444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Colombia animal feed market represents a dynamic and rapidly evolving sector within the country’s agricultural landscape, driven by increasing livestock production, growing protein consumption, and modernization of farming practices. Colombia’s strategic position in South America, combined with its diverse agricultural ecosystem, has positioned the nation as a significant player in the regional animal feed industry. The market encompasses a comprehensive range of feed products designed for various livestock categories including poultry, cattle, swine, aquaculture, and companion animals.

Market dynamics in Colombia reflect the country’s transition toward more intensive and efficient livestock production systems. The sector is experiencing robust growth, with industry projections indicating a compound annual growth rate (CAGR) of 6.2% over the forecast period. This expansion is primarily attributed to rising domestic protein demand, export opportunities, and technological advancements in feed formulation and production processes.

Regional distribution across Colombia shows concentrated activity in key agricultural zones, with the Andean region accounting for approximately 45% of total feed production, followed by the Caribbean coast and eastern plains. The market structure includes both large-scale commercial operations and smaller regional producers, creating a diverse competitive landscape that serves various market segments and geographic areas.

The Colombia animal feed market refers to the comprehensive industry encompassing the production, distribution, and sale of nutritionally formulated feed products designed to support the growth, health, and productivity of livestock and companion animals throughout Colombia. This market includes various feed types such as complete feeds, concentrates, premixes, and specialty nutritional supplements tailored to specific animal species and production stages.

Feed categories within this market span multiple livestock sectors, including poultry feed for broilers and layers, cattle feed for dairy and beef production, swine feed for different growth phases, aquaculture feed for fish and shrimp farming, and pet food for companion animals. The market also encompasses feed additives, vitamins, minerals, and other nutritional components that enhance animal performance and health outcomes.

Industry scope extends beyond basic nutrition to include specialized formulations addressing specific production challenges, environmental sustainability concerns, and food safety requirements. Modern animal feed in Colombia incorporates advanced nutritional science, quality control measures, and traceability systems to ensure optimal animal performance while meeting regulatory standards and consumer expectations for safe, high-quality animal products.

Colombia’s animal feed market demonstrates remarkable resilience and growth potential, supported by the country’s expanding livestock sector and increasing focus on agricultural modernization. The market benefits from favorable climatic conditions, abundant raw material availability, and growing domestic and international demand for animal protein products. Key growth drivers include rising per capita income, urbanization trends, and evolving dietary preferences toward higher protein consumption.

Market segmentation reveals poultry feed as the dominant category, representing approximately 52% of total market share, followed by cattle feed and swine feed. This distribution reflects Colombia’s strong poultry industry and the growing importance of efficient protein production systems. The aquaculture segment, while smaller, shows significant growth potential as the country develops its coastal and inland fish farming capabilities.

Competitive landscape features a mix of international corporations and domestic producers, with leading companies investing in production capacity expansion, technological upgrades, and distribution network enhancement. Innovation focuses on sustainable feed formulations, precision nutrition approaches, and digital technologies that optimize feed efficiency and animal performance while reducing environmental impact.

Future prospects indicate continued market expansion driven by export opportunities, particularly to neighboring countries, and domestic consumption growth. The sector is expected to benefit from government initiatives supporting agricultural development, infrastructure improvements, and trade facilitation measures that enhance Colombia’s competitiveness in regional and global markets.

Strategic market analysis reveals several critical insights that define the current state and future trajectory of Colombia’s animal feed industry. These insights provide valuable guidance for stakeholders seeking to understand market dynamics and identify growth opportunities within this evolving sector.

Primary growth drivers propelling Colombia’s animal feed market forward encompass both domestic demand factors and external market opportunities. These drivers create a favorable environment for sustained market expansion and industry development across multiple livestock sectors.

Rising protein consumption represents the most significant driver, fueled by increasing per capita income levels and changing dietary preferences among Colombian consumers. Urban populations, in particular, are consuming more animal protein products, creating sustained demand for efficient livestock production systems that rely on high-quality animal feed formulations.

Livestock sector modernization continues to drive feed market growth as producers adopt more intensive and efficient production methods. This transformation includes the transition from traditional extensive farming to commercial-scale operations that require specialized feed products and nutritional programs designed to optimize animal performance and production efficiency.

Export market opportunities provide substantial growth potential, with Colombia’s strategic geographic position enabling access to regional markets throughout Latin America and the Caribbean. The country’s competitive production costs and improving quality standards position it favorably for export market development, particularly in poultry and aquaculture feed segments.

