444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Colombia electrocardiograph (ECG) market represents a rapidly expanding segment within the nation’s healthcare technology landscape, driven by increasing cardiovascular disease prevalence and growing healthcare infrastructure investments. Colombia’s ECG market has experienced substantial growth as healthcare providers prioritize advanced cardiac monitoring solutions to address the rising burden of heart-related conditions across the population.

Market dynamics indicate that Colombia’s healthcare sector is undergoing significant modernization, with ECG technology adoption accelerating at approximately 8.2% annually. The country’s commitment to universal healthcare coverage through its reformed health system has created favorable conditions for medical device procurement, particularly in cardiology departments and primary care facilities.

Healthcare infrastructure development across Colombia’s major cities including Bogotá, Medellín, Cartagena, and Cali has stimulated demand for sophisticated ECG equipment. Public and private healthcare institutions are increasingly investing in portable ECG devices, multi-channel systems, and wireless monitoring solutions to enhance patient care delivery and diagnostic accuracy.

Technological advancement in ECG systems has transformed cardiac care delivery in Colombia, with digital ECG machines offering enhanced connectivity, cloud-based data storage, and artificial intelligence-powered interpretation capabilities. These innovations have improved diagnostic efficiency while reducing healthcare costs, making advanced cardiac monitoring more accessible across diverse healthcare settings.

The Colombia electrocardiograph (ECG) market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, sales, and servicing of electrocardiographic equipment and related technologies within Colombia’s healthcare sector. This market includes various ECG device categories, from basic single-channel units to sophisticated multi-lead systems with advanced analytical capabilities.

ECG technology encompasses devices that record the electrical activity of the heart over specific time periods, enabling healthcare professionals to diagnose cardiac arrhythmias, myocardial infarctions, and other cardiovascular conditions. In Colombia’s context, this market serves hospitals, clinics, diagnostic centers, and emergency medical services across urban and rural regions.

Market participants include international medical device manufacturers, local distributors, healthcare technology integrators, and service providers who collectively support the deployment and maintenance of ECG systems throughout Colombia’s healthcare network. The market also encompasses consumables, software solutions, and training services essential for effective ECG implementation.

Colombia’s ECG market demonstrates robust growth potential driven by demographic transitions, healthcare policy reforms, and technological innovations in cardiac monitoring. The market benefits from government initiatives promoting healthcare accessibility and quality improvement across the nation’s diverse geographical regions.

Key growth drivers include the aging population’s increasing cardiovascular risk profile, expanded health insurance coverage reaching approximately 95% of the population, and healthcare digitization initiatives. These factors collectively create sustained demand for advanced ECG solutions across various healthcare delivery points.

Market segmentation reveals strong demand across multiple categories, with portable ECG devices gaining particular traction due to their versatility and cost-effectiveness. Hospital-based installations continue to drive substantial revenue, while ambulatory and home-care applications represent emerging growth opportunities.

Competitive landscape features established international brands alongside emerging local players, creating a dynamic market environment that benefits end-users through improved product offerings and competitive pricing. Strategic partnerships between global manufacturers and Colombian distributors facilitate market penetration and customer support.

Market intelligence reveals several critical insights shaping Colombia’s ECG market trajectory and strategic development opportunities:

Demographic transformation represents the primary driver of Colombia’s ECG market growth, with an aging population experiencing higher cardiovascular disease rates. The country’s demographic transition creates sustained demand for cardiac monitoring equipment as healthcare providers address increasing patient volumes requiring ECG diagnostics.

Healthcare policy reforms have significantly expanded access to medical services, with universal health coverage initiatives ensuring broader population access to cardiac care. These reforms mandate healthcare providers to maintain adequate diagnostic capabilities, including ECG equipment, driving consistent market demand across public and private sectors.

Technological advancement in ECG systems attracts healthcare providers seeking improved diagnostic accuracy and operational efficiency. Modern ECG devices offer features such as automatic interpretation, wireless connectivity, and electronic health record integration, compelling healthcare facilities to upgrade their cardiac monitoring capabilities.

Economic development in Colombia supports healthcare infrastructure investments, with growing GDP enabling increased healthcare spending. Government and private sector investments in medical facilities create opportunities for ECG equipment suppliers to expand their market presence across diverse healthcare settings.

Medical tourism growth positions Colombia as a regional healthcare destination, driving demand for advanced medical equipment including state-of-the-art ECG systems. International patients expect high-quality diagnostic capabilities, motivating healthcare providers to invest in modern cardiac monitoring technologies.

