444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China has emerged as a global leader in the payments market, showcasing rapid growth and technological advancements in recent years. The country’s robust digital infrastructure, widespread adoption of smartphones, and a large tech-savvy population have contributed to the expansion of the payments industry. With a population of over 1.4 billion people, China offers a massive consumer base for businesses to tap into. This market overview delves into the meaning of the China payments market, provides an executive summary, highlights key market insights, examines market drivers, restraints, and opportunities, explores market dynamics, conducts a regional analysis, discusses the competitive landscape, provides segmentation and category-wise insights, outlines the key benefits for industry participants and stakeholders, performs a SWOT analysis, analyzes market key trends, evaluates the impact of Covid-19, highlights key industry developments, presents analyst suggestions, offers a future outlook, and concludes with key takeaways.

Meaning

The China payments market refers to the ecosystem of financial transactions conducted within the country, encompassing various methods and technologies utilized by individuals, businesses, and institutions to make payments. This market includes both traditional payment methods, such as cash and bank transfers, as well as modern digital payment solutions, including mobile payments, e-wallets, and online payment platforms. The China payments market is characterized by the widespread adoption of mobile payment apps, such as Alipay and WeChat Pay, which have revolutionized the way Chinese consumers make transactions.

Executive Summary

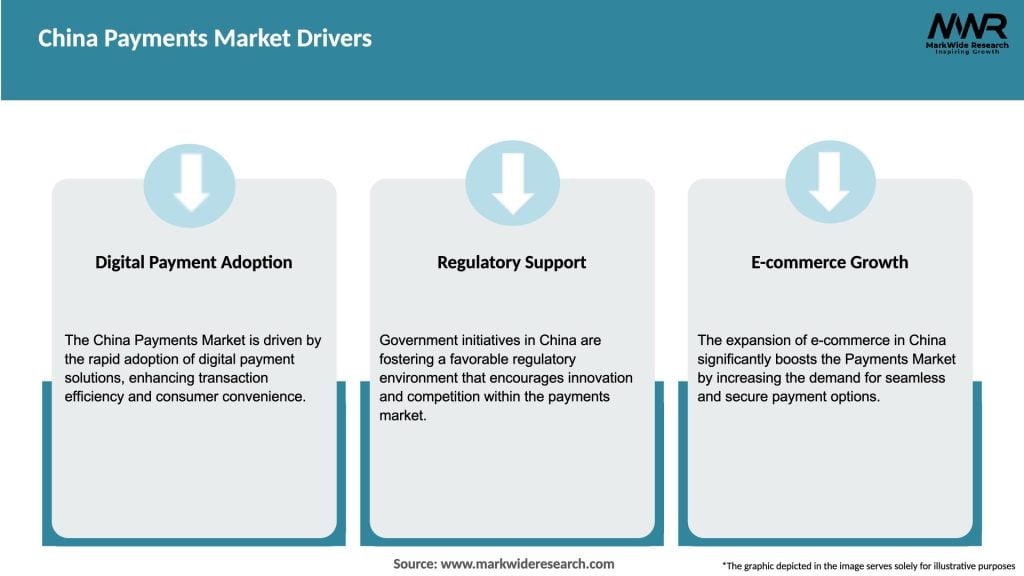

The China payments market has experienced tremendous growth over the past decade, driven by factors such as technological advancements, changing consumer behavior, and government initiatives to promote digital financial services. The market is dominated by mobile payment solutions, with a significant portion of the population using apps like Alipay and WeChat Pay for everyday transactions. The rise of e-commerce and the increasing popularity of online shopping have also contributed to the growth of the payments market. However, the market is not without its challenges, including concerns over data privacy and security. Despite these challenges, the China payments market presents lucrative opportunities for both domestic and international players, with a favorable regulatory environment and a tech-savvy population.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China payments market operates in a dynamic environment characterized by rapid technological advancements, evolving consumer preferences, regulatory changes, and intense competition among market players. The market dynamics are shaped by factors such as the adoption of new technologies, the introduction of innovative payment solutions, partnerships and collaborations between industry stakeholders, and changing government policies. Understanding these dynamics is crucial for market participants to stay competitive and seize growth opportunities.