Government support initiatives include agricultural development programs, infrastructure investments, and trade facilitation measures that enhance the competitiveness of Colombia’s livestock and feed industries. These initiatives create favorable conditions for market expansion and technological advancement within the sector.

Technological advancement adoption drives efficiency improvements and product innovation, enabling feed manufacturers to develop more effective formulations while reducing production costs. Advanced feed processing technologies and precision nutrition approaches contribute to improved animal performance and reduced environmental impact.

Significant challenges facing Colombia’s animal feed market include various structural and operational constraints that may limit growth potential and market development. Understanding these restraints is essential for stakeholders developing strategies to navigate market complexities and identify solutions to overcome barriers.

Raw material price volatility represents a major constraint, as feed production costs are significantly influenced by fluctuations in commodity prices for corn, soybeans, and other key ingredients. International market conditions and weather-related supply disruptions can create substantial cost pressures that impact profitability and pricing strategies throughout the value chain.

Infrastructure limitations in certain regions restrict market access and increase distribution costs, particularly for producers serving remote agricultural areas. Transportation networks, storage facilities, and logistics capabilities require continued investment to support efficient feed distribution and maintain product quality throughout the supply chain.

Regulatory compliance requirements create operational complexities and additional costs for feed manufacturers, particularly smaller producers who may lack resources to implement comprehensive quality control systems. Evolving food safety standards and environmental regulations require ongoing investment in compliance infrastructure and staff training.

Import dependency for certain raw materials and feed additives exposes the market to currency fluctuations and international supply chain disruptions. This dependency can create cost volatility and supply security concerns that impact production planning and pricing strategies.

Competition from informal markets in some regions creates pricing pressures and quality standardization challenges. Informal feed production and distribution networks may offer lower prices but potentially compromise product quality and food safety standards, creating market distortions that affect legitimate producers.

Emerging opportunities within Colombia’s animal feed market present significant potential for growth and innovation across multiple dimensions. These opportunities reflect evolving market conditions, technological advances, and changing consumer preferences that create new avenues for business development and market expansion.

Aquaculture sector expansion offers substantial growth potential as Colombia develops its coastal and inland fish farming capabilities. The country’s extensive water resources and favorable climatic conditions create opportunities for specialized aquaculture feed production, particularly for species with strong export market potential such as tilapia and shrimp.

Organic and sustainable feed products represent a growing market segment driven by consumer demand for environmentally responsible and natural animal products. This trend creates opportunities for feed manufacturers to develop premium product lines that command higher margins while meeting evolving market preferences for sustainable agriculture practices.

Regional export markets provide significant expansion opportunities, particularly in Central America and Caribbean countries where Colombia’s competitive advantages in production costs and geographic proximity create favorable conditions for market penetration. Trade agreements and regional integration initiatives further enhance these opportunities.

Technology integration solutions offer opportunities to develop value-added services and digital platforms that enhance customer relationships and operational efficiency. These include feed management software, nutritional consulting services, and precision agriculture technologies that optimize feed utilization and animal performance.

Specialty feed segments such as pet food and companion animal nutrition present high-growth opportunities driven by increasing pet ownership and premiumization trends. These segments typically offer higher margins and less price sensitivity compared to traditional livestock feed markets.

Contract manufacturing opportunities enable smaller producers to access advanced production capabilities and quality standards while allowing larger companies to optimize capacity utilization and geographic coverage. These partnerships can facilitate market access and technology transfer throughout the industry.

Complex market dynamics shape the competitive landscape and operational environment within Colombia’s animal feed industry. These dynamics reflect the interplay between supply and demand factors, competitive pressures, and external influences that determine market behavior and strategic decision-making processes.

Supply chain integration trends are reshaping industry structure as companies seek to control key inputs and distribution channels. Vertical integration strategies enable better cost control and quality assurance while reducing dependency on external suppliers. This trend particularly affects larger producers who have the resources to invest in upstream and downstream capabilities.

Demand seasonality patterns influence production planning and inventory management strategies throughout the industry. Seasonal variations in livestock production cycles, agricultural harvesting periods, and export market demands require sophisticated forecasting and supply chain management capabilities to optimize operational efficiency and customer service levels.

