444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China home loan market represents one of the world’s most dynamic and rapidly evolving residential mortgage sectors, driven by unprecedented urbanization, rising disposable incomes, and evolving government policies. China’s mortgage lending landscape has experienced remarkable transformation over the past decade, with digital innovation and regulatory reforms reshaping how consumers access home financing solutions.

Market dynamics indicate robust growth potential despite periodic regulatory adjustments, with the sector maintaining a compound annual growth rate of approximately 8.2% in recent years. The market encompasses diverse lending products ranging from traditional fixed-rate mortgages to innovative digital lending platforms that cater to China’s tech-savvy consumer base.

Regional variations across China’s vast geography create distinct market segments, with tier-one cities like Beijing, Shanghai, and Shenzhen commanding premium lending rates while emerging tier-two and tier-three cities offer substantial growth opportunities. The market’s evolution reflects China’s broader economic transition, with approximately 65% of urban households now having access to formal mortgage lending services.

Technological integration has become a defining characteristic of China’s home loan market, with fintech companies and traditional banks collaborating to deliver seamless digital mortgage experiences. This digital transformation has reduced processing times and improved accessibility for first-time homebuyers across diverse demographic segments.

The China home loan market refers to the comprehensive ecosystem of residential mortgage lending services, financial products, and regulatory frameworks that facilitate homeownership across the People’s Republic of China. This market encompasses traditional banking institutions, emerging fintech platforms, government-backed lending programs, and specialized mortgage brokers that collectively serve millions of Chinese homebuyers annually.

Home loan products in China include various mortgage types such as commercial housing loans, provident fund loans, combination loans, and specialized financing for affordable housing projects. The market operates within a complex regulatory environment that balances homeownership accessibility with financial stability concerns, creating unique lending criteria and approval processes.

Market participants range from state-owned commercial banks and joint-stock banks to rural credit cooperatives and innovative digital lending platforms. Each segment serves distinct customer demographics while adhering to central bank regulations and local government housing policies that influence lending practices and interest rate structures.

China’s home loan market stands as a cornerstone of the nation’s financial services sector, facilitating homeownership dreams for hundreds of millions of Chinese citizens while supporting the broader real estate economy. The market has demonstrated remarkable resilience and adaptability, navigating regulatory changes and economic cycles while maintaining steady growth trajectories.

Key market drivers include sustained urbanization trends, with approximately 64% of China’s population now residing in urban areas, creating continuous demand for residential financing solutions. Government initiatives promoting affordable housing and homeownership accessibility have expanded market reach to previously underserved demographic segments.

Digital transformation initiatives have revolutionized the mortgage application and approval process, with leading financial institutions reporting processing time reductions of up to 70% through automated underwriting systems and artificial intelligence integration. These technological advances have improved customer experience while reducing operational costs for lending institutions.

Market challenges include evolving regulatory landscapes, regional economic disparities, and the need to balance growth with financial stability. However, the sector’s fundamental strength lies in China’s continued economic development and the cultural importance of homeownership in Chinese society.

Strategic market insights reveal several critical trends shaping China’s home loan landscape. The sector demonstrates strong correlation with broader economic indicators while maintaining unique characteristics driven by government policy and cultural factors.

Urbanization momentum continues to serve as the primary driver of China’s home loan market expansion. As millions of rural residents migrate to urban centers annually, the demand for residential financing solutions grows correspondingly. This demographic shift creates sustained market demand while driving innovation in lending products and services.

Rising disposable incomes across China’s expanding middle class have improved mortgage affordability and accessibility. Higher income levels enable more families to qualify for home loans while supporting larger loan amounts that facilitate purchases in premium residential segments. This income growth trend particularly benefits tier-two and tier-three cities where housing costs remain relatively affordable.

Government policy support through various homeownership initiatives continues to stimulate market growth. Programs targeting first-time buyers, affordable housing projects, and rural homeownership expansion create new market segments while providing regulatory clarity for lending institutions. These policies balance market development with financial stability objectives.

