444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The China fitness rings market represents a rapidly expanding segment within the country’s broader fitness equipment industry, driven by increasing health consciousness and the growing popularity of functional training methods. Fitness rings, also known as gymnastic rings or suspension rings, have gained significant traction among Chinese consumers seeking versatile, space-efficient workout solutions that can be used both in commercial gyms and home environments.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 12.3% over recent years. This expansion reflects China’s evolving fitness landscape, where traditional exercise methods are increasingly complemented by innovative equipment that offers comprehensive strength training and functional movement capabilities.

Consumer adoption patterns show particularly strong uptake in tier-one cities like Beijing, Shanghai, and Shenzhen, where fitness awareness and disposable income levels support premium equipment purchases. The market encompasses various product categories, from basic plastic rings for beginners to professional-grade wooden and metal rings used in competitive gymnastics and CrossFit training facilities.

Digital integration has become a defining characteristic of the Chinese fitness rings market, with approximately 68% of consumers preferring products that come with accompanying mobile applications or online training programs. This trend aligns with China’s broader digitalization of fitness services and the popularity of home workout solutions that gained momentum during recent years.

The China fitness rings market refers to the commercial ecosystem encompassing the manufacturing, distribution, and retail of gymnastic rings and related suspension training equipment specifically within the Chinese domestic market. These products are designed to provide comprehensive upper body strength training, core stability development, and functional movement enhancement through bodyweight exercises.

Fitness rings consist of two suspended rings typically made from wood, plastic, or metal, connected to adjustable straps that can be anchored to various mounting points. The equipment enables users to perform a wide range of exercises including dips, pull-ups, muscle-ups, and various gymnastic movements that engage multiple muscle groups simultaneously.

Market scope includes both consumer and commercial segments, covering products sold to individual fitness enthusiasts, home gym setups, commercial fitness centers, educational institutions, and professional training facilities. The definition encompasses traditional gymnastic rings, modern suspension trainers with ring attachments, and hybrid systems that combine ring functionality with other training modalities.

Strategic positioning within China’s fitness equipment sector shows fitness rings occupying a unique niche that bridges traditional gymnastics training with modern functional fitness trends. The market benefits from China’s growing middle class, increased health awareness, and government initiatives promoting physical fitness and sports participation across all age groups.

Key growth drivers include the rise of functional fitness training methodologies, space constraints in urban living environments that favor compact equipment, and the influence of international fitness trends adapted to Chinese consumer preferences. The market shows particularly strong performance in the 25-40 age demographic, representing approximately 45% of total consumer base.

Competitive landscape features a mix of international brands establishing local presence and domestic manufacturers developing innovative products tailored to Chinese market needs. The sector demonstrates resilience through diversified distribution channels including e-commerce platforms, specialty fitness retailers, and direct-to-consumer sales models.

Future trajectory indicates continued expansion supported by technological integration, product innovation, and the growing acceptance of home-based fitness solutions. Market participants are increasingly focusing on smart features, app connectivity, and comprehensive training ecosystems to differentiate their offerings in this competitive space.

Consumer behavior analysis reveals distinct preferences shaping the Chinese fitness rings market landscape:

Health consciousness evolution represents the primary catalyst driving China’s fitness rings market expansion. Government initiatives promoting national fitness programs and increasing awareness of lifestyle-related health issues have created a favorable environment for fitness equipment adoption. The “Healthy China 2030” initiative specifically emphasizes regular physical activity, directly benefiting the fitness equipment sector.

Urbanization trends contribute significantly to market growth as city dwellers seek efficient workout solutions that accommodate limited living spaces. Fitness rings offer an ideal solution for apartment-based fitness routines, requiring minimal storage space while providing comprehensive training capabilities. This factor particularly resonates with young professionals in major metropolitan areas.

Digital fitness integration drives consumer interest through smart features and connected training experiences. The proliferation of fitness apps, online training programs, and virtual coaching services creates synergistic opportunities for fitness ring manufacturers to offer comprehensive fitness ecosystems rather than standalone equipment.

Functional training popularity reflects a shift from traditional gym-based workouts toward more dynamic, movement-based exercise approaches. Fitness rings align perfectly with this trend, offering natural movement patterns that improve strength, flexibility, and coordination simultaneously. Professional fitness communities and CrossFit popularity further amplify this driver.

E-commerce accessibility facilitates market penetration through online platforms that reach consumers across China’s vast geographic landscape. Digital marketing capabilities and direct-to-consumer sales models enable manufacturers to build brand awareness and customer relationships more effectively than traditional retail channels alone.

