444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The construction and mining equipment spare parts market represents a critical segment within the global heavy machinery industry, serving as the backbone for maintaining operational efficiency across construction sites and mining operations worldwide. This market encompasses a comprehensive range of replacement components, including hydraulic systems, engine parts, transmission components, electrical systems, and structural elements designed to keep heavy equipment functioning at optimal performance levels.

Market dynamics indicate robust growth driven by increasing infrastructure development, expanding mining activities, and the growing emphasis on equipment maintenance rather than replacement. The market experiences consistent demand as construction and mining companies prioritize extending equipment lifespan through strategic spare parts management, resulting in sustained growth rates of 6.2% CAGR across key regional markets.

Regional distribution shows significant concentration in Asia-Pacific, North America, and Europe, with emerging markets demonstrating accelerated adoption rates. The market benefits from technological advancements in predictive maintenance, digital inventory management, and improved manufacturing processes that enhance spare parts quality and availability.

Industry participants range from original equipment manufacturers (OEMs) to specialized aftermarket suppliers, creating a competitive landscape that drives innovation and cost optimization. The market’s resilience stems from the essential nature of spare parts in maintaining operational continuity across critical infrastructure and resource extraction projects.

The construction and mining equipment spare parts market refers to the comprehensive ecosystem of replacement components, consumables, and maintenance parts designed specifically for heavy machinery used in construction, mining, and related industrial applications. This market encompasses both genuine OEM parts and aftermarket alternatives that ensure equipment reliability, performance optimization, and operational continuity.

Spare parts categories include engine components such as filters, belts, and gaskets; hydraulic system elements including pumps, cylinders, and hoses; electrical components like sensors, wiring harnesses, and control modules; and structural parts such as buckets, blades, and wear plates. The market also covers consumable items like lubricants, fluids, and maintenance supplies essential for equipment operation.

Market participants operate across multiple channels, including direct OEM distribution, authorized dealer networks, independent aftermarket suppliers, and digital platforms that facilitate parts identification, ordering, and logistics. This multi-channel approach ensures comprehensive market coverage and accessibility for equipment operators across diverse geographical regions and operational scales.

Strategic analysis reveals the construction and mining equipment spare parts market as a resilient and growth-oriented sector driven by global infrastructure development, resource extraction activities, and evolving maintenance strategies. The market demonstrates strong fundamentals supported by increasing equipment populations, extended equipment lifecycles, and growing emphasis on operational efficiency.

Key growth drivers include rising construction activities in emerging economies, expanding mining operations driven by resource demand, and technological advancements that improve spare parts quality and availability. The market benefits from increasing adoption rates of 42% for predictive maintenance technologies that optimize spare parts utilization and reduce unplanned downtime.

Market segmentation reveals diverse opportunities across equipment types, with excavators, loaders, and mining trucks representing the largest segments. Regional analysis indicates Asia-Pacific leading market share at 38% of global demand, followed by North America and Europe, while emerging markets demonstrate accelerated growth potential.

Competitive dynamics feature a mix of established OEMs and specialized aftermarket suppliers, creating opportunities for innovation, cost optimization, and service enhancement. The market’s future outlook remains positive, supported by infrastructure investment trends, mining sector expansion, and technological integration that enhances spare parts management efficiency.

Market intelligence reveals several critical insights that shape the construction and mining equipment spare parts landscape:

Infrastructure development serves as the primary catalyst driving construction and mining equipment spare parts demand globally. Massive infrastructure projects across emerging economies require sustained equipment operation, generating consistent demand for replacement parts and maintenance components. Government investment in transportation networks, urban development, and industrial facilities creates long-term market opportunities.

Mining sector expansion contributes significantly to market growth as resource extraction activities intensify worldwide. Increasing demand for minerals, metals, and energy resources drives mining companies to maximize equipment utilization, resulting in higher spare parts consumption. The sector’s focus on operational efficiency and cost optimization further amplifies spare parts demand.

Equipment aging trends create substantial market opportunities as existing machinery fleets require more frequent maintenance and component replacement. Rather than investing in new equipment, many operators choose to extend existing equipment lifecycles through strategic spare parts management, generating sustained demand for replacement components.

