444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China hair care products market represents one of the most dynamic and rapidly evolving segments within the global beauty and personal care industry. Market dynamics indicate unprecedented growth driven by rising consumer awareness, increasing disposable income, and evolving beauty standards across diverse demographic segments. The market encompasses a comprehensive range of products including shampoos, conditioners, hair treatments, styling products, and specialized solutions targeting specific hair concerns prevalent among Chinese consumers.

Consumer preferences have shifted dramatically toward premium and natural formulations, with organic and herbal ingredients gaining significant traction. The market demonstrates robust expansion with a projected CAGR of 8.2% through the forecast period, reflecting strong underlying demand fundamentals. Digital transformation has revolutionized distribution channels, with e-commerce platforms capturing approximately 45% market share in hair care product sales, fundamentally altering traditional retail landscapes.

Regional variations across China’s vast geography create distinct market opportunities, with tier-one cities leading premium product adoption while tier-two and tier-three cities show accelerating growth in mid-range segments. The integration of traditional Chinese medicine principles with modern hair care formulations has created unique product categories that resonate strongly with local consumers, establishing China as a distinctive market requiring specialized approaches from global and domestic brands alike.

The China hair care products market refers to the comprehensive ecosystem of hair cleansing, conditioning, treatment, and styling products specifically formulated and distributed within the Chinese market to address the unique hair care needs and preferences of Chinese consumers across diverse demographic and geographic segments.

Market definition encompasses both domestic and international brands operating within China’s regulatory framework, including products sold through traditional retail channels, e-commerce platforms, and specialized beauty outlets. The market includes mass-market, premium, and luxury segments, each targeting different consumer price points and quality expectations. Product categories span basic hair care essentials to advanced treatment solutions incorporating cutting-edge technology and traditional Chinese medicinal ingredients.

Regulatory compliance plays a crucial role in market definition, with products required to meet stringent Chinese cosmetic regulations and safety standards. The market also includes professional salon products and consumer retail segments, creating a multi-tiered distribution ecosystem that serves various consumer touchpoints and purchase preferences throughout China’s diverse urban and rural markets.

Strategic analysis reveals the China hair care products market as a high-growth sector characterized by intense competition, rapid innovation, and evolving consumer preferences toward premium and natural formulations. Market leaders include both international giants and emerging domestic brands that have successfully adapted to local consumer needs and preferences. The competitive landscape demonstrates increasing fragmentation as niche brands capture market share through specialized product offerings and targeted marketing strategies.

Key growth drivers include rising urbanization rates, increasing female workforce participation, and growing awareness of hair health and aesthetics among younger demographics. Digital commerce has emerged as the dominant distribution channel, with live-streaming sales and social media marketing driving approximately 60% of new customer acquisition. The market shows strong resilience and adaptability, with brands successfully navigating regulatory changes and consumer preference shifts.

Innovation trends focus on personalized hair care solutions, sustainable packaging, and integration of traditional Chinese ingredients with modern formulation technology. The market demonstrates significant potential for continued expansion, supported by favorable demographic trends, increasing consumer sophistication, and ongoing premiumization across all product categories and consumer segments.

Consumer behavior analysis reveals distinct purchasing patterns that differentiate the Chinese market from global trends. Key insights demonstrate the importance of understanding local preferences and cultural factors that influence product selection and brand loyalty:

Economic prosperity across China has fundamentally transformed consumer spending patterns, with hair care products benefiting from increased discretionary income allocation toward personal care and beauty enhancement. Rising disposable income enables consumers to explore premium product categories and invest in comprehensive hair care routines that extend beyond basic cleansing to include specialized treatments and styling solutions.

Urbanization trends continue driving market expansion as rural populations migrate to cities, adopting urban lifestyle patterns and beauty standards that emphasize personal grooming and appearance. Cultural shifts toward Western beauty ideals, combined with growing appreciation for traditional Chinese wellness principles, create unique market opportunities for brands that successfully blend modern efficacy with traditional ingredients and philosophies.

Digital transformation has revolutionized product discovery, education, and purchasing processes, with social media influencers and beauty bloggers significantly impacting consumer preferences and brand awareness. E-commerce platforms provide unprecedented access to diverse product ranges, enabling consumers to explore international brands and niche products previously unavailable through traditional retail channels. The integration of artificial intelligence and personalization technology further enhances the shopping experience and drives consumer engagement with hair care brands.

