444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China neurology devices industry market represents a rapidly expanding sector within the country’s healthcare technology landscape, driven by an aging population, increasing prevalence of neurological disorders, and significant government investments in healthcare infrastructure. China’s neurology devices market has experienced remarkable growth, with adoption rates increasing by 12.5% annually as healthcare facilities nationwide integrate advanced neurological diagnostic and therapeutic equipment.

Market dynamics indicate that China’s focus on healthcare modernization and technological advancement has positioned the country as a key growth region for neurology device manufacturers. The market encompasses a comprehensive range of products including neurostimulation devices, neuroimaging equipment, neurosurgical instruments, and neuromonitoring systems. Regional distribution shows that tier-one cities account for approximately 45% of market adoption, while tier-two and tier-three cities are rapidly expanding their neurological care capabilities.

Healthcare infrastructure development across China has accelerated the deployment of sophisticated neurology devices, with public hospitals leading adoption at 68% market share compared to private healthcare facilities. The integration of artificial intelligence and digital health technologies into neurology devices has further enhanced market appeal, particularly among younger healthcare professionals and technology-forward medical institutions.

The China neurology devices industry market refers to the comprehensive ecosystem of medical devices, equipment, and technologies specifically designed for the diagnosis, treatment, monitoring, and management of neurological conditions within the Chinese healthcare system. This market encompasses both invasive and non-invasive devices used in clinical settings, hospitals, specialized neurology centers, and research institutions across mainland China.

Neurology devices in this context include neurostimulation systems for treating conditions like Parkinson’s disease and epilepsy, advanced neuroimaging equipment such as MRI and CT scanners optimized for neurological applications, neurosurgical instruments for brain and spine procedures, and neuromonitoring devices for critical care and surgical applications. The market also encompasses emerging technologies like brain-computer interfaces, robotic surgical systems for neurosurgery, and AI-powered diagnostic tools.

Industry scope extends beyond traditional medical devices to include software solutions, digital health platforms, telemedicine applications for neurology, and integrated healthcare information systems that support neurological care delivery. The market serves diverse stakeholders including neurologists, neurosurgeons, healthcare administrators, patients, and medical researchers throughout China’s vast healthcare network.

China’s neurology devices industry stands at the forefront of the country’s healthcare transformation, experiencing unprecedented growth driven by demographic shifts, technological advancement, and substantial healthcare investments. The market has demonstrated exceptional resilience and expansion, with government healthcare spending on neurological care increasing by 15.2% annually over recent years.

Key market characteristics include rapid adoption of advanced imaging technologies, growing demand for minimally invasive neurosurgical devices, and increasing integration of artificial intelligence in diagnostic applications. The market benefits from China’s robust manufacturing capabilities, strong research and development initiatives, and supportive regulatory environment for medical device innovation.

Competitive landscape features a mix of international technology leaders and emerging Chinese manufacturers, with domestic companies gaining significant market share through innovation and cost-effective solutions. The market’s growth trajectory is supported by expanding healthcare coverage, increasing awareness of neurological conditions, and growing patient populations requiring specialized neurological care.

Future prospects remain highly favorable, with market expansion expected to accelerate as China continues investing in healthcare infrastructure, medical education, and research capabilities. The integration of digital health technologies and personalized medicine approaches is creating new opportunities for device manufacturers and healthcare providers alike.

Strategic market analysis reveals several critical insights that define China’s neurology devices industry landscape:

Primary growth drivers propelling China’s neurology devices industry market include demographic, technological, and policy factors that create sustained demand for advanced neurological care solutions.

Aging population dynamics represent the most significant market driver, as China’s rapidly aging demographic creates unprecedented demand for neurological care services. Age-related neurological conditions including stroke, dementia, and Parkinson’s disease are increasing substantially, requiring sophisticated diagnostic and therapeutic devices. Healthcare utilization patterns show that neurological consultations have increased by 18.7% annually among patients over 60 years of age.

Government healthcare initiatives continue driving market expansion through substantial investments in medical infrastructure, healthcare accessibility programs, and technology modernization efforts. The Healthy China 2030 strategy specifically emphasizes neurological care improvement, creating favorable conditions for device adoption and market growth.

