444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China satellite imagery services market represents one of the most rapidly expanding segments within the nation’s space technology sector, driven by increasing demand for geospatial intelligence across multiple industries. China’s strategic investments in satellite constellation development and earth observation capabilities have positioned the country as a significant player in the global satellite imagery landscape. The market encompasses various applications including urban planning, agriculture monitoring, disaster management, environmental assessment, and defense intelligence.

Government initiatives supporting the development of indigenous satellite capabilities have accelerated market growth, with the China National Space Administration leading comprehensive programs to enhance earth observation infrastructure. The market benefits from substantial technological advancements in high-resolution imaging, synthetic aperture radar systems, and hyperspectral sensing technologies. Commercial applications are experiencing unprecedented growth, with private sector adoption increasing at a remarkable 12.5% annually across various industry verticals.

Regional development patterns show concentrated activity in major metropolitan areas including Beijing, Shanghai, and Shenzhen, where technology clusters drive innovation in satellite data processing and analytics. The integration of artificial intelligence and machine learning technologies with satellite imagery services has created new opportunities for automated analysis and real-time monitoring solutions. Cross-industry collaboration between space technology companies, software developers, and end-user industries continues to expand market applications and drive technological innovation.

The China satellite imagery services market refers to the comprehensive ecosystem of earth observation data acquisition, processing, analysis, and distribution services provided through satellite-based platforms within Chinese territory and for Chinese organizations. This market encompasses both government-operated and commercial satellite systems that capture, process, and deliver geospatial intelligence for various civilian and military applications.

Core components of this market include satellite constellation operations, ground station infrastructure, data processing facilities, software development, and value-added services such as analytics and interpretation. The market serves diverse customer segments ranging from government agencies and military organizations to commercial enterprises in agriculture, mining, urban development, and environmental monitoring sectors.

Service delivery models within this market include direct satellite data sales, subscription-based access to imagery archives, real-time monitoring services, and customized analytical solutions. The market also encompasses supporting technologies such as ground control systems, data transmission networks, and specialized software platforms for image processing and analysis.

Market dynamics in China’s satellite imagery services sector reflect the country’s broader strategic objectives in space technology development and national security enhancement. The market demonstrates robust growth patterns driven by increasing government investment in space infrastructure and expanding commercial applications across multiple industry sectors. Technological advancement remains a primary catalyst, with domestic companies developing sophisticated capabilities in satellite manufacturing, launch services, and data processing.

Competitive landscape features a mix of state-owned enterprises, private companies, and research institutions collaborating to advance satellite imagery capabilities. Key market participants include established space technology companies, emerging startups specializing in satellite data analytics, and international partnerships facilitating technology transfer and market expansion. The market benefits from strong government support through policy initiatives, funding programs, and regulatory frameworks that encourage innovation and commercial development.

Application diversity spans traditional sectors such as defense and mapping to emerging areas including precision agriculture, smart city development, and climate monitoring. The integration of big data analytics and cloud computing technologies has enhanced the value proposition of satellite imagery services, enabling more sophisticated analysis and faster decision-making processes for end users across various industries.

Strategic positioning of China’s satellite imagery services market reflects the country’s commitment to achieving technological independence and leadership in space-based earth observation capabilities. The market demonstrates several critical insights that shape its development trajectory and competitive dynamics:

Market maturation indicators include increasing standardization of data formats, development of industry-specific solutions, and growing emphasis on value-added services rather than raw data provision. The market shows strong potential for continued expansion as downstream applications become more sophisticated and user-friendly.

Government policy support serves as the primary driver for China’s satellite imagery services market, with comprehensive national strategies promoting space technology development and commercial space industry growth. The 14th Five-Year Plan specifically emphasizes satellite technology advancement and earth observation capabilities as strategic priorities for national development. Policy frameworks encourage private sector participation while maintaining strategic control over critical space infrastructure.

Technological advancement in satellite manufacturing, launch capabilities, and data processing systems drives market expansion through improved service quality and reduced operational costs. Domestic development of high-resolution imaging satellites and advanced sensor technologies reduces dependence on foreign suppliers while enhancing competitive positioning in global markets. Innovation in miniaturized satellite systems and constellation deployment strategies enables more frequent and comprehensive earth observation coverage.

Commercial demand growth across multiple industry sectors creates expanding market opportunities for satellite imagery services. The precision agriculture sector demonstrates particularly strong adoption rates, with farmers and agricultural companies utilizing satellite data for crop monitoring, yield prediction, and resource optimization. Urban development projects increasingly rely on satellite imagery for planning, monitoring, and environmental impact assessment, driving sustained demand for high-quality geospatial data.

