444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China outdoor LED lighting market represents one of the most dynamic and rapidly evolving segments within the global lighting industry. China’s commitment to sustainable urban development and smart city initiatives has positioned the country as a global leader in outdoor LED lighting adoption and innovation. The market encompasses a comprehensive range of applications including street lighting, architectural lighting, landscape illumination, and sports facility lighting across urban and rural environments.

Government initiatives promoting energy efficiency and environmental sustainability have accelerated the transition from traditional lighting technologies to advanced LED solutions. The market demonstrates robust growth potential, driven by urbanization trends, infrastructure modernization projects, and increasing awareness of energy conservation benefits. China’s manufacturing capabilities in LED technology have established the country as both a major consumer and global supplier of outdoor LED lighting solutions.

Market dynamics indicate strong growth momentum with the sector experiencing a compound annual growth rate of 12.8% over recent years. The integration of smart lighting technologies, IoT connectivity, and advanced control systems has transformed traditional outdoor lighting into intelligent infrastructure components. Regional development varies significantly, with tier-one cities leading adoption while smaller municipalities rapidly implementing LED upgrade programs.

The China outdoor LED lighting market refers to the comprehensive ecosystem of light-emitting diode lighting solutions designed for exterior applications across Chinese territories. This market encompasses the manufacturing, distribution, installation, and maintenance of LED lighting systems used in public spaces, commercial areas, residential complexes, and industrial facilities throughout China.

Outdoor LED lighting represents a technological advancement from conventional lighting methods, offering superior energy efficiency, extended operational lifespan, and enhanced illumination quality. The market includes various product categories such as street lights, floodlights, wall washers, landscape fixtures, and specialty lighting designed for specific outdoor applications. Smart lighting integration has expanded the market definition to include connected lighting systems capable of remote monitoring, automated control, and data collection.

Market participants range from large-scale manufacturers and technology developers to installation contractors and maintenance service providers. The ecosystem supports China’s broader infrastructure development goals while contributing to energy conservation objectives and urban beautification initiatives.

China’s outdoor LED lighting market has emerged as a cornerstone of the country’s sustainable development strategy, demonstrating exceptional growth across multiple application segments. The market benefits from strong government support, advanced manufacturing capabilities, and increasing consumer awareness of energy-efficient lighting solutions. Key growth drivers include rapid urbanization, smart city development programs, and environmental protection initiatives.

Technology advancement continues to reshape market dynamics, with innovations in LED chip efficiency, thermal management, and intelligent control systems driving product evolution. The market shows particular strength in street lighting applications, which account for approximately 45% of total market share. Regional distribution reflects China’s economic development patterns, with eastern coastal provinces leading in adoption rates and market penetration.

Competitive landscape features both domestic manufacturers and international players, with Chinese companies increasingly dominating through cost advantages and technological innovation. The market outlook remains highly positive, supported by ongoing infrastructure investments and the gradual replacement of legacy lighting systems across the country.

Market analysis reveals several critical insights that define the current state and future trajectory of China’s outdoor LED lighting sector:

Government initiatives represent the primary catalyst driving China’s outdoor LED lighting market expansion. National policies promoting energy conservation and emission reduction create strong incentives for LED adoption across public and private sectors. Smart city development programs incorporate outdoor LED lighting as essential infrastructure components, generating substantial demand for advanced lighting solutions.

Urbanization trends continue to fuel market growth as expanding cities require comprehensive lighting infrastructure for streets, parks, commercial districts, and residential areas. The ongoing migration from rural to urban areas creates continuous demand for new lighting installations and infrastructure upgrades. Economic development in tier-two and tier-three cities presents significant growth opportunities as these markets mature.

Environmental consciousness among consumers and businesses drives preference for energy-efficient lighting solutions. LED technology’s superior energy performance, typically achieving 60-70% energy savings compared to traditional lighting, aligns with China’s carbon neutrality commitments. Cost reduction in LED manufacturing has made these solutions increasingly accessible across all market segments.

Technological advancement in LED efficiency, control systems, and smart features enhances product appeal and functionality. The integration of wireless connectivity, sensors, and automated controls creates value-added solutions that extend beyond basic illumination to include security, traffic management, and environmental monitoring capabilities.

High initial investment requirements present significant barriers for some market segments, particularly in budget-constrained municipalities and smaller commercial applications. While LED technology offers long-term cost savings, the upfront capital expenditure can be substantial compared to traditional lighting alternatives. Financial constraints in certain regions limit the pace of LED adoption despite recognized benefits.

