444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China rechargeable battery market stands as one of the most dynamic and rapidly evolving sectors in the global energy storage landscape. China’s dominance in battery manufacturing has positioned the country as a critical hub for lithium-ion, nickel-metal hydride, and emerging solid-state battery technologies. The market encompasses diverse applications ranging from consumer electronics and electric vehicles to grid-scale energy storage systems and industrial equipment.

Market expansion is driven by China’s aggressive push toward carbon neutrality by 2060, substantial government investments in renewable energy infrastructure, and the world’s largest electric vehicle adoption program. The country’s integrated supply chain, from raw material processing to battery cell manufacturing and recycling, creates a comprehensive ecosystem that supports sustained growth at a robust CAGR of 12.3% through the forecast period.

Manufacturing capabilities in China account for approximately 76% of global lithium-ion battery production capacity, with major players like CATL, BYD, and Gotion High-Tech leading technological innovations. The market benefits from economies of scale, advanced automation in production facilities, and continuous research and development investments that drive cost reductions and performance improvements across all battery chemistries.

The China rechargeable battery market refers to the comprehensive ecosystem of secondary battery technologies that can be recharged and reused multiple times, manufactured, distributed, and consumed within China’s domestic market and export channels. This market encompasses various battery chemistries including lithium-ion, nickel-metal hydride, lead-acid, and emerging technologies such as solid-state and sodium-ion batteries.

Rechargeable batteries in the Chinese context represent critical energy storage solutions that power everything from smartphones and laptops to electric vehicles, energy storage systems, and industrial applications. The market includes the entire value chain from raw material sourcing and processing, cell manufacturing, battery pack assembly, distribution networks, and end-of-life recycling services.

Strategic importance of this market extends beyond commercial applications, as it serves as a cornerstone of China’s energy security strategy, environmental sustainability goals, and technological sovereignty initiatives. The market’s scope includes both domestic consumption and China’s position as the world’s largest exporter of battery technologies to global markets.

China’s rechargeable battery market represents a transformative force in the global energy storage industry, characterized by unprecedented scale, technological innovation, and strategic government support. The market has evolved from a manufacturing hub focused on cost-competitive production to a center of innovation driving next-generation battery technologies and sustainable energy solutions.

Key market dynamics include the rapid expansion of electric vehicle adoption, which accounts for 58% of total battery demand, alongside growing requirements for grid-scale energy storage systems supporting renewable energy integration. Consumer electronics continue to represent a stable demand base, while emerging applications in aerospace, marine, and stationary storage create new growth opportunities.

Technological advancement remains a primary market driver, with Chinese companies investing heavily in solid-state battery development, silicon nanowire anodes, and advanced battery management systems. The market benefits from a complete domestic supply chain, reducing dependency on international suppliers and enabling rapid scaling of production capacity to meet both domestic and global demand.

Competitive landscape features both established industry leaders and innovative startups, creating a dynamic environment that fosters continuous improvement in energy density, charging speeds, safety features, and cost-effectiveness. Government policies supporting new energy vehicles and renewable energy deployment provide sustained market momentum through the forecast period.

Market segmentation reveals distinct growth patterns across different battery chemistries and applications, with lithium-ion technologies maintaining dominant market share while alternative chemistries gain traction in specific use cases. The following insights highlight critical market characteristics:

Government policy initiatives serve as the primary catalyst for market expansion, with China’s commitment to carbon neutrality creating unprecedented demand for energy storage solutions. The New Energy Vehicle mandate requires 40% of new car sales to be electric or hybrid by 2030, directly driving battery demand across passenger and commercial vehicle segments.

Renewable energy integration necessitates large-scale energy storage systems to manage grid stability and power quality as solar and wind generation capacity expands rapidly. Grid-scale battery installations support China’s goal of achieving 1,200 GW of renewable energy capacity by 2030, creating substantial demand for utility-scale battery systems.

Technological breakthroughs in battery chemistry and manufacturing processes continue to improve performance characteristics while reducing costs. Advances in lithium iron phosphate (LFP) chemistry have achieved cost parity with traditional lithium-ion technologies while offering enhanced safety and longer cycle life, expanding addressable market opportunities.

Consumer electronics evolution drives demand for higher-capacity, faster-charging batteries as smartphones, tablets, and wearable devices become more sophisticated. The proliferation of 5G networks and edge computing applications increases power requirements, necessitating advanced battery solutions with superior energy density and thermal management capabilities.