Price transmission mechanisms between international commodity markets and domestic feed prices create complex pricing dynamics that affect profitability and competitive positioning. Feed manufacturers must develop hedging strategies and flexible pricing models to manage commodity price risk while maintaining competitive market positions.

Quality differentiation strategies are becoming increasingly important as customers demand higher performance standards and specialized nutritional solutions. This trend drives innovation in feed formulation, quality control systems, and technical support services that add value beyond basic nutritional requirements.

Regulatory environment evolution continues to influence market dynamics through changing food safety standards, environmental requirements, and trade regulations. Companies must invest in compliance capabilities and adapt operational processes to meet evolving regulatory expectations while maintaining cost competitiveness.

Comprehensive research approach employed in analyzing Colombia’s animal feed market combines multiple data collection methods and analytical techniques to ensure accuracy, reliability, and depth of market insights. The methodology encompasses both primary and secondary research components designed to capture current market conditions and future growth prospects.

Primary research activities include structured interviews with industry executives, feed manufacturers, livestock producers, and distribution partners throughout Colombia’s key agricultural regions. These interviews provide firsthand insights into market trends, competitive dynamics, operational challenges, and growth opportunities that shape strategic decision-making within the industry.

Secondary research sources encompass government agricultural statistics, industry association reports, trade publications, and regulatory documentation that provide quantitative data and contextual information about market size, production volumes, trade flows, and regulatory requirements affecting the animal feed sector.

Market segmentation analysis utilizes both top-down and bottom-up approaches to estimate market size and growth rates across different feed categories, livestock sectors, and geographic regions. This analysis incorporates production data, consumption patterns, and trade statistics to develop comprehensive market sizing and forecasting models.

Competitive intelligence gathering involves systematic analysis of major market participants, including company profiles, production capabilities, product portfolios, distribution networks, and strategic initiatives. This intelligence provides insights into competitive positioning and market share dynamics within the industry.

Data validation processes include cross-referencing multiple sources, conducting consistency checks, and validating findings through industry expert consultations. According to MarkWide Research analysis protocols, all quantitative estimates undergo rigorous validation procedures to ensure accuracy and reliability of market projections and trend analysis.

Geographic distribution of Colombia’s animal feed market reflects the country’s diverse agricultural landscape and regional specialization patterns. Each major region contributes distinct characteristics and growth dynamics that shape overall market development and competitive positioning within the national industry structure.

Andean Region dominance encompasses the central highlands and accounts for approximately 45% of national feed production, driven by concentrated poultry and dairy operations around major urban centers including Bogotá, Medellín, and surrounding municipalities. This region benefits from proximity to major consumption markets, established transportation infrastructure, and access to imported raw materials through inland distribution networks.

Caribbean Coast region represents approximately 28% of market activity, with significant cattle ranching operations and growing aquaculture development along the coastal areas. The region’s strategic ports facilitate raw material imports and finished product exports, while extensive grasslands support traditional cattle production systems that are gradually modernizing toward more intensive feed-based operations.

Eastern Plains (Llanos) contribute roughly 18% of market share, primarily through extensive cattle operations that are increasingly adopting supplemental feeding programs to improve productivity. This region’s vast land resources and favorable climate conditions create opportunities for both traditional grazing systems and more intensive livestock production models.

Pacific Coast region accounts for approximately 9% of market activity, with growing focus on aquaculture feed production and specialized livestock operations. The region’s unique ecological conditions and proximity to Pacific markets create opportunities for niche feed products and export-oriented production systems.

Regional specialization trends are emerging as different areas develop competitive advantages in specific feed categories and livestock sectors. This specialization enables more efficient resource utilization and targeted market development strategies that leverage regional strengths and infrastructure capabilities.

Market competition in Colombia’s animal feed industry features a diverse mix of international corporations, domestic companies, and regional producers that serve different market segments and geographic areas. The competitive environment reflects varying strategies focused on scale advantages, product differentiation, and market specialization.

Competitive strategies vary significantly among market participants, with larger companies focusing on scale advantages, technological innovation, and market expansion, while smaller producers emphasize regional specialization, customer relationships, and niche product development. Innovation areas include precision nutrition, sustainable ingredients, and digital service platforms.

Market consolidation trends show gradual concentration among larger players while maintaining competitive diversity in regional markets. Strategic partnerships, acquisitions, and capacity expansion investments characterize competitive dynamics as companies position for long-term growth opportunities.

