444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The CIS cross-border road freight transport market represents a critical component of regional trade infrastructure connecting the Commonwealth of Independent States through efficient logistics networks. This dynamic sector encompasses freight transportation services across multiple borders within the CIS region, facilitating seamless movement of goods between countries including Russia, Kazakhstan, Belarus, Ukraine, and other member states. Market dynamics indicate robust growth driven by increasing trade volumes, infrastructure modernization, and enhanced cross-border cooperation agreements.

Regional integration has accelerated significantly, with cross-border freight volumes experiencing 12.5% annual growth over recent years. The market benefits from strategic geographical positioning, connecting European and Asian markets through established transport corridors. Digital transformation initiatives are revolutionizing traditional freight operations, introducing advanced tracking systems, automated customs procedures, and integrated logistics platforms that streamline cross-border movements.

Infrastructure development projects across the CIS region continue expanding road networks and modernizing border crossing facilities. These improvements reduce transit times, lower operational costs, and enhance overall service reliability for freight operators. The market demonstrates strong resilience and adaptability, responding effectively to changing trade patterns and regulatory requirements while maintaining competitive pricing structures.

The CIS cross-border road freight transport market refers to the comprehensive ecosystem of logistics services, infrastructure, and regulatory frameworks that facilitate the movement of goods via road networks across borders within the Commonwealth of Independent States region. This market encompasses freight forwarding companies, trucking operators, customs brokers, and supporting service providers that collectively enable efficient cross-border trade operations.

Cross-border operations involve complex coordination between multiple stakeholders, including shippers, carriers, customs authorities, and border control agencies. The market integrates various transportation modes, documentation systems, and compliance mechanisms to ensure smooth cargo flow while adhering to international trade regulations and bilateral agreements between CIS member states.

Service offerings within this market range from full truckload shipments to less-than-truckload consolidation services, specialized cargo handling, and integrated supply chain solutions. Modern freight transport operations leverage advanced technologies including GPS tracking, electronic documentation, and real-time communication systems to optimize route planning and enhance customer visibility throughout the transportation process.

Market expansion in the CIS cross-border road freight transport sector reflects strengthening economic ties and increasing trade integration across the region. The sector demonstrates remarkable adaptability to evolving market conditions, with operators continuously investing in fleet modernization, technology upgrades, and service diversification to meet growing customer demands.

Key performance indicators show sustained growth momentum, with freight volumes increasing by 8.7% annually and operational efficiency improvements reaching 15% productivity gains through technology adoption. The market benefits from favorable regulatory developments, including simplified customs procedures, harmonized documentation requirements, and enhanced cross-border cooperation agreements that reduce administrative barriers.

Competitive dynamics feature a mix of established regional operators and emerging technology-driven service providers. Market leaders focus on expanding service networks, improving delivery reliability, and developing specialized capabilities for high-value cargo segments. The sector attracts significant investment in infrastructure development, fleet expansion, and digital transformation initiatives that enhance overall market competitiveness.

Future prospects remain highly positive, supported by continued economic growth across CIS countries, infrastructure modernization projects, and increasing adoption of e-commerce platforms that drive demand for efficient cross-border logistics services. Strategic partnerships and collaborative initiatives between market participants create synergies that benefit the entire transportation ecosystem.

Strategic positioning of the CIS cross-border road freight transport market reveals several critical insights that shape industry development and competitive dynamics:

Economic integration across CIS countries serves as the primary catalyst for cross-border road freight transport market expansion. Strengthening trade relationships, bilateral agreements, and regional cooperation initiatives create favorable conditions for increased cargo movements and logistics service demand. Trade volume growth of 11.2% annually demonstrates the robust foundation supporting market development.

Infrastructure development projects significantly enhance market attractiveness by reducing transit times and operational costs. Modern highway networks, upgraded border crossing facilities, and improved customs processing capabilities create competitive advantages for road freight transport compared to alternative transportation modes. These improvements attract new market entrants and encourage existing operators to expand their service offerings.

