444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China telecom towers market represents one of the most dynamic and rapidly evolving segments within the global telecommunications infrastructure landscape. As China continues its aggressive expansion of 5G networks and digital infrastructure modernization, the demand for sophisticated telecom tower solutions has reached unprecedented levels. The market encompasses various tower types including lattice towers, monopole towers, guyed towers, and stealth towers, each serving specific deployment requirements across urban and rural environments.

Market dynamics indicate robust growth driven by China’s commitment to achieving comprehensive 5G coverage nationwide. The telecommunications infrastructure sector is experiencing a 12.5% annual growth rate in tower installations, with particular emphasis on smart tower technologies and energy-efficient solutions. Major telecommunications operators including China Mobile, China Telecom, and China Unicom are investing heavily in tower infrastructure to support next-generation wireless services.

Regional distribution shows significant concentration in tier-one cities, with approximately 35% of new installations occurring in major metropolitan areas. However, rural deployment initiatives are gaining momentum as part of China’s digital inclusion strategy, representing a growing market opportunity for tower manufacturers and service providers.

The China telecom towers market refers to the comprehensive ecosystem of telecommunications infrastructure supporting wireless communication networks across the People’s Republic of China. This market encompasses the design, manufacturing, installation, and maintenance of various tower structures that enable cellular, data, and emerging 5G communications throughout the country.

Telecom towers serve as critical infrastructure components that house antennas, transmitters, receivers, and other essential equipment required for wireless signal transmission and reception. In the Chinese context, these structures must comply with stringent regulatory standards while supporting the nation’s ambitious digital transformation objectives. The market includes both traditional tower solutions and innovative smart tower technologies incorporating advanced monitoring systems, energy management capabilities, and multi-tenant configurations.

Market participants include tower manufacturers, installation contractors, maintenance service providers, and technology integrators working collaboratively to support China’s telecommunications infrastructure expansion. The sector plays a fundamental role in enabling digital connectivity for over 1.4 billion citizens while supporting industrial digitization and smart city initiatives.

China’s telecom towers market stands at the forefront of global telecommunications infrastructure development, driven by unprecedented demand for 5G network deployment and digital connectivity expansion. The market demonstrates exceptional growth momentum with tower installations accelerating at a 15.2% compound annual growth rate, reflecting the nation’s commitment to technological leadership in wireless communications.

Key market drivers include government initiatives promoting digital infrastructure development, increasing mobile data consumption, and the strategic imperative to achieve comprehensive 5G coverage across urban and rural areas. The market benefits from strong policy support through China’s Digital Economy Development Plan and substantial investments from major telecommunications operators.

Competitive landscape features both domestic and international players, with Chinese manufacturers gaining significant market share through technological innovation and cost-effective solutions. The market is characterized by increasing adoption of smart tower technologies, energy-efficient designs, and multi-tenant tower configurations that optimize infrastructure utilization and reduce deployment costs.

Future prospects remain highly favorable, with continued expansion expected across all market segments. The integration of artificial intelligence, IoT capabilities, and renewable energy solutions into tower infrastructure represents significant growth opportunities for market participants.

Strategic market insights reveal several critical trends shaping the China telecom towers landscape:

Market penetration analysis indicates strong growth potential in secondary and tertiary cities, where telecommunications infrastructure development is accelerating to support economic growth and urbanization trends.

Primary market drivers propelling China’s telecom towers market growth encompass both technological and policy-related factors that create sustained demand for advanced telecommunications infrastructure.

5G Network Expansion represents the most significant driver, with China’s commitment to achieving nationwide 5G coverage requiring massive tower infrastructure investments. The deployment of 5G base stations necessitates denser network configurations and more sophisticated tower solutions capable of supporting higher frequencies and increased data throughput requirements.

Government Policy Support through initiatives such as the Digital China Strategy and New Infrastructure Development Plan provides substantial momentum for telecommunications infrastructure expansion. These policies prioritize digital connectivity as a foundation for economic modernization and technological competitiveness.