Market segmentation within Colombia’s animal feed industry encompasses multiple classification criteria that reflect diverse customer needs, livestock categories, and product specifications. This segmentation enables targeted marketing strategies and specialized product development approaches that address specific market requirements.

By Animal Type:

By Product Type:

By Distribution Channel:

Detailed analysis of major feed categories reveals distinct market characteristics, growth patterns, and competitive dynamics that shape strategic opportunities within Colombia’s animal feed industry. Each category presents unique challenges and opportunities that require specialized approaches and market understanding.

Poultry Feed Segment dominates the market with sophisticated formulations designed for optimal growth rates and feed conversion efficiency. This segment benefits from Colombia’s well-developed poultry industry and strong domestic consumption patterns. Innovation focuses on antibiotic alternatives, gut health solutions, and precision nutrition approaches that enhance bird performance while meeting food safety requirements.

Cattle Feed Category encompasses both dairy and beef applications with growing emphasis on productivity enhancement and environmental sustainability. The segment is experiencing modernization as traditional extensive systems adopt supplemental feeding programs to improve land use efficiency and animal performance. Specialized products include mineral supplements, protein concentrates, and complete feeds for intensive operations.

Swine Feed Market shows strong growth potential driven by increasing pork consumption and industry modernization. This segment requires highly specialized formulations for different production phases, from starter feeds for piglets to finishing feeds for market-weight animals. Technical expertise and quality control are critical success factors in this demanding market segment.

Aquaculture Feed Segment represents the highest growth opportunity despite its current small market share. Colombia’s extensive water resources and favorable climate conditions create potential for significant expansion in fish and shrimp farming. This segment requires specialized floating feeds, precise nutritional formulations, and sustainable ingredient sourcing to support environmental responsibility goals.

Specialty Feed Products include companion animal nutrition, organic feeds, and therapeutic formulations that command premium pricing and offer higher profit margins. These categories benefit from growing consumer awareness of animal welfare and food quality issues that drive demand for specialized nutritional solutions.

Comprehensive benefits accrue to various stakeholders throughout Colombia’s animal feed value chain, creating value propositions that support continued market development and industry growth. These benefits encompass economic, operational, and strategic advantages that enhance competitiveness and profitability across the sector.

Feed Manufacturers benefit from growing market demand, technological advancement opportunities, and export market potential that support business expansion and profitability improvement. Access to diverse raw materials, favorable production costs, and strategic geographic positioning enable competitive advantages in regional markets. Innovation opportunities in sustainable feeds and precision nutrition create differentiation possibilities and premium pricing potential.

Livestock Producers gain access to high-quality nutritional solutions that improve animal performance, reduce production costs, and enhance product quality. Modern feed formulations enable better feed conversion ratios, faster growth rates, and improved animal health outcomes that translate into higher profitability and operational efficiency. Technical support services and customized nutrition programs provide additional value beyond basic feed products.

Agricultural Input Suppliers benefit from stable demand for raw materials, additives, and processing equipment that support feed manufacturing operations. The growing market creates opportunities for specialized ingredient suppliers, equipment manufacturers, and service providers who support the feed industry’s technological advancement and capacity expansion needs.

Financial Institutions find attractive investment opportunities in a growing industry with strong fundamentals and export potential. The sector’s essential role in food security and economic development makes it an attractive target for development financing and private investment initiatives that support agricultural modernization.

Government Stakeholders benefit from increased agricultural productivity, rural employment generation, and export revenue potential that contribute to economic development goals. The industry’s growth supports food security objectives while creating tax revenue and foreign exchange earnings that benefit national economic indicators.

Consumers ultimately benefit from improved availability, quality, and affordability of animal protein products that result from efficient feed utilization and livestock productivity improvements. Enhanced food safety standards and sustainable production practices address consumer concerns about food quality and environmental responsibility.

Strategic assessment of Colombia’s animal feed market through comprehensive SWOT analysis reveals critical internal strengths and weaknesses alongside external opportunities and threats that shape industry dynamics and competitive positioning within the regional and global marketplace.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends within Colombia’s animal feed market reflect evolving industry dynamics, technological advances, and changing customer requirements that shape future development directions and competitive strategies. These trends provide insights into market evolution and strategic opportunities for industry participants.

Sustainability Integration represents a fundamental shift toward environmentally responsible feed production and sourcing practices. This trend includes adoption of alternative protein sources, reduction of carbon footprint in manufacturing processes, and development of feeds that minimize environmental impact from livestock operations. Sustainable practices are becoming essential for market access and brand differentiation.