National security considerations motivate continued investment in indigenous satellite capabilities and data processing infrastructure. The emphasis on technological sovereignty drives development of domestic alternatives to foreign satellite imagery services, creating opportunities for local companies and reducing strategic dependencies on international providers.

High capital requirements for satellite development, launch, and ground infrastructure present significant barriers to market entry, particularly for smaller companies seeking to compete with established players. The technical complexity of satellite systems and the specialized expertise required for successful operations limit the number of organizations capable of providing comprehensive satellite imagery services.

Regulatory constraints governing satellite operations, data distribution, and international cooperation create compliance challenges for market participants. Data security regulations require domestic processing and storage of sensitive imagery data, necessitating substantial investments in local infrastructure and potentially limiting international market opportunities for Chinese companies.

Technology gaps in certain specialized areas such as hyperspectral imaging and advanced radar systems may limit competitive positioning relative to international providers. The long development cycles required for satellite systems and the substantial upfront investments needed before revenue generation create financial risks for companies entering the market.

Market fragmentation across different application sectors and customer segments can limit economies of scale and increase operational complexity for service providers. Competition from established international providers with proven track records and advanced technologies presents ongoing challenges for domestic companies seeking to expand their market presence.

Emerging applications in smart city development, environmental monitoring, and climate change research present substantial growth opportunities for satellite imagery service providers. The Belt and Road Initiative creates international market opportunities for Chinese satellite imagery companies to support infrastructure development projects across participating countries, with demand growing at approximately 15.2% annually in target regions.

Technology convergence opportunities exist in combining satellite imagery with other data sources such as IoT sensors, mobile devices, and social media to create comprehensive situational awareness solutions. The integration of 5G networks with satellite communication systems enables real-time data transmission and processing capabilities that enhance service value propositions.

Commercial space sector growth creates opportunities for specialized service providers to develop niche solutions for specific industry verticals. The agricultural technology sector shows particular promise, with precision farming applications driving demand for frequent, high-resolution imagery and analytical services. Disaster response and emergency management applications present opportunities for rapid-response satellite imagery services.

International partnerships and joint ventures offer pathways for technology transfer, market access, and capability enhancement. Export opportunities for Chinese satellite imagery services are expanding as domestic companies develop competitive capabilities and seek to monetize their investments through international market participation.

Supply chain dynamics in China’s satellite imagery services market reflect the country’s strategic emphasis on developing complete domestic capabilities across all components of the satellite value chain. Upstream activities including satellite manufacturing, launch services, and ground station development are increasingly dominated by domestic companies supported by government investment and policy incentives.

Demand patterns show strong growth in commercial applications, with the agriculture sector representing approximately 28% of total market demand for satellite imagery services. Government agencies continue to represent the largest customer segment, but commercial adoption is accelerating as costs decrease and service quality improves. Seasonal variations in demand reflect agricultural cycles and disaster monitoring requirements.

Competitive dynamics feature increasing collaboration between traditional aerospace companies and technology startups specializing in data analytics and software development. Vertical integration strategies are common among larger players seeking to control the entire value chain from satellite manufacturing to end-user applications. Horizontal partnerships enable companies to combine complementary capabilities and access new market segments.

Pricing dynamics reflect ongoing cost reductions in satellite manufacturing and launch services, enabling more competitive pricing for end users. The commoditization of basic imagery services drives companies to focus on value-added analytics and specialized applications to maintain profit margins and competitive differentiation.

Primary research for analyzing China’s satellite imagery services market involved comprehensive interviews with industry executives, government officials, technology developers, and end-user organizations across multiple sectors. Survey methodologies captured quantitative data on market adoption rates, spending patterns, and technology preferences from representative samples of market participants.

Secondary research incorporated analysis of government publications, industry reports, patent filings, and academic research to understand technology trends and market developments. Data triangulation methods ensured accuracy and reliability of market insights by cross-referencing multiple information sources and validation through expert interviews.

Market sizing methodologies employed bottom-up and top-down approaches to validate market scope and growth projections. Segmentation analysis utilized clustering techniques to identify distinct customer groups and application areas with unique characteristics and requirements. Competitive intelligence gathering involved systematic monitoring of company announcements, product launches, and strategic partnerships.

Analytical frameworks included Porter’s Five Forces analysis, SWOT assessment, and technology lifecycle evaluation to understand market structure and competitive dynamics. Forecasting models incorporated multiple scenarios to account for policy changes, technology developments, and economic factors that could influence market evolution.