Budget constraints within Colombia’s healthcare system limit the pace of ECG equipment procurement, particularly in public healthcare facilities operating under strict financial guidelines. Limited healthcare budgets require careful prioritization of medical equipment investments, potentially delaying ECG system upgrades or expansions.

Technical expertise limitations pose challenges for ECG system implementation and maintenance, particularly in rural healthcare facilities with limited access to specialized technical support. The shortage of trained biomedical technicians affects the optimal utilization of advanced ECG equipment across Colombia’s healthcare network.

Infrastructure challenges in remote regions limit ECG equipment deployment, with unreliable electricity supply and limited internet connectivity affecting the performance of modern digital ECG systems. These infrastructure limitations restrict market penetration in underserved geographical areas.

Import dependency creates cost pressures and supply chain vulnerabilities for ECG equipment, with currency fluctuations and international trade policies affecting product pricing and availability. Most ECG devices are imported, making the market susceptible to external economic factors and trade disruptions.

Regulatory compliance requirements can delay market entry for new ECG technologies, with medical device approval processes requiring substantial time and resources. Complex regulatory frameworks may discourage smaller manufacturers from entering the Colombian market, limiting product diversity and competition.

Telemedicine expansion creates significant opportunities for portable and wireless ECG devices, enabling remote cardiac monitoring and consultation services. The growing acceptance of telehealth solutions, accelerated by recent healthcare digitization trends, opens new market segments for innovative ECG technologies.

Rural healthcare initiatives present substantial growth potential for cost-effective, portable ECG solutions designed for resource-limited settings. Government programs aimed at improving healthcare access in underserved regions create demand for robust, easy-to-use ECG equipment suitable for primary care applications.

Private healthcare sector growth offers opportunities for premium ECG systems with advanced features and comprehensive service packages. Expanding private healthcare facilities seek competitive advantages through superior diagnostic capabilities, driving demand for state-of-the-art ECG technologies.

Medical education expansion in Colombia creates opportunities for ECG equipment suppliers to partner with universities and training institutions. Growing medical and nursing programs require ECG training equipment, creating a specialized market segment for educational ECG systems and simulation technologies.

Preventive healthcare emphasis drives demand for ECG screening programs and routine cardiac monitoring, creating opportunities for high-throughput ECG systems and mobile screening solutions. Public health initiatives focused on cardiovascular disease prevention support market expansion across diverse healthcare settings.

Supply chain dynamics in Colombia’s ECG market involve complex relationships between international manufacturers, local distributors, and healthcare end-users. The market operates through established distribution networks that provide product availability, technical support, and after-sales service across the country’s diverse geographical regions.

Competitive dynamics feature intense competition among established medical device manufacturers seeking market share through product differentiation, pricing strategies, and service excellence. Market leaders maintain competitive advantages through comprehensive product portfolios, strong distribution networks, and proven track records in healthcare technology deployment.

Technology adoption patterns reveal healthcare providers’ preferences for ECG systems offering reliability, ease of use, and integration capabilities. The transition from analog to digital ECG systems continues, with approximately 65% of new installations featuring digital technology and connectivity options.

Pricing dynamics reflect the balance between healthcare budget constraints and quality requirements, with successful suppliers offering value-based solutions that demonstrate clear return on investment. Competitive pricing strategies must account for total cost of ownership, including maintenance, training, and consumables over the equipment lifecycle.

Innovation cycles drive continuous product development, with manufacturers introducing enhanced features such as artificial intelligence-powered interpretation, cloud connectivity, and mobile device integration. These technological advances create opportunities for market differentiation while addressing evolving healthcare delivery requirements.

Market research methodology for Colombia’s ECG market analysis employs comprehensive primary and secondary research approaches to ensure accurate and actionable market intelligence. The research framework combines quantitative data analysis with qualitative insights from industry stakeholders across Colombia’s healthcare ecosystem.

Primary research activities include structured interviews with healthcare administrators, cardiologists, biomedical engineers, and procurement specialists from leading Colombian hospitals and clinics. These interviews provide firsthand insights into ECG equipment selection criteria, usage patterns, and future requirements across diverse healthcare settings.

Secondary research sources encompass government healthcare statistics, medical device import data, industry publications, and regulatory documentation from Colombian health authorities. This information provides context for market sizing, trend analysis, and regulatory environment assessment.

Data validation processes ensure research accuracy through cross-referencing multiple sources, expert review panels, and statistical analysis techniques. Market projections incorporate economic indicators, demographic trends, and healthcare policy developments to provide reliable forecasting for strategic planning purposes.

MarkWide Research methodology emphasizes local market expertise combined with global industry knowledge, ensuring comprehensive understanding of Colombia’s unique healthcare market characteristics and ECG technology adoption patterns.

