444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China packaging market represents one of the world’s most dynamic and rapidly evolving sectors, driven by unprecedented economic growth, urbanization, and changing consumer preferences. China’s packaging industry has transformed from a basic manufacturing sector into a sophisticated ecosystem encompassing advanced materials, sustainable solutions, and innovative technologies. The market demonstrates remarkable resilience and adaptability, responding to both domestic demand and global supply chain requirements.

Market dynamics in China’s packaging sector reflect the country’s broader economic transformation, with increasing emphasis on quality, sustainability, and technological advancement. The industry serves diverse sectors including food and beverage, pharmaceuticals, cosmetics, electronics, and e-commerce, each driving specific packaging innovations and requirements. Growth patterns indicate sustained expansion at approximately 6.2% CAGR through the forecast period, supported by robust domestic consumption and export activities.

Regional distribution across China shows concentrated activity in eastern coastal provinces, particularly Guangdong, Jiangsu, and Zhejiang, which collectively account for over 45% of packaging production capacity. The market’s evolution reflects China’s transition toward higher value-added manufacturing, with increasing focus on premium packaging solutions and environmentally conscious alternatives.

The China packaging market refers to the comprehensive ecosystem of packaging materials, technologies, and services operating within mainland China, encompassing the design, production, and distribution of protective and promotional packaging solutions across multiple industries. This market includes traditional packaging formats such as corrugated boxes, plastic containers, glass bottles, and metal cans, alongside emerging solutions like smart packaging, biodegradable materials, and specialized protective systems.

Packaging solutions in China serve dual purposes of product protection and brand communication, adapting to local consumer preferences while meeting international quality standards for export markets. The market encompasses both primary packaging that directly contacts products and secondary packaging used for distribution and retail presentation, reflecting the complex supply chain requirements of the world’s second-largest economy.

China’s packaging market stands as a cornerstone of the nation’s manufacturing economy, supporting diverse industries through innovative packaging solutions and sustainable practices. The market demonstrates exceptional growth momentum, driven by expanding e-commerce activities, rising disposable incomes, and evolving consumer preferences toward premium and environmentally friendly packaging options.

Key market drivers include rapid urbanization affecting 65% of China’s population, growing middle-class consumption patterns, and stringent environmental regulations promoting sustainable packaging alternatives. The sector benefits from China’s position as a global manufacturing hub, creating substantial demand for both domestic consumption and export packaging requirements.

Technology adoption accelerates across the industry, with digital printing, smart packaging solutions, and automated production systems gaining prominence. The market’s future trajectory indicates continued expansion, supported by government initiatives promoting circular economy principles and industry consolidation toward larger, more efficient operations.

Strategic insights reveal several critical trends shaping China’s packaging landscape:

Economic expansion serves as the primary catalyst for China’s packaging market growth, with GDP growth supporting increased manufacturing activity and consumer spending. The country’s position as the world’s largest manufacturing base creates substantial demand for packaging solutions across multiple industries, from electronics to textiles and consumer goods.

E-commerce proliferation fundamentally transforms packaging requirements, with online retail sales growth of approximately 12% annually driving demand for protective shipping materials, branded unboxing experiences, and sustainable delivery solutions. Major platforms like Alibaba, JD.com, and emerging social commerce channels require specialized packaging that balances protection, cost-effectiveness, and environmental responsibility.

Urbanization trends significantly impact packaging consumption patterns, as urban consumers demonstrate preferences for convenient, portion-controlled, and premium packaging formats. The shift from bulk purchasing to individual consumption drives demand for smaller package sizes and enhanced product presentation, particularly in food and personal care categories.

Government initiatives promoting domestic consumption and brand development encourage packaging innovation and quality improvements. Policies supporting the circular economy and waste reduction create opportunities for sustainable packaging solutions while challenging traditional materials and designs.

Environmental regulations present significant challenges for traditional packaging materials, particularly single-use plastics and non-recyclable composites. Stricter waste management policies and extended producer responsibility requirements increase compliance costs and necessitate material substitutions that may impact performance or economics.

Raw material volatility affects packaging production costs and supply chain stability, with petroleum-based materials experiencing price fluctuations that impact profit margins and planning capabilities. Supply chain disruptions, whether from geopolitical tensions or natural disasters, create additional uncertainty for packaging manufacturers and their customers.

Labor cost increases challenge the competitiveness of labor-intensive packaging operations, particularly in coastal regions where wages have risen substantially. This trend drives automation adoption but requires significant capital investment that smaller manufacturers may struggle to afford.

