue uncertainty for service providers dependent on construction industry health and activity levels.

Technology integration costs require substantial investments in advanced testing equipment, software systems, and staff training. Smaller service providers may struggle to afford necessary technological upgrades, potentially limiting their competitive capabilities and market participation in increasingly sophisticated testing requirements.

Emerging markets present substantial growth opportunities as developing economies invest in infrastructure development and modernize building standards. These regions require comprehensive testing and certification services to support construction quality improvement and regulatory compliance, creating expansion opportunities for established service providers with international capabilities.

Sustainability certification represents a rapidly growing market segment as green building standards become mainstream requirements. The increasing focus on environmental performance and energy efficiency creates demand for specialized testing services related to sustainable materials, energy systems, and environmental impact assessments.

Digital transformation enables service providers to develop innovative testing methodologies, automated reporting systems, and remote monitoring capabilities. These technological advances create opportunities for service differentiation and operational efficiency improvements while expanding service accessibility to geographically dispersed projects.

Retrofit and renovation projects generate increasing demand for specialized testing services as aging infrastructure requires assessment, upgrading, and certification. The growing focus on building modernization and adaptive reuse creates new market segments requiring unique testing expertise and certification processes for existing structures.

Supply chain integration increasingly connects testing and inspection services with broader construction project management systems, creating opportunities for enhanced collaboration and streamlined quality assurance processes. Service providers are developing integrated platforms that connect testing data with project scheduling, compliance tracking, and performance monitoring systems.

Competitive differentiation focuses on specialized expertise, technological capabilities, and comprehensive service offerings rather than price competition alone. Market leaders invest in advanced testing equipment, professional certifications, and innovative service delivery methods to maintain competitive advantages and command premium pricing for specialized services.

Client relationship evolution shows increasing emphasis on long-term partnerships rather than transactional service arrangements. Construction companies and developers seek strategic testing partners capable of providing consistent quality assurance across multiple projects and supporting continuous improvement initiatives through data analysis and performance insights.

Regulatory harmonization efforts across different jurisdictions create opportunities for standardized testing protocols and international certification recognition. This trend supports market expansion for service providers with capabilities to navigate multiple regulatory frameworks and provide consistent service quality across different geographic markets.

Primary research encompasses comprehensive interviews with industry stakeholders including testing service providers, construction companies, regulatory authorities, and technology suppliers. This direct engagement provides insights into market trends, challenges, and opportunities from multiple perspectives throughout the construction testing ecosystem.

Secondary research involves analysis of industry reports, regulatory documents, academic studies, and company financial statements to establish market context and validate primary research findings. This approach ensures comprehensive understanding of market dynamics and competitive landscape across different geographic regions and service segments.

Data triangulation methods combine quantitative market data with qualitative insights to provide balanced and accurate market assessment. Multiple data sources are cross-referenced to ensure reliability and eliminate potential biases in market analysis and trend identification processes.

Expert validation involves consultation with industry experts, academic researchers, and regulatory specialists to verify research findings and ensure accuracy of market projections and trend analysis. This validation process enhances the credibility and reliability of research conclusions and strategic recommendations.

North America maintains market leadership with approximately 35% global market share, driven by stringent building codes, extensive infrastructure networks, and advanced testing capabilities. The region benefits from established regulatory frameworks, sophisticated construction industry practices, and strong emphasis on quality assurance across residential, commercial, and industrial construction segments.

Europe represents the second-largest market with 23% market share, characterized by harmonized building standards, sustainability focus, and comprehensive regulatory compliance requirements. The region’s emphasis on energy efficiency and environmental performance creates substantial demand for specialized testing and certification services related to green building standards and sustainable construction practices.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 8.5% annually, fueled by rapid urbanization, infrastructure development, and modernizing building standards. Countries like China, India, and Southeast Asian nations are investing heavily in construction quality improvement and regulatory framework development, creating significant opportunities for testing service providers.

Latin America and Middle East show increasing market activity driven by infrastructure investment programs and evolving construction standards. These regions present growth opportunities for service providers capable of adapting to local regulatory requirements while providing international quality standards and technical expertise.

Market leadership is distributed among several multinational corporations and specialized regional providers, each offering distinct capabilities and service portfolios. The competitive environment emphasizes technical expertise, geographic coverage, and comprehensive service integration rather than price competition alone.

