444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s insurance industry is one of the largest and fastest-growing in the world. It comprises both life and non-life insurance segments, which play a crucial role in safeguarding individuals, businesses, and the overall economy. With a population of over 1.4 billion and a growing middle class, China presents immense opportunities for insurance providers. In this article, we will explore the China life and non-life insurance market, its key insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, the impact of Covid-19, industry developments, analyst suggestions, future outlook, and conclude with a summary of the market’s current status.

Meaning

The China life and non-life insurance market refer to the sector that offers financial protection and risk mitigation through various insurance products. Life insurance provides coverage for individuals, paying out benefits upon death or in cases of critical illness or disability. Non-life insurance, also known as general insurance, encompasses property and casualty insurance, such as auto, health, property, and liability coverage. These insurance policies offer compensation for losses, damages, and liability claims. The market’s primary objective is to safeguard individuals, businesses, and assets from unforeseen events, providing peace of mind and financial security.

Executive Summary

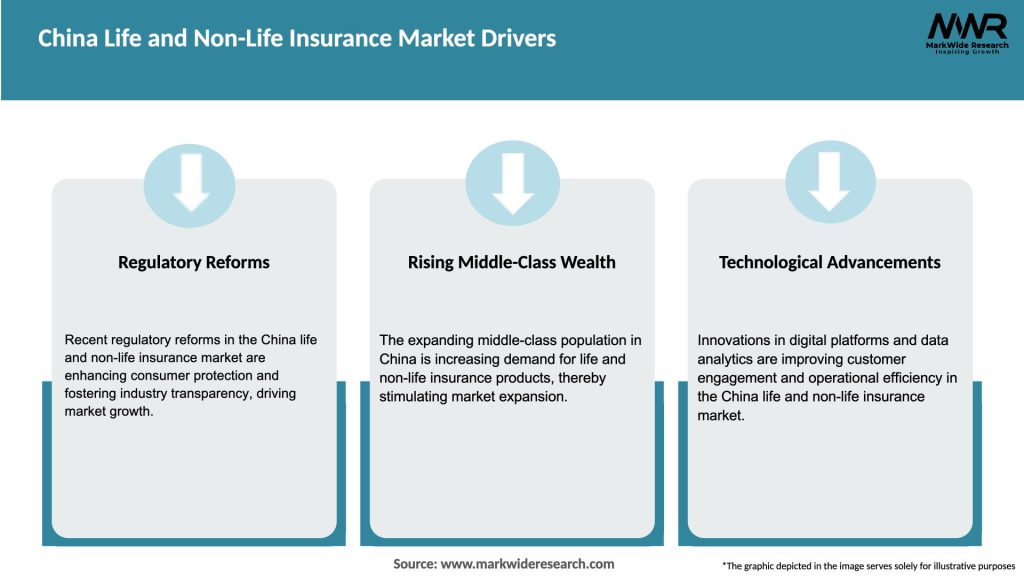

The China life and non-life insurance market have experienced significant growth over the years. The industry’s expansion is driven by factors such as a large population, rising disposable income, urbanization, increased awareness about insurance products, and favorable government policies. However, the market also faces challenges, including regulatory constraints, intense competition, and evolving customer preferences. Despite these obstacles, insurance companies in China have ample opportunities for growth, particularly through digital transformation, innovative product offerings, and tapping into underserved segments.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China life and non-life insurance market are characterized by dynamic factors such as changing customer preferences, technological advancements, regulatory reforms, and evolving socio-economic trends. These dynamics drive competition, shape product development, influence distribution channels, and impact the overall growth of the market. Insurance companies need to stay agile, embrace digitalization, and proactively adapt to market dynamics to maintain a competitive edge and capture emerging opportunities.

Regional Analysis

The China life and non-life insurance market exhibit regional variations in terms of market size, customer preferences, and economic factors. The eastern coastal regions, including Beijing, Shanghai, and Guangdong, are the most developed insurance markets, driven by their high population density, urbanization, and economic prosperity. Western and central regions, such as Sichuan and Chongqing, show promising growth potential due to government efforts to promote economic development and improve infrastructure. The insurance market in rural areas presents untapped opportunities, although challenges related to low awareness and purchasing power need to be addressed.

Competitive Landscape

Leading companies in the China Life and Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

