444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China fungicide market represents one of the most dynamic and rapidly evolving agricultural chemical sectors in the Asia-Pacific region. China’s agricultural landscape has undergone significant transformation over the past decade, with increasing emphasis on crop protection solutions to meet the growing food security demands of its massive population. The fungicide market in China encompasses a comprehensive range of chemical and biological products designed to prevent, control, and eliminate fungal diseases that threaten crop yields across diverse agricultural applications.

Market dynamics indicate robust growth driven by modernization of farming practices, increasing adoption of precision agriculture technologies, and rising awareness about crop protection benefits. The market demonstrates strong performance across multiple crop segments, including cereals, fruits, vegetables, and cash crops. Regional distribution shows concentrated activity in major agricultural provinces, with 65% market concentration in eastern and central China regions where intensive farming practices predominate.

Technological advancement continues to reshape the fungicide landscape, with innovative formulations and application methods gaining significant traction. The integration of sustainable agricultural practices has accelerated demand for environmentally friendly fungicide solutions, creating new opportunities for bio-based and reduced-risk products. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, supported by increasing agricultural productivity requirements and evolving pest management strategies.

The China fungicide market refers to the comprehensive ecosystem of antifungal agricultural chemicals, biological agents, and related products used to protect crops from fungal diseases within China’s agricultural sector. This market encompasses the development, manufacturing, distribution, and application of various fungicidal formulations designed to prevent crop losses caused by pathogenic fungi that can significantly impact agricultural productivity and food security.

Fungicides in the Chinese context include synthetic chemical compounds, biological control agents, and integrated pest management solutions that target specific fungal pathogens affecting major crops. The market covers both preventive and curative fungicide applications, ranging from seed treatments and soil applications to foliar sprays and post-harvest treatments. Product categories include contact fungicides, systemic fungicides, and translaminar fungicides, each serving specific agricultural needs and crop protection requirements.

Market scope extends beyond traditional chemical products to include emerging biotechnology solutions, precision application technologies, and sustainable crop protection alternatives. The definition encompasses the entire value chain from research and development through manufacturing, regulatory approval, distribution networks, and end-user application across China’s diverse agricultural regions and farming systems.

China’s fungicide market demonstrates exceptional growth potential driven by the country’s commitment to agricultural modernization and food security enhancement. The market benefits from strong government support for agricultural innovation, increasing farmer awareness about crop protection benefits, and growing demand for high-quality agricultural products. Key market drivers include expanding cultivated area, intensification of farming practices, and rising incidence of fungal diseases due to climate change impacts.

Market segmentation reveals diverse opportunities across multiple dimensions, including product type, crop application, formulation, and regional distribution. Synthetic fungicides currently dominate market share, while biological alternatives show rapid growth rates exceeding 12% annually. The cereals segment represents the largest application area, followed by fruits and vegetables, which demonstrate higher value-per-hectare fungicide usage patterns.

Competitive landscape features both international agrochemical giants and domestic manufacturers, creating a dynamic environment for innovation and market expansion. Regulatory developments increasingly favor environmentally sustainable products, driving research and development investments toward next-generation fungicide technologies. The market outlook remains highly positive, supported by China’s agricultural policy framework and increasing integration with global food supply chains.

Strategic market insights reveal several critical factors shaping the China fungicide market landscape. The following key insights provide comprehensive understanding of market dynamics and growth opportunities:

Primary market drivers propelling China’s fungicide market growth encompass multiple interconnected factors that create sustained demand for crop protection solutions. Food security imperatives represent the fundamental driver, as China must feed approximately 20% of the world’s population with limited arable land resources. This challenge necessitates maximizing agricultural productivity through effective disease management strategies.

Agricultural intensification continues accelerating across China’s farming regions, with farmers adopting higher-yielding crop varieties that often require enhanced protection against fungal diseases. Crop value enhancement drives farmers to invest in fungicide applications that preserve crop quality and marketability, particularly for export-oriented agricultural products. The growing middle class demands higher-quality food products, creating market incentives for improved crop protection practices.

