444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

China’s big data technology market represents one of the most compelling investment landscapes in the global digital economy, driven by unprecedented data generation, government policy support, and rapid technological advancement. The market encompasses comprehensive data analytics platforms, artificial intelligence integration, cloud computing infrastructure, and enterprise data management solutions that are transforming industries across the nation.

Investment opportunities in China’s big data sector are expanding at an accelerated pace, with the market experiencing robust growth driven by digital transformation initiatives across manufacturing, finance, healthcare, and retail sectors. The convergence of 5G technology, Internet of Things (IoT) deployment, and artificial intelligence capabilities creates a fertile environment for strategic investments in data-driven solutions.

Government initiatives including the Digital China strategy and New Infrastructure Development plan have positioned big data technology as a national priority, with significant policy support and funding mechanisms designed to accelerate market development. This regulatory framework provides investment security and long-term growth potential for both domestic and international investors.

Market dynamics indicate strong momentum across key segments, with enterprise adoption rates reaching 78% among large corporations and small-to-medium enterprises increasingly recognizing the competitive advantages of data-driven decision making. The integration of big data solutions with emerging technologies creates multiple investment vectors across the technology stack.

The China investment opportunities of big data technology market refers to the comprehensive ecosystem of financial prospects, strategic partnerships, and business development possibilities within China’s rapidly expanding big data technology sector. This market encompasses venture capital investments, private equity opportunities, strategic acquisitions, joint ventures, and public market investments in companies developing, deploying, or utilizing big data technologies.

Investment scope includes data analytics platforms, artificial intelligence algorithms, machine learning frameworks, cloud computing infrastructure, data storage solutions, cybersecurity technologies, and industry-specific applications that leverage big data capabilities. The market represents both direct technology investments and indirect opportunities in companies that significantly benefit from big data implementation.

Strategic significance extends beyond traditional technology investments to encompass transformational opportunities in sectors such as smart cities, industrial automation, financial technology, healthcare innovation, and e-commerce optimization. These investment opportunities reflect China’s commitment to becoming a global leader in data-driven economic development.

China’s big data technology investment market presents exceptional opportunities for investors seeking exposure to the world’s largest digital economy transformation. The market benefits from strong government support, massive data generation capabilities, and a sophisticated technology ecosystem that continues to attract significant capital investment.

Key investment drivers include accelerating digital transformation across traditional industries, growing demand for artificial intelligence solutions, expanding cloud computing adoption, and increasing focus on data-driven business optimization. The market demonstrates strong fundamentals with enterprise adoption growing at 23% annually across key sectors.

Investment landscape encompasses multiple opportunity categories including early-stage technology startups, established platform providers, infrastructure development companies, and sector-specific solution providers. The diversity of investment options allows for strategic portfolio construction across risk profiles and return expectations.

Market positioning benefits from China’s unique advantages including massive domestic market scale, advanced manufacturing capabilities, strong engineering talent pool, and supportive regulatory environment for technology innovation. These factors combine to create sustainable competitive advantages for well-positioned investments.

Digital transformation initiatives across China’s economy serve as the primary catalyst for big data technology investment opportunities. Traditional industries including manufacturing, retail, healthcare, and financial services are implementing comprehensive digitization strategies that require sophisticated data analytics capabilities, creating substantial demand for technology solutions and infrastructure.

Government policy support through initiatives such as the Digital China strategy and Made in China 2025 plan provides significant momentum for big data technology development. These policies include direct funding mechanisms, tax incentives, research grants, and regulatory frameworks designed to accelerate technology adoption and innovation.

Data generation explosion from mobile internet usage, IoT device deployment, and digital commerce activities creates unprecedented opportunities for companies that can effectively capture, process, and monetize this information. China’s massive consumer base generates data volumes that provide unique competitive advantages for analytics platforms and AI development.

Artificial intelligence integration with big data technologies creates synergistic opportunities for investment in companies developing machine learning algorithms, natural language processing capabilities, and automated decision-making systems. The convergence of these technologies enables new business models and revenue streams.

