444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Colombia renewable energy industry market represents one of Latin America’s most dynamic and rapidly evolving energy sectors, driven by abundant natural resources and progressive government policies. Colombia’s renewable energy landscape encompasses hydroelectric power, solar energy, wind power, biomass, and geothermal resources, positioning the country as a regional leader in sustainable energy development. The market has experienced remarkable growth momentum with renewable energy capacity expanding at approximately 12.5% annually over recent years.

Hydroelectric power dominates Colombia’s renewable energy portfolio, accounting for approximately 68% of total electricity generation, while non-conventional renewable sources including solar and wind are experiencing unprecedented expansion. The country’s strategic location near the equator provides exceptional solar irradiation levels averaging 4.5-6.0 kWh/m² daily, while coastal regions offer substantial wind energy potential with average speeds exceeding 7 m/s.

Government initiatives and regulatory frameworks have catalyzed market transformation, with Law 1715 of 2014 establishing comprehensive incentives for renewable energy development. The market benefits from international investment flows and technological partnerships, creating opportunities for both domestic and foreign stakeholders to participate in Colombia’s energy transition.

The Colombia renewable energy industry market refers to the comprehensive ecosystem of companies, technologies, infrastructure, and services dedicated to generating electricity from renewable sources within Colombian territory. This market encompasses the development, construction, operation, and maintenance of renewable energy projects including hydroelectric facilities, solar photovoltaic installations, wind farms, biomass plants, and emerging geothermal projects.

Market participants include energy developers, equipment manufacturers, engineering firms, financial institutions, government agencies, and utility companies working collaboratively to expand Colombia’s renewable energy capacity. The industry involves complex value chains spanning from resource assessment and project development to grid integration and energy distribution, supported by enabling services such as financing, consulting, and technology transfer.

Renewable energy development in Colombia encompasses both large-scale utility projects and distributed generation systems, addressing diverse energy needs across urban centers, rural communities, and industrial facilities while contributing to national energy security and environmental sustainability objectives.

Colombia’s renewable energy sector stands at a transformative juncture, characterized by accelerating investment, technological advancement, and policy support driving unprecedented market expansion. The industry has evolved from traditional hydroelectric dominance to embrace diversified renewable technologies, with solar and wind energy experiencing exponential growth rates exceeding 45% annually in recent project developments.

Market dynamics reflect Colombia’s commitment to achieving carbon neutrality by 2050, with renewable energy playing a central role in national climate strategies. The sector benefits from competitive electricity auction mechanisms that have successfully attracted international developers and reduced renewable energy costs by approximately 35% over five years.

Investment flows into Colombian renewable energy projects have intensified, supported by multilateral development banks, international climate funds, and private equity investors recognizing the country’s exceptional resource potential and improving regulatory environment. Grid modernization initiatives and transmission infrastructure development are facilitating renewable energy integration while addressing historical connectivity challenges in remote regions.

Technological innovation and knowledge transfer partnerships are enhancing local capabilities, with Colombian companies increasingly participating in renewable energy value chains and developing specialized expertise in project development, construction, and operations management.

Strategic market insights reveal Colombia’s renewable energy industry as a rapidly maturing sector with significant untapped potential across multiple technology segments:

Primary market drivers propelling Colombia’s renewable energy industry growth encompass policy, economic, environmental, and technological factors creating favorable conditions for sector expansion.

Government policy initiatives represent the most significant driver, with comprehensive renewable energy legislation providing long-term market certainty and financial incentives. National energy planning prioritizes renewable energy development to enhance energy security, reduce import dependence, and achieve climate commitments under international agreements.

Economic competitiveness of renewable technologies has improved dramatically, with solar and wind energy achieving grid parity in many Colombian regions. Declining technology costs and improving efficiency metrics make renewable energy increasingly attractive compared to conventional fossil fuel alternatives.

Climate change concerns and environmental sustainability requirements drive demand for clean energy solutions. Corporate sustainability initiatives and international supply chain requirements are encouraging Colombian businesses to adopt renewable energy sources, creating additional market demand.