Climate change impacts increasingly influence disease pressure patterns, with changing temperature and humidity conditions favoring fungal pathogen development. Government agricultural policies actively promote modern farming practices, including integrated pest management approaches that incorporate fungicide applications. Technology advancement in formulation chemistry and application methods improves fungicide efficacy while reducing environmental impact, encouraging broader adoption among environmentally conscious farmers.

Economic factors including rising farm incomes and improved access to agricultural credit enable greater investment in crop protection inputs. The expansion of agricultural insurance programs reduces farmer risk perception associated with fungicide investments, further supporting market growth.

Market restraints present significant challenges that could potentially limit the growth trajectory of China’s fungicide market. Environmental concerns represent the primary constraint, as increasing awareness about chemical residues in food and environmental contamination drives regulatory restrictions and consumer resistance. Regulatory compliance costs continue escalating as authorities implement stricter registration requirements and safety standards for fungicide products.

Resistance development in fungal pathogens poses ongoing challenges, requiring continuous investment in new active ingredients and formulation technologies. Cost pressures affect farmer adoption rates, particularly among smallholder farmers who may prioritize immediate economic returns over long-term crop protection benefits. Application complexity associated with modern fungicide products requires enhanced technical knowledge and training, creating barriers for traditional farming communities.

Market consolidation among agricultural input suppliers can limit product choice and pricing flexibility for farmers. Import dependency for certain active ingredients creates supply chain vulnerabilities and price volatility concerns. Alternative pest management approaches, including resistant crop varieties and cultural practices, may reduce fungicide dependency in specific applications.

Water scarcity in certain regions limits irrigation-dependent crops that typically require intensive fungicide applications. Labor shortages in rural areas affect proper fungicide application timing and techniques, potentially reducing product efficacy and farmer satisfaction with crop protection investments.

Emerging opportunities in China’s fungicide market present substantial potential for growth and innovation across multiple dimensions. Biological fungicides represent the most significant opportunity, with growing farmer interest in sustainable crop protection solutions and regulatory support for reduced-risk products. Market penetration rates for biological products remain below 15% of total fungicide usage, indicating substantial room for expansion.

Precision agriculture integration offers opportunities to develop smart fungicide application systems that optimize timing, dosage, and placement based on real-time disease monitoring and weather data. Specialty crop markets including fruits, vegetables, and ornamental plants demonstrate higher value-per-hectare potential and willingness to invest in premium fungicide solutions.

Regional expansion opportunities exist in western and northeastern provinces where agricultural development programs are increasing crop production and modernizing farming practices. Export market development for Chinese agricultural products creates demand for fungicide programs that meet international residue standards and quality requirements.

Technology partnerships between fungicide manufacturers and digital agriculture companies can create integrated solutions that combine disease prediction, application guidance, and product performance monitoring. Formulation innovation opportunities include extended-release products, combination fungicides, and application-specific formulations that improve convenience and efficacy. Service-based business models incorporating technical support, application services, and performance guarantees represent emerging market opportunities.

Market dynamics in China’s fungicide sector reflect complex interactions between supply-side innovations, demand-side pressures, and regulatory influences that shape competitive positioning and growth strategies. Supply chain evolution demonstrates increasing vertical integration among major players, with manufacturers expanding into distribution and technical services to capture greater value and improve market responsiveness.

Competitive intensity continues escalating as both domestic and international companies invest in research and development, manufacturing capacity, and market penetration strategies. Price competition remains significant in commodity fungicide segments, while specialty and biological products command premium pricing due to differentiated value propositions. Innovation cycles are accelerating, with new active ingredients and formulation technologies reaching market introduction phases more rapidly.

Customer behavior patterns show increasing sophistication, with farmers demanding comprehensive technical support, application guidance, and performance assurance from fungicide suppliers. Distribution channel evolution includes growth of e-commerce platforms and direct-to-farmer sales models that bypass traditional agricultural retailers. Seasonal demand patterns create inventory management challenges and working capital requirements for market participants.