Technical complexity associated with advanced LED lighting systems requires specialized knowledge for proper installation, configuration, and maintenance. The shortage of qualified technicians and installers in some regions creates implementation challenges and potential performance issues. Quality concerns regarding lower-cost LED products can impact market confidence and adoption rates.

Market fragmentation with numerous manufacturers and varying quality standards creates confusion among buyers and complicates procurement decisions. The presence of substandard products in the market can damage overall perception of LED technology reliability. Regulatory compliance requirements and evolving standards add complexity to product development and market entry processes.

Competition from alternative technologies and the existing installed base of conventional lighting systems create resistance to change in some applications. The need for infrastructure modifications to accommodate LED systems can increase total implementation costs and complexity.

Smart city development initiatives across China present unprecedented opportunities for outdoor LED lighting integration. The convergence of lighting infrastructure with IoT platforms, 5G networks, and urban management systems creates new revenue streams and value propositions. Data monetization through connected lighting networks offers additional business model opportunities beyond traditional product sales.

Rural electrification and infrastructure development programs extend market opportunities beyond major urban centers. Government initiatives to improve rural living standards include comprehensive lighting infrastructure upgrades, creating substantial demand for outdoor LED solutions. Tourism development in scenic areas and cultural sites drives demand for specialized architectural and landscape lighting applications.

Replacement market opportunities emerge as early LED installations reach end-of-life and require upgrades to newer, more efficient technologies. The installed base of first-generation LED systems presents a significant replacement market over the coming years. Retrofit applications in existing infrastructure offer cost-effective upgrade paths without complete system replacement.

Export opportunities leverage China’s manufacturing capabilities and cost advantages to serve international markets. The Belt and Road Initiative creates specific opportunities for Chinese LED lighting companies to participate in infrastructure projects across participating countries. Technology licensing and partnership opportunities enable market expansion through collaborative business models.

Supply chain dynamics in China’s outdoor LED lighting market reflect the country’s position as a global manufacturing hub. Vertical integration among major players creates competitive advantages through cost control and quality assurance. Raw material availability and pricing fluctuations impact manufacturing costs and market pricing strategies, with semiconductor shortages occasionally affecting production schedules.

Technology evolution drives continuous market transformation as LED efficiency improvements, smart features, and integration capabilities advance rapidly. The transition from basic LED fixtures to intelligent lighting systems requires ongoing investment in research and development. Market consolidation trends see larger companies acquiring smaller players to expand capabilities and market reach.

Customer behavior increasingly favors comprehensive lighting solutions over individual products, driving demand for integrated systems and services. The shift toward outcome-based procurement models, where customers pay for lighting services rather than equipment, transforms traditional business models. Performance expectations continue to rise as customers demand higher efficiency, longer lifespans, and enhanced functionality.

Regulatory environment evolution includes stricter energy efficiency standards, quality requirements, and environmental regulations that shape product development and market dynamics. The implementation of carbon trading systems and environmental taxes creates additional incentives for LED adoption while potentially impacting manufacturing costs.

Market research methodology for analyzing China’s outdoor LED lighting market employs a comprehensive multi-source approach combining primary and secondary research techniques. Primary research includes structured interviews with industry executives, manufacturers, distributors, and end-users across different regions and market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of government publications, industry reports, company financial statements, and trade association data to establish market baselines and validate primary research findings. Data triangulation methods ensure accuracy and reliability by cross-referencing information from multiple independent sources.

Market sizing methodologies utilize bottom-up and top-down approaches to estimate market dimensions and growth rates. Bottom-up analysis aggregates data from individual market segments and applications, while top-down analysis starts with macroeconomic indicators and industry-wide statistics. Quantitative analysis includes statistical modeling and trend analysis to project future market developments.

Qualitative assessment incorporates expert opinions, industry insights, and market intelligence to understand underlying market dynamics and competitive positioning. Field research and site visits provide practical insights into actual market conditions and customer experiences. Continuous monitoring ensures research findings remain current and relevant as market conditions evolve.

Eastern China dominates the outdoor LED lighting market, accounting for approximately 52% of national market share. The region benefits from advanced manufacturing capabilities, higher urbanization rates, and stronger economic development. Guangdong Province leads in both production and consumption, hosting major LED manufacturers and serving as a technology innovation hub.

Northern China represents a significant market segment driven by government infrastructure investments and urban development projects. Beijing and surrounding areas demonstrate high adoption rates for smart lighting solutions as part of comprehensive smart city initiatives. The region shows particular strength in large-scale municipal lighting projects and architectural applications.

