444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China lead-acid battery separator market represents a critical component of the nation’s energy storage ecosystem, serving as the backbone for automotive, industrial, and renewable energy applications. Lead-acid battery separators function as essential barriers between positive and negative electrodes, preventing short circuits while allowing ionic flow in battery cells. China’s dominance in global manufacturing has positioned the country as both the largest producer and consumer of these specialized materials.

Market dynamics indicate robust growth driven by expanding automotive production, increasing demand for backup power systems, and growing adoption of renewable energy storage solutions. The market benefits from China’s established supply chain infrastructure and cost-effective manufacturing capabilities. Technological advancements in separator materials, including enhanced porosity and improved chemical resistance, are driving innovation across the industry.

Regional concentration remains significant in eastern and southern provinces, where major battery manufacturers and automotive assembly plants are located. The market demonstrates strong integration with downstream industries, particularly automotive and telecommunications sectors. Growth projections suggest continued expansion at approximately 6.2% CAGR through the forecast period, supported by infrastructure development and energy storage requirements.

The China lead-acid battery separator market refers to the domestic industry focused on manufacturing, distributing, and utilizing specialized porous materials that separate positive and negative plates in lead-acid batteries while facilitating electrolyte flow and preventing electrical short circuits.

Battery separators serve multiple critical functions within lead-acid battery systems. They maintain physical separation between electrodes, provide uniform electrolyte distribution, and ensure optimal battery performance across various operating conditions. Material composition typically includes polyethylene, polypropylene, or specialized composite materials designed for specific applications and performance requirements.

Manufacturing processes involve sophisticated techniques including wet-laid nonwoven production, microporous film extrusion, and advanced coating applications. Quality control measures ensure consistent porosity, chemical resistance, and mechanical strength. Application diversity spans automotive starting batteries, industrial backup systems, telecommunications infrastructure, and renewable energy storage installations throughout China’s rapidly expanding economy.

China’s lead-acid battery separator market demonstrates remarkable resilience and growth potential, driven by the country’s position as a global manufacturing hub and increasing domestic energy storage demands. The market encompasses traditional automotive applications alongside emerging opportunities in renewable energy integration and industrial backup power systems.

Key market drivers include sustained automotive production growth, expanding telecommunications infrastructure, and government initiatives promoting energy storage solutions. Technological innovation focuses on developing advanced separator materials with enhanced performance characteristics, including improved acid resistance and extended operational life. Manufacturing efficiency improvements have resulted in approximately 15% cost reduction over recent years.

Competitive landscape features both domestic manufacturers and international players establishing local production facilities. Market consolidation trends indicate increasing focus on quality differentiation and specialized applications. Regional distribution shows concentration in key industrial provinces, with approximately 42% market share attributed to eastern coastal regions.

Future prospects remain positive, supported by infrastructure development projects, electric vehicle charging infrastructure requirements, and growing industrial automation. Sustainability initiatives are driving demand for recyclable separator materials and environmentally friendly manufacturing processes.

Strategic market insights reveal several critical trends shaping the China lead-acid battery separator landscape. Manufacturing capabilities have evolved significantly, with domestic producers achieving quality standards comparable to international competitors while maintaining cost advantages.

Automotive industry expansion serves as the primary driver for China’s lead-acid battery separator market. Continued vehicle production growth, both for domestic consumption and export markets, generates substantial demand for high-quality separator materials. Commercial vehicle segments particularly contribute to market growth, requiring robust battery systems for reliable operation.

Infrastructure development initiatives across China create significant opportunities for separator manufacturers. Telecommunications network expansion, data center construction, and industrial facility development all require reliable backup power systems utilizing lead-acid batteries. Government investment in infrastructure projects provides sustained demand visibility for market participants.

Renewable energy integration presents emerging growth opportunities as China pursues carbon neutrality goals. Solar and wind energy installations require energy storage solutions, with lead-acid batteries serving cost-effective applications in distributed energy systems. Grid stabilization requirements further drive demand for industrial-scale battery installations.

