444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China sports optic market represents a rapidly expanding segment within the country’s broader sporting goods and outdoor recreation industry. This dynamic market encompasses a comprehensive range of optical equipment specifically designed for sports and outdoor activities, including binoculars, telescopes, rifle scopes, rangefinders, and specialized sporting optics. Market growth has been particularly robust, driven by China’s increasing participation in outdoor sports, hunting activities, and recreational pursuits.

Consumer demand for high-quality sports optics has surged significantly, with the market experiencing a 12.5% annual growth rate over recent years. This expansion reflects China’s growing middle class, increased disposable income, and heightened interest in outdoor recreational activities. Technological advancements in optical manufacturing, combined with improved product accessibility, have positioned China as both a major consumer and producer of sports optical equipment.

Regional distribution shows concentrated demand in major metropolitan areas and provinces with strong outdoor recreation cultures. The market benefits from China’s vast manufacturing capabilities, established supply chains, and growing domestic brand presence alongside international competitors seeking to capitalize on this lucrative opportunity.

The China sports optic market refers to the comprehensive ecosystem of optical devices and equipment specifically designed and marketed for sporting, hunting, outdoor recreation, and competitive activities within the Chinese market. This market encompasses various product categories including hunting scopes, sporting binoculars, rangefinders, spotting scopes, and specialized optical accessories used by athletes, outdoor enthusiasts, and recreational users across China.

Market definition includes both imported premium brands and domestically manufactured products, covering distribution channels from specialized sporting goods retailers to online platforms. The sector represents the intersection of advanced optical technology, sporting goods retail, and China’s expanding outdoor recreation culture, serving diverse consumer segments from professional athletes to weekend outdoor enthusiasts.

Market dynamics in China’s sports optic sector demonstrate exceptional growth potential, driven by fundamental shifts in consumer behavior, recreational preferences, and technological accessibility. The market has experienced substantial expansion, with outdoor sports participation increasing by 28% annually among Chinese consumers, directly correlating with sports optic demand.

Key growth drivers include rising disposable incomes, urbanization trends, government initiatives promoting outdoor activities, and increasing awareness of outdoor recreation benefits. The market benefits from China’s position as a global manufacturing hub, enabling competitive pricing while maintaining quality standards. Digital transformation has revolutionized distribution channels, with online sales representing a significant portion of total market transactions.

Competitive landscape features a mix of established international brands and emerging domestic manufacturers, creating dynamic market conditions. Consumer preferences increasingly favor products offering advanced features, durability, and value propositions. Market segmentation reveals diverse applications across hunting, birdwatching, sports viewing, and professional sporting activities, each with distinct requirements and growth trajectories.

Strategic analysis reveals several critical insights shaping the China sports optic market landscape:

Economic prosperity serves as the fundamental driver propelling China’s sports optic market expansion. Rising disposable incomes enable consumers to invest in recreational equipment, with household spending on sporting goods increasing by 15.3% annually. This economic foundation supports sustained market growth across multiple consumer segments.

Lifestyle transformation represents another crucial driver, as urbanization and changing work patterns create demand for outdoor recreation and stress relief activities. Chinese consumers increasingly prioritize health, wellness, and outdoor experiences, driving demand for specialized optical equipment. Government initiatives promoting outdoor sports and recreational activities further amplify this trend through policy support and infrastructure development.

Technological advancement in optical manufacturing has made high-quality products more accessible and affordable. Improved manufacturing processes, materials science innovations, and production efficiency gains enable competitive pricing while maintaining performance standards. Digital integration features appeal to tech-savvy consumers, creating differentiation opportunities for manufacturers.

Cultural shifts toward outdoor recreation, influenced by social media, travel trends, and lifestyle aspirations, continue expanding the potential consumer base. Educational awareness about outdoor activities benefits and equipment importance drives informed purchasing decisions and market sophistication.

