444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

China’s fintech market has experienced significant growth in recent years, fueled by advancements in technology and changing consumer behavior. Fintech, which stands for financial technology, refers to the use of innovative technology to deliver financial services efficiently and conveniently. It encompasses a wide range of services such as mobile payments, online lending, digital banking, and wealth management.

Meaning

Fintech has revolutionized the way financial services are accessed and utilized in China. Traditional banking systems are being disrupted as fintech companies leverage mobile devices, internet connectivity, and data analytics to provide convenient and affordable financial solutions. This has led to greater financial inclusion, especially for underserved populations, and has transformed the way individuals and businesses interact with financial institutions.

Executive Summary

The Chinese fintech market has grown rapidly in recent years, driven by factors such as rising smartphone adoption, government support, and changing consumer preferences. The market is highly competitive, with both domestic and international players vying for a share of the growing market. However, there are challenges and opportunities that need to be carefully navigated to ensure sustainable growth in the long term.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Chinese fintech market is characterized by intense competition, rapid technological advancements, and evolving regulatory frameworks. Fintech companies are continuously innovating to stay ahead in the market, while traditional financial institutions are investing in digital transformation to remain competitive. Customer expectations are also evolving, with a growing demand for seamless, personalized, and secure financial services.

Regional Analysis

The Chinese fintech market is not evenly distributed across all regions of the country. Tier 1 cities such as Beijing, Shanghai, and Shenzhen have been at the forefront of fintech innovation, with a concentration of both domestic and international players. These cities have a favorable business environment, access to capital, and a tech-savvy population. However, there is also growing fintech activity in tier 2 and tier 3 cities as the market expands and reaches previously untapped regions.

Competitive Landscape

Leading companies in the China Fintech market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Chinese fintech market can be segmented based on the type of services offered. The key segments include:

Category-wise Insights

Mobile Payments: Mobile payment platforms such as Alipay and WeChat Pay have transformed the way payments are made in China. These platforms offer a seamless and convenient payment experience, allowing users to make payments for a wide range of goods and services, both online and offline. The adoption of mobile payments has been driven by factors such as the widespread use of smartphones, the convenience of digital wallets, and the integration of various services within the payment apps.

Online Lending: Online lending platforms have disrupted traditional lending channels by providing alternative financing options to individuals and small businesses. These platforms leverage technology to assess creditworthiness and facilitate loan transactions quickly. Online lending has gained popularity due to its accessibility, speed, and convenience. However, there are concerns about the quality of loans and the need for effective regulation to ensure the stability of the lending ecosystem.

Digital Banking: Digital banking services have gained traction in China as consumers increasingly prefer the convenience of managing their finances through mobile apps and online platforms. Digital banks offer a range of services, including account management, money transfers, bill payments, and personalized financial advice. Traditional banks are investing in digital transformation to meet customer expectations and compete with fintech companies.

Wealth Management: Fintech companies in the wealth management segment provide digital platforms that offer personalized investment advice, portfolio management, and access to a range of investment products. These platforms leverage algorithms and data analytics to develop tailored investment strategies based on individual risk profiles and financial goals. Digital wealth management has democratized access to investment opportunities and provides greater transparency and control to individual investors.

Insurtech: Insurtech companies in China are leveraging technology to streamline insurance processes and enhance customer experiences. These companies use data analytics, artificial intelligence, and digital platforms to assess risk, underwrite policies, and handle claims more efficiently. Insurtech has the potential to increase insurance penetration by making insurance products more accessible, affordable, and customized to individual needs.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a profound impact on the Chinese fintech market. The crisis accelerated the adoption of digital financial services as consumers sought contactless payment methods and remote access to banking services. Mobile payments and online banking experienced a surge in usage as people avoided physical cash and reduced visits to brick-and-mortar bank branches. The pandemic also highlighted the importance of financial inclusion, with fintech platforms playing a critical role in providing financial services to individuals and businesses affected by the economic downturn.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Chinese fintech market looks promising, with continued growth expected in various segments. Mobile payments will remain a dominant force, while digital banking, online lending, and wealth management will continue to evolve and attract more users. The integration of AI, big data analytics, and blockchain technology will drive further innovation and transform the way financial services are delivered.

The regulatory landscape will continue to evolve, with a focus on striking the right balance between innovation and consumer protection. Fintech companies will need to adapt to regulatory changes and invest in compliance to maintain trust and credibility.

International expansion will present new opportunities for Chinese fintech companies, particularly in emerging markets. Partnerships and collaborations with global players will facilitate market entry and enable knowledge sharing.

Conclusion

The Chinese fintech market has witnessed remarkable growth in recent years, driven by technological advancements, changing consumer behavior, and supportive government policies. Fintech services such as mobile payments, online lending, digital banking, and wealth management have transformed the way financial services are accessed and utilized.

While the market presents immense opportunities, it also poses challenges related to regulation, cybersecurity, and trust. Fintech companies need to navigate these challenges by prioritizing compliance, investing in security measures, and building trust through transparent and reliable operations.

What is Fintech?

Fintech refers to the integration of technology into offerings by financial services companies to improve their use of financial services. This includes innovations in areas such as mobile payments, online banking, and blockchain technology.

What are the key players in the China Fintech Market?

