444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The CIS building and construction sheets market represents a dynamic segment within the global construction materials industry, experiencing robust growth driven by increasing infrastructure development and modernization projects across the Commonwealth of Independent States region. CIS building sheets encompass a diverse range of construction materials including metal roofing sheets, wall cladding panels, insulation boards, and composite building materials designed specifically for the unique climatic and structural requirements of CIS countries.

Market dynamics indicate significant expansion opportunities as urbanization accelerates throughout Russia, Kazakhstan, Ukraine, Belarus, and other CIS nations. The market demonstrates strong growth potential with projected expansion at a compound annual growth rate of 6.8% through the forecast period. Construction activity in major metropolitan areas drives demand for high-quality building sheets that offer superior durability, thermal efficiency, and cost-effectiveness.

Regional infrastructure initiatives and government-backed construction programs contribute substantially to market growth, with residential construction accounting for approximately 45% of total demand for CIS building sheets. Commercial and industrial applications represent additional growth vectors, particularly in warehouse construction, manufacturing facilities, and retail developments across the region.

The CIS building and construction sheets market refers to the comprehensive industry segment encompassing the production, distribution, and application of specialized building materials designed for construction projects within Commonwealth of Independent States countries. These materials include various types of structural and decorative sheets used in residential, commercial, and industrial construction applications.

Building sheets in this context encompass metal roofing materials, wall cladding systems, insulation panels, composite materials, and specialized construction boards engineered to meet specific regional requirements. CIS-specific applications often require materials capable of withstanding extreme temperature variations, heavy snow loads, and diverse environmental conditions characteristic of the region’s vast geographical expanse.

Market scope includes both traditional materials such as galvanized steel sheets and modern composite solutions incorporating advanced polymers and insulation technologies. The definition extends to prefabricated building components, modular construction elements, and specialized architectural panels designed for contemporary construction methodologies prevalent throughout CIS markets.

Strategic market analysis reveals the CIS building and construction sheets market as a rapidly evolving sector characterized by technological innovation, increasing quality standards, and growing demand for energy-efficient building solutions. Market participants benefit from expanding construction activities across residential, commercial, and infrastructure development projects throughout the region.

Key growth drivers include government infrastructure investment programs, urbanization trends, and increasing adoption of modern construction techniques requiring specialized building materials. Technology advancement in manufacturing processes enables production of higher-quality sheets with improved thermal performance, representing approximately 35% improvement in energy efficiency compared to traditional materials.

Competitive landscape features both international manufacturers and regional producers competing on quality, pricing, and technical specifications. Market consolidation trends indicate increasing collaboration between global technology providers and local manufacturing capabilities, creating opportunities for enhanced product offerings and expanded market reach throughout CIS countries.

Future prospects remain positive with anticipated growth in green building initiatives, smart construction technologies, and sustainable material adoption driving long-term market expansion across the Commonwealth of Independent States region.

Market intelligence reveals several critical insights shaping the CIS building and construction sheets industry landscape:

Infrastructure development initiatives across CIS countries represent the primary catalyst driving market expansion, with government-sponsored construction projects requiring substantial quantities of high-quality building sheets. Urban development programs in major cities create sustained demand for modern construction materials capable of meeting contemporary architectural and performance standards.

Economic growth throughout the region translates into increased construction activity across residential, commercial, and industrial sectors. Rising disposable income enables private construction projects, while foreign investment in manufacturing and logistics facilities generates demand for specialized industrial building materials.

Energy efficiency regulations and building code modernization drive adoption of advanced building sheets offering superior thermal performance and environmental compliance. Climate considerations specific to CIS regions necessitate materials capable of withstanding extreme temperature variations and severe weather conditions.

Technological advancement in construction methodologies creates opportunities for innovative building sheet applications, including prefabricated construction systems and modular building approaches. Manufacturing capabilities continue expanding throughout the region, improving product availability and reducing import dependency for construction materials.