International trade tensions impact export-oriented packaging manufacturers, with tariffs and trade restrictions affecting demand for packaging materials used in export products. Currency fluctuations and changing trade relationships create additional complexity for companies serving both domestic and international markets.

Sustainable packaging innovation presents substantial growth opportunities as environmental consciousness increases among consumers and regulators. Development of biodegradable materials, recyclable designs, and circular economy solutions positions companies for long-term success while addressing regulatory requirements and consumer preferences.

Smart packaging technologies offer differentiation opportunities through integration of digital features, authentication systems, and consumer engagement tools. These solutions command premium pricing while providing value-added services that strengthen brand relationships and supply chain visibility.

Rural market expansion represents significant untapped potential as infrastructure development and income growth extend modern retail formats to smaller cities and rural areas. This expansion requires adapted packaging solutions that balance cost-effectiveness with quality and convenience.

Healthcare packaging growth accelerates due to aging population demographics and increased health awareness, creating demand for pharmaceutical packaging, medical device protection, and nutraceutical containers that meet stringent safety and regulatory requirements.

Supply chain evolution reshapes packaging requirements as manufacturers optimize for efficiency, sustainability, and consumer experience. Just-in-time delivery models and omnichannel retail strategies demand packaging solutions that perform across multiple distribution channels while minimizing waste and maximizing brand impact.

Consumer behavior shifts drive packaging innovation toward convenience, sustainability, and premium experiences. Younger demographics particularly value environmentally responsible packaging and brands that demonstrate social consciousness through their packaging choices and supply chain practices.

Technology integration accelerates across the packaging value chain, from design and production to distribution and consumer interaction. Digital printing enables mass customization and shorter production runs, while automation improves efficiency and quality consistency in manufacturing operations.

Competitive dynamics intensify as international companies establish local operations while domestic manufacturers expand capabilities and market reach. This competition drives innovation, quality improvements, and cost optimization throughout the industry.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of findings. Primary research includes extensive interviews with industry executives, packaging manufacturers, end-user companies, and regulatory officials across China’s major industrial regions.

Secondary research incorporates analysis of government statistics, industry association reports, company financial statements, and trade publication data to establish market baselines and validate primary research findings. MarkWide Research utilizes proprietary databases and analytical frameworks to identify trends and project future market developments.

Data validation processes include cross-referencing multiple sources, statistical analysis of market indicators, and expert review panels to ensure research conclusions accurately reflect market realities. Regional analysis incorporates province-level data to capture geographic variations in market development and opportunities.

Forecasting models integrate economic indicators, demographic trends, regulatory developments, and technology adoption patterns to project market evolution across multiple scenarios and timeframes.

Eastern China dominates packaging production and consumption, with Guangdong Province leading in manufacturing capacity and export activities. The region benefits from established supply chains, skilled workforce, and proximity to major ports, supporting both domestic and international market access. Regional concentration shows approximately 38% of total packaging production occurring in eastern coastal provinces.

Yangtze River Delta region, encompassing Shanghai, Jiangsu, and Zhejiang provinces, serves as a major packaging innovation hub with strong emphasis on high-value applications and sustainable solutions. The area’s advanced manufacturing capabilities and research institutions drive technology development and premium packaging solutions.

Pearl River Delta maintains its position as a global packaging manufacturing center, particularly for export-oriented production serving electronics, toys, and consumer goods industries. The region’s integration with Hong Kong and international markets provides competitive advantages in quality standards and logistics capabilities.

Central and Western China experience rapid growth in packaging demand driven by economic development and infrastructure investment. These regions offer cost advantages and government incentives that attract packaging manufacturers seeking to serve growing domestic markets while reducing production costs.

Market leadership includes both international corporations and domestic champions, creating a diverse competitive environment that drives innovation and market development:

Competitive strategies emphasize sustainability, technology integration, and customer service excellence as key differentiators in an increasingly sophisticated market environment.

By Material Type:

By Application:

Food packaging represents the largest application category, driven by changing dietary habits, food safety requirements, and convenience preferences. Growth in ready-to-eat meals, snack foods, and premium products creates demand for advanced barrier materials, modified atmosphere packaging, and attractive presentation formats.

Beverage packaging shows strong innovation in both alcoholic and non-alcoholic segments, with craft beverages driving demand for premium glass and specialty closures while functional drinks require advanced barrier properties and convenience features. Market penetration of sustainable alternatives reaches approximately 28% in beverage applications.