Energy access challenges in remote and rural areas present opportunities for distributed renewable energy solutions. Off-grid renewable systems offer cost-effective alternatives to traditional grid extension projects, particularly in Colombia’s geographically diverse regions.

International climate finance availability supports renewable energy project development through concessional funding, grants, and technical assistance programs from multilateral development banks and climate funds.

Market restraints affecting Colombia’s renewable energy industry development include infrastructure limitations, regulatory challenges, and financial constraints that may impede optimal sector growth.

Grid infrastructure limitations present significant challenges for renewable energy integration, particularly in regions with high resource potential but limited transmission capacity. Grid stability concerns related to variable renewable energy sources require substantial investments in smart grid technologies and energy storage systems.

Regulatory complexity and bureaucratic processes can delay project development timelines, increasing costs and creating uncertainty for investors. Permitting procedures involving multiple government agencies and environmental assessments may extend project development cycles beyond optimal timeframes.

Financing constraints affect smaller developers and distributed generation projects, with limited access to long-term, low-cost capital restricting market participation. Currency risk and macroeconomic volatility may deter international investment in renewable energy projects.

Technical workforce limitations in specialized renewable energy skills create bottlenecks in project implementation and operations. Local content requirements and supply chain constraints may increase project costs and complexity.

Land acquisition challenges and community consultation requirements can complicate large-scale renewable energy project development, particularly in areas with complex land tenure arrangements or indigenous territories.

Significant market opportunities exist across Colombia’s renewable energy landscape, driven by untapped resource potential, emerging technologies, and evolving market structures.

Solar energy development presents exceptional opportunities given Colombia’s favorable solar irradiation conditions and declining photovoltaic technology costs. Distributed solar installations for commercial and industrial customers offer attractive investment returns and energy cost savings.

Wind energy potential along Colombia’s Caribbean coast and mountainous regions remains largely undeveloped, representing substantial opportunities for utility-scale wind farm development. Offshore wind resources present long-term opportunities as technology costs decline and regulatory frameworks evolve.

Energy storage integration creates opportunities for hybrid renewable energy projects combining generation and storage capabilities. Battery storage systems can enhance grid stability while enabling higher renewable energy penetration levels.

Green hydrogen production using renewable electricity presents emerging opportunities for industrial applications and export potential. Electrolysis facilities powered by renewable energy could position Colombia as a regional green hydrogen hub.

Rural electrification programs using renewable energy technologies offer opportunities to serve underserved communities while supporting social development objectives. Mini-grid solutions combining solar, wind, and storage can provide reliable electricity access in remote areas.

Market dynamics within Colombia’s renewable energy industry reflect complex interactions between policy frameworks, technological advancement, investment flows, and competitive forces shaping sector evolution.

Competitive auction mechanisms have fundamentally transformed market dynamics by introducing transparent price discovery and encouraging competitive bidding among renewable energy developers. Reverse auction results demonstrate significant cost reductions with winning bids achieving prices approximately 40% below previous market levels.

Technology learning curves continue driving cost reductions across renewable energy technologies, with solar photovoltaic and wind energy experiencing particularly steep cost declines. Economies of scale in project development and construction are improving project economics and attracting larger international developers.

Grid integration challenges are driving innovation in energy management systems, forecasting technologies, and grid flexibility solutions. Smart grid investments and advanced metering infrastructure are enabling better renewable energy integration and system optimization.

Financial market development is improving access to long-term financing for renewable energy projects through green bonds, development finance institutions, and specialized renewable energy funds. Risk mitigation instruments are reducing investment barriers and lowering financing costs.

Supply chain localization efforts are creating opportunities for domestic manufacturing and services while reducing project costs and import dependencies. Technology transfer partnerships are building local capabilities and expertise in renewable energy development.

Comprehensive research methodology employed for analyzing Colombia’s renewable energy industry market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights.