Technological advancement in spare parts manufacturing improves quality, durability, and performance characteristics, encouraging more frequent component upgrades and replacements. Advanced materials and manufacturing processes enable the development of superior spare parts that offer enhanced reliability and operational efficiency.

Predictive maintenance adoption transforms spare parts procurement from reactive to proactive strategies. IoT integration and data analytics enable equipment operators to anticipate component failures and optimize spare parts inventory, driving consistent demand patterns and reducing emergency procurement costs.

High procurement costs represent a significant challenge for equipment operators, particularly smaller construction companies and mining operations with limited budgets. Premium pricing for genuine OEM parts can strain operational budgets, leading some operators to delay necessary maintenance or seek lower-quality alternatives that may compromise equipment performance.

Supply chain complexities create operational challenges including extended lead times, inventory management difficulties, and logistics coordination issues. Global supply chain disruptions can significantly impact spare parts availability, forcing equipment operators to maintain larger inventory investments or accept operational downtime risks.

Quality concerns with aftermarket parts pose risks to equipment reliability and performance. While aftermarket alternatives offer cost advantages, inconsistent quality standards and compatibility issues can result in premature failures, increased maintenance costs, and potential safety hazards that discourage adoption.

Technical complexity in modern equipment systems requires specialized knowledge for proper spare parts selection and installation. The increasing sophistication of construction and mining equipment creates challenges for maintenance personnel and may necessitate additional training investments or specialized service support.

Economic volatility in construction and mining sectors affects spare parts demand patterns. Economic downturns, commodity price fluctuations, and project delays can significantly impact equipment utilization rates and corresponding spare parts consumption, creating market uncertainty for suppliers and distributors.

Emerging market expansion presents substantial growth opportunities as developing economies invest heavily in infrastructure development and resource extraction capabilities. These markets demonstrate higher equipment utilization rates and spare parts consumption, creating favorable conditions for market participants seeking growth opportunities.

Digital platform development offers opportunities to revolutionize spare parts distribution and customer service. E-commerce platforms, mobile applications, and digital catalogues can improve parts identification, ordering efficiency, and customer experience while reducing distribution costs and expanding market reach.

Remanufacturing initiatives create sustainable business opportunities while addressing cost concerns. Remanufactured spare parts offer significant cost savings compared to new components while maintaining quality standards, appealing to cost-conscious operators and environmentally aware customers.

Service integration enables market participants to develop comprehensive solutions combining spare parts supply with maintenance expertise, training, and technical support. These value-added services create competitive differentiation and strengthen customer relationships while generating additional revenue streams.

Technology partnerships with equipment manufacturers and technology providers can accelerate innovation in spare parts design, manufacturing, and distribution. Collaborative relationships enable access to advanced technologies, market intelligence, and customer networks that support business growth and market expansion.

Demand patterns in the construction and mining equipment spare parts market exhibit cyclical characteristics influenced by economic conditions, seasonal factors, and project lifecycles. Construction activities typically peak during favorable weather conditions, while mining operations maintain more consistent demand patterns throughout the year, creating balanced market dynamics.

Competitive intensity varies significantly across different spare parts categories and regional markets. High-value, complex components often remain dominated by OEM suppliers, while commodity parts face intense competition from aftermarket alternatives. This dynamic creates opportunities for market segmentation and specialized positioning strategies.

Price sensitivity influences purchasing decisions across different customer segments, with larger operators often prioritizing quality and reliability over cost considerations, while smaller operators focus primarily on price competitiveness. This segmentation creates opportunities for differentiated product offerings and pricing strategies.

Supply chain dynamics continue evolving toward greater efficiency and responsiveness. According to MarkWide Research analysis, companies implementing advanced supply chain technologies report efficiency improvements of 35% in spare parts distribution and inventory management.