E-commerce packaging emerges as a distinct category with unique requirements for protection, branding, and sustainability. The segment demands solutions that perform across multiple handling stages while providing positive unboxing experiences and minimizing environmental impact.

Healthcare packaging experiences robust growth driven by aging demographics and increased health awareness, requiring specialized materials and designs that ensure product integrity, patient safety, and regulatory compliance across pharmaceutical and medical device applications.

Manufacturers benefit from China’s packaging market through access to cost-effective production capabilities, advanced manufacturing technologies, and comprehensive supply chain infrastructure. The market’s scale enables efficient production runs and competitive pricing while supporting innovation and quality improvements.

Brand owners gain access to sophisticated packaging solutions that enhance product protection, shelf appeal, and consumer engagement while meeting sustainability goals and regulatory requirements. The market’s diversity supports both premium positioning and cost-effective mass market strategies.

Consumers benefit from improved product quality, convenience, and safety through advanced packaging technologies and materials. Sustainable packaging options align with environmental consciousness while smart packaging features provide enhanced product information and authentication capabilities.

Investors find attractive opportunities in China’s packaging market through exposure to economic growth, technological innovation, and sustainability trends that drive long-term value creation and market expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainable packaging adoption accelerates across all market segments, driven by regulatory requirements, consumer preferences, and corporate sustainability commitments. Biodegradable materials, recyclable designs, and circular economy principles increasingly influence packaging decisions and investment priorities.

Digital integration transforms packaging from passive protection to active communication and engagement tools. QR codes, NFC chips, and augmented reality features enable brand interaction, product authentication, and supply chain transparency while providing valuable consumer data.

Customization capabilities expand through digital printing and flexible manufacturing systems, enabling shorter production runs, personalized packaging, and rapid response to market trends. This flexibility supports both premium brand positioning and efficient inventory management.

Supply chain optimization drives packaging design toward logistics efficiency, with emphasis on space utilization, handling convenience, and transportation cost reduction. These considerations increasingly influence material selection and structural design decisions.

Regulatory evolution includes implementation of extended producer responsibility programs, plastic waste reduction targets, and enhanced food safety requirements that reshape packaging material selection and design approaches. These developments create both challenges and opportunities for market participants.

Technology partnerships between packaging manufacturers and technology companies accelerate smart packaging development and digital integration capabilities. These collaborations enable rapid innovation and market introduction of advanced packaging solutions.

Sustainability investments include major capacity additions in recyclable and biodegradable packaging materials, with both domestic and international companies establishing production facilities focused on environmentally responsible solutions.

Market consolidation continues as larger companies acquire smaller specialists to expand capabilities, geographic reach, and technology access. This trend creates more comprehensive service offerings while potentially reducing competition in specific segments.

Strategic positioning should emphasize sustainability leadership and technology integration as key differentiators in an increasingly competitive market. Companies that successfully combine environmental responsibility with functional performance and cost-effectiveness will capture disproportionate market share and premium pricing opportunities.

Geographic expansion into China’s developing regions offers significant growth potential, but requires adapted product offerings and distribution strategies that reflect local market conditions and consumer preferences. MWR analysis indicates that companies establishing early presence in tier-2 and tier-3 cities achieve sustainable competitive advantages.

Innovation investment should focus on sustainable materials, smart packaging technologies, and manufacturing efficiency improvements that address multiple market trends simultaneously. Partnerships with research institutions and technology companies can accelerate development while sharing risks and costs.

Customer relationship development becomes increasingly important as packaging decisions integrate with broader supply chain and sustainability strategies. Companies providing comprehensive solutions and consultative support will strengthen customer loyalty and pricing power.

Market evolution indicates continued strong growth driven by economic expansion, urbanization, and evolving consumer preferences. The packaging industry’s transformation toward sustainability and technology integration positions it as a key enabler of China’s economic development and environmental goals.

Technology adoption will accelerate across all market segments, with smart packaging, automation, and digital integration becoming standard rather than premium features. Companies investing in these capabilities now will establish competitive advantages that compound over time.

Sustainability requirements will intensify, with circular economy principles becoming mandatory rather than voluntary. This transition creates opportunities for innovative companies while challenging those dependent on traditional materials and processes. Sustainable packaging adoption is projected to reach 55% market penetration within the next five years.

Regional development will continue shifting toward inland areas as infrastructure improves and labor costs rise in coastal regions. This geographic rebalancing creates opportunities for companies that establish early presence in developing markets while maintaining quality and service standards.