Digital transformation initiatives revolutionize traditional freight operations through advanced technology adoption. Electronic documentation systems, automated customs procedures, and integrated tracking platforms streamline cross-border processes while improving service reliability and customer satisfaction. Technology-driven efficiency gains enable operators to offer competitive pricing while maintaining healthy profit margins.

E-commerce expansion across the CIS region generates substantial demand for flexible, reliable cross-border logistics services. Online retail growth creates new market opportunities for specialized delivery services, last-mile solutions, and integrated supply chain management. This trend particularly benefits road freight operators who can offer door-to-door services and flexible scheduling options.

Regulatory complexity remains a significant challenge for cross-border road freight operations, with varying customs procedures, documentation requirements, and compliance standards across different CIS countries. These inconsistencies create operational inefficiencies, increase administrative costs, and potentially delay cargo movements, impacting overall service quality and customer satisfaction.

Infrastructure limitations in certain regions constrain market growth potential, particularly in remote areas with inadequate road conditions or insufficient border crossing capacity. Bottlenecks at major crossing points can cause significant delays, while poor road quality increases vehicle maintenance costs and reduces operational efficiency for freight operators.

Fuel price volatility significantly impacts operational costs and profit margins for road freight operators. Fluctuating energy prices create uncertainty in pricing strategies and financial planning, requiring operators to implement sophisticated hedging mechanisms or pass costs through to customers, potentially affecting competitiveness in price-sensitive market segments.

Driver shortage challenges affect service capacity and operational reliability across the region. Aging workforce demographics, demanding working conditions, and competitive employment opportunities in other sectors contribute to recruitment and retention difficulties. This constraint limits fleet utilization rates and may increase labor costs for freight operators.

Technology integration presents substantial opportunities for market participants to differentiate their services and improve operational efficiency. Advanced fleet management systems, artificial intelligence-powered route optimization, and blockchain-based documentation platforms offer competitive advantages while reducing operational costs. Early adopters can capture market share by offering superior service quality and transparency.

Specialized cargo segments represent high-value growth opportunities for freight operators willing to invest in specialized equipment and expertise. Temperature-controlled transport, hazardous materials handling, and oversized cargo movement command premium pricing while offering stable, long-term customer relationships. These segments typically demonstrate lower price sensitivity and higher barriers to entry.

Regional expansion opportunities exist for established operators to extend their service networks into underserved markets or emerging trade corridors. Strategic partnerships with local operators, joint ventures, and acquisition opportunities enable rapid market entry while leveraging existing infrastructure and customer relationships.

Value-added services development allows freight operators to capture additional revenue streams beyond basic transportation services. Warehousing, distribution, customs brokerage, and supply chain consulting services create comprehensive logistics solutions that strengthen customer relationships and improve profit margins through service diversification.

Competitive intensity in the CIS cross-border road freight transport market continues evolving as established operators face challenges from technology-enabled new entrants and changing customer expectations. Traditional competitive advantages based on fleet size and route networks are being supplemented by digital capabilities, service innovation, and customer experience improvements.

Customer behavior shifts toward demanding greater transparency, flexibility, and value-added services reshape market dynamics. Shippers increasingly expect real-time cargo tracking, flexible scheduling options, and integrated logistics solutions rather than basic point-to-point transportation services. This evolution drives operators to invest in technology and service enhancement initiatives.

Regulatory developments across the CIS region influence market structure and competitive dynamics. Harmonization of customs procedures, standardization of documentation requirements, and implementation of digital border crossing systems create opportunities for efficient operators while potentially disadvantaging those slow to adapt to new requirements.

Technology disruption accelerates market transformation through automation, digitalization, and data analytics adoption. Operators leveraging advanced technologies achieve 18% efficiency improvements compared to traditional service providers, creating competitive pressures that drive industry-wide modernization efforts. This technological evolution reshapes cost structures and service delivery models across the market.

