444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China study of data center water consumption market represents a critical research domain addressing the escalating environmental challenges posed by the nation’s rapidly expanding digital infrastructure. As China continues its digital transformation journey, data centers have emerged as significant consumers of water resources, primarily for cooling systems and operational maintenance. Recent analysis indicates that Chinese data centers consume approximately 15-20% more water per unit of computing capacity compared to global averages, highlighting the urgent need for comprehensive water consumption studies and optimization strategies.

Market dynamics in this sector are driven by stringent environmental regulations, corporate sustainability commitments, and the growing awareness of water scarcity issues across China’s major metropolitan areas. The study encompasses various methodologies including real-time monitoring systems, predictive analytics platforms, and comprehensive assessment tools designed to measure, analyze, and optimize water usage patterns in data center operations. Government initiatives promoting green data center development have accelerated demand for specialized water consumption analysis services, creating substantial opportunities for research organizations and technology providers.

Regional distribution shows concentrated activity in major technology hubs including Beijing, Shanghai, Shenzhen, and emerging centers in western provinces where data center construction is rapidly expanding. The market encompasses diverse stakeholder groups including hyperscale cloud providers, colocation facilities, enterprise data centers, and government research institutions, all seeking to understand and minimize their water footprint while maintaining operational efficiency.

The China study of data center water consumption market refers to the comprehensive research ecosystem focused on analyzing, measuring, and optimizing water usage patterns within Chinese data center facilities. This specialized market encompasses various research methodologies, monitoring technologies, assessment frameworks, and consulting services designed to understand the complex relationship between data center operations and water resource utilization across China’s diverse geographical and climatic regions.

Core components include advanced metering infrastructure, water usage effectiveness (WUE) measurement systems, predictive modeling platforms, and comprehensive reporting tools that enable facility operators to track consumption patterns, identify optimization opportunities, and implement sustainable water management practices. The market also encompasses academic research initiatives, government-sponsored studies, and private sector consulting services focused on developing industry best practices and regulatory compliance frameworks.

Market expansion in China’s data center water consumption study sector reflects the nation’s commitment to sustainable digital infrastructure development and environmental stewardship. The growing emphasis on carbon neutrality goals and resource efficiency has positioned water consumption analysis as a critical component of data center planning, design, and operations. Industry adoption rates have increased significantly, with approximately 78% of major data center operators now implementing some form of systematic water consumption monitoring and analysis.

Technology advancement continues to drive market evolution, with artificial intelligence and machine learning algorithms enabling more sophisticated consumption pattern analysis and predictive optimization capabilities. The integration of Internet of Things (IoT) sensors and real-time monitoring systems has enhanced data collection accuracy and enabled proactive water management strategies. Regulatory compliance requirements have become increasingly stringent, with local governments implementing water usage reporting mandates and efficiency standards that drive demand for comprehensive study services.

Market participants include specialized research organizations, environmental consulting firms, technology solution providers, and academic institutions collaborating to develop innovative approaches to water consumption analysis and optimization. The sector benefits from strong government support through funding initiatives, research grants, and policy frameworks promoting sustainable data center development practices.

Strategic insights reveal several critical trends shaping the China data center water consumption study market:

Environmental regulations serve as the primary catalyst driving demand for comprehensive data center water consumption studies in China. Government initiatives promoting carbon neutrality and resource efficiency have established stringent requirements for water usage monitoring, reporting, and optimization across the digital infrastructure sector. Local authorities in water-stressed regions have implemented particularly rigorous standards, requiring detailed consumption analysis and efficiency improvement plans from data center operators.

Corporate sustainability commitments from major technology companies and cloud service providers have created substantial demand for professional water consumption analysis services. These organizations require comprehensive studies to support their environmental reporting obligations, sustainability goal achievement, and stakeholder communication efforts. Investor pressure for environmental, social, and governance (ESG) compliance has further accelerated adoption of systematic water consumption monitoring and optimization practices.

Water scarcity concerns across China’s major metropolitan areas have heightened awareness of data center water consumption impacts and driven demand for detailed usage studies. The growing competition for water resources between industrial, residential, and commercial users has positioned data centers as significant stakeholders requiring careful consumption management and optimization strategies.

Technological advancement in monitoring and analysis capabilities has made comprehensive water consumption studies more accessible and cost-effective for data center operators. The availability of sophisticated IoT sensors, real-time monitoring platforms, and AI-powered analytics tools has reduced implementation barriers and enhanced study accuracy and value.

Implementation costs associated with comprehensive water consumption monitoring and analysis systems present significant barriers for smaller data center operators and emerging market participants. The initial investment required for advanced metering infrastructure, monitoring platforms, and professional consulting services can be substantial, particularly for facilities with limited operational budgets or older infrastructure requiring extensive retrofitting.