Regulatory dynamics increasingly influence product development priorities, with emphasis on environmental safety, residue profiles, and sustainable agriculture compatibility. Market consolidation trends affect competitive dynamics, with larger companies gaining advantages in regulatory compliance, research capabilities, and market access resources.

Research methodology employed for analyzing China’s fungicide market incorporates comprehensive primary and secondary research approaches designed to provide accurate, reliable, and actionable market intelligence. Primary research activities include extensive interviews with key industry stakeholders, including fungicide manufacturers, distributors, agricultural retailers, farmers, and regulatory officials across multiple Chinese provinces.

Data collection methods encompass structured surveys, in-depth interviews, focus group discussions, and field observations to capture both quantitative market data and qualitative insights about market trends, challenges, and opportunities. Secondary research involves analysis of government agricultural statistics, industry publications, company financial reports, regulatory documents, and academic research papers related to fungicide markets and agricultural development in China.

Market sizing methodology utilizes multiple validation approaches, including top-down analysis based on agricultural production data and bottom-up calculations derived from crop-specific fungicide usage patterns. Forecasting models incorporate historical trend analysis, regression modeling, and scenario planning to project market growth trajectories under different economic and regulatory conditions.

Quality assurance measures include data triangulation across multiple sources, expert validation of findings, and continuous monitoring of market developments to ensure research accuracy and relevance. Geographic coverage spans all major agricultural regions of China, with particular emphasis on provinces with significant crop production and fungicide consumption patterns.

Regional analysis reveals significant variations in fungicide market characteristics across China’s diverse agricultural landscapes. Eastern China dominates market consumption, accounting for approximately 42% of total fungicide usage, driven by intensive farming practices, high-value crop production, and advanced agricultural infrastructure. Jiangsu, Zhejiang, and Shandong provinces represent the largest individual markets, with sophisticated distribution networks and high farmer adoption rates for premium fungicide products.

Central China regions including Henan, Hubei, and Hunan provinces demonstrate strong growth potential, with expanding agricultural modernization programs and increasing crop diversification. These regions show growing adoption rates of 8-10% annually for modern fungicide technologies, supported by government agricultural development initiatives and improving farmer education programs.

Western China markets present emerging opportunities, particularly in Xinjiang and Sichuan provinces, where agricultural expansion and specialty crop development create demand for specialized fungicide solutions. Northeastern regions including Heilongjiang and Jilin focus primarily on cereal crop protection, with growing interest in biological fungicides and sustainable farming practices.

Southern China demonstrates unique market characteristics due to tropical and subtropical climates that create year-round disease pressure and multiple cropping seasons. Guangdong and Guangxi provinces show higher per-hectare fungicide usage rates due to intensive vegetable and fruit production systems. Regional market dynamics reflect varying levels of agricultural development, farmer education, and access to modern crop protection technologies.

Competitive landscape in China’s fungicide market features a diverse mix of multinational corporations, domestic manufacturers, and specialized biotechnology companies competing across different market segments and value propositions. Market leadership positions are held by established international players who leverage global research capabilities, extensive product portfolios, and strong regulatory expertise.

Competitive strategies increasingly emphasize innovation, sustainability, and comprehensive customer service rather than price competition alone. Market differentiation occurs through product efficacy, environmental profiles, application convenience, and technical support quality.

