444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Colombia agriculture market represents one of South America’s most dynamic and diversified agricultural sectors, characterized by exceptional biodiversity and favorable climatic conditions across multiple ecological zones. Colombia’s agricultural landscape encompasses tropical lowlands, temperate highlands, and coastal regions, creating ideal conditions for cultivating a wide variety of crops ranging from coffee and bananas to flowers and exotic fruits. The sector demonstrates remarkable resilience and growth potential, driven by increasing domestic consumption, expanding export opportunities, and government initiatives promoting agricultural modernization.

Market dynamics indicate that Colombia’s agriculture sector is experiencing significant transformation through technological adoption and sustainable farming practices. The country’s strategic geographic location provides access to both Pacific and Atlantic markets, positioning Colombian agricultural products competitively in international trade. Recent developments show growing at 6.2% annual growth rate in agricultural productivity, supported by investments in precision farming technologies and improved supply chain infrastructure.

Regional distribution across Colombia’s diverse geography creates specialized agricultural zones, with coffee cultivation dominating mountainous regions, while tropical fruits and vegetables thrive in coastal and lowland areas. The sector benefits from year-round growing seasons in many regions, enabling multiple harvests and consistent production cycles that enhance market stability and export reliability.

The Colombia agriculture market refers to the comprehensive ecosystem encompassing crop production, livestock farming, aquaculture, and forestry activities within Colombian territory, including all related supply chain operations, processing facilities, and export infrastructure that contribute to the nation’s food security and economic development.

Agricultural activities in Colombia span from traditional smallholder farming to large-scale commercial operations, incorporating both conventional and organic farming methods. The market encompasses primary production of staple crops like rice, corn, and beans, as well as high-value export commodities including coffee, cut flowers, bananas, and avocados. Livestock production includes cattle ranching, poultry farming, and aquaculture operations that serve both domestic consumption and international markets.

Market infrastructure includes processing facilities, storage systems, transportation networks, and export terminals that facilitate the movement of agricultural products from farms to consumers. The sector integrates traditional farming knowledge with modern agricultural technologies, creating a unique blend of practices that maximize productivity while preserving environmental sustainability.

Colombia’s agriculture market demonstrates exceptional growth potential driven by favorable natural conditions, strategic geographic positioning, and increasing global demand for sustainable agricultural products. The sector encompasses diverse production systems ranging from traditional coffee plantations to modern greenhouse operations producing premium flowers and vegetables for international markets.

Key performance indicators reveal that agricultural exports account for approximately 23% of total export revenues, highlighting the sector’s critical importance to Colombia’s economy. The market benefits from government support programs promoting agricultural modernization, including subsidies for technology adoption and infrastructure development initiatives that enhance productivity and competitiveness.

Strategic advantages include Colombia’s position as the world’s leading producer of certain specialty crops, including premium coffee varieties and exotic tropical fruits. The sector demonstrates resilience through diversified production systems that reduce dependency on single commodities while maximizing revenue opportunities across multiple market segments.

Future projections indicate continued expansion driven by increasing international demand for organic and sustainably produced agricultural products, positioning Colombia as a preferred supplier for environmentally conscious consumers in North American and European markets.

Market analysis reveals several critical insights that define Colombia’s agricultural sector performance and future trajectory:

Primary growth drivers propelling Colombia’s agriculture market include favorable natural conditions, strategic geographic positioning, and increasing global demand for diverse agricultural products. The country’s equatorial location provides consistent growing conditions throughout the year, enabling multiple harvest cycles and continuous production that meets international market demands.

Government initiatives play a crucial role in market development through agricultural modernization programs, infrastructure investments, and export promotion activities. Policy support includes subsidies for technology adoption, irrigation system development, and certification programs that enhance product quality and market access. Rural development programs provide technical assistance and financing options that enable smallholder farmers to improve productivity and integrate into formal market channels.

International trade agreements create expanded market access opportunities, reducing tariff barriers and facilitating agricultural exports to key markets including the United States, European Union, and Asia-Pacific regions. These agreements provide preferential market access that enhances competitiveness and revenue potential for Colombian agricultural products.

Consumer trends toward organic and sustainably produced foods drive demand for Colombian agricultural products that meet environmental and social responsibility standards. Growing health consciousness among international consumers creates premium market opportunities for specialty crops and organic products that command higher prices and profit margins.

Infrastructure limitations present significant challenges for Colombia’s agriculture market, particularly in rural areas where inadequate transportation networks increase logistics costs and limit market access for smallholder farmers. Poor road conditions and limited storage facilities contribute to post-harvest losses that reduce overall sector profitability and efficiency.

