444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s LNG bunkering market has been experiencing significant growth in recent years, driven by the country’s increasing focus on cleaner and more sustainable energy sources. LNG bunkering refers to the process of supplying liquefied natural gas (LNG) to ships for use as fuel instead of traditional marine fuels like heavy fuel oil or marine diesel oil. The rising environmental concerns, stringent regulations on emissions, and the need to reduce carbon footprint have accelerated the adoption of LNG as a cleaner marine fuel in China.

Meaning

LNG bunkering is an essential part of the global efforts to reduce greenhouse gas emissions from the shipping industry. It involves transferring LNG from a supply vessel to a receiving ship, where it is stored and used to power the ship’s engines. This process significantly reduces harmful air pollutants such as sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter, resulting in improved air quality and minimized environmental impact.

Executive Summary

The China LNG bunkering market has witnessed rapid growth in recent years due to increased demand for cleaner marine fuels and government initiatives to promote sustainable shipping practices. The market is expected to witness substantial growth over the forecast period, driven by the expansion of LNG infrastructure and the growing number of LNG-fueled vessels in the region. However, challenges related to infrastructure development, the high initial cost of LNG-fueled vessels, and the volatility of LNG prices could pose obstacles to the market’s growth.

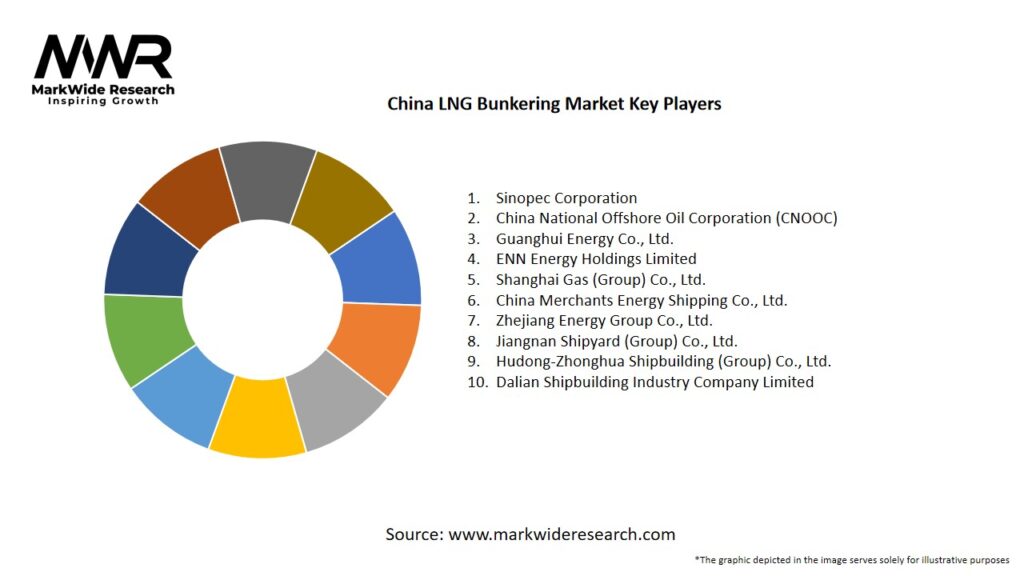

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The following factors are driving the growth of the LNG bunkering market in China:

Market Restraints

Despite the favorable market conditions, several challenges hinder the rapid expansion of the China LNG bunkering market:

Market Opportunities

Despite the challenges, the China LNG bunkering market presents several growth opportunities:

Market Dynamics

The China LNG bunkering market is dynamic, influenced by various factors such as government policies, environmental regulations, market demand, and technological advancements. As the country continues its efforts to promote green shipping practices, the demand for LNG bunkering is expected to grow steadily.

Regional Analysis

The China LNG bunkering market is concentrated in major ports along the country’s coastline. Key regions contributing to the growth of the market include:

Competitive Landscape

Leading companies in the China LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