Technological advancement in neurology devices, including AI-powered diagnostics, minimally invasive surgical systems, and advanced imaging technologies, attracts healthcare providers seeking to improve patient outcomes and operational efficiency. These innovations address traditional challenges in neurological care while offering enhanced precision and reduced treatment complexity.

Rising healthcare awareness among Chinese consumers has increased demand for quality neurological care, driving healthcare facilities to invest in advanced equipment and technologies. Patient expectations for modern, effective treatments continue pushing healthcare providers toward adopting cutting-edge neurology devices.

Market challenges facing China’s neurology devices industry include regulatory complexities, cost considerations, and technical implementation barriers that may limit growth potential in certain segments.

High capital requirements for advanced neurology devices present significant barriers for smaller healthcare facilities and rural hospitals. The substantial investment needed for sophisticated neuroimaging equipment, neurosurgical systems, and specialized monitoring devices can strain healthcare budgets, particularly in less developed regions.

Technical expertise limitations in operating and maintaining complex neurology devices create implementation challenges for healthcare facilities. The shortage of trained technicians and specialized medical professionals capable of utilizing advanced neurological equipment effectively limits market penetration in some areas.

Regulatory compliance requirements for medical devices in China, while supportive of innovation, can create lengthy approval processes and substantial documentation requirements. International manufacturers may face additional challenges navigating local regulatory frameworks and establishing compliant distribution networks.

Reimbursement constraints within China’s healthcare system may limit patient access to certain advanced neurology treatments and devices. Insurance coverage variations and out-of-pocket payment requirements can affect device utilization rates and market growth in specific therapeutic areas.

Competition from alternative treatments and traditional medicine approaches may influence patient and provider preferences, potentially limiting adoption of certain neurology devices in favor of conventional or culturally preferred treatment methods.

Emerging opportunities within China’s neurology devices market present significant potential for manufacturers, healthcare providers, and technology innovators seeking to capitalize on market expansion trends.

Rural healthcare expansion represents a substantial growth opportunity as government initiatives focus on improving medical care access in underserved regions. The development of portable, cost-effective neurology devices specifically designed for rural healthcare settings could capture significant market share while addressing critical healthcare needs.

Telemedicine integration offers opportunities for neurology device manufacturers to develop connected solutions that enable remote consultation, monitoring, and treatment guidance. The COVID-19 pandemic accelerated telemedicine adoption, creating lasting demand for devices with integrated digital health capabilities.

Artificial intelligence applications in neurology devices present opportunities for enhanced diagnostic accuracy, predictive analytics, and personalized treatment approaches. AI-powered solutions that can analyze complex neurological data and provide clinical decision support are increasingly valued by healthcare providers.

Home healthcare solutions represent an emerging opportunity as patients and families seek convenient, effective neurological care options outside traditional hospital settings. Portable monitoring devices, home-based therapy systems, and patient-friendly diagnostic tools could capture growing demand for decentralized care.

Research and development partnerships between international companies and Chinese institutions offer opportunities for collaborative innovation, market access, and technology transfer that benefit all stakeholders while advancing neurological care capabilities.

Complex market dynamics shape China’s neurology devices industry through interconnected factors including technological innovation, regulatory evolution, competitive pressures, and changing healthcare delivery models.

Supply chain considerations have become increasingly important as manufacturers balance global sourcing with local production capabilities. The emphasis on supply chain resilience and domestic manufacturing capacity has influenced device pricing, availability, and market competition patterns. Local manufacturing adoption has increased by 22.3% as companies establish Chinese production facilities.

Innovation cycles in neurology devices are accelerating, with shorter product development timelines and more frequent technology updates. This rapid pace of innovation creates opportunities for early adopters while challenging healthcare facilities to maintain current technology standards and staff training programs.

Market consolidation trends are emerging as larger healthcare systems acquire smaller facilities, creating opportunities for volume purchasing agreements and standardized device procurement across hospital networks. This consolidation influences manufacturer sales strategies and market access approaches.

Patient outcome focus increasingly drives device selection decisions, with healthcare providers prioritizing technologies that demonstrate clear clinical benefits, improved patient satisfaction, and cost-effective treatment outcomes. Evidence-based purchasing decisions are becoming standard practice across China’s healthcare system.