Beijing region serves as the primary hub for China’s satellite imagery services market, hosting major space technology companies, research institutions, and government agencies. The region accounts for approximately 35% of national market activity and leads in technology development, policy formulation, and international cooperation initiatives. Zhongguancun Science Park concentrates numerous satellite technology startups and established companies developing innovative applications and services.

Shanghai metropolitan area represents the second-largest regional market, with strong commercial applications in urban planning, port management, and financial services. The region’s international business orientation drives demand for satellite imagery services supporting global trade and logistics operations. Yangtze River Delta integration creates opportunities for regional satellite imagery applications in transportation, environmental monitoring, and industrial development.

Shenzhen and Guangdong Province demonstrate rapid growth in commercial satellite imagery applications, particularly in manufacturing, logistics, and technology sectors. The region’s innovation ecosystem supports development of consumer-oriented satellite imagery applications and mobile technology integration. Pearl River Delta industrial clusters drive demand for environmental monitoring and supply chain management applications.

Western regions including Xinjiang, Tibet, and Inner Mongolia present unique opportunities for satellite imagery services in natural resource exploration, agriculture monitoring, and border security applications. These regions account for approximately 18% of specialized market applications despite lower population density, reflecting the strategic importance of satellite monitoring in remote areas.

Market leadership in China’s satellite imagery services sector is characterized by a combination of state-owned enterprises, private companies, and research institutions working collaboratively to advance national capabilities. The competitive environment reflects strategic priorities for technological independence and commercial competitiveness in global markets.

Strategic partnerships between domestic companies and international technology providers facilitate knowledge transfer and capability development. Competition intensity varies across different market segments, with government contracts typically involving established players while commercial applications see increasing participation from startups and specialized service providers.

By Technology Type: The market segments into optical imaging systems, synthetic aperture radar (SAR), hyperspectral imaging, and multispectral sensors. Optical imaging dominates with approximately 52% market share due to widespread applications and established technology maturity. SAR technology shows rapid growth in specialized applications requiring all-weather monitoring capabilities.

By Application Sector: Key segments include agriculture and forestry, urban planning and development, defense and security, environmental monitoring, disaster management, and mining and energy. Agricultural applications represent the fastest-growing commercial segment, while defense applications maintain the largest overall market share.

By End User: The market serves government agencies, commercial enterprises, research institutions, and international organizations. Government customers account for approximately 65% of total market demand, though commercial adoption is accelerating rapidly across multiple industry sectors.

By Service Type: Segmentation includes raw imagery data, processed imagery products, analytical services, and custom solutions. Value-added analytical services show the highest growth rates as customers seek actionable insights rather than raw data.

Government and Defense Applications: This category represents the most mature and stable market segment, with established procurement processes and long-term contracts. National security applications drive continuous investment in advanced imaging capabilities and domestic technology development. Border monitoring and maritime surveillance applications show particular strength, with specialized requirements for real-time data processing and analysis.

Commercial Agriculture: The agricultural segment demonstrates exceptional growth potential, with precision farming adoption increasing at approximately 22% annually among large-scale farming operations. Crop monitoring services provide farmers with actionable intelligence for irrigation management, pest control, and yield optimization. Insurance applications for crop damage assessment create additional revenue opportunities for service providers.

Urban Development and Planning: This category benefits from China’s continued urbanization and smart city initiatives. Construction monitoring applications help track infrastructure development progress and ensure compliance with planning regulations. Traffic management and transportation planning applications integrate satellite imagery with other data sources to optimize urban mobility systems.

Environmental and Climate Monitoring: Growing environmental awareness and regulatory requirements drive demand for satellite-based monitoring services. Air quality assessment and water resource management applications support government environmental protection initiatives and corporate sustainability programs.

Technology Providers benefit from substantial government support for domestic space technology development, creating opportunities for innovation and market expansion. Research and development incentives enable companies to invest in advanced technologies while reducing financial risks. Market protection policies provide domestic companies with competitive advantages in securing government contracts and sensitive applications.

End Users gain access to increasingly sophisticated satellite imagery services at competitive prices due to domestic competition and technology advancement. Data sovereignty ensures that sensitive information remains within national boundaries, addressing security concerns for government and critical infrastructure applications. Customization capabilities allow users to obtain tailored solutions that meet specific operational requirements.

Government Stakeholders achieve strategic objectives including technological independence, national security enhancement, and economic development through space industry growth. Dual-use technologies developed for satellite imagery applications contribute to broader technological capabilities and innovation ecosystems. International competitiveness in space technology enhances China’s global standing and creates opportunities for technology export and cooperation.

