444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Colombia power market represents one of South America’s most dynamic and rapidly evolving energy sectors, characterized by significant transformation and modernization initiatives. Colombia’s electricity sector has experienced substantial growth driven by increasing energy demand, infrastructure development, and strategic government policies promoting renewable energy integration. The market demonstrates robust expansion with projected growth rates of 4.2% annually through the next decade, reflecting the country’s commitment to energy security and sustainable development.

Market dynamics in Colombia’s power sector are influenced by diverse factors including hydroelectric dominance, thermal generation capacity, and emerging renewable energy technologies. The country’s unique geographical advantages, particularly its abundant water resources and favorable wind and solar conditions, position it as a regional leader in clean energy development. Renewable energy sources currently account for approximately 68% of total generation capacity, with hydroelectric power representing the largest segment of the energy mix.

Infrastructure modernization initiatives continue to drive market expansion, supported by both public and private sector investments. The Colombian government’s strategic focus on grid reliability, transmission network enhancement, and rural electrification programs creates substantial opportunities for market participants. Energy access rates have improved significantly, reaching 97.4% national coverage, demonstrating the sector’s commitment to universal electricity access.

The Colombia power market refers to the comprehensive ecosystem encompassing electricity generation, transmission, distribution, and commercialization activities within Colombian territory. This market includes all stakeholders involved in the production, transportation, and supply of electrical energy to residential, commercial, industrial, and institutional consumers across the nation.

Market structure operates under a competitive wholesale electricity market model, where generators compete to supply electricity through a centralized dispatch system managed by the National Dispatch Center. The regulatory framework ensures fair competition while maintaining system reliability and promoting investment in new generation capacity and grid infrastructure.

Key components of the Colombia power market include generation companies, transmission system operators, distribution utilities, commercialization entities, and regulatory bodies that collectively ensure efficient electricity supply and market operations throughout the country.

Colombia’s power market stands at a pivotal transformation point, driven by ambitious renewable energy targets, grid modernization initiatives, and increasing electricity demand from economic growth. The sector demonstrates remarkable resilience and adaptability, successfully navigating challenges while maintaining reliable electricity supply to millions of consumers.

Strategic developments include significant investments in solar and wind energy projects, smart grid technologies, and energy storage solutions. The market benefits from favorable regulatory policies supporting renewable energy development, with non-conventional renewable energy projects experiencing growth rates of 15.3% annually. These initiatives align with Colombia’s commitment to reducing greenhouse gas emissions and achieving carbon neutrality goals.

Market participants range from large-scale utility companies to independent power producers, energy traders, and technology providers. The competitive landscape encourages innovation and efficiency improvements, resulting in enhanced service quality and competitive electricity prices for consumers across different market segments.

Critical insights reveal the Colombia power market’s strategic positioning and growth trajectory:

Economic growth serves as the primary driver for Colombia’s power market expansion, with increasing industrial activity, urbanization, and population growth creating sustained electricity demand. The country’s strategic geographic location and abundant natural resources provide competitive advantages for energy generation and regional electricity trade opportunities.

Government policy support significantly influences market development through renewable energy incentives, regulatory frameworks promoting competition, and infrastructure investment programs. The National Energy Plan establishes clear targets for renewable energy integration, grid modernization, and energy security enhancement, creating predictable market conditions for investors and developers.

Technological advancement drives efficiency improvements and cost reductions across the power value chain. Smart grid technologies, advanced metering infrastructure, and digital transformation initiatives enhance system reliability while reducing operational costs. Energy storage technologies become increasingly important for grid stability and renewable energy integration.

Environmental considerations motivate the transition toward cleaner energy sources and sustainable power generation technologies. Climate change mitigation commitments and international environmental agreements influence policy decisions and investment priorities, favoring low-carbon electricity generation options.

Infrastructure limitations present significant challenges for Colombia’s power market development, particularly in transmission network capacity and grid interconnection capabilities. Aging infrastructure in certain regions requires substantial investment for modernization and reliability improvements, creating financial pressures for utilities and system operators.

Regulatory complexity can slow project development and market entry for new participants. Lengthy permitting processes, environmental licensing requirements, and interconnection procedures may delay investment decisions and project implementation timelines, affecting market growth potential.

Climate variability poses risks to hydroelectric generation reliability, particularly during El Niño weather patterns that reduce water availability. This dependency on weather conditions creates market volatility and necessitates backup generation capacity and energy storage solutions.

Financial constraints limit infrastructure investment capacity for some market participants, particularly smaller utilities and independent power producers. Access to capital markets and project financing can be challenging, especially for innovative technologies and smaller-scale renewable energy projects.

Renewable energy development presents substantial opportunities for market expansion, particularly in solar, wind, and biomass generation technologies. Colombia’s favorable renewable energy resources and supportive policy environment create attractive investment prospects for domestic and international developers.

