444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China hybrid electric vehicle battery market represents one of the most dynamic and rapidly evolving segments within the global automotive industry. China’s commitment to sustainable transportation and environmental protection has positioned the country as a global leader in hybrid electric vehicle technology adoption. The market encompasses various battery technologies including lithium-ion, nickel-metal hydride, and emerging solid-state solutions specifically designed for hybrid electric vehicles.

Market dynamics indicate robust growth driven by government incentives, environmental regulations, and increasing consumer awareness about fuel efficiency. The sector is experiencing a compound annual growth rate of 12.5%, reflecting strong demand across passenger vehicles, commercial vehicles, and public transportation segments. Chinese manufacturers have established significant competitive advantages through vertical integration, cost optimization, and technological innovation.

Regional distribution shows concentrated activity in major automotive hubs including Beijing, Shanghai, Guangzhou, and emerging centers in Hefei and Chengdu. The market benefits from China’s comprehensive supply chain ecosystem, spanning raw material processing, battery cell manufacturing, pack assembly, and recycling infrastructure. Government policies continue to shape market development through the New Energy Vehicle mandate and carbon neutrality commitments by 2060.

The China hybrid electric vehicle battery market refers to the comprehensive ecosystem encompassing the development, manufacturing, distribution, and servicing of battery systems specifically designed for hybrid electric vehicles within Chinese territory. This market includes both domestic production for local consumption and export-oriented manufacturing serving global automotive markets.

Hybrid electric vehicle batteries combine internal combustion engines with electric propulsion systems, requiring sophisticated energy storage solutions that can efficiently capture regenerative braking energy, provide electric-only driving capability, and support seamless transitions between power sources. These battery systems typically feature higher power density requirements compared to conventional electric vehicle batteries, necessitating specialized cell chemistry and thermal management solutions.

Market scope encompasses various stakeholders including battery manufacturers, automotive OEMs, component suppliers, research institutions, and supporting infrastructure providers. The ecosystem extends from upstream raw material suppliers to downstream recycling and second-life applications, creating a circular economy approach to battery lifecycle management.

China’s hybrid electric vehicle battery market demonstrates exceptional growth momentum driven by supportive government policies, technological advancement, and increasing environmental consciousness among consumers. The market has achieved significant scale advantages through concentrated manufacturing capabilities and integrated supply chains, positioning Chinese companies as global leaders in battery technology and production capacity.

Key market characteristics include rapid technological evolution toward higher energy density solutions, cost reduction through manufacturing scale, and expanding application across diverse vehicle segments. The market benefits from China’s position as the world’s largest automotive market, providing substantial domestic demand while supporting export growth to international markets.

Competitive landscape features both established international players and emerging Chinese companies, with domestic manufacturers gaining market share of approximately 68% in the hybrid battery segment. Innovation focus areas include battery management systems, thermal management, fast-charging capabilities, and integration with vehicle control systems.

Future prospects remain highly positive, supported by continued government commitment to new energy vehicles, ongoing technological breakthroughs, and expanding global demand for hybrid electric vehicles as a transitional technology toward full electrification.

Strategic market insights reveal several critical trends shaping the China hybrid electric vehicle battery landscape:

Government policy support serves as the primary catalyst for China’s hybrid electric vehicle battery market expansion. The Chinese government’s commitment to carbon neutrality by 2060 has created comprehensive policy frameworks supporting new energy vehicle adoption, including hybrid electric vehicles as a transitional technology. Regulatory mandates require automotive manufacturers to achieve specific new energy vehicle production quotas, directly driving demand for hybrid battery systems.

Environmental concerns and air quality improvement initiatives in major Chinese cities have accelerated consumer adoption of cleaner transportation technologies. Urban pollution control measures and emission restrictions create favorable conditions for hybrid electric vehicles, particularly in tier-one cities where environmental regulations are most stringent. Consumer awareness of environmental issues continues to grow, supporting market demand for eco-friendly transportation solutions.

Technological advancement in battery chemistry, manufacturing processes, and system integration has significantly improved hybrid electric vehicle performance while reducing costs. Chinese manufacturers have achieved substantial progress in energy density improvements, charging speed optimization, and battery lifecycle extension. Manufacturing innovation has enabled cost reductions that make hybrid electric vehicles increasingly competitive with conventional vehicles.

Economic factors including fuel price volatility and total cost of ownership considerations favor hybrid electric vehicle adoption. Rising fuel costs and maintenance advantages of hybrid systems create compelling economic arguments for consumers and fleet operators. Infrastructure development supporting charging networks and service capabilities further enhances market attractiveness.

