444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The commodity contracts brokerage market plays a crucial role in facilitating trading activities in various commodity markets. Commodity contracts brokerage firms act as intermediaries between buyers and sellers, providing assistance in the execution of commodity contracts. These firms offer a range of services, including market analysis, trade execution, risk management, and clearing and settlement services.

Meaning

Commodity contracts brokerage involves the buying and selling of various commodities, such as agricultural products, metals, energy resources, and financial instruments. It enables market participants, including producers, consumers, and investors, to hedge against price fluctuations and manage their exposure to commodity markets. Commodity contracts brokers provide a platform for market participants to access and trade in these markets efficiently.

Executive Summary

The commodity contracts brokerage market has witnessed significant growth in recent years, driven by increasing globalization, growing demand for commodities, and the emergence of sophisticated trading technologies. The market has become highly competitive, with numerous brokerage firms offering specialized services to cater to the diverse needs of market participants.

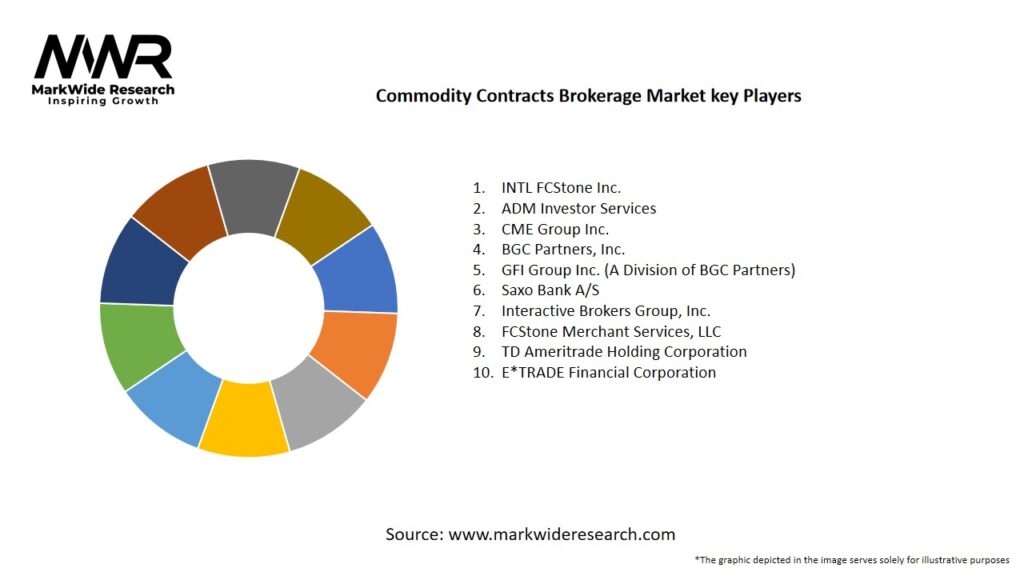

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The commodity contracts brokerage market is characterized by dynamic and interconnected factors that influence its growth and development. These dynamics include changes in global commodity demand and supply, regulatory frameworks, technological advancements, and competitive pressures.

Market participants must stay agile and adaptable to navigate the evolving landscape effectively. The ability to anticipate and respond to market dynamics is essential for sustaining growth and maintaining a competitive edge in the commodity contracts brokerage industry.

Regional Analysis

The commodity contracts brokerage market exhibits regional variations influenced by factors such as commodity production, consumption patterns, regulatory environments, and economic conditions. Some regions, such as North America and Europe, have well-established commodity markets and sophisticated brokerage infrastructure. Emerging economies in Asia-Pacific and Latin America offer significant growth potential due to increasing commodity consumption and expanding market access.

Competitive Landscape

Leading Companies in the Commodity Contracts Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