Technical complexity in data center water systems creates challenges for accurate consumption measurement and analysis. The interconnected nature of cooling systems, backup generators, humidification equipment, and other water-consuming components requires sophisticated monitoring approaches and specialized expertise that may not be readily available in all market segments or geographical regions.

Data standardization issues across the industry limit the effectiveness of consumption studies and benchmarking efforts. The lack of universally accepted measurement methodologies, reporting standards, and performance metrics creates difficulties in comparing results across different facilities, operators, and geographical regions, reducing the overall value of study investments.

Skilled workforce shortages in specialized areas such as data center environmental engineering, water system optimization, and sustainability analysis constrain market growth and service quality. The relatively new nature of comprehensive water consumption studies means that experienced professionals are limited, creating capacity constraints for service providers and implementation challenges for operators.

Government support for sustainable data center development creates substantial opportunities for water consumption study service providers and technology developers. National and regional initiatives promoting green infrastructure development include funding programs, research grants, and policy incentives that support comprehensive water consumption analysis and optimization projects across the sector.

Technology innovation opportunities exist in developing more sophisticated monitoring systems, predictive analytics platforms, and optimization algorithms specifically designed for Chinese data center environments and operational conditions. The integration of artificial intelligence, machine learning, and advanced sensor technologies presents significant potential for creating differentiated solutions and competitive advantages.

Market expansion into emerging data center regions, particularly in western and central China, offers growth opportunities as new facilities require comprehensive water consumption studies from the planning and design phases. The rapid expansion of edge computing infrastructure and smaller-scale data centers creates demand for scalable, cost-effective study solutions tailored to diverse facility types and operational requirements.

International collaboration opportunities with global research organizations, technology providers, and consulting firms can accelerate knowledge transfer and best practice development while creating new market entry pathways for international participants seeking to engage with China’s data center sustainability initiatives.

Supply chain dynamics in the China data center water consumption study market reflect the complex interplay between technology providers, research organizations, consulting services, and end-user facilities. The market ecosystem includes specialized monitoring equipment manufacturers, software platform developers, environmental consulting firms, and academic research institutions, each contributing essential components to comprehensive consumption analysis solutions.

Demand patterns show seasonal variations aligned with data center cooling requirements and regulatory reporting cycles. Peak demand typically occurs during summer months when cooling loads are highest and annual sustainability reporting periods when comprehensive consumption analysis is required for compliance and stakeholder communication purposes. Regional demand varies significantly based on local climate conditions, water availability, and regulatory requirements.

Competitive dynamics are characterized by collaboration rather than pure competition, as the market’s technical complexity and specialized requirements encourage partnership approaches between technology providers, research organizations, and consulting firms. Market consolidation trends show increasing integration of monitoring hardware, software analytics, and professional services to provide comprehensive solution packages.

Innovation cycles are accelerating as artificial intelligence and machine learning technologies enable more sophisticated consumption analysis and predictive optimization capabilities. The integration of real-time monitoring with predictive analytics is creating new value propositions and competitive differentiation opportunities for market participants.

Comprehensive research approaches employed in China’s data center water consumption studies utilize multiple methodologies to ensure accurate measurement, analysis, and optimization recommendations. Primary research methods include direct facility monitoring using advanced metering infrastructure, IoT sensor networks, and real-time data collection systems that capture detailed consumption patterns across various operational conditions and time periods.

Data collection techniques encompass both quantitative and qualitative research approaches, including facility audits, operator interviews, equipment performance analysis, and comparative benchmarking studies. Advanced analytics platforms utilize machine learning algorithms to identify consumption patterns, predict optimization opportunities, and develop customized efficiency improvement strategies based on facility-specific operational characteristics.

Validation methodologies ensure research accuracy through cross-referencing multiple data sources, implementing quality control protocols, and conducting peer review processes. Industry collaboration initiatives facilitate knowledge sharing and best practice development while maintaining research integrity and objectivity across different market participants and geographical regions.

Reporting frameworks follow established industry standards while incorporating China-specific regulatory requirements and sustainability metrics. Research outputs include detailed consumption analysis reports, optimization recommendations, benchmarking comparisons, and long-term trend projections that support strategic decision-making and regulatory compliance efforts.

Eastern China dominates the data center water consumption study market, with major metropolitan areas including Beijing, Shanghai, and Shenzhen accounting for approximately 60-65% of market activity. These regions benefit from concentrated data center infrastructure, advanced research capabilities, and stringent environmental regulations that drive demand for comprehensive consumption analysis services. Regulatory enforcement is particularly rigorous in these areas due to water scarcity concerns and high population density.