Infrastructure development including 5G network deployment, cloud computing expansion, and data center construction provides foundational support for big data technology adoption. These infrastructure investments create opportunities for both direct infrastructure investment and technology companies that benefit from improved connectivity and processing capabilities.

Regulatory complexity surrounding data privacy, cross-border data transfer, and cybersecurity requirements creates challenges for investors navigating the Chinese big data technology market. Evolving regulations require careful compliance management and may impact business model development for certain types of data-driven companies.

Technology talent competition has intensified as demand for qualified data scientists, AI engineers, and big data specialists exceeds supply. This talent shortage can increase operational costs and slow development timelines for technology companies, potentially impacting investment returns and growth trajectories.

Infrastructure limitations in certain regions and industry segments may constrain the deployment of advanced big data solutions. While major cities benefit from sophisticated technology infrastructure, expanding to secondary markets may require additional infrastructure investment that affects project economics.

Data quality challenges across various industries can limit the effectiveness of big data implementations and reduce the value proposition for certain technology solutions. Inconsistent data standards and legacy system integration complexities may slow adoption rates in some sectors.

Market saturation risks in certain segments as numerous companies compete for similar opportunities may compress margins and increase customer acquisition costs. The rapid growth of the sector has attracted significant competition that may impact long-term profitability for some market participants.

Smart city development initiatives across China present substantial investment opportunities in big data technologies that support urban planning, traffic management, environmental monitoring, and public service optimization. These comprehensive projects require integrated technology solutions that combine data analytics, IoT sensors, and artificial intelligence capabilities.

Industrial Internet of Things implementation in manufacturing creates opportunities for companies developing big data solutions that optimize production processes, predict equipment maintenance needs, and improve supply chain efficiency. The integration of Industry 4.0 concepts with Chinese manufacturing capabilities presents significant market potential.

Healthcare digitization offers investment opportunities in companies developing big data solutions for medical research, patient care optimization, drug discovery, and healthcare system management. China’s large population and comprehensive healthcare reform initiatives create substantial market demand for innovative technology solutions.

Financial technology innovation continues to expand with opportunities in big data applications for risk assessment, fraud detection, algorithmic trading, and personalized financial services. The sophisticated Chinese fintech ecosystem provides multiple investment vectors across the financial services value chain.

Cross-border expansion opportunities exist for Chinese big data technology companies seeking international markets, as well as foreign companies looking to establish operations in China. Strategic partnerships and joint ventures can facilitate market entry and technology transfer initiatives.

Competitive landscape evolution in China’s big data technology market reflects the dynamic interplay between established technology giants, emerging startups, and international companies seeking market entry. This competitive environment drives innovation while creating opportunities for strategic partnerships and acquisition activities that benefit investors.

Technology advancement cycles continue to accelerate with rapid development in artificial intelligence, machine learning algorithms, and data processing capabilities. These technological improvements create opportunities for companies that can successfully commercialize advanced capabilities while potentially disrupting existing market leaders.

Customer adoption patterns demonstrate increasing sophistication as enterprises move beyond basic analytics to implement comprehensive data-driven business strategies. This evolution creates demand for more advanced solutions while expanding the total addressable market for big data technology providers.

Investment capital flows into the sector remain robust with both domestic and international investors recognizing the strategic importance of big data technologies. According to MarkWide Research analysis, venture capital investment activity has increased significantly, with funding rounds growing 34% year-over-year across key technology segments.

Regulatory environment development continues to evolve with government agencies working to balance innovation promotion with data security and privacy protection. These regulatory developments create both challenges and opportunities for companies that can successfully navigate compliance requirements while maintaining competitive advantages.

Primary research activities for analyzing China’s big data technology investment opportunities included comprehensive interviews with industry executives, venture capital partners, government officials, and technology company leadership teams. These discussions provided insights into market trends, investment criteria, regulatory developments, and strategic priorities across the ecosystem.

