444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China Less than-Truck-Load (LTL) market represents a critical component of the nation’s comprehensive logistics infrastructure, serving as the backbone for small to medium-sized shipments across diverse industries. This specialized freight transportation segment has experienced remarkable transformation, driven by the rapid expansion of e-commerce, manufacturing diversification, and evolving consumer demands. The LTL market in China demonstrates exceptional growth potential, with industry analysts projecting a robust CAGR of 8.2% over the forecast period, reflecting the increasing demand for flexible and cost-effective shipping solutions.

Market dynamics indicate that China’s LTL sector has become increasingly sophisticated, incorporating advanced technologies such as route optimization software, real-time tracking systems, and automated sorting facilities. The integration of digital platforms has revolutionized traditional LTL operations, enabling greater efficiency and transparency throughout the supply chain. Regional distribution shows that eastern coastal provinces account for approximately 45% of total LTL volume, while emerging markets in central and western regions are experiencing accelerated growth rates.

The competitive landscape features a mix of established logistics giants and innovative technology-driven startups, creating a dynamic environment that fosters continuous improvement in service quality and operational efficiency. Major metropolitan areas including Shanghai, Beijing, Guangzhou, and Shenzhen serve as primary hubs for LTL operations, facilitating seamless connectivity across the vast Chinese territory.

The China Less than-Truck-Load (LTL) market refers to a specialized freight transportation segment that consolidates multiple smaller shipments from different customers into a single truck, optimizing cargo space utilization and reducing transportation costs for individual shippers. This logistics model serves businesses and individuals who need to transport goods that are too large for parcel services but insufficient to justify a full truckload shipment.

LTL services typically handle shipments ranging from 150 pounds to 15,000 pounds, providing a cost-effective solution for manufacturers, retailers, distributors, and e-commerce businesses. The system operates through a network of terminals and distribution centers, where freight is sorted, consolidated, and transferred between different transportation routes to reach final destinations efficiently.

Key characteristics of the Chinese LTL market include flexible pickup and delivery schedules, shared transportation costs among multiple shippers, comprehensive tracking capabilities, and specialized handling for various cargo types. The model has evolved to incorporate advanced logistics technologies, enabling real-time visibility, predictive analytics, and optimized routing algorithms that enhance overall operational performance.

China’s LTL market has emerged as a fundamental pillar supporting the country’s expansive logistics ecosystem, driven by unprecedented growth in domestic consumption, manufacturing output, and cross-border trade activities. The sector demonstrates remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities presented by digital transformation and infrastructure development.

Market penetration has reached significant levels across major industrial corridors, with technology adoption rates exceeding 70% among leading LTL providers. The integration of artificial intelligence, machine learning, and Internet of Things (IoT) technologies has enhanced operational efficiency, reduced transit times, and improved customer satisfaction levels throughout the supply chain.

Strategic developments include the expansion of automated sorting facilities, implementation of green logistics initiatives, and establishment of strategic partnerships between traditional logistics companies and technology innovators. These collaborative efforts have resulted in improved service quality, enhanced network coverage, and increased operational scalability across diverse market segments.

Future prospects remain highly favorable, supported by continued urbanization, industrial modernization, and the government’s commitment to developing world-class logistics infrastructure. The market is positioned to benefit from ongoing investments in transportation networks, digital technologies, and sustainable logistics solutions that align with national development priorities.

Strategic analysis reveals several critical insights that define the current state and future trajectory of China’s LTL market:

Partnership Strategies: Collaborative relationships between logistics providers, technology companies, and manufacturing enterprises are creating integrated solutions that deliver superior value propositions.

E-commerce expansion serves as the primary catalyst driving unprecedented growth in China’s LTL market, with online retail sales generating substantial demand for flexible and cost-effective shipping solutions. The proliferation of digital marketplaces, social commerce platforms, and direct-to-consumer business models has created diverse shipping requirements that align perfectly with LTL service capabilities.

Manufacturing diversification across various industries has increased the need for reliable freight transportation services that can accommodate varying shipment sizes and delivery schedules. Small and medium-sized enterprises, in particular, rely heavily on LTL services to maintain competitive supply chain operations while managing transportation costs effectively.