Cost competitiveness of lead-acid technology compared to alternative battery chemistries maintains market relevance across price-sensitive applications. Manufacturing efficiency improvements and economies of scale enable Chinese producers to offer competitive pricing while maintaining quality standards. Technological advancements in separator design continue enhancing battery performance and operational life.

Environmental regulations present significant challenges for the lead-acid battery separator market, as stricter policies regarding lead content and disposal requirements increase compliance costs. Manufacturing processes must adapt to evolving environmental standards, potentially impacting production efficiency and cost structures.

Competition from alternative technologies poses ongoing challenges, particularly from lithium-ion batteries in certain applications. Performance limitations of lead-acid technology, including energy density and cycle life constraints, restrict market expansion in emerging applications requiring advanced battery characteristics.

Raw material price volatility affects manufacturing cost predictability, particularly for petroleum-based separator materials. Supply chain disruptions can impact production schedules and delivery commitments, creating operational challenges for manufacturers serving time-sensitive applications.

Quality control requirements demand significant investment in testing equipment and process monitoring systems. International competition from established global players requires continuous innovation and cost optimization to maintain market position. Technological obsolescence risks necessitate ongoing research and development investments to remain competitive.

Export market expansion represents substantial growth opportunities for Chinese lead-acid battery separator manufacturers. Global demand for cost-effective, high-quality separator materials creates opportunities for market penetration in developing economies and established markets seeking supply chain diversification.

Specialty applications offer premium pricing opportunities, including separators designed for extreme temperature conditions, enhanced chemical resistance, or extended operational life. Customization capabilities enable manufacturers to serve niche markets with specific performance requirements and technical specifications.

Vertical integration strategies present opportunities for enhanced profitability and supply chain control. Backward integration into raw material production or forward integration into battery assembly can improve margins and market positioning. Strategic partnerships with battery manufacturers create stable demand relationships and collaborative innovation opportunities.

Technology licensing and joint venture arrangements with international companies provide access to advanced technologies and global market channels. Research and development investments in next-generation separator materials can establish competitive advantages and premium market positioning. Sustainability initiatives create opportunities for eco-friendly product development and green manufacturing processes.

Supply and demand dynamics in China’s lead-acid battery separator market reflect the interplay between manufacturing capacity, raw material availability, and end-user requirements. Production capacity has expanded significantly to meet growing domestic and international demand, with manufacturers investing in advanced equipment and process optimization.

Price dynamics demonstrate the influence of raw material costs, manufacturing efficiency, and competitive pressures. Market consolidation trends indicate increasing concentration among leading manufacturers, potentially affecting pricing strategies and competitive dynamics. Quality differentiation becomes increasingly important as customers prioritize performance over price considerations.

Innovation cycles drive continuous product development, with manufacturers introducing enhanced separator materials featuring improved porosity, chemical resistance, and mechanical strength. Customer relationships evolve toward long-term partnerships emphasizing technical support and customized solutions. Regulatory compliance requirements influence product specifications and manufacturing processes.

Market maturity indicators suggest transition from volume-based competition toward value-added services and specialized applications. Geographic expansion within China and internationally creates new growth vectors for established manufacturers. Technology transfer and knowledge sharing accelerate industry development and competitive capabilities.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into China’s lead-acid battery separator market. Primary research includes extensive interviews with industry executives, manufacturing specialists, and technical experts across the value chain.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements. Data triangulation techniques validate findings across multiple sources to ensure accuracy and reliability. Market sizing methodologies utilize both top-down and bottom-up approaches to establish comprehensive market perspectives.

Industry expert consultations provide insights into technological trends, competitive dynamics, and future market developments. Supply chain analysis examines raw material flows, manufacturing processes, and distribution channels. End-user surveys capture customer preferences, purchasing criteria, and application requirements.

Quantitative analysis includes statistical modeling and trend analysis to identify growth patterns and market drivers. Qualitative assessment explores market dynamics, competitive strategies, and regulatory impacts. Forecasting models incorporate multiple scenarios to project future market development under various conditions.

