444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China supply chain financing market represents a transformative financial ecosystem that bridges the gap between traditional banking and modern trade finance solutions. This dynamic market has emerged as a critical component of China’s economic infrastructure, facilitating seamless capital flow across complex supply chains while supporting both large enterprises and small-to-medium businesses. The market encompasses various financial instruments including trade credit, invoice factoring, purchase order financing, and inventory financing solutions.

Market dynamics indicate robust expansion driven by digital transformation initiatives and government policy support. The integration of advanced technologies such as blockchain, artificial intelligence, and big data analytics has revolutionized traditional supply chain financing approaches. Chinese financial institutions and fintech companies are experiencing significant growth rates exceeding traditional banking sectors, with supply chain financing solutions showing annual growth of approximately 15-18% across major metropolitan regions.

Digital innovation has become the cornerstone of market evolution, with platform-based solutions gaining substantial traction among manufacturers, distributors, and retailers. The market demonstrates strong resilience and adaptability, particularly in response to global trade uncertainties and supply chain disruptions. Technology adoption rates have accelerated dramatically, with over 70% of major supply chain financing providers implementing comprehensive digital platforms to enhance operational efficiency and risk management capabilities.

The China supply chain financing market refers to the comprehensive ecosystem of financial products, services, and technological solutions designed to optimize cash flow management and working capital efficiency across interconnected business networks. This market encompasses the provision of short-term credit facilities, trade finance instruments, and innovative funding mechanisms that enable businesses to manage their operational liquidity requirements while maintaining supply chain continuity.

Supply chain financing in the Chinese context involves multiple stakeholders including commercial banks, non-bank financial institutions, fintech platforms, core enterprises, suppliers, and distributors. The market facilitates various financing arrangements such as accounts receivable financing, inventory financing, pre-shipment financing, and post-shipment financing solutions. These instruments help businesses bridge timing gaps between cash outflows for production and cash inflows from sales.

Modern supply chain financing leverages advanced technologies to create transparent, efficient, and secure financing ecosystems. The market integrates traditional banking products with innovative digital solutions, enabling real-time transaction processing, automated risk assessment, and streamlined approval processes. This comprehensive approach supports China’s broader economic objectives of enhancing financial inclusion and promoting sustainable business growth across diverse industry sectors.

China’s supply chain financing market has established itself as a pivotal component of the nation’s financial services landscape, demonstrating remarkable resilience and innovation capacity. The market serves millions of businesses across manufacturing, retail, agriculture, and technology sectors, providing essential working capital solutions that support economic growth and operational efficiency. Digital transformation initiatives have accelerated market evolution, with technology-driven solutions accounting for an increasing share of total financing volumes.

Government policy support has played a crucial role in market development, with regulatory frameworks encouraging financial innovation while maintaining prudential oversight. The integration of supply chain financing with broader economic development strategies has created synergies that benefit both financial institutions and real economy participants. Market penetration rates continue to expand, with approximately 45% of eligible small and medium enterprises now accessing some form of supply chain financing solution.

Competitive dynamics reflect a diverse ecosystem comprising traditional banks, specialized financial institutions, and emerging fintech platforms. The market demonstrates strong growth momentum supported by increasing demand for flexible financing solutions, technological advancement, and evolving business models. Risk management capabilities have improved significantly through the adoption of advanced analytics and real-time monitoring systems, contributing to enhanced market stability and investor confidence.

Strategic market insights reveal several critical trends shaping the China supply chain financing landscape. The market exhibits strong correlation with broader economic cycles while maintaining independent growth drivers related to technological innovation and regulatory support.

Primary market drivers encompass a combination of macroeconomic factors, technological advancements, and regulatory initiatives that collectively support sustained market growth. The increasing complexity of modern supply chains has created substantial demand for sophisticated financing solutions that can adapt to dynamic business requirements.

