444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s residential real estate market is a dynamic and thriving sector that plays a significant role in the country’s economy. With a population of over 1.4 billion people and rapid urbanization, the demand for housing in China remains robust. Residential real estate in China encompasses a wide range of properties, including apartments, villas, and townhouses, catering to the diverse needs of its population.

Meaning

The China residential real estate market refers to the buying, selling, and renting of residential properties across the country. It encompasses both the primary market, where new properties are developed and sold, and the secondary market, which involves the resale of existing properties. The market is influenced by various factors, including economic conditions, government policies, and demographic trends.

Executive Summary

The China residential real estate market has experienced significant growth in recent years. The urbanization trend, rising disposable incomes, and favorable government policies have fueled demand for housing. However, the market also faces challenges such as housing affordability, property speculation, and regulatory interventions. Despite these challenges, the market presents numerous opportunities for investors, developers, and stakeholders.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China residential real estate market is characterized by a dynamic interplay of various factors:

Regional Analysis

The residential real estate market in China exhibits regional variations in terms of market dynamics, supply and demand, and price trends. Major cities such as Beijing, Shanghai, and Shenzhen are known for their high property prices and robust market activity. These cities attract both domestic and international investors. Tier 2 and Tier 3 cities, on the other hand, offer opportunities for affordable housing and emerging market growth.

Competitive Landscape

Leading Companies in the China Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

