444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China payment gateway market represents one of the most dynamic and rapidly evolving digital payment ecosystems globally, driven by unprecedented mobile adoption rates and innovative fintech solutions. Digital transformation across Chinese commerce has fundamentally reshaped how consumers and businesses conduct transactions, with payment gateways serving as the critical infrastructure enabling seamless financial exchanges. The market demonstrates exceptional growth momentum, expanding at a robust CAGR of 12.8% as traditional payment methods give way to sophisticated digital alternatives.

Mobile payment adoption in China has reached extraordinary levels, with over 85% of urban consumers regularly utilizing digital payment solutions for daily transactions. This widespread acceptance has created fertile ground for payment gateway providers to develop comprehensive solutions that integrate with e-commerce platforms, retail point-of-sale systems, and emerging technologies like Internet of Things devices. The market encompasses various payment methods including QR code payments, near-field communication transactions, and traditional card-based processing.

Regulatory frameworks established by Chinese financial authorities have provided both structure and innovation opportunities within the payment gateway landscape. Government initiatives promoting digital financial inclusion have accelerated market penetration across tier-two and tier-three cities, expanding the addressable market significantly. The integration of artificial intelligence and machine learning technologies has enhanced fraud detection capabilities while improving transaction processing speeds and user experiences.

The China payment gateway market refers to the comprehensive ecosystem of digital payment processing solutions that facilitate secure electronic transactions between consumers, merchants, and financial institutions across Chinese commercial networks. Payment gateways serve as intermediary platforms that authorize, process, and settle financial transactions while ensuring compliance with regulatory requirements and maintaining robust security protocols.

Core functionality encompasses transaction authorization, fraud detection, currency conversion, and settlement processing across multiple payment channels including mobile applications, e-commerce websites, and physical retail locations. These systems integrate with various payment methods ranging from traditional bank cards to innovative digital wallets and cryptocurrency solutions. The market includes both domestic Chinese providers and international companies operating within China’s regulatory framework.

Technological infrastructure supporting payment gateways incorporates advanced encryption protocols, real-time processing capabilities, and comprehensive analytics platforms that provide merchants with detailed transaction insights. The ecosystem extends beyond basic payment processing to include value-added services such as loyalty program integration, subscription management, and cross-border payment facilitation.

Market dynamics within China’s payment gateway sector reflect the country’s position as a global leader in digital payment innovation and adoption. The convergence of favorable regulatory policies, technological advancement, and consumer behavior shifts has created an environment where payment gateway solutions have become essential infrastructure for modern commerce. Growth drivers include increasing e-commerce penetration, rising smartphone usage, and government initiatives promoting cashless transactions.

Competitive landscape features a mix of established technology giants, specialized fintech companies, and traditional financial institutions, each offering differentiated solutions targeting specific market segments. The market demonstrates strong consolidation trends as larger players acquire innovative startups to enhance their technological capabilities and market reach. Innovation focus areas include artificial intelligence integration, blockchain technology adoption, and enhanced security protocols.

Regional expansion opportunities exist as payment gateway providers extend their services to underserved markets and develop solutions for cross-border commerce. The integration of payment gateways with emerging technologies such as Internet of Things devices and augmented reality platforms presents significant growth potential. Regulatory compliance remains a critical success factor as authorities continue refining digital payment oversight frameworks.

Strategic insights reveal several fundamental trends shaping the China payment gateway market landscape:

Market maturation indicators suggest increasing sophistication in payment gateway offerings, with providers focusing on specialized solutions for specific industries and use cases. The emphasis on user experience optimization has driven development of streamlined checkout processes and personalized payment options.

Digital transformation across Chinese commerce represents the primary catalyst driving payment gateway market expansion. The rapid shift from cash-based transactions to digital alternatives has created unprecedented demand for reliable, secure payment processing infrastructure. E-commerce growth continues accelerating as consumers embrace online shopping, particularly in categories like fashion, electronics, and daily necessities.

Smartphone penetration reaching near-universal levels in urban areas has enabled widespread adoption of mobile payment solutions. The integration of payment capabilities into social media platforms and messaging applications has further expanded the addressable market. Government initiatives promoting financial inclusion and digital payment adoption have provided regulatory support and infrastructure investment.

Consumer behavior evolution toward contactless transactions, accelerated by health and safety considerations, has increased demand for touchless payment solutions. The growing preference for instant gratification and seamless user experiences drives continuous innovation in payment gateway technologies. Merchant adoption of digital payment acceptance has expanded beyond traditional retail to include service providers, transportation, and entertainment sectors.