Strategic positioning varies among competitors, with some focusing on comprehensive global coverage while others specialize in particular testing methodologies or geographic regions. Market consolidation trends create opportunities for enhanced service offerings and operational efficiency improvements through strategic acquisitions and partnerships.

By Service Type:

By Application:

By Testing Method:

Materials Testing represents the largest service category, encompassing comprehensive analysis of concrete, steel, asphalt, and emerging composite materials. This segment benefits from increasing complexity of construction materials and stringent quality requirements, with advanced testing methodologies becoming essential for ensuring material performance and durability.

Structural Inspection services focus on evaluating completed construction work, identifying potential defects, and ensuring compliance with design specifications. This category experiences steady growth driven by safety regulations and increasing awareness of construction quality impacts on long-term performance and occupant safety.

Environmental Testing addresses growing concerns about construction impact on environmental quality, including air quality assessment, soil contamination evaluation, and water quality monitoring. This emerging category reflects increasing emphasis on sustainable construction practices and environmental compliance requirements.

Geotechnical Services provide essential foundation and soil analysis supporting construction project planning and execution. This specialized category requires advanced technical expertise and equipment, with demand driven by complex construction projects and site-specific challenges requiring detailed subsurface investigation.

Construction Companies benefit from comprehensive quality assurance programs that reduce project risks, ensure regulatory compliance, and enhance reputation for delivering high-quality construction projects. Testing and inspection services provide risk mitigation and support continuous improvement initiatives through performance data analysis and best practice identification.

Property Developers gain confidence in project quality and long-term performance through systematic testing and certification processes. These services support investment protection by ensuring construction meets design specifications and regulatory requirements while providing documentation for financing and insurance purposes.

Regulatory Authorities rely on independent testing and inspection services to verify compliance with building codes and safety standards. This partnership approach enables effective regulatory enforcement while supporting industry self-regulation and continuous improvement in construction quality standards.

Insurance Companies utilize testing and inspection data to assess construction project risks and determine appropriate coverage terms. Comprehensive quality assurance programs support risk assessment and enable more accurate pricing of construction-related insurance products.

End Users benefit from enhanced safety, performance, and durability of constructed facilities through systematic quality assurance processes. Testing and certification services provide confidence assurance that buildings and infrastructure meet safety standards and performance expectations.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation revolutionizes traditional testing methodologies through integration of IoT sensors, artificial intelligence, and automated data analysis systems. These technological advances enable real-time monitoring of construction quality and provide predictive insights for maintenance and performance optimization, with approximately 47% of service providers investing in digital platform development.

Sustainability certification becomes increasingly important as green building standards gain mainstream adoption across construction projects. Testing services related to environmental performance, energy efficiency, and sustainable materials represent the fastest-growing market segment, driven by regulatory requirements and corporate sustainability commitments.

Integrated service delivery combines testing, inspection, and certification services into comprehensive quality assurance programs. This trend reflects client preferences for single-source solutions and enables service providers to develop deeper client relationships while improving operational efficiency through coordinated service delivery.

Remote monitoring capabilities expand through wireless sensor networks and cloud-based data platforms, enabling continuous quality assessment throughout construction processes. These systems provide early warning capabilities for potential quality issues and support proactive intervention to prevent costly rework and delays.

Technological innovation drives development of advanced testing equipment incorporating artificial intelligence, machine learning, and automated analysis capabilities. These innovations enhance testing accuracy while reducing time requirements and human error potential, enabling more comprehensive quality assurance programs within project schedules and budgets.

Regulatory evolution introduces new building standards focused on resilience, sustainability, and occupant health, creating demand for specialized testing and certification services. Recent developments include enhanced seismic requirements, improved fire safety standards, and indoor air quality specifications requiring new testing methodologies and expertise.

Market consolidation continues through strategic acquisitions and partnerships, with larger service providers expanding capabilities and geographic coverage while smaller specialists focus on niche expertise areas. According to MarkWide Research analysis, consolidation activity has increased by 28% over the past three years, reflecting industry maturation and efficiency optimization efforts.

International standardization efforts promote harmonized testing protocols and certification recognition across different jurisdictions, supporting global construction project development and service provider expansion into new geographic markets with consistent quality standards and operational procedures.

Service diversification strategies should focus on emerging market segments including sustainability certification, smart building systems, and advanced materials testing. Companies investing in specialized capabilities for these growth areas position themselves advantageously for long-term market expansion and premium pricing opportunities.