Industrial automation and the Internet of Things (IoT) create new applications for rechargeable batteries in sensors, monitoring systems, and autonomous equipment. These emerging use cases require specialized battery solutions optimized for long-term reliability, low maintenance, and consistent performance across diverse operating conditions.

Raw material supply constraints pose significant challenges to sustained market growth, particularly regarding lithium, cobalt, and nickel availability. Price volatility in critical battery materials creates cost pressures that impact manufacturing margins and end-user adoption rates, especially in price-sensitive market segments.

Safety concerns related to thermal runaway, fire hazards, and toxic material exposure continue to influence regulatory requirements and consumer acceptance. High-profile battery failures in electric vehicles and energy storage systems have heightened scrutiny of safety standards and quality control processes throughout the supply chain.

Environmental impact of battery production and disposal creates regulatory and social pressure for sustainable manufacturing practices. Mining operations for battery materials face increasing environmental restrictions, while end-of-life battery management requires substantial investment in recycling infrastructure and processes.

International trade tensions and technology transfer restrictions limit access to certain advanced materials and manufacturing equipment. Geopolitical considerations influence global supply chain strategies and may impact China’s ability to maintain technological leadership in emerging battery technologies.

Technical limitations of current battery technologies, including charging speed, energy density, and cycle life, constrain adoption in certain applications. Cold weather performance degradation and capacity fade over time remain challenges that require ongoing research and development investments to address effectively.

Emerging applications in aerospace, marine, and defense sectors present substantial growth opportunities for specialized high-performance battery systems. These markets require advanced technologies with superior energy density, reliability, and environmental resistance, commanding premium pricing and higher profit margins.

Energy storage system integration with smart grid technologies creates opportunities for advanced battery management systems and grid-interactive capabilities. Vehicle-to-grid (V2G) applications enable electric vehicle batteries to provide grid services, creating additional revenue streams and market value propositions.

International market expansion offers significant growth potential as global demand for electric vehicles and renewable energy storage accelerates. Chinese manufacturers can leverage cost advantages and technological capabilities to capture market share in developing economies and established automotive markets.

Next-generation technologies including solid-state batteries, silicon anodes, and alternative chemistries present opportunities for technological differentiation and premium market positioning. Early commercialization of breakthrough technologies can establish competitive advantages and intellectual property portfolios.

Circular economy initiatives create opportunities in battery recycling, refurbishment, and second-life applications. Developing comprehensive recycling capabilities can reduce raw material costs while addressing environmental concerns and regulatory requirements for sustainable battery lifecycle management.

Supply and demand dynamics in China’s rechargeable battery market reflect the complex interplay between rapid demand growth and expanding production capacity. MarkWide Research analysis indicates that demand growth consistently outpaces supply expansion, maintaining favorable pricing conditions and capacity utilization rates across major manufacturers.

Competitive intensity drives continuous innovation and cost reduction efforts as manufacturers compete for market share in both domestic and international markets. Price competition in commodity battery segments contrasts with premium pricing opportunities in advanced technology applications, creating diverse market dynamics across different product categories.

Technology evolution accelerates market transformation as new battery chemistries and manufacturing processes emerge from research laboratories into commercial production. The transition from research and development to mass production requires substantial capital investments and technical expertise, creating barriers to entry for new market participants.

Regulatory environment influences market dynamics through safety standards, environmental regulations, and trade policies. Evolving regulations regarding battery recycling, material sourcing, and product safety create compliance requirements that impact manufacturing costs and market access opportunities.

Investment flows into battery technology development and manufacturing capacity expansion reflect strong investor confidence in long-term market growth prospects. Venture capital and government funding support innovation in emerging technologies while established manufacturers invest in scaling proven technologies to meet growing demand.

Primary research methodologies employed in analyzing China’s rechargeable battery market include comprehensive surveys of industry participants, in-depth interviews with key executives, and direct engagement with manufacturing facilities and research institutions. Data collection encompasses production capacity assessments, technology roadmap evaluations, and market demand analysis across multiple end-use segments.

Secondary research incorporates analysis of government statistics, industry association reports, patent filings, and academic research publications to establish comprehensive market understanding. Financial analysis of publicly traded companies provides insights into market trends, investment patterns, and competitive positioning strategies.

Market modeling techniques utilize statistical analysis and forecasting methodologies to project future market developments based on historical trends, policy initiatives, and technology adoption patterns. Scenario analysis considers various growth trajectories under different regulatory and economic conditions to provide robust market projections.