Digital transformation serves as a fundamental growth catalyst, enabling financial institutions to develop innovative products and services that address traditional market inefficiencies. The adoption of artificial intelligence, machine learning, and blockchain technologies has revolutionized risk assessment processes, reduced operational costs, and improved customer experience. Technology adoption rates among supply chain financing providers have increased by approximately 60% over recent years, reflecting strong commitment to digital innovation.

Government policy support represents another critical driver, with regulatory authorities implementing measures to enhance financial inclusion and support small business development. Policy initiatives encouraging fintech innovation, cross-border trade facilitation, and sustainable finance practices have created favorable market conditions. Regulatory compliance frameworks have evolved to balance innovation promotion with prudential oversight, ensuring market stability while fostering growth.

Economic diversification trends have expanded market opportunities across various industry sectors. The growth of e-commerce, manufacturing automation, and international trade has increased demand for flexible financing solutions. Supply chain complexity continues to drive innovation in financing products, with businesses requiring more sophisticated working capital management tools to maintain competitive advantages.

Market restraints present ongoing challenges that require strategic attention from industry participants and regulatory authorities. These constraints primarily relate to risk management complexities, regulatory compliance requirements, and technological implementation challenges that can impact market growth trajectories.

Credit risk management remains a significant concern, particularly when dealing with complex supply chain networks involving multiple counterparties. The interconnected nature of supply chain financing creates potential for systemic risks that require sophisticated monitoring and mitigation strategies. Default rates in certain market segments can impact overall portfolio performance and investor confidence, necessitating continuous improvement in risk assessment methodologies.

Regulatory compliance requirements impose operational costs and complexity that can limit market participation, particularly for smaller financial institutions and fintech companies. The evolving regulatory landscape requires continuous adaptation and investment in compliance infrastructure. Regulatory uncertainty in emerging technology applications can slow innovation adoption and market development initiatives.

Technology integration challenges present barriers for traditional financial institutions seeking to modernize their supply chain financing capabilities. Legacy system compatibility, cybersecurity concerns, and staff training requirements can delay digital transformation initiatives. Implementation costs for advanced technology solutions may exceed available budgets for some market participants, creating competitive disadvantages and limiting market access for certain customer segments.

Emerging market opportunities present substantial potential for growth and innovation within China’s supply chain financing ecosystem. These opportunities arise from technological advancement, market expansion possibilities, and evolving customer requirements that create new business models and service delivery approaches.

Cross-border trade financing represents a significant growth opportunity as China’s international trade relationships continue to expand. The Belt and Road Initiative and other international cooperation frameworks create demand for sophisticated trade finance solutions that can support complex cross-border transactions. International market penetration opportunities enable Chinese financial institutions to expand their global presence while supporting domestic businesses’ international expansion efforts.

Technology innovation continues to unlock new market possibilities through the development of advanced analytics, artificial intelligence applications, and blockchain-based solutions. These technologies enable the creation of more efficient, transparent, and secure financing platforms that can serve previously underserved market segments. Innovation adoption rates suggest strong market receptivity to new technology solutions, with early adopters experiencing 25-30% efficiency improvements in operational processes.

Sector-specific solutions present opportunities for specialized financing products tailored to unique industry requirements. Agriculture, healthcare, renewable energy, and technology sectors demonstrate particular potential for customized supply chain financing solutions. Market segmentation strategies enable financial institutions to develop expertise in specific sectors while building competitive advantages through specialized knowledge and relationships.

Market dynamics reflect the complex interplay of supply and demand factors, competitive pressures, and external influences that shape the China supply chain financing landscape. These dynamics create both challenges and opportunities for market participants while influencing strategic decision-making processes.

Competitive intensity has increased significantly as traditional banks, specialized financial institutions, and fintech companies compete for market share. This competition drives innovation, improves service quality, and reduces pricing for end customers. Market concentration patterns show a balanced distribution between large institutional players and emerging fintech platforms, creating a dynamic competitive environment that benefits customers through increased choice and improved services.