Technological advancement in areas such as artificial intelligence, machine learning, and blockchain technology has enabled development of more sophisticated payment gateway solutions. The emergence of Internet of Things devices and smart city initiatives creates new opportunities for embedded payment capabilities.

Regulatory complexity presents significant challenges for payment gateway providers operating in China’s highly regulated financial services environment. Compliance requirements continue evolving, necessitating substantial investments in legal expertise and system modifications. Data localization mandates require payment processors to maintain sensitive information within Chinese borders, increasing operational complexity and costs.

Security concerns related to digital payment fraud and data breaches create ongoing challenges for market participants. The sophisticated nature of cyber threats requires continuous investment in advanced security technologies and monitoring systems. Consumer trust issues, particularly regarding data privacy and transaction security, can limit adoption rates among certain demographic segments.

Market saturation in major urban centers has intensified competition and reduced profit margins for payment gateway providers. The challenge of differentiating services in a crowded marketplace requires substantial investment in innovation and marketing. Technical integration complexity can create barriers for smaller merchants seeking to implement payment gateway solutions.

Economic volatility and changing consumer spending patterns can impact transaction volumes and revenue generation for payment gateway providers. The dependence on stable internet connectivity and technological infrastructure creates vulnerability to service disruptions.

Rural market expansion represents a substantial growth opportunity as payment gateway providers extend services to underserved regions across China. The government’s rural development initiatives and improving internet infrastructure create favorable conditions for digital payment adoption in smaller cities and rural areas. Agricultural sector digitization presents unique opportunities for specialized payment solutions.

Cross-border commerce growth offers significant potential as Chinese consumers increasingly purchase from international merchants and Chinese businesses expand globally. Payment gateway providers can capitalize on this trend by developing solutions that facilitate seamless international transactions while managing currency conversion and regulatory compliance.

Industry-specific solutions present opportunities for payment gateway providers to develop specialized offerings for sectors such as healthcare, education, and government services. The unique requirements of these industries create demand for customized payment processing capabilities. B2B payment solutions represent an underserved market segment with substantial growth potential.

Emerging technology integration including Internet of Things devices, augmented reality platforms, and voice-activated systems creates new channels for payment gateway deployment. The development of embedded payment capabilities in smart devices and connected systems opens innovative revenue streams.

Competitive intensity within the China payment gateway market continues escalating as established players and new entrants vie for market share. The dynamic nature of consumer preferences and technological advancement requires continuous innovation and adaptation. Partnership strategies have become increasingly important as companies seek to leverage complementary capabilities and expand market reach.

Technology evolution drives constant market transformation as payment gateway providers integrate artificial intelligence, machine learning, and blockchain technologies into their offerings. The pace of innovation requires substantial research and development investment to maintain competitive positioning. User experience optimization has emerged as a key differentiator in an increasingly crowded marketplace.

Regulatory landscape changes continue shaping market dynamics as Chinese authorities refine oversight frameworks for digital payments. Compliance requirements influence product development priorities and operational strategies. Market consolidation trends reflect the advantages of scale in technology development and regulatory compliance.

Consumer expectations for seamless, secure, and instant payment experiences drive continuous improvement in payment gateway capabilities. The integration of social commerce and payment functionalities creates new market dynamics and competitive considerations.

Comprehensive analysis of the China payment gateway market employs multiple research methodologies to ensure accuracy and depth of insights. Primary research includes structured interviews with industry executives, technology providers, merchants, and regulatory officials to gather firsthand perspectives on market trends and challenges.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and technology publications to establish market context and validate primary findings. Quantitative analysis utilizes statistical modeling and trend analysis to project market growth patterns and identify key performance indicators.

Market segmentation analysis examines various dimensions including technology type, deployment model, end-user industry, and geographic distribution. Competitive landscape assessment evaluates market positioning, strategic initiatives, and technological capabilities of key market participants.

Regulatory analysis reviews current and proposed legislation affecting payment gateway operations in China. Technology assessment examines emerging trends and their potential impact on market development. Data validation processes ensure research findings meet rigorous quality standards for strategic decision-making.

Geographic distribution of payment gateway adoption across China reveals significant variations in market maturity and growth potential. Tier-one cities including Beijing, Shanghai, and Shenzhen demonstrate the highest penetration rates with over 90% digital payment adoption among urban consumers. These markets feature sophisticated payment infrastructure and intense competition among service providers.