Southern China represents a rapidly growing market segment, with Guangdong Province leading adoption of water consumption studies due to its significant data center presence and progressive environmental policies. The region’s subtropical climate creates unique cooling challenges that require specialized study approaches and optimization strategies. Market share in southern regions is expanding at approximately 12-15% annually as new facilities implement comprehensive monitoring systems.

Western China presents emerging opportunities as data center development accelerates in provinces such as Guizhou, Inner Mongolia, and Xinjiang. These regions offer advantages including lower costs, renewable energy availability, and favorable climate conditions, but require adapted study methodologies to address different operational environments and infrastructure characteristics. Government incentives promoting western development are driving increased investment in comprehensive water consumption analysis capabilities.

Northern China shows steady market growth driven by established data center infrastructure in cities like Tianjin and Qingdao. The region’s distinct seasonal climate variations require sophisticated consumption modeling and optimization approaches that account for significant temperature fluctuations and varying cooling requirements throughout the year.

Market leadership in China’s data center water consumption study sector is distributed among several key participant categories, each bringing specialized expertise and capabilities to the market:

Strategic partnerships between technology providers, consulting firms, and research institutions are common, creating comprehensive service offerings that combine monitoring hardware, software analytics, and professional expertise. Market differentiation occurs through specialized industry knowledge, advanced technology capabilities, and proven track records in delivering measurable water consumption optimization results.

Innovation focus areas include artificial intelligence integration, predictive analytics development, and real-time optimization systems that enable proactive water management strategies. Companies investing heavily in research and development are gaining competitive advantages through superior analytical capabilities and more accurate consumption forecasting.

By Service Type:

By Facility Type:

By Technology:

Cooling System Analysis represents the largest category within China’s data center water consumption studies, accounting for the majority of research focus and optimization efforts. This category encompasses detailed analysis of chiller systems, cooling towers, evaporative cooling equipment, and heat rejection systems that typically consume 80-90% of total facility water usage. Advanced monitoring in this category includes real-time temperature tracking, flow rate measurement, and efficiency analysis that enables precise optimization recommendations.

Humidification Systems constitute a secondary but important category, particularly in northern China where dry climate conditions require significant water consumption for maintaining optimal humidity levels in data center environments. Seasonal variations in this category create complex consumption patterns that require sophisticated modeling and predictive analysis capabilities to optimize water usage while maintaining environmental control requirements.

Emergency Systems including fire suppression, backup cooling, and emergency power generation represent a specialized category requiring careful analysis due to their critical safety functions and intermittent operation patterns. Compliance requirements in this category often conflict with water conservation goals, necessitating balanced approaches that maintain safety standards while minimizing consumption.

Auxiliary Systems encompass various facility support functions including landscaping, cleaning, and maintenance operations that contribute to overall water consumption but are often overlooked in traditional analysis approaches. Comprehensive studies increasingly include these systems to provide complete consumption profiles and identify additional optimization opportunities.

Operational efficiency improvements represent the primary benefit for data center operators implementing comprehensive water consumption studies. Detailed analysis enables identification of optimization opportunities that can reduce water usage by 15-25% while maintaining or improving cooling performance and environmental control capabilities. These efficiency gains translate directly into reduced operational costs and improved sustainability performance metrics.

Regulatory compliance benefits include streamlined reporting processes, reduced compliance risks, and enhanced relationships with government agencies and environmental regulators. Comprehensive documentation provided by systematic consumption studies supports permit applications, environmental impact assessments, and sustainability reporting requirements while demonstrating proactive environmental stewardship.

Strategic planning advantages enable data center operators to make informed decisions about facility expansion, technology upgrades, and long-term sustainability investments. Predictive analytics capabilities support capacity planning, budget forecasting, and risk assessment activities that improve overall business planning and investment decision-making processes.

Stakeholder communication benefits include enhanced credibility with investors, customers, and community organizations through transparent reporting and demonstrated commitment to environmental responsibility. Third-party validation of consumption studies provides additional credibility and supports marketing and business development efforts focused on sustainability-conscious customers and partners.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant trend transforming China’s data center water consumption study market. Machine learning algorithms are enabling more sophisticated consumption pattern analysis, predictive optimization capabilities, and automated anomaly detection that significantly enhance study accuracy and value. AI-powered platforms can process vast amounts of consumption data to identify subtle patterns and optimization opportunities that traditional analysis methods might miss.