Economic volatility and currency fluctuations across CIS countries create challenges for market stability and long-term planning, affecting both manufacturers and construction project developers. Raw material costs for steel, aluminum, and specialized polymers experience periodic price increases that impact overall product pricing and market accessibility.

Regulatory complexity and varying building standards across different CIS nations complicate product development and market entry strategies for manufacturers seeking regional expansion. Quality control challenges in some market segments affect consumer confidence and slow adoption of newer building sheet technologies.

Transportation limitations and logistics infrastructure constraints in remote regions restrict market penetration and increase distribution costs for building materials. Seasonal construction patterns create demand fluctuations that challenge inventory management and production planning for market participants.

Competition from alternative materials and traditional construction methods limits market share growth in certain applications, particularly in cost-sensitive residential construction segments. Technical expertise requirements for proper installation and application of advanced building sheets create barriers to adoption in markets with limited skilled labor availability.

Green building initiatives and sustainability mandates create substantial opportunities for manufacturers developing environmentally responsible building sheet solutions. Energy efficiency programs supported by government incentives drive demand for high-performance insulation and thermal management materials.

Smart building technologies integration presents opportunities for building sheets incorporating sensors, monitoring capabilities, and connectivity features that enhance building performance and maintenance efficiency. Modular construction growth creates demand for standardized, high-quality building components suitable for prefabricated construction systems.

Export potential to neighboring regions and emerging markets provides expansion opportunities for CIS-based manufacturers with established production capabilities and quality certifications. Technology partnerships with international companies enable access to advanced manufacturing processes and innovative material formulations.

Retrofit and renovation projects throughout the region create demand for building sheets suitable for upgrading existing structures with improved performance characteristics. Industrial facility expansion driven by economic development generates opportunities for specialized building materials designed for manufacturing and logistics applications.

Supply chain dynamics within the CIS building sheets market reflect complex interactions between raw material availability, manufacturing capacity, and regional demand patterns. Production facilities strategically located throughout major CIS countries enable responsive supply chain management and reduced transportation costs for end users.

Demand fluctuations correlate closely with construction industry cycles, government infrastructure spending, and economic conditions across individual CIS nations. Seasonal variations in construction activity create predictable demand patterns that influence production planning and inventory management strategies.

Competitive dynamics feature both price-based competition and differentiation through technical performance, quality standards, and customer service capabilities. Market consolidation trends indicate increasing collaboration between manufacturers and distributors to enhance market coverage and customer support services.

Innovation cycles driven by technological advancement and changing customer requirements create opportunities for market leadership through product development and technical expertise. Regulatory evolution continues shaping market dynamics as building codes and environmental standards become more stringent across CIS countries.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the CIS building and construction sheets market. Primary research includes extensive interviews with industry executives, construction professionals, distributors, and end users across major CIS markets to gather firsthand market intelligence.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements to establish market trends and competitive positioning. Data validation processes ensure information accuracy through cross-referencing multiple sources and expert verification.

Market sizing methodologies utilize bottom-up and top-down approaches to establish comprehensive market scope and segment analysis. Forecasting models incorporate economic indicators, construction industry trends, and regulatory developments to project future market conditions and growth trajectories.

Regional analysis examines market conditions across individual CIS countries, considering local economic factors, construction activity levels, and regulatory environments. Competitive intelligence gathering includes analysis of market participants, product offerings, pricing strategies, and strategic initiatives affecting market dynamics.

Russia dominates the CIS building and construction sheets market, representing approximately 52% of regional demand due to extensive infrastructure development projects and large-scale construction activities in major metropolitan areas. Moscow and St. Petersburg serve as primary consumption centers, with significant demand for high-quality building materials in both residential and commercial construction sectors.

Kazakhstan emerges as a significant growth market, driven by oil industry investments and urban development initiatives in Almaty and Nur-Sultan. Construction activity in the energy sector creates demand for specialized industrial building sheets capable of withstanding harsh environmental conditions.

