444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The composites industry has gained significant traction in the oil and gas sector due to their exceptional properties and advantages over traditional materials. Composites are materials made by combining two or more different components, typically a matrix and reinforcement, to create a stronger and more durable material. In the oil and gas industry, composites find applications in various areas such as offshore structures, pipelines, tanks, and equipment.

Meaning

Composites in the oil and gas industry refer to the use of composite materials in the exploration, production, and transportation of oil and gas. These materials offer exceptional strength-to-weight ratio, corrosion resistance, and durability, making them ideal for harsh environments and demanding applications.

Executive Summary

The composites in the oil and gas industry market has witnessed significant growth in recent years. The demand for lightweight and high-performance materials in offshore and onshore applications has driven the adoption of composites. The market is characterized by the presence of key players offering a wide range of composite solutions to meet the industry’s evolving needs. However, the market also faces challenges such as high costs and the need for stringent quality control measures.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

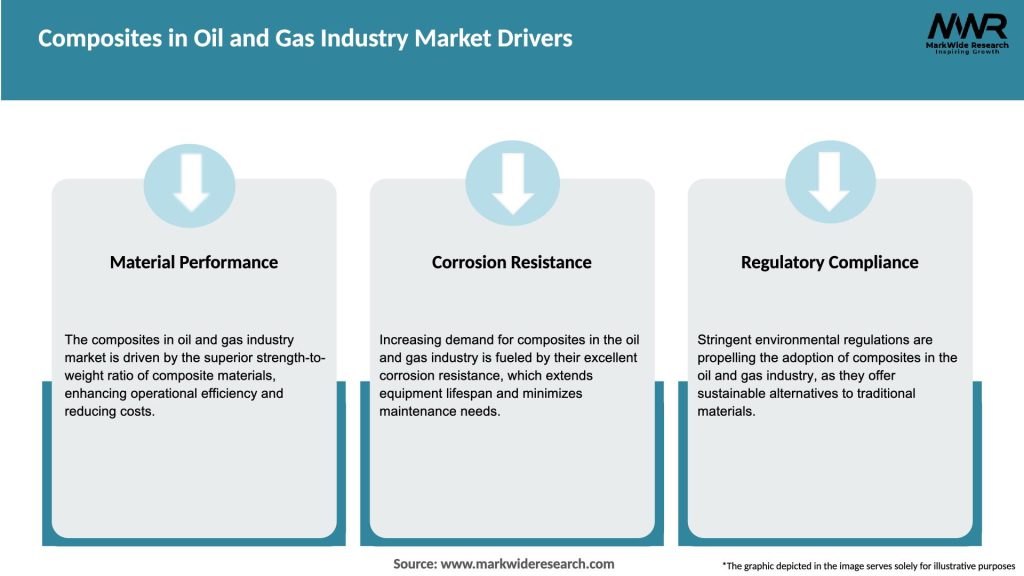

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The composites in the oil and gas industry market is driven by a combination of factors, including the demand for lightweight materials, the need for corrosion resistance, and the push towards energy efficiency. Additionally, technological advancements in composite materials, such as new resin systems and manufacturing techniques, continue to expand the application areas for composites in the industry. However, the market faces challenges related to high upfront costs, quality control, and the need for skilled labor. Overcoming these challenges will be crucial for the widespread adoption of composites in the oil and gas sector.

Regional Analysis

The market for composites in the oil and gas industry is geographically diverse, with significant demand from regions such as North America, Europe, Asia Pacific, and the Middle East and Africa. North America has been a prominent market due to its extensive offshore drilling activities and shale gas exploration. Europe is also witnessing growth, driven by the need to replace aging infrastructure and the focus on renewable energy sources. Asia Pacific is expected to show substantial growth, driven by the increasing demand for oil and gas and the expansion of offshore activities. The Middle East and Africa region has a significant presence in the oil and gas industry, offering potential opportunities for composite material manufacturers.

Competitive Landscape

Leading Companies in the Composites in Oil and Gas Industry Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