The China Fintech Market features several prominent companies, including Ant Group, Tencent, and JD Finance, which are known for their advancements in digital payments and online lending, among others.

What are the main drivers of growth in the China Fintech Market?

Key drivers of growth in the China Fintech Market include the increasing smartphone penetration, a growing middle class with rising disposable income, and the demand for convenient financial services.

What challenges does the China Fintech Market face?

The China Fintech Market faces challenges such as regulatory scrutiny, cybersecurity threats, and intense competition among existing players, which can hinder innovation and growth.

What opportunities exist in the China Fintech Market?

Opportunities in the China Fintech Market include the expansion of digital banking services, the rise of blockchain applications, and the potential for financial inclusion among underserved populations.

What trends are shaping the China Fintech Market?

Trends in the China Fintech Market include the increasing adoption of artificial intelligence for customer service, the growth of peer-to-peer lending platforms, and the integration of financial services with social media platforms.

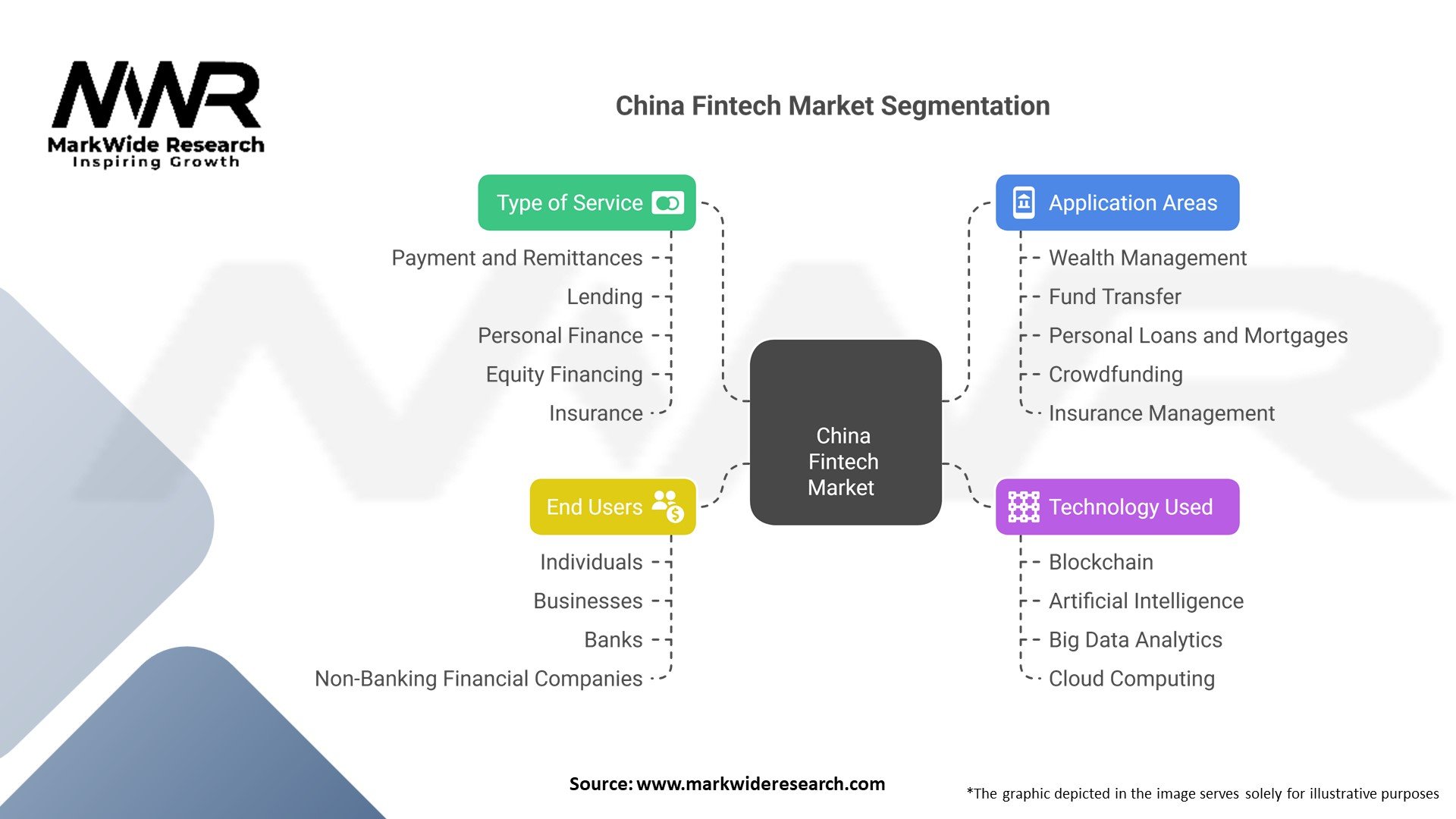

China Fintech Market Segmentation

| Segmentation | Details |

|---|---|

| Type of Service | Payment and Remittances, Lending, Personal Finance, Equity Financing, Insurance |

| Technology Used | Blockchain, Artificial Intelligence, Big Data Analytics, Cloud Computing |

| End Users | Individuals, Businesses, Banks, Non-Banking Financial Companies |

| Application Areas | Wealth Management, Fund Transfer, Personal Loans and Mortgages, Crowdfunding, Insurance Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the China Fintech market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at