Regulatory complexities present significant challenges for both domestic and international brands seeking to enter or expand within the Chinese market. Compliance requirements for cosmetic products involve extensive testing, documentation, and approval processes that can delay product launches and increase market entry costs. Frequent regulatory updates and evolving safety standards require continuous monitoring and adaptation, particularly affecting smaller brands with limited regulatory expertise and resources.

Intense competition from both established international brands and emerging domestic competitors creates pricing pressures and marketing cost inflation. Market saturation in certain product categories, particularly basic shampoos and conditioners, limits growth opportunities and forces brands to differentiate through innovation, premium positioning, or niche targeting strategies that may not achieve desired scale economies.

Consumer skepticism regarding product claims and ingredient safety, particularly following high-profile quality issues in the broader personal care industry, requires brands to invest heavily in transparency, education, and trust-building initiatives. Economic uncertainties and changing consumer priorities during economic downturns can impact discretionary spending on premium hair care products, forcing brands to maintain competitive pricing while preserving product quality and brand positioning.

Untapped segments within China’s diverse demographic landscape present substantial growth opportunities for brands willing to invest in market research and product development. Rural market penetration remains relatively low compared to urban areas, offering significant expansion potential as infrastructure development and e-commerce accessibility improve in smaller cities and rural regions. The growing male grooming segment represents an emerging opportunity with 25% annual growth in men’s hair care product adoption.

Technology integration offers innovative approaches to product development and customer engagement, including AI-powered hair analysis applications, personalized formulation services, and virtual try-on experiences that enhance the shopping journey. Sustainable product development aligns with growing environmental consciousness among Chinese consumers, creating opportunities for brands that prioritize eco-friendly ingredients, packaging, and manufacturing processes.

Cross-border e-commerce platforms enable international brands to test market reception and build brand awareness before establishing local operations, reducing entry barriers and investment risks. Partnership opportunities with local distributors, beauty retailers, and digital platforms can accelerate market penetration and provide valuable insights into consumer preferences and competitive dynamics that inform long-term strategic planning and product development initiatives.

Supply chain evolution reflects the market’s maturation and increasing sophistication, with brands investing in local manufacturing capabilities to reduce costs, improve responsiveness, and enhance quality control. Distribution channel diversification has created multiple pathways to reach consumers, from traditional department stores and specialty beauty retailers to online marketplaces and direct-to-consumer platforms that enable more personalized customer relationships and data collection.

Innovation cycles have accelerated significantly, with brands launching new products and formulations at unprecedented frequency to maintain consumer interest and competitive positioning. Seasonal demand patterns influence product development and marketing strategies, with summer months driving increased demand for oil-control and UV protection products, while winter seasons emphasize moisturizing and damage repair formulations.

Price sensitivity varies significantly across consumer segments and geographic regions, requiring brands to develop tiered product portfolios that address different price points without compromising brand equity or consumer perception. Brand loyalty dynamics show increasing fluidity, with consumers more willing to experiment with new brands and products, creating both opportunities and challenges for established market players seeking to maintain market share and customer retention.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the China hair care products market. Primary research includes extensive consumer surveys, focus groups, and in-depth interviews with industry stakeholders across different geographic regions and demographic segments. This approach provides direct insights into consumer preferences, purchasing behaviors, and brand perceptions that quantitative data alone cannot capture.

Secondary research incorporates analysis of industry reports, company financial statements, regulatory filings, and trade association data to establish market size, competitive positioning, and growth trends. Data triangulation methods validate findings across multiple sources, ensuring research conclusions are robust and reliable for strategic decision-making purposes.

Market modeling techniques incorporate economic indicators, demographic trends, and historical growth patterns to develop accurate forecasts and scenario analyses. Qualitative analysis complements quantitative findings through expert interviews, industry observation, and trend analysis that provides context and depth to numerical data. This multi-faceted approach ensures comprehensive understanding of market dynamics, competitive forces, and future growth opportunities within the China hair care products market.