Customer expectations continue to evolve toward more sophisticated, technology-enabled solutions that provide real-time visibility, automated processes, and integrated financial management capabilities. The demand for seamless digital experiences has become a critical competitive factor, requiring continuous investment in technology infrastructure and user interface design. Customer satisfaction rates correlate strongly with technology adoption levels, with digital-first providers achieving satisfaction scores 20-25% higher than traditional service models.

Regulatory evolution influences market dynamics through policy changes that affect operational requirements, competitive conditions, and innovation possibilities. The balance between promoting financial innovation and maintaining market stability creates ongoing adaptation requirements for all market participants. Compliance costs and regulatory complexity can impact competitive positioning, particularly for smaller market participants with limited resources for regulatory management.

Comprehensive research methodology employed for analyzing the China supply chain financing market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of findings. The research approach combines quantitative analysis with qualitative insights to provide a complete market perspective.

Primary research activities include structured interviews with industry executives, financial institution leaders, technology providers, and end-user businesses across various sectors. These interviews provide firsthand insights into market trends, challenges, and opportunities while validating quantitative findings through real-world perspectives. Survey methodologies capture statistically significant data samples representing diverse market segments and geographic regions.

Secondary research encompasses analysis of published financial reports, regulatory documents, industry publications, and academic research relevant to supply chain financing markets. This research provides historical context, benchmark data, and comparative analysis frameworks that support primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Analytical frameworks include statistical modeling, trend analysis, competitive benchmarking, and scenario planning methodologies. These analytical approaches enable identification of key market drivers, growth patterns, and future development trajectories. MarkWide Research employs proprietary analytical models specifically designed for financial services market analysis, ensuring comprehensive coverage of relevant market dynamics and competitive factors.

Regional market analysis reveals significant variations in supply chain financing adoption, regulatory environments, and competitive dynamics across different geographic areas within China. These regional differences reflect local economic conditions, industrial concentrations, and policy implementation variations that influence market development patterns.

Eastern coastal regions demonstrate the highest market penetration rates and most advanced technology adoption levels, benefiting from concentrated financial services infrastructure and strong manufacturing bases. Cities such as Shanghai, Shenzhen, and Guangzhou serve as innovation hubs for supply chain financing solutions, with market adoption rates exceeding 80% among eligible businesses in key industrial sectors.

Central and western regions present substantial growth opportunities as infrastructure development and industrial expansion create increased demand for supply chain financing solutions. Government initiatives promoting balanced regional development have improved access to financial services in these areas. Growth rates in emerging regions often exceed established markets, with some provinces experiencing annual expansion rates of 25-30% in supply chain financing volumes.

Cross-regional integration has become increasingly important as supply chains span multiple provinces and economic zones. This integration requires sophisticated coordination mechanisms and standardized processes that can operate effectively across different regulatory jurisdictions. Regional market share distribution shows approximately 55% concentration in eastern regions, with central and western areas accounting for the remaining market segments but demonstrating faster growth trajectories.

Competitive landscape analysis reveals a diverse ecosystem of market participants ranging from large state-owned banks to innovative fintech startups, each contributing unique capabilities and competitive advantages to the supply chain financing market.

Market positioning strategies vary significantly among competitors, with traditional banks leveraging established relationships and regulatory advantages while fintech companies focus on technology innovation and customer experience improvements. Competitive differentiation increasingly centers on digital capabilities, industry expertise, and integrated service offerings that provide comprehensive supply chain management solutions.

Market segmentation analysis provides detailed insights into various customer segments, product categories, and industry applications that comprise the China supply chain financing market. This segmentation enables targeted strategy development and resource allocation optimization.

By Business Size:

By Industry Sector:

By Product Type:

Category-wise market insights reveal distinct characteristics, growth patterns, and competitive dynamics within specific segments of the supply chain financing market. These insights enable more precise market understanding and strategic planning.

