444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s home mortgage finance market has experienced significant growth in recent years, driven by the country’s booming real estate sector and increasing urbanization. As one of the largest mortgage markets globally, China offers a vast array of opportunities for lenders, borrowers, and other stakeholders in the industry. This market overview will delve into the meaning of home mortgage finance, provide key insights into the market, examine the driving forces and restraints, highlight opportunities and dynamics, analyze the regional landscape, discuss the competitive landscape, and offer a future outlook for this thriving industry.

Meaning

Home mortgage finance refers to the provision of loans or financing options to individuals or families who intend to purchase residential properties. It allows borrowers to secure funds for buying a home while providing lenders with a reliable and profitable investment opportunity. Home mortgages typically involve the borrower pledging the purchased property as collateral, ensuring repayment of the loan over a specified period through regular installments.

Executive Summary

The China home mortgage finance market has witnessed remarkable growth over the years, supported by factors such as increasing disposable incomes, favorable government policies, and a strong demand for housing. This executive summary provides a concise overview of the market’s key aspects, including insights into market drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, and key industry trends. Furthermore, it examines the impact of the COVID-19 pandemic on the market and highlights the key industry developments. Lastly, it offers valuable suggestions from industry analysts and presents a future outlook for the market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The China home mortgage finance market is characterized by robust growth dynamics driven by urbanization, government policies, and evolving consumer preferences. The interplay between market drivers, restraints, and opportunities shapes the industry’s trajectory and creates an environment that continually adapts to changing circumstances. The market dynamics are influenced by factors such as economic conditions, regulatory measures, technological advancements, and shifts in consumer behavior. Monitoring and responding to these dynamics is crucial for industry participants to stay competitive and capitalize on emerging opportunities.

Regional Analysis

The China home mortgage finance market exhibits regional variations, reflecting the diverse economic landscape and housing market dynamics across the country. Key regions, such as Beijing, Shanghai, Guangzhou, and Shenzhen, have witnessed significant growth in the real estate sector and are home to a substantial portion of mortgage activity. These metropolitan areas attract a large influx of migrants seeking employment opportunities and a higher standard of living. Additionally, lower-tier cities and rural areas present untapped potential for market expansion, as they experience rapid urbanization and rising demand for housing. Understanding the regional nuances and tailoring strategies accordingly can help market players optimize their operations and capitalize on specific market conditions.

Competitive Landscape

Leading companies in the China Home Mortgage Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

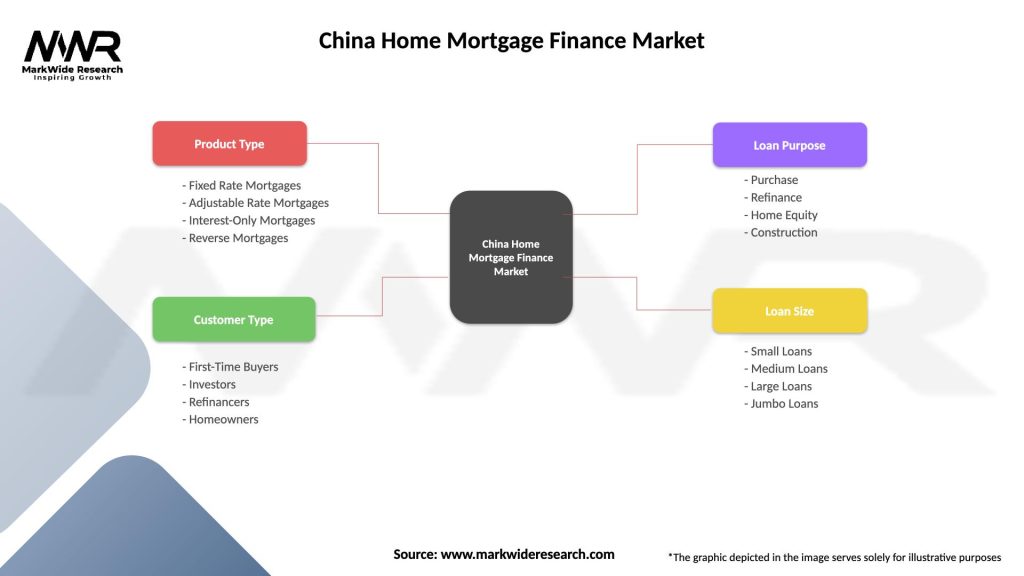

The home mortgage finance market in China can be segmented based on various factors, including borrower profiles, property types, and loan characteristics. Segmentation allows lenders to tailor their offerings to specific customer segments, meet unique financing needs, and manage risk effectively. Common segmentation categories in the market include:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