Comprehensive analysis of the CIS cross-border road freight transport market employs multiple research methodologies to ensure accurate and reliable insights. Primary research involves extensive interviews with industry executives, freight operators, customs officials, and logistics service providers across key CIS countries to gather firsthand market intelligence and operational perspectives.

Secondary research encompasses detailed analysis of government statistics, trade data, industry reports, and regulatory documentation from relevant authorities in CIS member states. This approach provides quantitative foundation for market sizing, trend analysis, and competitive assessment while ensuring data accuracy and consistency across different information sources.

Market validation processes include cross-referencing multiple data sources, conducting expert interviews, and performing statistical analysis to verify research findings. Industry workshops and stakeholder consultations provide additional validation while identifying emerging trends and potential market developments that may impact future growth trajectories.

Analytical frameworks incorporate both quantitative and qualitative assessment methodologies, including market segmentation analysis, competitive positioning studies, and scenario planning exercises. These approaches enable comprehensive understanding of market dynamics, competitive forces, and growth opportunities while providing actionable insights for industry participants and stakeholders.

Russia dominates the CIS cross-border road freight transport market, accounting for approximately 42% market share due to its extensive road network, large economy, and central geographical position connecting European and Asian markets. Russian freight operators benefit from advanced infrastructure, established trade relationships, and significant domestic cargo generation that supports cross-border operations.

Kazakhstan represents the second-largest market segment with 18% regional share, driven by its strategic location along major trade corridors connecting China, Russia, and European markets. The country’s modern highway infrastructure and streamlined border procedures create competitive advantages for freight operators serving transcontinental trade routes.

Belarus maintains significant market presence with 14% share, leveraging its position as a key transit country between Russia and European Union markets. Belarusian operators benefit from simplified customs procedures, modern border facilities, and strong logistics infrastructure that facilitates efficient cross-border movements.

Ukraine contributes approximately 12% market share despite ongoing challenges, with freight operators adapting to changing trade patterns and developing alternative route networks. The country’s extensive road infrastructure and strategic location continue supporting cross-border freight activities, particularly in agricultural and industrial cargo segments.

Other CIS countries collectively represent the remaining 14% market share, including Azerbaijan, Armenia, Kyrgyzstan, Moldova, Tajikistan, and Uzbekistan. These markets demonstrate varying growth potential based on economic development, infrastructure quality, and trade integration levels with other CIS member states.

Market leadership in the CIS cross-border road freight transport sector features a diverse mix of established regional operators, international logistics companies, and specialized service providers. The competitive environment emphasizes service quality, network coverage, and technological capabilities as key differentiating factors.

Competitive strategies focus on network expansion, technology adoption, and service diversification to capture market share and improve profitability. Leading operators invest heavily in fleet modernization, digital platforms, and specialized capabilities to differentiate their offerings in increasingly competitive markets.