Ukraine represents substantial market potential despite economic challenges, with reconstruction efforts and infrastructure modernization projects driving demand for cost-effective building materials. Regional manufacturing capabilities support both domestic consumption and export opportunities to neighboring markets.

Belarus and other CIS nations contribute approximately 23% of total market demand, with growth opportunities in residential construction and industrial facility development. Cross-border trade and regional cooperation agreements facilitate market access and distribution efficiency throughout the Commonwealth of Independent States region.

Market leadership within the CIS building and construction sheets sector features a combination of international manufacturers and regional producers competing across multiple product categories and market segments:

Competitive strategies focus on product quality, technical support services, distribution network expansion, and strategic partnerships with construction companies and distributors throughout CIS markets.

Product-based segmentation reveals diverse market categories serving different construction applications and performance requirements:

By Material Type:

By Application:

By End-User:

Metal building sheets dominate market share, representing approximately 68% of total demand across CIS countries due to proven performance, cost-effectiveness, and widespread acceptance in construction applications. Galvanized steel sheets remain the preferred choice for roofing and structural applications, offering excellent corrosion resistance and durability in challenging climatic conditions.

Composite materials experience rapid growth as construction professionals seek advanced solutions offering superior thermal performance and reduced maintenance requirements. Polymer-based sheets gain acceptance in specialized applications where traditional materials face limitations in performance or installation complexity.

Insulation boards represent a growing market segment driven by energy efficiency regulations and increasing awareness of thermal management benefits. Advanced insulation solutions incorporating phase-change materials and reflective technologies create opportunities for premium product positioning.

Decorative panels serve the expanding architectural market seeking aesthetic solutions that combine visual appeal with functional performance. Customization capabilities and color options enable differentiation in competitive market segments focused on design-oriented construction projects.

Manufacturers benefit from expanding market opportunities driven by infrastructure development and modernization projects throughout CIS countries. Production efficiency improvements through advanced manufacturing technologies enable competitive pricing while maintaining quality standards required for demanding construction applications.

Construction companies gain access to high-performance building materials that enhance project quality, reduce installation time, and improve long-term building performance. Technical support services provided by manufacturers facilitate proper material selection and application techniques.

Building owners realize long-term value through reduced maintenance costs, improved energy efficiency, and enhanced building durability. Warranty programs and performance guarantees provide confidence in material selection decisions for significant construction investments.

Distributors and retailers benefit from growing market demand and opportunities for value-added services including technical consultation, inventory management, and logistics support. Partnership programs with manufacturers enable access to training, marketing support, and competitive pricing structures.

Government agencies achieve infrastructure development objectives through access to quality building materials that meet regulatory requirements and performance standards. Local manufacturing capabilities support economic development goals and reduce import dependency for critical construction materials.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability integration emerges as a dominant trend, with manufacturers developing environmentally responsible building sheets incorporating recycled materials and improved lifecycle performance. Green building certifications drive demand for products meeting stringent environmental standards and energy efficiency requirements.

Digital transformation influences manufacturing processes through automation, quality control systems, and predictive maintenance technologies. Industry 4.0 adoption enables improved production efficiency and product consistency while reducing manufacturing costs and waste generation.

Customization capabilities expand as manufacturers invest in flexible production systems capable of producing specialized building sheets for unique architectural and performance requirements. Mass customization approaches enable cost-effective production of tailored solutions for specific project needs.

Smart material development incorporates sensors, monitoring capabilities, and responsive characteristics that enhance building performance and maintenance efficiency. Internet of Things integration creates opportunities for building sheets that contribute to intelligent building management systems.

Modular construction growth drives demand for standardized, high-quality building components suitable for prefabricated construction systems. Off-site manufacturing trends require building sheets designed for efficient transportation, assembly, and installation processes.

Technology partnerships between international companies and regional manufacturers accelerate innovation and improve product quality throughout the CIS building sheets market. Knowledge transfer initiatives enable adoption of advanced manufacturing processes and quality control systems.