Energy storage solutions offer significant market potential as grid flexibility requirements increase with renewable energy integration. Battery storage systems, pumped hydro storage, and other energy storage technologies provide opportunities for technology providers and project developers.

Grid modernization initiatives create opportunities for technology companies, equipment manufacturers, and service providers specializing in smart grid solutions, advanced metering infrastructure, and digital energy management systems. These investments improve system efficiency and enable new business models.

Regional energy integration opens possibilities for cross-border electricity trade and regional market participation. Colombia’s strategic location enables energy export opportunities to neighboring countries while providing access to diverse energy resources and market diversification benefits.

Supply and demand dynamics in Colombia’s power market reflect the complex interplay between generation capacity, consumption patterns, and seasonal variations. Peak demand typically occurs during dry seasons when hydroelectric generation capacity may be reduced, requiring thermal generation and energy imports to maintain system balance.

Price formation mechanisms operate through competitive wholesale markets where electricity prices reflect supply and demand conditions, fuel costs, and system constraints. The marginal cost pricing system ensures efficient resource allocation while providing price signals for investment decisions in new generation capacity.

Market competition intensifies as new participants enter the sector, particularly in renewable energy generation and energy commercialization segments. This competition drives innovation, efficiency improvements, and competitive pricing for end consumers while maintaining system reliability and service quality standards.

Regulatory evolution continues to shape market dynamics through policy updates, market rule modifications, and new regulatory frameworks addressing emerging technologies and market structures. These changes influence investment decisions, market participation strategies, and long-term sector development.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes interviews with industry executives, government officials, regulatory authorities, and market participants across the Colombian power sector value chain.

Secondary research incorporates analysis of government publications, regulatory documents, industry reports, financial statements, and statistical databases from relevant Colombian institutions. This approach provides historical context, market trends, and quantitative data supporting market analysis and projections.

Data validation processes ensure information accuracy through cross-referencing multiple sources, expert consultations, and statistical verification methods. Market modeling techniques incorporate economic indicators, policy impacts, and technological developments to project future market scenarios and growth trajectories.

Analytical frameworks include market segmentation analysis, competitive landscape assessment, regulatory impact evaluation, and scenario planning methodologies. These approaches provide comprehensive market understanding and strategic insights for stakeholders across the Colombian power sector.

Regional market distribution across Colombia reveals significant variations in electricity generation, consumption patterns, and infrastructure development. The Andean region dominates hydroelectric generation with major facilities located in Antioquia, Cundinamarca, and Huila departments, accounting for approximately 72% of total generation capacity.

Caribbean coastal region demonstrates strong potential for renewable energy development, particularly wind and solar projects. This region benefits from excellent wind resources and high solar irradiation levels, making it attractive for large-scale renewable energy investments. Thermal generation facilities in this region provide backup capacity and grid stability services.

Pacific coast region shows emerging opportunities for renewable energy development and rural electrification programs. Despite lower population density, this region requires continued infrastructure investment to improve electricity access and service reliability for remote communities.

Eastern plains region presents opportunities for distributed generation and off-grid solutions, particularly for oil and gas industry operations and agricultural activities. Solar energy applications show particular promise for remote area electrification and industrial applications in this region.

Market leadership in Colombia’s power sector includes both established utility companies and emerging renewable energy developers:

Competitive strategies focus on operational efficiency, renewable energy development, customer service excellence, and technological innovation. Companies invest in digital transformation, smart grid technologies, and energy storage solutions to maintain competitive advantages and meet evolving customer expectations.

By Generation Technology:

By End-User Segment:

By Market Function:

Hydroelectric generation maintains its position as Colombia’s primary electricity source, benefiting from extensive river systems and mountainous terrain. This category demonstrates stable performance with seasonal variations affecting output levels. Investment in modernization and efficiency improvements continues to enhance hydroelectric facility performance and environmental compliance.

Solar energy development shows remarkable growth momentum with decreasing technology costs and favorable solar irradiation conditions. Large-scale solar parks and distributed rooftop installations contribute to capacity expansion, supported by net metering regulations and renewable energy incentives.

Wind power projects concentrate primarily in coastal regions where wind resources are most favorable. This category benefits from international technology transfer, competitive equipment costs, and long-term power purchase agreements that provide revenue certainty for developers.

Thermal generation serves critical roles in system reliability and backup capacity provision. Natural gas-fired plants offer flexibility and quick response capabilities, while coal-fired facilities provide baseload capacity. Environmental regulations increasingly influence thermal generation operations and investment decisions.

Generation companies benefit from diverse revenue streams, competitive electricity markets, and renewable energy development opportunities. Long-term power purchase agreements provide revenue stability while spot market participation offers additional income potential during high-demand periods.