Infrastructure development initiatives, including highway expansion, railway modernization, and logistics park construction, have significantly enhanced the operational environment for LTL providers. These improvements have reduced transit times, increased network connectivity, and enabled more efficient cargo consolidation and distribution processes.

Urbanization trends continue to drive demand for LTL services as population centers expand and consumer markets develop in previously underserved regions. The growth of urban clusters and metropolitan areas creates concentrated demand for freight transportation services that support local economic development and commercial activities.

Technology advancement has transformed LTL operations through the implementation of sophisticated logistics management systems, mobile applications, and data analytics platforms. These technological improvements have enhanced service quality, operational efficiency, and customer satisfaction while reducing overall transportation costs.

Regulatory complexity presents ongoing challenges for LTL operators navigating diverse provincial and municipal transportation regulations, licensing requirements, and operational restrictions. The fragmented regulatory environment can create compliance burdens and operational inefficiencies that impact service delivery and cost structures.

Infrastructure limitations in certain regions, particularly rural and remote areas, constrain network expansion and service quality improvements. Inadequate road conditions, limited terminal facilities, and insufficient last-mile connectivity can negatively impact delivery performance and customer satisfaction levels.

Capacity constraints during peak shipping seasons and high-demand periods can strain operational resources, leading to service delays and increased transportation costs. The cyclical nature of demand in certain industries creates challenges for capacity planning and resource allocation optimization.

Competition intensity from alternative transportation modes, including express delivery services, full truckload carriers, and emerging logistics technologies, creates pricing pressure and market share challenges for traditional LTL providers. The need to differentiate services while maintaining competitive pricing structures requires continuous innovation and operational improvements.

Environmental regulations and sustainability requirements are increasing operational costs and necessitating significant investments in cleaner transportation technologies, alternative fuel systems, and carbon reduction initiatives. Compliance with evolving environmental standards requires substantial capital expenditures and operational modifications.

Digital transformation presents substantial opportunities for LTL providers to enhance operational efficiency, improve customer experience, and develop innovative service offerings. The integration of artificial intelligence, blockchain technology, and advanced analytics can create competitive advantages and unlock new revenue streams.

Cross-border logistics expansion, particularly related to Belt and Road Initiative projects and international trade growth, offers significant potential for LTL service providers to extend their networks and capture additional market share. The development of multimodal transportation solutions can facilitate seamless international freight movement.

Specialized services development, including temperature-controlled transportation, hazardous materials handling, and high-value cargo security, can command premium pricing and attract new customer segments. The growing demand for specialized logistics solutions creates opportunities for service differentiation and market expansion.

Rural market penetration represents an underexplored opportunity as economic development and consumer spending growth in rural areas create demand for reliable freight transportation services. The expansion of e-commerce into rural markets particularly drives the need for efficient LTL solutions.

Sustainability initiatives can create competitive advantages and attract environmentally conscious customers while potentially qualifying for government incentives and support programs. The development of green logistics solutions aligns with national environmental priorities and corporate sustainability goals.

Supply chain evolution continues to reshape the LTL market landscape as businesses seek more flexible, responsive, and cost-effective logistics solutions. The shift toward just-in-time inventory management, omnichannel distribution, and direct-to-consumer fulfillment models has increased demand for reliable LTL services that can accommodate diverse shipping requirements.

Technology disruption is fundamentally altering traditional LTL operations through the implementation of autonomous vehicles, drone delivery systems, and smart logistics platforms. These innovations promise to improve operational efficiency by approximately 25-30% while reducing labor costs and enhancing service reliability across transportation networks.

Customer expectations have evolved significantly, with shippers demanding greater visibility, faster transit times, and more flexible delivery options. The rise of real-time tracking, predictive delivery notifications, and customizable service levels has become standard requirements rather than premium features in the competitive LTL market.

Competitive dynamics reflect increasing consolidation among smaller operators while larger providers invest heavily in technology and network expansion. Market share concentration among the top 15 LTL providers has reached approximately 60%, indicating ongoing industry maturation and competitive positioning strategies.

