444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China organic fertilizer market represents one of the most dynamic and rapidly evolving agricultural sectors in the Asia-Pacific region. As the world’s largest agricultural producer, China has witnessed a significant transformation in farming practices, with increasing emphasis on sustainable agriculture and environmental protection. The organic fertilizer industry has emerged as a critical component of this agricultural revolution, driven by government policies promoting green farming practices and growing consumer demand for organic food products.

Market dynamics indicate that China’s organic fertilizer sector is experiencing robust growth, with adoption rates increasing by approximately 12% annually across major agricultural regions. The shift from conventional chemical fertilizers to organic alternatives reflects broader environmental consciousness and regulatory changes aimed at reducing soil degradation and water pollution. Agricultural modernization initiatives have further accelerated market expansion, with farmers increasingly recognizing the long-term benefits of organic soil enhancement.

Regional distribution shows significant concentration in major agricultural provinces, including Shandong, Henan, and Jiangsu, which collectively account for over 45% of national organic fertilizer consumption. The market encompasses various organic fertilizer types, including compost, manure-based products, biochar, and microbial fertilizers, each serving specific crop requirements and soil conditions.

The China organic fertilizer market refers to the comprehensive ecosystem of natural, biodegradable soil enhancement products derived from organic matter, including plant residues, animal waste, and microbial organisms, specifically designed to improve soil fertility and crop productivity while maintaining environmental sustainability.

Organic fertilizers in the Chinese context encompass a wide range of products that undergo natural decomposition processes to release essential nutrients gradually into the soil. Unlike synthetic chemical fertilizers, these products enhance soil structure, promote beneficial microbial activity, and contribute to long-term soil health improvement. The market includes both traditional organic materials and modern biotechnology-enhanced products that combine organic matter with beneficial microorganisms.

Market classification typically includes solid organic fertilizers, liquid organic fertilizers, and specialized bio-organic fertilizers. Each category serves distinct agricultural applications, from large-scale grain production to specialty crop cultivation and greenhouse farming operations.

China’s organic fertilizer market stands at the forefront of agricultural transformation, driven by stringent environmental regulations and increasing demand for sustainable farming practices. The sector has experienced unprecedented growth momentum, with government initiatives promoting organic agriculture adoption across diverse farming communities. Policy support through subsidies and tax incentives has significantly accelerated market penetration, particularly among small and medium-scale farmers.

Key market drivers include rising environmental awareness, soil health concerns, and growing organic food demand. The market benefits from China’s vast agricultural land base and diverse crop production systems, creating substantial opportunities for organic fertilizer applications. Technology integration has enhanced product effectiveness, with advanced composting techniques and microbial enhancement technologies improving nutrient delivery and soil conditioning capabilities.

Competitive dynamics reveal a fragmented market structure with numerous local and regional players alongside emerging national brands. The industry is characterized by continuous innovation in product formulations and application methods, driven by research collaboration between agricultural institutions and commercial enterprises.

Strategic analysis reveals several critical insights shaping China’s organic fertilizer market trajectory:

Environmental sustainability serves as the primary catalyst driving China’s organic fertilizer market expansion. Government initiatives aimed at reducing chemical fertilizer usage by 20% over five years have created substantial demand for organic alternatives. The national commitment to carbon neutrality and environmental protection has positioned organic fertilizers as essential components of sustainable agricultural development.

Soil health deterioration across major agricultural regions has intensified the need for organic soil enhancement solutions. Decades of intensive chemical fertilizer application have resulted in soil acidification, reduced organic matter content, and diminished microbial diversity. Organic fertilizers address these challenges by improving soil structure, enhancing water retention capacity, and promoting beneficial microbial ecosystems.

Consumer demand for organic food products has created upstream pressure for organic farming practices. Growing health consciousness among Chinese consumers, particularly in urban areas, has driven premium pricing for organically produced agricultural products. This market dynamic incentivizes farmers to adopt organic fertilizers to meet certification requirements and capture higher profit margins.

Agricultural modernization policies support the transition toward sustainable farming practices through financial incentives and technical assistance programs. Government subsidies covering up to 30% of organic fertilizer costs have significantly reduced adoption barriers for small-scale farmers. Additionally, rural development initiatives prioritize environmentally friendly agricultural technologies.