Technological advancement in financial services has dramatically improved mortgage accessibility and processing efficiency. Digital platforms enable faster loan approvals, enhanced customer experiences, and expanded reach to previously underserved populations. According to MarkWide Research analysis, technology-driven improvements have reduced average loan processing times while improving approval rates for qualified borrowers.

Cultural homeownership preferences deeply embedded in Chinese society continue to drive mortgage demand across all demographic segments. The cultural significance of property ownership creates consistent market demand that transcends economic cycles, providing stability for lending institutions and supporting long-term market growth.

Regulatory complexity presents ongoing challenges for market participants, with frequent policy adjustments requiring continuous adaptation of lending practices and product offerings. These regulatory changes, while necessary for market stability, can create uncertainty and compliance costs that impact operational efficiency.

Regional economic disparities across China create uneven market conditions that complicate lending strategies and risk assessment. Economic variations between developed coastal regions and emerging inland areas require tailored approaches to mortgage lending that increase operational complexity for national lenders.

Credit risk concerns related to borrower assessment and loan performance monitoring require sophisticated risk management systems and processes. The challenge of accurately evaluating creditworthiness across diverse demographic segments and geographic regions demands continuous investment in risk assessment capabilities.

Competition intensity among lending institutions has compressed interest margins while increasing customer acquisition costs. The proliferation of lending options, including fintech platforms and alternative lenders, creates pricing pressure that impacts profitability for traditional mortgage providers.

Economic cycle sensitivity exposes the home loan market to broader economic fluctuations that can impact demand, credit quality, and regulatory policies. Market participants must navigate these cyclical challenges while maintaining sustainable growth and risk management practices.

Digital transformation acceleration presents significant opportunities for market expansion and efficiency improvement. Advanced technologies including artificial intelligence, blockchain, and mobile platforms can further streamline mortgage processes while expanding access to underserved populations. These technological opportunities enable new business models and service delivery approaches.

Tier-two and tier-three city expansion offers substantial growth potential as these markets mature and develop. Rising incomes and improving infrastructure in smaller cities create new customer segments while offering more attractive risk-return profiles compared to saturated tier-one markets.

Product innovation opportunities exist in developing specialized mortgage solutions for emerging customer needs. Green mortgages, flexible payment structures, and integrated housing finance packages represent areas for product development and market differentiation.

Partnership development between traditional lenders and fintech companies can accelerate innovation while leveraging complementary strengths. These collaborations enable faster market entry, enhanced customer experiences, and improved operational efficiency through shared expertise and resources.

Rural market penetration represents a significant untapped opportunity as government policies support rural development and homeownership. Expanding lending services to rural areas requires innovative approaches but offers substantial long-term growth potential.

Supply and demand dynamics in China’s home loan market reflect the complex interplay between government policy, economic conditions, and demographic trends. The market demonstrates strong underlying demand driven by urbanization and income growth, while supply responds to regulatory guidance and competitive pressures.

Interest rate environment significantly influences market dynamics, with central bank policies affecting lending costs and borrower demand. The relationship between policy rates and mortgage rates creates cyclical patterns that impact loan origination volumes and lender profitability. Recent trends show interest rate stability supporting consistent market growth.

Competitive dynamics continue evolving as traditional banks face increasing competition from fintech platforms and alternative lenders. This competition drives innovation in product offerings, customer service, and operational efficiency while creating pricing pressure across market segments.

Regulatory dynamics play a crucial role in shaping market behavior, with government policies balancing homeownership accessibility against financial stability concerns. These regulatory influences create both opportunities and constraints that market participants must navigate strategically.

Technology dynamics are transforming traditional lending processes and customer interactions. Digital platforms enable new service delivery models while data analytics improve risk assessment and customer targeting capabilities. These technological changes create competitive advantages for early adopters while raising customer expectations across the market.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into China’s home loan market dynamics. The research approach combines quantitative data analysis with qualitative market intelligence to provide holistic market understanding.

