444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China LED lighting market represents one of the most dynamic and rapidly evolving segments within the global lighting industry. As the world’s largest manufacturer and consumer of LED lighting products, China has established itself as a dominant force in driving technological innovation and market expansion. The market encompasses a comprehensive range of applications including residential, commercial, industrial, and outdoor lighting solutions, with smart LED technology emerging as a key growth catalyst.

Market dynamics in China are characterized by robust government support for energy-efficient lighting solutions, aggressive urbanization initiatives, and increasing consumer awareness of environmental sustainability. The country’s commitment to carbon neutrality by 2060 has further accelerated the adoption of LED lighting systems across various sectors. With a growth trajectory showing 8.5% CAGR over the forecast period, the market demonstrates exceptional resilience and expansion potential.

Manufacturing capabilities in China have reached unprecedented levels, with domestic companies controlling approximately 70% of global LED chip production. This manufacturing dominance, combined with continuous technological advancement and cost optimization, positions China as the epicenter of global LED lighting innovation and distribution.

The China LED lighting market refers to the comprehensive ecosystem of light-emitting diode technology development, manufacturing, distribution, and consumption within Chinese territories. This market encompasses the entire value chain from semiconductor chip production to finished lighting products, including residential fixtures, commercial installations, industrial applications, and smart lighting systems.

LED technology represents a revolutionary advancement in lighting efficiency, utilizing semiconductor materials to convert electrical energy directly into light with minimal heat generation. In the Chinese context, this market includes both domestic consumption and export-oriented manufacturing, making China a global hub for LED lighting innovation and production.

Market scope extends beyond traditional lighting applications to include specialized segments such as automotive lighting, display backlighting, horticultural lighting, and architectural illumination. The integration of Internet of Things (IoT) capabilities and smart home technologies has further expanded the market definition to include connected lighting solutions and intelligent lighting management systems.

China’s LED lighting market stands at the forefront of global lighting transformation, driven by unprecedented technological advancement and supportive government policies. The market has experienced remarkable growth momentum, with residential applications accounting for the largest segment while smart lighting solutions represent the fastest-growing category.

Key market drivers include aggressive urbanization programs, energy efficiency mandates, and the rapid adoption of smart city initiatives across major metropolitan areas. The government’s commitment to phasing out traditional incandescent and fluorescent lighting has created substantial replacement demand, with commercial retrofits showing particularly strong growth at 12.3% annually.

Technological innovation remains a cornerstone of market development, with Chinese manufacturers investing heavily in research and development to maintain competitive advantages. The emergence of human-centric lighting, tunable white technology, and advanced dimming capabilities has opened new market opportunities and enhanced product differentiation.

Export performance continues to strengthen China’s global market position, with Chinese LED lighting products capturing significant market share in North America, Europe, and emerging Asian markets. This international expansion, combined with robust domestic demand, creates a dual-engine growth model that enhances market stability and growth prospects.

Market segmentation reveals distinct growth patterns across different application categories and technology types. The following insights highlight critical market dynamics:

Government policy support serves as the primary catalyst for LED lighting market expansion in China. The national energy efficiency standards and green building certifications mandate the use of high-efficiency lighting systems, creating substantial market demand. The 14th Five-Year Plan specifically targets lighting energy consumption reduction, providing clear regulatory direction for market development.

Urbanization acceleration continues to drive massive infrastructure development across Chinese cities. New residential complexes, commercial buildings, and industrial facilities require modern lighting solutions, with LED technology becoming the default choice for new construction projects. The smart city initiatives in major metropolitan areas further amplify demand for intelligent lighting systems.

Cost competitiveness has reached a tipping point where LED lighting solutions offer superior total cost of ownership compared to traditional alternatives. Declining manufacturing costs, improved product longevity, and reduced maintenance requirements make LED adoption economically attractive across all market segments.

Environmental consciousness among consumers and businesses drives preference for sustainable lighting solutions. The growing awareness of carbon footprint reduction and energy conservation aligns perfectly with LED technology benefits, creating strong market pull from end-users seeking environmentally responsible products.

Initial investment costs remain a significant barrier for price-sensitive market segments, particularly in rural areas and small businesses. Despite improving cost-effectiveness over time, the upfront capital requirement for comprehensive LED lighting upgrades can deter adoption among budget-conscious consumers.

Technical complexity associated with smart LED systems creates implementation challenges for traditional lighting installers and end-users. The integration of wireless connectivity, sensor systems, and control interfaces requires specialized knowledge and training, potentially slowing adoption rates in certain market segments.

Market saturation in developed urban areas limits growth opportunities as replacement cycles extend due to LED longevity. The durability advantage of LED technology, while beneficial for users, reduces repeat purchase frequency and impacts market growth dynamics in mature segments.

