444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Commercial Cyber Insurance Market is a vital component of risk management strategies for businesses in the digital age. This market addresses the growing threat of cyberattacks, data breaches, ransomware incidents, and other cyber risks faced by organizations across various industries. Commercial cyber insurance policies provide financial protection, risk mitigation, incident response support, and coverage for losses resulting from cyber incidents. With the increasing reliance on digital technologies, cloud computing, e-commerce, and remote work arrangements, the demand for cyber insurance solutions has surged, making this market a critical aspect of modern business resilience.

Meaning

Commercial Cyber Insurance refers to insurance policies specifically designed to protect businesses and organizations from financial losses, liabilities, and damages arising from cyber threats and security breaches. These policies cover a range of cyber risks, including data breaches, network intrusions, malware attacks, social engineering scams, business interruption, reputational damage, regulatory fines, legal expenses, and cyber extortion. Commercial cyber insurance providers offer customized policies tailored to the unique needs, risk profiles, and cyber exposures of different industries and businesses.

Executive Summary

The Commercial Cyber Insurance Market has experienced significant growth and evolution due to the escalating cyber threat landscape, regulatory pressures, data privacy concerns, digital transformation initiatives, and high-profile cyber incidents impacting businesses globally. Cyber insurance policies have become essential risk management tools, offering financial protection, incident response services, risk assessments, cyber risk mitigation advice, and post-breach support to policyholders. The market’s continued expansion is driven by increased awareness of cyber risks, regulatory mandates, contractual requirements, and the need for comprehensive cyber risk management strategies.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Commercial Cyber Insurance Market operates in a dynamic environment shaped by technological advancements, regulatory changes, cyber threat evolution, industry trends, competitive dynamics, customer demands, risk management practices, and geopolitical factors. Market dynamics influence policy coverage, pricing, underwriting criteria, claims handling processes, product innovation, service quality, market competitiveness, and industry growth. Adapting to these dynamics is essential for insurers, brokers, risk managers, cybersecurity professionals, and businesses to effectively navigate the complexities of the cyber insurance landscape and address evolving cyber risks.

Regional Analysis

The Commercial Cyber Insurance Market exhibits regional variations influenced by factors such as regulatory frameworks, industry sectors, cyber risk profiles, market maturity, technological adoption, and economic conditions. Key regions driving market growth and innovation include:

Competitive Landscape

Leading Companies in the Commercial Cyber Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

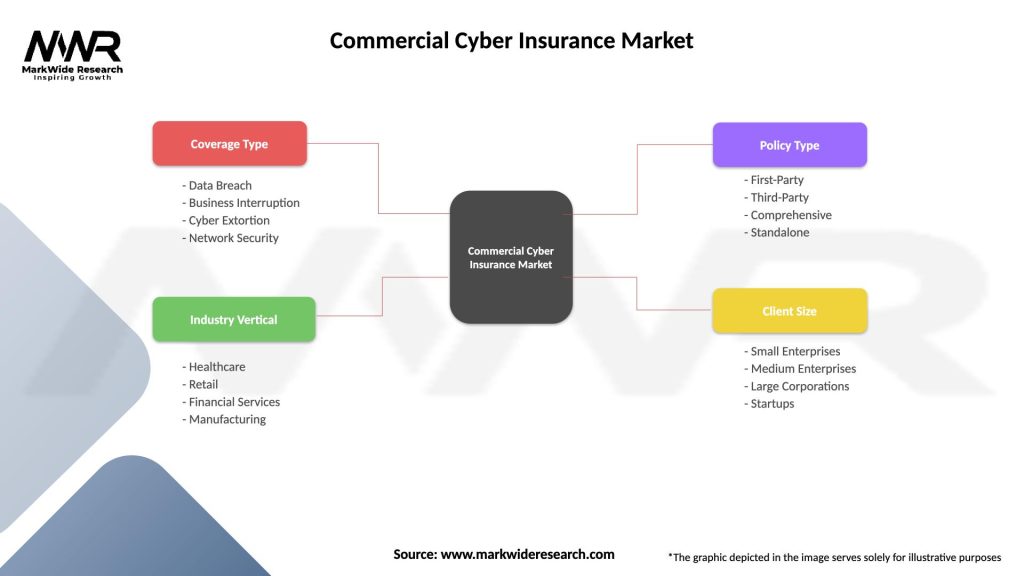

The Commercial Cyber Insurance Market can be segmented based on various criteria, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The Commercial Cyber Insurance Market is poised for continued growth, innovation, and evolution as businesses recognize the critical importance of cyber insurance in managing cyber risks, protecting digital assets, ensuring business continuity, and safeguarding against financial losses. Future trends shaping the market include:

Conclusion

In conclusion, the Commercial Cyber Insurance Market is a critical component of modern risk management strategies, offering financial protection, risk mitigation, incident response support, and regulatory compliance assistance to businesses facing cyber threats in an increasingly digitalized world. By embracing technology, fostering collaboration, enhancing risk awareness, and promoting cyber resilience, the market will continue to evolve, innovate, and address evolving cyber risks effectively.

What is Commercial Cyber Insurance?

Commercial Cyber Insurance refers to policies designed to protect businesses from financial losses due to cyber incidents, such as data breaches, ransomware attacks, and other cyber threats. These policies typically cover costs related to data recovery, legal fees, and business interruption.

What are the key players in the Commercial Cyber Insurance Market?

Key players in the Commercial Cyber Insurance Market include companies like AIG, Chubb, and Allianz, which offer a range of cyber insurance products tailored to different business needs. These companies are known for their comprehensive coverage options and risk management services, among others.

What are the main drivers of growth in the Commercial Cyber Insurance Market?

The growth of the Commercial Cyber Insurance Market is driven by the increasing frequency of cyberattacks, the rising awareness of cybersecurity risks among businesses, and the growing regulatory requirements for data protection. Additionally, the expansion of digital transformation initiatives across industries is contributing to the demand for cyber insurance.

What challenges does the Commercial Cyber Insurance Market face?

The Commercial Cyber Insurance Market faces challenges such as the evolving nature of cyber threats, which makes it difficult for insurers to accurately assess risks and set premiums. Additionally, there is a lack of standardized policies and coverage options, leading to confusion among businesses seeking insurance.

What opportunities exist in the Commercial Cyber Insurance Market?

Opportunities in the Commercial Cyber Insurance Market include the development of tailored insurance products for emerging technologies like IoT and cloud computing. Furthermore, as more businesses recognize the importance of cybersecurity, there is potential for growth in policy adoption and innovative coverage solutions.

What trends are shaping the Commercial Cyber Insurance Market?

Trends shaping the Commercial Cyber Insurance Market include the integration of advanced analytics and AI in underwriting processes, the rise of cyber risk assessment tools, and an increased focus on incident response planning. These trends are helping insurers better understand risks and provide more effective coverage options.

Commercial Cyber Insurance Market

| Segmentation Details | Description |

|---|---|

| Coverage Type | Data Breach, Business Interruption, Cyber Extortion, Network Security |

| Industry Vertical | Healthcare, Retail, Financial Services, Manufacturing |

| Policy Type | First-Party, Third-Party, Comprehensive, Standalone |

| Client Size | Small Enterprises, Medium Enterprises, Large Corporations, Startups |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Commercial Cyber Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at