Capacity expansion projects across major CIS countries increase production capabilities and improve market supply stability. Manufacturing facility upgrades incorporate modern equipment and environmental compliance systems that enhance operational efficiency and product quality.

Research and development investments focus on developing building sheets with enhanced performance characteristics, including improved thermal properties, durability, and aesthetic options. Innovation centers established by leading manufacturers accelerate product development and market introduction timelines.

Strategic acquisitions and partnerships reshape competitive dynamics as companies seek to expand market presence and enhance technological capabilities. Vertical integration strategies enable better supply chain control and cost management for market participants.

Certification programs and quality standards implementation improve product reliability and market acceptance across CIS countries. International standard adoption facilitates export opportunities and enhances competitive positioning in global markets.

MarkWide Research recommends that market participants focus on technology advancement and quality improvement initiatives to maintain competitive positioning in the evolving CIS building sheets market. Investment priorities should emphasize manufacturing efficiency, product innovation, and customer service capabilities that differentiate offerings in competitive market segments.

Strategic partnerships with international technology providers enable access to advanced manufacturing processes and innovative material formulations that enhance product performance and market appeal. Collaboration opportunities with construction companies and architects facilitate better understanding of market requirements and application-specific needs.

Market expansion strategies should consider regional diversification and export development to reduce dependency on individual country markets and economic conditions. Distribution network optimization improves market coverage and customer service capabilities across vast CIS territories.

Sustainability initiatives represent critical investment areas as environmental regulations and green building requirements become more stringent. Product development focus on energy efficiency, recyclability, and environmental compliance creates competitive advantages in evolving market conditions.

Digital transformation investments in manufacturing processes, customer service systems, and supply chain management enhance operational efficiency and market responsiveness. Data analytics capabilities enable better demand forecasting, inventory management, and customer relationship management throughout the market development process.

Long-term prospects for the CIS building and construction sheets market remain positive, with sustained growth expected through infrastructure development, urbanization trends, and modernization initiatives across the region. Market expansion will likely continue at a steady pace, supported by government investment programs and private sector construction activity.

Technology evolution will drive product innovation and performance improvements, creating opportunities for manufacturers investing in research and development capabilities. Smart building integration and sustainable material development represent key growth areas for forward-thinking market participants.

Regional integration and trade facilitation measures may enhance market accessibility and competitive dynamics across CIS countries. Economic stabilization and improved business environments support long-term investment planning and market development strategies.

Industry consolidation trends may continue as companies seek scale advantages and enhanced technological capabilities through strategic partnerships and acquisitions. Market maturation will likely emphasize quality differentiation and specialized applications rather than pure volume growth.

Export opportunities to neighboring regions and emerging markets provide additional growth potential for established CIS manufacturers with quality certifications and competitive cost structures. Global market integration creates opportunities for technology transfer and best practice adoption that benefit the entire regional industry.

The CIS building and construction sheets market demonstrates strong fundamentals and positive growth prospects driven by infrastructure development, urbanization trends, and modernization initiatives throughout the Commonwealth of Independent States region. Market dynamics reflect a maturing industry with increasing emphasis on quality, performance, and sustainability considerations that create opportunities for innovative manufacturers and service providers.

Competitive positioning will increasingly depend on technological capabilities, product quality, and customer service excellence as market participants seek differentiation in evolving construction industry requirements. Strategic investments in manufacturing efficiency, product innovation, and market expansion capabilities position companies for long-term success in this dynamic market environment.

Future success in the CIS building sheets market requires balanced approaches combining operational excellence, technological advancement, and market responsiveness to changing customer needs and regulatory requirements. Industry participants who embrace sustainability, digital transformation, and customer-centric strategies will likely achieve the strongest competitive positions and growth trajectories in the years ahead.

What is CIS Building and Construction Sheets?