Technology-enabled Solutions: This category demonstrates the strongest growth momentum, with digital platforms and automated processing systems gaining rapid market acceptance. Adoption rates for technology-enabled solutions have increased by approximately 40% annually among target customer segments. The integration of artificial intelligence and machine learning capabilities has improved risk assessment accuracy while reducing processing times significantly.

Traditional Banking Products: Conventional supply chain financing products maintain substantial market share, particularly among large enterprise customers requiring complex financing arrangements. These products benefit from established relationships, regulatory familiarity, and comprehensive service capabilities. Market stability in traditional segments provides reliable revenue streams for financial institutions while supporting innovation investment.

Sector-specific Solutions: Specialized financing products tailored to specific industry requirements demonstrate strong growth potential and customer loyalty. These solutions incorporate industry expertise, regulatory knowledge, and operational understanding that create competitive advantages. Customer retention rates for sector-specific solutions typically exceed 85%, reflecting high satisfaction levels and switching costs.

Cross-border Financing: International trade finance solutions represent a high-growth category driven by China’s expanding global trade relationships. These products require sophisticated risk management capabilities and regulatory compliance across multiple jurisdictions. Transaction volumes in cross-border supply chain financing have grown at rates exceeding domestic market averages.

Industry participants and stakeholders derive substantial benefits from the evolving supply chain financing market, including improved operational efficiency, enhanced risk management, and expanded business opportunities. These benefits create value for financial institutions, businesses, and the broader economic ecosystem.

For Financial Institutions:

For Businesses:

For the Economy:

Comprehensive SWOT analysis provides strategic insights into the China supply chain financing market’s internal capabilities and external environment factors that influence long-term development prospects.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shape the future direction of China’s supply chain financing industry, reflecting technological advancement, regulatory evolution, and changing customer expectations that drive innovation and competitive positioning.

Digital Transformation Acceleration: The integration of advanced technologies including artificial intelligence, blockchain, and Internet of Things capabilities has become a defining trend. Digital adoption rates continue to accelerate, with over 75% of market participants implementing some form of digital enhancement to their service offerings. This transformation enables real-time transaction processing, automated risk assessment, and enhanced customer experience delivery.

Ecosystem Integration: Supply chain financing is increasingly integrated with broader business ecosystems, including e-commerce platforms, enterprise resource planning systems, and logistics networks. This integration creates comprehensive solutions that address multiple business needs while improving operational efficiency. Platform integration has become a critical competitive factor, with integrated solutions demonstrating higher customer retention rates.

Sustainability Focus: Environmental, social, and governance considerations are becoming increasingly important in supply chain financing decisions. Green financing products and sustainable supply chain solutions are gaining market traction as businesses and financial institutions align with national sustainability objectives. Sustainable financing products are experiencing growth rates significantly above market averages.

Regulatory Technology Adoption: RegTech solutions are being widely adopted to manage compliance requirements more efficiently while reducing operational costs. These technologies enable automated regulatory reporting, risk monitoring, and compliance verification processes. RegTech implementation has improved compliance efficiency by approximately 35-40% among early adopters.

Recent industry developments demonstrate the dynamic nature of China’s supply chain financing market, with significant innovations, partnerships, and regulatory changes shaping the competitive landscape and market evolution.

Technology Platform Launches: Major financial institutions have launched comprehensive digital supply chain financing platforms that integrate multiple services and provide end-to-end solutions. These platforms incorporate advanced analytics, automated processing, and real-time monitoring capabilities that significantly improve service delivery efficiency and customer experience.

Strategic Partnerships: Collaboration between traditional banks and fintech companies has accelerated, creating hybrid solutions that combine regulatory expertise with technological innovation. These partnerships enable rapid market expansion while leveraging complementary capabilities and resources.

Regulatory Framework Updates: Government authorities have introduced updated regulations that promote innovation while maintaining prudential oversight. These regulatory changes support market development while ensuring consumer protection and systemic stability.

International Expansion: Chinese financial institutions are expanding their supply chain financing capabilities to support cross-border trade and international business development. This expansion includes establishing overseas operations and developing partnerships with international financial institutions.