Central China exhibits rapid growth potential as economic development accelerates and urbanization expands. Government policies promoting balanced regional development create opportunities for LED lighting infrastructure investments. Market penetration rates in this region currently stand at approximately 35%, indicating substantial growth potential.

Western China presents emerging opportunities driven by government development programs and infrastructure investments. While currently representing a smaller market share, the region shows strong growth momentum supported by tourism development and urban expansion initiatives. Rural electrification programs in western regions create specific demand for cost-effective outdoor LED lighting solutions.

Market leadership in China’s outdoor LED lighting sector features a mix of domestic manufacturers and international players, with Chinese companies increasingly dominating through technological innovation and cost advantages. The competitive environment emphasizes product quality, technological capabilities, and comprehensive solution offerings.

Domestic manufacturers continue to gain market share through competitive pricing, local market knowledge, and rapid innovation cycles. Strategic partnerships between international and domestic companies create opportunities for technology transfer and market expansion.

By Product Type:

By Application:

By Technology:

Street Lighting Category represents the dominant market segment, driven by extensive government infrastructure investments and urban expansion projects. This category benefits from standardized specifications and large-scale procurement programs that create economies of scale. Smart street lighting integration enables additional functionalities including traffic monitoring, environmental sensing, and public safety applications.

Architectural Lighting Category shows strong growth momentum fueled by urban beautification projects and tourism development initiatives. Cultural heritage lighting projects and landmark illumination create demand for specialized high-quality fixtures with advanced control capabilities. The category demonstrates higher profit margins due to customization requirements and premium positioning.

Industrial Lighting Category benefits from manufacturing sector expansion and facility modernization programs. Energy efficiency requirements in industrial applications drive LED adoption as companies seek to reduce operational costs. The category shows particular strength in logistics and e-commerce facility lighting due to rapid sector growth.

Solar LED Category presents significant opportunities in remote areas and applications where grid connectivity is challenging or expensive. Technology improvements in solar panels and battery systems enhance system reliability and performance. Government support for renewable energy integration creates favorable conditions for solar LED adoption.

Manufacturers benefit from China’s large domestic market and growing export opportunities. The country’s manufacturing ecosystem provides cost advantages, supply chain efficiency, and access to advanced technologies. Scale economies enable competitive pricing while supporting investment in research and development activities.

Government entities achieve multiple objectives through LED lighting adoption including energy conservation, cost reduction, and improved public services. Smart lighting integration enables data collection and urban management capabilities that support broader smart city initiatives. Environmental benefits align with national sustainability goals and carbon neutrality commitments.

End users realize significant operational cost savings through reduced energy consumption and maintenance requirements. Improved lighting quality enhances safety, security, and aesthetic appeal in outdoor environments. Smart lighting features provide additional value through automated controls and monitoring capabilities.

Technology providers find opportunities to integrate advanced features including IoT connectivity, sensors, and data analytics platforms. Service-based business models create recurring revenue streams beyond traditional product sales. Partnership opportunities with lighting manufacturers enable market access and technology deployment.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend transforming China’s outdoor LED lighting market. The convergence of lighting infrastructure with IoT platforms, 5G networks, and artificial intelligence creates intelligent urban ecosystems. Connected lighting systems enable real-time monitoring, predictive maintenance, and dynamic control based on usage patterns and environmental conditions.

Sustainability focus drives demand for environmentally responsible lighting solutions including recyclable materials, reduced carbon footprints, and circular economy principles. Solar integration becomes increasingly popular as solar panel efficiency improves and battery costs decline. The trend toward carbon neutrality creates additional incentives for energy-efficient lighting adoption.

Customization and personalization trends see customers demanding tailored lighting solutions that meet specific application requirements and aesthetic preferences. Modular design approaches enable flexible configurations while maintaining cost efficiency. The trend toward human-centric lighting considers biological and psychological impacts of lighting on human well-being.

Service-oriented business models shift focus from product sales to outcome-based solutions where customers pay for lighting services rather than equipment ownership. Lighting-as-a-Service models reduce upfront costs while ensuring ongoing performance and maintenance. Data monetization through connected lighting networks creates additional revenue opportunities.

Technology advancement continues to drive industry evolution with breakthrough developments in LED chip efficiency, thermal management, and optical design. MarkWide Research analysis indicates that recent innovations have achieved luminous efficacy improvements of 15-20% compared to previous generation products. Advanced manufacturing processes enable cost reductions while maintaining quality standards.

Strategic partnerships between lighting manufacturers and technology companies accelerate smart lighting development and market deployment. Collaborations with telecommunications providers enable 5G integration and edge computing capabilities. Acquisition activity consolidates market players and combines complementary technologies and market positions.