Innovation cycles drive continuous improvement in spare parts design, materials, and manufacturing processes. Regular product updates and technological enhancements create opportunities for market participants to differentiate their offerings and capture premium pricing for superior performance characteristics.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including equipment manufacturers, spare parts suppliers, distributors, and end-users across major regional markets. Direct engagement with market participants provides valuable insights into demand patterns, competitive dynamics, and emerging trends that shape market development.

Secondary research incorporates analysis of industry publications, company financial reports, government statistics, and trade association data to validate primary findings and establish comprehensive market understanding. This approach ensures data accuracy and provides historical context for market trend analysis.

Market modeling utilizes advanced analytical techniques to project future market scenarios based on historical data, current trends, and identified growth drivers. Statistical analysis and econometric modeling provide quantitative foundations for market forecasts and strategic recommendations.

Regional analysis examines market characteristics across key geographical regions, considering local economic conditions, regulatory environments, and competitive landscapes. This approach enables identification of regional opportunities and challenges that influence market development strategies.

Technology assessment evaluates the impact of emerging technologies on spare parts design, manufacturing, and distribution. Analysis of technological trends provides insights into future market evolution and innovation opportunities that may reshape competitive dynamics.

Asia-Pacific region dominates the global construction and mining equipment spare parts market, accounting for 38% of total demand, driven by massive infrastructure development projects and expanding mining activities across China, India, and Southeast Asian countries. The region benefits from large equipment populations, intensive utilization patterns, and growing focus on equipment maintenance optimization.

North American market demonstrates mature characteristics with emphasis on high-quality spare parts and advanced maintenance technologies. The region’s focus on operational efficiency and equipment reliability drives demand for premium spare parts and integrated service solutions. Mining activities in Canada and the United States contribute significantly to regional market growth.

European market exhibits strong demand for environmentally sustainable spare parts solutions, including remanufactured components and eco-friendly alternatives. Stringent environmental regulations and sustainability initiatives influence purchasing decisions, creating opportunities for innovative spare parts suppliers focused on circular economy principles.

Latin American region shows robust growth potential driven by mining sector expansion and infrastructure development initiatives. Countries like Brazil, Chile, and Peru demonstrate strong demand for mining equipment spare parts, while construction activities across the region support broader market growth.

Middle East and Africa present emerging opportunities supported by infrastructure investment and resource extraction activities. The region’s challenging operating conditions result in higher spare parts consumption rates, while government investment in economic diversification drives construction equipment demand.

Market leadership is distributed among several key categories of participants, each serving distinct market segments and customer needs:

Competitive strategies focus on service excellence, digital innovation, and supply chain optimization to differentiate offerings and strengthen customer relationships. Market participants invest heavily in distribution network expansion, inventory management systems, and customer support capabilities to maintain competitive advantages.

By Equipment Type:

By Component Type:

By Distribution Channel:

Engine components represent the most critical spare parts category, accounting for 28% of total market demand due to regular maintenance requirements and wear characteristics. This segment benefits from consistent replacement cycles and growing emphasis on engine performance optimization through advanced filtration and lubrication systems.

Hydraulic system parts demonstrate strong growth driven by increasing equipment complexity and performance demands. Advanced hydraulic technologies require specialized components that offer superior reliability and efficiency, creating opportunities for premium pricing and technical differentiation.

Wear parts category exhibits the highest replacement frequency due to direct contact with abrasive materials and harsh operating conditions. This segment offers predictable demand patterns and opportunities for innovative materials that extend component lifecycles while maintaining performance standards.

Electrical components show rapid growth as equipment becomes increasingly sophisticated with integrated electronics and automation systems. This category requires specialized technical expertise and creates opportunities for value-added services including diagnostics and system optimization.

Structural components vary significantly in demand patterns based on application requirements and operating conditions. Mining applications typically generate higher demand due to extreme operating environments, while construction applications focus on versatility and adaptability.

Equipment operators benefit from comprehensive spare parts availability that ensures operational continuity, minimizes downtime, and optimizes equipment performance. Strategic spare parts management enables cost-effective equipment lifecycle extension while maintaining productivity and safety standards.

Spare parts suppliers enjoy stable demand patterns and opportunities for long-term customer relationships through quality products and superior service. The market’s essential nature provides resilience against economic fluctuations while offering growth opportunities through innovation and market expansion.