Regional Analysis

China’s payments market exhibits regional variations due to differences in economic development, population density, and consumer behavior. The eastern coastal regions, including cities such as Shanghai and Beijing, have been at the forefront of digital payment adoption, driven by higher urbanization rates and greater access to technology. In contrast, rural and less developed regions show slower adoption rates but offer significant growth potential. Understanding regional nuances and tailoring payment solutions to specific market needs is essential for success in the diverse Chinese market.

Competitive Landscape

Leading Companies in the China Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

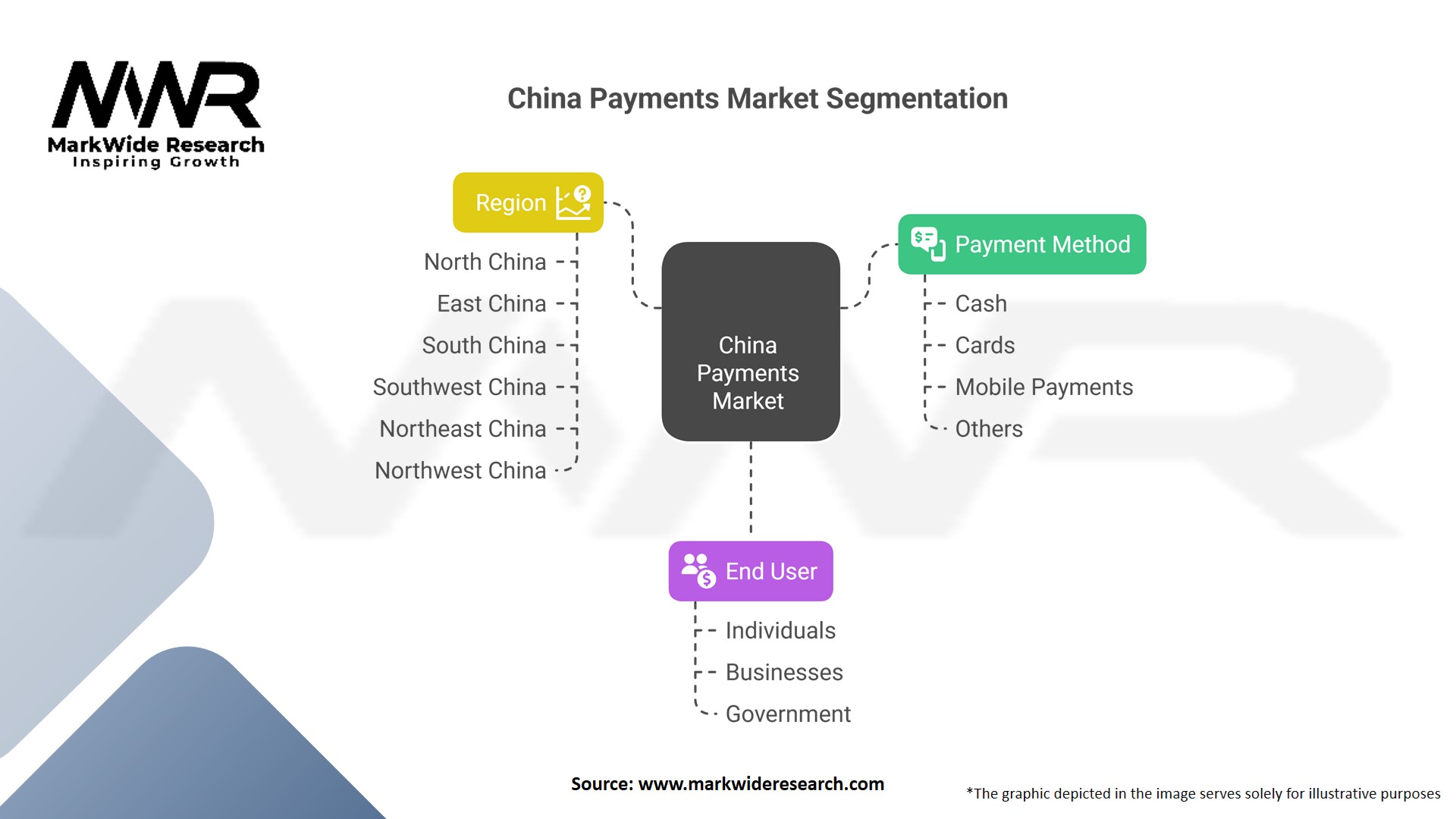

Segmentation

The China payments market can be segmented based on payment methods, including mobile payments, online payments, card payments, and bank transfers. Mobile payments account for the largest share, driven by the popularity of smartphone-based apps. Online payments, facilitated by e-commerce platforms and online payment gateways, have also gained significant traction. Card payments, primarily dominated by UnionPay, remain prevalent, particularly for offline transactions. Bank transfers continue to be used for large-scale and business transactions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital payment solutions in China. The fear of handling physical cash and the need for contactless transactions led to a surge in mobile and online payments. Businesses, ranging from small vendors to large retailers, quickly adopted digital payment methods to minimize physical contact. This shift in consumer behavior and the increased reliance on e-commerce platforms have significantly impacted the payments market. The pandemic served as a catalyst for the digital transformation of the payments industry, with long-lasting effects beyond the immediate crisis.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the China payments market looks promising, driven by ongoing technological advancements, changing consumer behavior, and government support. Mobile payments will continue to dominate, with further integration of advanced features such as biometrics and AI. The market is expected to witness increased collaboration and partnerships among industry players to enhance interoperability and customer experience. The expansion into rural markets, cross-border payment facilitation, and integration with other industries will unlock new growth opportunities. However, challenges related to data privacy, regulation, and competition will require continuous innovation and adaptation.

Conclusion