Digital transformation within healthcare is reshaping neurology device requirements, with increasing demand for interoperable systems, data analytics capabilities, and integration with electronic health records and hospital information systems.

Comprehensive research methodology employed in analyzing China’s neurology devices industry market incorporates multiple data sources, analytical frameworks, and validation techniques to ensure accuracy and reliability of market insights.

Primary research activities included extensive interviews with healthcare professionals, hospital administrators, device manufacturers, regulatory experts, and industry stakeholders across China’s major healthcare markets. These interviews provided firsthand insights into market trends, challenges, opportunities, and future development directions.

Secondary research analysis encompassed review of government healthcare statistics, industry reports, regulatory documentation, clinical literature, and market intelligence from authoritative sources. This research foundation supported quantitative analysis and trend identification across multiple market segments and geographic regions.

Market segmentation analysis utilized both top-down and bottom-up approaches to evaluate market size, growth patterns, and competitive dynamics across device categories, application areas, and regional markets. Cross-validation techniques ensured consistency and accuracy of segmentation insights.

Expert validation processes involved consultation with industry experts, medical professionals, and market analysts to verify research findings, validate assumptions, and refine market projections. This validation ensured that research conclusions accurately reflect market realities and future prospects.

Data triangulation methods combined quantitative analysis with qualitative insights to create comprehensive market understanding. Multiple analytical perspectives provided robust foundation for strategic recommendations and market forecasting.

Regional market distribution across China reveals significant variations in neurology device adoption, healthcare infrastructure development, and market growth potential among different geographic areas.

Eastern China dominates the neurology devices market, with major cities like Shanghai, Beijing, and Guangzhou leading in advanced device adoption and healthcare technology integration. These metropolitan areas account for approximately 52% of total market activity and serve as primary entry points for international manufacturers. The region benefits from concentrated healthcare resources, research institutions, and high-income patient populations.

Central China represents a rapidly growing market segment, with cities like Wuhan, Changsha, and Zhengzhou expanding their neurological care capabilities through substantial healthcare investments. Government initiatives to develop central region healthcare infrastructure have accelerated neurology device adoption, creating significant growth opportunities for manufacturers.

Western China presents emerging market potential despite current infrastructure limitations. Government development programs and healthcare accessibility initiatives are driving investment in medical equipment and technology, including neurology devices. Rural healthcare improvement programs specifically target neurological care enhancement in these regions.

Northeastern China maintains steady market presence through established healthcare systems and industrial base, though growth rates are more moderate compared to other regions. The area’s aging population creates sustained demand for neurological care services and supporting medical devices.

Market penetration rates vary significantly by region, with tier-one cities achieving 78% adoption of advanced neurology devices compared to 34% adoption in tier-three cities, indicating substantial expansion potential in developing markets.

Competitive dynamics within China’s neurology devices market feature a diverse mix of international technology leaders, established Chinese manufacturers, and emerging innovative companies competing across multiple product segments and market channels.

International market leaders maintain strong positions through advanced technology offerings, established clinical relationships, and comprehensive service networks:

Chinese manufacturers are gaining market share through innovation, cost competitiveness, and deep understanding of local market requirements:

Market competition intensity has increased as domestic manufacturers develop advanced capabilities while international companies expand local operations and partnerships.

Market segmentation analysis reveals distinct categories within China’s neurology devices industry, each characterized by specific growth patterns, competitive dynamics, and market opportunities.

By Product Type:

By Application:

By End User:

Detailed category analysis provides specific insights into market performance, growth drivers, and competitive dynamics across major neurology device segments in China.

Neurostimulation Devices Category: This segment demonstrates exceptional growth potential driven by increasing prevalence of neurological conditions and growing acceptance of neurostimulation therapies. Deep brain stimulation systems lead category growth with 16.8% annual adoption increase among Parkinson’s disease patients. The category benefits from improved surgical techniques, enhanced device longevity, and expanding clinical indications.

Neuroimaging Equipment Category: Advanced imaging technologies continue driving category expansion as healthcare facilities upgrade capabilities and expand diagnostic services. MRI systems specifically designed for neurological applications show strong demand, particularly high-field strength systems offering superior image quality and faster scan times. The integration of artificial intelligence in imaging analysis creates additional value for healthcare providers.