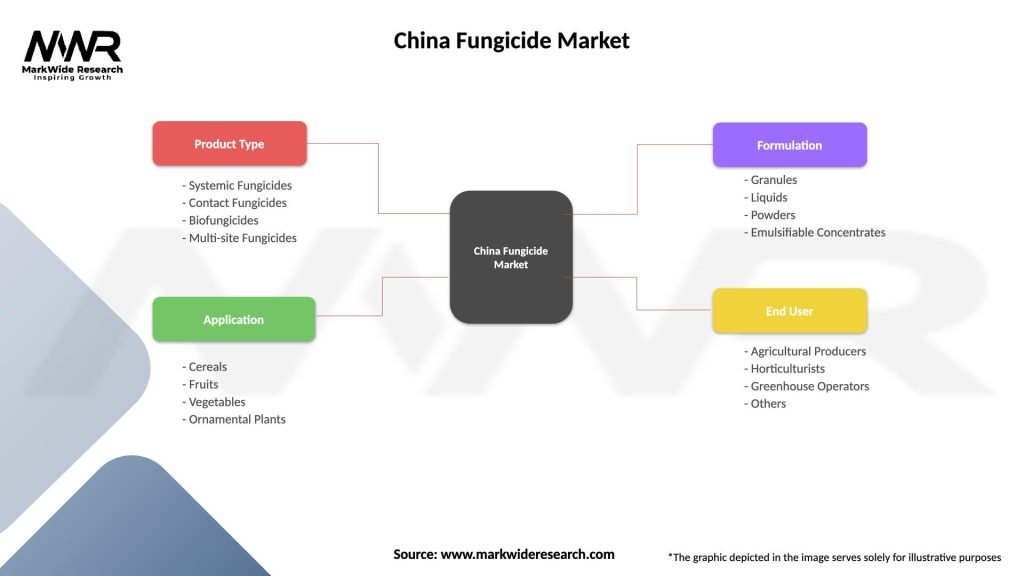

Market segmentation analysis reveals multiple dimensions that define competitive positioning and growth opportunities within China’s fungicide market. Product type segmentation represents the primary classification framework, distinguishing between chemical and biological fungicide categories with distinct market dynamics and growth trajectories.

By Product Type:

By Crop Application:

By Formulation:

Category-wise analysis provides detailed understanding of market performance and growth potential across different fungicide segments. Chemical fungicides maintain market dominance with approximately 78% market share, driven by proven efficacy, established farmer familiarity, and comprehensive product availability across all major crop applications.

Systemic fungicides demonstrate the strongest performance within chemical categories, offering superior disease control and longer-lasting protection compared to contact products. Triazole fungicides represent the largest chemical subgroup, with broad-spectrum activity and excellent crop safety profiles. Strobilurin fungicides show continued growth due to unique mode of action and plant health benefits beyond disease control.

Biological fungicides represent the fastest-growing category, with annual growth rates exceeding 15% driven by regulatory support, environmental concerns, and organic farming expansion. Microbial fungicides based on Bacillus and Trichoderma species demonstrate strong market acceptance, particularly in vegetable and fruit production systems.

Combination fungicides gain market traction by offering resistance management benefits and broad-spectrum disease control in single applications. Seed treatment fungicides show robust growth due to increasing adoption of treated seeds and early-season disease prevention strategies. Post-harvest fungicides represent emerging opportunities in fruit and vegetable supply chains focused on storage and transportation disease control.

Industry participants and stakeholders across China’s fungicide market value chain realize substantial benefits from market participation and strategic positioning. Farmers achieve significant value through improved crop yields, enhanced product quality, and reduced risk of disease-related losses that can devastate agricultural income and food security.

Crop yield protection represents the primary farmer benefit, with effective fungicide programs typically delivering yield improvements of 10-25% compared to untreated crops under disease pressure conditions. Quality enhancement benefits include reduced mycotoxin contamination, improved storage life, and better market acceptance for agricultural products. Risk mitigation through fungicide applications provides farmers with insurance against unpredictable disease outbreaks and weather-related disease pressure.

Manufacturers benefit from growing market demand, opportunities for innovation, and potential for premium pricing on differentiated products. Research and development investments create competitive advantages through novel active ingredients, improved formulations, and sustainable product alternatives. Market expansion opportunities exist through geographic diversification, crop segment penetration, and value-added service offerings.