The China payments market has witnessed exponential growth and transformation, driven by technological advancements, changing consumer preferences, and supportive government initiatives. Mobile payments, e-commerce integration, QR code technology, and the dominance of platforms like Alipay and WeChat Pay have reshaped the way transactions are conducted in the country. While the market offers immense opportunities, challenges such as data privacy concerns, regulatory complexities, and cash dependency persist. However, by focusing on user experience, embracing innovation, addressing data security, and fostering collaboration, industry participants can navigate the dynamic market landscape and thrive in the evolving China payments ecosystem.

What is China Payments?

China Payments refers to the various methods and systems used for financial transactions within China, including digital wallets, bank transfers, and credit card payments. This sector has seen significant growth due to the rise of e-commerce and mobile payment technologies.

What are the key players in the China Payments Market?

Key players in the China Payments Market include Alipay, WeChat Pay, UnionPay, and JD Pay. These companies dominate the landscape by offering innovative payment solutions and extensive user bases, among others.

What are the growth factors driving the China Payments Market?

The China Payments Market is driven by factors such as the increasing adoption of smartphones, the growth of e-commerce, and the government’s push for a cashless society. Additionally, advancements in fintech are enhancing payment security and convenience.

What challenges does the China Payments Market face?

Challenges in the China Payments Market include regulatory scrutiny, competition among payment platforms, and cybersecurity threats. These factors can impact consumer trust and the overall growth of payment solutions.

What opportunities exist in the China Payments Market?

Opportunities in the China Payments Market include the expansion of cross-border payment solutions, the integration of blockchain technology, and the potential for financial inclusion among underserved populations. These trends can lead to innovative payment methods and services.

What trends are shaping the China Payments Market?

Trends shaping the China Payments Market include the rise of contactless payments, the integration of artificial intelligence for fraud detection, and the growing popularity of social commerce. These innovations are transforming how consumers engage with payment systems.

China Payments Market

| Segmentation | Details |

|---|---|

| Payment Method | Cash, cards, mobile payments, others |

| End User | Individuals, businesses, government |

| Region | North China, East China, South China, Southwest China, Northeast China, Northwest China |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the China Payments Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at