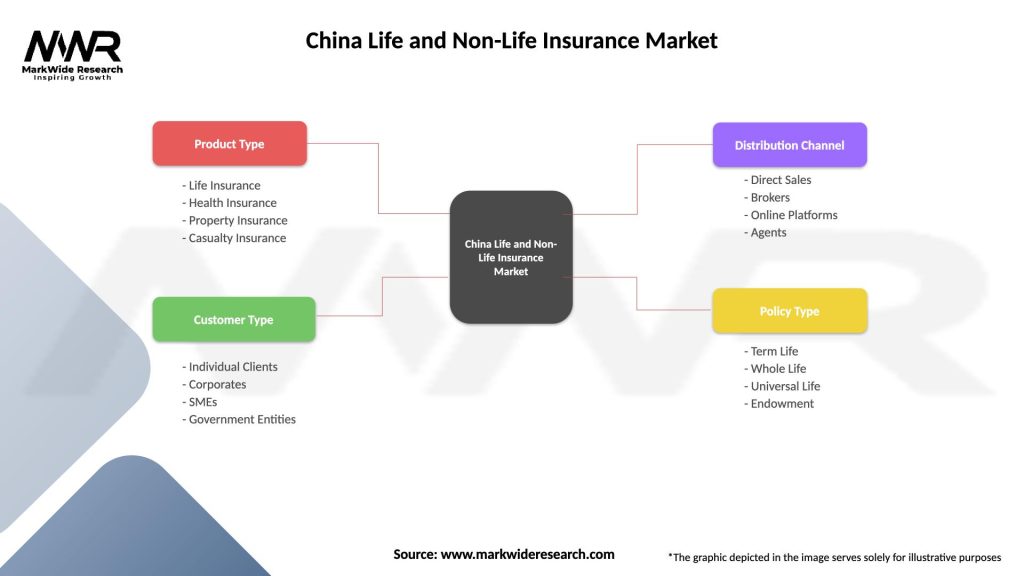

Segmentation

The China life and non-life insurance market can be segmented based on various factors, including insurance type, customer demographics, distribution channels, and geographical regions. Life insurance can be further segmented into term life insurance, whole life insurance, endowment insurance, and health insurance. Non-life insurance can be categorized into auto insurance, property insurance, health insurance, liability insurance, and others. Demographic segmentation may include age groups, income levels, and occupation types. Distribution channels encompass agency networks, bancassurance, brokers, online platforms, and partnerships with other institutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the China life and non-life insurance market. The outbreak highlighted the importance of health insurance, with individuals seeking coverage for medical expenses and potential income loss due to illness. Insurers experienced increased claims related to healthcare costs, travel insurance, business interruption, and event cancellation. The pandemic also accelerated the adoption of digital technologies, as customers turned to online channels for insurance purchases and contactless service delivery. However, the pandemic also posed challenges, such as reduced premium collection, investment volatility, and increased uncertainty in risk assessment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the China life and non-life insurance market is promising. The market is expected to continue growing, driven by factors such as increasing insurance awareness, rising middle-class incomes, digital transformation, and government support for the industry. The demand for health insurance, property insurance, and retirement plans is anticipated to rise, reflecting changing demographics and socio-economic trends. Insurers that embrace innovation, leverage technology, and adapt to evolving customer preferences will be well-positioned to capitalize on the market’s potential and drive sustainable growth.

Conclusion

The China life and non-life insurance market present significant growth opportunities driven by a large population, rising disposable incomes, increasing insurance awareness, and supportive government policies. While the market faces challenges such as regulatory constraints and intense competition, insurers can leverage digital transformation, develop innovative products, and tap into underserved segments to drive growth. Partnerships, strategic alliances, and a customer-centric approach are crucial for insurers to remain competitive and meet the evolving needs of Chinese consumers. The future outlook for the market remains positive, with increasing demand for health insurance, property insurance, and retirement planning products. By embracing innovation and adapting to market dynamics, insurance companies can navigate the changing landscape and unlock the market’s vast potential.

What is Life and Non-Life Insurance?

Life and Non-Life Insurance refers to the two main categories of insurance products. Life insurance provides financial protection against the risk of death, while non-life insurance covers various risks such as property damage, liability, and health-related expenses.

What are the key players in the China Life and Non-Life Insurance Market?

Key players in the China Life and Non-Life Insurance Market include China Life Insurance Company, Ping An Insurance, China Pacific Insurance, and New China Life Insurance, among others.

What are the growth factors driving the China Life and Non-Life Insurance Market?

The growth of the China Life and Non-Life Insurance Market is driven by increasing disposable incomes, a growing middle class, and rising awareness of the importance of insurance products for financial security.

What challenges does the China Life and Non-Life Insurance Market face?

Challenges in the China Life and Non-Life Insurance Market include regulatory changes, intense competition among insurers, and the need for digital transformation to meet consumer expectations.

What opportunities exist in the China Life and Non-Life Insurance Market?

Opportunities in the China Life and Non-Life Insurance Market include the expansion of digital insurance platforms, the introduction of innovative insurance products, and the increasing demand for health and wellness coverage.

What trends are shaping the China Life and Non-Life Insurance Market?

Trends in the China Life and Non-Life Insurance Market include the rise of insurtech companies, the integration of artificial intelligence in underwriting processes, and a growing focus on customer-centric insurance solutions.

China Life and Non-Life Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Life Insurance, Health Insurance, Property Insurance, Casualty Insurance |

| Customer Type | Individual Clients, Corporates, SMEs, Government Entities |

| Distribution Channel | Direct Sales, Brokers, Online Platforms, Agents |

| Policy Type | Term Life, Whole Life, Universal Life, Endowment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Life and Non-Life Insurance Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at