Mobile Data Consumption Growth continues accelerating, with Chinese consumers demonstrating increasing demand for high-speed mobile internet services. This trend drives requirements for enhanced network capacity and coverage, directly translating to increased tower deployment needs.

Industrial Digitization initiatives across manufacturing, logistics, and service sectors create demand for reliable wireless connectivity supporting Industry 4.0 applications, IoT implementations, and smart manufacturing solutions.

Smart City Development programs in major Chinese cities require comprehensive telecommunications infrastructure supporting various connected services, traffic management systems, and citizen engagement platforms.

Market restraints affecting China’s telecom towers sector include several challenges that may impact growth trajectory and market development pace.

High Capital Investment Requirements represent a significant constraint, as tower deployment involves substantial upfront costs for equipment, installation, and site preparation. These financial requirements can limit market entry for smaller players and impact project timelines for major deployments.

Regulatory Complexity poses challenges through stringent approval processes, environmental compliance requirements, and local zoning restrictions. Permitting delays can significantly impact project schedules and increase overall deployment costs.

Site Acquisition Difficulties in densely populated urban areas create obstacles for optimal tower placement. Limited available land, high real estate costs, and community resistance to tower installations can constrain network optimization efforts.

Environmental Concerns regarding electromagnetic radiation and visual impact generate public opposition to tower installations in certain areas. These concerns require careful stakeholder management and may necessitate alternative deployment strategies.

Technology Obsolescence Risk exists as rapid technological advancement may render existing tower infrastructure inadequate for future requirements. This risk requires careful planning and investment in future-ready solutions.

Skilled Labor Shortage in specialized tower installation and maintenance services can impact project execution quality and timelines, particularly in rapidly expanding markets.

Significant market opportunities exist within China’s telecom towers sector, driven by technological advancement and evolving market requirements.

Smart Tower Technologies present substantial opportunities for companies developing intelligent infrastructure solutions. These technologies include automated monitoring systems, predictive maintenance capabilities, and integrated edge computing platforms that enhance tower functionality and operational efficiency.

Rural Market Expansion offers considerable growth potential as government initiatives focus on bridging the digital divide between urban and rural areas. The deployment of cost-effective tower solutions in underserved regions represents a significant market opportunity.

Energy-Efficient Solutions create opportunities for companies specializing in sustainable tower designs, renewable energy integration, and energy management systems. Growing environmental consciousness drives demand for eco-friendly infrastructure solutions.

Tower Sharing Services present opportunities for optimizing infrastructure utilization through multi-tenant configurations. These arrangements reduce deployment costs while maximizing tower asset value for operators and service providers.

Maintenance and Upgrade Services represent growing opportunities as existing tower infrastructure requires ongoing maintenance, technology upgrades, and performance optimization to support evolving network requirements.

International Expansion opportunities exist for Chinese tower companies to leverage domestic expertise in global markets, particularly in developing countries pursuing telecommunications infrastructure modernization.

Market dynamics within China’s telecom towers sector reflect the complex interplay of technological advancement, regulatory evolution, and competitive pressures shaping industry development.

Supply chain dynamics demonstrate increasing localization as Chinese manufacturers enhance their capabilities in tower design, manufacturing, and installation services. This trend reduces dependence on international suppliers while improving cost competitiveness and delivery timelines.

Competitive dynamics show intensifying competition among tower manufacturers and service providers, driving innovation in smart tower technologies, energy efficiency, and cost optimization. Market leaders are investing heavily in research and development to maintain competitive advantages.

Technology dynamics reflect rapid evolution toward 5G-ready infrastructure, with tower designs adapting to support higher frequency bands, increased antenna loads, and enhanced cooling requirements. Integration of artificial intelligence and IoT capabilities is becoming standard practice.

Regulatory dynamics continue evolving with updated standards for electromagnetic compatibility, structural safety, and environmental protection. These changes require ongoing adaptation by market participants to ensure compliance and market access.

Customer dynamics show telecommunications operators increasingly demanding comprehensive solutions that include design, installation, maintenance, and upgrade services. This trend favors companies offering integrated service portfolios.