Secondary research analysis encompassed review of government policy documents, industry reports, financial filings, patent applications, and academic research publications related to big data technology development in China. This analysis provided quantitative data and trend identification across multiple market segments and time periods.

Market participant surveys were conducted with enterprise customers, technology vendors, system integrators, and consulting firms to understand adoption patterns, investment priorities, and market demand dynamics. These surveys provided ground-level insights into market conditions and growth prospects.

Financial analysis methodology included evaluation of public company performance, private company funding rounds, merger and acquisition activity, and market valuation trends. This analysis provided insights into investment returns, market dynamics, and valuation methodologies across different investment categories.

Technology assessment frameworks were developed to evaluate the competitive positioning, innovation capabilities, and market potential of various big data technology solutions. These frameworks considered technical capabilities, market adoption rates, competitive advantages, and scalability potential.

Beijing-Tianjin-Hebei region serves as the primary hub for big data technology investment opportunities, benefiting from concentrated government support, leading universities, established technology companies, and sophisticated venture capital ecosystem. The region accounts for approximately 35% of national big data investment activity and hosts major technology development centers.

Yangtze River Delta including Shanghai, Jiangsu, and Zhejiang provinces represents the second-largest investment opportunity region with strong manufacturing integration, financial services concentration, and international business connectivity. The region demonstrates advanced enterprise adoption rates and significant cross-border investment activity.

Pearl River Delta centered around Guangzhou and Shenzhen offers substantial opportunities in hardware-software integration, manufacturing automation, and export-oriented technology development. The region’s proximity to Hong Kong facilitates international investment and provides access to global capital markets.

Western China development initiatives create emerging opportunities in cities such as Chengdu, Xi’an, and Chongqing where government incentives, lower operational costs, and growing talent pools attract technology companies and investment capital. These regions show rapid growth in technology adoption and infrastructure development.

Specialized economic zones and technology parks across multiple regions offer targeted investment opportunities with preferential policies, infrastructure support, and clustering effects that benefit big data technology companies. These zones facilitate both domestic and international investment participation.

Market competition dynamics reflect both collaboration and competition among major players, with strategic partnerships common for addressing complex enterprise requirements while maintaining competitive differentiation in core technology capabilities.

By Technology Type:

By Industry Application:

By Investment Type:

Enterprise Software Solutions represent the largest investment opportunity category with companies developing comprehensive platforms that integrate data analytics, artificial intelligence, and business process automation. These solutions demonstrate strong recurring revenue models and high customer retention rates, making them attractive for both growth and income-focused investors.

Infrastructure Technology investments focus on cloud computing platforms, data storage systems, and networking technologies that support big data processing requirements. This category benefits from the fundamental infrastructure needs of the digital economy and typically offers more stable, utility-like investment characteristics.

Industry-Specific Applications provide targeted investment opportunities in companies developing specialized big data solutions for particular sectors such as healthcare, manufacturing, or financial services. These investments often command premium valuations due to their specialized expertise and strong competitive moats.

Artificial Intelligence Integration companies that combine big data capabilities with advanced AI technologies represent high-growth investment opportunities with significant upside potential. However, these investments typically carry higher risk profiles due to technology complexity and competitive dynamics.

Data Services and Consulting companies provide implementation, integration, and optimization services for big data technologies. These service-oriented businesses often demonstrate predictable revenue streams and lower capital requirements, appealing to investors seeking steady returns with moderate growth potential.

Investors benefit from exposure to China’s rapidly expanding digital economy through diversified investment opportunities across technology segments, company stages, and risk profiles. The market offers potential for both capital appreciation and strategic positioning in transformational technology trends that are reshaping global business operations.

Technology companies gain access to substantial capital resources, strategic partnerships, and market expansion opportunities that accelerate product development and customer acquisition. The investment ecosystem provides both funding and expertise that enhance competitive positioning and growth potential.

Enterprise customers benefit from increased innovation, competitive pricing, and comprehensive solution offerings as investment capital drives technology advancement and market competition. The robust investment environment ensures continued development of sophisticated big data capabilities that address evolving business requirements.