Technical complexity barriers limit market accessibility for novice fitness enthusiasts who may find fitness rings intimidating or difficult to use effectively. Unlike traditional weight training equipment, rings require significant upper body strength and coordination, potentially deterring beginners from adoption. This learning curve represents a significant market entry barrier.

Safety concerns associated with suspension training create hesitation among potential users, particularly regarding proper installation and usage techniques. Inadequate mounting systems or improper form can lead to injuries, creating liability concerns for manufacturers and reluctance among risk-averse consumers.

Space limitations paradoxically both drive and restrain market growth. While compact storage appeals to urban consumers, the actual usage space required for effective ring training may exceed what many apartments can accommodate, limiting the practical utility for some potential customers.

Price sensitivity in certain market segments restricts premium product adoption, particularly among price-conscious consumers who may opt for lower-cost alternatives or forego purchases entirely. Economic uncertainties can amplify this restraint, affecting discretionary spending on fitness equipment.

Competition from alternatives includes other home fitness solutions such as resistance bands, suspension trainers, and bodyweight training programs that may offer similar benefits with lower complexity or cost barriers. This competitive pressure requires continuous innovation and value proposition enhancement.

Smart technology integration presents substantial opportunities for market differentiation and value creation. Incorporating sensors, connectivity features, and AI-powered training guidance can transform basic fitness rings into comprehensive fitness platforms. MarkWide Research indicates that smart fitness equipment adoption rates are increasing by 18% annually in the Chinese market.

Educational market penetration offers significant growth potential as schools and universities increasingly emphasize physical education and fitness programs. Fitness rings can serve multiple educational objectives, from basic physical conditioning to advanced gymnastic skill development, creating opportunities for bulk institutional sales.

Corporate wellness programs represent an emerging opportunity as Chinese companies invest more heavily in employee health and wellness initiatives. Compact, versatile equipment like fitness rings can be easily integrated into workplace fitness facilities or provided as employee benefits for home use.

Rural market expansion remains largely untapped, with significant potential as internet connectivity and e-commerce penetration reach smaller cities and rural areas. Developing products and marketing strategies tailored to these markets could unlock substantial new customer bases.

Rehabilitation and therapy applications present specialized market opportunities through partnerships with healthcare providers and physical therapy clinics. Fitness rings can support various rehabilitation protocols, creating new market segments beyond traditional fitness applications.

Supply chain evolution reflects the dynamic nature of China’s fitness rings market, with manufacturers increasingly adopting flexible production models to respond quickly to changing consumer preferences and seasonal demand fluctuations. Local manufacturing capabilities provide cost advantages and faster time-to-market for new product innovations.

Consumer education initiatives play a crucial role in market development, with manufacturers and fitness professionals collaborating to create comprehensive training resources, safety guidelines, and progressive workout programs. These efforts help overcome technical barriers and expand the accessible user base.

Regulatory landscape changes influence product standards, safety requirements, and import/export regulations affecting international brands operating in the Chinese market. Compliance with evolving standards requires ongoing investment in quality assurance and certification processes.

Seasonal demand patterns create dynamic market conditions, with peak sales typically occurring during New Year resolution periods and pre-summer fitness preparation phases. Understanding these cycles enables better inventory management and marketing campaign timing.

Technology convergence drives innovation as fitness rings increasingly integrate with broader digital health ecosystems, including wearable devices, health monitoring apps, and virtual reality training environments. This convergence creates new value propositions and competitive advantages for forward-thinking manufacturers.

Primary research approaches employed in analyzing the China fitness rings market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and direct observation of market trends across multiple distribution channels. These methodologies provide firsthand insights into consumer preferences, purchasing behaviors, and market dynamics.

Secondary data analysis incorporates examination of industry reports, government statistics, trade association data, and competitive intelligence gathered from public sources. This approach ensures comprehensive market understanding while validating primary research findings through multiple data sources.

Market segmentation analysis utilizes both demographic and psychographic variables to identify distinct consumer groups and their specific needs, preferences, and purchasing patterns. This segmentation enables more targeted analysis and strategic recommendations for market participants.

Competitive landscape assessment involves detailed analysis of key market players, their product offerings, pricing strategies, distribution channels, and market positioning. This analysis provides insights into competitive dynamics and identifies opportunities for differentiation.