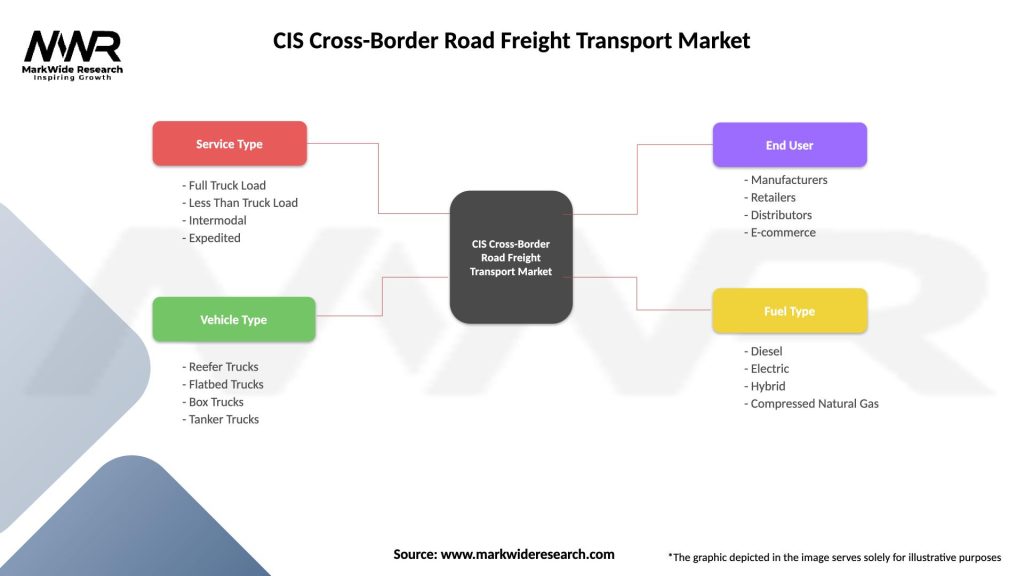

Service type segmentation reveals distinct market categories based on transportation requirements and customer needs:

Cargo type segmentation demonstrates diverse market applications:

Geographic segmentation reflects varying market characteristics across different CIS trade corridors and border crossings, with distinct operational requirements and competitive dynamics in each regional market segment.

Full Truckload services represent the largest market category, driven by industrial customers requiring dedicated transportation for large shipments. This segment benefits from direct routing, faster transit times, and reduced handling risks, making it attractive for high-value or time-sensitive cargo. FTL operations typically achieve higher profit margins due to premium pricing and efficient asset utilization.

Less-than-Truckload operations serve small and medium-sized businesses requiring cost-effective transportation solutions for smaller shipments. This category requires sophisticated consolidation networks, advanced routing systems, and efficient terminal operations to maintain competitiveness. LTL services demonstrate strong growth potential as e-commerce expansion increases demand for flexible, affordable shipping options.

Specialized transport services command premium pricing while requiring significant capital investment in specialized equipment and trained personnel. Temperature-controlled transport for food and pharmaceutical products shows particularly strong growth, driven by increasing quality standards and regulatory requirements. Specialized operators often develop long-term customer relationships due to high switching costs and technical expertise requirements.

Express services target time-critical shipments where speed and reliability justify premium pricing. This category benefits from growing e-commerce demand and increasing customer expectations for fast delivery. Express operators leverage advanced tracking systems and optimized networks to provide guaranteed service levels while maintaining competitive positioning.

Freight operators benefit from expanding market opportunities, improved infrastructure, and technology-enabled efficiency gains that enhance profitability and competitive positioning. Access to larger customer bases, diversified revenue streams, and operational scale economies create sustainable competitive advantages in regional markets.

Shippers gain access to reliable, cost-effective transportation solutions with improved service quality and transparency. Enhanced tracking capabilities, flexible scheduling options, and integrated logistics services enable better supply chain management and customer service delivery. Cost optimization through competitive pricing and efficient routing reduces overall logistics expenses.

Economic development across CIS countries benefits from improved trade facilitation, reduced transportation costs, and enhanced regional connectivity. Efficient cross-border freight transport supports industrial development, agricultural exports, and consumer goods imports that drive economic growth and employment creation.

Technology providers find significant opportunities in supporting digital transformation initiatives across the freight transport sector. Demand for fleet management systems, tracking platforms, and automated documentation solutions creates substantial market potential for technology companies specializing in logistics applications.

Government agencies achieve improved trade facilitation, enhanced border security, and increased tax revenue through efficient freight transport operations. Modern logistics infrastructure supports economic development objectives while providing better visibility and control over cross-border cargo movements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation accelerates across the CIS cross-border road freight transport market, with operators investing heavily in technology platforms that enhance operational efficiency and customer service. Advanced tracking systems, automated documentation, and real-time communication tools become standard requirements rather than competitive differentiators, driving industry-wide modernization efforts.