Regulatory evolution continues to influence market dynamics through new safety standards, environmental requirements, and operational guidelines that shape investment priorities and strategic planning decisions across the industry.

Comprehensive analysis of China’s LTL market employed a multi-faceted research approach combining primary data collection, secondary source analysis, and industry expert consultations to ensure accuracy and reliability of findings. The methodology incorporated both quantitative and qualitative research techniques to provide a holistic understanding of market dynamics and trends.

Primary research included structured interviews with key industry stakeholders, including LTL service providers, technology vendors, logistics managers, and end-user customers across diverse industry segments. Survey data collection from over 500 market participants provided statistical validation for key market insights and trend analysis.

Secondary research encompassed extensive analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. MarkWide Research databases and proprietary analytical tools supported comprehensive market sizing and forecasting activities.

Data validation processes included cross-referencing multiple information sources, statistical analysis of survey responses, and expert review panels to ensure research accuracy and reliability. Market modeling techniques incorporated economic indicators, industry growth patterns, and regulatory impact assessments to develop robust forecasting frameworks.

Geographic coverage spanned all major Chinese provinces and metropolitan areas, with particular focus on key logistics hubs and emerging market regions that demonstrate significant growth potential for LTL services.

Eastern China dominates the LTL market landscape, accounting for approximately 48% of total market activity, driven by concentrated manufacturing bases, major ports, and dense population centers. The Yangtze River Delta region, including Shanghai, Jiangsu, and Zhejiang provinces, serves as the primary hub for LTL operations, benefiting from excellent infrastructure and high industrial activity levels.

Southern China, particularly the Pearl River Delta region encompassing Guangdong province, represents approximately 22% of market share and serves as a critical gateway for international trade and manufacturing exports. The region’s proximity to Hong Kong and extensive manufacturing base creates substantial demand for flexible freight transportation solutions.

Northern China, centered around Beijing and Tianjin, accounts for roughly 18% of LTL market activity, supported by government institutions, heavy industry, and growing consumer markets. The region’s strategic location and transportation infrastructure make it an important hub for north-south freight movement.

Central and Western China represent emerging growth markets with combined market share of approximately 12%, but demonstrate the highest growth rates as economic development initiatives and infrastructure investments create new opportunities for LTL service expansion. Cities like Chengdu, Chongqing, and Xi’an are becoming increasingly important logistics centers.

Cross-regional connectivity continues to improve through highway expansion, high-speed rail development, and logistics park construction, facilitating more efficient freight movement and network optimization across diverse geographic regions.

Market leadership in China’s LTL sector is characterized by a diverse mix of established logistics companies, technology-driven startups, and international operators, each bringing unique capabilities and competitive advantages to the marketplace.

Competitive strategies focus on network expansion, technology integration, service diversification, and strategic partnerships to enhance market position and customer value propositions. The industry continues to evolve through consolidation activities and collaborative arrangements that strengthen operational capabilities.

By Service Type:

By Industry Vertical:

By Transportation Mode:

Standard LTL services continue to represent the largest market segment, driven by consistent demand from small and medium-sized businesses requiring cost-effective freight transportation solutions. This category benefits from economies of scale, established operational processes, and competitive pricing structures that appeal to price-sensitive customers across diverse industries.

Expedited LTL services demonstrate strong growth potential as businesses increasingly prioritize speed and reliability in their supply chain operations. The premium pricing associated with expedited services provides attractive margins for operators while meeting critical customer requirements for time-sensitive deliveries.

Specialized LTL services represent a high-value market segment with significant growth opportunities, particularly in temperature-controlled transportation, hazardous materials handling, and high-security cargo movement. These services command premium pricing and require specialized equipment, training, and regulatory compliance capabilities.

E-commerce-focused LTL has emerged as a rapidly growing category, driven by the expansion of online retail and direct-to-consumer business models. This segment requires flexible delivery options, enhanced tracking capabilities, and integration with e-commerce platforms to support seamless customer experiences.

Cross-border LTL services are gaining importance as international trade volumes increase and businesses seek integrated logistics solutions for import and export activities. This category requires specialized expertise in customs procedures, international regulations, and multimodal transportation coordination.