High initial costs represent a significant barrier to organic fertilizer adoption, particularly for price-sensitive small-scale farmers. Organic fertilizers typically cost 2-3 times more than conventional chemical alternatives, creating financial challenges for farmers operating on tight margins. The longer payback period for organic fertilizer investments further complicates adoption decisions.

Supply chain limitations constrain market growth in certain regions, particularly remote agricultural areas with limited access to organic fertilizer production facilities. Transportation costs for bulky organic fertilizer products can significantly impact final pricing, reducing competitiveness compared to concentrated chemical fertilizers.

Quality inconsistency among organic fertilizer products has created market skepticism and adoption hesitancy. Variations in raw material quality, processing methods, and storage conditions can result in inconsistent nutrient content and effectiveness. Standardization challenges persist despite regulatory efforts to establish quality benchmarks.

Knowledge gaps regarding optimal organic fertilizer application methods and timing continue to limit market penetration. Many farmers lack technical expertise in organic fertilizer management, leading to suboptimal results and reduced confidence in organic alternatives. Extension services remain inadequate in many rural areas, hampering effective technology transfer.

Waste-to-fertilizer conversion presents enormous opportunities for market expansion, given China’s substantial organic waste generation from agricultural, municipal, and industrial sources. The circular economy approach to waste management aligns with national sustainability goals while creating cost-effective raw material sources for organic fertilizer production.

Technology integration offers significant potential for product innovation and market differentiation. Advanced biotechnology applications, including beneficial microorganism enhancement and slow-release formulations, can improve organic fertilizer effectiveness and justify premium pricing. Smart agriculture integration through precision application technologies represents another growth avenue.

Export market development provides substantial expansion opportunities, particularly in Southeast Asian and African markets where demand for sustainable agricultural inputs is growing rapidly. China’s manufacturing capabilities and cost advantages position domestic producers favorably for international market penetration.

Specialty crop applications represent high-value market segments with premium pricing potential. Organic fertilizers designed for specific crops such as tea, fruits, and vegetables can command higher margins while addressing unique nutritional requirements. Greenhouse agriculture expansion further creates demand for specialized organic fertilizer formulations.

Supply-demand equilibrium in China’s organic fertilizer market reflects complex interactions between production capacity, raw material availability, and agricultural demand patterns. Seasonal variations significantly impact both supply and demand dynamics, with peak demand occurring during spring planting and autumn fertilization periods. Production capacity has expanded rapidly, with new facilities achieving 15% annual growth in processing capabilities.

Price volatility remains a characteristic feature of the organic fertilizer market, influenced by raw material costs, transportation expenses, and competitive pressures from chemical fertilizers. Government subsidies help stabilize pricing and maintain market competitiveness, though subsidy levels vary significantly across different provinces and product categories.

Competitive intensity has increased substantially as new entrants recognize market opportunities and existing players expand production capabilities. Market consolidation trends are emerging as larger companies acquire smaller producers to achieve economies of scale and expand geographic coverage. Innovation competition focuses on product effectiveness, application convenience, and environmental benefits.

Regulatory evolution continues to shape market dynamics through evolving quality standards, environmental requirements, and certification processes. MarkWide Research analysis indicates that regulatory compliance costs account for approximately 8% of total production expenses for established organic fertilizer manufacturers.

Comprehensive market analysis employs multiple research methodologies to ensure data accuracy and insight reliability. Primary research involves extensive interviews with industry stakeholders, including organic fertilizer manufacturers, distributors, agricultural cooperatives, and end-users across major agricultural regions. Survey methodology encompasses structured questionnaires administered to representative farmer samples in key provinces.

Secondary research incorporates analysis of government statistics, industry reports, academic publications, and regulatory documents. Data triangulation methods validate findings across multiple sources to ensure consistency and reliability. Market modeling utilizes statistical analysis techniques to identify trends, correlations, and growth patterns within the organic fertilizer sector.

Expert consultation involves collaboration with agricultural scientists, policy researchers, and industry veterans to provide contextual insights and validate analytical conclusions. Field observations at production facilities and farming operations provide practical insights into market realities and operational challenges.

Data validation processes include cross-referencing multiple sources, statistical significance testing, and peer review by industry experts. Quality assurance measures ensure research findings accurately represent market conditions and provide actionable insights for stakeholders.