Primary research activities include structured interviews with industry stakeholders, government officials, technology providers, and financial institutions active in Colombian renewable energy markets. Field surveys and site visits to operational renewable energy projects provide firsthand insights into market conditions and operational challenges.

Secondary research sources encompass government energy statistics, regulatory documents, industry reports, academic studies, and international energy agency publications. Market data validation involves cross-referencing multiple sources and applying statistical analysis techniques to ensure data consistency and accuracy.

Analytical frameworks include market sizing methodologies, competitive analysis models, and scenario planning techniques to assess market potential and future development trajectories. Quantitative analysis incorporates statistical modeling and trend analysis to identify market patterns and growth drivers.

Expert consultation with renewable energy specialists, policy analysts, and market researchers provides additional validation and insights into market dynamics and future prospects. Stakeholder feedback ensures research findings reflect diverse perspectives and market realities.

Regional analysis of Colombia’s renewable energy market reveals significant geographical variations in resource potential, infrastructure development, and market activity across different departments and regions.

Caribbean Coast Region leads in wind energy development potential, with La Guajira department hosting Colombia’s largest wind farms and representing approximately 85% of operational wind capacity. The region benefits from consistent trade winds and proximity to transmission infrastructure connecting to major consumption centers.

Andean Region dominates hydroelectric generation with major facilities in Antioquia, Huila, and Tolima departments. The region accounts for approximately 75% of Colombia’s hydroelectric capacity and continues attracting investment in small and medium-scale hydroelectric projects.

Eastern Plains (Llanos Orientales) present exceptional solar energy potential with high irradiation levels and available land for large-scale photovoltaic installations. Meta and Casanare departments are emerging as preferred locations for utility-scale solar projects.

Pacific Coast Region offers biomass energy opportunities utilizing agricultural residues and forest resources, while also possessing untapped small-scale hydroelectric potential. Valle del Cauca leads in sugarcane bagasse-based biomass generation.

Central Region including Cundinamarca and Boyacá focuses on distributed renewable energy systems serving industrial and commercial customers in major urban centers. The region represents approximately 30% of renewable energy consumption despite limited generation resources.

Competitive landscape within Colombia’s renewable energy industry encompasses diverse participants including international developers, domestic utilities, technology providers, and specialized service companies.

Market competition has intensified through competitive auction processes, driving innovation and cost reductions while attracting new market entrants. Strategic partnerships between international developers and local companies are common, leveraging global expertise with local market knowledge.

Technology competition focuses on efficiency improvements, cost optimization, and grid integration capabilities, with companies differentiating through advanced forecasting systems, energy storage integration, and digital monitoring platforms.

Market segmentation of Colombia’s renewable energy industry reveals distinct categories based on technology type, project scale, end-user applications, and geographical distribution.

By Technology:

By Project Scale:

By End-User Application:

Category-wise analysis provides detailed insights into performance, growth potential, and market dynamics across different renewable energy segments in Colombia.

Hydroelectric Power Category: Maintains market leadership with established infrastructure and operational expertise. Large hydroelectric facilities provide baseload generation capacity while small hydroelectric projects offer opportunities for rural development and distributed generation. The category faces challenges from climate variability affecting water availability and environmental concerns regarding large dam projects.

Solar Energy Category: Experiences the fastest growth trajectory with declining technology costs and improving efficiency metrics. Utility-scale solar projects benefit from competitive auction mechanisms while distributed solar installations serve growing commercial and industrial demand. The category benefits from Colombia’s exceptional solar resource potential and supportive regulatory framework.

Wind Energy Category: Concentrated geographically in coastal regions with high-quality wind resources. The category has achieved significant scale with large wind farms operational and additional projects under development. Offshore wind potential represents future growth opportunities as technology costs decline and regulatory frameworks develop.

Biomass Energy Category: Leverages Colombia’s agricultural sector with sugarcane bagasse representing the primary feedstock. The category offers opportunities for circular economy approaches and rural development while addressing waste management challenges. Biogas projects utilizing organic waste streams present emerging opportunities.