High initial costs remain a significant barrier to widespread hybrid electric vehicle adoption, particularly in price-sensitive market segments. Despite ongoing cost reductions, hybrid battery systems still command premium pricing compared to conventional powertrain components. Consumer price sensitivity in lower-tier cities and rural markets limits market penetration beyond affluent urban areas.

Technical complexity associated with hybrid electric vehicle battery systems creates challenges for service networks and consumer confidence. The integration of multiple power sources requires sophisticated control systems and specialized maintenance capabilities that may not be readily available in all markets. Consumer education regarding hybrid technology benefits and maintenance requirements remains an ongoing challenge.

Supply chain constraints for critical raw materials including lithium, cobalt, and rare earth elements create potential bottlenecks for market expansion. Material price volatility affects manufacturing costs and profit margins, while geopolitical factors may impact supply security for imported materials. Competition for raw materials with other battery applications creates additional pressure on supply chains.

Regulatory uncertainty regarding long-term policy support and potential changes in government incentives creates planning challenges for market participants. Technology transition risks toward full electric vehicles may reduce long-term demand for hybrid solutions, affecting investment decisions and market confidence.

Export market expansion presents substantial growth opportunities for Chinese hybrid electric vehicle battery manufacturers. Global automotive markets are increasingly adopting hybrid technologies, creating demand for cost-competitive, high-quality battery solutions. International partnerships with foreign automotive OEMs provide access to new markets and technology collaboration opportunities.

Commercial vehicle applications offer significant untapped potential for hybrid battery systems. Fleet operators in logistics, public transportation, and commercial services are increasingly interested in fuel efficiency improvements and emission reductions. Government procurement policies favoring new energy vehicles in public sector applications create additional market opportunities.

Technology innovation in next-generation battery chemistries and system architectures provides competitive differentiation opportunities. Solid-state battery development, advanced thermal management systems, and integrated power electronics represent areas for technological leadership and premium market positioning.

Circular economy initiatives including battery recycling, second-life applications, and material recovery create new revenue streams and sustainability advantages. Service business models encompassing battery leasing, performance monitoring, and lifecycle management offer recurring revenue opportunities beyond traditional manufacturing.

Competitive dynamics in China’s hybrid electric vehicle battery market reflect intense competition between domestic and international players. Chinese manufacturers have gained significant competitive advantages through scale economies, cost optimization, and government support, while international companies leverage technological expertise and global market presence. Market consolidation trends favor larger players with comprehensive capabilities and financial resources.

Innovation cycles continue to accelerate, with manufacturers investing heavily in research and development to maintain competitive positioning. Technology roadmaps focus on energy density improvements, cost reduction, safety enhancement, and manufacturing efficiency. Collaboration between industry participants, research institutions, and government agencies drives innovation ecosystem development.

Supply chain evolution toward greater localization and vertical integration reflects strategic priorities for cost control and supply security. Manufacturing capacity expansion continues across major production centers, with new facilities incorporating advanced automation and quality control systems. Regional specialization emerges based on local advantages in materials, labor, or market access.

Market maturation brings increased focus on quality, reliability, and customer service as competitive differentiators. Brand development and customer relationship management become increasingly important as the market transitions from rapid growth to sustainable competition.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into China’s hybrid electric vehicle battery market. Primary research includes extensive interviews with industry executives, technical experts, government officials, and market participants across the value chain. Survey data collection encompasses manufacturers, suppliers, automotive OEMs, and end-users to capture diverse perspectives on market trends and dynamics.

Secondary research incorporates analysis of government publications, industry reports, financial statements, patent databases, and academic research to validate primary findings and provide comprehensive market context. Data triangulation methods ensure consistency and reliability across multiple information sources.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market development scenarios. Market sizing methodologies employ bottom-up and top-down approaches to validate market estimates and growth projections. Regional analysis incorporates local market characteristics, regulatory environments, and competitive dynamics.

Expert validation processes involve review and feedback from industry specialists, academic researchers, and market participants to ensure accuracy and relevance of research findings. Continuous monitoring of market developments, policy changes, and technological advancement ensures research currency and reliability.

Eastern China dominates the hybrid electric vehicle battery market, with major manufacturing centers in Shanghai, Jiangsu, and Zhejiang provinces. This region benefits from established automotive industry clusters, advanced manufacturing capabilities, and proximity to major consumer markets. Market concentration in eastern regions accounts for approximately 45% of national production capacity, supported by comprehensive supply chains and skilled workforce availability.