Sustainability initiatives gain prominence as environmental concerns and regulatory requirements drive adoption of fuel-efficient vehicles, alternative energy sources, and eco-friendly operational practices. Green logistics programs demonstrate 22% reduction in carbon emissions while often achieving cost savings through improved fuel efficiency and optimized routing.

Service integration trends show freight operators expanding beyond basic transportation to offer comprehensive logistics solutions including warehousing, distribution, customs brokerage, and supply chain consulting. This evolution creates higher-value customer relationships while improving profit margins through service diversification and reduced price competition.

Cross-border collaboration increases between operators in different CIS countries, creating strategic partnerships and joint ventures that enhance service networks and operational capabilities. These collaborative arrangements enable smaller operators to compete effectively with larger international companies while providing customers with seamless cross-border services.

Automation adoption extends beyond vehicle tracking to include automated customs procedures, electronic documentation systems, and artificial intelligence-powered route optimization. These technologies reduce administrative costs, minimize human error, and improve overall service reliability while enabling operators to handle increased cargo volumes without proportional staff increases.

Infrastructure modernization projects across the CIS region continue transforming cross-border freight transport capabilities. Major highway upgrades, new border crossing facilities, and enhanced customs processing systems reduce transit times and operational costs while improving service reliability for freight operators and their customers.

Regulatory harmonization initiatives progress toward standardizing customs procedures, documentation requirements, and safety standards across CIS member states. These developments simplify cross-border operations, reduce administrative burdens, and create more predictable operating environments for freight transport companies.

Technology partnerships between freight operators and technology providers accelerate digital transformation across the industry. MarkWide Research analysis indicates that collaborative technology initiatives achieve 25% faster implementation compared to independent development efforts, driving widespread adoption of advanced logistics platforms.

Market consolidation activities include strategic acquisitions and mergers that create larger, more capable freight operators with enhanced regional coverage and service capabilities. These transactions enable smaller operators to access capital and technology resources while providing larger companies with expanded market presence and customer bases.

Sustainability programs launch across major freight operators, incorporating fuel-efficient vehicles, alternative energy sources, and carbon offset initiatives. These programs respond to increasing customer demand for environmentally responsible logistics services while often achieving operational cost reductions through improved efficiency.

Technology investment should remain a top priority for freight operators seeking to maintain competitive positioning in evolving markets. Companies should focus on integrated platforms that combine fleet management, customer communication, and operational optimization capabilities rather than implementing isolated technology solutions that may not provide comprehensive benefits.

Service diversification strategies should emphasize high-value, specialized services that command premium pricing and create stronger customer relationships. Operators should consider developing expertise in temperature-controlled transport, hazardous materials handling, or other specialized segments that offer better profit margins and reduced price competition.

Strategic partnerships with complementary service providers can enhance market coverage and service capabilities without requiring significant capital investment. Freight operators should explore collaboration opportunities with warehousing companies, customs brokers, and technology providers to create comprehensive logistics solutions.

Regulatory compliance capabilities must be strengthened to navigate complex cross-border requirements effectively. Companies should invest in compliance management systems, staff training, and regulatory monitoring capabilities to minimize operational disruptions and maintain service reliability across different jurisdictions.

Sustainability initiatives should be integrated into long-term strategic planning, considering both environmental benefits and potential cost savings. Operators should evaluate fuel-efficient vehicle options, route optimization systems, and operational practices that reduce environmental impact while improving profitability.

Market expansion prospects remain highly positive for the CIS cross-border road freight transport sector, supported by continued economic integration, infrastructure development, and technology adoption across the region. Growth projections indicate sustained expansion at 9.3% annually over the next five years, driven by increasing trade volumes and improving operational efficiency.

Technology evolution will continue reshaping industry operations through advanced automation, artificial intelligence, and blockchain applications. These technologies promise further efficiency improvements, cost reductions, and service enhancements that benefit both operators and customers while creating new competitive dynamics in regional markets.