Tier-two cities represent substantial growth opportunities as improving internet infrastructure and rising disposable incomes drive digital payment adoption. Cities such as Chengdu, Hangzhou, and Nanjing show rapid growth rates exceeding 15% annually in payment gateway transaction volumes. The expansion of e-commerce and mobile commerce in these markets creates favorable conditions for payment gateway providers.

Tier-three and rural markets present the greatest long-term growth potential despite current lower adoption rates. Government initiatives promoting digital financial inclusion and infrastructure development are accelerating market penetration. Rural payment adoption has increased by over 40% in recent years as smartphone access and internet connectivity improve.

Regional specialization opportunities exist as different areas demonstrate varying preferences for payment methods and merchant types. Coastal regions show higher adoption of international payment solutions, while inland areas focus more on domestic payment platforms. Cross-regional integration capabilities become increasingly important as businesses expand their geographic reach.

Market leadership in China’s payment gateway sector is characterized by intense competition among technology giants, specialized fintech companies, and traditional financial institutions. The competitive environment drives continuous innovation and service enhancement.

Strategic positioning varies among competitors, with some focusing on consumer-facing applications while others emphasize merchant services and B2B solutions. Innovation investment remains critical for maintaining competitive advantage in the rapidly evolving market landscape.

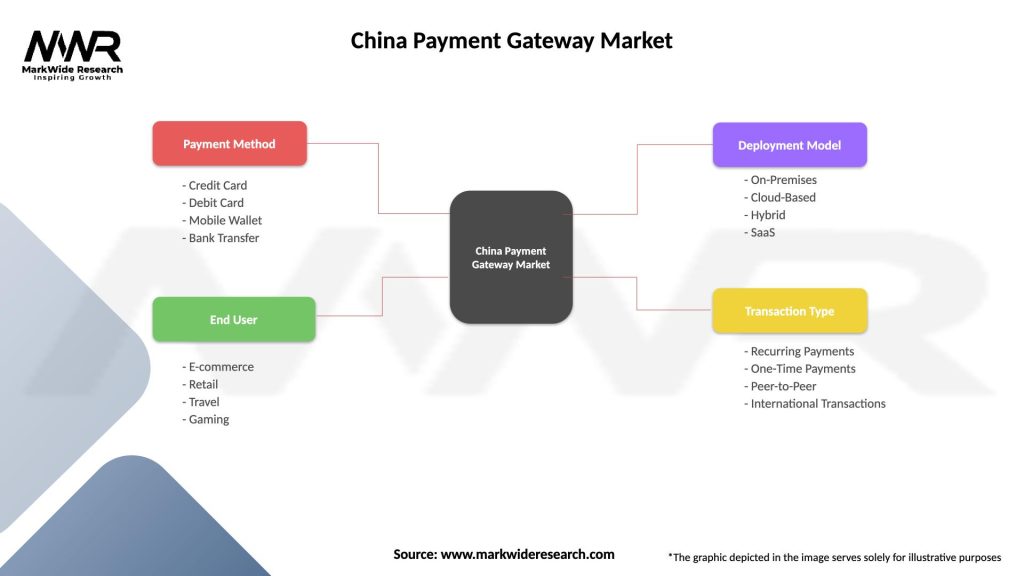

Technology segmentation within the China payment gateway market encompasses various processing methods and integration approaches:

By Payment Method:

By Deployment Model:

By End-User Industry:

Mobile payment gateways dominate the Chinese market landscape, accounting for the majority of transaction volumes and demonstrating the strongest growth trajectory. QR code technology has emerged as the preferred method for both online and offline transactions due to its simplicity and universal smartphone compatibility. The integration of social media platforms with payment capabilities has created unique ecosystem advantages.

E-commerce payment gateways continue evolving to support increasingly sophisticated online shopping experiences. Features such as one-click checkout, subscription management, and installment payment options have become standard offerings. Cross-border payment capabilities are increasingly important as Chinese consumers purchase from international merchants and domestic businesses expand globally.

B2B payment solutions represent an emerging category with substantial growth potential as businesses digitize their procurement and payment processes. These solutions require enhanced security features, detailed reporting capabilities, and integration with enterprise resource planning systems. Supply chain finance integration creates additional value propositions for business customers.