Industry participants and stakeholders involved in the China home mortgage finance market can derive several key benefits, including:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of the China home mortgage finance market provides valuable insights into its internal and external factors:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the China home mortgage finance market. Initially, the market experienced a temporary slowdown due to lockdown measures, travel restrictions, and economic uncertainties. However, the Chinese government swiftly implemented supportive measures, such as interest rate cuts, relaxed lending regulations, and stimulus packages, to stabilize the market and stimulate demand. As the situation improved and the economy recovered, the real estate sector witnessed a strong rebound, leading to increased mortgage activity. The pandemic also accelerated digital transformation within the industry, with online mortgage platforms and contactless transactions becoming more prevalent.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the China home mortgage finance market appears promising, with sustained growth expected due to ongoing urbanization, rising disposable incomes, and government support. The integration of technology and digitalization will continue to shape the industry, improving operational efficiency and enhancing customer experience. Market players who can adapt to evolving customer needs, offer innovative products, and leverage data analytics and artificial intelligence will be well-positioned for success. Furthermore, the growing emphasis on sustainability and green financing presents opportunities for lenders to align with environmental goals and capture the emerging market demand for energy-efficient homes.

Conclusion

The China home mortgage finance market has undergone significant growth and transformation, driven by urbanization, government policies, and changing consumer preferences. The market offers a wide range of opportunities for lenders, borrowers, and other stakeholders, supported by favorable economic conditions and increasing demand for housing. While certain challenges exist, such as regulatory restrictions and market volatility, proactive measures, such as digitalization, innovation, and risk management, can mitigate risks and drive future growth. With a focus on sustainability and technological advancements, the market is poised for continued expansion, enabling more individuals and families to achieve their dreams of homeownership while providing attractive investment opportunities for industry participants.

What is Home Mortgage Finance?

Home Mortgage Finance refers to the financial services and products that facilitate the borrowing of funds to purchase residential properties. This includes various types of loans, interest rates, and repayment options available to homebuyers.

What are the key players in the China Home Mortgage Finance Market?

Key players in the China Home Mortgage Finance Market include major banks such as Industrial and Commercial Bank of China, China Construction Bank, and Agricultural Bank of China, among others. These institutions provide a range of mortgage products to consumers.

What are the growth factors driving the China Home Mortgage Finance Market?

The growth of the China Home Mortgage Finance Market is driven by factors such as increasing urbanization, rising disposable incomes, and government policies aimed at promoting home ownership. Additionally, low interest rates have made borrowing more attractive.

What challenges does the China Home Mortgage Finance Market face?

The China Home Mortgage Finance Market faces challenges such as regulatory changes, potential housing market corrections, and rising default rates. These factors can impact lenders’ willingness to extend credit and affect overall market stability.

What opportunities exist in the China Home Mortgage Finance Market?

Opportunities in the China Home Mortgage Finance Market include the growing demand for affordable housing and the potential for digital mortgage solutions. Additionally, the expansion of financial technology can enhance customer experience and streamline processes.

What trends are shaping the China Home Mortgage Finance Market?

Trends in the China Home Mortgage Finance Market include the increasing adoption of online mortgage applications, the rise of alternative lending platforms, and a focus on sustainable financing options. These trends are reshaping how consumers access mortgage products.

China Home Mortgage Finance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate Mortgages, Adjustable Rate Mortgages, Interest-Only Mortgages, Reverse Mortgages |

| Customer Type | First-Time Buyers, Investors, Refinancers, Homeowners |

| Loan Purpose | Purchase, Refinance, Home Equity, Construction |

| Loan Size | Small Loans, Medium Loans, Large Loans, Jumbo Loans |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Home Mortgage Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at