444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China flexible plastic packaging market represents one of the most dynamic and rapidly evolving sectors within the global packaging industry. China’s position as the world’s largest manufacturing hub and consumer market has created unprecedented demand for innovative flexible packaging solutions across diverse industries including food and beverages, pharmaceuticals, personal care, and industrial applications. The market demonstrates robust growth momentum driven by urbanization, changing consumer lifestyles, and increasing demand for convenient packaging formats.

Market dynamics indicate that China’s flexible plastic packaging sector is experiencing significant transformation through technological advancement and sustainability initiatives. The integration of smart packaging technologies, barrier enhancement solutions, and recyclable materials is reshaping the competitive landscape. E-commerce expansion and the rise of online retail platforms have further accelerated demand for protective and lightweight flexible packaging solutions that ensure product integrity during transportation and storage.

Regional distribution across China shows concentrated activity in major manufacturing provinces including Guangdong, Jiangsu, Zhejiang, and Shandong, where established industrial infrastructure supports large-scale production capabilities. The market exhibits strong growth potential with increasing adoption rates of approximately 12.5% annually in emerging applications such as pharmaceutical packaging and specialty food products.

The China flexible plastic packaging market refers to the comprehensive ecosystem of manufacturing, distribution, and application of flexible plastic-based packaging materials and solutions within the Chinese domestic and export markets. Flexible plastic packaging encompasses a wide range of products including pouches, bags, films, wraps, and specialized barrier materials that can be easily shaped, folded, or compressed without losing structural integrity.

This market segment includes various polymer-based materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and specialized multilayer structures designed to provide specific barrier properties, printability, and mechanical strength. Key characteristics of flexible plastic packaging include lightweight construction, cost-effectiveness, customizable barrier properties, and enhanced product protection capabilities compared to rigid packaging alternatives.

Market scope extends beyond traditional packaging applications to include innovative solutions such as stand-up pouches, retort packaging, vacuum-sealed products, and smart packaging with integrated sensors or indicators. The definition encompasses both primary packaging that directly contacts products and secondary packaging used for transportation, storage, and retail presentation purposes.

China’s flexible plastic packaging market stands at the forefront of global packaging innovation, driven by massive domestic consumption, export manufacturing requirements, and evolving consumer preferences toward convenient packaging solutions. The market demonstrates exceptional resilience and adaptability, successfully navigating challenges including raw material price volatility, environmental regulations, and changing international trade dynamics.

Key market drivers include rapid urbanization affecting approximately 65% of China’s population, growing middle-class purchasing power, and increasing demand for processed and packaged foods. The e-commerce boom has created substantial opportunities for flexible packaging solutions that offer superior protection-to-weight ratios and cost-effective shipping characteristics. Sustainability initiatives are increasingly influencing market development, with growing emphasis on recyclable materials and circular economy principles.

Technological advancement remains a critical success factor, with Chinese manufacturers investing heavily in advanced extrusion technologies, digital printing capabilities, and smart packaging integration. The market benefits from strong government support for manufacturing modernization and export competitiveness, creating favorable conditions for continued expansion and innovation in flexible packaging applications.

Strategic analysis reveals several fundamental insights that define the current state and future trajectory of China’s flexible plastic packaging market:

Multiple interconnected factors are propelling the growth and development of China’s flexible plastic packaging market, creating a robust foundation for sustained expansion across diverse application segments.

Consumer lifestyle changes represent the primary growth driver, with increasing urbanization and busy lifestyles driving demand for convenient, portable packaging solutions. The rise of single-person households and changing family structures have created substantial demand for smaller portion sizes and resealable packaging formats. Food safety awareness among Chinese consumers has increased significantly, driving preference for sealed, tamper-evident packaging that ensures product integrity and freshness.

E-commerce expansion continues to create unprecedented demand for protective packaging solutions that can withstand the rigors of automated sorting, long-distance transportation, and multiple handling points. Online retail growth has particularly benefited flexible packaging manufacturers specializing in lightweight, cost-effective solutions that reduce shipping costs while maintaining product protection.