CIS Building and Construction Sheets refer to a range of materials used in the construction industry, including insulation sheets, roofing sheets, and wall panels. These sheets are designed to provide structural support, thermal insulation, and weather resistance in various building applications.

What are the key players in the CIS Building and Construction Sheets Market?

Key players in the CIS Building and Construction Sheets Market include companies like Kingspan Group, Saint-Gobain, and Owens Corning, which are known for their innovative building materials and solutions. These companies focus on enhancing energy efficiency and sustainability in construction, among others.

What are the main drivers of the CIS Building and Construction Sheets Market?

The CIS Building and Construction Sheets Market is driven by factors such as the increasing demand for energy-efficient building materials, the growth of the construction industry, and the rising focus on sustainable building practices. Additionally, advancements in manufacturing technologies contribute to market growth.

What challenges does the CIS Building and Construction Sheets Market face?

Challenges in the CIS Building and Construction Sheets Market include fluctuating raw material prices, stringent regulations regarding building materials, and competition from alternative materials. These factors can impact production costs and market dynamics.

What opportunities exist in the CIS Building and Construction Sheets Market?

Opportunities in the CIS Building and Construction Sheets Market include the growing trend of green building initiatives, increased investment in infrastructure development, and the rising demand for lightweight and durable construction materials. These trends are expected to create new avenues for growth.

What trends are shaping the CIS Building and Construction Sheets Market?

Current trends in the CIS Building and Construction Sheets Market include the adoption of smart building technologies, the use of recycled materials in sheet production, and the increasing popularity of modular construction. These trends reflect a shift towards more efficient and sustainable building practices.

CIS Building and Construction Sheets Market

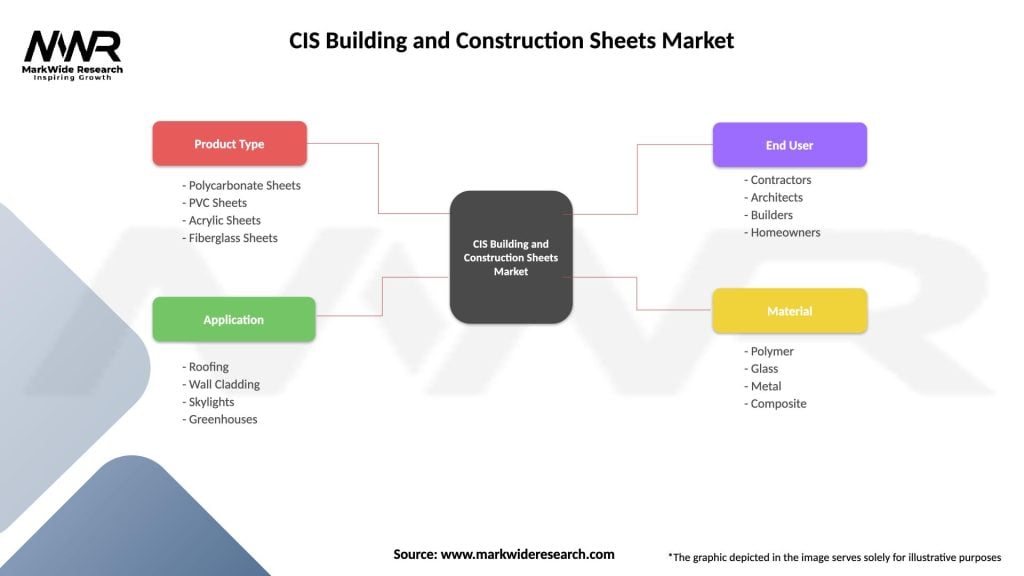

| Segmentation Details | Description |

|---|---|

| Product Type | Polycarbonate Sheets, PVC Sheets, Acrylic Sheets, Fiberglass Sheets |

| Application | Roofing, Wall Cladding, Skylights, Greenhouses |

| End User | Contractors, Architects, Builders, Homeowners |

| Material | Polymer, Glass, Metal, Composite |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the CIS Building and Construction Sheets Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at