Climate variability associated with phenomena such as El Niño and La Niña creates production uncertainties that affect crop yields and quality. Extreme weather events including droughts, floods, and storms can cause significant production losses and disrupt supply chains, creating market volatility and financial risks for agricultural producers.

Security concerns in certain rural regions limit agricultural development and investment opportunities, creating barriers to expansion and modernization efforts. These challenges affect both domestic and international investor confidence, potentially limiting access to capital and technology needed for sector growth.

Market concentration in certain crops creates vulnerability to price fluctuations and demand changes, particularly for export-dependent commodities like coffee and bananas. Limited diversification in some regions increases economic risks and reduces resilience against market downturns or production challenges.

Emerging market opportunities in Colombia’s agriculture sector include expanding organic production to meet growing international demand for certified sustainable products. The global organic food market presents significant revenue potential for Colombian producers who can obtain proper certifications and meet quality standards required by premium market segments.

Technology integration offers substantial opportunities for productivity improvements through precision agriculture, automated irrigation systems, and data-driven farming practices. Digital agriculture solutions can optimize resource utilization, reduce production costs, and improve crop quality while providing real-time monitoring capabilities that enhance decision-making processes.

Value-added processing presents opportunities to increase product value and extend shelf life for export markets. Development of processing facilities for fruits, vegetables, and specialty crops can capture additional value while creating employment opportunities in rural areas and reducing dependency on raw commodity exports.

Agritourism development offers diversification opportunities that combine agricultural production with tourism services, creating additional revenue streams while promoting Colombian agricultural heritage and sustainable farming practices to international visitors.

Market dynamics in Colombia’s agriculture sector reflect complex interactions between production capabilities, international demand patterns, and domestic policy frameworks. The sector demonstrates cyclical patterns influenced by global commodity prices, weather conditions, and international trade relationships that create both opportunities and challenges for market participants.

Supply chain evolution shows increasing integration between producers, processors, and exporters, creating more efficient distribution networks that reduce costs and improve product quality. Modern logistics infrastructure development enhances market access while reducing post-harvest losses that historically limited sector profitability.

Competitive positioning within regional and global markets depends on quality differentiation, sustainable production practices, and reliable supply chain performance. Colombian agricultural products compete based on unique characteristics including flavor profiles, organic certification, and environmental sustainability that appeal to premium market segments.

Investment patterns indicate growing interest from both domestic and international investors in agricultural modernization projects, processing facilities, and export infrastructure development. These investments support sector transformation while creating employment opportunities and enhancing rural economic development.

Comprehensive research methodology employed for analyzing Colombia’s agriculture market incorporates multiple data sources and analytical approaches to ensure accurate and reliable market insights. Primary research includes direct engagement with agricultural producers, processors, exporters, and government agencies to gather firsthand information about market conditions, challenges, and opportunities.

Secondary research utilizes official government statistics, international trade data, and industry reports to validate findings and provide quantitative context for market analysis. Data sources include Colombia’s National Administrative Department of Statistics (DANE), Ministry of Agriculture, and international organizations such as FAO and World Bank.

Field research activities encompass site visits to major agricultural regions, interviews with key stakeholders, and participation in industry events to gather qualitative insights about market trends and future developments. This approach provides comprehensive understanding of regional variations and sector-specific dynamics that influence market performance.

Analytical frameworks combine quantitative data analysis with qualitative assessment methods to identify market patterns, growth drivers, and competitive dynamics. Statistical analysis techniques validate trends while expert interviews provide context and interpretation for numerical findings.

Regional distribution of Colombia’s agricultural activities reflects diverse geographical and climatic conditions that create specialized production zones across the country. The Andean region dominates coffee production, accounting for approximately 78% of national coffee output, while also supporting potato, flower, and vegetable cultivation in highland areas with temperate climates.

Caribbean coastal region specializes in tropical fruit production, cattle ranching, and rice cultivation, benefiting from flat terrain and consistent rainfall patterns. This region contributes significantly to banana and plantain exports while supporting domestic food security through staple crop production. Magdalena Valley serves as a major agricultural corridor connecting highland and coastal regions.

Pacific coastal region focuses on palm oil production, aquaculture, and tropical fruit cultivation, taking advantage of high rainfall and fertile soils. The region demonstrates growing potential for sustainable agriculture development while maintaining important biodiversity conservation areas.

Eastern plains (Llanos) represent Colombia’s largest agricultural frontier, with extensive cattle ranching operations and increasing crop production including rice, corn, and soybeans. This region shows significant expansion potential for large-scale commercial agriculture while requiring careful environmental management to preserve ecosystem integrity.