Distribution utilities gain from regulated revenue frameworks, infrastructure investment recovery mechanisms, and opportunities to implement smart grid technologies. Energy efficiency programs and demand response initiatives create additional value streams while improving customer satisfaction.

Industrial consumers access competitive electricity prices, reliable power supply, and opportunities for direct market participation. Large industrial users can negotiate favorable supply contracts and implement on-site generation solutions to reduce electricity costs and improve energy security.

Technology providers find expanding markets for renewable energy equipment, smart grid solutions, energy storage systems, and digital energy management platforms. Colombia’s modernization initiatives create substantial opportunities for innovative technology deployment and market penetration.

Financial institutions participate in project financing, infrastructure investment, and energy sector development. The stable regulatory environment and government support for renewable energy create attractive investment opportunities with reasonable risk-return profiles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Renewable energy acceleration represents the most significant trend transforming Colombia’s power market. Solar and wind projects demonstrate unprecedented growth rates, supported by declining technology costs, favorable financing conditions, and strong government policy support. This trend reshapes the generation mix and creates new market dynamics.

Digital transformation initiatives revolutionize power sector operations through smart grid deployment, advanced metering infrastructure, and data analytics applications. These technologies improve system efficiency, enable demand response programs, and facilitate distributed energy resource integration.

Energy storage adoption accelerates as renewable energy penetration increases and grid flexibility requirements grow. Battery storage systems, both utility-scale and distributed, provide grid services and enable higher renewable energy integration levels while maintaining system reliability.

Distributed generation expansion empowers consumers to become electricity producers through rooftop solar installations and small-scale renewable energy systems. Net metering regulations and declining equipment costs drive this trend, creating new market dynamics and business models.

Regional market integration strengthens through improved interconnection infrastructure and harmonized market rules. Cross-border electricity trade increases, providing market diversification benefits and enhanced energy security for participating countries.

Major renewable energy auctions have allocated significant generation capacity to solar and wind projects, demonstrating strong investor interest and competitive pricing. These auctions establish long-term power purchase agreements that provide revenue certainty for developers while securing clean energy supply for the system.

Grid modernization programs advance through smart grid pilot projects, advanced metering infrastructure deployment, and transmission network expansion. These investments improve system reliability, enable renewable energy integration, and provide foundation for future market developments.

Energy storage project announcements indicate growing recognition of storage technology importance for grid stability and renewable energy integration. Both utility-scale and distributed storage projects receive regulatory approval and financing commitments.

International partnership agreements facilitate technology transfer, knowledge sharing, and investment flows in Colombia’s power sector. These collaborations accelerate renewable energy development and bring international best practices to local market conditions.

Regulatory framework updates address emerging technologies, market structure evolution, and environmental requirements. New regulations support distributed generation, energy storage deployment, and electric vehicle integration while maintaining system reliability and market efficiency.

MarkWide Research recommends that market participants focus on renewable energy development opportunities, particularly in solar and wind technologies where Colombia demonstrates significant untapped potential. Strategic positioning in these segments offers attractive growth prospects and alignment with national energy policy objectives.

Investment priorities should emphasize grid modernization, energy storage solutions, and digital transformation initiatives that enhance system flexibility and efficiency. These areas provide sustainable competitive advantages and support long-term market development goals.

Risk management strategies must address climate variability impacts on hydroelectric generation through portfolio diversification, energy storage deployment, and flexible generation capacity development. Market participants should develop comprehensive risk mitigation approaches addressing both operational and financial exposures.

Strategic partnerships with international technology providers, financial institutions, and development organizations can accelerate market entry and project development. These collaborations provide access to advanced technologies, financing solutions, and market expertise essential for success in Colombia’s evolving power market.

Regulatory engagement remains crucial for market participants to influence policy development, understand regulatory changes, and ensure compliance with evolving requirements. Active participation in industry associations and regulatory consultations supports favorable market conditions and business development.

Long-term market projections indicate continued robust growth in Colombia’s power sector, driven by economic development, population growth, and industrial expansion. MWR analysis suggests that electricity demand will maintain steady growth rates of approximately 3.8% annually over the next decade, supported by urbanization trends and economic diversification initiatives.

Renewable energy integration will accelerate significantly, with solar and wind technologies expected to represent 25% of total generation capacity by 2030. This transformation requires substantial investment in grid infrastructure, energy storage systems, and system flexibility solutions to maintain reliable electricity supply.

Technology advancement will continue reshaping market dynamics through smart grid deployment, artificial intelligence applications, and advanced energy management systems. These innovations improve operational efficiency, reduce costs, and enable new business models that benefit both utilities and consumers.

Regional integration prospects remain strong, with enhanced electricity trade relationships and coordinated market development initiatives. Colombia’s strategic position enables it to serve as a regional energy hub, facilitating electricity flows between South American markets and providing energy security benefits.