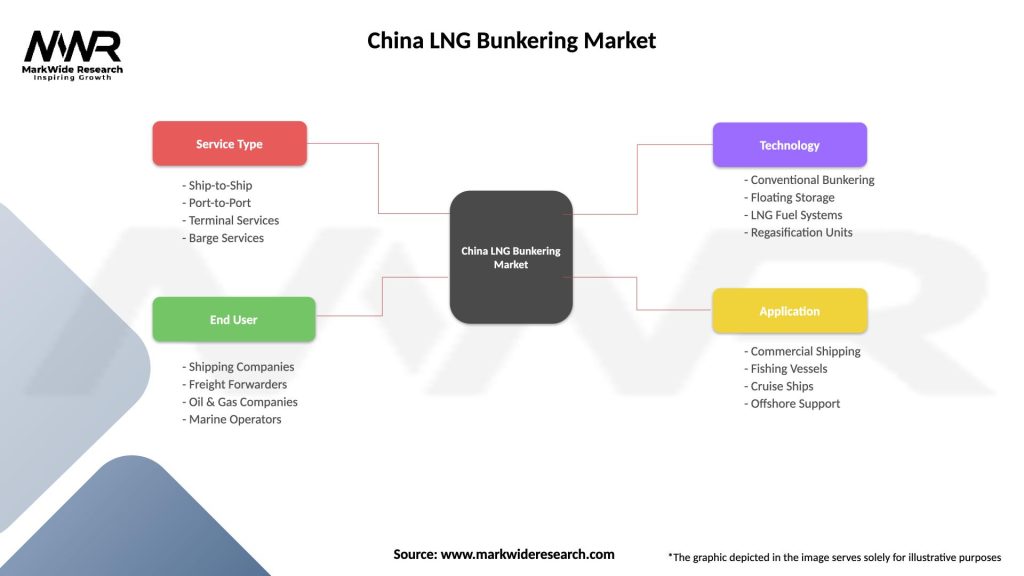

The China LNG bunkering market can be segmented based on various parameters, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on global shipping and energy markets, including the China LNG bunkering market. During the pandemic, the shipping industry faced disruptions in trade, affecting vessel movements and demand for bunkering services. However, as the world recovers from the pandemic, the demand for LNG bunkering is expected to rebound, driven by the shipping industry’s focus on sustainable practices and compliance with emission regulations.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the China LNG bunkering market appears promising, with a strong emphasis on sustainable shipping practices and compliance with environmental regulations. The market is expected to witness substantial growth over the coming years, driven by continued government support, expanding LNG infrastructure, and the increasing adoption of LNG-fueled vessels in the region.

Conclusion

The China LNG bunkering market is on a growth trajectory, propelled by the maritime industry’s increasing focus on sustainability and environmental protection. The shift towards cleaner marine fuels and the development of LNG bunkering infrastructure are expected to create abundant opportunities for industry participants and stakeholders. While challenges related to infrastructure development and price volatility of LNG remain, strategic collaborations and technological advancements can pave the way for a greener and more efficient future for the shipping industry in China. With the support of favorable government policies and a growing awareness of environmental concerns, LNG bunkering is set to play a pivotal role in shaping the future of the country’s marine transportation sector.

What is LNG Bunkering?

LNG Bunkering refers to the process of supplying liquefied natural gas (LNG) as fuel to ships and vessels. This method is gaining traction due to its environmental benefits and compliance with international maritime regulations.

What are the key players in the China LNG Bunkering Market?

Key players in the China LNG Bunkering Market include China National Offshore Oil Corporation (CNOOC), Sinopec, and China National Petroleum Corporation (CNPC), among others.

What are the growth factors driving the China LNG Bunkering Market?

The growth of the China LNG Bunkering Market is driven by increasing demand for cleaner marine fuels, stricter emissions regulations, and the expansion of LNG infrastructure in major ports.

What challenges does the China LNG Bunkering Market face?

Challenges in the China LNG Bunkering Market include high initial investment costs, limited availability of bunkering infrastructure, and competition from alternative fuels such as hydrogen and biofuels.

What opportunities exist in the China LNG Bunkering Market?

Opportunities in the China LNG Bunkering Market include the potential for technological advancements in LNG storage and delivery systems, as well as the growing interest in sustainable shipping practices.

What trends are shaping the China LNG Bunkering Market?

Trends in the China LNG Bunkering Market include the increasing adoption of LNG as a marine fuel, the development of small-scale LNG terminals, and collaborations between shipping companies and energy providers to enhance supply chains.

China LNG Bunkering Market

| Segmentation Details | Description |

|---|---|

| Service Type | Ship-to-Ship, Port-to-Port, Terminal Services, Barge Services |

| End User | Shipping Companies, Freight Forwarders, Oil & Gas Companies, Marine Operators |

| Technology | Conventional Bunkering, Floating Storage, LNG Fuel Systems, Regasification Units |

| Application | Commercial Shipping, Fishing Vessels, Cruise Ships, Offshore Support |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China LNG Bunkering Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at