Government initiatives supporting manufacturing modernization and export competitiveness have created favorable conditions for industry investment and expansion. Belt and Road Initiative projects are opening new export markets and creating demand for Chinese flexible packaging products in emerging economies. Food processing industry growth driven by changing dietary preferences and convenience food consumption is generating sustained demand for specialized barrier packaging solutions.

Several significant challenges are constraining the full potential of China’s flexible plastic packaging market, requiring strategic responses from industry participants to maintain competitive positioning and growth momentum.

Environmental regulations and sustainability concerns pose increasing challenges for traditional plastic packaging applications. Plastic waste management requirements and growing consumer environmental consciousness are forcing manufacturers to invest heavily in recyclable materials and sustainable production processes. Regulatory compliance costs associated with environmental standards are impacting profit margins, particularly for smaller manufacturers with limited resources for technology upgrades.

Raw material price volatility remains a persistent challenge, with petroleum-based polymer costs subject to global commodity price fluctuations. Supply chain disruptions and international trade tensions have created uncertainty in raw material availability and pricing, forcing manufacturers to develop more resilient sourcing strategies. Labor cost increases in traditional manufacturing regions are pressuring manufacturers to invest in automation or relocate production facilities to lower-cost areas.

International trade restrictions and changing global trade policies are creating uncertainty for export-oriented manufacturers. Quality standards in international markets are becoming increasingly stringent, requiring continuous investment in quality control systems and certification processes. Technology gaps in specialized applications such as pharmaceutical packaging and high-barrier films continue to limit market penetration in premium segments.

Substantial growth opportunities are emerging across multiple segments of China’s flexible plastic packaging market, driven by technological innovation, changing consumer preferences, and expanding application areas.

Sustainable packaging solutions represent the most significant opportunity area, with growing demand for recyclable, biodegradable, and compostable flexible packaging materials. Circular economy initiatives are creating opportunities for manufacturers who can develop closed-loop recycling systems and sustainable material alternatives. Bio-based polymers and renewable material integration offer potential for premium market positioning and regulatory compliance advantages.

Smart packaging technologies present substantial opportunities for value-added solutions incorporating sensors, indicators, and digital connectivity features. Internet of Things (IoT) integration in packaging applications is creating new revenue streams through data collection and consumer engagement capabilities. Pharmaceutical packaging expansion offers high-margin opportunities, particularly in specialized applications requiring advanced barrier properties and tamper-evident features.

Export market expansion through Belt and Road Initiative projects and regional trade agreements is opening new geographic markets for Chinese flexible packaging products. Premium food packaging applications including organic products, specialty beverages, and gourmet foods are creating demand for high-quality flexible packaging solutions with enhanced aesthetic and functional properties.

Complex market dynamics are shaping the competitive landscape and strategic direction of China’s flexible plastic packaging market, influenced by technological advancement, regulatory changes, and evolving consumer expectations.

Supply chain integration is becoming increasingly important, with successful manufacturers developing vertical integration strategies that encompass raw material sourcing, production, and distribution capabilities. Technology partnerships between Chinese manufacturers and international equipment suppliers are accelerating the adoption of advanced production technologies and quality control systems. Market consolidation trends are creating larger, more capable organizations with enhanced research and development resources.

Competitive intensity continues to increase as manufacturers compete on multiple dimensions including cost, quality, innovation, and sustainability credentials. Price competition remains significant in commodity packaging segments, while premium applications offer opportunities for differentiation through advanced materials and specialized capabilities. Customer relationship management is becoming more sophisticated, with manufacturers developing closer partnerships with major brand owners and retailers.

Innovation cycles are accelerating, with manufacturers required to continuously develop new products and capabilities to maintain market position. Digital transformation initiatives are improving operational efficiency and enabling more responsive customer service capabilities. Sustainability metrics are increasingly influencing purchasing decisions, creating competitive advantages for manufacturers with strong environmental credentials.