Geographic segmentation reveals distinct market characteristics across China’s diverse regions, with tier-one cities including Beijing, Shanghai, and Shenzhen leading premium product adoption and innovation trends. Eastern coastal regions demonstrate the highest market penetration rates and consumer sophistication, with approximately 35% market share concentrated in these economically developed areas. Consumer preferences in these regions favor international brands and cutting-edge formulations that incorporate advanced technology and premium ingredients.

Central and western regions show accelerating growth potential as economic development and urbanization expand consumer access to diverse product ranges. Tier-two cities represent significant growth opportunities, with rising middle-class populations increasingly investing in personal care and beauty products. These markets often prefer value-oriented premium products that offer superior quality compared to mass-market alternatives without reaching luxury price points.

Rural market dynamics differ substantially from urban patterns, with traditional retail channels maintaining stronger influence and word-of-mouth recommendations playing crucial roles in product adoption. Regional preferences for traditional Chinese ingredients and formulations create opportunities for brands that incorporate local botanical extracts and time-tested hair care principles. MarkWide Research analysis indicates that regional market development strategies require careful consideration of local economic conditions, cultural preferences, and distribution infrastructure capabilities.

Market leadership remains highly contested among international giants and emerging domestic brands that have successfully adapted to local market conditions. Key players demonstrate varying strategies for market penetration and growth:

Competitive strategies increasingly focus on digital marketing, influencer partnerships, and personalized customer experiences that differentiate brands in an increasingly crowded marketplace. Innovation leadership requires continuous investment in research and development, with brands racing to introduce new formulations, packaging solutions, and application technologies that address evolving consumer needs and preferences.

Product category segmentation reveals diverse market opportunities across multiple hair care solution types. By product type, the market encompasses several key categories:

By distribution channel, market segmentation reflects evolving consumer shopping preferences:

Shampoo category analysis reveals strong demand for specialized formulations addressing specific hair concerns prevalent among Chinese consumers. Anti-dandruff shampoos maintain consistent market leadership due to climate conditions and lifestyle factors that contribute to scalp issues. Color-safe formulations show increasing demand as hair coloring becomes more popular among younger demographics seeking personal expression and style differentiation.

Conditioner market dynamics demonstrate growing consumer understanding of hair care routines and willingness to invest in complementary products that enhance shampoo benefits. Leave-in treatments gain popularity among busy urban consumers seeking convenient solutions that provide ongoing hair protection and styling benefits throughout the day. Deep conditioning masks represent a premium growth segment appealing to consumers willing to invest in intensive hair repair and maintenance.

Styling product categories reflect changing lifestyle patterns and fashion trends that emphasize personal grooming and appearance. Heat protection products show strong growth as hair styling tool usage increases among Chinese consumers. Natural hold products appeal to consumers seeking styling solutions that maintain hair health while providing desired aesthetic results. Multi-functional styling products that combine multiple benefits in single formulations address consumer preferences for simplified routines and value optimization.

Manufacturers benefit from China’s large consumer base and growing market demand that supports economies of scale and investment in advanced production technologies. Local manufacturing capabilities enable cost optimization, quality control, and rapid response to market trends and consumer preferences. Innovation opportunities arise from unique consumer needs and preferences that drive product development and differentiation strategies.

Retailers gain from diverse product portfolios that attract different consumer segments and price points, enabling comprehensive market coverage and customer retention. E-commerce platforms benefit from high-frequency purchase patterns and strong consumer engagement with hair care content and education. Cross-selling opportunities with complementary beauty and personal care products enhance average transaction values and customer lifetime value.

Consumers receive unprecedented access to diverse product ranges, competitive pricing, and educational resources that enable informed purchase decisions. Product innovation continuously improves hair care efficacy and user experience, while digital platforms provide convenient shopping experiences and personalized recommendations. Quality improvements across all price segments ensure consumers can access effective hair care solutions regardless of budget constraints, while ingredient transparency enables informed choices aligned with personal values and preferences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Personalization revolution transforms how consumers approach hair care, with brands investing in diagnostic tools, customized formulations, and individualized product recommendations. AI-powered solutions analyze hair conditions, lifestyle factors, and personal preferences to create tailored product regimens that address specific consumer needs and concerns. This trend reflects growing consumer sophistication and willingness to invest in products that deliver measurable results.