Quality concerns surrounding low-cost LED products have created consumer skepticism in certain market segments. Inconsistent product performance, premature failures, and inadequate warranty support from some manufacturers have impacted overall market confidence and brand perception.

Smart lighting integration presents exceptional growth opportunities as IoT adoption accelerates across Chinese markets. The convergence of lighting with building automation, security systems, and energy management platforms creates new revenue streams and enhanced value propositions for manufacturers and system integrators.

Rural market penetration offers substantial expansion potential as government infrastructure investment reaches smaller cities and rural communities. The rural revitalization strategy includes lighting infrastructure upgrades, creating significant opportunities for LED lighting suppliers targeting these underserved markets.

Specialized applications such as horticultural lighting, UV disinfection systems, and circadian rhythm lighting represent emerging market niches with high growth potential. These specialized segments command premium pricing and offer differentiation opportunities for innovative manufacturers.

Export market expansion continues to provide growth avenues as Chinese manufacturers leverage cost advantages and technological capabilities to penetrate international markets. The Belt and Road Initiative creates additional opportunities for Chinese LED lighting companies in developing markets across Asia, Africa, and Latin America.

Supply chain integration has become increasingly sophisticated within China’s LED lighting ecosystem. Vertical integration from semiconductor manufacturing to finished product assembly provides Chinese companies with significant competitive advantages in cost control, quality management, and time-to-market capabilities.

Technology evolution continues at a rapid pace, with manufacturers investing heavily in next-generation LED technologies including micro-LEDs, quantum dot enhancement, and advanced thermal management systems. These innovations drive product differentiation and enable premium pricing strategies in competitive markets.

Market consolidation trends are evident as larger manufacturers acquire smaller competitors to expand market share and technological capabilities. This consolidation improves operational efficiency and creates stronger competitive positions for leading market participants.

Customer preferences are shifting toward integrated solutions that combine lighting with additional functionalities such as air purification, wireless charging, and environmental monitoring. This trend creates opportunities for manufacturers to develop multi-functional products with enhanced value propositions.

Primary research methodologies employed in analyzing the China LED lighting market include comprehensive surveys of manufacturers, distributors, and end-users across major metropolitan areas. Direct interviews with industry executives, government officials, and technology experts provide qualitative insights into market trends and future developments.

Secondary research encompasses analysis of government publications, industry reports, patent filings, and trade statistics to establish market size, growth patterns, and competitive dynamics. Financial analysis of publicly traded companies provides insights into profitability trends and investment patterns within the industry.

Market modeling techniques utilize statistical analysis and econometric methods to project future market trends based on historical data, economic indicators, and policy developments. Scenario analysis considers various growth trajectories under different economic and regulatory conditions.

Data validation processes ensure accuracy and reliability through triangulation of multiple data sources, expert review panels, and cross-verification with industry benchmarks. Regular updates incorporate the latest market developments and emerging trends to maintain research relevance and accuracy.

Eastern China dominates the LED lighting market with major manufacturing hubs in Guangdong, Jiangsu, and Zhejiang provinces. These regions benefit from established supply chains, skilled workforce availability, and proximity to international shipping ports. Guangdong Province alone accounts for approximately 35% of national LED production capacity.

Northern China markets, centered around Beijing and Tianjin, show strong demand for premium LED lighting solutions driven by government buildings, commercial complexes, and high-end residential developments. The region’s focus on smart city development creates substantial opportunities for intelligent lighting systems.

Western China represents an emerging market with significant growth potential as infrastructure development accelerates. Government investment in western region development includes substantial lighting infrastructure projects, creating opportunities for LED lighting suppliers targeting these expanding markets.

Central China markets demonstrate balanced growth across residential and commercial segments, with cities like Wuhan and Changsha leading adoption rates. The region’s industrial development drives demand for high-performance LED lighting in manufacturing facilities and logistics centers.

Market leadership is distributed among several major Chinese manufacturers who have established strong positions through technological innovation, cost optimization, and extensive distribution networks. The competitive environment is characterized by intense price competition balanced with innovation-driven differentiation strategies.

Competitive strategies focus on technological differentiation, cost leadership, and channel expansion. Leading companies invest heavily in research and development to maintain technological advantages while optimizing manufacturing processes to achieve cost competitiveness.

By Application:

By Technology:

By Distribution Channel:

Residential LED lighting demonstrates the strongest volume growth, driven by new housing construction and renovation activities. Consumer preferences increasingly favor smart lighting solutions with dimming capabilities, color temperature adjustment, and smartphone connectivity. The segment shows 42% adoption rate for smart features in premium residential projects.