Eastern China dominates the lead-acid battery separator market, accounting for approximately 38% market share due to concentrated automotive manufacturing and industrial activity. Jiangsu Province leads production capacity with major separator manufacturers and battery assembly facilities. Zhejiang Province contributes significantly through specialized separator production and export activities.

Southern China represents another major market region, with Guangdong Province serving as a key manufacturing hub for both separators and downstream battery applications. Export-oriented production characterizes this region, with manufacturers serving international markets alongside domestic demand. Supply chain integration with electronics and automotive industries drives regional market development.

Northern China shows growing market presence, particularly in Shandong and Hebei provinces, where industrial applications and automotive manufacturing create substantial separator demand. Infrastructure development in this region supports market expansion through telecommunications and power generation projects.

Western China demonstrates emerging market potential, with approximately 12% regional market share driven by infrastructure development and renewable energy projects. Government initiatives promoting industrial development in western provinces create new opportunities for separator manufacturers. Logistics considerations influence market development patterns and distribution strategies.

Market leadership in China’s lead-acid battery separator industry features a combination of domestic manufacturers and international companies with local production facilities. Competitive dynamics emphasize quality differentiation, cost optimization, and technical innovation.

Competitive strategies include capacity expansion, technology licensing, and strategic partnerships with battery manufacturers. Market differentiation occurs through product quality, technical support, and customization capabilities. Innovation investments focus on developing next-generation separator materials with enhanced performance characteristics.

By Material Type:

By Application:

By End-User:

Automotive segment maintains market dominance with approximately 65% application share, driven by continued vehicle production growth and replacement market demand. Performance requirements emphasize durability, chemical resistance, and consistent quality across varying operating conditions. Technology trends focus on enhanced separator designs supporting longer battery life and improved cold-weather performance.

Industrial applications demonstrate strong growth potential, particularly in telecommunications and data center backup power systems. Reliability requirements exceed automotive standards, demanding superior separator materials with extended operational life. Customization opportunities exist for specialized industrial applications requiring unique performance characteristics.

Stationary energy storage represents an emerging category with significant growth prospects as China expands renewable energy capacity. Grid-scale applications require large-format separators with enhanced performance specifications. Cost considerations remain important while maintaining quality standards for long-term installations.

Material innovation across all categories focuses on improving porosity control, chemical resistance, and mechanical strength. Manufacturing efficiency improvements enable cost optimization while maintaining product quality. Quality assurance programs ensure consistent performance across different application categories and customer requirements.

Manufacturers benefit from China’s established supply chain infrastructure, cost-effective production capabilities, and access to both domestic and international markets. Economies of scale enable competitive pricing while maintaining quality standards. Technology development opportunities exist through collaboration with research institutions and customer partnerships.

Battery producers gain access to reliable separator supply, technical support, and customization capabilities meeting specific application requirements. Supply chain integration opportunities reduce costs and improve quality control. Innovation partnerships enable development of advanced battery systems with enhanced performance characteristics.

End users benefit from improved battery performance, extended operational life, and reliable power supply solutions. Cost optimization through efficient separator design reduces total ownership costs. Technical support from manufacturers ensures optimal battery system performance and troubleshooting assistance.

Investors find attractive opportunities in a growing market with established demand drivers and expansion potential. Market stability provides predictable returns while growth opportunities offer upside potential. Technology investments create competitive advantages and premium market positioning possibilities.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology advancement drives development of next-generation separator materials incorporating nanotechnology and advanced polymer compositions. Performance enhancement focuses on improved porosity control, chemical resistance, and mechanical strength. Manufacturing innovation includes automated production processes and quality control systems ensuring consistent product specifications.

Sustainability initiatives gain prominence as manufacturers develop eco-friendly separator materials and implement recycling programs. Environmental compliance requirements drive adoption of cleaner production processes and waste reduction strategies. Circular economy principles influence product design and end-of-life management approaches.

