444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The commercial aircraft airborne collision avoidance system (ACAS) market is an essential segment of the aviation industry dedicated to enhancing flight safety. ACAS serves as a critical tool for preventing mid-air collisions by providing real-time alerts and collision avoidance guidance to pilots. With the increasing volume of air traffic and emphasis on passenger safety, the demand for advanced ACAS solutions continues to rise, driving innovation and market growth in the aerospace sector.

Meaning

The commercial aircraft airborne collision avoidance system (ACAS) is a safety technology designed to prevent collisions between aircraft in flight. It employs radar, transponder data, and algorithms to detect nearby aircraft and issue resolution advisories to pilots to avoid potential collisions. ACAS is a vital component of the aircraft’s avionics system, providing an additional layer of safety by alerting pilots to the presence of other aircraft and recommending evasive actions when necessary.

Executive Summary

The commercial aircraft ACAS market is witnessing steady growth fueled by increasing air traffic, stringent safety regulations, and the need to mitigate the risk of mid-air collisions. Key market players focus on developing advanced ACAS solutions compliant with international standards and regulations to address evolving safety requirements and customer demands. Despite challenges such as regulatory compliance, technological complexity, and cost pressures, the ACAS market presents opportunities for growth, innovation, and market expansion in the global aviation industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The commercial aircraft ACAS market operates in a dynamic environment influenced by factors such as technological advancements, regulatory mandates, market trends, and industry dynamics. Market dynamics such as evolving safety regulations, increasing air traffic, technological innovations, and competitive pressures shape market growth, innovation, and strategic decision-making for manufacturers and stakeholders.

Regional Analysis

The commercial aircraft ACAS market exhibits regional variations in demand, market maturity, regulatory frameworks, and industry dynamics due to factors such as aviation safety regulations, air traffic volumes, fleet composition, and economic conditions. Regional analysis provides insights into market trends, growth opportunities, and competitive landscapes in key regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Competitive Landscape

Leading Companies in the Commercial Aircraft Airborne Collision Avoidance System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

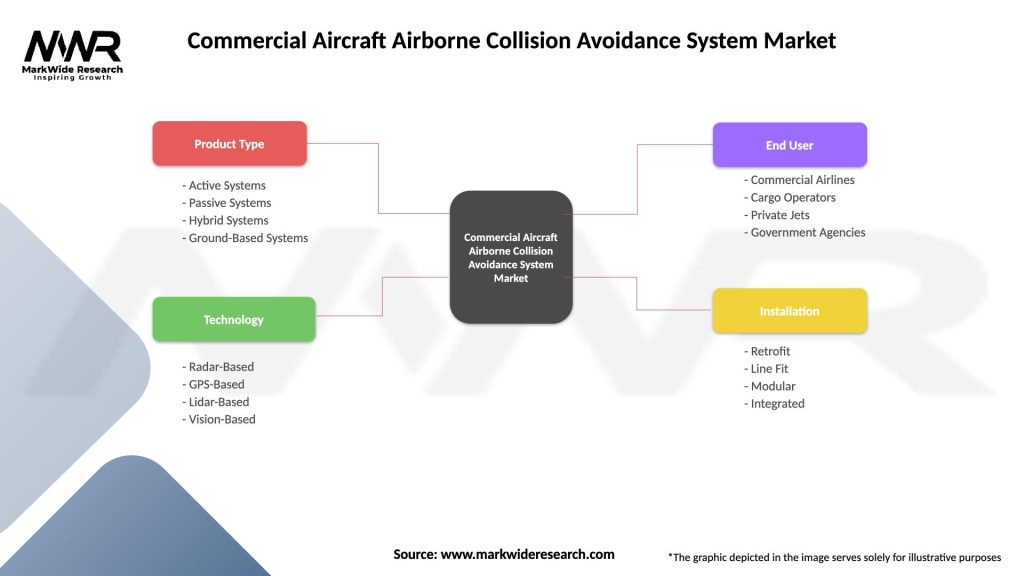

Segmentation

The commercial aircraft ACAS market can be segmented based on various factors such as system type, aircraft type, end-user, and region:

Segmentation provides a detailed understanding of market dynamics, customer preferences, and growth opportunities, enabling manufacturers to tailor their strategies and offerings to specific market segments and target audiences effectively.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis of the commercial aircraft ACAS market provides insights into its strengths, weaknesses, opportunities, and threats:

Understanding these factors enables industry participants to capitalize on strengths, address weaknesses, leverage opportunities, and mitigate threats effectively in the commercial aircraft ACAS market.