Neurosurgical Instruments Category: Minimally invasive surgical approaches and robotic-assisted procedures drive demand for sophisticated neurosurgical equipment. Surgical navigation systems experience growing adoption as neurosurgeons seek enhanced precision and improved patient outcomes. The category benefits from advancing surgical techniques and increasing case volumes across China’s healthcare system.

Neuromonitoring Devices Category: Critical care applications and surgical monitoring requirements drive steady category growth. EEG systems show particular strength in epilepsy monitoring and critical care applications, while intracranial pressure monitors gain adoption in neurosurgical and trauma care settings. The category benefits from increasing awareness of neurological monitoring importance and expanding critical care capabilities.

Industry participants and stakeholders in China’s neurology devices market realize substantial benefits through market participation, technological advancement, and strategic positioning within the growing healthcare ecosystem.

Healthcare Providers Benefits:

Device Manufacturers Benefits:

Patient Benefits:

Comprehensive SWOT analysis evaluates China’s neurology devices industry market strengths, weaknesses, opportunities, and threats to provide strategic insights for market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging market trends are reshaping China’s neurology devices industry, creating new opportunities while challenging traditional approaches to neurological care and device development.

Artificial Intelligence Integration represents the most significant trend transforming neurology devices, with AI-powered diagnostic tools, predictive analytics, and treatment optimization systems becoming standard features. Machine learning algorithms enhance image analysis, automate routine tasks, and provide clinical decision support, improving both efficiency and accuracy in neurological care.

Minimally Invasive Technologies continue gaining prominence as patients and providers seek less traumatic treatment options with faster recovery times. Robotic surgical systems, advanced endoscopic equipment, and precision-guided instruments enable complex neurological procedures through smaller incisions and reduced tissue damage.

Personalized Medicine Approaches are influencing neurology device development, with manufacturers creating systems capable of adapting treatments to individual patient characteristics, genetic profiles, and specific neurological conditions. This trend supports more effective treatments and improved patient outcomes.

Connected Health Solutions integrate neurology devices with digital health platforms, enabling remote monitoring, telemedicine consultations, and continuous patient care management. IoT connectivity allows real-time data sharing between devices, healthcare providers, and patients, supporting coordinated care approaches.

Portable and Home-Based Devices address growing demand for decentralized neurological care, allowing patients to receive monitoring and treatment outside traditional hospital settings. This trend supports healthcare accessibility while reducing costs and improving patient convenience.

Sustainability Focus influences device design and manufacturing processes, with companies developing environmentally friendly products, sustainable packaging, and energy-efficient operations to meet growing environmental consciousness among healthcare providers and patients.

Recent industry developments highlight the dynamic nature of China’s neurology devices market, with significant advances in technology, regulatory frameworks, and market structure shaping future growth directions.

Regulatory Modernization has streamlined device approval processes while maintaining safety standards, with Chinese authorities implementing fast-track pathways for innovative neurology devices and establishing clearer guidelines for AI-powered medical technologies. These changes accelerate market entry for new products while ensuring patient safety.

Manufacturing Localization initiatives have attracted international companies to establish Chinese production facilities, reducing costs, improving supply chain resilience, and enhancing market responsiveness. MarkWide Research analysis indicates that local manufacturing adoption has increased significantly as companies seek competitive advantages.

Research Collaboration Expansion between international manufacturers and Chinese institutions has accelerated innovation in neurology devices, with joint development programs focusing on AI integration, advanced materials, and novel therapeutic approaches specifically adapted for Chinese patient populations.

Digital Health Platform Integration has become standard practice, with neurology device manufacturers developing comprehensive software solutions that connect devices to hospital information systems, electronic health records, and telemedicine platforms for seamless clinical workflow integration.

Market Consolidation Activities include strategic acquisitions, partnerships, and joint ventures that strengthen market positions, expand product portfolios, and enhance distribution capabilities across China’s diverse healthcare landscape.

Innovation Investment Increases from both government and private sources support research and development in advanced neurology technologies, including brain-computer interfaces, advanced neuroimaging techniques, and next-generation neurostimulation systems.