Economic volatility poses significant challenges to market stability, as sports optics represent discretionary purchases sensitive to economic downturns. Consumer spending on recreational equipment typically decreases during economic uncertainty, impacting overall market demand and growth trajectories.

Regulatory complexities surrounding optical equipment importation, certification requirements, and quality standards create barriers for international manufacturers. Compliance costs and administrative procedures can limit market entry and increase operational expenses for both domestic and foreign companies.

Counterfeit products represent a persistent challenge, undermining brand value and consumer confidence. Fake optical equipment not only damages legitimate manufacturers’ reputations but also creates safety concerns and market confusion. Intellectual property protection remains an ongoing concern for innovative companies investing in research and development.

Seasonal demand fluctuations create inventory management challenges and cash flow pressures for retailers and manufacturers. Weather dependency of outdoor activities directly impacts sales patterns, requiring sophisticated demand forecasting and supply chain management strategies.

Emerging market segments present substantial growth opportunities, particularly in specialized applications such as wildlife photography, astronomical observation, and competitive shooting sports. These niche markets offer higher margins and less price competition while serving dedicated enthusiast communities with specific requirements.

Rural market expansion represents significant untapped potential, as improved infrastructure and rising rural incomes create new consumer bases. Government rural development initiatives and improved logistics networks facilitate market penetration in previously underserved regions.

Technology integration opportunities include smart optics with connectivity features, augmented reality capabilities, and digital enhancement technologies. These innovations can command premium pricing while attracting tech-savvy consumers seeking advanced functionality.

Export market development leverages China’s manufacturing capabilities to serve international markets, creating additional revenue streams and economies of scale. Belt and Road Initiative countries represent particularly attractive export destinations with growing outdoor recreation markets.

Partnership opportunities with outdoor recreation companies, sporting goods retailers, and tourism operators can create integrated marketing approaches and expanded distribution channels. Cross-industry collaboration enables market expansion and customer base diversification.

Supply chain dynamics in China’s sports optic market reflect the country’s manufacturing strengths and global trade relationships. Domestic production capabilities enable competitive pricing and rapid product development cycles, while international partnerships provide access to advanced technologies and premium brand positioning.

Consumer behavior patterns demonstrate increasing sophistication and quality awareness, with buyers conducting extensive research before purchases. Online reviews and social media influence significantly impact brand perception and purchasing decisions, requiring manufacturers to maintain strong digital presence and customer engagement strategies.

Competitive dynamics feature intense rivalry between international premium brands and emerging domestic manufacturers. Price competition remains significant in mid-range segments, while premium markets focus on technology, brand prestige, and performance differentiation. Market share distribution shows domestic brands capturing 38% of total market volume through competitive pricing and localized marketing approaches.

Innovation cycles accelerate as manufacturers invest in research and development to maintain competitive advantages. Product lifecycle management becomes increasingly important as technology advancement rates increase and consumer expectations evolve rapidly.

Comprehensive market analysis employed multiple research methodologies to ensure accuracy and reliability of findings. Primary research included extensive consumer surveys, industry expert interviews, and manufacturer consultations to gather firsthand market insights and validate secondary data sources.

Data collection methods encompassed both quantitative and qualitative approaches, utilizing structured questionnaires, focus groups, and in-depth interviews with key stakeholders across the value chain. Sample sizes were statistically significant, representing diverse geographic regions, demographic segments, and product categories within the Chinese market.

Secondary research involved analysis of industry reports, government statistics, trade publications, and company financial statements to establish market baselines and trend analysis. Cross-validation techniques ensured data consistency and reliability across multiple sources and research methodologies.

Analytical frameworks included market sizing models, competitive analysis matrices, and trend projection algorithms to generate actionable insights and future market scenarios. Statistical analysis employed advanced techniques to identify correlations, market drivers, and growth patterns within the sports optic sector.

Eastern China dominates market consumption, with provinces including Guangdong, Jiangsu, and Zhejiang accounting for 52% of total market demand. These regions benefit from higher disposable incomes, established outdoor recreation cultures, and superior retail infrastructure supporting sports optic sales.