Cost optimization represents the primary benefit for shippers utilizing LTL services, as shared transportation costs significantly reduce per-unit shipping expenses compared to full truckload alternatives. Small and medium-sized businesses particularly benefit from access to professional logistics capabilities without the need for substantial capital investments in transportation infrastructure.

Operational flexibility enables businesses to adapt quickly to changing market conditions, seasonal demand fluctuations, and customer requirements without maintaining dedicated transportation resources. LTL services provide scalable solutions that can accommodate varying shipment volumes and delivery schedules.

Network access through established LTL providers gives shippers immediate connectivity to extensive transportation networks, terminal facilities, and distribution capabilities that would be prohibitively expensive to develop independently. This access enables market expansion and customer reach extension across diverse geographic regions.

Technology integration provides shippers with advanced tracking, reporting, and analytics capabilities that enhance supply chain visibility and decision-making processes. Real-time shipment monitoring, predictive analytics, and automated notifications improve operational efficiency and customer service levels.

Risk mitigation through professional logistics management, insurance coverage, and regulatory compliance reduces operational risks and liability exposure for businesses utilizing LTL services. Experienced providers offer expertise in handling various cargo types, navigating regulatory requirements, and managing transportation-related challenges.

Sustainability benefits result from shared transportation resources, optimized routing, and consolidated shipments that reduce overall environmental impact compared to individual shipping alternatives. LTL services support corporate sustainability goals while maintaining operational efficiency and cost effectiveness.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization acceleration continues to transform LTL operations through the implementation of cloud-based logistics platforms, mobile applications, and data analytics tools that enhance operational visibility and customer engagement. The adoption rate of digital technologies among LTL providers has reached approximately 75%, indicating widespread industry transformation.

Automation integration is revolutionizing traditional LTL processes through automated sorting systems, robotic handling equipment, and intelligent routing algorithms that improve operational efficiency and reduce labor costs. These technological advances are expected to increase productivity by 20-25% over the next five years.

Sustainability focus has become a critical trend as environmental regulations tighten and customers demand greener logistics solutions. LTL providers are investing in electric vehicles, alternative fuels, and carbon-neutral transportation options to meet evolving environmental requirements and corporate sustainability goals.

Service customization reflects growing customer demands for tailored logistics solutions that address specific industry requirements, delivery preferences, and operational constraints. Flexible service offerings and value-added capabilities have become essential differentiators in the competitive LTL market.

Network optimization through strategic hub placement, route consolidation, and capacity sharing arrangements is improving operational efficiency while reducing transportation costs. Advanced analytics and machine learning algorithms enable continuous optimization of network performance and resource utilization.

Partnership strategies are becoming increasingly important as LTL providers collaborate with technology companies, e-commerce platforms, and manufacturing enterprises to create integrated solutions and expand market reach through strategic alliances.

Technology investments have accelerated significantly as major LTL providers allocate substantial resources to digital transformation initiatives, including artificial intelligence implementation, blockchain integration, and IoT deployment across transportation networks. These investments are reshaping operational capabilities and competitive positioning within the industry.

Network expansion activities continue as leading operators establish new terminals, distribution centers, and service routes to enhance geographic coverage and market penetration. Strategic facility investments focus on emerging markets and underserved regions with significant growth potential.

Regulatory compliance initiatives have intensified in response to evolving transportation policies, environmental standards, and safety requirements. Industry participants are implementing comprehensive compliance programs and investing in cleaner technologies to meet regulatory expectations.

Strategic partnerships and acquisition activities are reshaping the competitive landscape as companies seek to enhance capabilities, expand market reach, and achieve operational synergies. Collaborative arrangements between traditional logistics providers and technology innovators are creating new service offerings and competitive advantages.

Sustainability programs have gained prominence as LTL providers implement green logistics initiatives, including electric vehicle adoption, renewable energy utilization, and carbon footprint reduction strategies. These programs align with national environmental policies and corporate sustainability commitments.

Customer experience enhancements through improved tracking systems, mobile applications, and responsive customer service capabilities are becoming standard requirements for competitive differentiation and market success in the evolving LTL landscape.