Strategic recommendations for market participants in China’s neurology devices industry focus on maximizing opportunities while addressing key challenges and positioning for long-term success.

Market Entry Strategies should prioritize partnerships with established Chinese healthcare providers and distributors to navigate complex market dynamics and regulatory requirements effectively. Local collaboration provides market insights, regulatory expertise, and established customer relationships that accelerate market penetration and reduce entry risks.

Technology Investment Priorities should focus on AI integration, digital health connectivity, and user-friendly interfaces that address specific needs of Chinese healthcare providers and patients. Innovation investments in locally relevant solutions create competitive advantages and support sustainable market growth.

Regional Expansion Approaches should balance opportunities in tier-one cities with emerging potential in developing markets. Phased expansion strategies allow companies to establish strong positions in major markets while gradually building capabilities in emerging regions with appropriate product offerings and service models.

Regulatory Compliance Focus requires dedicated resources and expertise to navigate China’s evolving medical device regulations effectively. Proactive compliance strategies ensure smooth market access while positioning companies for future regulatory developments and requirements.

Customer Education Programs should address knowledge gaps and build confidence in advanced neurology technologies among healthcare providers. Training initiatives and clinical support programs enhance device adoption while improving patient outcomes and customer satisfaction.

Supply Chain Optimization should emphasize resilience, cost-effectiveness, and responsiveness to local market needs. Hybrid supply strategies combining global sourcing with local manufacturing provide flexibility and competitive advantages in dynamic market conditions.

Future market prospects for China’s neurology devices industry remain exceptionally positive, with multiple growth drivers supporting sustained expansion and technological advancement across all market segments.

Demographic trends will continue driving market growth as China’s aging population creates increasing demand for neurological care services and supporting medical devices. Population projections indicate that citizens over 65 will represent 25% of the total population by 2030, substantially expanding the patient base requiring neurological care and advanced medical technologies.

Technology evolution will accelerate with artificial intelligence, robotics, and digital health solutions becoming integral components of neurology devices. Next-generation technologies including brain-computer interfaces, advanced neuroimaging techniques, and personalized treatment systems will create new market categories and growth opportunities.

Healthcare infrastructure development will continue expanding across China, with particular focus on improving neurological care capabilities in tier-two and tier-three cities. Government healthcare investments are projected to increase by 12.4% annually through 2028, supporting continued device adoption and market expansion.

Market maturation will bring increased sophistication in device selection, with healthcare providers prioritizing evidence-based purchasing decisions, total cost of ownership considerations, and integration capabilities. This evolution will favor manufacturers offering comprehensive solutions and demonstrated clinical value.

International collaboration will deepen as Chinese companies develop advanced capabilities while international manufacturers expand local operations and partnerships. MWR projections suggest that collaborative innovation will accelerate, benefiting all market participants through shared expertise and resources.

Regulatory environment will continue evolving to support innovation while maintaining safety standards, with streamlined approval processes and clearer guidelines for emerging technologies creating favorable conditions for market development and technology adoption.

China’s neurology devices industry market represents one of the most dynamic and promising sectors within the global medical device landscape, characterized by robust growth, technological innovation, and substantial market opportunities. The convergence of demographic trends, government support, technological advancement, and healthcare modernization creates an exceptionally favorable environment for sustained market expansion and development.

Market fundamentals remain strong across all key indicators, with aging population dynamics, increasing neurological disease prevalence, and expanding healthcare infrastructure supporting continued demand growth. The integration of artificial intelligence, digital health technologies, and minimally invasive approaches is transforming neurological care delivery while creating new opportunities for device manufacturers and healthcare providers.

Competitive dynamics reflect a healthy balance between international technology leaders and emerging Chinese manufacturers, fostering innovation, competitive pricing, and diverse solution offerings that benefit healthcare providers and patients. The market’s evolution toward evidence-based purchasing decisions and total value considerations creates opportunities for companies offering superior clinical outcomes and cost-effective solutions.

Strategic positioning for long-term success requires understanding of local market dynamics, regulatory requirements, and customer needs, combined with investment in relevant technologies and collaborative partnerships. Companies that successfully navigate China’s complex healthcare landscape while delivering innovative, cost-effective solutions will capture significant market opportunities and establish sustainable competitive advantages in this rapidly expanding market.