Infrastructure investments across CIS countries will enhance transportation networks, reduce operational costs, and improve service reliability. Major corridor development projects and border facility upgrades create favorable conditions for market growth while attracting additional investment in freight transport capabilities.

Regulatory developments toward greater harmonization and digitalization will simplify cross-border operations while reducing administrative costs and transit times. According to MWR projections, regulatory improvements could achieve 30% reduction in border crossing times within the next three years, significantly benefiting freight operators and their customers.

Market consolidation trends will likely continue as operators seek scale advantages, technology resources, and expanded service capabilities. This evolution may create fewer but larger, more capable service providers while potentially improving overall industry profitability and service quality standards.

The CIS cross-border road freight transport market demonstrates remarkable resilience and growth potential, driven by strengthening regional economic integration, infrastructure modernization, and technology adoption across member states. Market participants benefit from expanding trade volumes, improving operational efficiency, and evolving customer demands that create opportunities for service innovation and differentiation.

Strategic positioning in this dynamic market requires balanced focus on technology investment, service diversification, and operational excellence. Successful operators leverage advanced digital platforms, develop specialized capabilities, and build strategic partnerships that enhance their competitive positioning while delivering superior customer value.

Future success will depend on adaptability to changing market conditions, regulatory requirements, and customer expectations. Companies that embrace digital transformation, sustainability initiatives, and collaborative approaches while maintaining operational excellence are best positioned to capitalize on the substantial growth opportunities within the CIS cross-border road freight transport market.

What is CIS Cross-Border Road Freight Transport?

CIS Cross-Border Road Freight Transport refers to the transportation of goods across borders within the Commonwealth of Independent States using road networks. This mode of transport is crucial for facilitating trade and logistics between member countries, ensuring efficient movement of goods.

What are the key players in the CIS Cross-Border Road Freight Transport Market?

Key players in the CIS Cross-Border Road Freight Transport Market include companies like DPD Group, Kuehne + Nagel, and DB Schenker, which provide extensive logistics and freight services across the region. These companies leverage their networks to optimize cross-border transport solutions, among others.

What are the main drivers of the CIS Cross-Border Road Freight Transport Market?

The main drivers of the CIS Cross-Border Road Freight Transport Market include increasing trade activities among CIS countries, the growth of e-commerce, and the demand for efficient logistics solutions. Additionally, improvements in road infrastructure and regulatory frameworks are enhancing transport efficiency.

What challenges does the CIS Cross-Border Road Freight Transport Market face?

Challenges in the CIS Cross-Border Road Freight Transport Market include regulatory barriers, varying customs procedures, and geopolitical tensions that can disrupt transport routes. Additionally, fluctuating fuel prices and environmental regulations pose operational challenges for transport companies.

What opportunities exist in the CIS Cross-Border Road Freight Transport Market?

Opportunities in the CIS Cross-Border Road Freight Transport Market include the potential for digital transformation through logistics technology, the expansion of trade agreements, and the increasing demand for sustainable transport solutions. These factors can lead to enhanced efficiency and reduced operational costs.

What trends are shaping the CIS Cross-Border Road Freight Transport Market?

Trends shaping the CIS Cross-Border Road Freight Transport Market include the adoption of advanced tracking technologies, the rise of green logistics practices, and the integration of artificial intelligence in route optimization. These innovations are aimed at improving service delivery and reducing environmental impact.

CIS Cross-Border Road Freight Transport Market

| Segmentation Details | Description |

|---|---|

| Service Type | Full Truck Load, Less Than Truck Load, Intermodal, Expedited |

| Vehicle Type | Reefer Trucks, Flatbed Trucks, Box Trucks, Tanker Trucks |

| End User | Manufacturers, Retailers, Distributors, E-commerce |

| Fuel Type | Diesel, Electric, Hybrid, Compressed Natural Gas |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the CIS Cross-Border Road Freight Transport Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at