Product Innovation: New financing products incorporating blockchain technology, artificial intelligence, and advanced analytics have been introduced to address specific market needs and competitive challenges. These innovations demonstrate the market’s commitment to continuous improvement and customer value creation.

Strategic recommendations from MarkWide Research analysis provide actionable insights for market participants seeking to optimize their competitive positioning and capitalize on emerging opportunities within China’s supply chain financing market.

Technology Investment Priorities: Financial institutions should prioritize investments in artificial intelligence and machine learning capabilities to enhance risk assessment accuracy and operational efficiency. Technology infrastructure development should focus on scalable, secure platforms that can support rapid business growth while maintaining regulatory compliance. Organizations investing in advanced technology solutions are experiencing operational efficiency improvements of 30-35% compared to traditional approaches.

Market Segmentation Strategy: Developing specialized expertise in specific industry sectors or customer segments can create competitive advantages and improve customer retention. Sector-specific solutions demonstrate higher profitability and customer satisfaction compared to generic offerings. Market participants should consider focusing resources on segments where they can develop distinctive capabilities and market leadership positions.

Partnership Development: Strategic partnerships with technology providers, industry associations, and complementary service providers can accelerate market expansion and capability development. Collaboration strategies should focus on creating mutual value while maintaining competitive differentiation. Successful partnerships typically result in market reach expansion of 40-50% beyond individual organization capabilities.

Risk Management Enhancement: Continuous improvement in risk management capabilities through advanced analytics, real-time monitoring, and comprehensive data integration is essential for sustainable growth. Risk management systems should incorporate multiple data sources and predictive analytics to improve decision-making accuracy and portfolio performance.

Future market outlook for China’s supply chain financing industry indicates continued strong growth supported by technological innovation, regulatory support, and expanding market demand. The market is positioned for sustained development across multiple dimensions including geographic expansion, product innovation, and customer segment penetration.

Growth Trajectory: The market is expected to maintain robust expansion rates driven by increasing digitalization, expanding international trade, and growing demand for sophisticated financing solutions. Projected growth rates suggest the market will continue expanding at annual rates of 12-15% over the medium term, with technology-enabled segments demonstrating even stronger performance.

Technology Evolution: Advanced technologies including blockchain, artificial intelligence, and Internet of Things integration will continue transforming market capabilities and competitive dynamics. Innovation cycles are accelerating, with new technology applications emerging regularly to address evolving customer needs and market opportunities.

Market Maturation: As the market matures, consolidation among smaller players and increased specialization among market leaders are expected. Competitive positioning will increasingly depend on technology capabilities, customer relationships, and operational efficiency rather than traditional competitive factors.

International Integration: Cross-border supply chain financing capabilities will become increasingly important as China’s international trade relationships continue expanding. Global market integration presents both opportunities and challenges that will require sophisticated risk management and regulatory compliance capabilities.

Regulatory Development: Continued regulatory evolution will support market growth while ensuring stability and consumer protection. Policy frameworks are expected to become more sophisticated, balancing innovation promotion with prudential oversight requirements.

China’s supply chain financing market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting the nation’s economic development and business competitiveness. The market has demonstrated remarkable resilience and innovation capacity, successfully adapting to changing economic conditions while maintaining strong growth momentum.

Technology integration has emerged as the primary driver of market transformation, enabling new business models, improving operational efficiency, and enhancing customer experience. The successful adoption of digital solutions has created competitive advantages for early adopters while establishing new industry standards for service delivery and risk management.

Market opportunities remain substantial, particularly in underserved segments, emerging technologies, and cross-border applications. The combination of supportive regulatory frameworks, advancing technology capabilities, and expanding customer demand creates favorable conditions for continued market growth and innovation.

Strategic success in this market requires balancing innovation with risk management, developing specialized capabilities while maintaining operational efficiency, and building sustainable competitive advantages through technology, relationships, and expertise. Organizations that can effectively navigate these requirements while adapting to evolving market conditions are well-positioned for long-term success in China’s supply chain financing market.

