444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China rigid plastic packaging market represents one of the most dynamic and rapidly evolving sectors within the global packaging industry. China’s manufacturing prowess combined with increasing consumer demand for durable, lightweight, and cost-effective packaging solutions has positioned the country as a dominant force in rigid plastic packaging production and consumption. The market encompasses a diverse range of products including bottles, containers, jars, trays, and specialized packaging formats across multiple industries.

Market growth in China’s rigid plastic packaging sector is driven by robust industrialization, urbanization trends, and expanding consumer goods markets. The food and beverage industry remains the largest consumer segment, accounting for approximately 45% of total market demand. Additionally, pharmaceutical, personal care, and household products sectors contribute significantly to market expansion. Technological advancements in manufacturing processes, including injection molding, blow molding, and thermoforming, have enhanced production efficiency and product quality standards.

Regional distribution shows concentrated manufacturing activities in eastern coastal provinces, with Guangdong, Jiangsu, and Zhejiang leading production capabilities. The market demonstrates strong growth momentum with an estimated compound annual growth rate of 6.2%, reflecting China’s position as both a major producer and consumer of rigid plastic packaging solutions.

The China rigid plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and consumption of non-flexible plastic packaging materials within Chinese territory. Rigid plastic packaging encompasses containers and packaging solutions that maintain their shape and structural integrity under normal handling conditions, manufactured from various polymer materials including polyethylene terephthalate (PET), high-density polyethylene (HDPE), polypropylene (PP), and polystyrene (PS).

Market definition includes primary packaging applications such as bottles for beverages and pharmaceuticals, food containers, cosmetic jars, and industrial packaging solutions. The scope extends beyond domestic consumption to include export-oriented manufacturing activities, making China a significant global supplier of rigid plastic packaging products. Value chain integration spans raw material procurement, manufacturing processes, quality control systems, and distribution networks serving both domestic and international markets.

Industry classification encompasses various manufacturing techniques including injection molding for complex shapes, blow molding for hollow containers, and thermoforming for tray and container applications. The market represents a critical component of China’s broader packaging industry, supporting diverse sectors from food processing to pharmaceutical manufacturing.

China’s rigid plastic packaging market demonstrates exceptional growth potential driven by sustained economic development, changing consumer preferences, and expanding industrial applications. The market benefits from China’s established manufacturing infrastructure, competitive labor costs, and proximity to major raw material suppliers. Key market dynamics include increasing demand for sustainable packaging solutions, technological innovations in barrier properties, and growing emphasis on food safety standards.

Strategic positioning reveals China’s dual role as both a major domestic consumer and global exporter of rigid plastic packaging products. The food and beverage sector maintains market leadership, while pharmaceutical and personal care segments show accelerated growth rates. Manufacturing capabilities continue expanding with investments in advanced production technologies and automation systems.

Market challenges include environmental regulations promoting sustainable packaging alternatives, fluctuating raw material costs, and increasing competition from flexible packaging formats. However, opportunities emerge from e-commerce growth, premium product segments, and international market expansion. Industry consolidation trends indicate larger manufacturers gaining market share through strategic acquisitions and capacity expansions.

Market intelligence reveals several critical insights shaping China’s rigid plastic packaging landscape:

Economic growth serves as the primary catalyst driving China’s rigid plastic packaging market expansion. Rising disposable incomes and urbanization trends fuel increased consumption of packaged goods across food, beverage, and consumer product categories. Industrial development in manufacturing sectors creates sustained demand for protective packaging solutions, while export-oriented industries require high-quality packaging meeting international standards.

Consumer lifestyle changes significantly impact market dynamics, with growing preference for convenience foods, ready-to-drink beverages, and personal care products driving packaging demand. E-commerce expansion creates new requirements for durable packaging capable of protecting products during shipping and handling processes. The rise of premium product segments demands sophisticated packaging solutions with enhanced aesthetic appeal and functional properties.

Technological advancements in manufacturing processes enable cost-effective production of complex packaging designs with improved barrier properties and extended shelf life capabilities. Government initiatives supporting manufacturing sector development, including favorable policies for foreign investment and infrastructure improvements, contribute to market growth momentum.

Environmental regulations present significant challenges for China’s rigid plastic packaging market, with increasing restrictions on single-use plastics and mandatory recycling requirements. Sustainability concerns from consumers and regulatory bodies drive demand for alternative packaging materials, potentially limiting market growth in traditional plastic segments.

Raw material price volatility affects manufacturing costs and profit margins, particularly for petroleum-based polymer materials. Supply chain disruptions and fluctuating crude oil prices create uncertainty in production planning and pricing strategies. Competition from flexible packaging alternatives offers cost advantages and improved functionality in certain applications, challenging rigid plastic packaging market share.