Trend analysis methodology combines historical data examination with forward-looking indicators to identify emerging market trends and predict future developments. This approach enables stakeholders to make informed strategic decisions based on comprehensive market intelligence.

Eastern China dominance characterizes the regional distribution of the fitness rings market, with major metropolitan areas including Shanghai, Beijing, and Guangzhou accounting for approximately 52% of total market activity. These regions benefit from higher disposable incomes, greater health awareness, and more developed fitness infrastructure supporting equipment adoption.

Tier-one cities demonstrate the highest per-capita consumption of fitness rings, driven by affluent urban professionals seeking convenient home workout solutions. Premium product segments perform particularly well in these markets, where consumers prioritize quality and advanced features over price considerations.

Southern China regions show strong growth potential, particularly in cities like Shenzhen and Dongguan, where technology industry concentration creates demand for innovative fitness solutions. The region’s manufacturing base also supports local production capabilities and supply chain efficiency.

Central and Western China represent emerging opportunities as economic development and urbanization expand fitness market reach. While currently accounting for smaller market shares, these regions demonstrate rapid growth rates exceeding 15% annually as fitness awareness increases and e-commerce accessibility improves.

Northern China markets exhibit seasonal variation in demand patterns, with indoor fitness equipment like rings showing stronger performance during harsh winter months when outdoor activities are limited. This regional characteristic influences inventory management and marketing strategies for market participants.

Market leadership in China’s fitness rings sector features a diverse competitive environment combining international fitness equipment manufacturers with innovative domestic companies. The landscape continues evolving as new entrants introduce technological innovations and established players adapt to changing consumer preferences.

Key market participants include:

Competitive strategies focus increasingly on differentiation through technology integration, comprehensive training content, and customer experience enhancement rather than competing solely on price or basic product features.

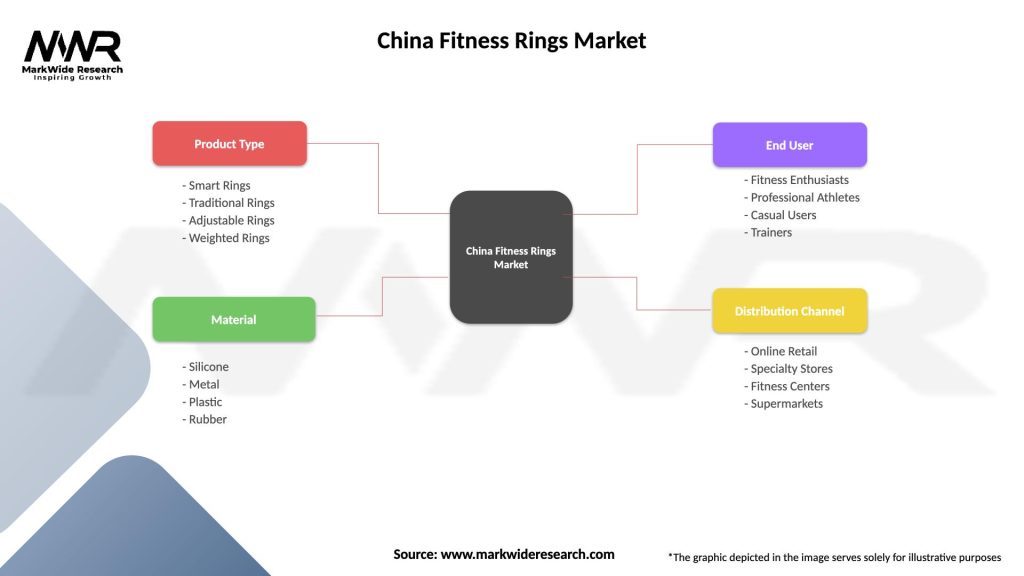

By Product Type:

By Material:

By End User:

By Distribution Channel:

Traditional Gymnastic Rings maintain strong performance among serious fitness enthusiasts and professional users who prioritize authentic training experiences and superior build quality. This segment commands premium pricing but represents a smaller overall market share due to its specialized nature and higher skill requirements.

Suspension Training Rings dominate the consumer market through their accessibility and versatility, appealing to a broader audience seeking functional fitness solutions. This category benefits from extensive marketing support and educational content that helps consumers understand proper usage and benefits.

Smart Fitness Rings represent the fastest-growing segment, with adoption rates increasing 25% annually as Chinese consumers embrace connected fitness solutions. These products command premium pricing while offering enhanced user experiences through app integration and progress tracking capabilities.