Distributors and retailers realize benefits through expanding product portfolios, technical service differentiation, and customer relationship strengthening. Government stakeholders achieve agricultural policy objectives including food security enhancement, environmental protection, and rural economic development. Consumers benefit from improved food safety, consistent product quality, and stable food supply chains supported by effective crop protection programs.

SWOT analysis provides comprehensive evaluation of China’s fungicide market strategic position, identifying internal strengths and weaknesses alongside external opportunities and threats that influence market development and competitive dynamics.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping China’s fungicide landscape reflect evolving agricultural practices, technological advancement, and changing stakeholder priorities. Sustainability focus represents the most significant trend, with increasing demand for environmentally compatible fungicide solutions that minimize ecological impact while maintaining crop protection efficacy.

Biological integration accelerates across all market segments, with farmers increasingly adopting bio-based fungicides as components of integrated pest management programs. Digital agriculture adoption creates opportunities for precision fungicide applications based on real-time disease monitoring, weather data analysis, and predictive modeling systems.

Formulation innovation trends include development of extended-release products, microencapsulated formulations, and nano-technology applications that improve efficacy and reduce environmental exposure. Resistance management becomes increasingly critical, driving demand for fungicide rotation programs and combination products with multiple modes of action.

Service integration trends show manufacturers expanding beyond product supply to offer comprehensive crop protection services including disease monitoring, application guidance, and performance guarantees. Regulatory harmonization efforts aim to streamline registration processes while maintaining safety standards, potentially accelerating new product introductions.

Supply chain digitization improves product traceability, inventory management, and customer service delivery across distribution networks. Consolidation trends continue among both manufacturers and distributors, creating larger entities with enhanced research capabilities and market reach.

Recent industry developments demonstrate the dynamic nature of China’s fungicide market, with significant investments in research, manufacturing capacity, and market expansion initiatives. Regulatory approvals for new biological fungicides have accelerated, with several microbial and botanical products receiving registration for major crop applications during the past year.

Manufacturing investments by both domestic and international companies include new production facilities for active ingredients and formulated products, reflecting confidence in long-term market growth prospects. Syngenta’s expansion of its biological fungicide production capacity in China represents significant commitment to sustainable crop protection solutions.

Technology partnerships between fungicide manufacturers and digital agriculture companies create integrated platforms combining disease prediction, product recommendations, and application monitoring capabilities. Acquisition activities include consolidation among domestic manufacturers seeking scale advantages and international market access.

Research collaborations between universities, government institutes, and private companies focus on developing next-generation fungicide technologies with improved environmental profiles and resistance management characteristics. Distribution network expansion includes growth of e-commerce platforms and direct-to-farmer sales channels that improve product accessibility in rural markets.

Sustainability initiatives by major manufacturers include commitments to reduce environmental impact, improve product stewardship, and support sustainable agriculture practices through technical education and training programs.

Strategic recommendations for market participants focus on positioning for long-term success in China’s evolving fungicide market environment. MarkWide Research analysis suggests that companies should prioritize investment in biological product development and sustainable agriculture solutions to align with regulatory trends and farmer preferences.

Innovation investment should emphasize resistance management solutions, including novel modes of action and combination products that extend product life cycles. Market expansion strategies should target underserved regions and specialty crop segments where premium pricing and technical differentiation create competitive advantages.

Digital integration represents critical success factor, with companies needing to develop capabilities in precision agriculture, data analytics, and decision support systems. Partnership strategies should focus on collaboration with technology companies, research institutions, and distribution partners to create comprehensive value propositions.

Regulatory compliance capabilities require continuous investment to navigate evolving registration requirements and safety standards. Supply chain optimization should emphasize flexibility, responsiveness, and cost efficiency to maintain competitive positioning in price-sensitive market segments.

Customer education programs should focus on proper product selection, application techniques, and integrated pest management practices to maximize product performance and customer satisfaction. Sustainability communication becomes increasingly important for brand positioning and market acceptance, particularly among environmentally conscious farmers and food processors.