Geothermal Energy Category: Remains in early development stages with exploration activities identifying potential resources in volcanic regions. The category offers long-term potential for baseload renewable generation but requires significant upfront investment and technical expertise.

Industry participants and stakeholders in Colombia’s renewable energy market realize substantial benefits across economic, environmental, and social dimensions.

Economic Benefits:

Environmental Benefits:

Social Benefits:

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping Colombia’s renewable energy industry reflect technological advancement, policy evolution, and changing market dynamics driving sector transformation.

Hybrid Renewable Projects: Growing trend toward combining multiple renewable technologies and energy storage in single projects to optimize resource utilization and grid integration. Solar-plus-storage and wind-solar hybrid projects are gaining popularity among developers seeking to maximize project economics and grid stability.

Digitalization and Smart Technologies: Increasing adoption of digital monitoring systems, artificial intelligence, and IoT technologies for renewable energy project optimization. Predictive maintenance and advanced forecasting systems are improving operational efficiency and reducing costs.

Corporate Renewable Energy Procurement: Growing demand from commercial and industrial customers for renewable energy through power purchase agreements and distributed generation systems. Corporate sustainability commitments are driving market demand beyond traditional utility procurement.

Community Engagement and Social Impact: Enhanced focus on community participation and social benefit sharing in renewable energy project development. Local content requirements and community investment programs are becoming standard practice.

Green Finance Innovation: Development of green bonds, blended finance, and innovative financing mechanisms specifically designed for renewable energy projects. Climate finance from international sources is increasingly available for Colombian renewable energy development.

Grid Modernization: Accelerated investment in smart grid infrastructure and transmission system upgrades to accommodate higher renewable energy penetration levels. Grid flexibility solutions including demand response and energy storage are gaining importance.

Recent industry developments demonstrate the dynamic nature of Colombia’s renewable energy market with significant project announcements, policy updates, and technological advancements.

Major Project Developments: Several large-scale renewable energy projects have achieved financial closure and commenced construction, including utility-scale solar installations exceeding 100 MW capacity and wind farms utilizing latest turbine technologies. MarkWide Research analysis indicates these projects represent substantial capacity additions to Colombia’s renewable energy portfolio.

Regulatory Enhancements: Government agencies have streamlined permitting procedures and introduced additional incentives for renewable energy development, including enhanced tax benefits for energy storage integration and distributed generation systems.

Technology Partnerships: Colombian companies have established strategic alliances with international technology providers, facilitating knowledge transfer and local manufacturing capabilities development. These partnerships are enhancing domestic renewable energy industry competitiveness.

Financial Market Development: Launch of specialized renewable energy investment funds and green bond issuances providing additional financing options for project developers. International development finance institutions have increased lending commitments for Colombian renewable energy projects.

Grid Integration Improvements: Completion of transmission infrastructure projects connecting high renewable resource regions to major consumption centers, reducing grid integration constraints and enabling additional renewable energy development.

Innovation Initiatives: Establishment of renewable energy research centers and innovation hubs promoting technology development and entrepreneurship in clean energy sectors.

Strategic recommendations for stakeholders in Colombia’s renewable energy market focus on capitalizing on growth opportunities while addressing key challenges and market constraints.

For Developers and Investors:

For Government and Policymakers:

For Financial Institutions:

Future outlook for Colombia’s renewable energy industry indicates continued robust growth driven by favorable market conditions, technological advancement, and policy support creating substantial opportunities for market participants.

Capacity Expansion Projections: MWR analysis suggests Colombia’s renewable energy capacity could expand at approximately 15-20% annually over the next decade, with solar and wind energy representing the fastest-growing segments. Non-conventional renewable sources are projected to account for an increasing share of total electricity generation.

Technology Evolution: Continued cost reductions and efficiency improvements in solar photovoltaic and wind technologies will enhance competitiveness and market penetration. Energy storage integration will become increasingly common, enabling higher renewable energy penetration levels and grid stability.