Eastern China dominates the organic fertilizer market, accounting for approximately 38% of national consumption. Provinces including Shandong, Jiangsu, and Zhejiang lead in both production and consumption due to intensive agricultural activities and higher farmer income levels. Advanced agricultural practices and proximity to major urban markets drive organic fertilizer adoption in these regions.

Central China represents a rapidly growing market segment, with Henan, Hubei, and Hunan provinces showing strong adoption rates. The region’s grain production focus creates substantial demand for soil improvement solutions, while government support programs accelerate organic fertilizer implementation. Agricultural modernization initiatives in central provinces emphasize sustainable farming practices.

Western China presents significant growth potential despite current lower adoption rates. Provinces such as Sichuan, Shaanxi, and Xinjiang offer opportunities for organic fertilizer expansion, particularly in specialty crop production and ecological agriculture zones. Environmental protection priorities in western regions align with organic fertilizer benefits.

Northeastern China shows increasing interest in organic fertilizers, driven by soil health concerns in major grain-producing areas. Heilongjiang, Jilin, and Liaoning provinces are implementing organic agriculture initiatives to address soil degradation issues. Cold-climate formulations represent specialized market opportunities in this region.

Market leadership in China’s organic fertilizer sector is distributed among several key players, each with distinct competitive advantages and market positioning strategies:

Competitive strategies focus on product differentiation, geographic expansion, and technology innovation. Companies invest heavily in research and development to create specialized formulations for specific crops and growing conditions.

Product type segmentation reveals diverse market categories serving different agricultural applications and farmer preferences:

Application method segmentation includes broadcast application, precision placement, and fertigation systems. Technology adoption varies significantly based on farm size, crop type, and regional infrastructure development.

End-user segmentation encompasses large-scale commercial farms, smallholder farmers, greenhouse operations, and specialty crop producers. Each segment demonstrates distinct purchasing patterns, price sensitivity, and product preferences.

Geographic segmentation reflects regional agricultural characteristics, with grain-producing areas favoring bulk organic fertilizers while fruit and vegetable regions prefer specialized formulations.

Compost-based fertilizers dominate the market due to abundant raw material availability and established production processes. Municipal organic waste, agricultural residues, and livestock manure provide consistent feedstock for large-scale composting operations. Quality improvements through controlled composting processes have enhanced product consistency and farmer acceptance.

Microbial fertilizers represent the fastest-growing category, with adoption rates increasing by 18% annually among progressive farmers. These products combine organic nutrients with beneficial bacteria and fungi to improve soil biology and nutrient cycling. Research advancement in microbial strain selection and formulation stability drives continued innovation.

Liquid organic fertilizers gain popularity in intensive agriculture systems due to application convenience and uniform nutrient distribution. Greenhouse operations and high-value crop production increasingly adopt liquid formulations for precision nutrition management. Fertigation compatibility enhances market appeal among modern farming operations.

Biochar-enhanced fertilizers emerge as premium products offering long-term soil carbon sequestration benefits. These products appeal to environmentally conscious farmers and carbon credit programs. Technology development focuses on optimizing biochar particle size and nutrient loading for maximum effectiveness.

Farmers benefit from improved soil health, reduced input costs over time, and access to premium organic food markets. Long-term soil fertility enhancement reduces dependence on external inputs while maintaining or improving crop yields. Environmental benefits include reduced water pollution, enhanced biodiversity, and improved soil carbon storage.

Manufacturers gain from growing market demand, government policy support, and opportunities for product differentiation. The shift toward sustainable agriculture creates stable long-term demand for organic fertilizer products. Innovation opportunities in biotechnology and precision agriculture applications provide competitive advantages.

Distributors and retailers benefit from expanding product portfolios and higher-margin organic fertilizer sales. Growing farmer awareness and government promotion programs drive consistent demand growth. Service opportunities in technical support and application guidance create additional revenue streams.

Government stakeholders achieve environmental protection objectives, rural development goals, and agricultural sustainability targets. Organic fertilizer promotion supports broader policy initiatives including pollution reduction and carbon neutrality commitments. Economic benefits include rural job creation and reduced environmental remediation costs.

Strengths:

Weaknesses:

Opportunities:

Threats:

Biotechnology integration represents the most significant trend shaping China’s organic fertilizer market. Advanced microbial enhancement technologies improve nutrient availability and soil health benefits, driving premium product development. Precision agriculture applications increasingly incorporate organic fertilizers through smart application systems and data-driven nutrient management.