Beginner-Friendly Options serve as important market entry points, featuring enhanced safety features, progressive training programs, and lower price points that encourage initial adoption. Success in this category often leads to upgrades to more advanced products as users develop skills and confidence.

Commercial-Grade Equipment shows steady growth driven by expanding fitness facility networks and increasing emphasis on functional training in professional gym environments. This segment prioritizes durability and intensive-use capabilities over consumer-friendly features.

Manufacturers benefit from growing market demand, opportunities for product innovation, and expanding distribution channels that enable broader market reach. The sector’s growth trajectory provides attractive returns on investment in research and development, particularly for companies focusing on technology integration and user experience enhancement.

Retailers gain from strong consumer interest in fitness equipment, relatively high profit margins on specialized products, and opportunities to build customer relationships through education and support services. The category’s compact nature also minimizes inventory storage requirements compared to larger fitness equipment.

Consumers enjoy access to versatile, space-efficient fitness solutions that provide comprehensive workout capabilities at relatively affordable price points. The equipment’s portability enables consistent training routines regardless of location, supporting long-term fitness goals and lifestyle flexibility.

Fitness Professionals can incorporate rings into diverse training programs, offering clients innovative workout experiences that differentiate their services. The equipment’s versatility enables creative programming that addresses multiple fitness objectives simultaneously.

Healthcare Providers find applications in rehabilitation and physical therapy programs, where rings can support controlled movement patterns and progressive strength development. This creates opportunities for specialized product development and professional partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Integration Acceleration represents the most significant trend shaping the fitness rings market, with consumers increasingly expecting smart features, app connectivity, and comprehensive digital training ecosystems. This trend drives product development priorities and influences purchasing decisions across all market segments.

Personalization Focus emerges as manufacturers develop products and services tailored to individual user needs, fitness levels, and goals. Customizable training programs, adjustable difficulty levels, and personalized progress tracking become standard expectations rather than premium features.

Sustainability Emphasis gains importance as environmentally conscious consumers seek products made from sustainable materials and manufactured through responsible processes. This trend influences material selection, packaging design, and corporate social responsibility messaging.

Community Building through social features, group challenges, and shared training experiences aligns with Chinese preferences for collective activities and social validation. Manufacturers increasingly incorporate community elements into their product ecosystems to enhance user engagement and retention.

Professional Integration sees fitness rings becoming standard equipment in commercial gyms, personal training studios, and rehabilitation facilities. This trend validates the equipment’s effectiveness while creating new distribution channels and market opportunities.

Hybrid Training Approaches combine rings with other equipment types and training methodologies, creating comprehensive fitness systems that address diverse user needs. This trend encourages product innovation and strategic partnerships between equipment manufacturers.

Technology Partnerships between fitness equipment manufacturers and app developers create integrated training experiences that enhance user value and market differentiation. These collaborations enable comprehensive fitness ecosystems that extend beyond hardware sales to ongoing service relationships.

Manufacturing Localization trends see international brands establishing Chinese production facilities to reduce costs, improve supply chain efficiency, and better serve local market needs. This development enhances product availability while supporting competitive pricing strategies.

Certification Standards Evolution includes development of specific safety and quality standards for suspension training equipment, providing consumers with greater confidence while establishing barriers to entry for low-quality manufacturers.

Retail Channel Expansion encompasses growth in specialized fitness retailers, online marketplaces, and direct-to-consumer sales models that improve product accessibility and customer education. MWR analysis indicates that online sales channels now account for 67% of total market transactions.

Educational Program Development involves creation of comprehensive training curricula, certification programs for fitness professionals, and consumer education initiatives that expand market accessibility and proper usage understanding.

International Market Integration sees Chinese manufacturers expanding globally while international brands deepen their Chinese market presence, creating cross-border knowledge transfer and competitive dynamics that benefit overall market development.

Product Innovation Focus should prioritize smart technology integration, user-friendly design improvements, and comprehensive training content development. Manufacturers must balance advanced features with accessibility to serve both novice and experienced users effectively.

Market Education Investment remains crucial for expanding the addressable market through consumer education about proper usage, safety protocols, and training benefits. Collaborative industry efforts in education can benefit all market participants by growing overall demand.

Distribution Strategy Optimization should emphasize multi-channel approaches that combine online convenience with physical retail experiences where customers can test products and receive professional guidance. Strategic partnerships with fitness facilities and trainers can enhance market penetration.