What is Neurology Devices?

Neurology devices refer to medical instruments and technologies used for diagnosing and treating neurological disorders. These devices include neurostimulation systems, imaging equipment, and surgical instruments designed for conditions such as epilepsy, Parkinson’s disease, and multiple sclerosis.

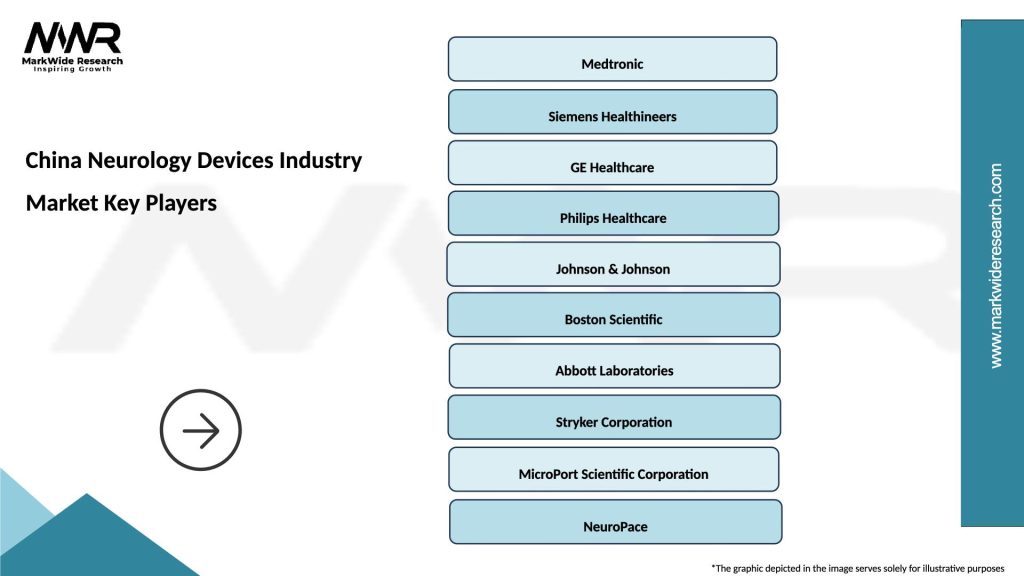

What are the key players in the China Neurology Devices Industry Market?

Key players in the China Neurology Devices Industry Market include Medtronic, Boston Scientific, and Siemens Healthineers, which are known for their innovative products and technologies in neurology. These companies focus on developing advanced solutions for neurological disorders, among others.

What are the growth factors driving the China Neurology Devices Industry Market?

The growth of the China Neurology Devices Industry Market is driven by an increasing prevalence of neurological disorders, advancements in medical technology, and a growing aging population. Additionally, rising healthcare expenditure and improved access to healthcare services contribute to market expansion.

What challenges does the China Neurology Devices Industry Market face?

The China Neurology Devices Industry Market faces challenges such as regulatory hurdles, high costs of advanced devices, and a lack of skilled professionals for device operation. These factors can hinder market growth and the adoption of new technologies.

What opportunities exist in the China Neurology Devices Industry Market?

Opportunities in the China Neurology Devices Industry Market include the development of innovative neuromodulation therapies, expansion into rural healthcare markets, and increasing investment in research and development. These factors can enhance treatment options and accessibility for patients.

What trends are shaping the China Neurology Devices Industry Market?

Trends shaping the China Neurology Devices Industry Market include the integration of artificial intelligence in diagnostic tools, the rise of telemedicine for remote patient monitoring, and the development of minimally invasive surgical techniques. These innovations are improving patient outcomes and operational efficiency.

China Neurology Devices Industry Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electroencephalography, Magnetic Resonance Imaging, Neurostimulation Devices, Cerebrospinal Fluid Management |

| Technology | Transcranial Magnetic Stimulation, Deep Brain Stimulation, Functional MRI, Neuroimaging |

| End User | Hospitals, Research Institutions, Rehabilitation Centers, Neurology Clinics |

| Application | Seizure Disorders, Neurodegenerative Diseases, Pain Management, Cognitive Disorders |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Neurology Devices Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at