Northern regions including Beijing, Tianjin, and surrounding provinces demonstrate strong growth in premium product segments, driven by affluent urban populations and proximity to outdoor recreation areas. Winter sports popularity in northern regions creates specific demand patterns for specialized optical equipment.

Western China presents emerging opportunities as infrastructure development and economic growth create new consumer markets. Tourism development in scenic western provinces drives demand for binoculars and spotting scopes among both domestic and international visitors.

Southern regions show consistent demand across multiple product categories, with hunting and wildlife observation activities particularly popular. Climate advantages enable year-round outdoor activities, supporting stable demand patterns and reduced seasonal volatility.

Central China represents the fastest-growing regional market, with annual growth rates exceeding 18% as economic development and urbanization create expanding middle-class consumer bases interested in outdoor recreation and sporting activities.

Market leadership features a diverse mix of international premium brands and competitive domestic manufacturers, creating dynamic competitive conditions across multiple market segments and price points.

Domestic manufacturers including various Chinese companies increasingly compete through competitive pricing, localized marketing, and rapid product development cycles, capturing significant market share in mid-range segments.

Product-based segmentation reveals distinct market categories with unique characteristics, growth patterns, and consumer requirements:

By Product Type:

By Application:

Premium segment analysis reveals strong growth potential driven by affluent consumers seeking superior optical performance and brand prestige. This category demonstrates price elasticity characteristics, with consumers willing to pay significant premiums for proven quality and advanced features.

Mid-range category represents the largest volume segment, balancing performance requirements with price sensitivity. Value proposition becomes critical in this segment, with successful products offering optimal feature combinations at competitive price points. Brand reputation and customer service significantly influence purchasing decisions within this category.

Entry-level segment serves price-conscious consumers and first-time buyers, emphasizing affordability and basic functionality. This category provides market entry opportunities for new brands and serves as a stepping stone for consumers upgrading to higher-end products over time.

Specialty categories including astronomical telescopes and professional-grade equipment serve niche markets with specific requirements and higher margins. These segments require specialized knowledge, technical support, and targeted marketing approaches to effectively reach and serve dedicated enthusiast communities.

Manufacturers benefit from China’s expanding market through increased sales volumes, economies of scale, and opportunities for local production partnerships. The growing market enables investment in research and development, product innovation, and brand building activities that strengthen competitive positions.

Retailers gain from expanding product categories, higher-margin opportunities, and growing consumer interest in outdoor recreation equipment. Specialized retailers can develop expertise and customer relationships that create competitive advantages and sustainable business models.

Consumers enjoy improved product availability, competitive pricing, and access to advanced optical technologies previously unavailable or prohibitively expensive. Market competition drives innovation and value improvements benefiting end users across all segments.

Distributors capitalize on growing demand through expanded product portfolios, improved margins, and opportunities for value-added services including technical support and customer education. Supply chain efficiency improvements benefit all stakeholders through reduced costs and improved availability.

Government stakeholders benefit from increased tax revenues, employment opportunities, and economic development in manufacturing and retail sectors. Tourism promotion through outdoor recreation activities creates additional economic benefits and regional development opportunities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital integration emerges as a dominant trend, with manufacturers incorporating smart features, connectivity options, and digital enhancement technologies into traditional optical products. Smartphone compatibility and app integration create new user experiences and value propositions appealing to tech-savvy consumers.

Sustainability focus influences product development and manufacturing processes, with consumers increasingly considering environmental impact in purchasing decisions. Eco-friendly materials and sustainable manufacturing practices become competitive differentiators and brand positioning elements.

Customization demand grows as consumers seek personalized products tailored to specific applications and preferences. Modular designs and accessory systems enable users to adapt equipment for different situations and requirements, increasing product versatility and value.

Online sales expansion continues transforming distribution channels, with e-commerce platforms accounting for increasing market share. Virtual try-before-buy technologies and augmented reality applications help overcome traditional online shopping limitations for optical products.