Original equipment manufacturers generate substantial aftermarket revenue streams that often exceed initial equipment sales profitability. Spare parts business provides ongoing customer engagement opportunities and supports brand loyalty through quality and service excellence.

Distributors and dealers benefit from recurring revenue opportunities and local market presence that creates competitive advantages. Value-added services including inventory management, technical support, and logistics coordination enhance customer relationships and profitability.

End-user industries including construction and mining sectors benefit from improved equipment reliability, reduced operational costs, and enhanced safety performance through quality spare parts availability. Strategic maintenance approaches enabled by spare parts accessibility support operational efficiency and project success.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration transforms spare parts management through IoT sensors, predictive analytics, and automated ordering systems. Equipment operators increasingly adopt digital solutions that optimize inventory levels, predict component failures, and streamline procurement processes, resulting in operational efficiency improvements of 30%.

Sustainability focus drives growing demand for remanufactured spare parts and environmentally responsible alternatives. Companies prioritize circular economy principles, leading to increased adoption of refurbished components that offer cost savings while supporting environmental objectives.

Supply chain localization emerges as companies seek to reduce dependency on global supply chains and improve responsiveness. Regional manufacturing and distribution strategies enhance supply security while reducing logistics costs and delivery times.

Quality standardization in aftermarket parts improves as independent suppliers invest in advanced manufacturing capabilities and quality control systems. This trend increases customer confidence in non-OEM alternatives while intensifying competitive pressure on traditional suppliers.

Service bundling becomes increasingly common as suppliers offer comprehensive packages combining spare parts with maintenance services, training, and technical support. These integrated solutions create value differentiation and strengthen customer relationships through enhanced service delivery.

Technology partnerships between equipment manufacturers and technology companies accelerate innovation in spare parts design and manufacturing. Collaborative relationships enable development of advanced materials, manufacturing processes, and digital solutions that enhance spare parts performance and availability.

Manufacturing facility expansion across emerging markets improves local spare parts availability while reducing logistics costs and delivery times. Regional manufacturing strategies support market growth while providing supply chain resilience and customer service improvements.

Digital platform launches revolutionize spare parts distribution through e-commerce capabilities, mobile applications, and integrated inventory management systems. These platforms improve customer experience while reducing distribution costs and expanding market reach for suppliers.

Acquisition activities consolidate market participants as larger companies seek to expand product portfolios, geographic coverage, and technical capabilities. Strategic acquisitions enable rapid market expansion while providing access to specialized expertise and customer relationships.

Sustainability initiatives drive investment in remanufacturing capabilities and environmentally responsible manufacturing processes. Companies develop circular economy business models that support environmental objectives while creating cost-effective alternatives for customers.

Investment priorities should focus on digital transformation initiatives that improve customer experience and operational efficiency. Companies investing in e-commerce platforms, predictive analytics, and automated inventory management systems position themselves for sustainable competitive advantages in evolving market conditions.

Geographic expansion strategies should prioritize emerging markets with strong infrastructure development and mining activities. MWR analysis indicates that companies establishing early presence in developing economies capture market share advantages of 15-20% compared to later entrants.

Product portfolio diversification through remanufacturing capabilities and aftermarket alternatives can reduce dependency on OEM relationships while addressing customer cost concerns. Balanced portfolios combining premium and value-oriented offerings serve diverse market segments effectively.

Partnership development with technology providers, logistics companies, and regional distributors can accelerate market expansion while reducing investment requirements. Strategic alliances enable access to specialized capabilities and market knowledge that support business growth.

Sustainability integration should become central to business strategy as environmental considerations increasingly influence purchasing decisions. Companies developing circular economy solutions and environmentally responsible practices create competitive differentiation while addressing regulatory requirements.

Market trajectory remains positive with sustained growth expected across all major regional markets driven by infrastructure investment, mining sector expansion, and evolving maintenance strategies. The market’s essential nature provides resilience against economic volatility while technological advancement creates new growth opportunities.