Technology investment priorities should emphasize digital platforms, automated testing systems, and data analytics capabilities that enhance service efficiency and accuracy. Organizations developing integrated technology solutions create competitive advantages while improving client value proposition through faster turnaround times and comprehensive reporting capabilities.

Geographic expansion opportunities exist in emerging markets experiencing infrastructure development and regulatory modernization. Service providers should evaluate market entry strategies including partnerships, acquisitions, and direct investment based on local regulatory requirements and competitive landscape dynamics.

Talent development programs addressing skilled workforce shortages should combine technical training with digital literacy and customer service capabilities. Companies investing in professional development and certification programs build competitive advantages while supporting industry-wide quality improvement initiatives.

Market expansion prospects remain positive supported by continued infrastructure investment, evolving construction technologies, and increasing emphasis on quality assurance across all construction segments. MWR projects sustained growth driven by regulatory compliance requirements and technological advancement in testing methodologies.

Technology integration will accelerate with widespread adoption of digital platforms, automated testing systems, and artificial intelligence applications. These developments enable service innovation while improving operational efficiency and expanding service accessibility to geographically dispersed construction projects.

Sustainability focus creates substantial growth opportunities as environmental compliance and green building certification become standard requirements. The market for environmental testing services is projected to grow at rates exceeding 9.2% annually, reflecting increasing emphasis on sustainable construction practices and regulatory compliance.

Global harmonization of testing standards and certification processes supports international market expansion while reducing complexity for multinational construction projects. This trend enables service standardization and creates opportunities for established providers to expand geographic coverage through consistent service delivery capabilities.

The construction testing, inspection, and certification market demonstrates robust growth potential driven by essential safety requirements, regulatory compliance needs, and technological advancement in testing methodologies. Market dynamics favor service providers capable of adapting to evolving construction technologies while maintaining comprehensive quality assurance capabilities across diverse project types and geographic regions.

Strategic opportunities exist in emerging markets, sustainability certification, and digital transformation initiatives that enhance service delivery efficiency and accuracy. Companies investing in specialized expertise, advanced technology platforms, and comprehensive service integration position themselves advantageously for sustained growth and competitive differentiation in an increasingly sophisticated market environment.

The sector’s future success depends on continuous adaptation to regulatory evolution, technology integration, and changing client expectations while maintaining the fundamental commitment to construction quality and safety that defines the industry’s essential value proposition.

What is Construction Testing, Inspection, and Certification?

Construction Testing, Inspection, and Certification refers to the processes and services that ensure construction materials and structures meet specified standards and regulations. This includes testing materials for quality, inspecting construction sites for compliance, and certifying that projects adhere to safety and performance criteria.

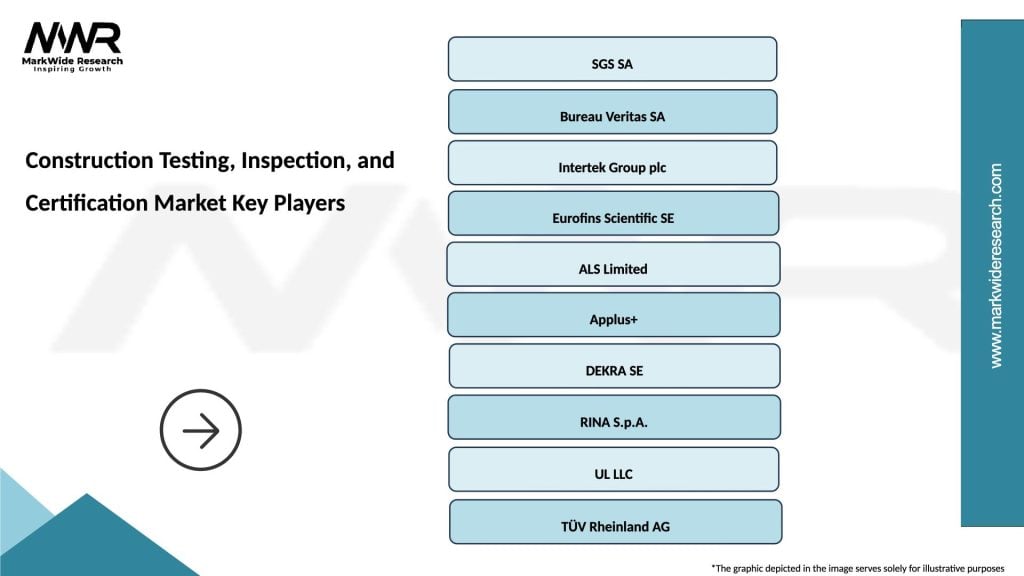

What are the key players in the Construction Testing, Inspection, and Certification Market?