Education and content marketing become essential for market development, with manufacturers investing in consumer education, technical content, and community building to support informed purchasing decisions and brand loyalty development.

Technology partnerships between international optical companies and Chinese manufacturers create new product development opportunities and market access strategies. These collaborations combine advanced optical technologies with competitive manufacturing capabilities and local market knowledge.

Retail channel evolution includes expansion of specialized outdoor recreation stores, improved online platforms, and integration of virtual reality technologies for product demonstration and customer education. Omnichannel strategies become essential for reaching diverse consumer segments effectively.

Product innovation accelerates with introduction of image stabilization technologies, enhanced durability features, and improved optical coatings that deliver superior performance in challenging conditions. Miniaturization trends enable compact designs without compromising optical quality.

Market consolidation activities include strategic acquisitions, partnerships, and joint ventures as companies seek to strengthen market positions and expand product portfolios. Vertical integration strategies help manufacturers control quality and costs while improving customer service capabilities.

Regulatory developments include updated quality standards, import regulations, and safety requirements that influence product development and market entry strategies. Standardization efforts help improve consumer confidence and market transparency.

MarkWide Research recommends manufacturers focus on developing comprehensive product portfolios that serve multiple market segments while maintaining clear brand positioning and value propositions. Market segmentation strategies should address diverse consumer needs and price sensitivity levels across different applications and user experience levels.

Investment priorities should emphasize technology development, brand building, and distribution channel optimization to create sustainable competitive advantages. Digital transformation initiatives including e-commerce capabilities, customer relationship management, and data analytics become essential for market success.

Partnership strategies with outdoor recreation companies, tourism operators, and educational institutions can create new market opportunities and customer acquisition channels. Cross-industry collaboration enables market expansion and customer base diversification while reducing marketing costs.

Quality assurance and customer service excellence become critical differentiators in increasingly competitive market conditions. After-sales support and technical assistance capabilities influence brand reputation and customer loyalty development significantly.

Market expansion strategies should prioritize underserved regional markets and emerging consumer segments while maintaining focus on core competencies and brand strengths. Gradual expansion approaches minimize risks while enabling sustainable growth and market share development.

Long-term growth prospects remain highly positive, with the China sports optic market positioned for sustained expansion driven by fundamental demographic and economic trends. Market maturation will likely result in increased consumer sophistication and demand for higher-quality products with advanced features.

Technology evolution will continue driving product innovation, with artificial intelligence, augmented reality, and advanced materials creating new product categories and user experiences. Smart optics integration with mobile devices and cloud services will become standard features rather than premium options.

Market consolidation may accelerate as successful companies acquire smaller competitors and expand their market presence through strategic partnerships and vertical integration. Brand differentiation will become increasingly important as market competition intensifies and consumer choices expand.

Regulatory environment evolution will likely include stricter quality standards and environmental requirements that favor established manufacturers with strong compliance capabilities. International trade dynamics will continue influencing market access and competitive positioning for both domestic and foreign companies.

Consumer behavior will increasingly emphasize value, sustainability, and technology integration, requiring manufacturers to adapt product development and marketing strategies accordingly. MWR analysis projects the market will maintain robust growth trajectories with annual expansion rates exceeding 10% over the next five years, driven by continued economic development and outdoor recreation popularity growth.

The China sports optic market represents a compelling growth opportunity characterized by strong fundamentals, expanding consumer base, and favorable long-term trends. Market dynamics reflect China’s economic development, changing lifestyle preferences, and increasing participation in outdoor recreation activities that drive sustained demand for quality optical equipment.

Competitive landscape evolution creates opportunities for both international brands and domestic manufacturers to establish strong market positions through differentiated strategies, superior products, and effective customer engagement. Technology integration and innovation will continue driving market development and creating new value propositions for consumers across all segments.