Technology integration will accelerate with widespread adoption of IoT sensors, artificial intelligence, and automated systems that optimize spare parts management. These technologies enable predictive maintenance strategies that improve equipment reliability while reducing total cost of ownership for operators.

Regional dynamics will continue favoring emerging markets where infrastructure development and industrialization drive equipment demand. Established markets will focus on technology adoption and service enhancement while emerging markets prioritize basic parts availability and distribution network development.

Competitive evolution will intensify as aftermarket suppliers improve quality standards and OEM manufacturers enhance service capabilities. Market success will increasingly depend on customer service excellence, digital capabilities, and comprehensive solution offerings rather than product availability alone.

Sustainability trends will reshape business models as circular economy principles become mainstream. Companies developing remanufacturing capabilities and environmentally responsible practices will capture growing market segments while supporting global sustainability objectives through innovative spare parts solutions.

The construction and mining equipment spare parts market represents a dynamic and essential sector characterized by consistent demand, technological innovation, and evolving customer requirements. Market fundamentals remain strong, supported by global infrastructure development, expanding mining activities, and increasing focus on equipment lifecycle optimization through strategic maintenance approaches.

Growth opportunities abound across emerging markets, digital transformation initiatives, and sustainability-focused solutions that address evolving customer needs and regulatory requirements. Companies that successfully integrate technology, expand geographic presence, and develop comprehensive service offerings will capture disproportionate market benefits in the evolving competitive landscape.

Strategic success requires balanced approaches that combine operational excellence with innovation capabilities, customer service focus with cost competitiveness, and global reach with local responsiveness. The market rewards participants who understand diverse customer needs and develop differentiated solutions that create sustainable competitive advantages.

Future market development will be shaped by technological advancement, sustainability requirements, and changing customer expectations that demand higher service levels and integrated solutions. Companies positioning themselves at the forefront of these trends while maintaining operational excellence will achieve superior performance in this essential and growing market segment.

What is Construction And Mining Equipment Spare Parts?

Construction and mining equipment spare parts refer to the components and accessories used to maintain and repair machinery utilized in construction and mining operations. These parts are essential for ensuring the efficiency and longevity of equipment such as excavators, bulldozers, and drilling machines.

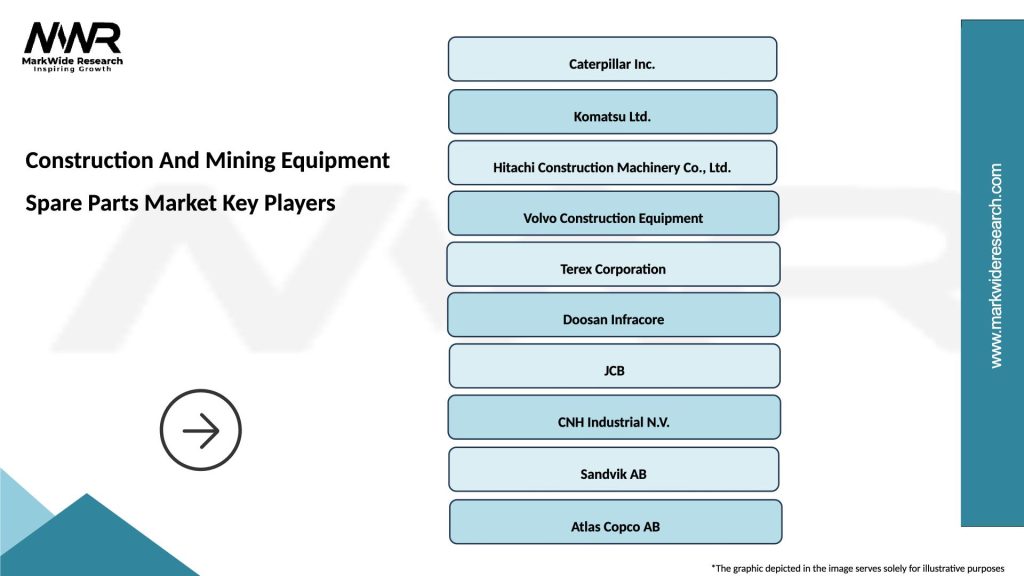

What are the key players in the Construction And Mining Equipment Spare Parts Market?