Key players in the Construction Testing, Inspection, and Certification Market include SGS SA, Bureau Veritas, Intertek Group, and TUV Rheinland, among others. These companies provide a range of services from material testing to compliance certification across various construction projects.

What are the main drivers of growth in the Construction Testing, Inspection, and Certification Market?

The growth of the Construction Testing, Inspection, and Certification Market is driven by increasing safety regulations, the demand for high-quality construction materials, and the need for sustainable building practices. Additionally, the rise in infrastructure development projects globally contributes to market expansion.

What challenges does the Construction Testing, Inspection, and Certification Market face?

Challenges in the Construction Testing, Inspection, and Certification Market include the high costs associated with testing and certification processes, the complexity of regulatory compliance, and the need for skilled professionals. These factors can hinder timely project completion and increase operational costs.

What opportunities exist in the Construction Testing, Inspection, and Certification Market?

Opportunities in the Construction Testing, Inspection, and Certification Market include the growing emphasis on green building certifications, advancements in testing technologies, and the increasing adoption of digital solutions for project management. These trends can enhance efficiency and accuracy in construction processes.

What trends are shaping the Construction Testing, Inspection, and Certification Market?

Trends in the Construction Testing, Inspection, and Certification Market include the integration of automation and digital tools in testing processes, a focus on sustainability and environmental impact assessments, and the increasing use of non-destructive testing methods. These innovations are transforming how construction quality is ensured.

Construction Testing, Inspection, and Certification Market

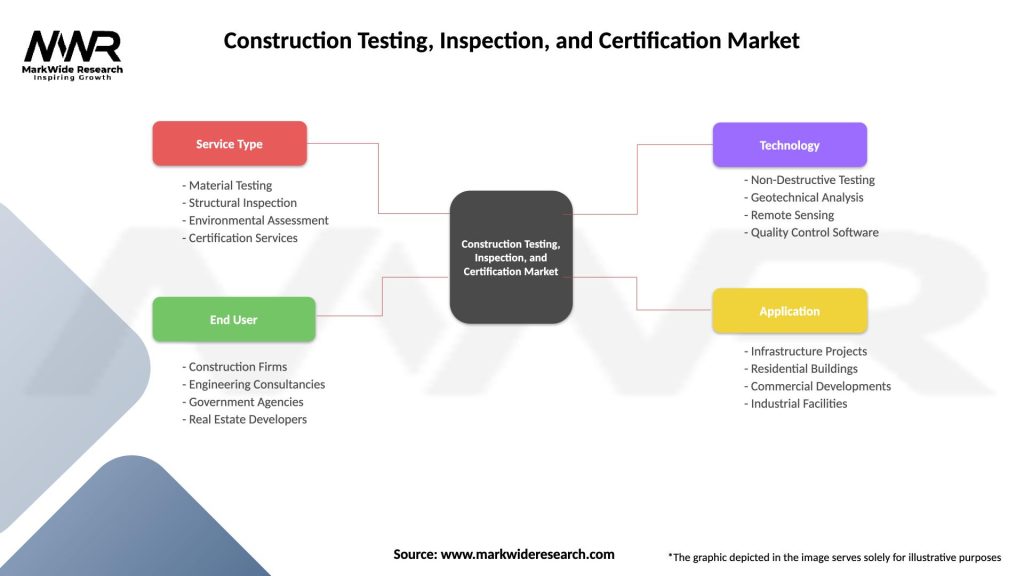

| Segmentation Details | Description |

|---|---|

| Service Type | Material Testing, Structural Inspection, Environmental Assessment, Certification Services |

| End User | Construction Firms, Engineering Consultancies, Government Agencies, Real Estate Developers |

| Technology | Non-Destructive Testing, Geotechnical Analysis, Remote Sensing, Quality Control Software |

| Application | Infrastructure Projects, Residential Buildings, Commercial Developments, Industrial Facilities |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Construction Testing, Inspection, and Certification Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at