Comprehensive research methodology employed in analyzing China’s flexible plastic packaging market incorporates multiple data collection and analysis techniques to ensure accuracy, reliability, and actionable insights for industry stakeholders.

Primary research activities include extensive interviews with industry executives, manufacturing managers, technology specialists, and key customers across the flexible packaging value chain. Survey methodologies capture quantitative data on production capacities, technology adoption rates, market share distributions, and growth projections from representative samples of market participants. Field observations at manufacturing facilities and trade exhibitions provide insights into operational practices, technology trends, and competitive positioning strategies.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and regulatory documentation to establish market context and validate primary research findings. Data triangulation techniques ensure consistency and reliability across multiple information sources. MarkWide Research analytical frameworks incorporate both quantitative modeling and qualitative assessment methodologies to provide comprehensive market understanding.

Market modeling utilizes statistical analysis techniques including regression analysis, trend extrapolation, and scenario planning to develop growth projections and identify key success factors. Competitive analysis employs benchmarking methodologies to assess relative market positioning and strategic capabilities of major industry participants.

Geographic distribution of China’s flexible plastic packaging market reveals distinct regional characteristics, competitive advantages, and growth patterns that reflect underlying economic and industrial development patterns.

Eastern China dominates market activity with approximately 55% of total production capacity, concentrated in Jiangsu, Zhejiang, and Shanghai regions. Guangdong Province serves as a major manufacturing hub, particularly for export-oriented production, benefiting from proximity to Hong Kong and established logistics infrastructure. Shandong Province has emerged as a significant production center, leveraging petrochemical industry integration and cost advantages.

Central China regions including Henan, Hubei, and Hunan are experiencing rapid growth in flexible packaging manufacturing, driven by lower labor costs and government incentives for industrial development. Western China markets show increasing potential, particularly in Sichuan and Chongqing, supported by infrastructure development and growing domestic consumption. Northeastern provinces maintain specialized capabilities in industrial packaging applications, serving heavy industry and agricultural sectors.

Regional specialization patterns are emerging, with coastal areas focusing on high-value export products and advanced technology applications, while inland regions concentrate on cost-competitive commodity packaging for domestic markets. Transportation infrastructure improvements are reducing regional cost disparities and enabling more distributed production strategies.

China’s flexible plastic packaging market features a diverse competitive landscape encompassing large multinational corporations, domestic industry leaders, and specialized niche players, each contributing unique capabilities and market positioning strategies.

Domestic competitors include numerous regional manufacturers with strong local market knowledge and cost advantages, creating intense competition in commodity packaging segments while international players maintain advantages in specialized applications requiring advanced technology and quality standards.

Market segmentation analysis reveals distinct categories within China’s flexible plastic packaging market, each characterized by unique requirements, growth patterns, and competitive dynamics.

By Material Type:

By Application:

By Technology:

Detailed category analysis provides specific insights into performance characteristics, growth drivers, and competitive dynamics within major segments of China’s flexible plastic packaging market.

Food Packaging Category represents the largest market segment, driven by changing consumer lifestyles and increasing demand for convenient food products. Fresh food packaging applications are experiencing rapid growth, with approximately 18% annual adoption of modified atmosphere packaging technologies. Snack food packaging continues to drive innovation in barrier properties and resealable closure systems. Frozen food packaging benefits from cold chain infrastructure development and growing consumption of convenience foods.

Pharmaceutical Packaging Category demonstrates the highest growth potential, driven by aging population demographics and healthcare system expansion. Blister packaging applications are growing rapidly, requiring specialized materials with excellent barrier properties and regulatory compliance. Medical device packaging represents a premium segment with stringent quality requirements and sterilization compatibility needs.

