444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Commercial Collection Service Market plays a crucial role in the financial sector, providing vital services for businesses to recover outstanding debts and manage receivables. Commercial collection services are instrumental in maintaining healthy cash flows, reducing bad debts, improving liquidity, and ensuring financial stability for businesses across various industries. This market encompasses a range of collection agencies, debt recovery firms, legal entities, and financial institutions specializing in commercial debt collection.

Meaning

Commercial collection services refer to the professional services offered by collection agencies, debt recovery firms, and legal entities to recover outstanding debts on behalf of businesses. These services involve the collection of delinquent accounts, unpaid invoices, overdue payments, and past-due receivables from commercial clients, customers, vendors, and business partners. Commercial collection agencies employ various strategies, including negotiation, communication, legal action, and skip tracing, to recover debts while adhering to regulatory guidelines and ethical standards.

Executive Summary

The Commercial Collection Service Market has experienced steady growth due to the increasing complexity of commercial transactions, globalization of business operations, economic fluctuations, and the need for efficient debt recovery solutions. Businesses across industries rely on commercial collection services to recover outstanding debts, minimize financial losses, maintain cash flows, and protect their bottom line. Key players in the market offer comprehensive debt collection solutions, innovative technologies, legal expertise, and industry-specific strategies to address the diverse needs of businesses facing commercial debt challenges.

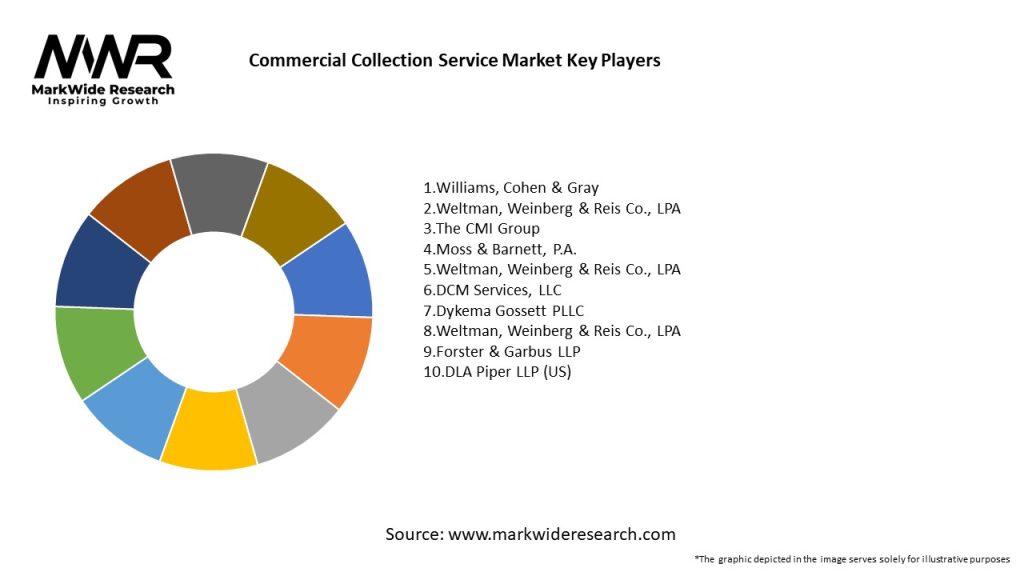

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Commercial Collection Service Market operates in a dynamic environment influenced by economic trends, regulatory changes, technological advancements, industry shifts, debtor behavior, and market competition. These dynamics shape the strategies, operations, and growth opportunities for collection agencies, debt recovery firms, and financial institutions operating in the market.

Regional Analysis

The Commercial Collection Service Market exhibits regional variations influenced by factors such as economic conditions, business landscapes, legal frameworks, cultural norms, industry sectors, and debt recovery practices. Key regions driving market growth and innovation include:

Competitive Landscape

Leading Companies in the Commercial Collection Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Commercial Collection Service Market can be segmented based on various factors to cater to the diverse needs of businesses and industries:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had significant implications for the Commercial Collection Service Market, including:

Key Industry Developments

Analyst Suggestions

Future Outlook

The Commercial Collection Service Market is expected to witness continued growth and evolution driven by technological advancements, regulatory developments, industry collaborations, and changing debtor behaviors. Key trends shaping the future outlook of the market include:

Conclusion

In conclusion, the Commercial Collection Service Market plays a vital role in supporting businesses across industries by providing efficient debt recovery solutions, regulatory compliance expertise, and technology-driven innovations to optimize cash flows, reduce bad debts, and protect financial stability. The market’s future growth will be driven by digital transformation, regulatory adherence, industry specialization, and customer-centric approaches, addressing evolving market dynamics and debtor challenges in a dynamic business environment.

What is Commercial Collection Service?

Commercial Collection Service refers to specialized services that assist businesses in recovering outstanding debts from clients or customers. These services often involve negotiation, legal action, and various collection strategies to ensure that businesses receive payments owed to them.

What are the key players in the Commercial Collection Service Market?

Key players in the Commercial Collection Service Market include companies like CBE Group, Inc., IC System, and Allied International Credit, which provide a range of debt recovery solutions. These firms utilize various techniques and technologies to enhance collection efficiency, among others.

What are the main drivers of growth in the Commercial Collection Service Market?

The growth of the Commercial Collection Service Market is driven by increasing levels of consumer debt, the need for businesses to maintain cash flow, and the rising complexity of financial transactions. Additionally, the expansion of e-commerce has led to more businesses requiring collection services.

What challenges does the Commercial Collection Service Market face?

The Commercial Collection Service Market faces challenges such as regulatory compliance, the potential for negative customer experiences, and the impact of economic downturns on debt recovery rates. These factors can complicate the collection process and affect service effectiveness.

What opportunities exist in the Commercial Collection Service Market?

Opportunities in the Commercial Collection Service Market include the adoption of advanced technologies like AI and machine learning to improve collection strategies, as well as expanding services to new industries such as healthcare and technology. These innovations can enhance efficiency and client satisfaction.

What trends are shaping the Commercial Collection Service Market?

Trends in the Commercial Collection Service Market include the increasing use of digital communication methods for debt collection, a focus on ethical collection practices, and the integration of data analytics to optimize collection strategies. These trends are reshaping how collection services operate.

Commercial Collection Service Market

| Segmentation Details | Description |

|---|---|

| Service Type | Debt Recovery, Credit Control, Skip Tracing, Legal Collections |

| Client Type | Small Businesses, Corporations, Government Agencies, Nonprofits |

| Industry Vertical | Retail, Healthcare, Construction, Transportation |

| Engagement Model | Contingency Fee, Flat Fee, Hybrid Model, Subscription |

Leading Companies in the Commercial Collection Service Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at