Government initiatives including the National Smart City Pilot Program create specific opportunities for outdoor LED lighting integration. New standards and regulations establish quality requirements and performance benchmarks that drive market maturation. Financial incentives and subsidies support LED adoption across various application segments.

International expansion by Chinese manufacturers increases global market presence and technology transfer. Belt and Road Initiative projects create specific opportunities for Chinese LED lighting companies to participate in international infrastructure development. Export growth demonstrates the competitiveness of Chinese LED lighting products in global markets.

Market participants should prioritize smart lighting capabilities and IoT integration to differentiate their offerings and capture emerging opportunities. Investment in research and development remains critical for maintaining competitive advantage in rapidly evolving technology landscape. Quality focus becomes increasingly important as market maturity demands higher performance standards and reliability.

Manufacturers should consider vertical integration strategies to control costs and quality while building comprehensive solution capabilities. Service business model development creates opportunities for recurring revenue and stronger customer relationships. International expansion strategies should leverage China’s manufacturing advantages while addressing local market requirements.

Government entities should develop comprehensive procurement strategies that balance cost considerations with quality requirements and long-term performance objectives. Standardization efforts can reduce market fragmentation and improve overall quality levels. Investment in technical training and certification programs addresses skills gaps in installation and maintenance.

Technology providers should focus on platform approaches that enable integration with multiple lighting manufacturers and applications. Data analytics capabilities become increasingly valuable as connected lighting generates substantial information resources. Partnership strategies with established lighting companies provide market access and deployment opportunities.

Market growth prospects remain highly positive, supported by ongoing urbanization, infrastructure investment, and technology advancement. MWR projections indicate the market will continue expanding at a compound annual growth rate of 11.5% over the next five years. Smart lighting integration and IoT connectivity will drive premium segment growth and value creation.

Technology evolution will focus on improved efficiency, enhanced functionality, and seamless integration with urban infrastructure systems. Artificial intelligence and machine learning capabilities will enable predictive maintenance, optimized performance, and automated system management. The convergence of lighting with 5G networks creates opportunities for advanced applications and services.

Market consolidation trends will continue as larger players acquire smaller companies to expand capabilities and market reach. International expansion by Chinese manufacturers will increase global market presence and technology transfer. The development of global standards and certification programs will facilitate international trade and market access.

Sustainability requirements will drive innovation in materials, manufacturing processes, and end-of-life management. Circular economy principles will influence product design and business model development. The integration of renewable energy sources with LED lighting systems will create self-sustaining infrastructure solutions.

China’s outdoor LED lighting market stands at the forefront of global lighting industry transformation, driven by technological innovation, government support, and massive infrastructure development initiatives. The market demonstrates exceptional growth potential across multiple segments, with smart lighting integration creating new value propositions and business opportunities.

Key success factors include quality focus, technology innovation, and comprehensive solution capabilities that address evolving customer requirements. The convergence of lighting infrastructure with IoT platforms and smart city systems transforms traditional lighting into intelligent urban infrastructure components. Market participants who embrace these trends and invest in advanced capabilities will be well-positioned for future success.

Future market development will be characterized by continued technology advancement, international expansion, and the evolution toward service-based business models. The emphasis on sustainability and energy efficiency aligns with China’s broader environmental objectives while creating substantial market opportunities. Strategic positioning in smart lighting and connected infrastructure will determine competitive advantage in the evolving market landscape.

What is Outdoor LED Lighting?

Outdoor LED lighting refers to the use of light-emitting diodes (LEDs) for illumination in outdoor spaces. This technology is widely used for street lighting, landscape lighting, and architectural lighting due to its energy efficiency and long lifespan.

