444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Commercial Low Earth Orbit (LEO) Satellite market is experiencing a surge in demand, driven by the growing need for high-speed internet connectivity, remote sensing services, and global communication networks. LEO satellites orbit the Earth at altitudes ranging from 160 to 2,000 kilometers, offering advantages such as low latency, high data throughput, and global coverage. With advancements in satellite technology, decreasing launch costs, and increasing investment in space-based infrastructure, the commercial LEO satellite market is poised for significant growth and innovation.

Meaning

Commercial LEO satellites are spacecraft operated by private companies for various commercial purposes, including telecommunications, Earth observation, remote sensing, and scientific research. These satellites operate in low Earth orbit, enabling rapid data transmission, real-time imaging, and seamless connectivity for a wide range of applications. Commercial LEO satellite constellations consist of hundreds or even thousands of interconnected satellites working together to provide global coverage and high-speed internet access to remote regions.

Executive Summary

The Commercial LEO Satellite market is witnessing rapid expansion fueled by the demand for broadband internet services, IoT connectivity, and Earth observation data. Key players in the market are investing in satellite manufacturing, launch services, and ground infrastructure to deploy large-scale satellite constellations and capture market share. However, challenges such as regulatory hurdles, spectrum allocation issues, and competition from terrestrial networks pose constraints to market growth. Understanding market dynamics, technology trends, and regulatory frameworks is essential for stakeholders to capitalize on the opportunities in the commercial LEO satellite market.

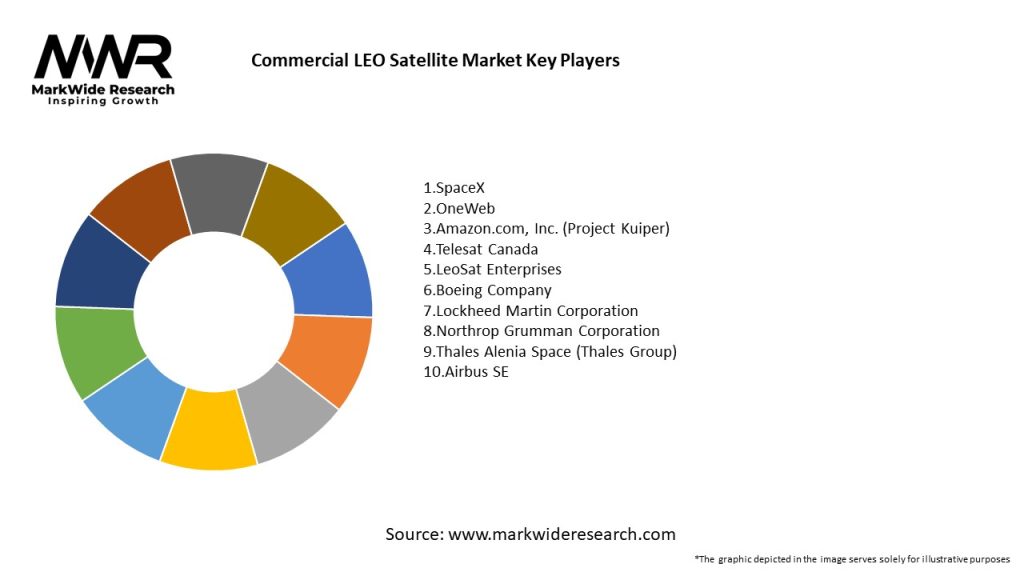

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Commercial LEO Satellite market operates in a dynamic environment shaped by technological advancements, regulatory frameworks, competitive dynamics, and market trends. Market dynamics influence investment decisions, business strategies, and market positioning, requiring stakeholders to adapt, innovate, and collaborate to succeed in the rapidly evolving space industry landscape.

Regional Analysis

The Commercial LEO Satellite market exhibits regional variations influenced by factors such as market demand, regulatory environments, technological capabilities, and infrastructure development. Key regions driving market growth and innovation include:

Competitive Landscape

Leading Companies in the Commercial LEO Satellite Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Commercial LEO Satellite market can be segmented based on various factors such as:

Segmentation provides insights into market dynamics, customer preferences, and growth opportunities, enabling stakeholders to tailor their strategies and offerings to specific market segments.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had both positive and negative impacts on the commercial LEO satellite market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Commercial LEO Satellite market is poised for significant growth and innovation, driven by increasing demand for broadband internet access, IoT connectivity, Earth observation data, and global communication networks. Technological advancements, regulatory reforms, and market dynamics will shape the future of the commercial LEO satellite industry, with opportunities for industry participants to capitalize on emerging trends, address evolving customer needs, and contribute to the global space economy.

Conclusion

The Commercial LEO Satellite market presents lucrative opportunities for stakeholders across the value chain, from satellite operators and manufacturers to launch service providers, telecommunications companies, and end-users. With advancements in satellite technology, decreasing launch costs, and increasing demand for connectivity, the commercial LEO satellite market is undergoing rapid expansion and transformation. By embracing innovation, collaboration, and market intelligence, stakeholders can navigate the complexities of the space industry, unlock new revenue streams, and shape the future of satellite-based services in a connected and data-driven world.

What is Commercial LEO Satellite?

Commercial LEO Satellite refers to low Earth orbit satellites that are used for various commercial applications, including telecommunications, Earth observation, and data services. These satellites operate at altitudes typically between one hundred to two thousand kilometers above the Earth.

What are the key players in the Commercial LEO Satellite Market?

Key players in the Commercial LEO Satellite Market include SpaceX, OneWeb, and Amazon’s Project Kuiper, which are actively developing and deploying satellite constellations for global internet coverage and other services, among others.

What are the main drivers of the Commercial LEO Satellite Market?

The main drivers of the Commercial LEO Satellite Market include the increasing demand for high-speed internet access in remote areas, advancements in satellite technology, and the growing need for real-time data for applications such as agriculture and disaster management.

What challenges does the Commercial LEO Satellite Market face?

The Commercial LEO Satellite Market faces challenges such as regulatory hurdles, the risk of space debris, and high initial investment costs for satellite deployment and infrastructure development.

What opportunities exist in the Commercial LEO Satellite Market?

Opportunities in the Commercial LEO Satellite Market include expanding services in underserved regions, partnerships with telecommunications companies, and innovations in satellite technology that enhance data transmission capabilities.

What trends are shaping the Commercial LEO Satellite Market?

Trends shaping the Commercial LEO Satellite Market include the rise of mega-constellations, increased collaboration between private and public sectors, and advancements in miniaturization and launch technologies that reduce costs and improve accessibility.

Commercial LEO Satellite Market

| Segmentation Details | Description |

|---|---|

| Product Type | Communication Satellites, Earth Observation Satellites, Navigation Satellites, Scientific Satellites |

| End User | Telecommunications, Government, Defense, Research Institutions |

| Deployment | Launch Services, Ground Stations, Satellite Operations, Data Services |

| Technology | Optical Communication, Radio Frequency, Propulsion Systems, Onboard Processing |

Leading Companies in the Commercial LEO Satellite Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at