Market consolidation continues as leading manufacturers acquire smaller players to expand capacity and market reach. Vertical integration strategies create competitive advantages through supply chain control and cost optimization. Strategic partnerships between separator manufacturers and battery producers strengthen market relationships.

Digital transformation impacts manufacturing processes through Industry 4.0 technologies, predictive maintenance, and data analytics. Quality assurance systems incorporate advanced testing methods and real-time monitoring capabilities. Customer service evolution includes technical support platforms and digital communication channels.

Capacity expansion projects across major manufacturers indicate strong market confidence and growing demand expectations. Investment announcements include new production facilities and equipment upgrades supporting increased output and improved quality capabilities. Technology licensing agreements facilitate knowledge transfer and accelerate innovation adoption.

Research and development initiatives focus on advanced separator materials with enhanced performance characteristics. University partnerships support fundamental research into polymer science and material engineering. Government funding programs encourage innovation in energy storage technologies and manufacturing processes.

International expansion activities include establishment of overseas production facilities and distribution networks. Export growth demonstrates increasing global acceptance of Chinese separator products. Quality certifications from international standards organizations validate product performance and reliability.

Sustainability programs address environmental concerns through cleaner production methods and recycling initiatives. Regulatory compliance efforts ensure adherence to evolving environmental standards. Industry associations promote best practices and coordinate sustainability initiatives across the sector.

Strategic positioning recommendations emphasize differentiation through quality excellence and technical innovation rather than price competition alone. Investment priorities should focus on research and development capabilities, manufacturing efficiency improvements, and customer relationship development. Market expansion strategies should balance domestic growth with international opportunities.

Technology development investments in advanced separator materials and manufacturing processes create competitive advantages and premium market positioning. Sustainability initiatives address environmental concerns while potentially creating new market opportunities. Quality assurance programs ensure consistent product performance and customer satisfaction.

Partnership strategies with battery manufacturers, automotive companies, and industrial users strengthen market relationships and create collaborative innovation opportunities. Supply chain optimization reduces costs and improves delivery reliability. Export development requires understanding of international quality standards and customer requirements.

Risk management strategies should address raw material price volatility, regulatory changes, and competitive pressures. Diversification opportunities across application segments and geographic markets reduce concentration risks. Continuous improvement programs maintain competitiveness in evolving market conditions.

Market growth prospects remain positive, supported by continued automotive production, infrastructure development, and industrial expansion. Technology evolution will drive demand for advanced separator materials with enhanced performance characteristics. Sustainability trends create opportunities for eco-friendly product development and manufacturing processes.

Competitive dynamics will increasingly emphasize quality differentiation and technical innovation over price competition. Market consolidation may continue as leading manufacturers seek scale advantages and market expansion opportunities. International growth potential remains significant for Chinese manufacturers with quality capabilities and cost advantages.

Application diversification beyond traditional automotive markets creates new growth vectors in renewable energy storage and industrial applications. Technology convergence with advanced battery systems may create hybrid opportunities combining lead-acid reliability with enhanced performance. Regional expansion within China and internationally supports long-term growth objectives.

Innovation investments in next-generation separator materials and manufacturing processes will determine competitive positioning. Sustainability initiatives become increasingly important for market acceptance and regulatory compliance. Growth projections suggest continued market expansion at approximately 6.8% CAGR through the forecast period, driven by diverse application growth and technological advancement.

China’s lead-acid battery separator market demonstrates remarkable resilience and growth potential, supported by the country’s manufacturing excellence and diverse application demand. Market fundamentals remain strong, with automotive applications providing stable demand while industrial and renewable energy segments offer expansion opportunities.

Competitive advantages of Chinese manufacturers include cost-effective production capabilities, established supply chains, and growing technological sophistication. Innovation focus on advanced separator materials and sustainable manufacturing processes positions the industry for continued growth and international competitiveness.

Future success will depend on maintaining quality standards while pursuing technological advancement and market diversification. Strategic investments in research and development, manufacturing efficiency, and customer relationships create sustainable competitive advantages. The China lead-acid battery separator market represents a dynamic industry with significant potential for continued expansion and technological evolution.