Sustainable beauty movement gains momentum as environmentally conscious consumers seek products with minimal environmental impact. Refillable packaging systems, biodegradable formulations, and sustainable ingredient sourcing become key differentiators for brands targeting eco-aware demographics. Transparency initiatives provide detailed ingredient information and environmental impact data that enable informed consumer choices.

Traditional Chinese medicine integration creates unique product categories that blend ancient wisdom with modern formulation technology. Herbal ingredients like ginseng, green tea, and traditional botanical extracts appeal to consumers seeking natural alternatives to synthetic formulations. Holistic hair care approaches that address overall scalp health and hair wellness align with traditional Chinese health philosophies and contemporary wellness trends.

Digital transformation initiatives reshape how brands engage with consumers and distribute products throughout China’s diverse market landscape. Live-streaming commerce has emerged as a dominant sales channel, with beauty influencers and brand ambassadors driving significant product sales through real-time demonstrations and interactive customer engagement. Social commerce integration enables seamless shopping experiences within popular social media platforms.

Manufacturing localization accelerates as international brands establish production facilities within China to reduce costs, improve supply chain efficiency, and enhance responsiveness to local market demands. Research and development centers focus on developing formulations specifically designed for Chinese hair types and consumer preferences, creating products that outperform globally standardized alternatives.

Regulatory evolution continues shaping market dynamics, with authorities implementing new safety standards, ingredient restrictions, and labeling requirements that impact product development and marketing strategies. Cross-border e-commerce regulations create new opportunities for international brands while establishing clear frameworks for market entry and operation. MWR analysis indicates that regulatory compliance has become a key competitive advantage for brands that successfully navigate complex requirements and maintain market access.

Strategic recommendations for market participants emphasize the importance of local market adaptation and consumer-centric product development. Investment priorities should focus on digital marketing capabilities, e-commerce platform optimization, and data analytics systems that enable personalized customer experiences and targeted marketing campaigns. Brand positioning strategies must balance global brand equity with local market relevance and cultural sensitivity.

Product development initiatives should prioritize formulations that address specific hair concerns prevalent among Chinese consumers while incorporating ingredients and benefits that resonate with local preferences. Distribution strategy optimization requires multi-channel approaches that leverage both traditional retail and digital platforms to maximize market reach and consumer accessibility. Partnership opportunities with local distributors, beauty retailers, and digital platforms can accelerate market penetration and provide valuable market insights.

Innovation investments should focus on sustainable product development, personalization technology, and traditional Chinese medicine integration that differentiate brands in competitive markets. Consumer education programs can build brand awareness and loyalty while establishing thought leadership in hair care expertise. Quality assurance systems must exceed regulatory requirements to build consumer trust and protect brand reputation in markets where product safety concerns significantly impact purchase decisions.

Long-term growth projections indicate continued market expansion driven by demographic trends, economic development, and evolving consumer preferences toward premium and specialized hair care solutions. Technology integration will accelerate, with artificial intelligence, augmented reality, and personalization platforms becoming standard components of successful hair care brands. Market consolidation may occur as smaller brands struggle to compete with established players that have superior resources and market access.

Consumer behavior evolution suggests increasing sophistication and willingness to invest in comprehensive hair care routines that extend beyond basic cleansing to include treatments, styling, and maintenance products. Sustainability requirements will become more stringent, forcing brands to innovate in packaging, formulation, and manufacturing processes to meet environmental expectations. Regulatory frameworks will continue evolving, potentially creating both challenges and opportunities for market participants.

Emerging market segments including male grooming, senior consumer products, and specialized treatments for hair damage and scalp conditions present significant growth opportunities. MarkWide Research projects that successful brands will be those that combine global expertise with local market understanding, creating products and experiences that resonate with Chinese consumers while maintaining international quality standards and innovation capabilities.

Market assessment reveals the China hair care products market as a dynamic and rapidly evolving sector with substantial growth potential driven by favorable demographic trends, economic development, and changing consumer preferences. Success factors include local market adaptation, digital marketing excellence, product innovation, and sustainable business practices that align with evolving consumer values and regulatory requirements.

Strategic imperatives for market participants emphasize the importance of understanding local consumer needs, investing in digital capabilities, and developing products that combine global quality standards with local relevance and cultural sensitivity. Future opportunities exist across multiple market segments, distribution channels, and geographic regions, requiring strategic focus and resource allocation to capture growth potential effectively.