Primary research activities include extensive interviews with industry executives, regulatory officials, and market participants across different geographic regions and market segments. These interviews provide firsthand insights into market trends, challenges, and opportunities that complement secondary data sources.

Secondary research analysis incorporates data from government statistics, industry reports, financial institution disclosures, and regulatory publications. This comprehensive data collection ensures broad market coverage while maintaining analytical rigor and accuracy.

Market modeling techniques utilize advanced statistical methods to analyze market trends, forecast growth patterns, and identify key market drivers. These analytical approaches provide quantitative foundations for market insights and strategic recommendations.

Validation processes ensure research accuracy through cross-referencing multiple data sources, expert review, and market participant feedback. This validation approach maintains research quality while ensuring practical relevance for market stakeholders.

Eastern China regions, including Shanghai, Jiangsu, and Zhejiang provinces, dominate the home loan market with approximately 35% of national lending volume. These economically developed areas feature mature mortgage markets with sophisticated lending products and high customer penetration rates. The region’s strong economic fundamentals support premium lending rates while attracting national and international financial institutions.

Northern China markets, centered around Beijing and Tianjin, represent significant market segments with unique characteristics driven by government presence and industrial development. These markets demonstrate stable growth patterns with lending volumes growing at approximately 6.5% annually, supported by steady employment and income growth in key economic sectors.

Southern China regions, particularly Guangdong and Fujian provinces, show dynamic market conditions influenced by international trade and manufacturing activities. The region’s economic diversity creates varied lending opportunities while supporting innovation in mortgage products and services tailored to local market needs.

Western China development initiatives are creating new market opportunities as government policies support economic development and urbanization in previously underserved regions. These emerging markets offer substantial growth potential while requiring specialized approaches to risk assessment and product development.

Central China regions demonstrate balanced market characteristics with steady growth supported by agricultural modernization and industrial development. These markets provide stable lending opportunities while serving as testing grounds for new products and services before broader market rollout.

Market leadership in China’s home loan sector is dominated by major state-owned commercial banks that leverage extensive branch networks and government relationships to maintain competitive advantages. These institutions combine traditional lending expertise with increasing digital capabilities to serve diverse customer segments.

Competitive strategies focus on digital transformation, customer experience enhancement, and product innovation to differentiate offerings in an increasingly crowded marketplace. Market leaders invest heavily in technology infrastructure while maintaining strong risk management capabilities.

Market consolidation trends show increasing collaboration between traditional banks and fintech companies, creating hybrid business models that combine regulatory expertise with technological innovation. These partnerships enable faster market adaptation while maintaining compliance with evolving regulatory requirements.

By Loan Type: The market segments into commercial housing loans, provident fund loans, and combination loan products. Commercial housing loans represent the largest segment, serving middle and upper-income borrowers with competitive interest rates and flexible terms. Provident fund loans provide government-subsidized financing for eligible employees, while combination loans offer hybrid solutions that maximize borrowing capacity.

By Customer Segment: First-time homebuyers constitute the primary market segment, driving demand for entry-level mortgage products and specialized support services. Repeat buyers and property investors represent secondary segments with distinct financing needs and risk profiles. Each segment requires tailored marketing approaches and product features.

By Geographic Region: Tier-one cities command premium pricing but show market maturation, while tier-two and tier-three cities demonstrate higher growth rates and expansion opportunities. Rural markets represent emerging segments with government policy support and specialized product requirements.

By Property Type: New residential properties dominate lending volumes, while secondary market transactions and commercial-to-residential conversions create additional market segments. Each property type requires specific underwriting criteria and risk assessment approaches.

By Distribution Channel: Traditional branch networks maintain significant market share while digital platforms show rapid growth. Mortgage brokers and real estate partnerships provide alternative distribution channels that expand market reach and customer convenience.