Bogotá metropolitan area dominates Colombia’s ECG market, accounting for approximately 35% of total equipment installations due to its concentration of major hospitals, specialty clinics, and healthcare institutions. The capital region’s advanced healthcare infrastructure and higher patient volumes drive consistent demand for sophisticated ECG systems across public and private facilities.

Medellín and Antioquia region represent the second-largest ECG market segment, with strong healthcare infrastructure and medical tourism activities supporting demand for advanced cardiac monitoring equipment. The region’s industrial development and economic growth enable healthcare investments that benefit ECG equipment suppliers.

Caribbean coastal region, including Cartagena, Barranquilla, and Santa Marta, demonstrates growing ECG market potential driven by healthcare infrastructure development and medical tourism initiatives. The region’s strategic location and economic development create opportunities for ECG equipment expansion across diverse healthcare facilities.

Pacific coast region, centered around Cali, shows steady ECG market growth supported by regional healthcare networks and university medical centers. The area’s agricultural and industrial economy supports healthcare investments that include cardiac monitoring equipment procurement.

Rural and remote regions present emerging opportunities for portable and cost-effective ECG solutions, with government healthcare initiatives aimed at improving medical access in underserved areas. These regions require specialized ECG equipment designed for challenging operational environments and limited technical support availability.

Market leadership in Colombia’s ECG sector features established international medical device manufacturers with strong local distribution networks and comprehensive product portfolios. The competitive environment emphasizes product quality, service excellence, and long-term customer relationships.

Competitive strategies include product innovation, strategic partnerships with local distributors, comprehensive training programs, and flexible financing options. Successful market participants demonstrate commitment to the Colombian healthcare sector through local investment and long-term customer support.

By Product Type:

By End User:

By Technology:

Resting ECG systems dominate Colombia’s market due to their fundamental role in cardiac diagnostics across all healthcare settings. These systems provide essential diagnostic capabilities for routine cardiac assessments, with digital models gaining preference for their enhanced features and connectivity options.

Portable ECG devices experience rapid growth driven by their versatility and cost-effectiveness, particularly in resource-limited settings and emergency applications. These devices enable cardiac monitoring in diverse environments, from rural clinics to ambulance services, expanding diagnostic access across Colombia’s healthcare network.

Holter monitoring systems show increasing adoption as healthcare providers recognize the value of continuous cardiac surveillance for arrhythmia detection and treatment monitoring. The growing emphasis on preventive cardiology drives demand for extended monitoring capabilities in both inpatient and outpatient settings.

Wireless ECG technologies represent the fastest-growing category, with approximately 25% annual adoption growth among Colombian healthcare providers. These systems enable telemedicine applications and remote patient monitoring, aligning with healthcare digitization trends and improving patient access to cardiac care.

Stress test ECG systems maintain steady demand in specialized cardiology practices and hospital cardiac departments, supporting comprehensive cardiac risk assessment and treatment planning. These sophisticated systems require specialized training and technical support, creating opportunities for full-service equipment providers.

Healthcare providers benefit from improved diagnostic accuracy and operational efficiency through modern ECG systems that offer automated interpretation, electronic health record integration, and enhanced workflow capabilities. These advantages translate to better patient outcomes and reduced diagnostic errors in cardiac care delivery.

Patients experience enhanced cardiac care through faster diagnosis, improved monitoring capabilities, and increased access to specialized cardiac services. Modern ECG technologies enable earlier detection of cardiac conditions and more effective treatment monitoring, contributing to better health outcomes across Colombia’s population.

Equipment manufacturers gain access to Colombia’s growing healthcare market with opportunities for long-term partnerships and service relationships. The market’s emphasis on quality and reliability creates competitive advantages for manufacturers offering comprehensive solutions and local support capabilities.

Healthcare system administrators achieve cost-effective cardiac care delivery through efficient ECG technologies that reduce diagnostic time, improve resource utilization, and support evidence-based treatment decisions. These benefits contribute to overall healthcare system sustainability and quality improvement.

Medical professionals benefit from advanced ECG technologies that enhance their diagnostic capabilities and support continuing education through sophisticated analysis tools and training resources. Modern ECG systems provide decision support that improves clinical confidence and patient care quality.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across Colombia’s healthcare sector, driving demand for ECG systems with advanced connectivity, cloud integration, and artificial intelligence capabilities. Healthcare providers increasingly prioritize digital solutions that enhance workflow efficiency and enable remote monitoring capabilities.

Artificial intelligence integration emerges as a significant trend, with ECG systems incorporating AI-powered interpretation algorithms that improve diagnostic accuracy and reduce physician workload. These intelligent systems provide decision support that enhances clinical outcomes while addressing healthcare professional shortage challenges.