Real-time Monitoring adoption is accelerating across the market as IoT sensor costs decrease and connectivity infrastructure improves. Continuous data collection enables proactive water management strategies and immediate response to consumption anomalies or system inefficiencies. This trend is shifting the market from periodic assessment approaches toward continuous optimization and management paradigms.

Regulatory Integration trends show increasing alignment between study methodologies and government reporting requirements, streamlining compliance processes and reducing administrative burdens for data center operators. Standardized reporting frameworks are emerging that combine consumption analysis with regulatory compliance documentation, creating more comprehensive and valuable study outputs.

Sustainability Focus continues to intensify as corporate environmental commitments and investor ESG requirements drive demand for more comprehensive and transparent water consumption analysis. Third-party verification of study results is becoming more common as stakeholders seek independent validation of sustainability performance claims and improvement initiatives.

Technology advancement initiatives have accelerated significantly, with major cloud providers and data center operators investing heavily in advanced water consumption monitoring and optimization systems. Recent developments include deployment of comprehensive IoT sensor networks, implementation of AI-powered analytics platforms, and integration of real-time optimization systems that enable proactive water management strategies.

Regulatory evolution has introduced more stringent water usage reporting requirements and efficiency standards across major data center markets in China. Government initiatives include mandatory consumption reporting, efficiency improvement targets, and incentive programs supporting advanced monitoring system implementation. These developments are driving systematic adoption of comprehensive consumption studies across the industry.

Industry collaboration efforts have expanded through formation of research consortiums, best practice sharing initiatives, and standardization working groups focused on developing common methodologies and performance metrics. MarkWide Research analysis indicates that collaborative approaches are accelerating innovation development and market maturation while reducing implementation costs for individual operators.

International partnerships have emerged between Chinese research organizations and global technology providers, facilitating knowledge transfer and accelerating development of advanced consumption analysis capabilities. These partnerships are bringing international best practices to the Chinese market while creating opportunities for domestic solution providers to expand globally.

Strategic investment in comprehensive water consumption monitoring infrastructure should be prioritized by data center operators seeking to maintain competitive positioning and regulatory compliance in China’s evolving market environment. Early adoption of advanced monitoring systems and analytics platforms will provide significant advantages as regulatory requirements continue to strengthen and stakeholder expectations for environmental performance increase.

Partnership development with specialized research organizations and technology providers can accelerate implementation of effective consumption study programs while reducing internal resource requirements and technical risks. Collaborative approaches enable access to specialized expertise and advanced capabilities that may not be cost-effective to develop internally, particularly for smaller operators or emerging market participants.

Technology integration strategies should focus on scalable, future-ready solutions that can adapt to evolving regulatory requirements and technological advancement. Platform selection should prioritize interoperability, data standardization, and integration capabilities that support long-term value creation and avoid technology lock-in risks that could limit future flexibility.

Skill development initiatives should address the growing demand for specialized expertise in data center water system analysis and optimization. Training programs and professional development investments will be critical for maintaining competitive capabilities and ensuring effective utilization of advanced monitoring and analysis technologies.

Market expansion prospects for China’s data center water consumption study sector remain highly positive, driven by continued digital infrastructure growth, strengthening environmental regulations, and increasing corporate sustainability commitments. Growth projections indicate sustained expansion at approximately 18-22% annually over the next five years as comprehensive consumption studies become standard practice across the industry.

Technology evolution will continue to enhance study capabilities and value propositions, with artificial intelligence, machine learning, and advanced sensor technologies enabling more sophisticated analysis and optimization approaches. Innovation focus areas include predictive analytics, automated optimization systems, and integrated sustainability management platforms that combine water consumption analysis with broader environmental performance monitoring.

Regulatory development is expected to introduce more stringent requirements for water consumption monitoring, reporting, and efficiency improvements across China’s data center sector. Policy trends suggest increasing integration of water consumption metrics with carbon emission reporting and broader sustainability compliance frameworks, creating more comprehensive environmental management requirements.

Market maturation will likely result in increased standardization of study methodologies, performance metrics, and reporting frameworks, improving comparability and reducing implementation complexity. MarkWide Research projects that industry standardization efforts will accelerate market adoption while reducing costs and improving study quality across all market segments and geographical regions.

China’s data center water consumption study market represents a critical and rapidly evolving sector addressing the intersection of digital infrastructure growth and environmental sustainability. The market’s development reflects broader trends toward resource efficiency, regulatory compliance, and corporate environmental responsibility that are reshaping the global data center industry. Strong government support, technological advancement, and increasing stakeholder awareness of water consumption impacts have created substantial opportunities for specialized research organizations, technology providers, and consulting services.