What is Supply Chain Financing?

Supply Chain Financing refers to financial solutions that optimize cash flow in supply chains, enabling businesses to manage their working capital more effectively. It includes various methods such as invoice financing, inventory financing, and purchase order financing.

What are the key players in the China Supply Chain Financing Market?

Key players in the China Supply Chain Financing Market include companies like Ant Financial, JD Finance, and Ping An Technology, which provide innovative financing solutions tailored to supply chain needs, among others.

What are the main drivers of the China Supply Chain Financing Market?

The main drivers of the China Supply Chain Financing Market include the increasing demand for efficient cash flow management, the growth of e-commerce, and the need for small and medium-sized enterprises to access financing options.

What challenges does the China Supply Chain Financing Market face?

Challenges in the China Supply Chain Financing Market include regulatory hurdles, the risk of default by borrowers, and the complexity of integrating financing solutions with existing supply chain processes.

What opportunities exist in the China Supply Chain Financing Market?

Opportunities in the China Supply Chain Financing Market include the expansion of digital financing platforms, the rise of fintech innovations, and the increasing collaboration between banks and technology companies to enhance financing solutions.

What trends are shaping the China Supply Chain Financing Market?

Trends shaping the China Supply Chain Financing Market include the adoption of blockchain technology for transparency, the use of big data analytics for risk assessment, and the growing emphasis on sustainability in financing practices.

China Supply Chain Financing Market

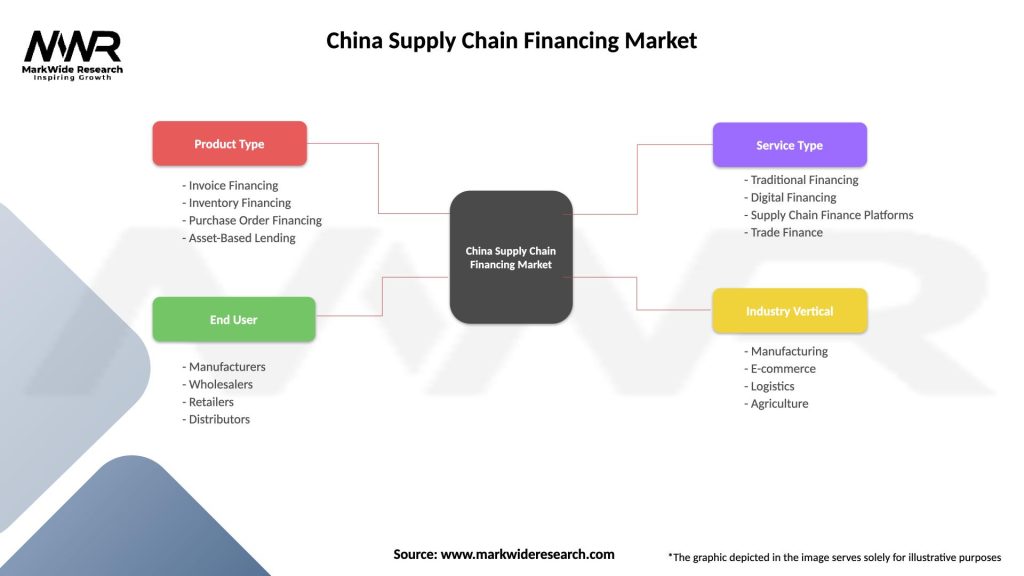

| Segmentation Details | Description |

|---|---|

| Product Type | Invoice Financing, Inventory Financing, Purchase Order Financing, Asset-Based Lending |

| End User | Manufacturers, Wholesalers, Retailers, Distributors |

| Service Type | Traditional Financing, Digital Financing, Supply Chain Finance Platforms, Trade Finance |

| Industry Vertical | Manufacturing, E-commerce, Logistics, Agriculture |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Supply Chain Financing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at