Industrial Packaging Category serves diverse applications including chemical products, agricultural inputs, and construction materials. Bulk packaging solutions are experiencing growth driven by industrial production expansion and export requirements. Specialty chemical packaging requires advanced barrier properties and chemical resistance characteristics, creating opportunities for high-performance materials.

Multiple stakeholder groups derive significant benefits from participating in China’s flexible plastic packaging market, creating value through various mechanisms and strategic positioning approaches.

Manufacturers benefit from substantial economies of scale, with large production volumes enabling cost optimization and competitive pricing strategies. Technology advancement opportunities allow manufacturers to develop proprietary capabilities and differentiated product offerings. Export market access provides revenue diversification and growth opportunities beyond domestic market limitations. Vertical integration possibilities enable manufacturers to capture additional value chain margins and improve supply chain control.

Brand owners gain access to innovative packaging solutions that enhance product protection, shelf life extension, and consumer appeal. Cost optimization through lightweight packaging reduces transportation costs and material usage. Sustainability credentials through recyclable packaging options support corporate environmental responsibility objectives. Market differentiation through premium packaging aesthetics and functionality creates competitive advantages.

Consumers benefit from improved product freshness, convenience features, and portion control options. Food safety enhancements through barrier packaging reduce contamination risks and extend product shelf life. Convenience features including resealable closures and easy-open systems improve user experience. Environmental benefits through reduced packaging waste and recyclable materials support sustainability preferences.

Comprehensive SWOT analysis reveals the strategic position and key considerations for China’s flexible plastic packaging market participants.

Strengths:

Weaknesses:

Opportunities:

Threats:

Several transformative trends are reshaping China’s flexible plastic packaging market, driving innovation and creating new competitive dynamics across industry segments.

Sustainability Revolution represents the most significant trend, with manufacturers investing heavily in recyclable materials, biodegradable alternatives, and circular economy solutions. Consumer awareness of environmental issues is driving demand for sustainable packaging options, with approximately 42% of consumers willing to pay premium prices for eco-friendly packaging. Regulatory pressure is accelerating adoption of sustainable materials and waste reduction strategies.

Smart Packaging Integration is gaining momentum through incorporation of sensors, QR codes, and interactive features that enhance consumer engagement and product traceability. Digital printing technologies are enabling mass customization and shorter production runs for specialized applications. Internet connectivity features are creating new opportunities for brand interaction and supply chain visibility.

Advanced Barrier Technologies continue to evolve, with development of ultra-thin films that maintain superior protection properties while reducing material usage. Nanotechnology applications are enhancing barrier performance and enabling new functionality in flexible packaging materials. Active packaging systems incorporating oxygen scavengers and antimicrobial agents are extending product shelf life and improving food safety.

E-commerce Optimization is driving development of packaging solutions specifically designed for online retail requirements, including tamper-evident features, easy-open systems, and enhanced protection during shipping. Automation compatibility is becoming increasingly important as fulfillment centers adopt robotic handling systems.

Recent industry developments highlight the dynamic nature of China’s flexible plastic packaging market and the continuous evolution of technologies, partnerships, and strategic initiatives.

Technology Advancement initiatives include major investments in next-generation extrusion equipment and digital printing capabilities. Research and development collaborations between Chinese manufacturers and international technology providers are accelerating innovation in barrier materials and sustainable packaging solutions. Automation projects are improving production efficiency and quality consistency across manufacturing facilities.

Sustainability Initiatives encompass development of recyclable multilayer films, bio-based polymer integration, and closed-loop recycling systems. Industry partnerships with waste management companies are creating infrastructure for packaging material recovery and reprocessing. Certification programs for sustainable packaging are gaining adoption among manufacturers seeking to differentiate their products.

Market Expansion activities include establishment of new production facilities in strategic locations and capacity expansion projects to meet growing demand. International partnerships are facilitating technology transfer and market access for Chinese manufacturers. Acquisition activities are consolidating market capabilities and creating larger, more competitive organizations.