Expert validation ensures research accuracy through consultation with industry specialists, technology experts, and market analysts familiar with China’s battery industry dynamics. Cross-verification of data sources and analytical findings maintains research integrity and reliability of market insights and projections.

Eastern China dominates battery manufacturing with major production clusters in Jiangsu, Zhejiang, and Guangdong provinces, accounting for approximately 62% of national production capacity. These regions benefit from established electronics manufacturing ecosystems, skilled workforce availability, and proximity to major ports for international trade.

Central China emerges as a significant manufacturing hub with substantial investments in Hubei, Hunan, and Anhui provinces. Government incentives and lower operational costs attract battery manufacturers seeking to expand capacity while maintaining cost competitiveness in domestic and export markets.

Western China focuses on raw material processing and mining operations, particularly lithium extraction and processing facilities in Qinghai, Tibet, and Xinjiang. These regions provide critical upstream supply chain components while developing downstream manufacturing capabilities to capture additional value creation opportunities.

Northeastern China leverages industrial heritage and automotive manufacturing presence to develop specialized battery applications for electric vehicles and industrial equipment. Collaboration between traditional automotive manufacturers and battery companies creates integrated supply chains and technology development partnerships.

Regional specialization patterns reflect comparative advantages in different aspects of the battery value chain, from raw material processing to advanced manufacturing and research and development activities. This geographic distribution creates resilient supply chains while enabling economies of scale and specialization benefits.

Market leadership in China’s rechargeable battery sector is characterized by intense competition among both established industry giants and innovative emerging companies. The competitive environment fosters rapid technological advancement and cost optimization across all market segments.

By Technology: The market segments into distinct technology categories, each serving specific application requirements and performance characteristics. Lithium-ion technologies dominate with 78% market share, while alternative chemistries address specialized applications and cost-sensitive segments.

By Application: Market segmentation reflects diverse end-use requirements and growth patterns across different industry sectors and consumer applications.

Electric Vehicle Batteries represent the most dynamic market category with rapid technological advancement and substantial investment in manufacturing capacity. Automotive applications drive demand for high-energy density, fast-charging capabilities, and enhanced safety features, with LFP chemistry gaining 45% market share in passenger vehicles due to cost advantages and improved performance characteristics.

Consumer Electronics Batteries focus on miniaturization, energy density optimization, and fast-charging capabilities to support increasingly sophisticated mobile devices. This mature market segment emphasizes incremental improvements in capacity, safety, and manufacturing cost reduction while maintaining compatibility with existing device designs and charging infrastructure.

Energy Storage System Batteries prioritize cycle life, grid integration capabilities, and cost-effectiveness for utility-scale applications. These systems require advanced battery management systems, thermal management, and grid-interactive capabilities to provide services including peak shaving, frequency regulation, and renewable energy integration support.

Industrial and Specialty Batteries serve niche applications with specific performance requirements including extreme temperature operation, long-term reliability, and specialized form factors. These applications often command premium pricing due to stringent quality requirements and lower production volumes compared to consumer and automotive segments.

Emerging Application Categories include marine propulsion, aerospace systems, and grid-edge storage solutions that require customized battery solutions optimized for specific operating conditions and performance requirements. These developing markets offer opportunities for technological differentiation and premium market positioning.

Manufacturers benefit from economies of scale, integrated supply chains, and access to the world’s largest domestic market for battery applications. Chinese production capabilities enable cost-competitive manufacturing while supporting rapid scaling of new technologies from laboratory development to commercial production.

Technology Companies gain access to comprehensive research and development ecosystems, government funding support, and collaboration opportunities with leading academic institutions. The concentration of battery industry expertise facilitates knowledge transfer and accelerates innovation cycles across all technology categories.

End Users benefit from competitive pricing, rapid technology advancement, and comprehensive product availability across all application segments. The mature supply chain ensures reliable product availability while continuous innovation provides access to improved performance characteristics and new capabilities.

Investors find attractive opportunities in a rapidly growing market with strong government support, technological leadership, and global export potential. The market offers diverse investment opportunities from established manufacturers to innovative startups developing next-generation technologies.

Supply Chain Partners benefit from stable demand growth, long-term partnership opportunities, and participation in a globally competitive industry cluster. Raw material suppliers, equipment manufacturers, and service providers gain access to the world’s largest battery manufacturing ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence drives integration of artificial intelligence, advanced materials science, and manufacturing automation to optimize battery performance and production efficiency. MWR analysis indicates that smart manufacturing technologies improve production yield rates by 23% while reducing quality defects and manufacturing costs.