Technology adoption should remain a top priority for LTL providers seeking to maintain competitive advantages and operational efficiency in an increasingly digital marketplace. MarkWide Research analysis indicates that companies investing heavily in technology integration achieve 15-20% higher customer satisfaction rates compared to traditional operators.

Network optimization strategies should focus on strategic hub placement, route consolidation, and capacity sharing arrangements that maximize operational efficiency while minimizing transportation costs. Advanced analytics and predictive modeling can support data-driven decision making for network planning and resource allocation.

Service diversification efforts should target high-value market segments including specialized transportation, expedited delivery, and value-added logistics services that command premium pricing and enhance customer loyalty. Customized solutions addressing specific industry requirements can create sustainable competitive advantages.

Partnership development with technology providers, e-commerce platforms, and manufacturing enterprises can create integrated solutions and expand market reach through collaborative arrangements. Strategic alliances enable access to new customer segments and innovative capabilities without substantial capital investments.

Sustainability initiatives should be integrated into long-term strategic planning as environmental regulations continue to evolve and customers increasingly prioritize green logistics solutions. Early adoption of sustainable technologies and practices can create competitive advantages and regulatory compliance benefits.

Market expansion into tier-two and tier-three cities presents significant growth opportunities as economic development and infrastructure improvements create demand for professional LTL services in previously underserved regions.

Growth trajectory for China’s LTL market remains highly positive, supported by continued economic expansion, industrial modernization, and evolving consumer behaviors that drive demand for flexible freight transportation solutions. The market is expected to maintain robust growth rates exceeding 8% annually over the next five years, reflecting strong underlying fundamentals and emerging opportunities.

Technology transformation will continue to reshape industry dynamics through the implementation of autonomous vehicles, artificial intelligence, and blockchain technologies that promise to revolutionize traditional LTL operations. These innovations are expected to improve operational efficiency by 30-35% while enhancing service quality and customer satisfaction levels.

Market consolidation trends are likely to accelerate as larger operators acquire smaller competitors and form strategic partnerships to achieve economies of scale and expand service capabilities. This consolidation will create more efficient networks and enhanced service offerings for customers across diverse market segments.

Regulatory evolution will continue to influence industry development through new environmental standards, safety requirements, and operational guidelines that shape investment priorities and strategic planning decisions. Proactive compliance strategies will become increasingly important for maintaining competitive positioning.

International expansion opportunities related to Belt and Road Initiative projects and growing cross-border trade will create new revenue streams and market development possibilities for established LTL providers with appropriate capabilities and strategic positioning.

Sustainability requirements will become increasingly stringent, driving adoption of electric vehicles, alternative fuels, and carbon-neutral logistics solutions that align with national environmental policies and corporate sustainability commitments across the industry.

China’s Less than-Truck-Load market represents a dynamic and rapidly evolving sector that plays a crucial role in supporting the nation’s comprehensive logistics infrastructure and economic development objectives. The market demonstrates exceptional resilience and growth potential, driven by technological innovation, infrastructure development, and evolving customer requirements across diverse industry segments.

Strategic opportunities abound for industry participants who can successfully navigate competitive challenges while capitalizing on emerging trends including digitalization, sustainability, and market expansion into underserved regions. The integration of advanced technologies, development of specialized services, and establishment of strategic partnerships will be critical success factors for future market leadership.

Market fundamentals remain strong, supported by continued economic growth, industrial diversification, and the expansion of e-commerce activities that generate substantial demand for flexible and cost-effective freight transportation solutions. The sector’s ability to adapt to changing market conditions and customer requirements positions it well for sustained growth and development.

Future success in China’s LTL market will depend on companies’ ability to embrace technological transformation, develop sustainable operational practices, and create customer-centric service offerings that deliver superior value propositions. Organizations that can effectively balance operational efficiency with service quality while maintaining competitive pricing structures will be best positioned to capture market opportunities and achieve long-term success in this dynamic and evolving marketplace.

What is Less than-Truck-Load (LTL)?