Precision Nutrition Adoption involves the use of advanced analytical techniques and data-driven approaches to optimize feed formulations for specific animal requirements and production conditions. This trend enables more efficient nutrient utilization, reduced waste, and improved animal performance outcomes. Technology integration includes feed management software and real-time monitoring systems.

Alternative Protein Sources exploration includes insect-based proteins, algae derivatives, and other novel ingredients that reduce dependency on traditional protein sources while potentially offering superior nutritional profiles. This trend addresses both cost management and sustainability objectives while creating opportunities for product differentiation and innovation.

Digital Platform Development encompasses e-commerce solutions, mobile applications, and digital service platforms that enhance customer engagement and operational efficiency. These platforms enable better inventory management, technical support delivery, and customer relationship management throughout the distribution network.

Functional Feed Additives focus on products that provide benefits beyond basic nutrition, including immune system support, gut health enhancement, and performance optimization. This trend reflects growing understanding of animal physiology and nutrition science that enables more targeted and effective feed formulations.

Regional Specialization involves development of feed products specifically designed for local livestock breeds, production systems, and environmental conditions. This trend enables better adaptation to regional requirements while supporting local agricultural development and competitive positioning.

Recent developments within Colombia’s animal feed industry demonstrate the sector’s dynamic evolution and strategic responses to market opportunities and challenges. These developments reflect investment patterns, technological advancement, and competitive positioning strategies that shape industry structure and future growth prospects.

Production Capacity Expansion initiatives by major feed manufacturers include new facility construction and existing plant upgrades to meet growing demand and improve operational efficiency. These investments incorporate advanced processing technologies, quality control systems, and environmental management capabilities that enhance competitive positioning and market service capabilities.

Strategic Partnership Formation between feed manufacturers, livestock producers, and technology providers creates integrated value chains that improve efficiency and market responsiveness. These partnerships enable knowledge sharing, risk management, and coordinated development of specialized products and services that address specific market requirements.

Technology Implementation Projects include adoption of automated production systems, digital inventory management, and precision nutrition platforms that enhance operational efficiency and product quality. These technological advances enable better cost control, quality consistency, and customer service delivery throughout the market.

Export Market Development initiatives focus on establishing distribution networks and regulatory compliance capabilities for regional market penetration. These developments include product certification, quality standardization, and logistics infrastructure investments that support international market expansion strategies.

Sustainability Program Implementation encompasses environmental management systems, sustainable sourcing initiatives, and carbon footprint reduction programs that address growing environmental responsibility requirements. These programs position companies for future regulatory compliance and market differentiation opportunities.

Research and Development Investment in feed formulation science, alternative ingredients, and nutritional optimization technologies demonstrates industry commitment to innovation and competitive advancement. These investments support product differentiation and performance improvement initiatives that create value for customers and stakeholders.

Strategic recommendations for stakeholders in Colombia’s animal feed market focus on capitalizing on growth opportunities while addressing operational challenges and competitive pressures. These suggestions reflect comprehensive market analysis and industry expertise that guide strategic decision-making and investment priorities.

Market Entry Strategies should emphasize regional specialization and customer relationship development rather than attempting broad market coverage. New entrants should focus on specific livestock sectors or geographic regions where they can develop competitive advantages and establish strong market positions before expanding to additional segments.

Technology Investment Priorities should focus on production efficiency improvements and quality control systems that enhance competitiveness and customer satisfaction. Companies should evaluate automation opportunities, digital platform development, and precision nutrition capabilities that provide measurable returns on investment and sustainable competitive advantages.

Product Development Focus should address sustainability requirements and specialized nutrition needs that command premium pricing and customer loyalty. Innovation efforts should concentrate on functional additives, alternative protein sources, and customized formulations that differentiate products from commodity offerings.

Distribution Network Optimization requires investment in logistics capabilities and customer service systems that improve market reach and operational efficiency. Companies should evaluate direct sales opportunities, digital platform development, and strategic partnerships that enhance market access and customer relationships.

Export Market Development should begin with neighboring countries where geographic proximity and cultural similarities provide natural advantages. Companies should invest in quality certification, regulatory compliance, and distribution partnerships that support sustainable international market expansion.