Quality control challenges in maintaining consistent product standards across diverse manufacturing facilities impact export competitiveness. Labor cost increases and skilled workforce shortages in manufacturing regions affect production efficiency and operational costs. Stringent international quality standards and certification requirements create barriers for smaller manufacturers seeking to enter export markets.

Sustainable packaging innovation presents substantial opportunities for market participants developing biodegradable and recyclable rigid plastic solutions. Circular economy initiatives create demand for packaging designs facilitating easy recycling and material recovery processes. Advanced barrier technologies enable expansion into high-value applications requiring extended shelf life and product protection.

Premium market segments offer growth opportunities through specialized packaging solutions for luxury goods, organic products, and health-conscious consumer categories. Smart packaging integration incorporating sensors, indicators, and digital connectivity features opens new market possibilities across pharmaceutical and food safety applications.

International market expansion through strategic partnerships and direct investment in overseas manufacturing facilities enables access to global markets. Industry consolidation creates opportunities for strategic acquisitions and capacity expansion among leading manufacturers. Government support for advanced manufacturing technologies and export promotion provides favorable conditions for market development.

Supply chain integration characterizes China’s rigid plastic packaging market dynamics, with vertical integration strategies enabling manufacturers to control raw material costs and quality standards. Competitive landscape features both large multinational corporations and numerous small-to-medium enterprises serving regional markets and specialized applications.

Technology transfer and joint venture arrangements facilitate knowledge sharing and capability development among domestic manufacturers. Market consolidation trends indicate larger companies acquiring smaller competitors to expand geographic coverage and production capacity. Innovation cycles drive continuous product development in barrier properties, design flexibility, and manufacturing efficiency.

Regulatory compliance requirements influence product development priorities and manufacturing processes, with increasing emphasis on food safety standards and environmental impact reduction. Customer relationship management becomes increasingly important as manufacturers develop closer partnerships with major brand owners and retailers. Digital transformation initiatives improve supply chain visibility and operational efficiency across manufacturing and distribution networks.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence for China’s rigid plastic packaging sector. Primary research includes structured interviews with industry executives, manufacturing facility visits, and surveys of key market participants across the value chain.

Secondary research encompasses analysis of government statistics, industry association reports, trade publications, and company financial statements. Market sizing methodologies utilize production capacity data, consumption patterns, and trade flow analysis to establish market parameters and growth projections.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical analysis to ensure information accuracy and reliability. Trend analysis incorporates historical data patterns, current market conditions, and forward-looking indicators to develop comprehensive market insights. Regional analysis examines provincial-level data and manufacturing cluster characteristics to understand geographic market dynamics.

Eastern China dominates rigid plastic packaging manufacturing with Guangdong Province leading production capacity and export activities. Jiangsu Province hosts numerous multinational manufacturing facilities and serves as a major supply hub for domestic and international markets. Zhejiang Province specializes in small-to-medium container production and innovative packaging solutions for consumer goods applications.

Northern regions including Beijing and Tianjin focus on high-value pharmaceutical and food packaging applications, benefiting from proximity to major consumer markets. Central China emerges as a growing manufacturing hub with lower operational costs and improved transportation infrastructure connecting eastern and western markets.

Western provinces show increasing manufacturing activity driven by government incentives and expanding domestic consumption. Regional specialization patterns indicate coastal areas focusing on export-oriented production while inland regions serve domestic market demand. Infrastructure development including high-speed rail networks and logistics facilities improves market connectivity and distribution efficiency across regions.

Market leadership in China’s rigid plastic packaging sector features a combination of international corporations and domestic manufacturers competing across various market segments:

Competitive strategies emphasize technological innovation, capacity expansion, and strategic partnerships with major brand owners. Market positioning varies from cost leadership in commodity segments to differentiation through specialized applications and premium product offerings.

By Material Type:

By Application:

By Manufacturing Process:

Food packaging applications represent the largest market segment, driven by China’s expanding food processing industry and changing consumer preferences toward packaged foods. Innovation focus includes extended shelf life capabilities, microwave-safe containers, and portion control packaging formats. Regulatory compliance with food safety standards drives material selection and manufacturing process improvements.

Beverage packaging shows strong growth momentum with increasing consumption of bottled water, soft drinks, and premium beverage categories. Lightweighting initiatives reduce material usage while maintaining container performance and consumer appeal. Barrier technology advancements enable extended shelf life for sensitive beverage products.

Pharmaceutical packaging demands highest quality standards with stringent regulatory requirements and specialized features including child-resistant closures and tamper-evident seals. Market growth reflects China’s expanding pharmaceutical industry and aging population demographics. Serialization requirements drive adoption of smart packaging technologies and track-and-trace capabilities.