What is Lead-Acid Battery Separator?

Lead-Acid Battery Separator refers to the material used to electrically isolate the positive and negative plates in lead-acid batteries, ensuring efficient performance and safety. These separators are crucial for preventing short circuits and enhancing the overall lifespan of the battery.

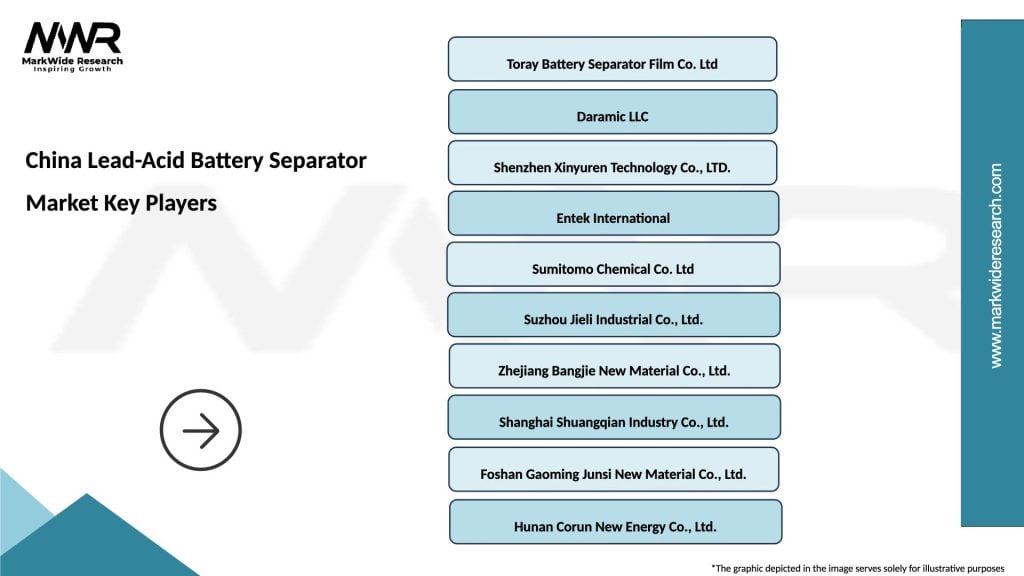

What are the key players in the China Lead-Acid Battery Separator Market?

Key players in the China Lead-Acid Battery Separator Market include companies like Asahi Kasei Corporation, Entek International LLC, and W. R. Grace & Co., which are known for their innovative separator technologies and extensive market presence, among others.

What are the growth factors driving the China Lead-Acid Battery Separator Market?

The growth of the China Lead-Acid Battery Separator Market is driven by the increasing demand for lead-acid batteries in automotive and industrial applications, as well as advancements in separator materials that enhance battery efficiency and safety.

What challenges does the China Lead-Acid Battery Separator Market face?

The China Lead-Acid Battery Separator Market faces challenges such as environmental regulations regarding lead usage, competition from alternative battery technologies, and the need for continuous innovation to meet evolving consumer demands.

What opportunities exist in the China Lead-Acid Battery Separator Market?

Opportunities in the China Lead-Acid Battery Separator Market include the growing adoption of renewable energy storage solutions and the expansion of electric vehicle production, which require efficient lead-acid battery systems.

What trends are shaping the China Lead-Acid Battery Separator Market?

Trends shaping the China Lead-Acid Battery Separator Market include the development of advanced polymer separators, increased focus on recycling and sustainability, and the integration of smart technologies in battery management systems.

China Lead-Acid Battery Separator Market

| Segmentation Details | Description |

|---|---|

| Product Type | Polyethylene, Polypropylene, Glass Fiber, Others |

| End User | Automotive OEMs, Industrial Applications, Renewable Energy, Telecommunications |

| Technology | Wet Process, Dry Process, Coating Technology, Others |

| Application | Electric Vehicles, UPS Systems, Solar Energy Storage, Forklifts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Lead-Acid Battery Separator Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at