Southern China represents another significant market hub, particularly in Guangdong province, where automotive manufacturing and battery production capabilities converge. The region’s proximity to Hong Kong and international markets facilitates export activities, while strong manufacturing infrastructure supports cost-competitive production. Innovation centers in Shenzhen and Guangzhou drive technological advancement and startup ecosystem development.

Northern China including Beijing and surrounding regions focuses on research and development activities, policy formulation, and high-end manufacturing. Government research institutions and leading universities contribute to technology innovation, while state-owned enterprises maintain significant market presence. Policy influence from the capital region shapes national market development directions.

Central and Western China emerge as growth markets with expanding manufacturing capabilities and increasing local demand. Government policies promoting balanced regional development support investment in battery manufacturing facilities in these regions. Cost advantages in labor and land resources attract manufacturing investment, while improving infrastructure enhances market accessibility.

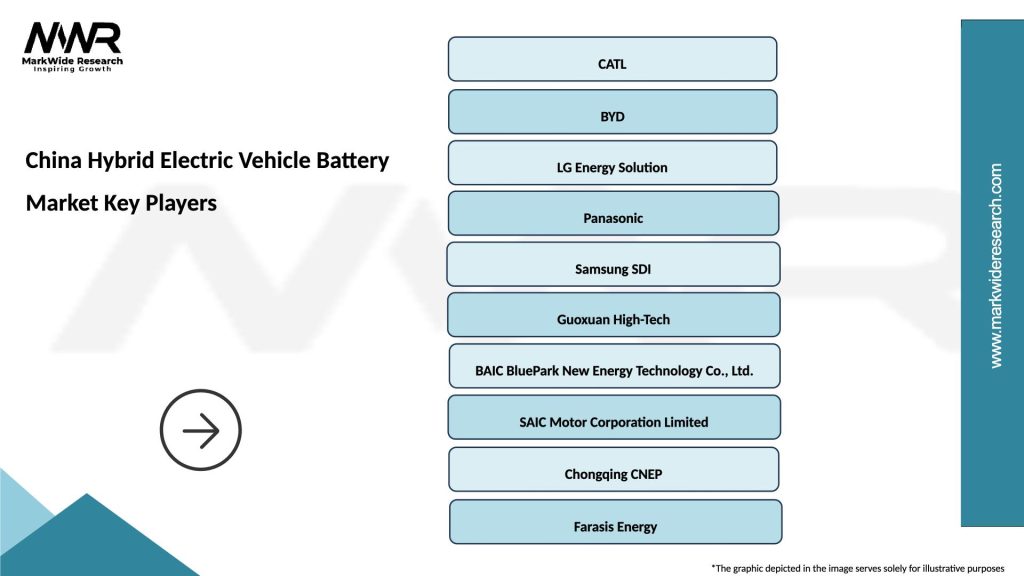

Market leadership in China’s hybrid electric vehicle battery sector features a mix of domestic champions and international players, each leveraging distinct competitive advantages:

Competitive strategies emphasize technological innovation, cost leadership, customer relationships, and global market expansion. Partnership approaches with automotive manufacturers create long-term supply agreements and collaborative development programs.

By Battery Type:

By Vehicle Type:

By Application:

Passenger vehicle segment represents the largest and most dynamic category within China’s hybrid electric vehicle battery market. Consumer preferences increasingly favor hybrid solutions that provide fuel efficiency benefits without range anxiety associated with full electric vehicles. Premium vehicle segments demonstrate higher adoption rates, while mass-market penetration accelerates through cost reduction and government incentives.

Commercial vehicle applications show strong growth potential driven by fleet operators’ focus on total cost of ownership optimization. Urban delivery vehicles particularly benefit from hybrid technology in stop-and-go traffic conditions where regenerative braking provides maximum efficiency gains. Public transportation adoption creates additional market opportunities through government procurement policies.

Technology categories reflect different performance and cost trade-offs. Lithium-ion solutions dominate new installations due to superior energy density and declining costs, while nickel-metal hydride maintains presence in cost-sensitive applications. Advanced battery management systems become increasingly important for optimizing performance and ensuring safety across all categories.

Regional category preferences vary based on local market conditions, with tier-one cities favoring advanced hybrid systems while lower-tier markets emphasize cost-effective solutions. Export categories focus on high-quality, reliable products meeting international automotive standards and certification requirements.

Manufacturers benefit from China’s hybrid electric vehicle battery market through access to the world’s largest automotive market, comprehensive supply chain ecosystems, and supportive government policies. Scale advantages enable cost optimization and competitive positioning in global markets, while domestic market success provides foundation for international expansion.