Government stakeholders achieve policy objectives related to digital economy development, technological innovation, and economic competitiveness through private sector investment that complements public sector initiatives. The investment activity supports job creation, tax revenue generation, and strategic technology development.

Academic and research institutions benefit from increased collaboration opportunities, research funding, and technology transfer initiatives that advance scientific knowledge while supporting commercial applications. The investment ecosystem creates pathways for academic research to reach practical implementation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration continues to accelerate with big data platforms incorporating advanced machine learning capabilities, natural language processing, and automated decision-making systems. This trend creates opportunities for companies that can successfully combine data analytics with AI technologies to deliver enhanced business value and competitive advantages.

Edge Computing Adoption is expanding as organizations seek to process data closer to its source for improved performance and reduced latency. This trend drives investment opportunities in companies developing edge computing solutions and hybrid cloud-edge architectures that support distributed big data processing.

Industry-Specific Solutions are gaining prominence as enterprises demand specialized big data applications tailored to their specific operational requirements and regulatory environments. This trend favors companies with deep industry expertise and vertical market focus over generic platform providers.

Real-Time Analytics capabilities are becoming essential as businesses require immediate insights for operational decision-making and customer engagement. Companies developing streaming analytics and real-time processing technologies benefit from this trend through increased market demand and premium pricing opportunities.

Data Privacy and Security considerations are driving investment in companies that can provide comprehensive data protection, compliance management, and cybersecurity integration within big data solutions. This trend creates opportunities for specialized security technology providers and comprehensive platform vendors.

Strategic Partnership Formations between major technology companies and traditional industry leaders are accelerating market development and creating new investment opportunities. These partnerships combine technology expertise with industry knowledge and customer relationships to develop comprehensive solutions that address complex business requirements.

International Expansion Initiatives by Chinese big data companies are creating opportunities for cross-border investment and technology transfer. Companies are establishing overseas operations, forming international partnerships, and pursuing acquisition opportunities that expand their global market presence and capabilities.

Government Infrastructure Projects including smart city initiatives, digital government platforms, and industrial internet development are creating substantial market opportunities for big data technology providers. These projects provide stable revenue sources and reference implementations that support broader market expansion.

Venture Capital Investment Growth continues with both domestic and international investors increasing their commitments to Chinese big data technology companies. MWR data indicates that investment activity has reached new levels with funding volumes increasing 42% annually across key technology segments.

Technology Standard Development efforts by industry associations and government agencies are creating more standardized approaches to big data implementation and interoperability. These developments reduce implementation complexity and support broader market adoption of big data technologies.

Investment Strategy Diversification across multiple technology segments, company stages, and industry applications can help investors manage risk while capturing opportunities in China’s dynamic big data market. Portfolio construction should consider both growth-oriented and stability-focused investments to balance return potential with risk management.

Due Diligence Enhancement should include comprehensive evaluation of regulatory compliance, technology differentiation, market positioning, and management team capabilities. Investors should pay particular attention to data privacy compliance, intellectual property protection, and competitive sustainability in their investment analysis.

Partnership Strategy Development with local partners, industry experts, and government stakeholders can significantly enhance investment success rates and market access capabilities. Strategic partnerships provide valuable market insights, regulatory guidance, and business development support that benefit investment outcomes.

Long-term Perspective Adoption is essential given the transformational nature of big data technology adoption and the time required for companies to achieve market leadership positions. Investors should focus on companies with sustainable competitive advantages and long-term growth potential rather than short-term market fluctuations.

Technology Trend Monitoring should include continuous assessment of emerging technologies, changing customer requirements, and evolving competitive dynamics. Successful investors maintain awareness of technology developments that may create new opportunities or threaten existing investments.

Market expansion prospects remain exceptionally strong with continued government support, accelerating enterprise adoption, and expanding application opportunities across multiple industry sectors. The convergence of big data with emerging technologies creates multiple growth vectors that support sustained market development and investment opportunities.