Market Key Trends

COVID-19 Impact

The COVID-19 pandemic has had a significant impact on the commercial aircraft ACAS market:

Key Industry Developments

Analyst Suggestions

Future Outlook

The commercial aircraft ACAS market is poised for steady growth and innovation driven by increasing air traffic, stringent safety regulations, technological advancements, and market trends shaping the future of aviation safety and collision avoidance. Despite challenges such as regulatory compliance, cost pressures, and supply chain disruptions, the ACAS market presents opportunities for growth, expansion, and market leadership in the global aerospace industry.

Conclusion

The commercial aircraft airborne collision avoidance system (ACAS) market is a critical segment of the aviation industry dedicated to enhancing flight safety, preventing mid-air collisions, and ensuring the integrity of the global airspace system. Despite challenges such as regulatory compliance, technological complexity, and cost pressures, the ACAS market offers opportunities for growth, innovation, and market expansion driven by increasing air traffic, stringent safety regulations, and the need to mitigate safety risks in commercial aviation operations. By investing in research and development, regulatory compliance, customer engagement, and strategic partnerships, ACAS manufacturers can capitalize on emerging opportunities, address evolving market needs, and contribute to the advancement of aviation safety and collision avoidance technology.

What is Commercial Aircraft Airborne Collision Avoidance System?

Commercial Aircraft Airborne Collision Avoidance System refers to technologies and systems designed to prevent mid-air collisions between aircraft. These systems utilize radar, transponders, and other sensors to detect nearby aircraft and provide alerts to pilots, enhancing flight safety.

What are the key players in the Commercial Aircraft Airborne Collision Avoidance System Market?

Key players in the Commercial Aircraft Airborne Collision Avoidance System Market include Honeywell International Inc., Rockwell Collins, Thales Group, and BAE Systems, among others. These companies are known for their innovative technologies and solutions that enhance airborne safety.

What are the growth factors driving the Commercial Aircraft Airborne Collision Avoidance System Market?

The growth of the Commercial Aircraft Airborne Collision Avoidance System Market is driven by increasing air traffic, advancements in aviation technology, and a heightened focus on safety regulations. Additionally, the rising demand for new aircraft equipped with advanced collision avoidance systems contributes to market expansion.

What challenges does the Commercial Aircraft Airborne Collision Avoidance System Market face?

Challenges in the Commercial Aircraft Airborne Collision Avoidance System Market include high development costs, the complexity of integrating new systems with existing aircraft, and regulatory compliance issues. These factors can hinder the timely adoption of advanced collision avoidance technologies.

What opportunities exist in the Commercial Aircraft Airborne Collision Avoidance System Market?

Opportunities in the Commercial Aircraft Airborne Collision Avoidance System Market include the development of next-generation systems utilizing artificial intelligence and machine learning. Additionally, increasing investments in aviation safety and modernization of aging fleets present significant growth potential.

What trends are shaping the Commercial Aircraft Airborne Collision Avoidance System Market?

Trends in the Commercial Aircraft Airborne Collision Avoidance System Market include the integration of satellite-based navigation systems and the use of data analytics for predictive safety measures. Furthermore, the push towards automation in aviation is leading to more sophisticated collision avoidance technologies.

Commercial Aircraft Airborne Collision Avoidance System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Active Systems, Passive Systems, Hybrid Systems, Ground-Based Systems |

| Technology | Radar-Based, GPS-Based, Lidar-Based, Vision-Based |

| End User | Commercial Airlines, Cargo Operators, Private Jets, Government Agencies |

| Installation | Retrofit, Line Fit, Modular, Integrated |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Commercial Aircraft Airborne Collision Avoidance System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at