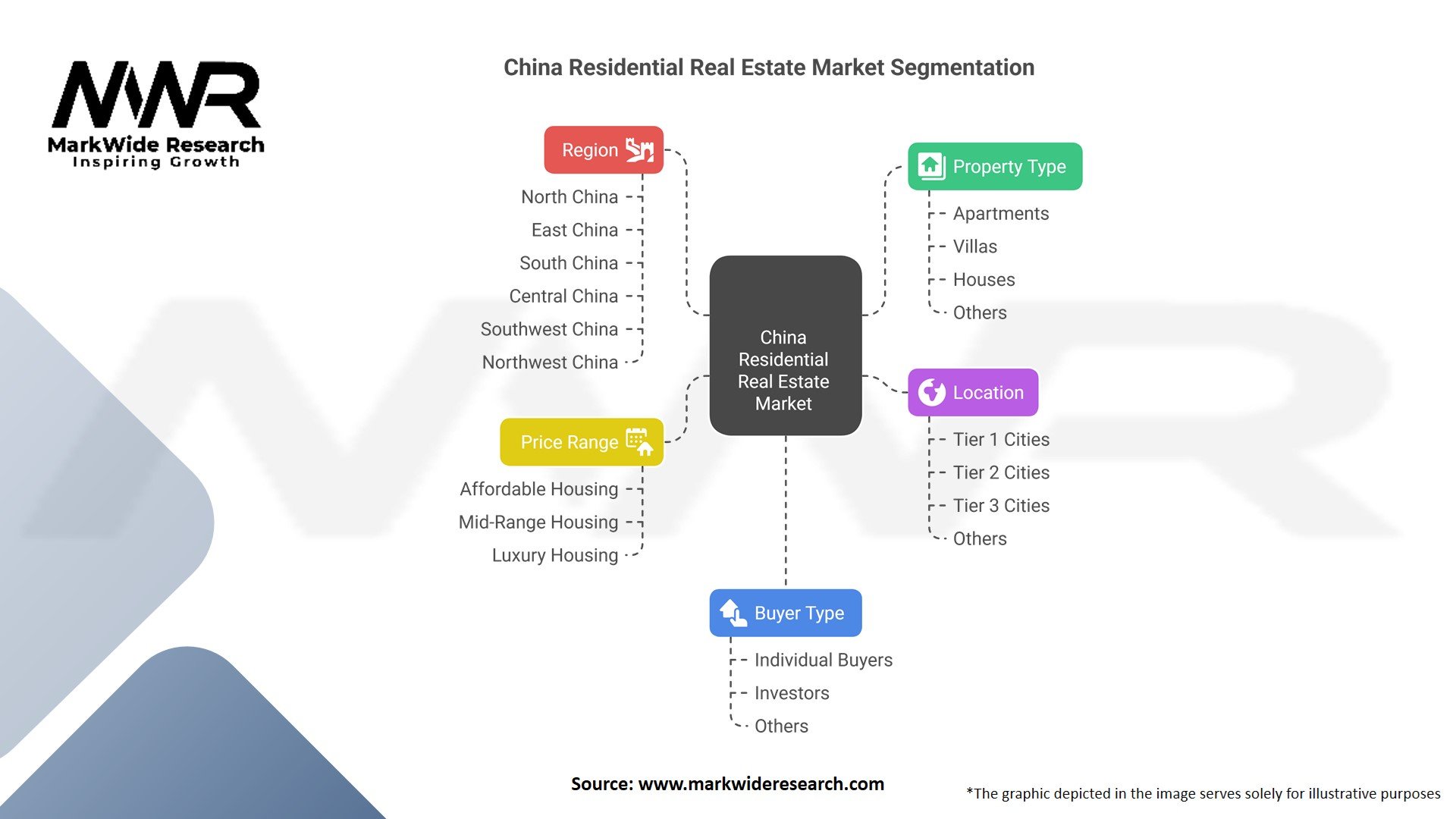

Segmentation

The China residential real estate market can be segmented based on various criteria, including property type, location, price range, and target market. Common property types include apartments, villas, townhouses, and mixed-use developments. Segmentation based on location encompasses major cities, emerging cities, and suburban areas.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the China residential real estate market. During the initial outbreak, market activity slowed down as people adhered to lockdown measures and faced economic uncertainties. However, as the situation improved and the economy recovered, the market rebounded. Government stimulus measures, including interest rate cuts and policy support, helped stabilize the market and restore buyer confidence.

The pandemic also accelerated certain trends, such as the adoption of digital technologies in property transactions and the growing preference for spacious homes with home office setups. The residential real estate market proved resilient, reflecting the fundamental demand for housing in China.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the China residential real estate market remains positive, driven by factors such as urbanization, population growth, and government policies. While challenges in affordability and regulatory interventions persist, the market presents opportunities for industry participants to innovate and adapt. Sustainable development, digital transformation, and catering to the evolving needs of homebuyers and renters will be key focus areas in the future.

Conclusion

The China residential real estate market is a vibrant and evolving sector that plays a crucial role in the country’s economy. Urbanization, population growth, and favorable government policies have fueled demand for housing. However, challenges such as housing affordability, regulatory interventions, and oversupply concerns exist. Industry participants can capitalize on opportunities in affordable housing, emerging cities, green development, and the rental market. Adapting to digital transformation and staying abreast of government policies will be crucial for success in this dynamic market. Despite challenges, the China residential real estate market holds immense potential for investors, developers, and stakeholders.

What is China Residential Real Estate?

China Residential Real Estate refers to the sector that encompasses the buying, selling, and leasing of residential properties in China, including apartments, houses, and condominiums.

What are the key players in the China Residential Real Estate Market?

Key players in the China Residential Real Estate Market include companies like Country Garden, Evergrande Group, and Vanke, which are involved in property development and management, among others.

What are the main drivers of the China Residential Real Estate Market?

The main drivers of the China Residential Real Estate Market include urbanization, increasing disposable incomes, and government policies aimed at promoting home ownership.

What challenges does the China Residential Real Estate Market face?

The China Residential Real Estate Market faces challenges such as regulatory restrictions, fluctuating demand, and concerns over housing affordability, which can impact market stability.

What opportunities exist in the China Residential Real Estate Market?

Opportunities in the China Residential Real Estate Market include the growth of smart homes, the development of sustainable housing projects, and the increasing demand for rental properties in urban areas.

What trends are shaping the China Residential Real Estate Market?

Trends shaping the China Residential Real Estate Market include a shift towards eco-friendly building practices, the rise of co-living spaces, and the integration of technology in property management.

China Residential Real Estate Market:

| Segment | Description |

|---|---|

| Property Type | Apartments, Villas, Houses, Others |

| Location | Tier 1 Cities, Tier 2 Cities, Tier 3 Cities, Others |

| Price Range | Affordable Housing, Mid-Range Housing, Luxury Housing |

| Buyer Type | Individual Buyers, Investors, Others |

| Region | North China, East China, South China, Central China, Southwest China, Northwest China |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the China Residential Real Estate Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at