Strategic success in this market requires comprehensive understanding of consumer needs, effective brand positioning, and operational excellence in product development, manufacturing, and distribution. Companies that invest in quality, innovation, and customer relationships will be best positioned to capitalize on the substantial growth opportunities ahead in China’s expanding sports optic market.

What is Sports Optic?

Sports Optic refers to optical products designed specifically for sports applications, including binoculars, scopes, and sunglasses that enhance visibility and performance in various sporting activities.

What are the key players in the China Sports Optic Market?

Key players in the China Sports Optic Market include companies like Nikon Corporation, Bushnell, and Leupold & Stevens, which offer a range of optical products for sports enthusiasts, among others.

What are the growth factors driving the China Sports Optic Market?

The growth of the China Sports Optic Market is driven by increasing participation in outdoor sports, rising disposable incomes, and advancements in optical technology that enhance product performance.

What challenges does the China Sports Optic Market face?

Challenges in the China Sports Optic Market include intense competition among manufacturers, fluctuating raw material prices, and the need for continuous innovation to meet consumer demands.

What opportunities exist in the China Sports Optic Market?

Opportunities in the China Sports Optic Market include the growing trend of sports tourism, increasing demand for high-quality optical products, and the potential for expansion into e-commerce platforms.

What trends are shaping the China Sports Optic Market?

Trends in the China Sports Optic Market include the integration of smart technology in optical devices, a focus on sustainability in product manufacturing, and the rising popularity of personalized sports optics.

China Sports Optic Market

| Segmentation Details | Description |

|---|---|

| Product Type | Binoculars, Spotting Scopes, Rifle Scopes, Rangefinders |

| Technology | Optical, Digital, Thermal, Night Vision |

| End User | Athletes, Outdoor Enthusiasts, Hunters, Wildlife Observers |

| Distribution Channel | Online Retail, Specialty Stores, Supermarkets, Direct Sales |

Please note: The segmentation can be entirely customized to align with our client’s needs.

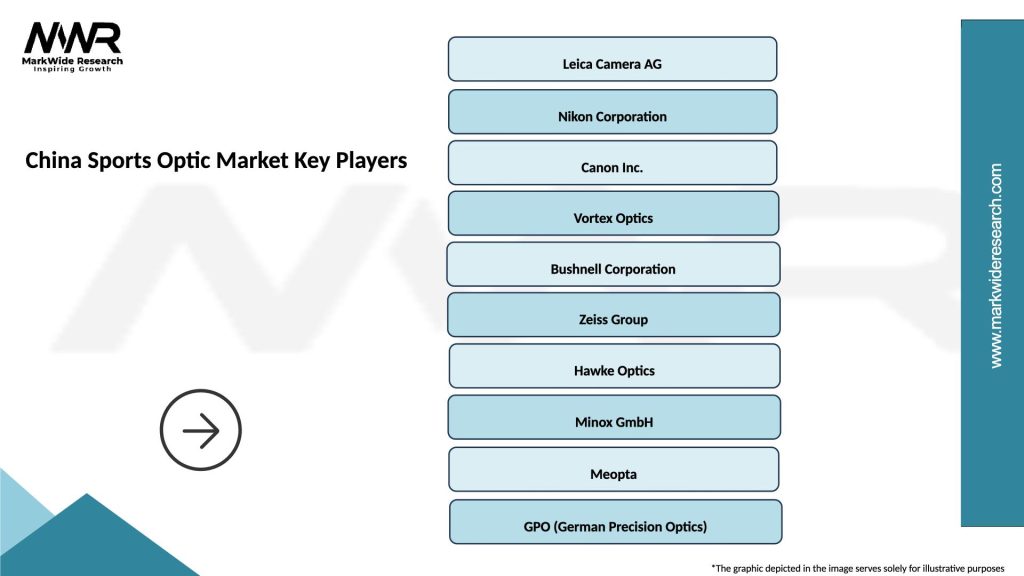

Leading companies in the China Sports Optic Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at