Market Structure Development: Evolution toward more sophisticated electricity market mechanisms including capacity markets, ancillary services, and flexibility products will create additional revenue streams for renewable energy projects. Peer-to-peer energy trading and virtual power plants may emerge as market innovations.

Regional Integration: Colombia’s renewable energy sector may expand beyond domestic markets through regional electricity trade and renewable energy exports to neighboring countries. Green hydrogen production for export markets represents a potential long-term opportunity.

Investment Flows: Continued strong international investment interest supported by climate finance availability and improving project economics. Institutional investor participation through infrastructure funds and pension fund investments will provide additional capital sources.

Innovation and Digitalization: Accelerated adoption of digital technologies, artificial intelligence, and advanced analytics will optimize renewable energy project performance and reduce operational costs. Blockchain applications and smart contracts may streamline energy transactions and grid management.

Colombia’s renewable energy industry market represents one of Latin America’s most promising clean energy sectors, characterized by exceptional resource potential, supportive policy frameworks, and growing international investment interest. The market has evolved from traditional hydroelectric dominance to embrace technology diversification, with solar and wind energy experiencing remarkable growth momentum.

Market fundamentals remain strong, supported by competitive economics, regulatory incentives, and increasing corporate demand for renewable energy solutions. The industry benefits from Colombia’s strategic geographic advantages, abundant natural resources, and commitment to sustainable development objectives aligned with international climate goals.

Future prospects indicate continued robust growth across multiple renewable energy segments, driven by technological advancement, cost reductions, and expanding market opportunities. Grid modernization initiatives and transmission infrastructure development will facilitate higher renewable energy penetration while addressing integration challenges.

Success factors for market participants include technology diversification, local partnership development, community engagement, and adaptation to evolving market structures and regulatory frameworks. The Colombia renewable energy industry market offers substantial opportunities for developers, investors, and stakeholders committed to sustainable energy development and long-term value creation in this dynamic and rapidly expanding sector.

What is Renewable Energy?

Renewable energy refers to energy derived from natural processes that are replenished constantly, such as solar, wind, hydro, and biomass. In Colombia, renewable energy plays a crucial role in diversifying the energy mix and reducing reliance on fossil fuels.

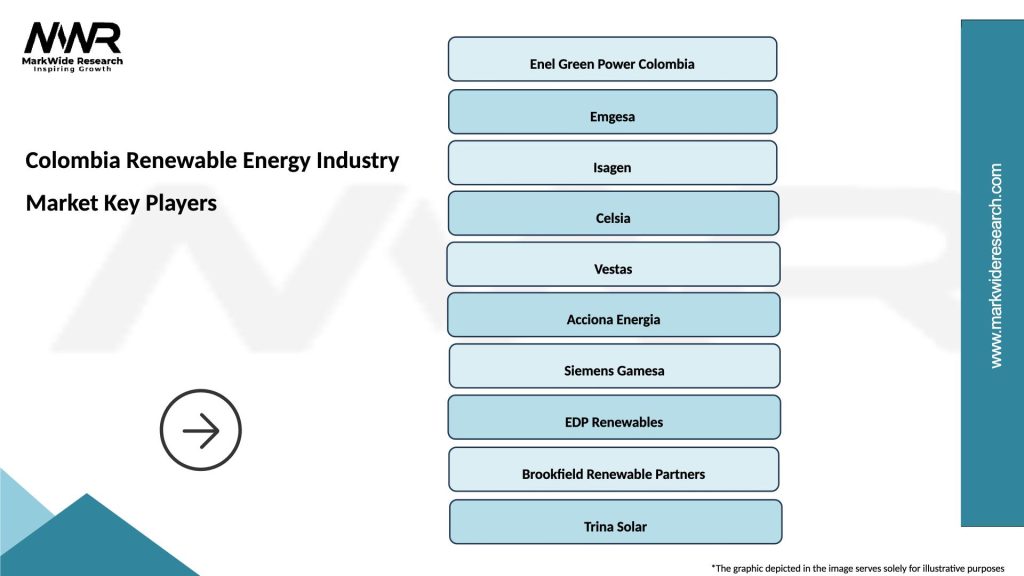

What are the key players in the Colombia Renewable Energy Industry Market?