China’s packaging market represents a dynamic and rapidly evolving sector that reflects the country’s broader economic transformation and environmental consciousness. The market’s substantial scale, technological advancement, and sustainability focus position it as a global leader in packaging innovation and production capability.

Future success in this market requires strategic focus on sustainability, technology integration, and customer relationship development while maintaining cost competitiveness and operational efficiency. Companies that successfully navigate regulatory evolution, consumer preference changes, and competitive intensification will capture significant value creation opportunities.

Market fundamentals remain strong, supported by economic growth, urbanization trends, and expanding applications across diverse industries. The packaging sector’s critical role in enabling commerce, protecting products, and communicating brand values ensures continued relevance and growth potential in China’s developing economy.

What is Packaging?

Packaging refers to the technology and process of enclosing or protecting products for distribution, storage, sale, and use. It encompasses various materials and designs tailored to different industries, including food, pharmaceuticals, and consumer goods.

What are the key players in the China Packaging Market?

Key players in the China Packaging Market include companies like Amcor, Sealed Air, and Huhtamaki, which provide innovative packaging solutions across various sectors. These companies focus on sustainability and efficiency in their packaging designs, among others.

What are the main drivers of growth in the China Packaging Market?

The growth of the China Packaging Market is driven by increasing consumer demand for convenience, the rise of e-commerce, and a focus on sustainable packaging solutions. Additionally, advancements in packaging technology are enhancing product shelf life and reducing waste.

What challenges does the China Packaging Market face?

The China Packaging Market faces challenges such as regulatory compliance, rising raw material costs, and environmental concerns regarding plastic waste. Companies must navigate these issues while meeting consumer expectations for quality and sustainability.

What opportunities exist in the China Packaging Market?

Opportunities in the China Packaging Market include the growing demand for eco-friendly packaging solutions and the expansion of the food and beverage sector. Innovations in smart packaging and biodegradable materials are also paving the way for future growth.

What trends are shaping the China Packaging Market?

Trends in the China Packaging Market include the shift towards sustainable materials, the adoption of smart packaging technologies, and increased customization to meet consumer preferences. These trends are influencing how products are packaged and marketed.

China Packaging Market

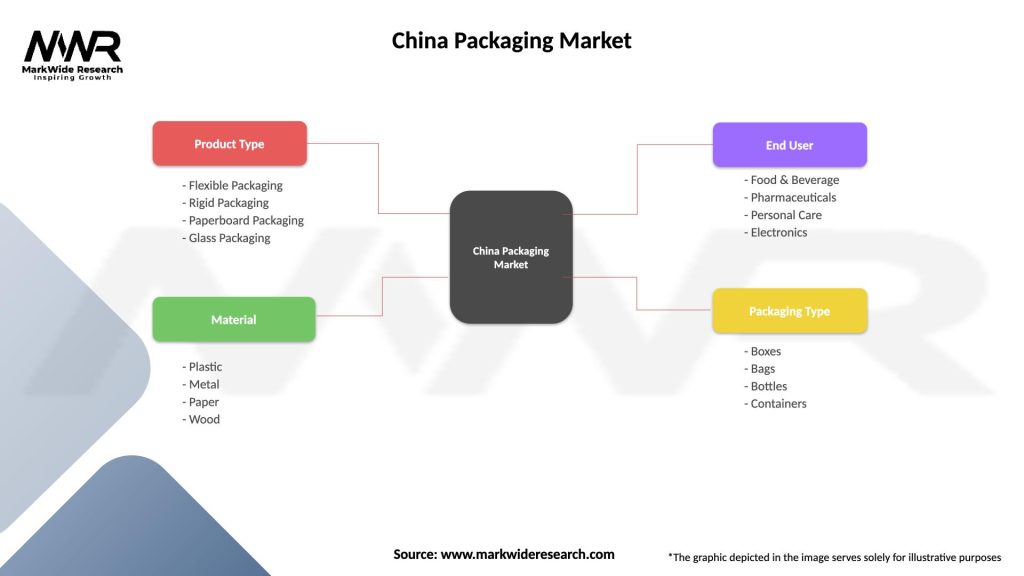

| Segmentation Details | Description |

|---|---|

| Product Type | Flexible Packaging, Rigid Packaging, Paperboard Packaging, Glass Packaging |

| Material | Plastic, Metal, Paper, Wood |

| End User | Food & Beverage, Pharmaceuticals, Personal Care, Electronics |

| Packaging Type | Boxes, Bags, Bottles, Containers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at