Research Institutions benefit from increased funding opportunities and collaboration with industry partners on advanced satellite technology development. Talent development programs supported by industry growth create career opportunities for graduates and researchers in space technology fields.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration represents the most significant technological trend, with machine learning algorithms increasingly used for automated image analysis, pattern recognition, and anomaly detection. Deep learning applications enable more sophisticated interpretation of satellite imagery data, reducing the need for manual analysis and improving accuracy of insights. Real-time processing capabilities are becoming standard requirements for many applications.

Constellation Deployment Strategies are shifting toward larger numbers of smaller satellites to provide more frequent coverage and improved temporal resolution. CubeSat technology adoption enables cost-effective constellation development while maintaining acceptable image quality for many applications. Coordinated satellite operations allow for simultaneous multi-angle imaging and enhanced data collection capabilities.

Cloud-Based Service Delivery is transforming how satellite imagery services are accessed and utilized by end users. Software-as-a-Service models reduce barriers to adoption for smaller organizations while providing scalable access to advanced analytical capabilities. API-based integration enables seamless incorporation of satellite imagery into existing business workflows and decision-making processes.

Hyperspectral Imaging Advancement creates new opportunities for specialized applications in agriculture, mining, and environmental monitoring. Spectral analysis capabilities enable identification of specific materials, crop health assessment, and pollution detection with unprecedented precision. Miniaturization of hyperspectral sensors makes this technology more accessible for commercial applications.

Policy Initiatives: The Chinese government has implemented comprehensive policies supporting commercial space development, including streamlined licensing procedures and financial incentives for private companies. National Space Administration reforms have created more opportunities for commercial participation in government programs while maintaining strategic oversight of critical capabilities.

Technology Breakthroughs: Recent advances in satellite miniaturization and launch cost reduction have made satellite imagery services more economically viable for commercial applications. Domestic launch capabilities have achieved significant cost reductions, with launch costs decreasing by approximately 40% over the past five years through technological improvements and operational efficiency gains.

International Partnerships: Strategic collaborations with international space agencies and technology companies have accelerated capability development and market access. Technology transfer agreements and joint development programs have enhanced domestic capabilities while providing pathways for global market participation.

Commercial Milestones: Several Chinese companies have achieved significant milestones in satellite constellation deployment and commercial service delivery. MarkWide Research analysis indicates that domestic satellite imagery service providers have achieved competitive parity with international providers in several key application areas, particularly in agricultural monitoring and urban planning applications.

Technology Investment Priorities: Companies should prioritize development of AI-powered analytics capabilities and real-time processing systems to differentiate their service offerings and capture higher-value market segments. Investment in hyperspectral imaging technology and synthetic aperture radar capabilities will enable access to specialized application markets with premium pricing opportunities.

Market Entry Strategies: New entrants should focus on niche applications and specialized customer segments rather than competing directly with established players in commodity imagery markets. Partnership strategies with technology companies, system integrators, and end-user organizations can provide market access and capability enhancement opportunities.

International Expansion: Companies should leverage Belt and Road Initiative opportunities to establish international market presence while building experience in global project delivery. Technology export strategies should focus on countries with complementary capabilities and regulatory frameworks that support international cooperation.

Service Development: Focus on value-added services and industry-specific solutions rather than generic imagery provision to maintain competitive differentiation and pricing power. Subscription-based service models provide more predictable revenue streams and stronger customer relationships than transaction-based approaches.

Market evolution over the next decade will be characterized by continued technology advancement, expanding commercial applications, and increasing integration with other digital technologies. MarkWide Research projects that the commercial segment will grow at approximately 18.5% annually through 2030, driven by increasing adoption in agriculture, urban planning, and environmental monitoring applications.

Technology trends will focus on enhanced automation, real-time processing capabilities, and integration with emerging technologies such as 5G networks and edge computing systems. Constellation sizes are expected to increase significantly, with some operators planning deployments of hundreds of satellites to provide near-continuous global coverage and improved temporal resolution.

Market structure will likely evolve toward greater specialization, with companies focusing on specific technology areas, application sectors, or geographic regions. Vertical integration strategies may become less common as the market matures and specialized service providers develop competitive advantages in specific value chain segments.

International competitiveness of Chinese satellite imagery service providers is expected to improve substantially, with domestic companies achieving global market leadership in selected application areas and technology segments. Export opportunities will expand as domestic capabilities mature and international customers recognize the quality and cost-effectiveness of Chinese satellite imagery services.