Research methodology employed for analyzing China’s telecom towers market incorporates comprehensive primary and secondary research approaches to ensure accurate and reliable market insights.

Primary research activities include extensive interviews with industry executives, telecommunications operators, tower manufacturers, and regulatory officials. These discussions provide firsthand insights into market trends, challenges, and opportunities from key stakeholders across the value chain.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements. This approach ensures comprehensive coverage of market dynamics and competitive landscape developments.

Data validation processes involve cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings. MarkWide Research employs rigorous quality control measures to ensure data accuracy and reliability.

Market sizing methodology utilizes bottom-up and top-down approaches, analyzing tower deployment patterns, operator investment plans, and government infrastructure initiatives to develop comprehensive market assessments.

Trend analysis incorporates historical data review, current market assessment, and forward-looking projections based on identified growth drivers and market dynamics. This approach provides stakeholders with actionable insights for strategic planning.

Regional analysis of China’s telecom towers market reveals significant variations in demand patterns, deployment strategies, and growth opportunities across different geographic areas.

Eastern China dominates market activity with approximately 42% of total installations, driven by high population density, advanced economic development, and early 5G adoption. Major cities including Shanghai, Beijing, and Shenzhen lead in smart tower deployments and innovative infrastructure solutions.

Southern China represents 28% of market share, with Guangdong Province serving as a major manufacturing and technology hub. The region benefits from strong telecommunications infrastructure investments supporting export-oriented industries and cross-border connectivity requirements.

Central China accounts for 18% of market activity, experiencing rapid growth as government initiatives promote balanced regional development. Cities like Wuhan, Changsha, and Zhengzhou are witnessing significant tower deployment acceleration.

Western China comprises 12% of current installations but represents the highest growth potential due to ongoing infrastructure development programs and digital inclusion initiatives. The region requires specialized tower solutions adapted to challenging geographic conditions and lower population densities.

Rural areas across all regions present significant opportunities as government policies prioritize digital connectivity expansion to support agricultural modernization and rural economic development.

Competitive landscape analysis reveals a dynamic market structure featuring both established industry leaders and emerging technology innovators competing across various market segments.

Market competition intensifies around technology innovation, cost optimization, and service quality differentiation. Companies are investing heavily in smart tower capabilities, energy efficiency improvements, and integrated service offerings to maintain competitive positioning.

Market segmentation analysis provides detailed insights into various categories and applications within China’s telecom towers market.

By Tower Type:

By Technology:

By Application:

Category-wise analysis reveals distinct trends and opportunities across different tower types and applications within the Chinese market.

Lattice Tower Category maintains strong demand in rural and industrial areas where load capacity and cost-effectiveness are primary considerations. These towers demonstrate steady growth in agricultural regions and industrial parks requiring reliable wireless connectivity for operational efficiency.

Monopole Tower Category experiences rapid expansion in urban markets, driven by space constraints and aesthetic requirements. The segment benefits from increasing adoption of 5G small cell deployments and smart city infrastructure initiatives.

Smart Tower Category represents the fastest-growing segment with advanced monitoring capabilities, predictive maintenance features, and energy optimization systems. These solutions appeal to operators seeking to reduce operational costs while improving network performance.

5G-Ready Infrastructure category shows exceptional growth as telecommunications operators prepare for comprehensive 5G network rollouts. These towers require enhanced structural capacity, improved cooling systems, and advanced power management capabilities.

Multi-Tenant Configurations gain popularity as operators seek to optimize infrastructure investments through shared tower arrangements. This category offers improved return on investment while reducing environmental impact through consolidated deployments.

Industry participants and stakeholders realize numerous benefits from China’s expanding telecom towers market, creating value across the entire telecommunications ecosystem.

Telecommunications Operators benefit from enhanced network capacity, improved coverage quality, and reduced operational costs through advanced tower solutions. Smart tower technologies enable operators to optimize network performance while minimizing maintenance requirements and energy consumption.

Tower Manufacturers experience sustained demand growth, technology innovation opportunities, and market expansion potential. The shift toward 5G infrastructure creates opportunities for premium product offerings and value-added services.