Sustainability focus accelerates development of environmentally responsible battery technologies, manufacturing processes, and end-of-life management solutions. Companies invest in renewable energy-powered manufacturing facilities, sustainable material sourcing, and comprehensive recycling programs to address environmental concerns and regulatory requirements.

Application diversification expands beyond traditional consumer electronics and automotive applications into emerging sectors including aerospace, marine, and grid-scale energy storage. These new applications require specialized battery solutions with unique performance characteristics and reliability requirements.

Supply chain localization trends reflect efforts to reduce dependency on international suppliers while building resilient domestic supply chains. Investments in domestic raw material processing, component manufacturing, and technology development create more integrated and controllable supply chain structures.

Performance optimization continues through advances in battery chemistry, cell design, and system integration technologies. Focus areas include faster charging capabilities, enhanced safety features, improved energy density, and extended cycle life to meet evolving application requirements and user expectations.

Manufacturing capacity expansion continues at unprecedented scale with multiple gigafactory projects under construction or planned across China. Major manufacturers invest heavily in automated production lines, quality control systems, and research facilities to maintain technological leadership and cost competitiveness.

Strategic partnerships between battery manufacturers, automotive companies, and technology firms accelerate innovation and market development. Collaborative research programs focus on next-generation battery technologies, manufacturing process optimization, and application-specific solutions for emerging market segments.

International expansion initiatives include establishment of overseas manufacturing facilities, research centers, and sales operations to serve global markets more effectively. Chinese companies pursue strategic acquisitions and joint ventures to access international markets and advanced technologies.

Regulatory developments include updated safety standards, environmental regulations, and quality certification requirements that influence product development and manufacturing processes. Government policies continue to support electric vehicle adoption and renewable energy deployment through subsidies and regulatory mandates.

Technology breakthroughs in solid-state batteries, silicon anodes, and advanced battery management systems progress from laboratory research toward commercial viability. These innovations promise significant improvements in energy density, safety, and performance characteristics for next-generation applications.

Investment priorities should focus on advanced manufacturing technologies, research and development capabilities, and supply chain integration to maintain competitive advantages in an increasingly competitive global market. Companies should prioritize automation, quality control systems, and sustainable manufacturing practices to meet evolving market requirements.

Technology development efforts should emphasize next-generation battery chemistries, safety enhancements, and application-specific solutions that address emerging market opportunities. Collaboration with research institutions and international partners can accelerate innovation while sharing development risks and costs.

Market expansion strategies should balance domestic market growth with international opportunities, considering regulatory requirements, competitive dynamics, and local market preferences. Establishing regional manufacturing and service capabilities can improve market access while reducing trade-related risks.

Sustainability initiatives require comprehensive approaches including renewable energy adoption, sustainable material sourcing, and circular economy principles. Companies should invest in recycling capabilities and environmental management systems to address regulatory requirements and stakeholder expectations.

Risk management strategies should address supply chain vulnerabilities, regulatory changes, and technology disruption risks through diversification, strategic partnerships, and continuous monitoring of market developments. Scenario planning and contingency strategies can help companies navigate uncertain market conditions.

Market trajectory indicates sustained growth driven by electric vehicle adoption, renewable energy integration, and emerging applications in aerospace and industrial sectors. MarkWide Research projects that the market will maintain robust expansion with compound annual growth rates exceeding 11% through 2030, supported by technological advancement and policy initiatives.

Technology evolution will focus on solid-state batteries, advanced lithium-ion chemistries, and alternative technologies including sodium-ion and metal-air systems. Commercial viability of next-generation technologies is expected within the next five years, creating new market opportunities and competitive dynamics.

Manufacturing transformation will emphasize automation, artificial intelligence integration, and sustainable production practices. Smart manufacturing technologies will optimize production efficiency while reducing costs and environmental impact, maintaining China’s competitive advantages in global markets.

Application expansion into grid-scale energy storage, aerospace systems, and marine applications will diversify market demand and create premium pricing opportunities. Vehicle-to-grid integration and smart city initiatives will generate new revenue streams and market value propositions.

Global integration will continue as Chinese manufacturers establish international presence while maintaining domestic manufacturing advantages. Strategic partnerships and technology collaboration will facilitate market access while supporting continued innovation and development.