Circular economy principles gain prominence as manufacturers develop integrated waste processing and fertilizer production systems. Urban organic waste, agricultural residues, and industrial byproducts provide sustainable raw material sources while addressing environmental challenges. Zero waste initiatives create synergies between waste management and agricultural productivity.

Customization trends reflect growing demand for crop-specific and region-specific organic fertilizer formulations. Manufacturers invest in research to develop specialized products for rice, wheat, fruits, vegetables, and other major crops. Soil testing integration enables precise nutrient recommendations and customized fertilizer blends.

Digital agriculture adoption influences organic fertilizer marketing and application methods. Mobile applications provide farmers with technical guidance, product information, and application timing recommendations. E-commerce platforms expand market access for both manufacturers and farmers, particularly in remote agricultural areas.

Recent industry developments highlight the dynamic nature of China’s organic fertilizer sector and emerging growth opportunities. Major manufacturers have announced significant capacity expansion projects, with new production facilities focusing on advanced biotechnology applications and automated processing systems.

Strategic partnerships between fertilizer companies and agricultural research institutions accelerate product innovation and technology transfer. Collaborative research programs focus on developing next-generation organic fertilizers with enhanced effectiveness and environmental benefits. International cooperation expands through technology licensing agreements and joint venture formations.

Regulatory developments include updated quality standards for organic fertilizers and streamlined certification processes for organic agriculture. Government initiatives promote organic fertilizer adoption through expanded subsidy programs and technical assistance services. Environmental regulations increasingly favor organic alternatives over chemical fertilizers.

Investment activity remains robust, with venture capital and private equity firms supporting innovative organic fertilizer startups. MWR analysis indicates that investment in organic fertilizer technology companies has grown by 25% annually over the past three years, reflecting strong investor confidence in market prospects.

Market participants should prioritize product quality and consistency to build farmer trust and market credibility. Investing in advanced processing technologies and quality control systems will differentiate products in an increasingly competitive marketplace. Brand building through farmer education and demonstration programs creates long-term customer loyalty.

Geographic expansion strategies should focus on underserved regions with strong agricultural potential and government support for organic farming. Western and central China provinces offer significant growth opportunities for established manufacturers. Distribution network development requires partnerships with local agricultural cooperatives and extension services.

Technology investment in biotechnology applications and precision agriculture integration will drive future competitiveness. Companies should collaborate with research institutions to develop innovative products and application methods. Digital transformation through e-commerce platforms and mobile applications enhances market reach and customer engagement.

Sustainability positioning aligns with government policies and consumer preferences while creating competitive advantages. Emphasizing environmental benefits and circular economy contributions resonates with stakeholders across the value chain. Carbon footprint reduction initiatives support broader sustainability objectives and regulatory compliance.

Long-term prospects for China’s organic fertilizer market remain highly positive, supported by sustained government commitment to sustainable agriculture and environmental protection. The sector is projected to maintain robust growth momentum, with adoption rates expected to increase by 10-12% annually over the next five years. Market maturation will bring improved product quality, standardization, and farmer acceptance.

Technology evolution will drive significant improvements in organic fertilizer effectiveness and application convenience. Advanced biotechnology applications, including engineered microorganisms and slow-release formulations, will enhance product performance and justify premium pricing. Precision agriculture integration will optimize application timing and rates for maximum effectiveness.

Market consolidation trends are expected to accelerate as larger companies acquire smaller producers to achieve economies of scale and expand geographic coverage. MarkWide Research projects that the top ten companies will account for approximately 60% of market share within the next decade, compared to current levels of around 40%.

International expansion opportunities will grow as Chinese manufacturers leverage cost advantages and technical expertise to serve global markets. Southeast Asian and African markets present particularly attractive opportunities for organic fertilizer exports. Belt and Road Initiative countries offer strategic expansion possibilities through infrastructure development and agricultural cooperation programs.

China’s organic fertilizer market stands at a pivotal moment in its development trajectory, characterized by strong government support, growing environmental awareness, and increasing farmer acceptance of sustainable agricultural practices. The sector has evolved from a niche market to a mainstream agricultural input category, driven by policy initiatives and market demand for environmentally friendly farming solutions.

Market fundamentals remain robust, with abundant raw material availability, expanding production capacity, and growing end-user adoption across diverse agricultural regions. The combination of environmental necessity and economic opportunity creates a compelling value proposition for all stakeholders in the organic fertilizer value chain.