Automotive OEMs gain access to cost-competitive, high-quality battery solutions that enable hybrid vehicle development and market competitiveness. Partnership opportunities with Chinese battery manufacturers provide technology access, cost advantages, and supply security for global operations.

Consumers benefit from improved vehicle fuel efficiency, reduced emissions, and lower total cost of ownership through hybrid electric vehicle adoption. Government incentives and infrastructure development support consumer adoption while advancing environmental objectives.

Government stakeholders achieve environmental policy objectives, industrial development goals, and technological leadership through market development support. Economic benefits include job creation, export revenue generation, and reduced dependence on imported fossil fuels.

Investors find attractive opportunities in a rapidly growing market supported by favorable policies and strong demand fundamentals. Technology innovation and market expansion create multiple investment themes across the value chain.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology convergence represents a fundamental trend shaping China’s hybrid electric vehicle battery market. Integration advances combine battery systems with power electronics, thermal management, and vehicle control systems to optimize overall performance and reduce complexity. This convergence enables more efficient packaging, improved reliability, and enhanced user experience.

Sustainability focus drives increasing emphasis on battery lifecycle management, recycling capabilities, and environmental impact reduction. Circular economy principles influence product design, manufacturing processes, and end-of-life planning. Companies increasingly adopt sustainable practices to meet regulatory requirements and consumer expectations.

Digitalization trends incorporate advanced analytics, artificial intelligence, and connectivity features into battery systems. Smart battery management enables predictive maintenance, performance optimization, and integration with vehicle telematics systems. Data-driven insights support product development and customer service improvements.

Cost optimization continues through manufacturing innovation, material substitution, and design simplification. Manufacturing automation and process improvement drive cost reduction while maintaining quality standards. Scale economies and supply chain optimization contribute to competitive pricing.

Customization trends reflect diverse application requirements across vehicle segments and use cases. Application-specific solutions optimize battery characteristics for particular performance requirements, operating conditions, and cost targets. Modular design approaches enable flexible configuration options.

Manufacturing capacity expansion continues across major Chinese battery manufacturers, with new facilities incorporating advanced automation and quality control systems. Investment announcements indicate continued confidence in market growth prospects and competitive positioning requirements. Regional manufacturing distribution reflects strategic considerations for cost optimization and market access.

Technology partnerships between Chinese and international companies accelerate innovation and market development. Joint ventures and licensing agreements facilitate technology transfer while providing market access for international players. Collaborative research programs advance next-generation battery technologies and applications.

Regulatory developments including updated safety standards, performance requirements, and environmental regulations shape product development priorities. Certification processes for international markets drive quality improvements and standardization efforts. Government policy updates continue to influence market dynamics and investment decisions.

Supply chain initiatives focus on securing critical material supplies and reducing import dependency. Vertical integration strategies and strategic partnerships with mining companies enhance supply security. Recycling infrastructure development supports circular economy objectives and material recovery.

Market expansion activities include international facility development, export growth, and partnership establishment in key global markets. Brand development efforts support international market acceptance and premium positioning strategies.

MarkWide Research analysis suggests that market participants should prioritize technology innovation and quality improvement to maintain competitive positioning in an increasingly sophisticated market environment. Investment focus should emphasize next-generation battery chemistries, advanced manufacturing processes, and integrated system solutions that provide clear performance advantages.

Strategic recommendations include developing comprehensive international expansion strategies that leverage China’s cost advantages while addressing quality and brand perception challenges in global markets. Partnership approaches with established automotive OEMs provide market access and technology collaboration opportunities that support sustainable growth.

Supply chain diversification initiatives should reduce dependency on single-source suppliers and geographic concentration risks. Vertical integration in critical materials and components enhances cost control and supply security while supporting long-term competitive positioning.

Sustainability initiatives including recycling capabilities, environmental impact reduction, and circular economy practices become increasingly important for regulatory compliance and market acceptance. Investment in recycling infrastructure creates additional revenue streams while supporting environmental objectives.

Market intelligence capabilities should monitor technology trends, competitive developments, and regulatory changes to support strategic decision-making. Customer relationship management becomes increasingly important as market competition intensifies and differentiation requirements evolve.

Long-term market prospects for China’s hybrid electric vehicle battery market remain highly positive, supported by continued government commitment to new energy vehicles, ongoing technology advancement, and expanding global demand for hybrid solutions. Market evolution toward higher performance, lower cost solutions will continue driving adoption across diverse vehicle segments and applications.

