444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The construction industry relies on various tools and equipment to carry out its operations efficiently. Among these essential components, lubricants play a vital role in ensuring the smooth functioning of machinery and equipment. Construction lubricants are specially formulated to withstand harsh working conditions, reducing friction and wear, and extending the lifespan of equipment. In this comprehensive analysis of the construction lubricants market, we delve into the meaning, market dynamics, regional analysis, competitive landscape, key industry developments, and future outlook of this thriving industry.

Meaning

Construction lubricants refer to specialized oils, greases, and fluids used to reduce friction and wear between moving parts in construction machinery and equipment. These lubricants offer protection against corrosion, contaminants, and excessive heat, ensuring optimal performance and longevity. They are designed to withstand the demanding conditions of construction sites, including heavy loads, high temperatures, and exposure to dust and debris.

Executive Summary

The construction lubricants market has witnessed significant growth in recent years, driven by the expanding construction industry worldwide. Increasing infrastructure development projects, urbanization, and the rising demand for residential and commercial spaces are key factors propelling market growth. Construction lubricants enhance the efficiency and productivity of construction equipment, reduce maintenance costs, and minimize downtime, leading to improved overall operational performance.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The shift from mineral-based to synthetic and semi-synthetic lubricants is accelerating, driven by the need for longer oil change intervals and enhanced thermal stability.

Hydraulic oils represent the largest volume segment, owing to the ubiquitous use of hydraulics in construction machinery for digging, lifting, and earth-moving operations.

Growing emphasis on predictive maintenance and equipment uptime is boosting demand for condition-monitoring fluids with built-in sensor compatibility.

Bio-based lubricants are gaining traction in regions with strict biodegradable requirements, particularly for equipment operating near waterways or sensitive ecosystems.

Market Drivers

Several factors are propelling the Construction Lubricants market:

Infrastructure Investment: Large-scale projects in transportation, energy, and urban development—especially in Asia Pacific and the Middle East—drive machinery utilization and lubricant consumption.

Equipment Automation: Advanced hydraulic and telematics systems in modern construction equipment require lubricants with precise viscosity and anti-foaming properties to support automated controls.

Total Cost of Ownership (TCO) Focus: Contractors prioritize extended drain-interval lubricants and maintenance services to reduce downtime and lifecycle costs of heavy machinery.

Environmental Regulations: Strict disposal guidelines and spill-mitigation standards encourage use of biodegradable and low-toxicity lubricant formulations.

OEM Collaborations: Partnerships between lubricant producers and equipment manufacturers enable co-developed products optimized for specific engine and hydraulic system requirements.

Market Restraints

Despite strong demand, the market faces several challenges:

Price Volatility: Fluctuating crude oil prices impact base-oil costs, leading to variable lubricant pricing and margin pressures for manufacturers.

Counterfeit Products: The proliferation of substandard and counterfeit lubricants in unregulated markets undermines brand trust and equipment reliability.

Infrastructure Lag in Some Regions: Delays in project approvals and funding constraints in certain emerging markets can temporarily suppress lubricant demand.

High Entry Barriers: Developing and validating high-performance lubricant formulations requires significant R&D investment and rigorous field testing.

Disposal and Recycling Costs: Compliance with used-oil collection and recycling regulations increases end-of-life management expenses for both suppliers and end-users.

Market Opportunities

The Construction Lubricants market presents lucrative growth avenues:

Bio-Based Lubricants: Innovation in plant-derived base oils and biodegradable additives responds to ecological mandates and appeals to green construction initiatives.

Condition-Monitoring Fluids: Integration of sensor-ready formulations enables real-time lubricant health assessment, reducing unplanned maintenance events.

Modular Service Contracts: Bundled offerings—including lubricant supply, machinery diagnostics, and change services—provide value and reinforce customer loyalty.

Regional Manufacturing Footprints: Establishing localized blending and distribution centers in high-growth markets (e.g., India, Brazil) cuts lead times and import duties.

Digital Ordering Platforms: E-commerce portals and fleet management apps streamline procurement and inventory monitoring for construction firms.

Market Dynamics

The Construction Lubricants market is shaped by the following dynamics:

Technological Advancements: Continuous R&D into additive chemistries and base-oil refining enhances product performance under extreme operating demands.

Regulatory Landscape: Global alignment of lubricant biodegradability and emissions standards influences product formulations and market entry strategies.

Vertical Integration: Major oil companies expanding into specialty lubricant segments through acquisitions improve control over supply chains.

Customer Education: Emphasis on training programs and field demonstrations helps end-users understand the performance benefits of premium lubricants.

Sustainability Initiatives: Pressure to reduce carbon footprints drives demand for lubricants with lower lifecycle greenhouse gas emissions.

Regional Analysis

Regional variations in demand and regulation include:

Asia Pacific: Largest growth market due to rapid infrastructure expansion in China, India, and Southeast Asia, coupled with rising construction equipment fleets.

North America: Mature market emphasizing equipment uptime, OEM-approved synthetic lubricants, and aftermarket service contracts.

Europe: Stringent environmental regulations and recycling mandates spur adoption of biodegradable and high-performance eco-friendly lubricants.