Future success will depend on continued innovation in product development, quality improvement, and application technologies. Companies that invest in research and development, build strong distribution networks, and maintain focus on farmer education and support services will capture the greatest market opportunities. The transition toward sustainable agriculture represents not just an environmental imperative but also a significant economic opportunity for forward-thinking industry participants.

What is Organic Fertilizer?

Organic fertilizer refers to natural substances derived from plant or animal matter that are used to enhance soil fertility and promote plant growth. These fertilizers improve soil structure, provide essential nutrients, and support sustainable agricultural practices.

What are the key players in the China Organic Fertilizer Market?

Key players in the China Organic Fertilizer Market include companies like China National Chemical Corporation, Haifa Group, and Yara International, among others. These companies are involved in the production and distribution of organic fertilizers to meet the growing demand in the agricultural sector.

What are the growth factors driving the China Organic Fertilizer Market?

The China Organic Fertilizer Market is driven by increasing awareness of sustainable farming practices, rising demand for organic food, and government initiatives promoting organic agriculture. Additionally, the need for soil health improvement and environmental protection contributes to market growth.

What challenges does the China Organic Fertilizer Market face?

Challenges in the China Organic Fertilizer Market include the high cost of production, limited availability of raw materials, and competition from synthetic fertilizers. These factors can hinder the adoption of organic fertilizers among farmers.

What opportunities exist in the China Organic Fertilizer Market?

Opportunities in the China Organic Fertilizer Market include the expansion of organic farming practices, increasing consumer demand for organic products, and advancements in organic fertilizer technology. These factors can lead to innovative product development and market growth.

What trends are shaping the China Organic Fertilizer Market?

Trends in the China Organic Fertilizer Market include the rising popularity of bio-based fertilizers, the integration of technology in fertilizer production, and a shift towards sustainable agricultural practices. These trends reflect a growing commitment to environmental sustainability in agriculture.

China Organic Fertilizer Market

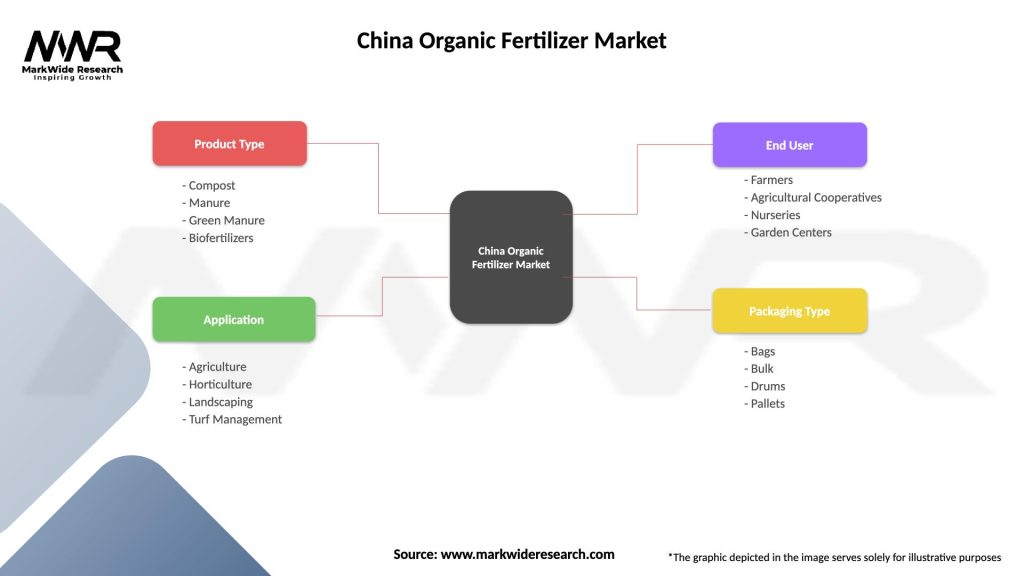

| Segmentation Details | Description |

|---|---|

| Product Type | Compost, Manure, Green Manure, Biofertilizers |

| Application | Agriculture, Horticulture, Landscaping, Turf Management |

| End User | Farmers, Agricultural Cooperatives, Nurseries, Garden Centers |

| Packaging Type | Bags, Bulk, Drums, Pallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Organic Fertilizer Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at