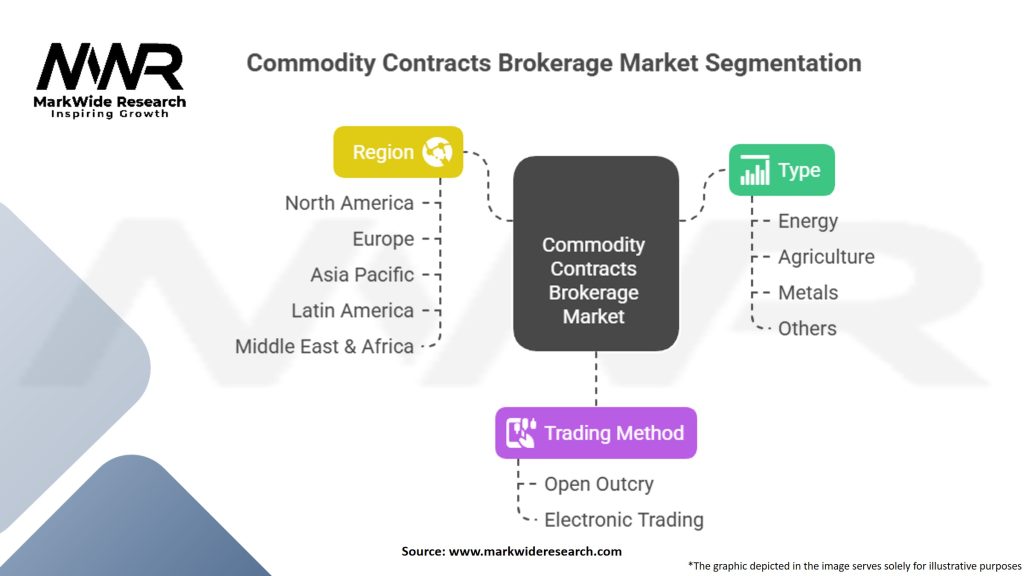

Segmentation

The commodity contracts brokerage market can be segmented based on the type of commodities traded, market participants, and geographic regions. Commodity categories commonly traded include agriculture (grains, livestock, etc.), energy (crude oil, natural gas, etc.), metals (gold, silver, copper, etc.), and financial instruments (futures, options, etc.).

Market participants can be categorized into producers, consumers, traders, speculators, and investors. Geographic segmentation considers regional variations in commodity markets and regulatory frameworks.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the commodity contracts brokerage market. The pandemic led to disruptions in global supply chains, reduced demand for certain commodities, and increased market volatility. Commodity contracts brokerage firms faced challenges in managing increased trading volumes, ensuring business continuity, and adapting to remote work environments. However, the pandemic also accelerated digital transformation efforts, as firms embraced online trading platforms and remote collaboration tools to continue operations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the commodity contracts brokerage market is promising, driven by factors such as increasing global commodity demand, technological advancements, and the growing importance of sustainable investing. However, market participants need to navigate challenges such as price volatility, regulatory changes, and intense competition. Firms that can adapt to evolving market dynamics, leverage technology effectively, and deliver value-added services are likely to thrive in the competitive landscape.

Conclusion

The commodity contracts brokerage market plays a crucial role in facilitating trading activities in various commodity markets. The market has experienced significant growth, driven by factors such as increasing global demand for commodities, technological advancements, and evolving regulatory frameworks. Market participants need to navigate challenges such as price volatility, regulatory compliance, and intense competition. By embracing technology, enhancing risk management capabilities, and diversifying service offerings, commodity contracts brokerage firms can position themselves for success in the future. The outlook for the market remains promising, with ample opportunities for growth and innovation in the years to come.

What is Commodity Contracts Brokerage?

Commodity Contracts Brokerage refers to the services provided by firms that facilitate the buying and selling of commodity contracts, which include agreements for the future delivery of commodities such as oil, gold, and agricultural products. These brokers help clients navigate the complexities of commodity trading, providing market insights and execution services.

What are the key players in the Commodity Contracts Brokerage Market?

Key players in the Commodity Contracts Brokerage Market include firms like CME Group, Intercontinental Exchange, and Cargill, which offer a range of brokerage services for various commodities. These companies play a significant role in connecting buyers and sellers, providing market access and trading platforms, among others.

What are the main drivers of growth in the Commodity Contracts Brokerage Market?

The growth of the Commodity Contracts Brokerage Market is driven by increasing global demand for commodities, volatility in commodity prices, and the expansion of trading platforms. Additionally, advancements in technology and the rise of retail trading are contributing to market growth.

What challenges does the Commodity Contracts Brokerage Market face?

The Commodity Contracts Brokerage Market faces challenges such as regulatory compliance, market volatility, and competition from alternative trading platforms. These factors can impact broker profitability and the ability to attract new clients.

What opportunities exist in the Commodity Contracts Brokerage Market?

Opportunities in the Commodity Contracts Brokerage Market include the expansion of digital trading platforms, the growing interest in sustainable commodities, and the potential for new market entrants. These trends can lead to innovative brokerage solutions and increased market participation.

What trends are shaping the Commodity Contracts Brokerage Market?

Trends shaping the Commodity Contracts Brokerage Market include the integration of artificial intelligence for trading strategies, the rise of environmental, social, and governance (ESG) considerations in commodity trading, and the increasing use of blockchain technology for transaction transparency. These innovations are transforming how brokers operate and engage with clients.

Commodity Contracts Brokerage Market

| Segmentation Details | Description |

|---|---|

| Type | Energy, Agriculture, Metals, Others |

| Trading Method | Open Outcry, Electronic Trading |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Commodity Contracts Brokerage Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at