Less than-Truck-Load (LTL) refers to a shipping method where multiple shipments from different customers are combined into one truckload. This approach is cost-effective for transporting smaller freight volumes and is commonly used in logistics and supply chain management.

What are the key companies in the China Less than-Truck-Load (LTL) Market?

Key companies in the China Less than-Truck-Load (LTL) Market include SF Express, YTO Express, and ZTO Express, among others. These companies play significant roles in providing efficient logistics solutions and expanding their service networks across the region.

What are the growth factors driving the China Less than-Truck-Load (LTL) Market?

The growth of the China Less than-Truck-Load (LTL) Market is driven by the increasing demand for e-commerce logistics, the rise in small and medium-sized enterprises, and the need for cost-effective shipping solutions. Additionally, advancements in technology and infrastructure improvements are contributing to market expansion.

What challenges does the China Less than-Truck-Load (LTL) Market face?

The China Less than-Truck-Load (LTL) Market faces challenges such as fluctuating fuel prices, regulatory compliance issues, and competition from alternative shipping methods. These factors can impact operational efficiency and profitability for logistics providers.

What opportunities exist in the China Less than-Truck-Load (LTL) Market?

Opportunities in the China Less than-Truck-Load (LTL) Market include the potential for technological innovations in tracking and logistics management, the expansion of cross-border trade, and the growing demand for sustainable shipping practices. These trends can enhance service offerings and customer satisfaction.

What trends are shaping the China Less than-Truck-Load (LTL) Market?

Trends shaping the China Less than-Truck-Load (LTL) Market include the increasing adoption of digital platforms for logistics management, the rise of green logistics initiatives, and the integration of artificial intelligence in route optimization. These trends are transforming how logistics companies operate and serve their customers.

China Less than-Truck-Load (LTL) Market

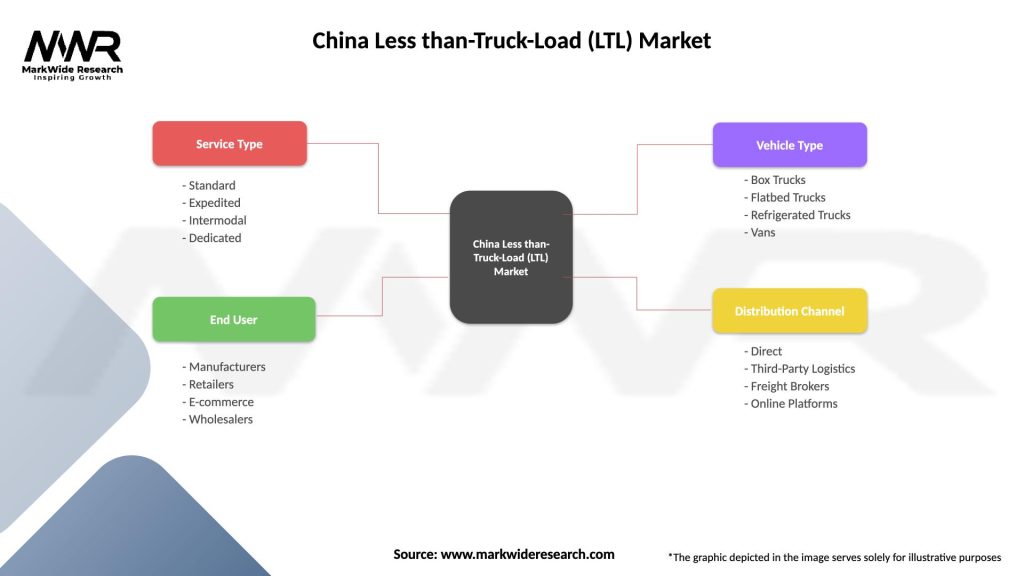

| Segmentation Details | Description |

|---|---|

| Service Type | Standard, Expedited, Intermodal, Dedicated |

| End User | Manufacturers, Retailers, E-commerce, Wholesalers |

| Vehicle Type | Box Trucks, Flatbed Trucks, Refrigerated Trucks, Vans |

| Distribution Channel | Direct, Third-Party Logistics, Freight Brokers, Online Platforms |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Less than-Truck-Load (LTL) Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at