Key players in the Colombia Renewable Energy Industry Market include companies like Enel Colombia, Celsia, and EPM, which are involved in various renewable energy projects such as solar and wind farms, among others.

What are the growth factors driving the Colombia Renewable Energy Industry Market?

The growth of the Colombia Renewable Energy Industry Market is driven by factors such as government incentives for clean energy, increasing energy demand, and the need to reduce greenhouse gas emissions. Additionally, advancements in technology are making renewable energy sources more accessible.

What challenges does the Colombia Renewable Energy Industry Market face?

The Colombia Renewable Energy Industry Market faces challenges such as regulatory hurdles, infrastructure limitations, and competition from traditional energy sources. These factors can hinder the growth and implementation of renewable energy projects.

What opportunities exist in the Colombia Renewable Energy Industry Market?

Opportunities in the Colombia Renewable Energy Industry Market include the potential for investment in solar and wind energy projects, as well as the development of energy storage solutions. The increasing focus on sustainability also opens avenues for innovative technologies.

What trends are shaping the Colombia Renewable Energy Industry Market?

Trends shaping the Colombia Renewable Energy Industry Market include the rise of decentralized energy systems, increased investment in renewable technologies, and a growing emphasis on sustainability practices. These trends are influencing how energy is produced and consumed in the country.

Colombia Renewable Energy Industry Market

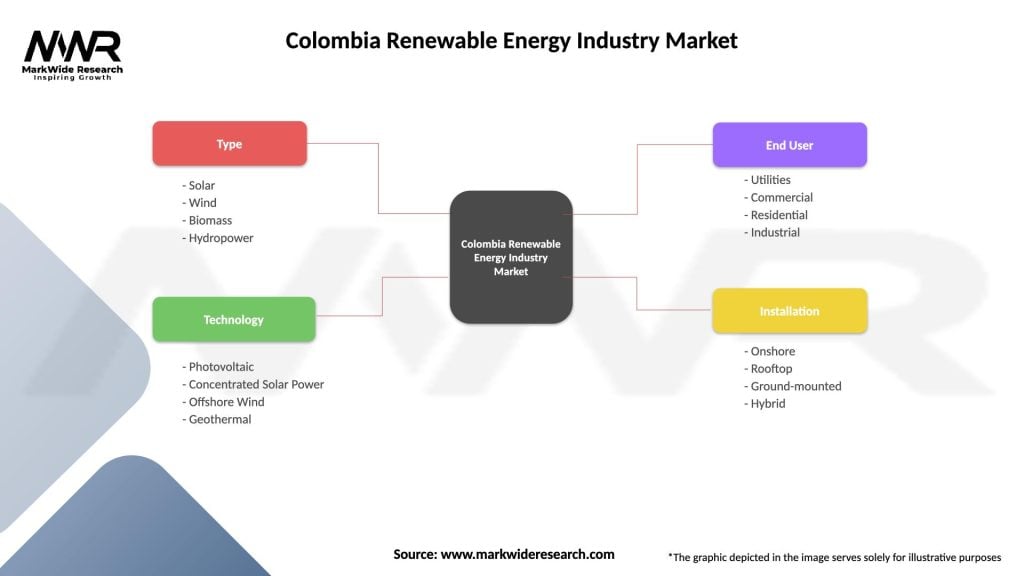

| Segmentation Details | Description |

|---|---|

| Type | Solar, Wind, Biomass, Hydropower |

| Technology | Photovoltaic, Concentrated Solar Power, Offshore Wind, Geothermal |

| End User | Utilities, Commercial, Residential, Industrial |

| Installation | Onshore, Rooftop, Ground-mounted, Hybrid |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Renewable Energy Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at