Industry-specific gateways are gaining traction as payment providers develop specialized solutions for sectors with unique requirements. Healthcare payment processing requires HIPAA compliance and insurance integration, while government solutions need enhanced security and audit capabilities. Customization capabilities become increasingly important for serving diverse industry needs.

Merchants benefit from payment gateway solutions through expanded customer reach, reduced transaction costs, and improved cash flow management. Multi-channel integration enables seamless customer experiences across online and offline touchpoints. Advanced analytics and reporting capabilities provide valuable insights into customer behavior and transaction patterns.

Consumers gain convenience, security, and choice through diverse payment options and streamlined checkout experiences. Fraud protection features and dispute resolution mechanisms enhance transaction security and confidence. Loyalty program integration and personalized offers create additional value for regular users.

Financial institutions can expand their service offerings and customer relationships through payment gateway partnerships. Risk management capabilities help maintain portfolio quality while supporting business growth. Integration with existing banking infrastructure reduces implementation complexity and costs.

Technology providers benefit from recurring revenue streams and opportunities to develop value-added services. Data insights generated from payment transactions can inform product development and market expansion strategies. Partnership opportunities with merchants and financial institutions create ecosystem advantages.

Regulatory authorities gain enhanced visibility into payment flows and improved ability to monitor financial system stability. Digital payment adoption supports broader economic digitization goals and financial inclusion initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming payment gateway capabilities through enhanced fraud detection, personalized user experiences, and predictive analytics. Machine learning algorithms continuously improve transaction approval rates while reducing false positives in security screening. Natural language processing enables voice-activated payment commands and customer service automation.

Blockchain technology adoption is gaining momentum as payment providers explore distributed ledger solutions for enhanced transparency and security. Smart contracts enable automated payment processing for complex business arrangements. Cryptocurrency integration is expanding as regulatory frameworks develop and consumer acceptance grows.

Internet of Things integration creates new payment channels through connected devices and smart appliances. Embedded payment capabilities in vehicles, vending machines, and home automation systems expand the addressable market. Wearable device integration enables contactless payments through smartwatches and fitness trackers.

Social commerce evolution continues blurring the lines between social media and payment processing. Live streaming commerce integration enables real-time purchasing during entertainment content. Social media platform payment features create seamless shopping experiences within familiar user interfaces.

Biometric authentication adoption is increasing as payment providers implement fingerprint, facial recognition, and voice verification technologies. Multi-factor authentication combines multiple biometric methods for enhanced security without compromising user convenience.

Regulatory framework evolution continues shaping the payment gateway landscape as Chinese authorities refine oversight mechanisms for digital payments. Recent policy updates have clarified data localization requirements and enhanced consumer protection measures. Cross-border payment regulations are being streamlined to support international commerce while maintaining security standards.

Technology partnerships between payment gateway providers and technology companies are accelerating innovation in areas such as artificial intelligence, blockchain, and cybersecurity. Strategic alliances enable companies to leverage complementary capabilities and expand market reach more efficiently than independent development efforts.

Acquisition activity has intensified as larger players seek to acquire innovative startups and specialized technology capabilities. Market consolidation trends reflect the advantages of scale in technology development, regulatory compliance, and customer acquisition. International expansion through acquisitions is becoming more common.

Infrastructure investment in 5G networks and edge computing capabilities is enhancing payment processing speed and reliability. Cloud computing adoption is enabling more flexible and scalable payment gateway deployments. Cybersecurity infrastructure improvements are addressing evolving threat landscapes.

Industry standardization efforts are progressing as market participants collaborate on interoperability standards and best practices. API development is facilitating easier integration between payment gateways and merchant systems.

MarkWide Research analysis indicates that payment gateway providers should prioritize rural market expansion and cross-border payment capabilities to capture emerging growth opportunities. Investment in artificial intelligence and machine learning technologies will be critical for maintaining competitive advantage in fraud detection and user experience optimization.

Strategic partnerships with technology companies, financial institutions, and industry-specific players can accelerate market penetration and capability development. Regulatory compliance should be viewed as a competitive advantage rather than merely a cost center, with proactive engagement with authorities recommended.

Customer experience optimization through streamlined checkout processes, personalized payment options, and seamless integration across channels will differentiate successful providers. Security investment must keep pace with evolving threat landscapes while maintaining user convenience.

Data analytics capabilities should be developed to provide merchants with actionable insights that drive business value beyond basic payment processing. Industry specialization can create sustainable competitive advantages in sectors with unique payment requirements.