Environmental sustainability will increasingly influence market development through carbon pricing mechanisms, environmental regulations, and international climate commitments. These factors favor renewable energy investments and clean technology deployment while creating challenges for traditional thermal generation.

Colombia’s power market demonstrates exceptional potential for continued growth and transformation, supported by abundant natural resources, favorable regulatory frameworks, and strong government commitment to renewable energy development. The market’s evolution toward greater sustainability, efficiency, and reliability creates substantial opportunities for domestic and international participants across the entire power sector value chain.

Strategic market positioning requires understanding of local conditions, regulatory requirements, and stakeholder expectations while maintaining focus on technological innovation and operational excellence. Success in this dynamic market depends on adaptability, strategic partnerships, and commitment to sustainable development principles that align with Colombia’s long-term energy objectives.

The Colombia power market stands poised for continued expansion and modernization, offering attractive investment opportunities and sustainable growth prospects for market participants who can navigate its complexities while contributing to the country’s energy security and environmental sustainability goals.

What is Colombia Power?

Colombia Power refers to the generation, distribution, and consumption of electricity in Colombia, encompassing various energy sources such as hydroelectric, thermal, and renewable energy. The sector plays a crucial role in supporting the country’s economic growth and energy security.

What are the key players in the Colombia Power Market?

Key players in the Colombia Power Market include Empresas Públicas de Medellín (EPM), Isagen, and Codensa, which are involved in electricity generation and distribution. These companies contribute significantly to the energy landscape and infrastructure development in Colombia, among others.

What are the growth factors driving the Colombia Power Market?

The Colombia Power Market is driven by factors such as increasing energy demand due to urbanization, government initiatives promoting renewable energy, and investments in infrastructure. Additionally, the push for sustainability and energy efficiency is shaping the market’s growth.

What challenges does the Colombia Power Market face?

The Colombia Power Market faces challenges including regulatory hurdles, the need for modernization of aging infrastructure, and environmental concerns related to energy production. These factors can impact the reliability and sustainability of power supply.

What opportunities exist in the Colombia Power Market?

Opportunities in the Colombia Power Market include the expansion of renewable energy projects, such as solar and wind, and the potential for technological advancements in energy storage. Additionally, increasing foreign investment can enhance the sector’s growth prospects.

What trends are shaping the Colombia Power Market?

Trends in the Colombia Power Market include a shift towards renewable energy sources, the integration of smart grid technologies, and a focus on energy efficiency. These trends are influencing how energy is produced, distributed, and consumed in the country.

Colombia Power Market

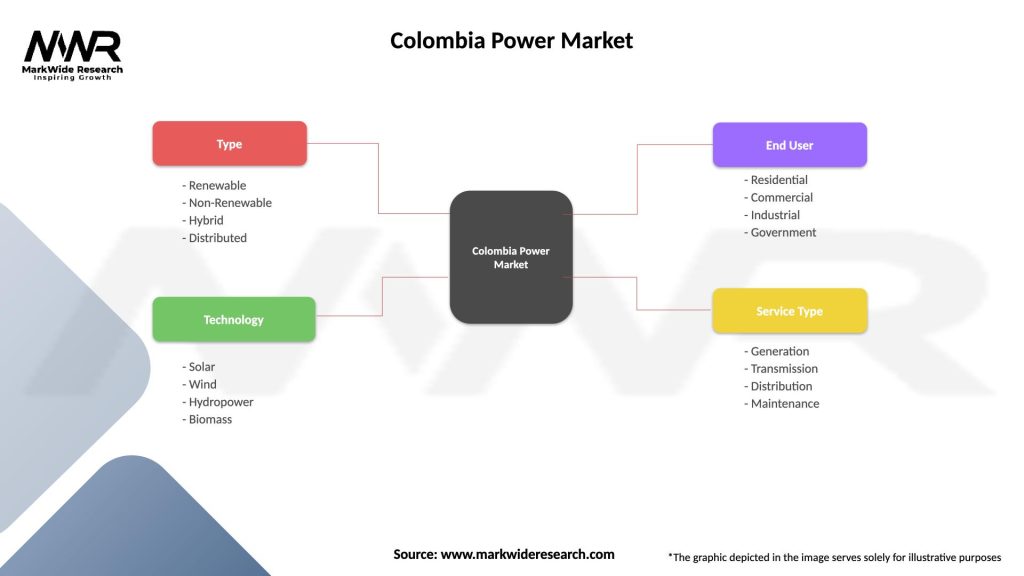

| Segmentation Details | Description |

|---|---|

| Type | Renewable, Non-Renewable, Hybrid, Distributed |

| Technology | Solar, Wind, Hydropower, Biomass |

| End User | Residential, Commercial, Industrial, Government |

| Service Type | Generation, Transmission, Distribution, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at