Mobile health solutions gain traction through smartphone-compatible ECG devices and mobile applications that enable point-of-care testing and patient self-monitoring. This trend supports healthcare accessibility initiatives and empowers patients to participate actively in their cardiac health management.

Preventive cardiology focus drives demand for ECG screening programs and routine monitoring solutions, with healthcare providers implementing systematic approaches to cardiovascular disease prevention. This trend creates opportunities for high-throughput ECG systems and mobile screening technologies.

Value-based healthcare influences ECG equipment selection criteria, with healthcare providers seeking solutions that demonstrate clear clinical and economic benefits. Manufacturers respond by offering comprehensive value propositions that include equipment, software, training, and outcome measurement capabilities.

Regulatory modernization initiatives by Colombian health authorities streamline medical device approval processes, facilitating faster market entry for innovative ECG technologies. These regulatory improvements support market growth by reducing barriers to technology adoption and encouraging manufacturer investment.

Public-private partnerships emerge in healthcare infrastructure development, creating opportunities for ECG equipment suppliers to participate in large-scale healthcare facility projects. These partnerships leverage private sector expertise while addressing public healthcare needs across Colombia’s diverse regions.

Medical education expansion drives demand for ECG training equipment and simulation technologies, with growing medical and nursing programs requiring comprehensive cardiac monitoring education resources. This development creates specialized market opportunities for educational ECG solutions.

Telemedicine platform integration becomes increasingly important, with ECG manufacturers developing solutions compatible with popular telehealth platforms used in Colombia. This integration enables seamless remote consultation and monitoring capabilities that support healthcare accessibility initiatives.

Local manufacturing initiatives explore opportunities for ECG equipment assembly or production within Colombia, potentially reducing costs and improving supply chain resilience. These developments could transform market dynamics by creating local manufacturing capabilities and reducing import dependency.

Market entry strategies should prioritize partnership development with established Colombian distributors who possess deep healthcare market knowledge and strong customer relationships. Successful market penetration requires understanding local procurement processes, regulatory requirements, and customer service expectations.

Product positioning must emphasize value-based benefits that address Colombia’s healthcare priorities, including cost-effectiveness, reliability, and ease of use. MarkWide Research analysis indicates that successful ECG suppliers demonstrate clear return on investment through improved diagnostic efficiency and reduced operational costs.

Service capabilities represent critical success factors, with healthcare providers requiring comprehensive technical support, training programs, and maintenance services. Companies should invest in local service infrastructure and technical expertise to support long-term customer relationships and equipment performance.

Technology adaptation should consider Colombia’s infrastructure realities, with ECG solutions designed to operate effectively in challenging environments while providing advanced features when conditions permit. Flexible technology platforms that scale with infrastructure development offer competitive advantages.

Financing solutions become increasingly important for market penetration, with healthcare providers seeking flexible payment options and leasing arrangements that align with budget constraints. Creative financing approaches can differentiate suppliers and accelerate market adoption.

Market growth trajectory indicates sustained expansion driven by demographic trends, healthcare infrastructure development, and technology advancement. Colombia’s ECG market is positioned for continued growth as cardiovascular disease prevalence increases and healthcare access expands across diverse population segments.

Technology evolution will emphasize connectivity, artificial intelligence, and mobile integration, with ECG systems becoming increasingly sophisticated while maintaining user-friendly operation. Future ECG technologies will likely incorporate advanced analytics, predictive capabilities, and seamless integration with electronic health records.

Market consolidation may occur as successful suppliers expand their presence while smaller players face competitive pressures. This consolidation could benefit customers through improved service capabilities and more comprehensive solution offerings from established market participants.

Regional expansion opportunities will emerge as healthcare infrastructure development reaches underserved areas, creating demand for portable and cost-effective ECG solutions designed for resource-limited settings. Rural healthcare initiatives will drive market growth beyond traditional urban centers.

Innovation focus will shift toward integrated cardiac care solutions that combine ECG monitoring with other diagnostic modalities and treatment technologies. Future market leaders will likely offer comprehensive cardiac care platforms rather than standalone ECG equipment, with growth projections indicating approximately 12% annual expansion in integrated solution adoption.

Colombia’s electrocardiograph market presents substantial opportunities for growth and innovation, driven by favorable demographic trends, healthcare policy support, and technological advancement. The market’s evolution reflects broader healthcare transformation initiatives that prioritize improved access, quality, and efficiency in cardiac care delivery.