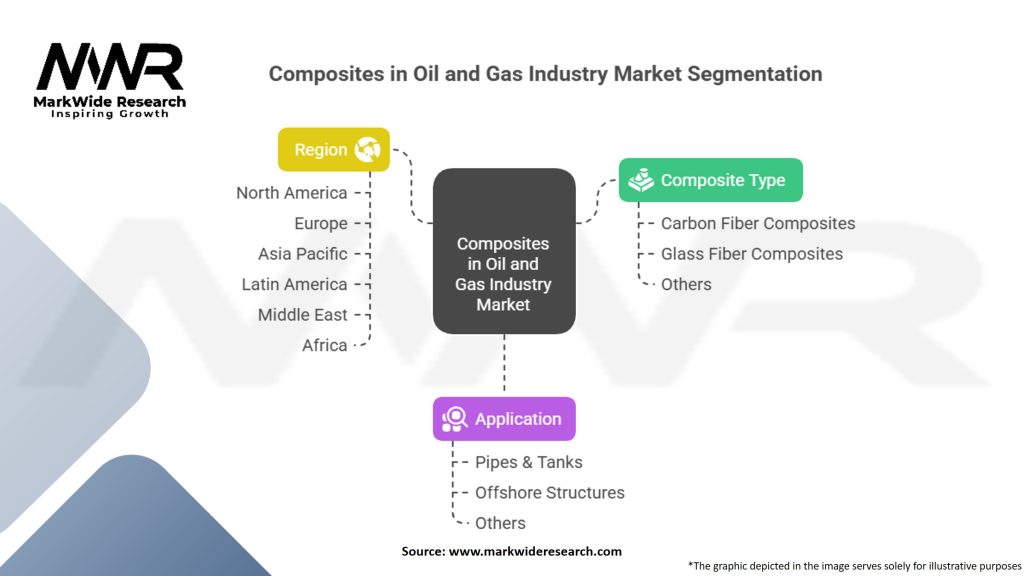

Segmentation

The composites in the oil and gas industry market can be segmented based on the type of composites, application areas, and end-users. By type, the market can be divided into fiber-reinforced composites, polymer matrix composites, and ceramic matrix composites. Application areas include offshore structures, pipelines, tanks, and equipment. End-users encompass exploration and production companies, pipeline operators, and equipment manufacturers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the composites in the oil and gas industry market. The industry experienced disruptions in the supply chain, project delays, and reduced investments due to the uncertain economic conditions. However, the pandemic also highlighted the importance of lightweight and durable materials in ensuring operational resilience. As the industry recovers from the pandemic, there is a renewed focus on adopting composites to improve efficiency, reduce maintenance costs, and enhance the sustainability of oil and gas operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for composites in the oil and gas industry is promising. The demand for lightweight and high-performance materials will continue to drive the adoption of composites in various applications. Technological advancements in composite materials and manufacturing processes will lead to further improvements in performance, cost-effectiveness, and sustainability. However, overcoming challenges related to costs, quality control, and awareness will be crucial for the market’s growth and widespread acceptance of composites in the oil and gas sector.

Conclusion

Composites have emerged as a viable alternative to traditional materials in the oil and gas industry, offering exceptional mechanical properties, corrosion resistance, and lightweight characteristics. Despite the challenges, the market for composites in the oil and gas industry is expected to grow significantly in the coming years. The industry’s focus on innovation, sustainability, and collaboration will drive the development of advanced composite solutions and foster a more efficient and resilient oil and gas sector.

What is Composites in Oil and Gas Industry?

Composites in Oil and Gas Industry refer to advanced materials made from two or more constituent materials that provide enhanced properties such as strength, durability, and resistance to corrosion. These composites are increasingly used in various applications including pipelines, offshore structures, and drilling equipment.

What are the key players in the Composites in Oil and Gas Industry Market?

Key players in the Composites in Oil and Gas Industry Market include companies like Hexcel Corporation, Toray Industries, and Owens Corning, which specialize in manufacturing composite materials for various applications in the oil and gas sector, among others.

What are the growth factors driving the Composites in Oil and Gas Industry Market?

The growth of the Composites in Oil and Gas Industry Market is driven by the increasing demand for lightweight and corrosion-resistant materials, advancements in composite manufacturing technologies, and the need for enhanced performance in harsh environments.

What challenges does the Composites in Oil and Gas Industry Market face?

Challenges in the Composites in Oil and Gas Industry Market include high manufacturing costs, the complexity of composite material recycling, and regulatory hurdles related to material certifications and safety standards.

What opportunities exist in the Composites in Oil and Gas Industry Market?

Opportunities in the Composites in Oil and Gas Industry Market include the development of new composite materials with improved properties, increasing investments in renewable energy projects, and the growing trend towards sustainable practices in the oil and gas sector.

What trends are shaping the Composites in Oil and Gas Industry Market?

Trends shaping the Composites in Oil and Gas Industry Market include the integration of smart materials, the use of nanotechnology to enhance composite properties, and a shift towards more sustainable and environmentally friendly composite solutions.

Composites in Oil and Gas Industry Market

| Segmentation Details | Description |

|---|---|

| By Composite Type | Carbon Fiber Composites, Glass Fiber Composites, and Others |

| By Application | Pipes & Tanks, Offshore Structures, and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East, and Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Composites in Oil and Gas Industry Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at