Risk Management Strategies must address commodity price volatility, currency fluctuations, and supply chain disruptions that affect operational stability and profitability. Companies should develop hedging strategies, supplier diversification, and inventory management systems that minimize exposure to external risks.

Long-term prospects for Colombia’s animal feed market indicate sustained growth driven by domestic demand expansion, export market development, and technological advancement throughout the industry. MWR projections suggest continued market evolution toward more sophisticated and sustainable production systems that serve diverse customer requirements and geographic markets.

Growth trajectory expectations point to continued expansion at a compound annual growth rate of 6.2% over the next five years, supported by increasing livestock production, rising protein consumption, and modernization of agricultural practices. This growth will be distributed across multiple livestock sectors with particularly strong performance expected in poultry and aquaculture segments.

Technology integration advancement will accelerate adoption of precision nutrition, automated production systems, and digital service platforms that enhance efficiency and customer value. These technological developments will enable more targeted product offerings, improved operational efficiency, and enhanced customer relationships throughout the market.

Sustainability requirements will become increasingly important for market access and competitive positioning, driving innovation in alternative ingredients, environmental management, and sustainable production practices. Companies that successfully integrate sustainability into their operations will gain competitive advantages and access to premium market segments.

Export market potential offers significant opportunities for Colombian feed manufacturers to expand beyond domestic markets and achieve economies of scale that support continued growth and investment. Regional integration initiatives and trade agreements will facilitate market access and competitive positioning in international markets.

Industry consolidation trends are expected to continue as larger companies acquire smaller producers and form strategic partnerships that enhance market coverage and operational efficiency. This consolidation will create opportunities for specialized producers while enabling scale advantages for integrated operations.

Innovation focus areas will include alternative protein sources, functional additives, and precision nutrition technologies that address evolving customer requirements and regulatory standards. Research and development investments will drive product differentiation and competitive advancement throughout the industry.

Colombia’s animal feed market presents a compelling growth opportunity characterized by strong fundamentals, favorable market conditions, and significant potential for expansion across multiple dimensions. The market benefits from the country’s strategic geographic position, abundant natural resources, and growing livestock sector that creates sustained demand for high-quality feed products and nutritional solutions.

Market dynamics reflect a healthy balance between domestic consumption growth and export market opportunities that provide multiple avenues for business development and revenue expansion. The industry’s evolution toward more sophisticated production systems, sustainable practices, and technological integration positions it for continued growth and competitive advancement in regional and global markets.

Strategic opportunities encompass product innovation, market expansion, technology adoption, and sustainability integration that create value for stakeholders throughout the value chain. Companies that successfully navigate these opportunities while addressing operational challenges and competitive pressures will be well-positioned for long-term success and market leadership.

Future success in Colombia’s animal feed market will depend on the ability to adapt to evolving customer requirements, regulatory standards, and competitive conditions while maintaining operational efficiency and profitability. The market’s continued development will support Colombia’s agricultural modernization goals and contribute to food security and economic development objectives that benefit all stakeholders in the agricultural value chain.

What is Animal Feed?

Animal feed refers to food given to domestic animals, primarily livestock, for the purpose of growth, reproduction, and health. It includes various types of feed such as grains, protein meals, and supplements tailored to specific animal needs.