Market dynamics indicate continued expansion driven by regulatory requirements, corporate sustainability commitments, and technological innovation that enables more sophisticated consumption analysis and optimization capabilities. The integration of artificial intelligence, IoT monitoring systems, and predictive analytics is transforming traditional assessment approaches into comprehensive, real-time management platforms that deliver measurable efficiency improvements and environmental benefits.

Future success in this market will depend on continued innovation, strategic partnerships, and adaptation to evolving regulatory and stakeholder requirements. Organizations that invest in advanced capabilities, develop specialized expertise, and maintain focus on delivering measurable value to data center operators will be well-positioned to capitalize on the substantial growth opportunities ahead. The China study of data center water consumption market will continue to play an increasingly important role in supporting sustainable digital infrastructure development and environmental stewardship across the nation’s rapidly expanding technology sector.

What is Data Center Water Consumption?

Data Center Water Consumption refers to the amount of water used by data centers for cooling and other operational processes. This includes water used in cooling towers, chillers, and other systems that manage heat generated by servers and equipment.

What are the key players in the China Study Of Data Center Water Consumption Market?

Key players in the China Study Of Data Center Water Consumption Market include Alibaba Cloud, Tencent Cloud, and China Telecom, among others. These companies are actively involved in optimizing water usage in their data center operations.

What are the main drivers of the China Study Of Data Center Water Consumption Market?

The main drivers include the increasing demand for data processing, the growth of cloud computing, and the need for efficient cooling solutions. As data centers expand, optimizing water consumption becomes critical for sustainability.

What challenges does the China Study Of Data Center Water Consumption Market face?

Challenges include regulatory pressures regarding water usage, the high cost of implementing water-efficient technologies, and the variability of water availability in different regions. These factors can hinder the adoption of sustainable practices.

What opportunities exist in the China Study Of Data Center Water Consumption Market?

Opportunities include the development of innovative cooling technologies, the integration of water recycling systems, and partnerships with local governments for sustainable water management. These initiatives can enhance operational efficiency and reduce environmental impact.

What trends are shaping the China Study Of Data Center Water Consumption Market?

Trends include the increasing adoption of green data centers, advancements in water-efficient cooling technologies, and a focus on sustainability practices. Companies are also exploring alternative cooling methods to minimize water usage.

China Study Of Data Center Water Consumption Market

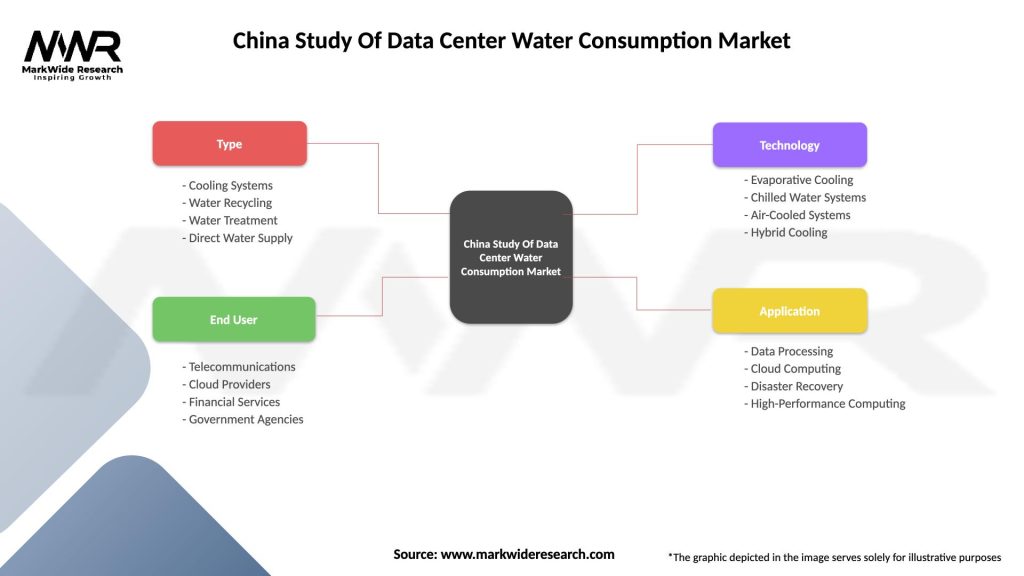

| Segmentation Details | Description |

|---|---|

| Type | Cooling Systems, Water Recycling, Water Treatment, Direct Water Supply |

| End User | Telecommunications, Cloud Providers, Financial Services, Government Agencies |

| Technology | Evaporative Cooling, Chilled Water Systems, Air-Cooled Systems, Hybrid Cooling |

| Application | Data Processing, Cloud Computing, Disaster Recovery, High-Performance Computing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Study Of Data Center Water Consumption Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at