Commercial Housing Loans represent the core market segment, serving mainstream homebuyers with standardized products and competitive pricing. This category benefits from regulatory clarity and established underwriting processes while facing increasing competition from alternative lenders. Market penetration rates exceed 75% in major urban markets, indicating mature market conditions.

Provident Fund Loans provide government-subsidized financing that supports homeownership accessibility for middle-income employees. This category offers lower interest rates but requires employer participation and contribution compliance. The segment shows steady growth aligned with employment expansion and wage increases across various industries.

Combination Loan Products enable borrowers to maximize financing capacity by combining commercial and provident fund lending. These products require sophisticated coordination between different lending institutions while providing enhanced affordability for qualified borrowers. The category demonstrates growing popularity among first-time buyers in high-cost markets.

Green Mortgage Products represent an emerging category that incorporates environmental considerations into lending decisions. These products offer preferential terms for energy-efficient properties while supporting government sustainability objectives. Early market adoption shows promising growth potential as environmental awareness increases.

Digital-First Lending categories leverage technology platforms to deliver streamlined mortgage experiences with faster processing and enhanced customer convenience. These products appeal particularly to younger demographics while requiring robust digital infrastructure and risk management capabilities.

Financial Institutions benefit from diversified revenue streams, stable long-term assets, and opportunities for cross-selling additional financial products. Mortgage lending provides predictable income flows while supporting broader customer relationship development and market expansion strategies.

Homebuyers gain access to affordable financing solutions that enable property ownership and wealth building opportunities. Competitive market conditions ensure favorable terms while product innovation provides flexible options that accommodate diverse financial circumstances and preferences.

Real Estate Developers benefit from enhanced market liquidity and expanded customer bases through accessible financing options. Mortgage availability supports property sales while enabling developers to target broader demographic segments and geographic markets.

Government Stakeholders achieve policy objectives related to homeownership promotion, economic development, and financial stability through a well-functioning mortgage market. The sector supports broader economic goals while providing regulatory oversight opportunities.

Technology Providers find significant opportunities in supporting digital transformation initiatives across the mortgage lending ecosystem. Fintech companies and technology vendors benefit from increasing demand for innovative solutions that improve efficiency and customer experience.

Economic Development benefits from mortgage market growth through increased construction activity, employment generation, and consumer spending related to homeownership. The sector’s multiplier effects support broader economic development objectives across various regions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital-First Customer Experience has become the dominant trend reshaping how consumers interact with mortgage lenders. Mobile applications, online portals, and automated processing systems are replacing traditional paper-based processes, with digital application rates increasing by over 40% annually. This trend reflects broader consumer preferences for convenient, transparent, and efficient financial services.

Artificial Intelligence Integration in underwriting and risk assessment processes is improving loan approval accuracy while reducing processing times. AI-powered systems analyze vast amounts of data to make more informed lending decisions, resulting in better risk management and enhanced customer experiences throughout the mortgage journey.

Sustainable Finance Adoption shows growing momentum as environmental considerations influence lending decisions and product development. Green mortgages and energy-efficient property financing represent emerging trends that align with government sustainability objectives while appealing to environmentally conscious consumers.

Partnership Ecosystem Development between traditional banks, fintech companies, and real estate platforms creates integrated service offerings that streamline the homebuying process. These collaborations leverage complementary strengths while providing customers with comprehensive solutions that extend beyond basic mortgage lending.

Personalization and Customization trends focus on tailoring mortgage products and services to individual customer needs and preferences. Data analytics enable lenders to offer customized terms, payment structures, and additional services that enhance customer satisfaction and loyalty.

Regulatory Framework Evolution continues shaping market dynamics through policy adjustments that balance homeownership accessibility with financial stability objectives. Recent developments include refined lending criteria, enhanced consumer protection measures, and improved coordination between different regulatory agencies overseeing the mortgage market.