Competitive landscape in Colombia’s agriculture market includes diverse participants ranging from multinational agribusiness companies to smallholder farmer cooperatives, creating a complex ecosystem of competition and collaboration across different market segments.

Market competition intensifies through quality differentiation, sustainable production practices, and supply chain efficiency improvements that enhance competitiveness in both domestic and international markets.

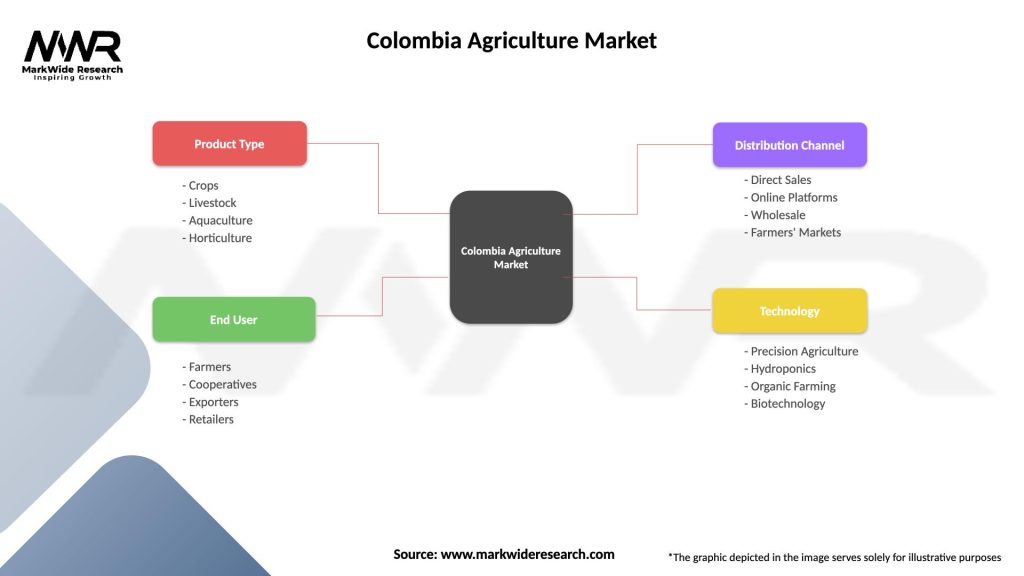

Market segmentation in Colombia’s agriculture sector reflects diverse production systems, crop categories, and market channels that serve different consumer segments and geographic markets.

By Crop Type:

By Production System:

By Market Channel:

Coffee production remains Colombia’s most internationally recognized agricultural category, with premium arabica varieties commanding higher prices in specialty markets. The sector demonstrates consistent quality improvements through selective breeding programs and processing innovations that enhance flavor profiles and market positioning. Sustainable certification programs including Fair Trade and Rainforest Alliance create additional value while supporting environmental conservation efforts.

Tropical fruit cultivation shows remarkable diversity with over 50 commercial varieties produced for both domestic consumption and export markets. Avocado production demonstrates particularly strong growth potential, with increasing international demand driving expansion in suitable growing regions. Advanced post-harvest handling and cold chain logistics enhance product quality and extend shelf life for export markets.

Cut flower industry positions Colombia as the world’s second-largest flower exporter, with sophisticated greenhouse operations utilizing advanced climate control and hydroponic systems. The sector demonstrates technological leadership in flower production while maintaining competitive advantages through favorable climate conditions and skilled labor availability.

Livestock production encompasses cattle ranching, poultry farming, and aquaculture operations that serve both domestic and export markets. Cattle ranching shows modernization trends through improved genetics, pasture management, and animal health programs that enhance productivity and meat quality.

Agricultural producers benefit from Colombia’s diverse growing conditions that enable year-round production and multiple harvest cycles, maximizing land utilization and revenue generation opportunities. Natural advantages include fertile soils, abundant water resources, and favorable climate conditions that reduce production costs while enhancing crop quality and yields.

Export companies leverage Colombia’s strategic geographic location and established trade relationships to access international markets efficiently. Logistical advantages include proximity to major shipping routes and well-developed port infrastructure that facilitates cost-effective transportation to North American and European markets.

Processing companies benefit from reliable raw material supplies and competitive production costs that enhance profitability and market competitiveness. Supply chain integration opportunities enable vertical coordination that improves quality control while reducing transaction costs and market risks.

International buyers gain access to high-quality agricultural products with unique characteristics and competitive pricing. Reliability factors include consistent production volumes, established quality standards, and dependable supply chain performance that meets international market requirements.