Key players in the Construction And Mining Equipment Spare Parts Market include Caterpillar Inc., Komatsu Ltd., and Volvo Construction Equipment, among others. These companies are known for their extensive range of spare parts and commitment to quality and innovation.

What are the growth factors driving the Construction And Mining Equipment Spare Parts Market?

The growth of the Construction And Mining Equipment Spare Parts Market is driven by increasing infrastructure development, rising demand for mining activities, and the need for regular maintenance of heavy machinery. Additionally, advancements in technology are enhancing the efficiency of spare parts.

What challenges does the Construction And Mining Equipment Spare Parts Market face?

The Construction And Mining Equipment Spare Parts Market faces challenges such as fluctuating raw material prices, supply chain disruptions, and the increasing complexity of machinery that requires specialized parts. These factors can impact the availability and cost of spare parts.

What opportunities exist in the Construction And Mining Equipment Spare Parts Market?

Opportunities in the Construction And Mining Equipment Spare Parts Market include the growing trend of equipment modernization, the rise of e-commerce platforms for spare parts distribution, and the increasing focus on sustainability in manufacturing processes. These trends can lead to new business models and market expansion.

What trends are shaping the Construction And Mining Equipment Spare Parts Market?

Trends shaping the Construction And Mining Equipment Spare Parts Market include the integration of smart technology in spare parts, the rise of aftermarket services, and a growing emphasis on sustainability. These trends are influencing how companies design, manufacture, and distribute spare parts.

Construction And Mining Equipment Spare Parts Market

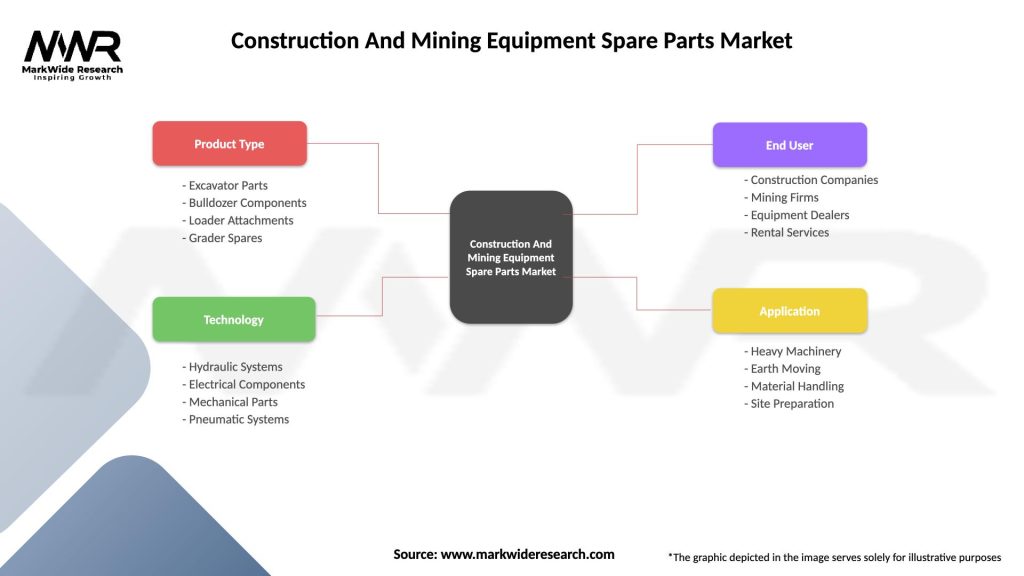

| Segmentation Details | Description |

|---|---|

| Product Type | Excavator Parts, Bulldozer Components, Loader Attachments, Grader Spares |

| Technology | Hydraulic Systems, Electrical Components, Mechanical Parts, Pneumatic Systems |

| End User | Construction Companies, Mining Firms, Equipment Dealers, Rental Services |

| Application | Heavy Machinery, Earth Moving, Material Handling, Site Preparation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Construction And Mining Equipment Spare Parts Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at