China’s satellite imagery services market represents a dynamic and rapidly evolving sector that combines strategic national priorities with expanding commercial opportunities. The market benefits from strong government support, substantial investment in technology development, and growing demand across multiple application sectors. Technological advancement continues to drive market expansion, with artificial intelligence integration and constellation deployment strategies creating new capabilities and service offerings.

Competitive dynamics reflect the unique characteristics of China’s space industry, combining state-owned enterprises with emerging private companies in a collaborative ecosystem focused on achieving technological independence and global competitiveness. The market demonstrates strong potential for continued growth, driven by expanding commercial applications and increasing sophistication of satellite imagery services.

Future success in this market will depend on continued innovation, effective integration of emerging technologies, and development of specialized solutions that address specific customer needs. Companies that can combine advanced technical capabilities with deep understanding of application requirements will be best positioned to capitalize on the substantial opportunities presented by China’s expanding satellite imagery services market.

What is Satellite Imagery Services?

Satellite Imagery Services involve the collection, processing, and distribution of images captured by satellites. These services are used in various applications such as agriculture, urban planning, and environmental monitoring.

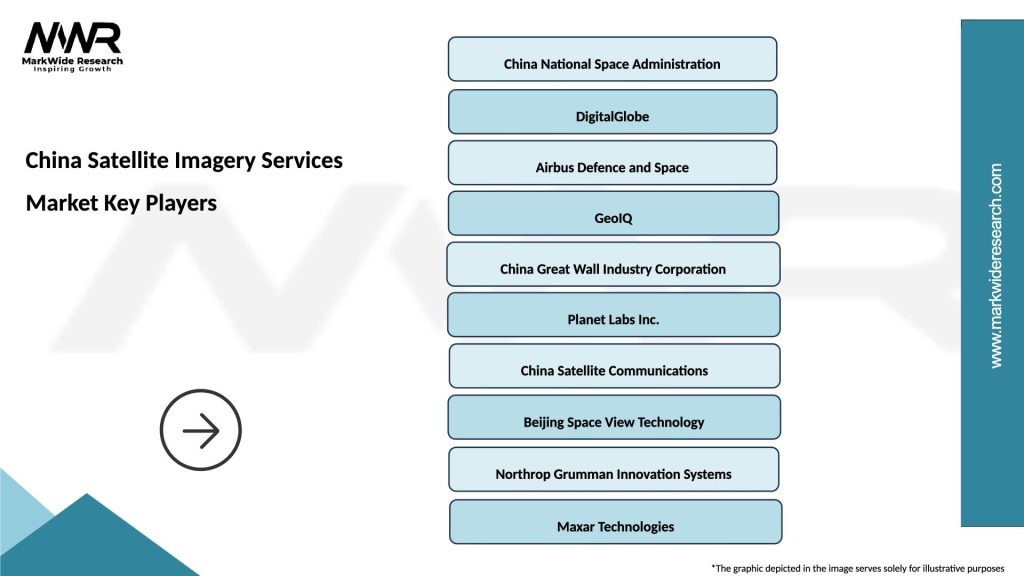

What are the key players in the China Satellite Imagery Services Market?

Key players in the China Satellite Imagery Services Market include companies like China Aerospace Science and Technology Corporation, DigitalGlobe, and GeoIQ, among others.

What are the growth factors driving the China Satellite Imagery Services Market?

The growth of the China Satellite Imagery Services Market is driven by increasing demand for geospatial data in sectors like agriculture, defense, and disaster management. Additionally, advancements in satellite technology and data analytics are enhancing service capabilities.

What challenges does the China Satellite Imagery Services Market face?

Challenges in the China Satellite Imagery Services Market include regulatory hurdles, high operational costs, and competition from alternative data sources. These factors can hinder market growth and service adoption.

What opportunities exist in the China Satellite Imagery Services Market?

Opportunities in the China Satellite Imagery Services Market include the expansion of smart city initiatives and the growing need for environmental monitoring. The integration of artificial intelligence in data analysis also presents significant potential for innovation.

What trends are shaping the China Satellite Imagery Services Market?

Trends in the China Satellite Imagery Services Market include the increasing use of high-resolution imagery and real-time data processing. Additionally, there is a growing focus on sustainability and the use of satellite data for climate change monitoring.

China Satellite Imagery Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Earth Observation, Mapping, Surveillance, Disaster Management |

| Technology | Optical, Radar, Hyperspectral, LiDAR |

| End User | Aerospace, Agriculture, Environmental Monitoring, Urban Planning |

| Deployment | Cloud-Based, On-Premises, Hybrid, Mobile |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Satellite Imagery Services Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at