Rural communities benefit from employment opportunities, income generation, and infrastructure development associated with agricultural activities. Economic development includes improved access to education, healthcare, and financial services that enhance quality of life in rural areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend across Colombia’s agriculture sector, with increasing adoption of environmentally responsible farming practices that meet international certification standards. Organic production shows accelerating growth as producers respond to premium market opportunities and consumer preferences for sustainably produced foods.

Technology adoption accelerates through precision agriculture tools, automated irrigation systems, and data-driven farming practices that optimize resource utilization while improving crop yields. Digital agriculture platforms provide real-time monitoring capabilities and decision support systems that enhance farm management efficiency.

Supply chain modernization includes cold chain infrastructure development, improved packaging technologies, and logistics optimization that reduce post-harvest losses while extending product shelf life. Traceability systems enable quality assurance and food safety compliance that meets international market requirements.

Market diversification trends show expanding crop varieties and new market channel development that reduce dependency on traditional commodities. Direct marketing approaches including online platforms and farmer-to-consumer sales create additional revenue opportunities while building brand recognition.

Cooperative development strengthens smallholder farmer participation in formal markets through collective bargaining, shared resources, and technical assistance programs. MarkWide Research analysis indicates that cooperative membership shows 42% growth rate among small-scale producers seeking market integration opportunities.

Government policy initiatives include comprehensive agricultural modernization programs that provide subsidies for technology adoption, infrastructure development, and export promotion activities. Rural development strategies focus on improving smallholder farmer productivity while enhancing market access through cooperative development and technical assistance programs.

Infrastructure investments encompass transportation network improvements, storage facility construction, and port modernization projects that enhance supply chain efficiency and reduce logistics costs. Digital infrastructure development includes rural internet connectivity expansion that enables access to agricultural information systems and online marketing platforms.

International partnerships establish technical cooperation agreements with developed countries that provide access to advanced agricultural technologies and best practices. Trade agreement negotiations create expanded market access opportunities while reducing tariff barriers for Colombian agricultural exports.

Private sector investments include processing facility development, greenhouse construction, and supply chain modernization projects that enhance value addition and market competitiveness. Foreign direct investment brings capital and technology transfer that supports sector modernization and expansion efforts.

Research and development initiatives focus on crop improvement programs, sustainable farming practices, and climate adaptation strategies that enhance productivity while maintaining environmental sustainability.

Strategic recommendations for Colombia’s agriculture market emphasize diversification, technology adoption, and sustainable development practices that enhance long-term competitiveness and resilience. Market participants should prioritize investments in modern agricultural technologies that improve productivity while reducing environmental impact.

Infrastructure development requires coordinated public-private partnerships that address transportation, storage, and processing facility needs across rural regions. Priority investments should focus on cold chain logistics and quality assurance systems that meet international market standards and reduce post-harvest losses.

Certification programs offer significant opportunities for market differentiation and premium pricing, particularly for organic and sustainably produced agricultural products. Producers should pursue international certifications that provide access to high-value market segments while demonstrating environmental responsibility.

Cooperative development provides essential support for smallholder farmers seeking market integration and improved bargaining power. Technical assistance programs should focus on modern farming practices, financial management, and market access strategies that enhance farmer incomes and rural development.

Export market diversification reduces dependency on traditional markets while creating new revenue opportunities in emerging economies. MWR analysis suggests that market diversification strategies can reduce revenue volatility by 28% compared to single-market approaches.

Future projections for Colombia’s agriculture market indicate continued growth driven by increasing global demand for diverse agricultural products, technological advancement adoption, and sustainable production practices. Market expansion opportunities include organic product development, value-added processing, and new crop variety introduction that meet evolving consumer preferences.

Technology integration will accelerate through precision agriculture adoption, automated systems implementation, and data-driven farming practices that optimize resource utilization while improving productivity. Digital agriculture solutions are projected to achieve 65% adoption rate among commercial farms within the next decade, significantly enhancing operational efficiency.

Sustainability initiatives will become increasingly important as international markets demand environmentally responsible production practices and certified sustainable products. Climate adaptation strategies will focus on resilient crop varieties, water conservation technologies, and soil health improvement programs that maintain productivity under changing environmental conditions.

Market integration will strengthen through improved supply chain infrastructure, enhanced logistics systems, and expanded processing capabilities that add value while reducing post-harvest losses. Export growth is projected to maintain steady expansion as Colombian agricultural products gain recognition for quality and sustainability in international markets.

Investment opportunities will continue attracting both domestic and international capital for agricultural modernization projects, processing facility development, and export infrastructure enhancement that supports long-term sector growth and competitiveness.