The China hair care products market represents a compelling opportunity for brands that can successfully navigate competitive dynamics, regulatory requirements, and consumer preferences while delivering innovative products and exceptional customer experiences. Long-term success will depend on continuous adaptation to market changes, investment in consumer education and brand building, and commitment to quality and sustainability that builds lasting consumer trust and loyalty in this important and growing market.

What is Hair Care Products?

Hair care products refer to a range of items designed to cleanse, condition, and style hair. This includes shampoos, conditioners, hair oils, and styling gels, which cater to various hair types and concerns.

What are the key players in the China Hair Care Products Market?

Key players in the China Hair Care Products Market include Procter & Gamble, L’Oréal, Unilever, and Shiseido, among others. These companies offer a diverse range of products targeting different consumer needs and preferences.

What are the growth factors driving the China Hair Care Products Market?

The growth of the China Hair Care Products Market is driven by increasing consumer awareness of personal grooming, rising disposable incomes, and the growing influence of social media on beauty trends. Additionally, the demand for natural and organic hair care products is on the rise.

What challenges does the China Hair Care Products Market face?

The China Hair Care Products Market faces challenges such as intense competition among brands, fluctuating raw material prices, and changing consumer preferences. Additionally, regulatory compliance and sustainability concerns are becoming increasingly important.

What opportunities exist in the China Hair Care Products Market?

Opportunities in the China Hair Care Products Market include the expansion of e-commerce platforms, the introduction of innovative product formulations, and the growing trend of personalized hair care solutions. Brands can leverage these trends to capture a larger market share.

What trends are shaping the China Hair Care Products Market?

Trends shaping the China Hair Care Products Market include the rise of clean beauty, increased demand for multifunctional products, and the popularity of DIY hair care solutions. Consumers are increasingly seeking products that align with their values and lifestyle choices.

China Hair Care Products Market

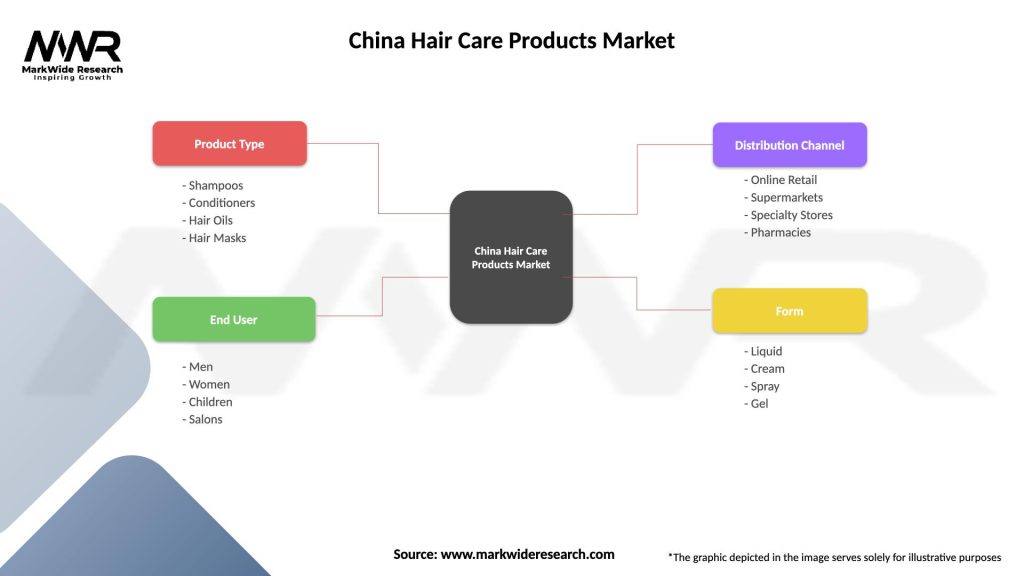

| Segmentation Details | Description |

|---|---|

| Product Type | Shampoos, Conditioners, Hair Oils, Hair Masks |

| End User | Men, Women, Children, Salons |

| Distribution Channel | Online Retail, Supermarkets, Specialty Stores, Pharmacies |

| Form | Liquid, Cream, Spray, Gel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Hair Care Products Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at