Service Providers benefit from increasing demand for installation, maintenance, and upgrade services. The complexity of modern tower systems creates opportunities for specialized service companies offering comprehensive support solutions.

Technology Companies find opportunities in developing smart tower components, monitoring systems, and energy management solutions. Integration of artificial intelligence and IoT technologies creates new revenue streams and competitive advantages.

Government Stakeholders achieve digital infrastructure development objectives, economic growth stimulation, and improved citizen connectivity. Tower infrastructure investments support broader digitization goals and technological competitiveness.

End Users benefit from improved mobile connectivity, faster data speeds, and enhanced service reliability. Advanced tower infrastructure enables new applications and services that improve quality of life and business productivity.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping China’s telecom towers landscape reflect technological advancement, regulatory evolution, and changing operator requirements.

5G Infrastructure Acceleration represents the dominant trend, with operators rapidly deploying 5G-capable tower solutions to support next-generation wireless services. This trend drives demand for enhanced structural capacity, improved cooling systems, and advanced power management capabilities.

Smart Tower Integration gains momentum as operators seek to optimize network performance through intelligent monitoring systems, predictive maintenance capabilities, and automated optimization features. These technologies reduce operational costs while improving service reliability.

Energy Efficiency Focus intensifies with growing emphasis on sustainable tower designs, renewable energy integration, and energy management optimization. Operators prioritize solutions that reduce environmental impact while minimizing operational expenses.

Tower Sharing Expansion accelerates as operators recognize the benefits of multi-tenant configurations for optimizing infrastructure investments and reducing deployment costs. This trend promotes collaborative approaches to network expansion.

Edge Computing Integration emerges as towers increasingly incorporate edge computing capabilities to support low-latency applications and reduce network congestion. This trend creates new revenue opportunities for tower operators and service providers.

Modular Design Adoption grows as manufacturers develop standardized tower components that reduce installation time, improve quality consistency, and enable rapid deployment scaling.

Recent industry developments highlight the dynamic nature of China’s telecom towers market and emerging opportunities for market participants.

China Tower Corporation announced major expansion plans for 5G infrastructure deployment, including investments in smart tower technologies and rural connectivity initiatives. The company’s strategic focus on technology innovation demonstrates market leadership commitment.

Huawei Technologies introduced advanced 5G tower solutions incorporating artificial intelligence and automated optimization capabilities. These innovations address operator requirements for enhanced network performance and reduced operational complexity.

Government initiatives including the Digital Infrastructure Development Plan provide substantial funding for telecommunications infrastructure expansion, creating favorable conditions for market growth and technology advancement.

International partnerships between Chinese companies and global technology providers facilitate knowledge transfer and market expansion opportunities. These collaborations enhance technological capabilities while opening new market channels.

Regulatory updates streamline approval processes for tower installations while maintaining stringent safety and environmental standards. These changes improve project timelines and reduce deployment costs for operators.

Research and development investments by major market players focus on next-generation tower technologies, including 6G-ready infrastructure and sustainable energy solutions. These investments position companies for future market opportunities.

Strategic recommendations for market participants focus on positioning for sustained growth while addressing emerging challenges and opportunities.

Technology Innovation Priority: Companies should prioritize investment in smart tower technologies, 5G-ready solutions, and energy-efficient designs to maintain competitive positioning. MWR analysis indicates that technology leadership will be critical for long-term market success.

Market Diversification Strategy: Participants should consider expanding beyond traditional tower manufacturing to include comprehensive service offerings, maintenance solutions, and technology integration services. This approach creates multiple revenue streams and stronger customer relationships.

Rural Market Focus: Companies should develop specialized solutions for rural deployments, including cost-effective tower designs and alternative power solutions. Government initiatives supporting rural connectivity create significant opportunities for appropriately positioned players.

Partnership Development: Strategic partnerships with telecommunications operators, technology providers, and service companies can enhance market access and capability development. Collaborative approaches often prove more effective than purely competitive strategies.

Sustainability Integration: Environmental considerations should be integrated into product development and service delivery strategies. Sustainable tower solutions will become increasingly important as environmental regulations evolve and operator sustainability commitments strengthen.