Colombia’s agriculture market demonstrates exceptional potential for continued growth and development, supported by favorable natural conditions, strategic geographic positioning, and increasing global demand for diverse agricultural products. The sector’s strength lies in its remarkable biodiversity, year-round growing conditions, and established international trade relationships that provide competitive advantages in global markets.

Key success factors include ongoing technology adoption, sustainable production practices, and infrastructure development that enhance productivity while maintaining environmental responsibility. The market benefits from government support programs, private sector investments, and international partnerships that facilitate modernization and expansion efforts across all agricultural segments.

Future opportunities encompass organic market development, value-added processing, and new market access through trade agreements and diplomatic relationships. Strategic focus on sustainability, quality improvement, and supply chain efficiency will position Colombian agriculture for long-term success in increasingly competitive global markets while supporting rural economic development and food security objectives.

What is Colombia Agriculture?

Colombia Agriculture refers to the sector involved in the cultivation of crops, livestock production, and related activities in Colombia. It plays a crucial role in the country’s economy, providing employment and food security.

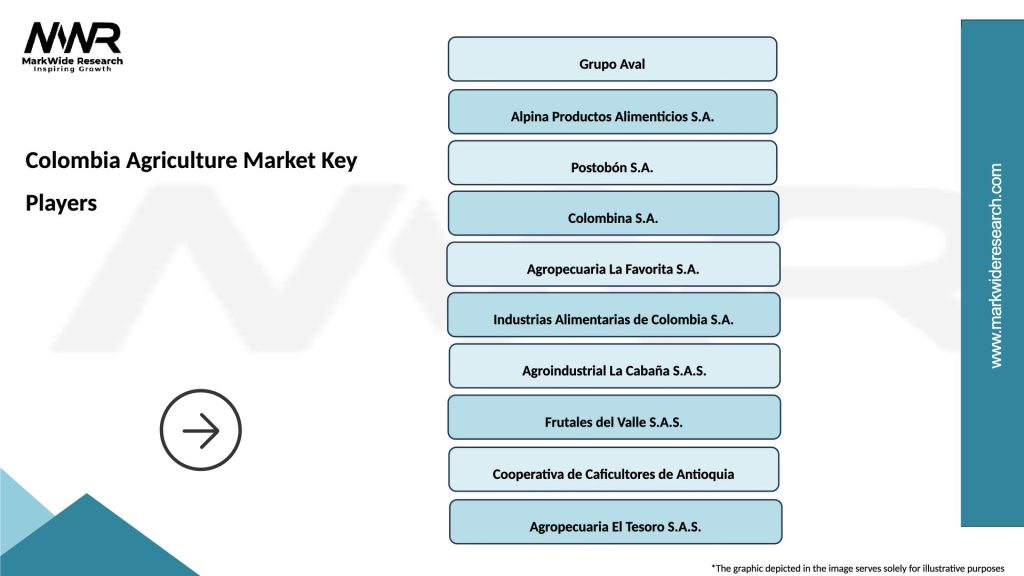

What are the key players in the Colombia Agriculture Market?

Key players in the Colombia Agriculture Market include companies like Grupo Argos, Cargill, and Alpina, which are involved in various agricultural activities such as crop production, food processing, and distribution, among others.

What are the growth factors driving the Colombia Agriculture Market?

The Colombia Agriculture Market is driven by factors such as increasing demand for organic produce, advancements in agricultural technology, and government support for rural development. These elements contribute to enhancing productivity and sustainability in the sector.

What challenges does the Colombia Agriculture Market face?

The Colombia Agriculture Market faces challenges such as climate change impacts, land degradation, and issues related to rural infrastructure. These challenges can hinder agricultural productivity and affect food security.

What opportunities exist in the Colombia Agriculture Market?

Opportunities in the Colombia Agriculture Market include the potential for export growth in specialty crops, investment in sustainable farming practices, and the adoption of innovative technologies. These factors can enhance competitiveness and market reach.

What trends are shaping the Colombia Agriculture Market?

Trends shaping the Colombia Agriculture Market include the rise of precision agriculture, increased focus on sustainability, and the growing popularity of agro-tourism. These trends reflect changing consumer preferences and technological advancements.

Colombia Agriculture Market

| Segmentation Details | Description |

|---|---|

| Product Type | Crops, Livestock, Aquaculture, Horticulture |

| End User | Farmers, Cooperatives, Exporters, Retailers |

| Distribution Channel | Direct Sales, Online Platforms, Wholesale, Farmers’ Markets |

| Technology | Precision Agriculture, Hydroponics, Organic Farming, Biotechnology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Colombia Agriculture Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at