Personal care packaging emphasizes aesthetic appeal and premium positioning with sophisticated design elements and specialized dispensing systems. Sustainability trends influence material selection and refillable packaging concepts. Customization capabilities enable brand differentiation through unique container shapes and decorative features.

Manufacturers benefit from China’s competitive manufacturing environment including lower production costs, skilled workforce availability, and established supply chain networks. Economies of scale enable cost-effective production of large volume orders while maintaining quality standards. Technology access through partnerships and joint ventures facilitates capability development and innovation.

Brand owners gain access to comprehensive packaging solutions with customization capabilities and reliable supply chain support. Cost advantages improve product competitiveness in domestic and international markets. Quality assurance programs ensure consistent product performance and regulatory compliance.

Consumers benefit from improved product protection, convenience features, and aesthetic appeal of rigid plastic packaging solutions. Food safety enhancements through advanced barrier properties and contamination prevention. Sustainability initiatives provide environmentally responsible packaging options with recycling capabilities.

Government stakeholders benefit from industrial development, employment generation, and export revenue contributions. Environmental programs promote sustainable manufacturing practices and waste reduction initiatives. Economic development in manufacturing regions supports broader industrialization objectives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping China’s rigid plastic packaging market, with manufacturers investing in recycled content integration and circular economy initiatives. Lightweighting technologies reduce material usage while maintaining packaging performance and functionality. Bio-based materials development offers alternatives to traditional petroleum-based polymers.

Smart packaging integration incorporates digital technologies including QR codes, NFC chips, and sensor systems enabling product authentication and supply chain traceability. Consumer engagement features provide interactive experiences and product information access. Anti-counterfeiting measures protect brand integrity and consumer safety.

Customization capabilities enable brand differentiation through unique container shapes, colors, and decorative elements. Digital printing technologies facilitate short-run customization and rapid design changes. Premium positioning drives demand for sophisticated packaging solutions with enhanced aesthetic appeal.

E-commerce optimization influences packaging design priorities including durability, stackability, and shipping efficiency. Unboxing experience considerations affect consumer perception and brand loyalty. Return logistics requirements drive reusable and recyclable packaging concepts.

Capacity expansion initiatives by major manufacturers include new production facilities and technology upgrades to meet growing market demand. Strategic acquisitions consolidate market position and expand geographic coverage among leading companies. Joint venture agreements facilitate technology transfer and market access for international players.

Sustainability investments focus on recycling infrastructure development and closed-loop packaging systems. Research partnerships with universities and technology institutes advance material science and manufacturing process innovations. Certification achievements including ISO standards and industry-specific quality approvals enhance market credibility.

Digital transformation projects implement Industry 4.0 technologies including automated production systems and predictive maintenance capabilities. Supply chain optimization initiatives improve efficiency and reduce environmental impact through logistics improvements. Customer collaboration programs develop customized solutions and strengthen business relationships.

MarkWide Research analysis indicates that market participants should prioritize sustainability initiatives and circular economy strategies to address regulatory requirements and consumer preferences. Investment recommendations include advanced recycling technologies and bio-based material development to maintain competitive positioning in evolving market conditions.

Strategic focus should emphasize premium market segments and value-added applications offering higher profit margins and growth potential. Technology adoption in smart packaging and digital integration creates differentiation opportunities and enhanced customer value propositions. Quality certification achievements enable access to international markets and premium customer segments.

Partnership strategies with brand owners and retailers facilitate long-term business relationships and collaborative innovation programs. Geographic expansion into emerging markets provides growth opportunities beyond traditional manufacturing regions. Operational excellence initiatives including lean manufacturing and automation improve cost competitiveness and quality consistency.

Market trajectory for China’s rigid plastic packaging sector indicates continued growth driven by economic development, urbanization, and expanding consumer goods markets. Sustainability transformation will reshape industry dynamics with increasing emphasis on recyclable materials and circular economy principles. Technology integration including smart packaging and digital connectivity features will create new market opportunities and applications.

Innovation priorities focus on advanced barrier properties, lightweighting technologies, and sustainable material alternatives. MWR projections suggest that manufacturers investing in sustainability and premium market positioning will achieve superior growth performance. Regulatory evolution will continue influencing material selection and manufacturing processes toward more environmentally responsible solutions.

Competitive landscape evolution indicates further consolidation among manufacturers seeking scale advantages and technology capabilities. International expansion opportunities will grow as Chinese manufacturers achieve quality standards and certifications required for global markets. Digital transformation will enhance operational efficiency and customer service capabilities across the value chain.

Long-term prospects remain positive with estimated growth rates of 6-8% annually over the next five years, supported by domestic consumption growth and export market expansion. Investment opportunities exist in sustainable packaging solutions, premium applications, and technology-enhanced manufacturing capabilities.