Strategic success in this market requires understanding Colombia’s unique healthcare landscape, including budget constraints, infrastructure challenges, and regulatory requirements. Companies that demonstrate commitment to local market development through partnerships, service investment, and technology adaptation will achieve sustainable competitive advantages.

Future market development will be shaped by continued healthcare digitization, expanding telemedicine adoption, and growing emphasis on preventive cardiology. MWR projections indicate that suppliers offering comprehensive solutions combining equipment, software, training, and service will capture the largest market opportunities.

Market participants should prepare for evolving customer requirements that emphasize value-based outcomes, technological sophistication, and comprehensive support capabilities. The Colombia ECG market rewards suppliers who demonstrate long-term commitment to customer success and continuous innovation in cardiac monitoring technologies.

What is Electrocardiograph (ECG)?

An Electrocardiograph (ECG) is a medical device that records the electrical activity of the heart over a period of time. It is commonly used to diagnose heart conditions, monitor heart health, and guide treatment decisions.

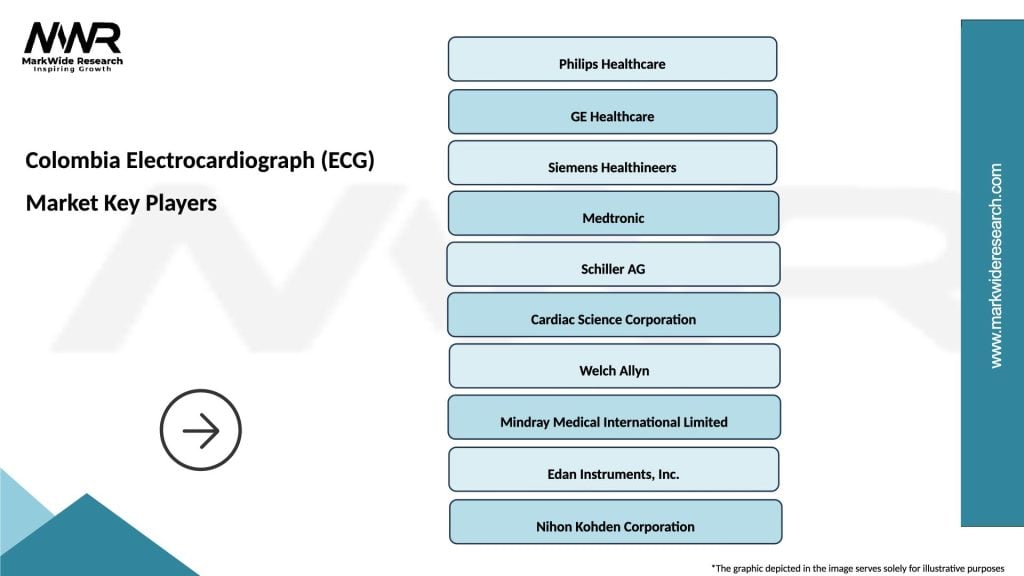

What are the key players in the Colombia Electrocardiograph (ECG) Market?

Key players in the Colombia Electrocardiograph (ECG) Market include Philips Healthcare, GE Healthcare, and Siemens Healthineers, among others. These companies are known for their innovative ECG technologies and comprehensive healthcare solutions.

What are the growth factors driving the Colombia Electrocardiograph (ECG) Market?

The growth of the Colombia Electrocardiograph (ECG) Market is driven by the increasing prevalence of cardiovascular diseases, advancements in ECG technology, and the rising demand for early diagnosis and monitoring of heart conditions.

What challenges does the Colombia Electrocardiograph (ECG) Market face?

The Colombia Electrocardiograph (ECG) Market faces challenges such as high costs of advanced ECG devices, a lack of trained professionals for proper usage, and regulatory hurdles that can delay product approvals.

What opportunities exist in the Colombia Electrocardiograph (ECG) Market?

Opportunities in the Colombia Electrocardiograph (ECG) Market include the growing adoption of telemedicine, the integration of artificial intelligence in ECG analysis, and the expansion of healthcare infrastructure in rural areas.

What trends are shaping the Colombia Electrocardiograph (ECG) Market?

Trends shaping the Colombia Electrocardiograph (ECG) Market include the shift towards portable and wearable ECG devices, increased focus on preventive healthcare, and the development of cloud-based ECG data management systems.

Colombia Electrocardiograph (ECG) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable ECG, Holter Monitor, Stress ECG, Wireless ECG |

| Technology | Analog ECG, Digital ECG, Telemetry ECG, 3D ECG |

| End User | Cardiology Clinics, Diagnostic Centers, Home Care, Research Institutions |

| Application | Arrhythmia Detection, Heart Rate Monitoring, Stress Testing, Patient Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Electrocardiograph (ECG) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at