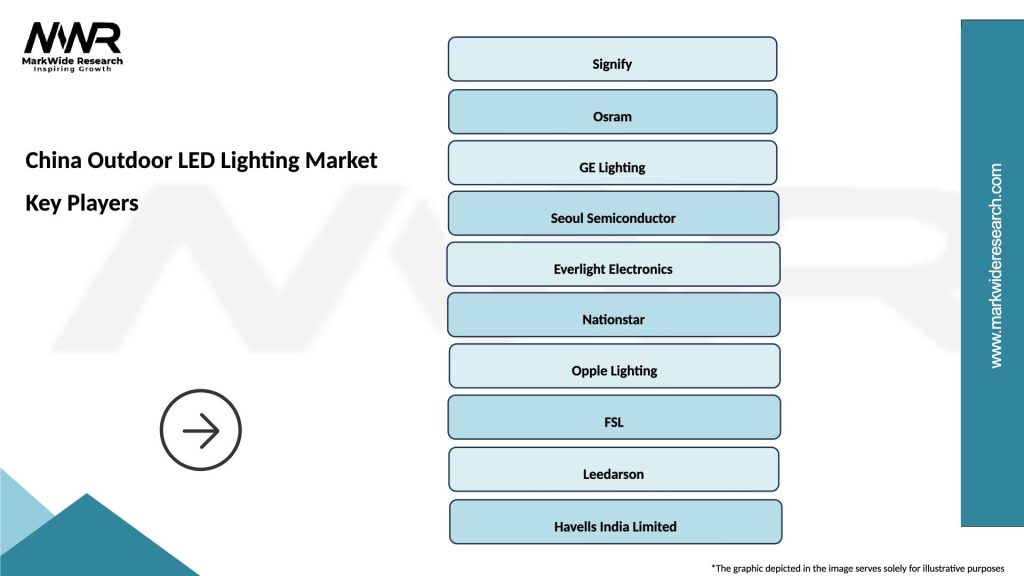

What are the key companies in the China Outdoor LED Lighting Market?

Key companies in the China Outdoor LED Lighting Market include Signify, Osram, and Cree, which are known for their innovative lighting solutions and extensive product ranges, among others.

What are the growth factors driving the China Outdoor LED Lighting Market?

The growth of the China Outdoor LED Lighting Market is driven by increasing urbanization, the demand for energy-efficient lighting solutions, and government initiatives promoting smart city developments.

What challenges does the China Outdoor LED Lighting Market face?

Challenges in the China Outdoor LED Lighting Market include high initial installation costs, competition from traditional lighting technologies, and regulatory hurdles related to environmental standards.

What opportunities exist in the China Outdoor LED Lighting Market?

Opportunities in the China Outdoor LED Lighting Market include advancements in smart lighting technologies, the integration of IoT for enhanced control, and the growing trend of sustainable urban development.

What trends are shaping the China Outdoor LED Lighting Market?

Trends in the China Outdoor LED Lighting Market include the increasing adoption of solar-powered LED lights, the rise of smart lighting systems, and a focus on reducing carbon footprints through energy-efficient solutions.

China Outdoor LED Lighting Market

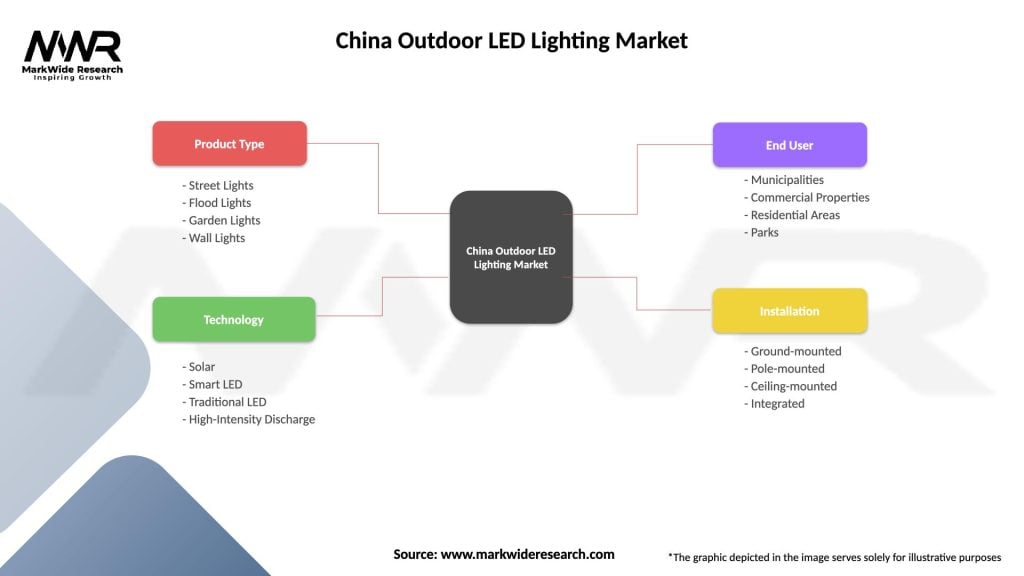

| Segmentation Details | Description |

|---|---|

| Product Type | Street Lights, Flood Lights, Garden Lights, Wall Lights |

| Technology | Solar, Smart LED, Traditional LED, High-Intensity Discharge |

| End User | Municipalities, Commercial Properties, Residential Areas, Parks |

| Installation | Ground-mounted, Pole-mounted, Ceiling-mounted, Integrated |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Outdoor LED Lighting Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at