International Expansion: Chinese companies should leverage domestic market expertise to pursue international opportunities, particularly in developing markets requiring telecommunications infrastructure modernization.

Future outlook for China’s telecom towers market remains highly positive, with sustained growth expected across all major segments driven by technological advancement and infrastructure modernization requirements.

5G Deployment Acceleration will continue driving market expansion with comprehensive nationwide coverage expected within the next five years. This deployment will require substantial tower infrastructure investments and create opportunities for advanced technology providers.

Smart Infrastructure Evolution will transform tower operations through increased integration of artificial intelligence, machine learning, and IoT technologies. These capabilities will enable predictive maintenance, automated optimization, and enhanced operational efficiency.

Rural Connectivity Expansion will accelerate as government initiatives prioritize digital inclusion and agricultural modernization. This trend creates substantial opportunities for cost-effective tower solutions adapted to rural deployment requirements.

Technology Convergence will see towers increasingly serving multiple functions including edge computing, IoT connectivity, and smart city services. This evolution will create new revenue streams and market opportunities for innovative companies.

Sustainability Focus will intensify with growing emphasis on renewable energy integration, carbon footprint reduction, and circular economy principles. Companies developing sustainable solutions will gain competitive advantages in future market conditions.

Market growth projections indicate continued expansion at a robust pace, with particular strength in smart tower technologies and rural deployment segments. The market is expected to maintain strong momentum through the remainder of the decade.

China’s telecom towers market represents one of the most dynamic and promising segments within the global telecommunications infrastructure landscape. The market benefits from strong government support, massive domestic demand, and technological leadership in 5G development and deployment.

Market fundamentals remain exceptionally strong, with sustained growth driven by nationwide 5G rollout requirements, smart city initiatives, and rural connectivity expansion programs. The integration of advanced technologies including artificial intelligence, IoT capabilities, and renewable energy solutions creates substantial opportunities for innovative market participants.

Competitive dynamics favor companies that can combine technological innovation with cost-effective solutions and comprehensive service capabilities. The market rewards participants who can adapt to evolving operator requirements while maintaining high quality standards and regulatory compliance.

Future prospects indicate continued robust growth with expanding opportunities in smart infrastructure, rural deployments, and international markets. Companies positioned to capitalize on these trends through strategic investments in technology, partnerships, and market development will achieve sustained success in this dynamic and rapidly evolving market environment.

What is Telecom Towers?

Telecom towers are structures that support antennas and other equipment for telecommunications. They are essential for mobile network coverage, enabling communication services across various regions.

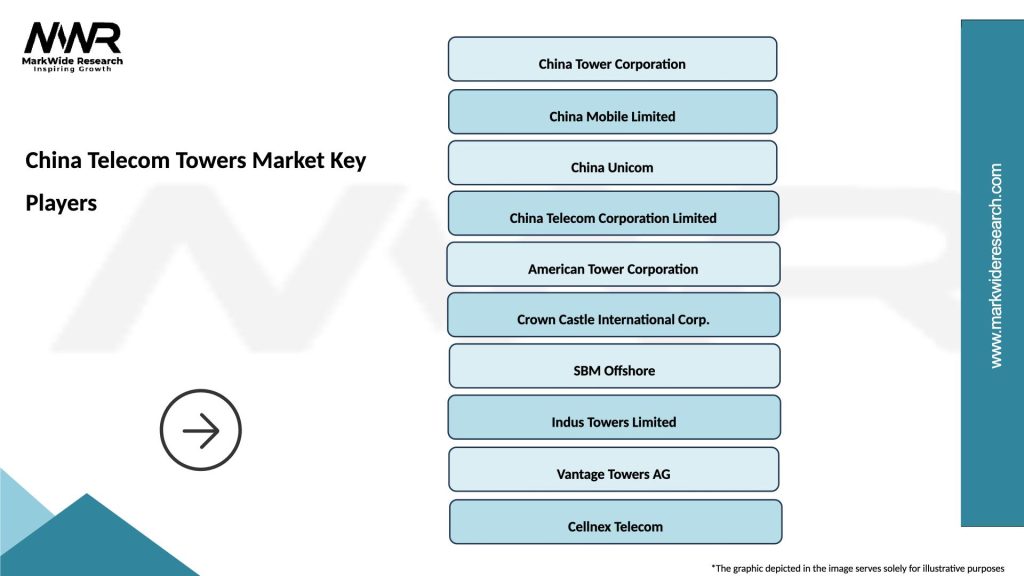

What are the key players in the China Telecom Towers Market?