Commercial lighting applications focus on energy efficiency and occupant comfort, with human-centric lighting gaining traction in office environments. The integration of daylight harvesting, occupancy sensing, and circadian rhythm optimization creates differentiated product offerings for commercial customers.

Industrial LED solutions emphasize durability, high light output, and maintenance reduction. Manufacturing facilities report average 65% energy cost savings when upgrading from traditional high-intensity discharge lighting to LED systems, driving strong adoption rates in industrial segments.

Outdoor lighting infrastructure benefits from government smart city initiatives and energy efficiency mandates. Street lighting modernization programs incorporate advanced controls, remote monitoring, and adaptive lighting capabilities to optimize energy consumption and maintenance costs.

Manufacturers benefit from expanding market opportunities, technological advancement possibilities, and export growth potential. The large domestic market provides economies of scale while serving as a testing ground for innovative products before international expansion.

Distributors and retailers enjoy improved profit margins from LED products compared to traditional lighting, along with reduced inventory management complexity due to longer product lifecycles. The growing smart lighting segment creates opportunities for value-added services and system integration.

End-users realize significant energy cost savings, reduced maintenance requirements, and enhanced lighting quality. Commercial users report average 70% reduction in lighting-related energy consumption, while residential users appreciate improved ambiance and smart home integration capabilities.

Government stakeholders achieve energy efficiency targets, carbon emission reductions, and economic development objectives through supporting the LED lighting industry. The sector’s export success contributes to trade balance improvements and technological leadership positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Smart lighting integration represents the most significant trend reshaping the Chinese LED lighting market. The convergence of lighting with IoT platforms, artificial intelligence, and building automation systems creates new value propositions and market opportunities. MarkWide Research indicates that smart lighting adoption rates are accelerating across all market segments.

Human-centric lighting gains momentum as awareness of circadian rhythm impacts on health and productivity increases. Commercial and residential applications increasingly incorporate tunable white technology and automated lighting schedules to optimize human comfort and well-being.

Sustainability focus drives demand for environmentally responsible lighting solutions, including recyclable materials, reduced packaging, and carbon-neutral manufacturing processes. Consumers and businesses increasingly consider environmental impact in purchasing decisions.

Customization and personalization trends enable users to tailor lighting experiences to specific preferences and requirements. Mobile app control, voice activation, and automated scene setting become standard features in premium LED lighting products.

Technology breakthroughs in LED efficiency and performance continue to expand application possibilities and market opportunities. Recent developments in quantum dot technology, micro-LED arrays, and advanced thermal management systems enhance product capabilities and competitive positioning.

Strategic partnerships between lighting manufacturers and technology companies accelerate smart lighting development and market penetration. Collaborations with smartphone manufacturers, home automation providers, and cloud service platforms create integrated ecosystem solutions.

Government initiatives supporting LED adoption include updated building codes, energy efficiency standards, and public procurement preferences for high-efficiency lighting systems. These policy developments create stable demand and encourage market investment.

International expansion activities by Chinese LED manufacturers include overseas manufacturing facilities, distribution partnerships, and brand development investments. These initiatives strengthen global market presence and reduce dependence on domestic demand.

Market participants should prioritize smart lighting technology development and integration capabilities to capitalize on the fastest-growing market segment. Investment in IoT platforms, mobile applications, and cloud-based management systems will be essential for competitive positioning.

Manufacturers should focus on brand building and quality improvement to address market perception challenges and enable premium pricing strategies. International certification, warranty programs, and customer service excellence will differentiate successful companies from price-focused competitors.

Distribution strategies should emphasize omnichannel approaches combining online and offline presence to reach diverse customer segments effectively. E-commerce capabilities, technical support services, and installation partnerships will enhance market reach and customer satisfaction.

Innovation investment in specialized applications and emerging technologies will create new market opportunities and competitive advantages. Research and development focus should include human-centric lighting, horticultural applications, and advanced control systems.

Market growth is expected to continue at robust levels driven by ongoing urbanization, smart city development, and energy efficiency initiatives. MWR analysis projects sustained expansion across all major market segments with smart lighting showing the highest growth rates at 22% annually.

Technology evolution will focus on enhanced connectivity, artificial intelligence integration, and energy efficiency improvements. The convergence of lighting with other building systems will create comprehensive smart building solutions and expanded market opportunities.

International expansion by Chinese manufacturers will accelerate as cost advantages and technological capabilities enable competitive positioning in global markets. Export growth will complement domestic demand to support overall market expansion.

Regulatory developments will continue supporting LED adoption through energy efficiency standards, environmental regulations, and smart city initiatives. Government policy alignment with market trends will provide stable growth foundations for industry participants.