Regulatory Compliance efforts include alignment with international food safety standards and environmental regulations to support export market access. Quality certification initiatives are improving product consistency and customer confidence in Chinese flexible packaging products.

Strategic recommendations for market participants in China’s flexible plastic packaging sector focus on positioning for long-term success while addressing immediate market challenges and opportunities.

Sustainability Investment should be prioritized, with manufacturers developing comprehensive strategies for recyclable materials, waste reduction, and circular economy participation. MWR analysis indicates that companies with strong sustainability credentials will capture increasing market share as environmental regulations tighten and consumer preferences evolve. Technology partnerships with material suppliers and recycling companies can accelerate sustainable innovation and market positioning.

Digital Transformation initiatives should encompass both production optimization and customer engagement capabilities. Industry 4.0 technologies including predictive maintenance, quality control automation, and supply chain visibility systems will become competitive necessities. Smart packaging development should focus on practical applications that deliver measurable value to brand owners and consumers.

Market Diversification strategies should balance domestic growth opportunities with international expansion initiatives. Premium segment development in pharmaceutical and specialty food applications offers higher margins and growth potential. Export market development through Belt and Road Initiative projects and regional trade agreements can provide revenue diversification and growth opportunities.

Innovation Focus should emphasize practical solutions that address real market needs while maintaining cost competitiveness. Barrier technology advancement and material optimization can create differentiation opportunities in competitive market segments.

Future prospects for China’s flexible plastic packaging market indicate continued growth and transformation driven by technological innovation, sustainability requirements, and evolving consumer preferences across domestic and international markets.

Growth trajectory projections suggest sustained expansion with increasing emphasis on value-added applications and sustainable packaging solutions. Market maturation in commodity segments will drive manufacturers toward specialized applications and premium market positioning. Technology adoption rates are expected to accelerate, with approximately 60% of manufacturers planning significant automation investments over the next five years.

Sustainability transformation will fundamentally reshape market dynamics, with recyclable and bio-based materials gaining substantial market share. Regulatory evolution will continue driving adoption of sustainable packaging solutions and waste reduction strategies. Consumer preferences for environmentally responsible packaging will create competitive advantages for manufacturers with strong sustainability credentials.

International expansion opportunities will continue growing through trade agreements and infrastructure development projects. Technology leadership in specialized applications will become increasingly important for maintaining competitive positioning in global markets. MarkWide Research projections indicate that Chinese flexible packaging manufacturers will capture increasing share of international premium market segments through quality improvement and innovation initiatives.

Digital integration will become standard practice, with smart packaging features and supply chain connectivity creating new value propositions for customers and consumers. Market consolidation trends will continue, creating larger organizations with enhanced research and development capabilities and broader market reach.

China’s flexible plastic packaging market represents a dynamic and rapidly evolving sector with substantial growth potential driven by domestic consumption expansion, technological innovation, and increasing international competitiveness. The market demonstrates remarkable resilience and adaptability, successfully navigating challenges while capitalizing on emerging opportunities in sustainability, smart packaging, and premium applications.

Strategic success in this market requires balanced focus on operational excellence, innovation capabilities, and sustainability credentials. Market leaders will be those organizations that can effectively combine cost competitiveness with advanced technology capabilities and environmental responsibility. Future growth will increasingly depend on ability to serve premium market segments while maintaining competitive positioning in commodity applications.

Industry transformation toward sustainable packaging solutions presents both challenges and opportunities, requiring significant investment in new technologies and materials while creating potential for market differentiation and premium positioning. Digital integration and smart packaging capabilities will become essential competitive requirements rather than optional enhancements.

Long-term outlook remains positive, with China’s position as a global manufacturing hub and large domestic market providing fundamental advantages for flexible plastic packaging industry development. Continued investment in technology advancement, sustainability initiatives, and international market development will be essential for maintaining competitive leadership in this rapidly evolving market landscape.

What is Flexible Plastic Packaging?