Technology Platform Launches by major financial institutions demonstrate commitment to digital transformation and customer experience enhancement. These platforms integrate mortgage lending with broader financial services while providing seamless user experiences that meet evolving customer expectations.

Strategic Partnership Announcements between traditional banks and fintech companies highlight industry collaboration trends. These partnerships combine regulatory expertise with technological innovation to create competitive advantages while expanding market reach and service capabilities.

Product Innovation Initiatives focus on developing specialized mortgage solutions for emerging market segments and customer needs. Recent innovations include flexible payment mortgages, green financing products, and integrated housing finance packages that address comprehensive homeownership requirements.

Market Expansion Programs by leading lenders target previously underserved geographic regions and demographic segments. These initiatives support government policy objectives while creating new growth opportunities for financial institutions seeking market diversification.

Digital Capability Investment should remain a top priority for market participants seeking competitive advantages and operational efficiency improvements. MWR analysis indicates that institutions with advanced digital platforms achieve significantly higher customer satisfaction scores while reducing operational costs through automated processes.

Risk Management Enhancement requires continuous attention as market conditions evolve and customer segments diversify. Lenders should invest in sophisticated credit scoring models, alternative data sources, and predictive analytics to improve loan performance while maintaining appropriate risk-return profiles.

Partnership Strategy Development can accelerate market expansion and capability building through strategic collaborations with fintech companies, real estate platforms, and technology providers. These partnerships enable faster innovation cycles while leveraging complementary expertise and market access.

Customer Experience Focus should drive product development and service delivery improvements that differentiate offerings in competitive markets. Streamlined processes, transparent communication, and personalized services create customer loyalty while supporting premium pricing strategies.

Market Diversification Strategies can reduce concentration risk while capturing growth opportunities in emerging segments and geographic regions. Balanced portfolio approaches that include tier-two cities, rural markets, and specialized customer segments provide sustainable growth foundations.

Long-term growth prospects for China’s home loan market remain positive, supported by continued urbanization, rising incomes, and government policies promoting homeownership accessibility. The market is projected to maintain steady expansion with annual growth rates of approximately 7-9% over the next five years, driven by demographic trends and economic development.

Technology transformation will accelerate, with artificial intelligence, blockchain, and mobile platforms becoming standard features of mortgage lending operations. These technological advances will improve efficiency, reduce costs, and enhance customer experiences while enabling new business models and service delivery approaches.

Market maturation in tier-one cities will drive expansion into tier-two and tier-three markets, where growth opportunities remain substantial. This geographic expansion will require tailored approaches to risk assessment, product development, and customer service that reflect local market conditions and customer preferences.

Regulatory evolution will continue balancing market development objectives with financial stability concerns, creating both opportunities and challenges for market participants. Successful institutions will adapt quickly to regulatory changes while maintaining competitive positioning and customer service quality.

Competitive dynamics will intensify as fintech companies expand their market presence and traditional banks enhance their digital capabilities. This competition will benefit consumers through improved products and services while requiring market participants to continuously innovate and differentiate their offerings.

China’s home loan market stands at a pivotal juncture, characterized by robust fundamentals, technological transformation, and evolving competitive dynamics. The market’s substantial scale, supported by continued urbanization and rising disposable incomes, provides a solid foundation for sustained growth and development across diverse geographic regions and customer segments.

Digital innovation has emerged as a key differentiator, with successful market participants leveraging technology to improve customer experiences, operational efficiency, and risk management capabilities. The integration of artificial intelligence, mobile platforms, and data analytics is reshaping traditional lending processes while creating new opportunities for market expansion and service enhancement.

Strategic positioning for future success requires balanced approaches that combine digital capabilities with strong risk management, customer focus, and regulatory compliance. Market participants who successfully navigate these requirements while maintaining competitive pricing and service quality will capture the most significant growth opportunities in this dynamic market environment.

The China home loan market represents a compelling opportunity for financial institutions, technology providers, and other stakeholders who understand its unique characteristics and evolving dynamics. With appropriate strategies and execution capabilities, market participants can achieve sustainable growth while contributing to China’s broader economic development and homeownership objectives.