Future outlook for China’s fungicide market remains highly positive, supported by fundamental drivers including population growth, agricultural intensification, and modernization of farming practices. Market growth projections indicate sustained expansion at compound annual growth rates of 6-8% through the next decade, with biological products expected to achieve even higher growth rates.

Technology evolution will continue reshaping market dynamics, with precision agriculture, biotechnology, and digital platforms creating new opportunities for product differentiation and value creation. Regulatory environment evolution toward sustainability and environmental protection will favor companies with strong research capabilities and innovative product portfolios.

Market consolidation trends are expected to continue, creating larger, more capable companies with enhanced research and development resources. Geographic expansion opportunities will emerge in western and northeastern regions as agricultural development programs increase crop production and modernize farming practices.

International integration of China’s agricultural sector will create demand for fungicide programs that meet global food safety and quality standards. Climate change adaptation will require flexible fungicide strategies capable of addressing evolving disease pressure patterns and extreme weather events.

MWR projections suggest that biological fungicides will achieve market share exceeding 25% within the next five years, driven by regulatory support, farmer acceptance, and technological advancement. Innovation cycles will accelerate, with new product introductions occurring more frequently as research and development investments yield commercial results.

China’s fungicide market represents one of the most dynamic and promising agricultural input sectors globally, characterized by strong growth fundamentals, technological innovation, and evolving market dynamics that create substantial opportunities for industry participants. The market benefits from China’s commitment to agricultural modernization, food security enhancement, and sustainable farming practices that drive demand for effective crop protection solutions.

Market evolution toward sustainability and environmental compatibility creates competitive advantages for companies investing in biological products, innovative formulations, and integrated pest management solutions. Digital agriculture integration offers transformative potential for precision fungicide applications and enhanced customer value propositions.

Strategic success in this market requires balanced focus on innovation, sustainability, customer education, and operational excellence. Companies that effectively navigate regulatory requirements, invest in research and development, and build strong customer relationships will capture disproportionate value from market growth opportunities. The future outlook remains highly favorable, with sustained growth expected across all major market segments and geographic regions within China’s diverse agricultural landscape.

What is Fungicide?

Fungicides are chemical compounds or biological organisms used to prevent or eliminate fungal infections in crops. They play a crucial role in agriculture by protecting plants from diseases caused by fungi, thereby enhancing crop yield and quality.

What are the key players in the China Fungicide Market?

Key players in the China Fungicide Market include BASF, Syngenta, and Bayer, which are known for their extensive portfolios of fungicide products. These companies focus on innovation and sustainability to meet the growing demands of the agricultural sector, among others.

What are the growth factors driving the China Fungicide Market?

The China Fungicide Market is driven by increasing agricultural productivity needs, rising awareness of crop protection, and the growing prevalence of fungal diseases. Additionally, advancements in fungicide formulations and the adoption of integrated pest management practices contribute to market growth.

What challenges does the China Fungicide Market face?

The China Fungicide Market faces challenges such as regulatory restrictions on chemical use, environmental concerns, and the development of fungicide-resistant strains of fungi. These factors can hinder the effectiveness of existing products and impact market dynamics.

What opportunities exist in the China Fungicide Market?

Opportunities in the China Fungicide Market include the development of bio-based fungicides and the increasing demand for organic farming solutions. Additionally, expanding export markets for Chinese agricultural products can drive the need for effective fungicide solutions.

What trends are shaping the China Fungicide Market?

Trends in the China Fungicide Market include the rise of precision agriculture technologies and the integration of digital tools for crop management. Furthermore, there is a growing emphasis on sustainable practices and the use of environmentally friendly fungicides.

China Fungicide Market

| Segmentation Details | Description |

|---|---|

| Product Type | Systemic Fungicides, Contact Fungicides, Biofungicides, Multi-site Fungicides |

| Application | Cereals, Fruits, Vegetables, Ornamental Plants |

| Formulation | Granules, Liquids, Powders, Emulsifiable Concentrates |

| End User | Agricultural Producers, Horticulturists, Greenhouse Operators, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Fungicide Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at