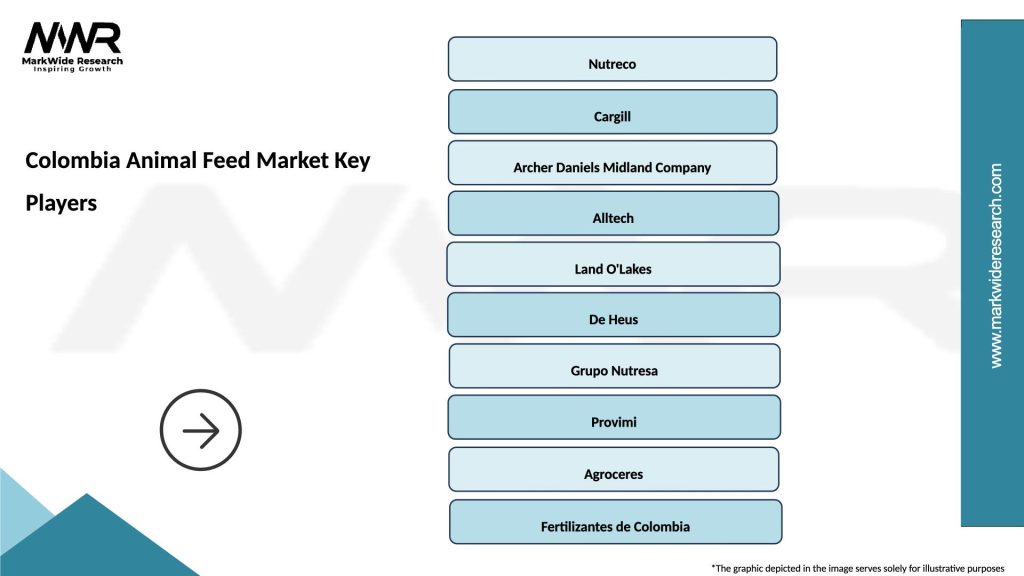

What are the key players in the Colombia Animal Feed Market?

Key players in the Colombia Animal Feed Market include companies like Nutreco, Cargill, and Provimi, which provide a range of feed products for livestock and poultry. These companies focus on innovation and quality to meet the growing demand for animal nutrition among others.

What are the growth factors driving the Colombia Animal Feed Market?

The Colombia Animal Feed Market is driven by increasing meat consumption, rising livestock production, and a growing awareness of animal health and nutrition. Additionally, advancements in feed formulation technology contribute to market growth.

What challenges does the Colombia Animal Feed Market face?

Challenges in the Colombia Animal Feed Market include fluctuating raw material prices, regulatory compliance issues, and competition from alternative protein sources. These factors can impact the cost and availability of feed products.

What opportunities exist in the Colombia Animal Feed Market?

Opportunities in the Colombia Animal Feed Market include the increasing demand for organic and sustainable feed options, as well as the potential for export to neighboring countries. Innovations in feed additives and formulations also present growth avenues.

What trends are shaping the Colombia Animal Feed Market?

Trends in the Colombia Animal Feed Market include a shift towards more sustainable and environmentally friendly feed production practices. There is also a growing interest in precision nutrition and the use of technology to enhance feed efficiency.

Colombia Animal Feed Market

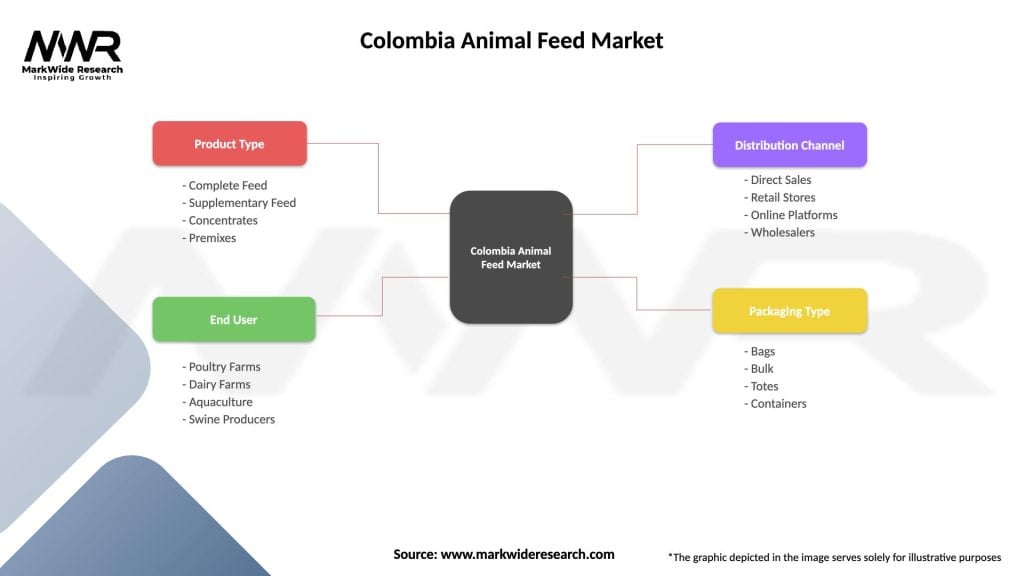

| Segmentation Details | Description |

|---|---|

| Product Type | Complete Feed, Supplementary Feed, Concentrates, Premixes |

| End User | Poultry Farms, Dairy Farms, Aquaculture, Swine Producers |

| Distribution Channel | Direct Sales, Retail Stores, Online Platforms, Wholesalers |

| Packaging Type | Bags, Bulk, Totes, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Animal Feed Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at