What is China Home Loan?

China Home Loan refers to the financial products offered by banks and financial institutions to individuals for purchasing residential properties in China. These loans typically involve a mortgage agreement where the property serves as collateral.

What are the key players in the China Home Loan Market?

Key players in the China Home Loan Market include major banks such as Industrial and Commercial Bank of China, China Construction Bank, and Agricultural Bank of China, among others. These institutions provide various home loan products tailored to different consumer needs.

What are the main drivers of the China Home Loan Market?

The main drivers of the China Home Loan Market include urbanization, rising disposable incomes, and government policies aimed at promoting home ownership. These factors contribute to increased demand for residential properties and, consequently, home loans.

What challenges does the China Home Loan Market face?

The China Home Loan Market faces challenges such as regulatory changes, fluctuating interest rates, and potential economic slowdowns. These factors can impact borrowers’ ability to repay loans and the overall stability of the housing market.

What opportunities exist in the China Home Loan Market?

Opportunities in the China Home Loan Market include the growing demand for affordable housing and the increasing adoption of digital mortgage solutions. Additionally, the expansion of financial technology can enhance customer experience and streamline loan processing.

What trends are shaping the China Home Loan Market?

Trends shaping the China Home Loan Market include the rise of online mortgage platforms, increased focus on sustainable housing, and the integration of big data in credit assessments. These trends are transforming how consumers access and manage home loans.

China Home Loan Market

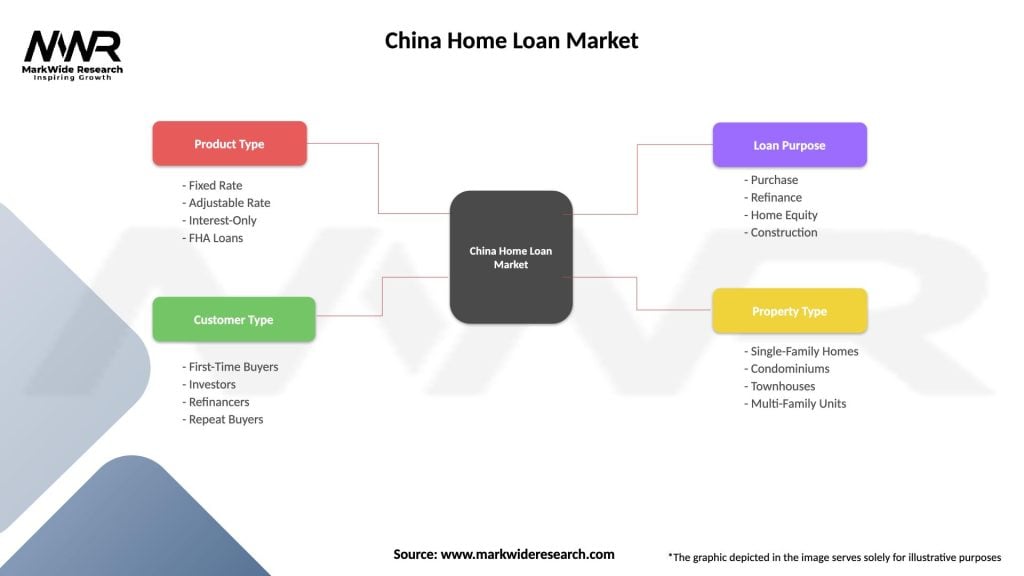

| Segmentation Details | Description |

|---|---|

| Product Type | Fixed Rate, Adjustable Rate, Interest-Only, FHA Loans |

| Customer Type | First-Time Buyers, Investors, Refinancers, Repeat Buyers |

| Loan Purpose | Purchase, Refinance, Home Equity, Construction |

| Property Type | Single-Family Homes, Condominiums, Townhouses, Multi-Family Units |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Home Loan Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at