Flexible Plastic Packaging refers to packaging made from flexible materials that can be easily shaped and molded. It is widely used in various applications such as food packaging, personal care products, and pharmaceuticals due to its lightweight and versatile nature.

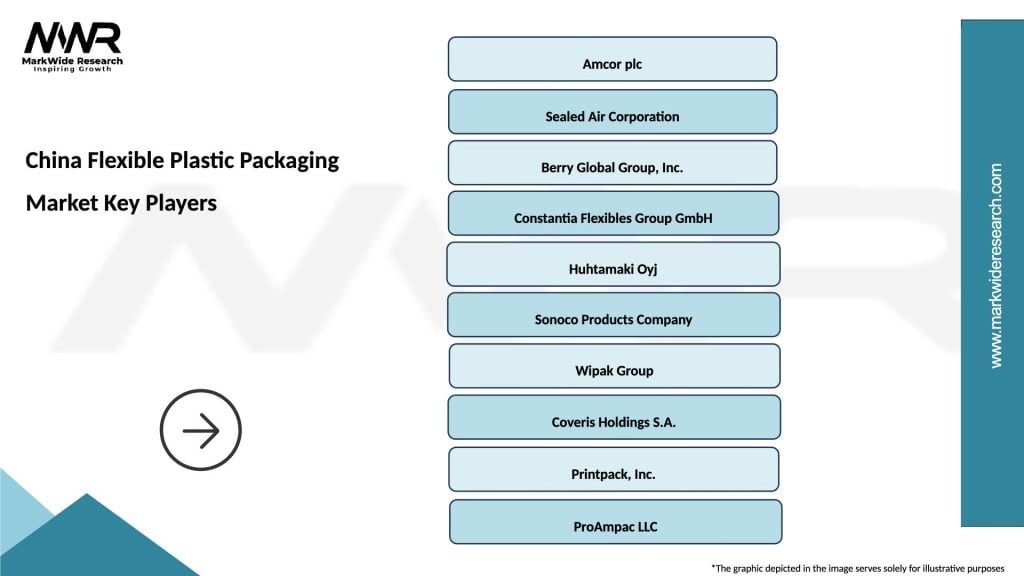

What are the key players in the China Flexible Plastic Packaging Market?

Key players in the China Flexible Plastic Packaging Market include companies like Amcor, Sealed Air Corporation, and Berry Global, among others. These companies are known for their innovative packaging solutions and extensive product offerings.

What are the growth factors driving the China Flexible Plastic Packaging Market?

The growth of the China Flexible Plastic Packaging Market is driven by increasing demand for convenient packaging solutions, the rise of e-commerce, and a growing focus on sustainable packaging options. Additionally, the food and beverage sector’s expansion significantly contributes to market growth.

What challenges does the China Flexible Plastic Packaging Market face?

The China Flexible Plastic Packaging Market faces challenges such as stringent regulations regarding plastic waste and environmental concerns. Additionally, competition from alternative packaging materials and fluctuating raw material prices can impact market dynamics.

What opportunities exist in the China Flexible Plastic Packaging Market?

Opportunities in the China Flexible Plastic Packaging Market include the development of biodegradable packaging solutions and innovations in smart packaging technologies. The increasing consumer preference for eco-friendly products also presents a significant opportunity for growth.

What trends are shaping the China Flexible Plastic Packaging Market?

Trends shaping the China Flexible Plastic Packaging Market include the shift towards sustainable materials, the adoption of advanced printing technologies, and the growing demand for customized packaging solutions. These trends reflect changing consumer preferences and the industry’s response to environmental challenges.

China Flexible Plastic Packaging Market

| Segmentation Details | Description |

|---|---|

| Product Type | Stand-Up Pouches, Shrink Films, Rigid Containers, Flexible Bags |

| Material | Polyethylene, Polypropylene, Polyvinyl Chloride, Bioplastics |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Household Products |

| Packaging Type | Flexible Packaging, Rigid Packaging, Vacuum Packaging, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Flexible Plastic Packaging Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at