Technology advancement trajectories indicate continued innovation in artificial intelligence integration, real-time processing capabilities, and industry-specific applications. These developments will create new market segments and investment opportunities while potentially disrupting existing market leaders and business models.

Investment capital availability is expected to remain robust with both domestic and international investors recognizing the strategic importance of big data technologies. According to MarkWide Research projections, investment activity is anticipated to grow at sustained double-digit rates over the next several years.

Regulatory environment evolution will continue to balance innovation promotion with data security and privacy protection requirements. Companies that can successfully navigate regulatory requirements while maintaining competitive advantages will benefit from reduced competition and enhanced market positioning.

Global expansion opportunities for Chinese big data companies will create additional investment value through international market access and technology transfer initiatives. Cross-border partnerships and acquisition activities will provide pathways for market expansion and competitive positioning in global markets.

China’s big data technology investment market represents one of the most compelling opportunities in the global technology sector, combining massive market scale, strong government support, advanced technology capabilities, and diverse investment options across multiple segments and risk profiles. The market benefits from unique advantages including unprecedented data generation, sophisticated technology infrastructure, and comprehensive policy support that create sustainable competitive advantages.

Investment opportunities span the entire technology ecosystem from early-stage startups developing innovative solutions to established platform providers serving enterprise customers across multiple industries. The diversity of opportunities allows investors to construct portfolios that match their risk tolerance and return objectives while gaining exposure to transformational technology trends.

Strategic positioning in China’s big data technology market provides investors with access to the world’s largest digital economy transformation and the opportunity to participate in the development of technologies that will shape global business operations for decades to come. The combination of market scale, technology advancement, and policy support creates a foundation for sustained growth and investment returns that justify the strategic importance of this market for forward-looking investors.

What is Big Data Technology?

Big Data Technology refers to the tools and techniques used to process and analyze large volumes of data that traditional data processing software cannot handle. It encompasses various technologies such as data mining, machine learning, and predictive analytics, which are essential for extracting valuable insights from complex datasets.

What are the China Investment Opportunities of Big Data Technology Market?

The China Investment Opportunities of Big Data Technology Market are vast, driven by the increasing demand for data-driven decision-making across industries. Key sectors such as finance, healthcare, and retail are leveraging big data analytics to enhance operational efficiency and customer experience.

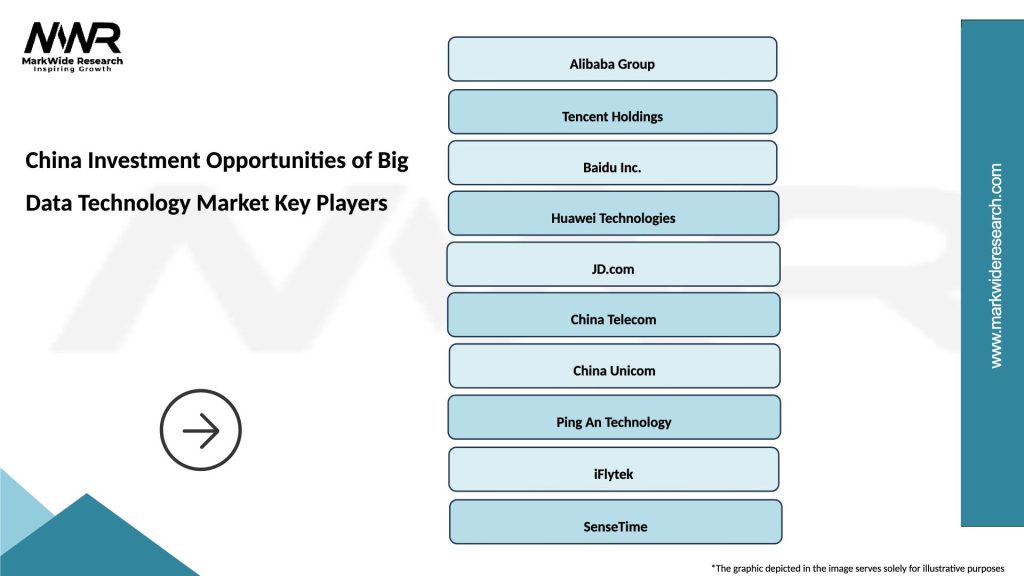

Who are the key players in the China Investment Opportunities of Big Data Technology Market?