Key players in the China Telecom Towers Market include China Tower Corporation, China Mobile, and China Unicom, among others. These companies play significant roles in the development and maintenance of telecom infrastructure.

What are the growth factors driving the China Telecom Towers Market?

The growth of the China Telecom Towers Market is driven by the increasing demand for mobile data services, the expansion of 5G networks, and the rising number of smartphone users. These factors contribute to the need for more robust telecom infrastructure.

What challenges does the China Telecom Towers Market face?

The China Telecom Towers Market faces challenges such as regulatory hurdles, high operational costs, and competition among telecom providers. These factors can impact the speed and efficiency of infrastructure development.

What opportunities exist in the China Telecom Towers Market?

Opportunities in the China Telecom Towers Market include the rollout of advanced technologies like 5G, the potential for smart city developments, and the increasing need for rural connectivity. These trends can lead to significant investments in telecom infrastructure.

What trends are shaping the China Telecom Towers Market?

Trends shaping the China Telecom Towers Market include the shift towards small cell technology, the integration of renewable energy sources, and the focus on enhancing network reliability. These innovations are crucial for meeting the growing demands of consumers.

China Telecom Towers Market

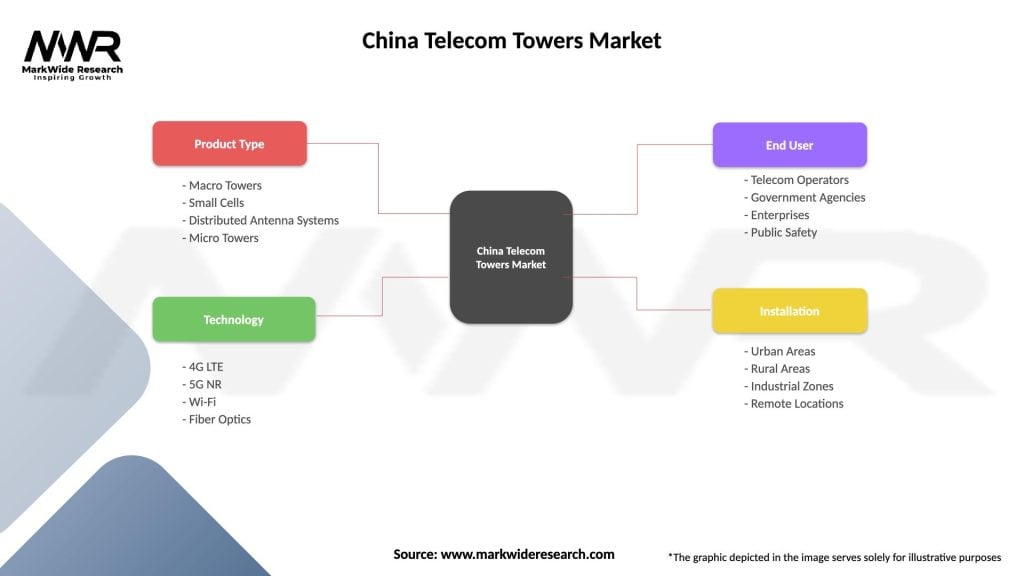

| Segmentation Details | Description |

|---|---|

| Product Type | Macro Towers, Small Cells, Distributed Antenna Systems, Micro Towers |

| Technology | 4G LTE, 5G NR, Wi-Fi, Fiber Optics |

| End User | Telecom Operators, Government Agencies, Enterprises, Public Safety |

| Installation | Urban Areas, Rural Areas, Industrial Zones, Remote Locations |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Telecom Towers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at