444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The civilian grade combustible gas detector market includes devices designed for detecting the presence of combustible gases in residential, commercial, and industrial settings. These detectors are crucial for ensuring safety by alerting users to potential gas leaks, thereby preventing fires, explosions, and other hazards.

Meaning

Civilian grade combustible gas detectors are electronic devices that monitor the air for the presence of combustible gases such as methane, propane, butane, and natural gas. They provide early warnings through visual and audible alarms when gas concentrations exceed safe levels, prompting immediate action to mitigate risks.

Executive Summary

The market for civilian grade combustible gas detectors is driven by increasing awareness of gas safety, stringent regulatory standards, and the growing adoption of smart home technologies. Manufacturers focus on enhancing detection accuracy, reliability, and user-friendliness to cater to diverse consumer needs across residential and commercial sectors.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The civilian grade combustible gas detector market is characterized by rapid technological advancements, regulatory compliance requirements, and evolving consumer preferences. Manufacturers are focusing on innovation, strategic partnerships, and expanding market reach to capitalize on growing safety concerns and market opportunities.

Regional Analysis

Competitive Landscape

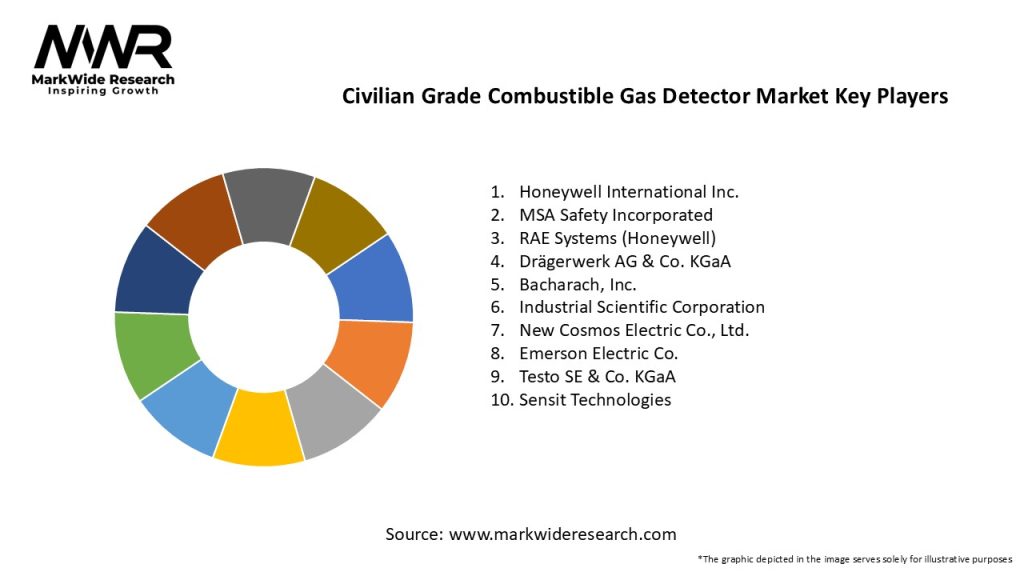

Key players in the civilian grade combustible gas detector market include Honeywell International Inc., MSA Safety Incorporated, Siemens AG, Tyco Fire Protection Products, and General Electric Company. These companies compete based on product innovation, reliability, affordability, and customer service to maintain market leadership and meet diverse consumer needs.

Segmentation

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

Key Industry Developments

Analyst Suggestions

Future Outlook

The civilian grade combustible gas detector market is poised for significant growth, driven by technological advancements, regulatory mandates, and increasing awareness of gas safety. Companies that innovate, collaborate, and expand their market reach will capitalize on opportunities presented by smart home integration, industrial safety regulations, and urban infrastructure developments.

Conclusion

The civilian grade combustible gas detector market plays a crucial role in ensuring safety across residential, commercial, and industrial sectors by detecting and alerting users to potentially hazardous gas leaks. Despite challenges such as cost barriers and technical complexities, the market offers substantial growth opportunities driven by advancements in sensor technology, regulatory compliance requirements, and the adoption of smart home solutions. Industry participants can leverage innovation, strategic partnerships, and market expansion initiatives to enhance product offerings, address evolving consumer needs, and strengthen their market positions in this dynamic and essential market segment.

Civilian Grade Combustible Gas Detector Market

| Segmentation Details | Description |

|---|---|

| Product Type | Portable Detectors, Fixed Detectors, Multi-Gas Detectors, Single-Gas Detectors |

| Technology | Infrared, Catalytic, Electrochemical, Ultrasonic |

| Application | Residential Safety, Industrial Safety, Commercial Use, HVAC Systems |

| End User | Homeowners, Facility Managers, Contractors, Safety Inspectors |

Leading Companies in the Civilian Grade Combustible Gas Detector Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at