International expansion strategies should consider both Chinese businesses expanding globally and international companies entering the Chinese market. Technology roadmap planning should incorporate emerging trends such as Internet of Things integration and blockchain adoption.

Market evolution over the next five years will be characterized by continued technological innovation, geographic expansion, and industry specialization. Growth projections indicate sustained expansion at a CAGR of approximately 11.5% driven by rural market penetration and cross-border commerce development. The integration of emerging technologies will create new revenue streams and competitive dynamics.

Technology advancement will focus on artificial intelligence enhancement, blockchain integration, and Internet of Things connectivity. 5G network deployment will enable new payment use cases and improve transaction processing capabilities. Quantum computing developments may influence long-term security architecture requirements.

Regulatory landscape evolution will likely emphasize consumer protection, data privacy, and financial system stability while supporting innovation and competition. International coordination on payment standards and regulations may facilitate cross-border commerce growth.

Market consolidation trends are expected to continue as companies seek scale advantages in technology development and regulatory compliance. Ecosystem integration will become increasingly important as payment gateways expand beyond basic transaction processing to comprehensive financial services platforms.

Consumer expectations will continue evolving toward more seamless, secure, and personalized payment experiences. Merchant requirements will emphasize comprehensive analytics, multi-channel integration, and value-added services that support business growth objectives.

China’s payment gateway market represents a dynamic and rapidly evolving ecosystem that has established global leadership in digital payment innovation and adoption. The convergence of favorable regulatory policies, advanced technological infrastructure, and widespread consumer acceptance has created an environment where payment gateway solutions have become essential infrastructure for modern commerce. Market growth continues at robust rates driven by rural expansion, cross-border commerce development, and emerging technology integration.

Competitive dynamics within the market reflect intense innovation pressure and the need for continuous adaptation to changing consumer preferences and technological capabilities. Successful payment gateway providers must balance security, convenience, and regulatory compliance while developing specialized solutions for diverse industry requirements. Strategic partnerships and ecosystem integration have become critical success factors in an increasingly complex market landscape.

Future opportunities lie in geographic expansion to underserved markets, development of industry-specific solutions, and integration with emerging technologies such as artificial intelligence, blockchain, and Internet of Things platforms. The market’s evolution toward comprehensive financial services ecosystems presents substantial growth potential for providers that can successfully navigate regulatory requirements while delivering superior customer experiences. Long-term success will depend on the ability to innovate continuously while maintaining the security and reliability that underpin consumer and merchant confidence in digital payment systems.

What is Payment Gateway?

A payment gateway is a technology that facilitates online transactions by authorizing credit card or direct payments for e-commerce businesses. It acts as a bridge between the customer and the merchant, ensuring secure data transfer and payment processing.

What are the key players in the China Payment Gateway Market?

Key players in the China Payment Gateway Market include Alipay, WeChat Pay, UnionPay, and PayPal, among others. These companies dominate the market by offering various payment solutions tailored to local consumer preferences.

What are the growth factors driving the China Payment Gateway Market?

The growth of the China Payment Gateway Market is driven by the increasing adoption of e-commerce, the rise of mobile payments, and the growing demand for secure online transactions. Additionally, advancements in technology and digital wallets are contributing to market expansion.

What challenges does the China Payment Gateway Market face?

The China Payment Gateway Market faces challenges such as regulatory compliance, cybersecurity threats, and intense competition among service providers. These factors can hinder the growth and operational efficiency of payment gateway solutions.

What opportunities exist in the China Payment Gateway Market?

Opportunities in the China Payment Gateway Market include the expansion of cross-border e-commerce, the integration of artificial intelligence for fraud detection, and the increasing demand for contactless payment solutions. These trends present avenues for innovation and growth.

What trends are shaping the China Payment Gateway Market?

Trends shaping the China Payment Gateway Market include the rise of mobile payment applications, the integration of blockchain technology for enhanced security, and the growing popularity of subscription-based payment models. These trends are influencing consumer behavior and payment preferences.

China Payment Gateway Market

| Segmentation Details | Description |

|---|---|

| Payment Method | Credit Card, Debit Card, Mobile Wallet, Bank Transfer |

| End User | E-commerce, Retail, Travel, Gaming |

| Deployment Model | On-Premises, Cloud-Based, Hybrid, SaaS |

| Transaction Type | Recurring Payments, One-Time Payments, Peer-to-Peer, International Transactions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Payment Gateway Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at