China’s rigid plastic packaging market represents a dynamic and evolving sector with substantial growth potential driven by economic development, technological innovation, and changing consumer preferences. The market benefits from established manufacturing capabilities, competitive cost structures, and comprehensive supply chain networks supporting both domestic consumption and export activities.

Key success factors include sustainability initiatives, quality improvements, and technology adoption enabling manufacturers to address regulatory requirements and market demands. Strategic opportunities exist in premium market segments, smart packaging applications, and international market expansion through quality certification and partnership development.

Future market development will be shaped by environmental regulations, technological advancement, and evolving consumer expectations toward sustainable and functional packaging solutions. Industry participants investing in innovation, sustainability, and operational excellence are positioned to achieve superior performance in this competitive and growing market environment.

What is Rigid Plastic Packaging?

Rigid plastic packaging refers to containers made from plastic that maintain their shape and do not deform under normal handling. This type of packaging is commonly used for products such as food, beverages, and consumer goods due to its durability and versatility.

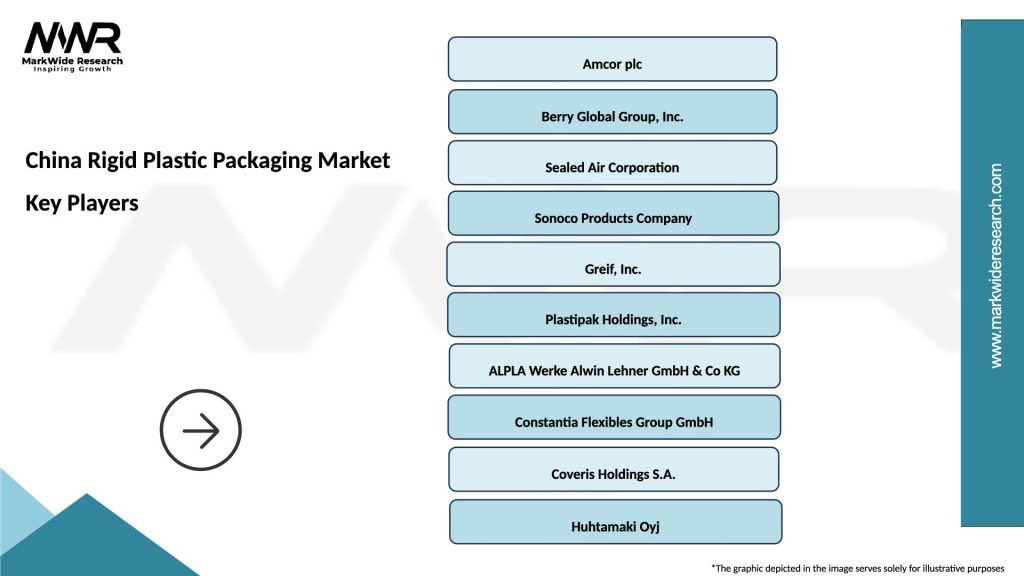

What are the key players in the China Rigid Plastic Packaging Market?

Key players in the China Rigid Plastic Packaging Market include companies like Amcor, Berry Global, and Sealed Air, which are known for their innovative packaging solutions. These companies focus on various applications, including food and beverage packaging, personal care, and household products, among others.

What are the growth factors driving the China Rigid Plastic Packaging Market?

The growth of the China Rigid Plastic Packaging Market is driven by increasing consumer demand for convenience and sustainability. Additionally, the rise in e-commerce and the need for efficient packaging solutions in the food and beverage sector contribute to market expansion.

What challenges does the China Rigid Plastic Packaging Market face?

The China Rigid Plastic Packaging Market faces challenges such as regulatory pressures regarding plastic waste and environmental concerns. Additionally, competition from alternative packaging materials and fluctuating raw material prices can impact market dynamics.

What opportunities exist in the China Rigid Plastic Packaging Market?

Opportunities in the China Rigid Plastic Packaging Market include the development of biodegradable and recyclable packaging solutions. Furthermore, innovations in design and functionality can enhance product appeal and meet the evolving needs of consumers.

What trends are shaping the China Rigid Plastic Packaging Market?

Trends in the China Rigid Plastic Packaging Market include a shift towards lightweight packaging and the integration of smart packaging technologies. Additionally, there is a growing emphasis on sustainability, with companies exploring eco-friendly materials and production processes.

China Rigid Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bottles, Containers, Trays, Tubs |

| Material | Polyethylene, Polypropylene, Polystyrene, PET |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household |

| Packaging Type | Flexible, Rigid, Resealable, Tamper-Evident |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Rigid Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at