China’s rechargeable battery market represents a cornerstone of the global energy transition, combining manufacturing excellence, technological innovation, and strategic market positioning to drive sustained growth and development. The market’s comprehensive ecosystem, from raw material processing to advanced manufacturing and recycling, creates competitive advantages that support both domestic applications and global export opportunities.

Future success will depend on continued investment in research and development, sustainable manufacturing practices, and strategic market expansion initiatives. The convergence of electric vehicle adoption, renewable energy integration, and emerging applications creates unprecedented opportunities for growth and innovation across all market segments.

Strategic positioning of Chinese manufacturers in next-generation technologies, combined with established manufacturing capabilities and government support, provides a strong foundation for maintaining global market leadership. The market’s evolution toward higher-performance, safer, and more sustainable battery solutions aligns with global trends and regulatory requirements, ensuring continued relevance and growth potential in the rapidly evolving energy storage landscape.

What is Rechargeable Battery?

Rechargeable batteries are energy storage devices that can be charged and discharged multiple times. They are commonly used in various applications, including consumer electronics, electric vehicles, and renewable energy systems.

What are the key players in the China Rechargeable Battery Market?

Key players in the China Rechargeable Battery Market include CATL, BYD, and LG Chem, which are known for their innovations in battery technology and production capabilities, among others.

What are the main drivers of the China Rechargeable Battery Market?

The main drivers of the China Rechargeable Battery Market include the increasing demand for electric vehicles, the growth of renewable energy storage solutions, and advancements in battery technology that enhance performance and efficiency.

What challenges does the China Rechargeable Battery Market face?

The China Rechargeable Battery Market faces challenges such as raw material supply constraints, environmental concerns related to battery disposal, and intense competition among manufacturers, which can impact pricing and innovation.

What opportunities exist in the China Rechargeable Battery Market?

Opportunities in the China Rechargeable Battery Market include the expansion of electric vehicle infrastructure, increasing investments in renewable energy projects, and the development of next-generation battery technologies that promise higher energy densities.

What trends are shaping the China Rechargeable Battery Market?

Trends shaping the China Rechargeable Battery Market include the shift towards solid-state batteries, the integration of smart technologies in battery management systems, and a growing focus on sustainability and recycling initiatives within the industry.

China Rechargeable Battery Market

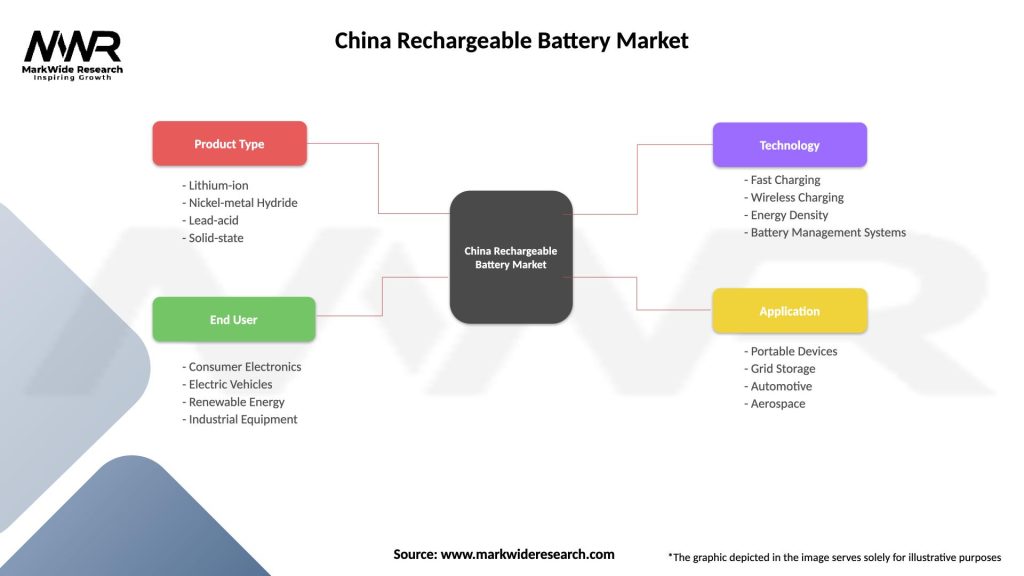

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Lead-acid, Solid-state |

| End User | Consumer Electronics, Electric Vehicles, Renewable Energy, Industrial Equipment |

| Technology | Fast Charging, Wireless Charging, Energy Density, Battery Management Systems |

| Application | Portable Devices, Grid Storage, Automotive, Aerospace |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Rechargeable Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at