Latin America: Gradual infrastructure development and fleet modernization create steady aftermarket demand, despite occasional economic fluctuations.

Middle East & Africa: Oil-and-gas-driven construction projects boost lubricant consumption; arid conditions demand high-temperature stable formulations.

Competitive Landscape

Leading Companies in the Construction Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

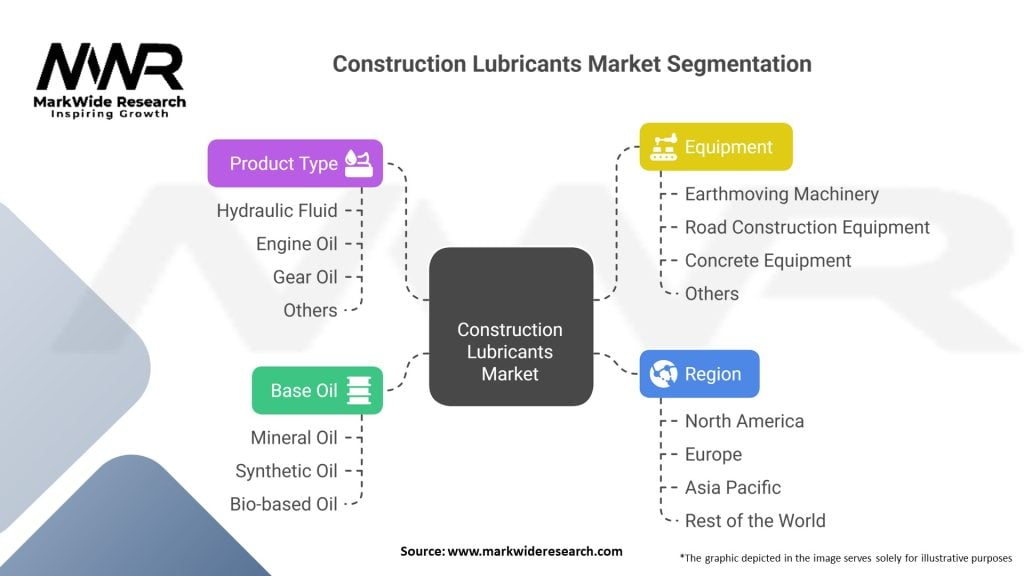

Segmentation

The construction lubricants market can be segmented based on product type, application, and end-user industries. Common product types include engine oils, hydraulic fluids, gear oils, and greases. Applications range from heavy construction machinery to light equipment and tools. Major end-user industries encompass residential, commercial, and infrastructure construction.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a profound impact on the construction industry, disrupting supply chains, delaying projects, and affecting investments. Consequently, the construction lubricants market faced temporary setbacks due to decreased construction activities. However, as economies recover and construction projects resume, the market is expected to regain momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The construction lubricants market is poised for steady growth in the coming years. Factors such as infrastructure investments, urbanization, and increasing construction activities will continue to drive market expansion. Technological advancements and sustainability initiatives will shape the market landscape, providing opportunities for market players to develop cutting-edge lubricants that meet the evolving needs of the construction industry.

Conclusion

Construction lubricants play a vital role in optimizing the performance and efficiency of construction machinery and equipment. The market is driven by the growing construction sector, infrastructure development projects, and the need for reliable and high-performance lubricants. Manufacturers need to focus on sustainability, technological advancements, and strategic collaborations to capitalize on the opportunities presented by this thriving industry. With the right strategies in place, industry participants can enhance their market presence and contribute to the success of the construction lubricants market.

What are construction lubricants?

Construction lubricants are specialized substances used to reduce friction and wear between surfaces in construction machinery and equipment. They play a crucial role in enhancing the performance and longevity of tools and machinery used in various construction applications.

Who are the key players in the Construction Lubricants Market?

Key players in the Construction Lubricants Market include companies such as ExxonMobil, Shell, and TotalEnergies, which provide a range of lubricants tailored for construction applications, among others.

What are the main drivers of the Construction Lubricants Market?

The main drivers of the Construction Lubricants Market include the increasing demand for efficient machinery, the growth of the construction industry, and the need for improved equipment performance and maintenance.

What challenges does the Construction Lubricants Market face?

The Construction Lubricants Market faces challenges such as fluctuating raw material prices, stringent environmental regulations, and the need for continuous innovation to meet evolving industry standards.

What opportunities exist in the Construction Lubricants Market?

Opportunities in the Construction Lubricants Market include the development of bio-based lubricants, advancements in lubricant formulations, and the growing trend towards sustainability in construction practices.

What trends are shaping the Construction Lubricants Market?

Trends shaping the Construction Lubricants Market include the increasing adoption of synthetic lubricants, the focus on eco-friendly products, and the integration of smart technology in lubrication systems.

Construction Lubricants Market

| Segmentation | Details |

|---|---|

| Base Oil | Mineral Oil, Synthetic Oil, Bio-based Oil |

| Product Type | Hydraulic Fluid, Engine Oil, Gear Oil, Others |

| Equipment | Earthmoving Machinery, Road Construction Equipment, Concrete Equipment, Others |

| Region | North America, Europe, Asia Pacific, Rest of the World |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Construction Lubricants Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at