Key players in the China Investment Opportunities of Big Data Technology Market include Alibaba Cloud, Tencent, and Baidu, which are leading the way in providing big data solutions and services. These companies focus on cloud computing, AI integration, and data analytics, among others.

What are the challenges in the China Investment Opportunities of Big Data Technology Market?

Challenges in the China Investment Opportunities of Big Data Technology Market include data privacy concerns, regulatory compliance, and the need for skilled professionals. Additionally, the rapid pace of technological change can make it difficult for companies to keep up with the latest advancements.

What is the future outlook for the China Investment Opportunities of Big Data Technology Market?

The future outlook for the China Investment Opportunities of Big Data Technology Market is promising, with expected growth driven by advancements in AI and machine learning. As more businesses recognize the value of data analytics, investment in big data technologies is likely to increase significantly.

What trends are shaping the China Investment Opportunities of Big Data Technology Market?

Trends shaping the China Investment Opportunities of Big Data Technology Market include the rise of real-time data analytics, increased adoption of cloud-based solutions, and the integration of AI technologies. These trends are enabling businesses to make faster, data-driven decisions and improve overall efficiency.

China Investment Opportunities of Big Data Technology Market

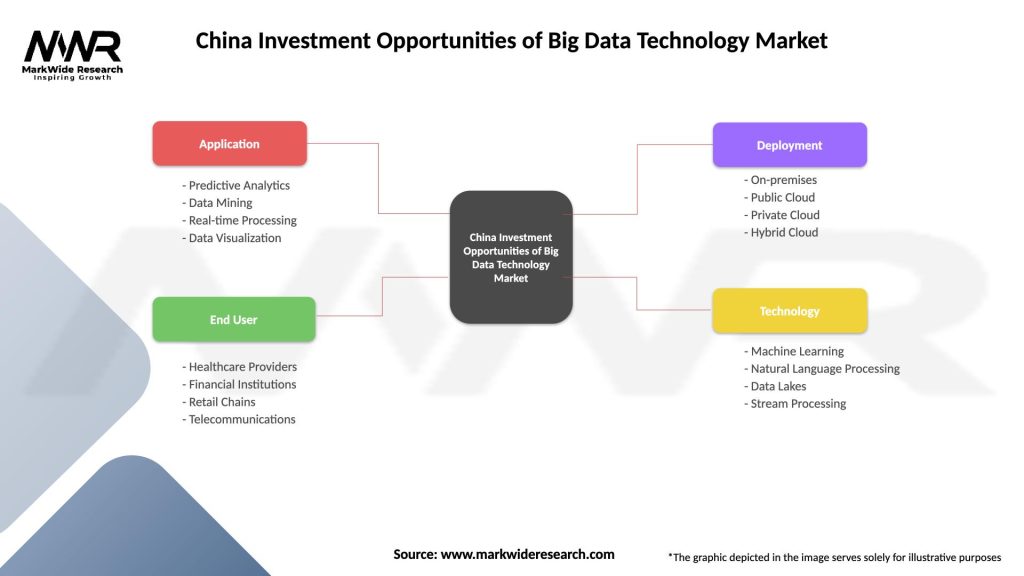

| Segmentation Details | Description |

|---|---|

| Application | Predictive Analytics, Data Mining, Real-time Processing, Data Visualization |

| End User | Healthcare Providers, Financial Institutions, Retail Chains, Telecommunications |

| Deployment | On-premises, Public Cloud, Private Cloud, Hybrid Cloud |

| Technology | Machine Learning, Natural Language Processing, Data Lakes, Stream Processing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Investment Opportunities of Big Data Technology Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at