Technology roadmaps indicate continued advancement in energy density, charging speed, safety, and lifecycle performance. Next-generation technologies including solid-state batteries and advanced thermal management systems will provide competitive differentiation opportunities for market leaders. Integration with vehicle systems and connectivity features will enhance value propositions.

Global market expansion represents significant growth opportunity for Chinese manufacturers, with international automotive markets increasingly adopting hybrid technologies. Export growth potential exceeds 20% annually as Chinese companies establish international manufacturing capabilities and brand recognition. Strategic partnerships with global automotive OEMs will facilitate market access and technology collaboration.

Regulatory environment will continue supporting market development through environmental standards, safety requirements, and performance incentives. Policy evolution toward carbon neutrality objectives creates long-term demand visibility for clean transportation technologies. International regulatory harmonization will facilitate global market participation.

MWR projections indicate sustained market growth driven by technology advancement, cost reduction, and expanding application opportunities. Market maturation will bring increased focus on quality, reliability, and customer service as competitive differentiators, while innovation continues driving performance improvements and new application development.

China’s hybrid electric vehicle battery market represents a dynamic and rapidly evolving sector with exceptional growth prospects driven by supportive government policies, technological innovation, and increasing environmental consciousness. The market has achieved significant scale advantages through concentrated manufacturing capabilities and integrated supply chains, positioning Chinese companies as global leaders in battery technology and production capacity.

Key success factors include continued investment in research and development, quality improvement initiatives, international market expansion, and sustainable business practices. Market participants must navigate challenges including raw material supply security, technology transition risks, and intensifying competition while capitalizing on opportunities in export markets, commercial applications, and next-generation technologies.

Strategic priorities for market participants should emphasize technology leadership, cost competitiveness, quality excellence, and customer relationship development. The market’s evolution toward higher performance, more sustainable solutions creates opportunities for companies that successfully balance innovation, cost optimization, and market responsiveness.

Future market development will be shaped by continued government support, technology advancement, global market expansion, and sustainability requirements. Companies that successfully execute comprehensive strategies addressing these factors will be well-positioned to capture the significant growth opportunities in China’s hybrid electric vehicle battery market while contributing to the global transition toward sustainable transportation solutions.

What is Hybrid Electric Vehicle Battery?

Hybrid Electric Vehicle Battery refers to the energy storage systems used in hybrid vehicles, which combine an internal combustion engine with an electric propulsion system. These batteries are crucial for improving fuel efficiency and reducing emissions in the automotive sector.

What are the key players in the China Hybrid Electric Vehicle Battery Market?

Key players in the China Hybrid Electric Vehicle Battery Market include CATL, BYD, and LG Chem, which are known for their advancements in battery technology and production capacity. These companies are actively involved in developing innovative battery solutions for hybrid electric vehicles, among others.

What are the growth factors driving the China Hybrid Electric Vehicle Battery Market?

The growth of the China Hybrid Electric Vehicle Battery Market is driven by increasing government support for electric vehicles, rising consumer demand for fuel-efficient vehicles, and advancements in battery technology. Additionally, environmental concerns are pushing manufacturers to adopt hybrid solutions.

What challenges does the China Hybrid Electric Vehicle Battery Market face?

The China Hybrid Electric Vehicle Battery Market faces challenges such as high production costs, limited charging infrastructure, and competition from fully electric vehicles. These factors can hinder the widespread adoption of hybrid technologies in the automotive industry.

What opportunities exist in the China Hybrid Electric Vehicle Battery Market?

Opportunities in the China Hybrid Electric Vehicle Battery Market include the potential for technological innovations in battery efficiency and recycling, as well as expanding partnerships between automakers and battery manufacturers. The growing trend towards sustainable transportation also presents new avenues for growth.

What trends are shaping the China Hybrid Electric Vehicle Battery Market?

Trends shaping the China Hybrid Electric Vehicle Battery Market include the shift towards higher energy density batteries, the integration of smart technologies in battery management systems, and the increasing focus on sustainability in battery production. These trends are influencing the future direction of the market.

China Hybrid Electric Vehicle Battery Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-Metal Hydride, Lead-Acid, Solid-State |

| End User | OEMs, Fleet Operators, Aftermarket Providers, Dealerships |

| Technology | Fast Charging, Regenerative Braking, Battery Management Systems, Thermal Management |

| Application | Passenger Vehicles, Commercial Vehicles, Public Transport, Industrial Equipment |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Hybrid Electric Vehicle Battery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at