Quality Assurance Emphasis becomes increasingly important as market growth attracts new entrants with varying quality standards. Established manufacturers should leverage superior quality and safety as key differentiators while supporting industry-wide standards development.

Regional Expansion Planning should consider the unique characteristics of different Chinese markets, adapting products and marketing strategies to local preferences, economic conditions, and competitive landscapes. Gradual expansion with local partnerships can minimize risks while maximizing opportunities.

Market trajectory indicates continued robust growth for China’s fitness rings market, supported by sustained health consciousness trends, technological advancement integration, and expanding consumer accessibility through improved distribution channels. The sector is positioned to benefit from broader fitness industry growth and evolving consumer preferences toward functional training solutions.

Technology evolution will likely drive the next phase of market development, with artificial intelligence, augmented reality, and advanced sensor technologies creating more sophisticated and engaging user experiences. These innovations may transform basic equipment into comprehensive fitness platforms that provide personalized coaching and progress optimization.

Market maturation is expected to bring increased competition, product standardization, and consumer sophistication that will reward manufacturers focusing on quality, innovation, and customer experience. Price-based competition may diminish as consumers become more discerning about features and long-term value.

Geographic expansion will continue as e-commerce penetration and urbanization reach previously underserved markets throughout China. Rural and smaller city markets represent significant growth potential as internet connectivity and disposable income levels improve.

Integration opportunities with broader health and wellness ecosystems, including wearable devices, health monitoring platforms, and telemedicine services, may create new value propositions and market expansion possibilities beyond traditional fitness applications.

China’s fitness rings market demonstrates remarkable growth potential driven by evolving consumer preferences, technological innovation, and supportive market conditions. The sector benefits from strong fundamentals including increasing health consciousness, urbanization trends, and digital fitness adoption that create favorable long-term prospects for market participants.

Strategic success in this market requires balanced approaches that address both current consumer needs and emerging trends through product innovation, quality assurance, and comprehensive customer experience development. Companies that effectively combine traditional fitness equipment expertise with modern technology integration and consumer education will be best positioned for sustained growth.

Market evolution continues toward more sophisticated, connected, and personalized fitness solutions that extend beyond basic equipment sales to ongoing service relationships. This transformation creates opportunities for value creation and customer loyalty development that can support premium positioning and sustainable competitive advantages.

Future success will depend on manufacturers’ ability to navigate evolving consumer expectations, technological advancement, and competitive pressures while maintaining focus on safety, quality, and user experience. The China fitness rings market represents a dynamic and promising sector within the broader fitness equipment industry, offering substantial opportunities for growth-oriented companies willing to invest in innovation and market development.

What is Fitness Rings?

Fitness rings are versatile exercise tools used for strength training, flexibility, and balance. They are popular in various fitness routines, including yoga, pilates, and functional training.

What are the key players in the China Fitness Rings Market?

Key players in the China Fitness Rings Market include companies like Decathlon, ProForm, and TRX, which offer a range of fitness products. These companies focus on innovation and quality to meet the growing demand for fitness equipment among consumers.

What are the growth factors driving the China Fitness Rings Market?

The China Fitness Rings Market is driven by increasing health awareness, a growing trend towards home workouts, and the rise of fitness influencers promoting diverse exercise routines. Additionally, the convenience and affordability of fitness rings contribute to their popularity.

What challenges does the China Fitness Rings Market face?

Challenges in the China Fitness Rings Market include intense competition among manufacturers, fluctuating raw material prices, and the need for continuous product innovation to meet consumer preferences. These factors can impact profitability and market share.

What opportunities exist in the China Fitness Rings Market?

Opportunities in the China Fitness Rings Market include expanding e-commerce platforms, increasing collaborations with fitness trainers, and the potential for product diversification to cater to different fitness levels and age groups. These trends can enhance market reach and consumer engagement.

What trends are shaping the China Fitness Rings Market?

Trends in the China Fitness Rings Market include the integration of smart technology in fitness equipment, the rise of online fitness classes, and a growing emphasis on holistic health approaches. These trends are influencing consumer purchasing decisions and shaping product development.

China Fitness Rings Market

| Segmentation Details | Description |

|---|---|

| Product Type | Smart Rings, Traditional Rings, Adjustable Rings, Weighted Rings |

| Material | Silicone, Metal, Plastic, Rubber |

| End User | Fitness Enthusiasts, Professional Athletes, Casual Users, Trainers |

| Distribution Channel | Online Retail, Specialty Stores, Fitness Centers, Supermarkets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Fitness Rings Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at