China’s LED lighting market stands as a testament to the country’s technological advancement and manufacturing excellence in the global lighting industry. The market’s robust growth trajectory, supported by government initiatives, technological innovation, and expanding applications, positions it as a critical driver of worldwide LED adoption.

Key success factors for market participants include embracing smart lighting technologies, maintaining quality excellence, and developing comprehensive distribution strategies. The convergence of lighting with IoT platforms and building automation systems creates unprecedented opportunities for innovation and market expansion.

Future prospects remain exceptionally positive as urbanization continues, energy efficiency becomes increasingly important, and smart city initiatives expand across Chinese metropolitan areas. The market’s evolution from basic LED replacement to intelligent lighting ecosystems represents a fundamental transformation that will define the industry’s next growth phase.

Strategic positioning in this dynamic market requires balancing cost competitiveness with technological advancement, domestic market leadership with international expansion, and traditional lighting expertise with smart system capabilities. Companies successfully navigating these challenges will capture the substantial opportunities presented by China’s LED lighting market transformation.

What is LED Lighting?

LED lighting refers to the use of light-emitting diodes as a source of illumination. This technology is known for its energy efficiency, long lifespan, and versatility in various applications such as residential, commercial, and industrial lighting.

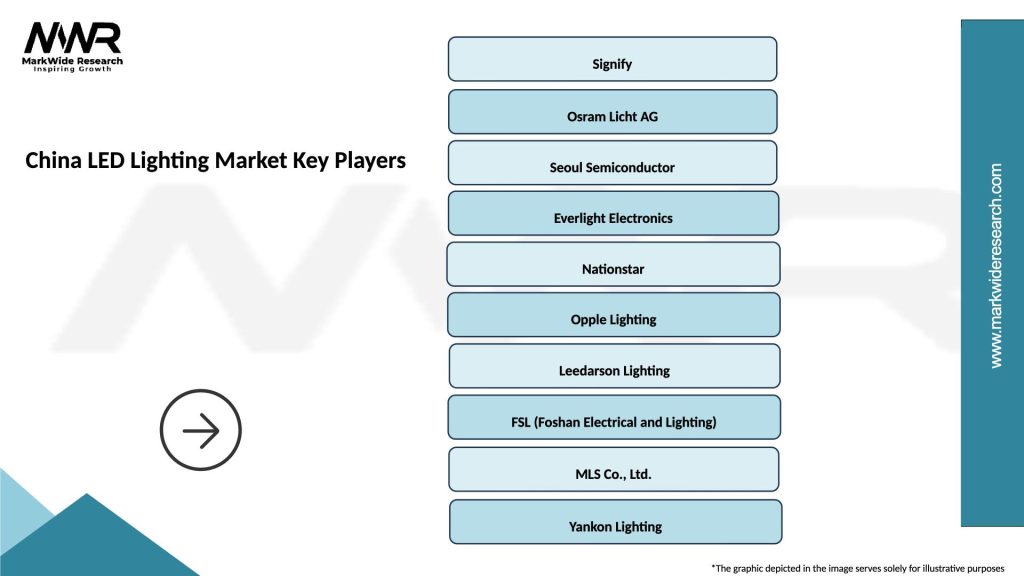

Who are the key players in the China LED Lighting Market?

Key players in the China LED Lighting Market include companies like Signify, Osram, and Cree, which are known for their innovative lighting solutions and extensive product ranges, among others.

What are the main drivers of the China LED Lighting Market?

The main drivers of the China LED Lighting Market include the increasing demand for energy-efficient lighting solutions, government initiatives promoting LED adoption, and the growing trend of smart lighting technologies in urban areas.

What challenges does the China LED Lighting Market face?

The China LED Lighting Market faces challenges such as intense competition among manufacturers, fluctuating raw material prices, and the need for continuous innovation to meet evolving consumer preferences.

What opportunities exist in the China LED Lighting Market?

Opportunities in the China LED Lighting Market include the expansion of smart city projects, the integration of IoT in lighting systems, and the rising popularity of sustainable lighting solutions among consumers.

What trends are shaping the China LED Lighting Market?

Trends shaping the China LED Lighting Market include the shift towards smart lighting systems, the increasing use of LED technology in horticultural lighting, and the growing focus on energy-efficient and environmentally friendly products.

China LED Lighting Market

| Segmentation Details | Description |

|---|---|

| Product Type | Bulbs, Fixtures, Strips, Panels |

| Technology | OLED, Quantum Dot, Smart LED, RGB |

| End User | Commercial, Industrial, Residential, Hospitality |

| Application | Street Lighting, Indoor Lighting, Architectural Lighting, Landscape Lighting |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China LED Lighting Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at